After breaking below key support levels, where does Bitcoin find its next floor?

- Core View: Bitcoin's market structure has deteriorated, with prices entering a defensive posture after breaking below key support levels. The current market lacks effective spot demand to absorb selling pressure. Sustained selling and leverage unwinding have left prices vulnerable. Any rebound is likely to be a technical correction, and a trend reversal requires a substantial recovery in spot buying and capital inflows.

- Key Factors:

- Prices have broken below the crucial support of the Realized Price at $80,200, confirming a deterioration in market structure, similar to the deep correction phase in early 2022.

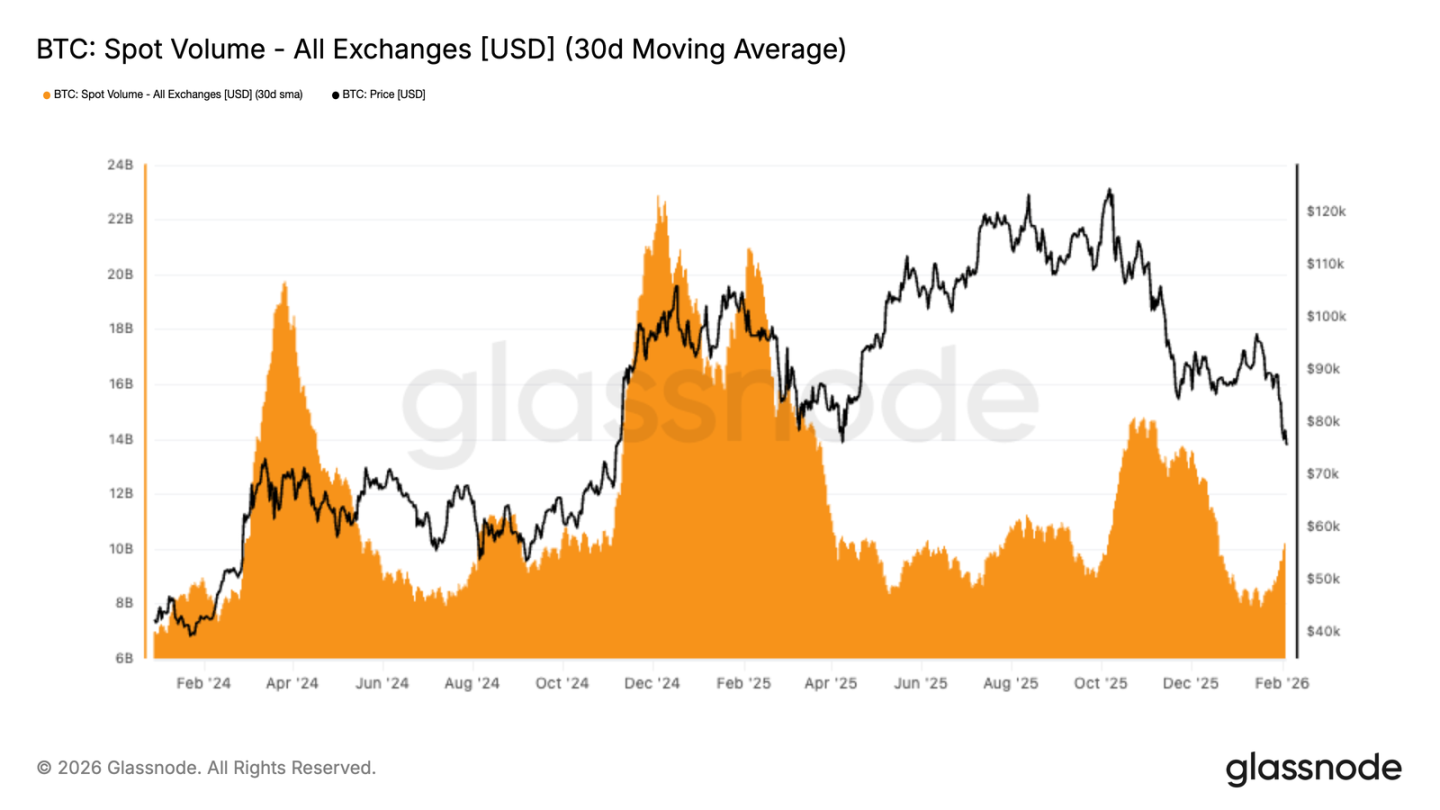

- Spot trading volume remains persistently low, with the 30-day average showing weakness. This indicates a severe lack of buying interest during the decline, with market activity dominated by risk-off position reduction.

- On-chain data shows a dense cost basis cluster formed in the $66,900 to $70,600 range, which may serve as short-term support. However, the Realized Loss metric indicates an intensification of panic selling.

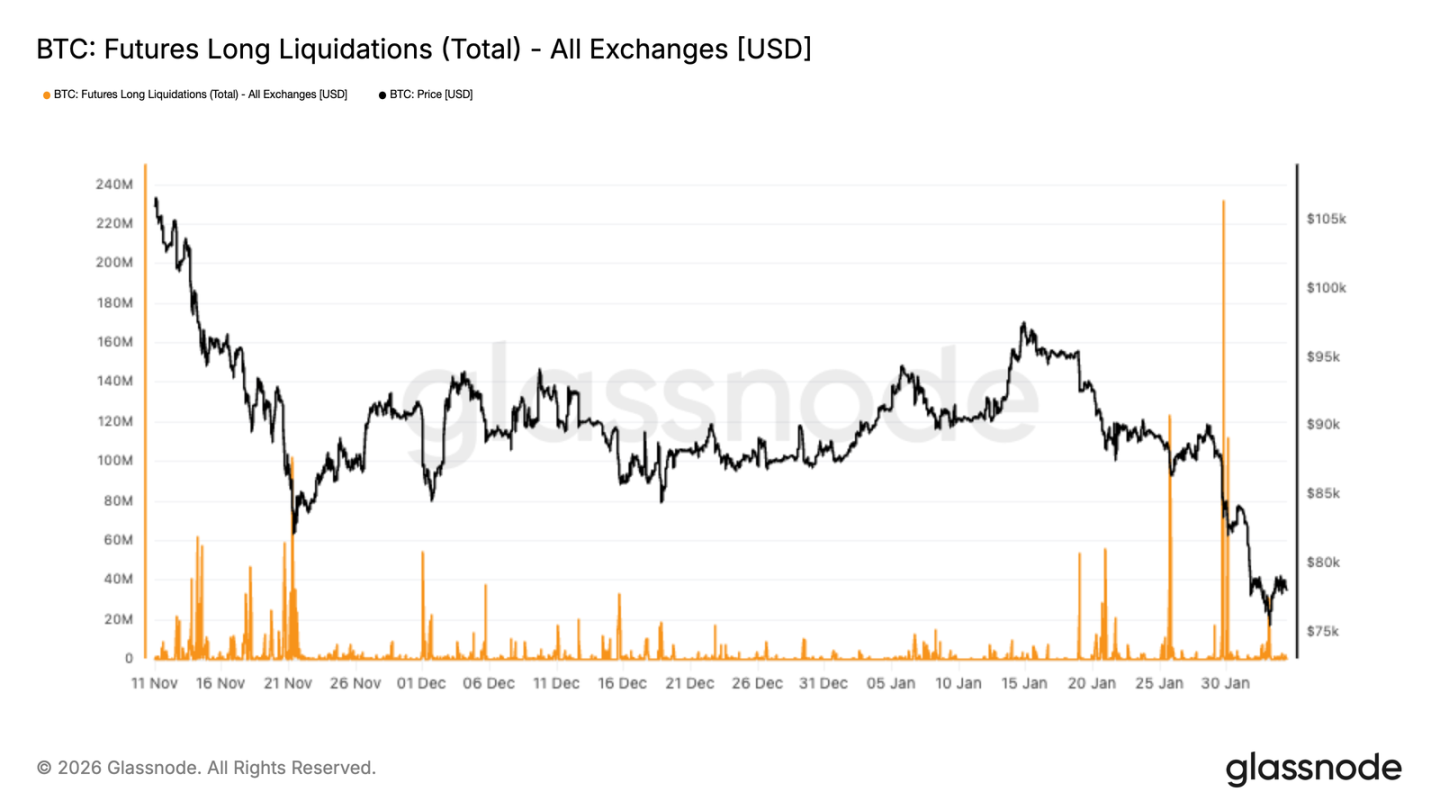

- The futures market is undergoing forced deleveraging. Large-scale long liquidations are exacerbating market volatility and downward pressure, clearing speculative froth but insufficient to form a solid bottom.

- Institutional capital inflows have significantly weakened. The willingness of incremental funds, such as ETF flows, to enter the market has declined, failing to provide sustained buying support.

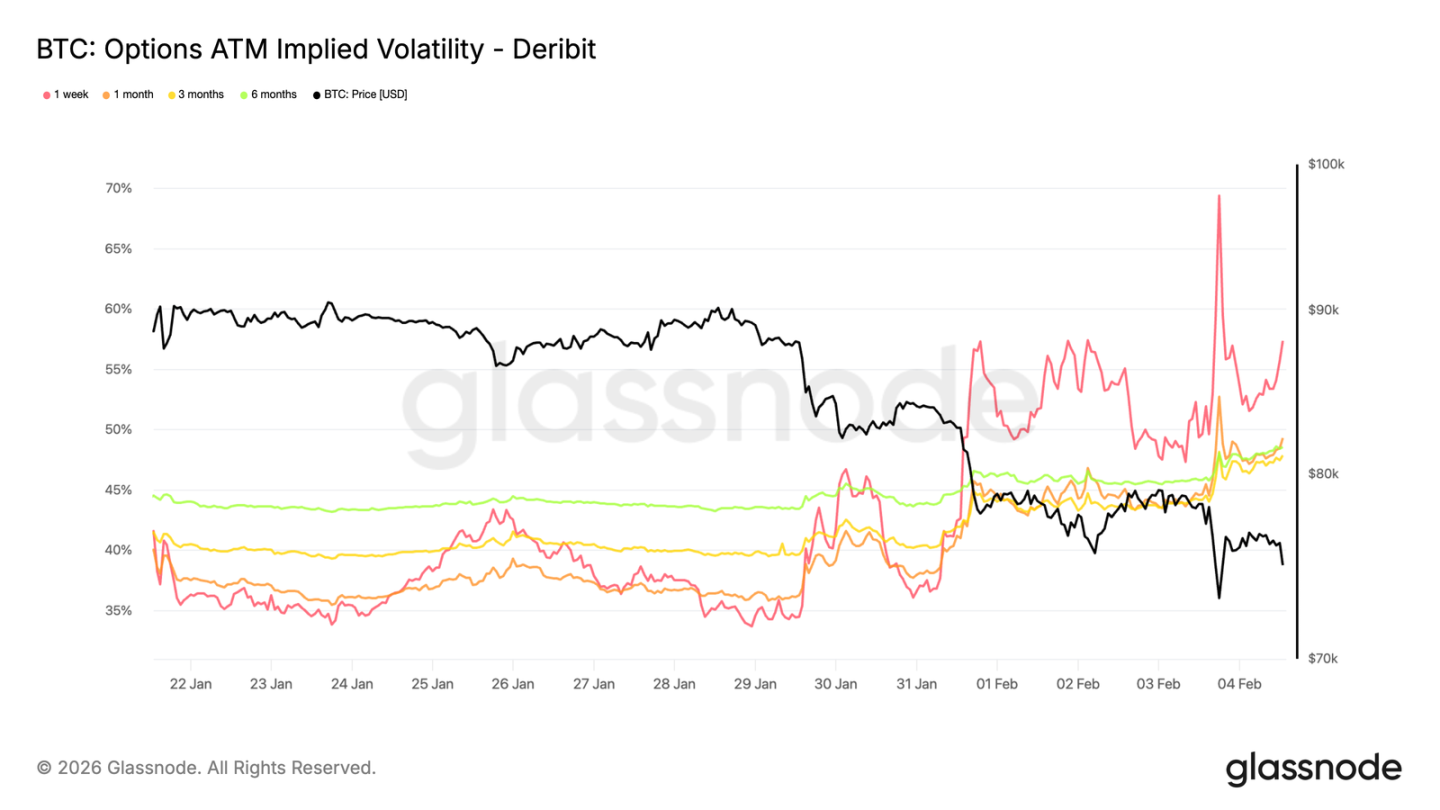

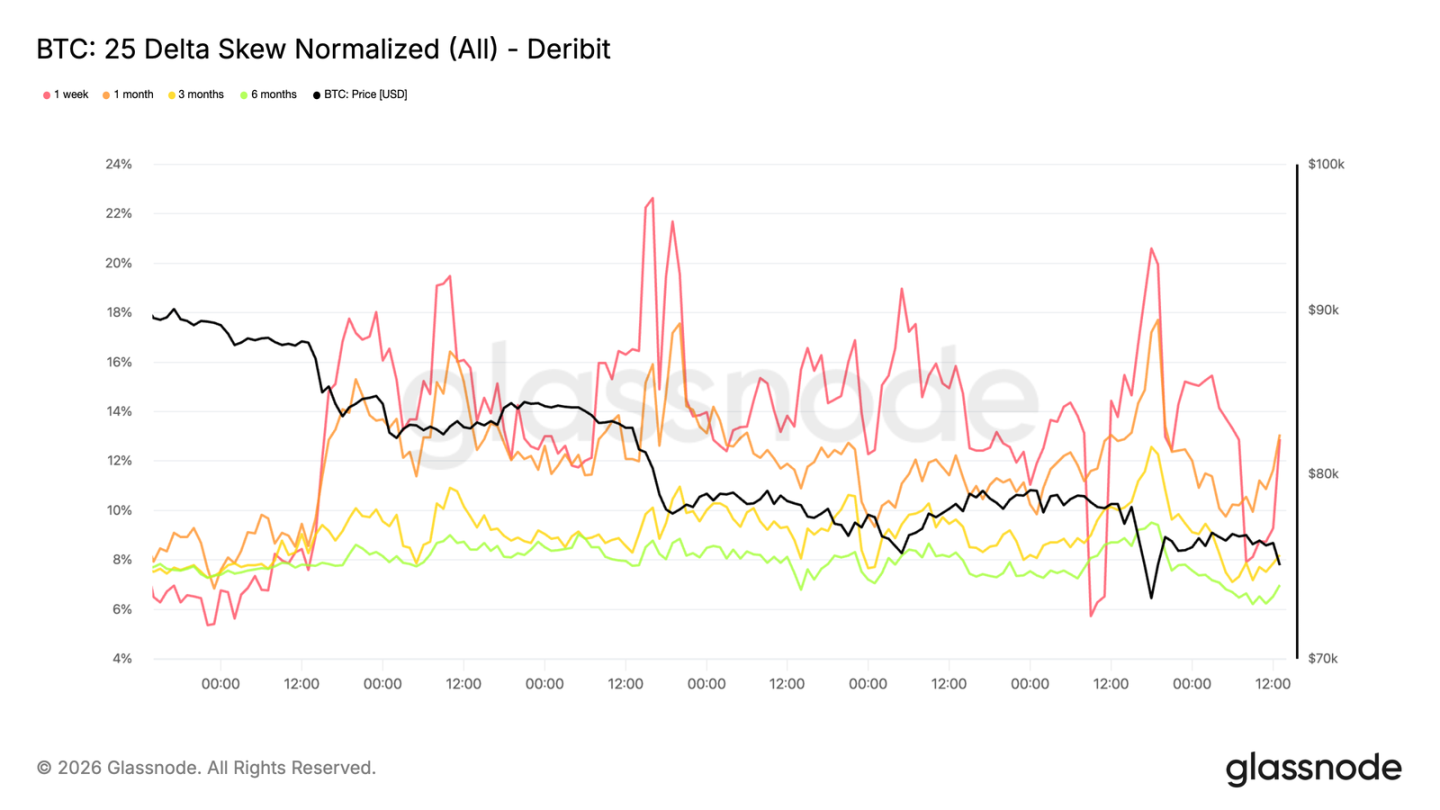

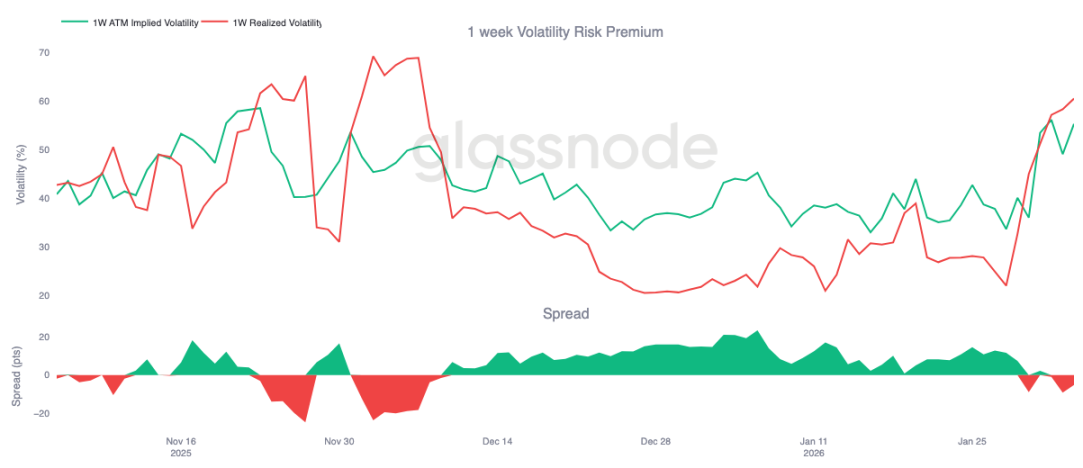

- Options market implied volatility remains elevated. Demand for put options is rising, and the volatility risk premium has turned negative, reflecting strong risk aversion and hedging against further downside.

Original Author: Glassnode

Original Compilation: AididiaoJP, Foresight News

Bitcoin spot trading volume remains sluggish. Despite the price falling from $98,000 to $72,000, the 30-day average volume remains weak. This reflects insufficient market demand and a lack of effective absorption of selling pressure.

Core Viewpoints

- Bitcoin has confirmed a breakdown, with the price falling below the true market average, shifting market sentiment to cautious defense.

- On-chain data shows initial accumulation signs in the $70,000 to $80,000 range, while a dense cost concentration zone has formed between $66,900 and $70,600, which could act as a short-term buffer against selling pressure.

- Investor loss-selling has intensified. As the price continues to decline, more holders are being forced to cut losses and exit.

- Persistently weak spot trading volume further indicates insufficient market absorption capacity and a lack of effective digestion of sell orders.

- The futures market has entered a phase of forced deleveraging, with large-scale long liquidations exacerbating market volatility and downward pressure.

- Institutional capital inflows have significantly weakened. Net inflows into ETFs and related funds have shrunk, unable to provide sustained buying support as they did during the previous rally phase.

- The options market continues to reflect high expectations for downside risk. Implied volatility remains elevated, and rising demand for put options shows strong risk-aversion sentiment.

- With market leverage being cleared while spot demand remains weak, the price remains fragile. Any rebound may be merely a technical correction rather than a trend reversal.

On-Chain Data Observations

Following last week's analysis pointing out the downside risk after the market failed to reclaim the $94,500 short-term cost basis, the price has now clearly fallen below the true market average.

Breaking Below Key Support

The true market average (the average cost basis of actively circulating supply, excluding long-dormant tokens) has served as a key support line multiple times during this correction.

The loss of this support confirms the deterioration of market structure since late November. The current pattern resembles the phase in early 2022 when the market transitioned from consolidation to a deep correction. Weak demand coupled with persistent selling pressure indicates the market is in a fragile equilibrium.

From a medium-term perspective, the price range is gradually narrowing. Resistance lies near the true market average at approximately $80,200, while support is around the realized price of $55,800, a level that has historically attracted long-term capital inflows.

Potential Demand Zone Analysis

As the market structure resets, the focus shifts to potential levels for stabilization on the downside. The following on-chain metrics help identify zones where a potential interim bottom might form:

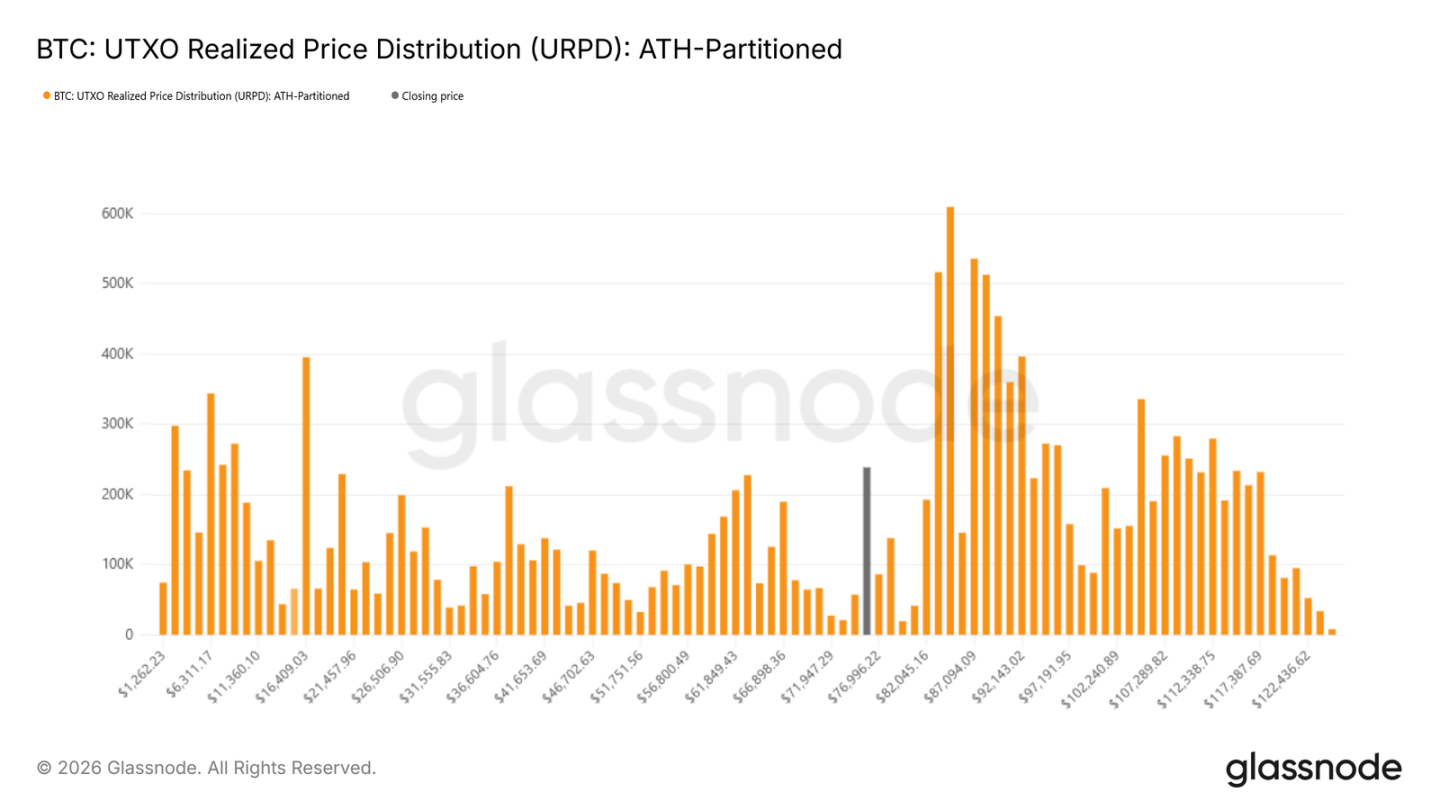

The UTXO Realized Price Distribution shows significant accumulation by new investors in the $70,000 to $80,000 range, indicating willingness to buy the dip in this zone. Below that, a dense cost concentration exists between $66,900 and $70,600. Historically, such cost concentration zones often act as short-term support bands.

Market Stress Indicators

The Realized Loss metric directly reflects the level of investor stress. The current 7-day average realized loss has exceeded $1.26 billion daily, indicating an increase in panic selling after the market broke below key support.

Historical experience shows that peaks in realized loss often coincide with exhaustion in selling. For example, during the recent rebound from $72,000, daily losses briefly exceeded $2.4 billion. Such extreme values often correspond to short-term inflection points.

Comparison with Historical Cycles

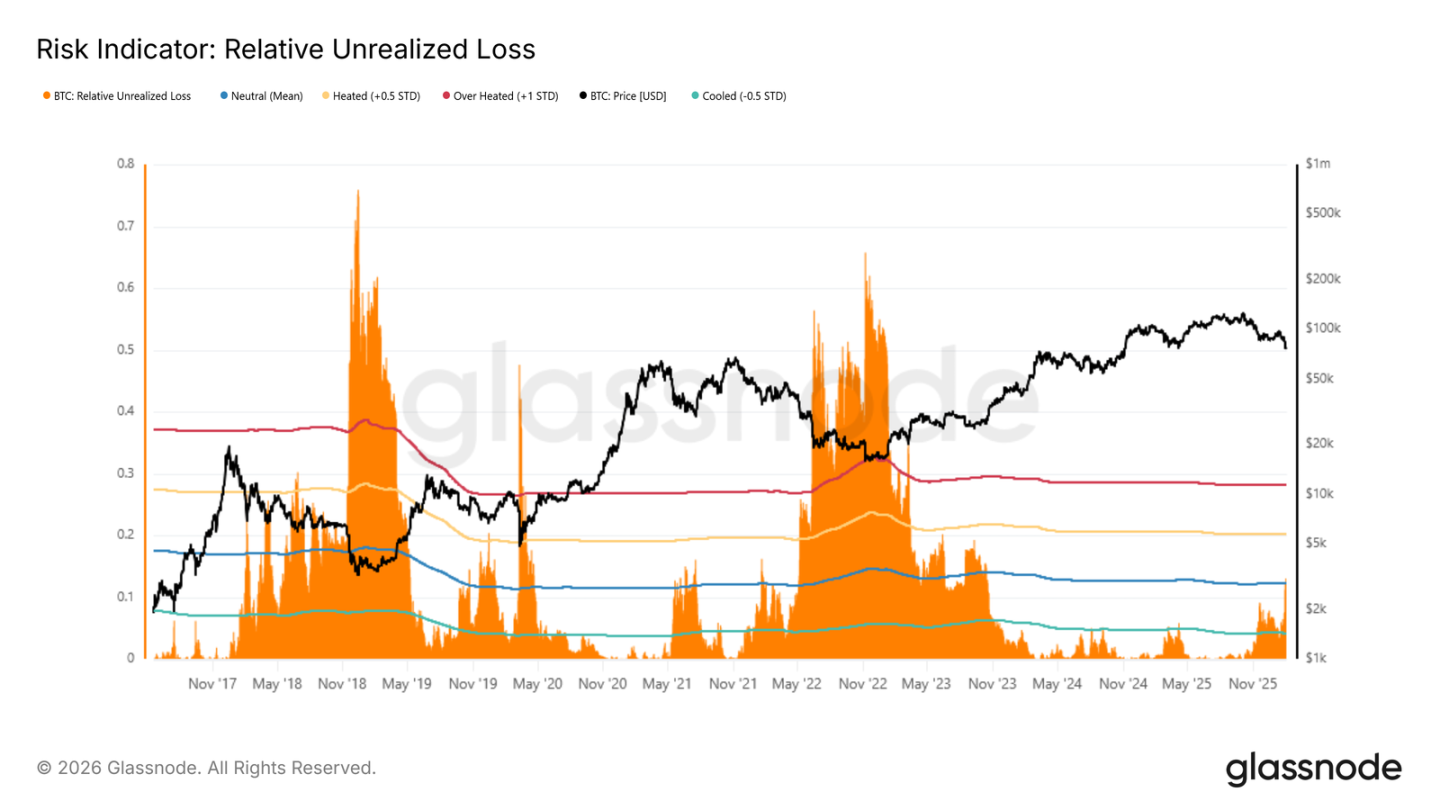

The Relative Unrealized Loss indicator (the proportion of unrealized loss to total market cap) helps compare market stress across different cycles. Historical bear market extremes typically exceed 30%, with cycle bottoms in 2018 and 2022 even reaching 65%-75%.

This indicator has now risen above its long-term average (around 12%), showing that investors with cost bases above the current price are under pressure. However, reaching historical extreme levels usually requires a systemic risk event on the scale of the LUNA or FTX collapse.

Market Dynamics

Spot and futures trading volumes remain low, while the options market continues to focus on downside protection.

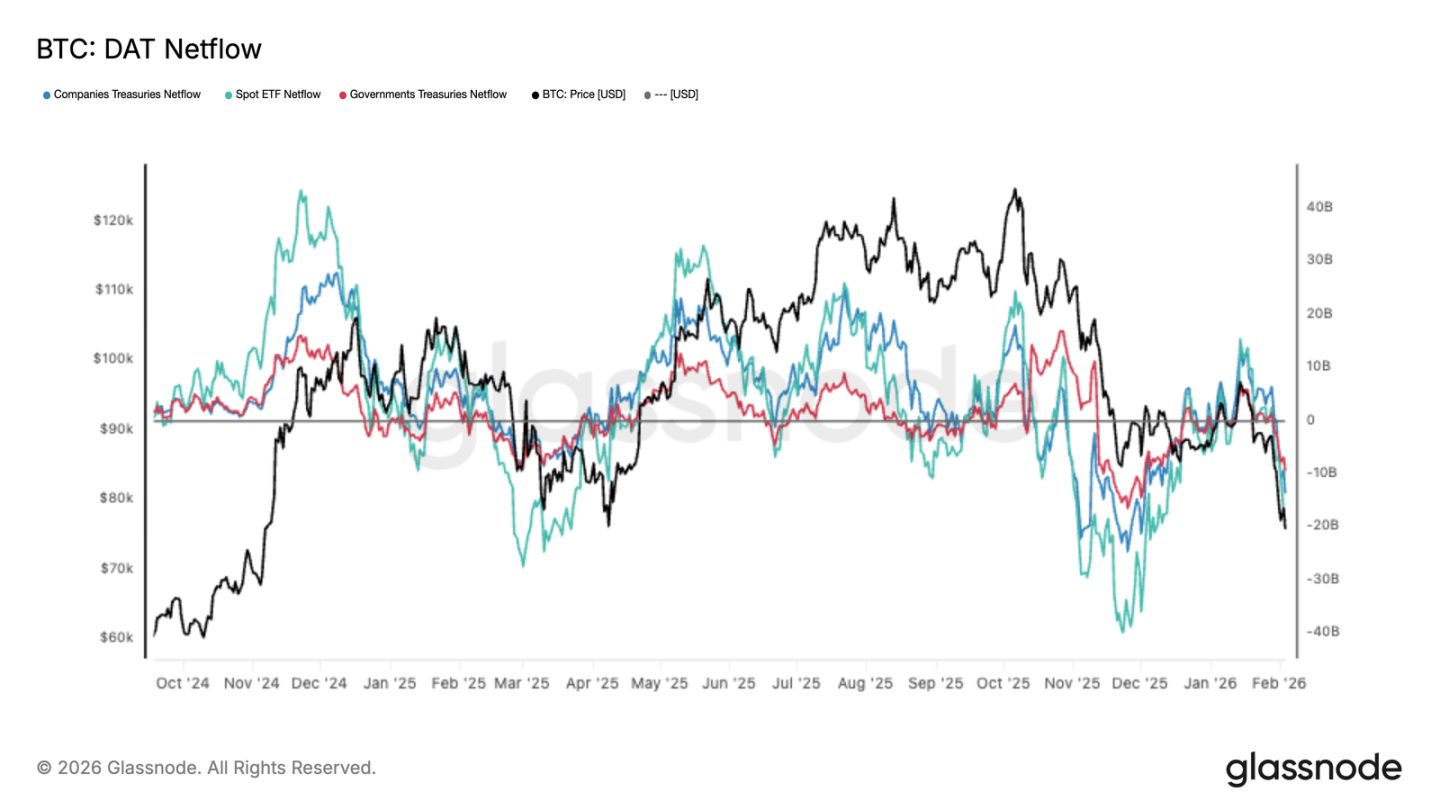

Institutional Capital Turns to Net Outflows

As prices have fallen, demand from major institutional investors has noticeably weakened. Spot ETF inflows have slowed, and corporate and government-related capital flows are also decreasing, indicating reduced willingness for incremental capital to enter the market.

This contrasts sharply with the previous rally phase, where sustained capital inflows provided support for price appreciation. The current shift in capital flows further confirms the lack of new capital entering the market at current price levels.

Spot Trading Volume Remains Thin

Despite the price falling from $98,000 to $72,000, the 30-day average trading volume has not expanded significantly. This indicates a lack of sufficient buying absorption during the decline.

Historically, genuine trend reversals are often accompanied by a significant expansion in spot trading volume. The current volume has only slightly recovered, suggesting market activity is still dominated by position reduction and risk aversion, rather than active accumulation.

Insufficient liquidity makes the market more sensitive to selling pressure, meaning even medium-sized sell orders can trigger larger price declines.

Forced Liquidations in the Futures Market

The derivatives market has seen large-scale long liquidations, setting the highest record since the start of this decline. This indicates that as prices fell, leveraged long positions were forcibly cleared, exacerbating the downward momentum.

It is worth noting that liquidation activity was relatively mild during November-December, suggesting leverage was gradually being rebuilt. The recent surge marks the market's entry into a forced deleveraging phase, where forced liquidations have become a primary factor influencing price.

Whether prices can stabilize going forward depends on whether the deleveraging process is sufficient. A genuine recovery requires the intervention of spot buying; relying solely on position unwinding is unlikely to form a sustained rebound.

Short-Term Volatility Remains Elevated

When the price tested the previous high of $73,000 (now turned support), short-term implied volatility rose to around 70%. Volatility levels over the past week are about 20 volatility points higher than two weeks ago, with the entire volatility curve shifting upwards.

Short-term implied volatility consistently exceeding recent realized volatility indicates investors are willing to pay a premium for short-term protection. This repricing is particularly evident in near-term contracts, showing risk concentration here.

This reflects more a demand for protection against sudden declines rather than a clear directional view. Traders' reluctance to sell short-term options in large quantities keeps the cost of downside protection elevated.

Sustained Increase in Put Option Demand

The volatility repricing shows a clear directional bias. The skew of put options relative to call options has widened again, indicating the market is more focused on downside risks than rebound opportunities.

Even with prices holding above $73,000, option flows remain concentrated in protective positions. This biases the implied volatility distribution negatively, reinforcing the market's defensive tone.

Volatility Risk Premium Turns Negative

The 1-week volatility risk premium has turned negative for the first time since early December, currently around -5, compared to around +23 a month ago.

A negative risk premium means implied volatility is lower than realized volatility. For option sellers, this turns the profit from time decay into a loss, forcing them to hedge more frequently, which in turn increases short-term market pressure.

In this environment, options trading no longer plays a stabilizing role for the market and may instead exacerbate price volatility.

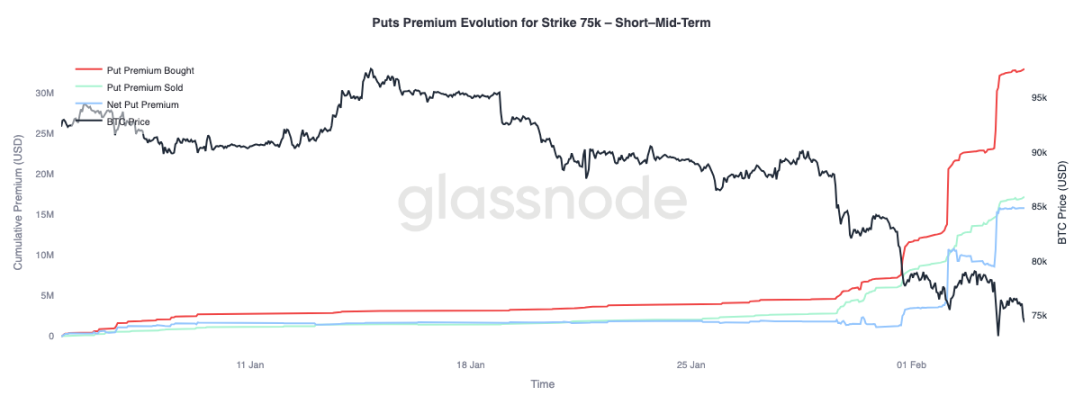

Change in Premium for $75,000 Put Options

The $75,000 strike put option has become a focal point for the market, with this level being repeatedly tested. The net buying premium for put options has increased significantly, a process that has advanced in three stages, each synchronized with price declines lacking effective rebounds.

The situation is different for longer-dated options (over 3 months): selling premiums have begun to exceed buying premiums, indicating traders are willing to sell high volatility in forward contracts while continuing to pay a premium for short-term protection.

Summary

After failing to reclaim the key level of $94,500, Bitcoin broke below the true market average of $80,200, entering a defensive state. As the price fell into the $70,000 range, unrealized profits contracted and realized losses increased. Although initial accumulation signs appeared in the $70,000-$80,000 range and a dense holding zone formed in the $66,900-$70,600 area, persistent loss-selling indicates market sentiment remains cautious.

In the derivatives market, selling pressure shows disorderly characteristics, with large-scale long liquidations confirming the leverage reset process. While this helps clear speculative froth, it is insufficient on its own to form a solid bottom. The options market reflects heightened uncertainty, with rising put demand and high volatility indicating investors are preparing for continued volatility.

The key to future price action still lies in spot demand. Without seeing an increase in spot participation and sustained capital inflows, the market will continue to face downward pressure, and any rebounds may lack sustainability. Until fundamentals improve, risks remain skewed to the downside. A genuine recovery requires time, sufficient turnover of holdings, and a substantive restoration of buyer confidence.