Defi Weekly is a column launched by Odaily in conjunction with global DeFi incubator DeFictory, blockchain marketing consulting company WXY, data provider OKLink, and content partner BlockArk. The four sections of market investment and financing information show important changes in the Defi world in the past week.

secondary title

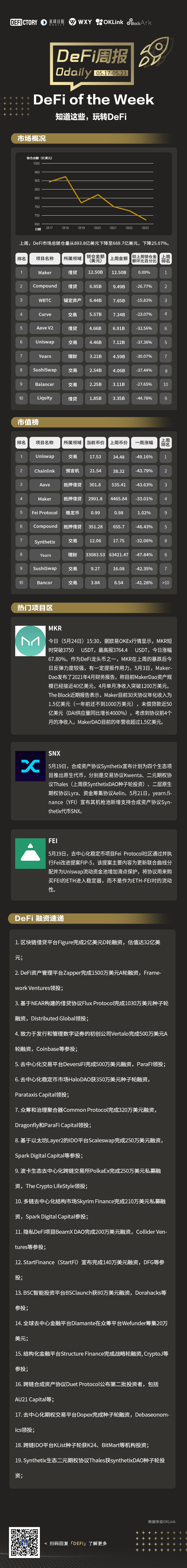

popular items

MKR

popular items

SNX

Today (May 24th) at 15:30, according to the OKEx market, MKR broke through 3750 USDT for a short time, and the highest price was 3764.4 USDT, an increase of 67.80% today. As one of the leading DeFi coins, MKR rebounded strongly today after last week's plunge, which has a certain boost. On May 3, MakerDao released its financial report for April 2021, stating that MakerDao's current asset size is close to US$4 billion, and its monthly net income in April exceeded US$12 million. The Block recently reported that Maker’s current 30-day agreement annualized revenue is $150 million (less than $10 million a year ago), with nearly $5 billion in outstanding loans (DAI supply increased by 4,000% year-on-year). Considering the net income in the first 4 months of the protocol, MakerDAO is currently generating over $150 million in annual revenue.

FEI

On May 19, the Fei Protocol community, a decentralized stablecoin project, passed and implemented the Fei Improvement Proposal FIP-5. The main content of the proposal is to update the bonding curve allocation and add slippage protection to the Uniswap liquidity pool, and use the protocol to purchase FEI ETH goes into the stabilizer, not as liquidity for the ETH-FEI pair.

financing information

financing information

Blockchain lending platform Figure completes $200 million in Series D funding at a valuation of $3.2 billion

DeFi asset management platform Zapper completes $15 million in Series A financing, led by Framework Ventures

Flux Protocol, a NEAR-based lending protocol, completed a $10.3 million seed round led by Distributed Global

Vertalo, a startup dedicated to issuing and managing digital securities, completes $5 million in Series A financing, with participation from Coinbase and others

DeversiFi, a decentralized trading platform, completes $5 million in financing led by ParaFI

Decentralized stable currency market HaloDAO received $3.5 million in seed round financing, led by Parataxis Capital

Crowdfunding and governance aggregator Common Protocol closes $3.2 million funding round led by Dragonfly and ParaFi Capital

Scaleswap, an IDO platform based on Ethereum Layer 2, completed a financing of 2.5 million US dollars, and Spark Digital Capital and others participated in the investment

PolkaEx's decentralized cross-chain exchange PolkaEx completes $2.5 million in private equity financing led by The Crypto LifeStyle

Multi-chain decentralized structure market Skyrim Finance completed $2.1 million private placement financing, Spark Digital Capital participated in the investment

Privacy DeFi project BeamX DAO completes $2 million in financing, Collider Ventures and others participate

StartFinance (StartFi) announced the completion of financing of 1.4 million US dollars, DFG and others participated in the investment

BSClaunch, an intelligent investment platform for BSC, received USD 800,000 in financing, and Dorahacks and others participated in the investment

Global Decentralized Finance Platform Diamante Raises $200,000 on Crowdfunding Platform Wefunder

Structure Finance, a structured financial platform, completed a strategic round of financing, with participation from CryptoJ and others

Duet Protocol, a cross-chain synthetic asset agreement, announced the second batch of investors, including AU21 Capital, etc.

Decentralized options trading platform Dopex completes seed round financing led by Debaseonomics

Cross-chain IDO platform KList seed round received investment from K24, BitMart and other institutions