The Next Phase of RWA: The Return of Productive Assets

- Core Viewpoint: In early 2026, the RWA sector experienced counter-trend growth, signaling its transition from proof-of-concept to large-scale implementation. The current growth is primarily driven by highly financialized, compliant assets (such as U.S. Treasuries), but the long-term value of the industry lies in activating the liquidity of productive assets.

- Key Elements:

- The total market size has climbed to $22.9 billion, with the number of holders increasing to 650,000, showing stable growth and stronger asset allocation attributes than trading attributes.

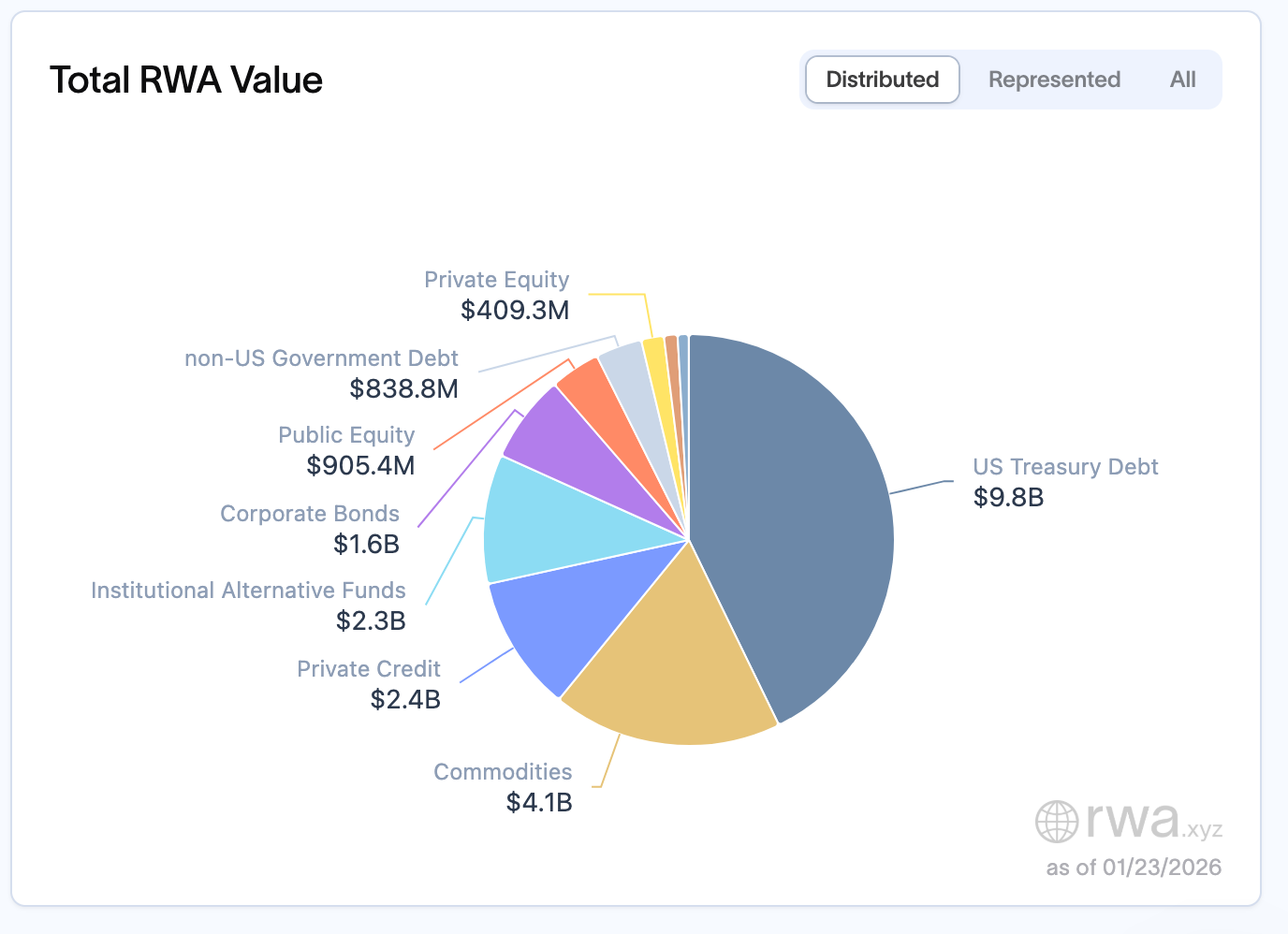

- Assets are highly concentrated in financialized assets, with U.S. Treasuries ($9.8 billion) and gold tokens being the main components, serving scenarios focused on efficiency upgrades such as stablecoin allocation and institutional fund management.

- The trend of institutional dominance is evident, with assets favoring payment chains like Ethereum that have low settlement risk and well-developed regulatory tools.

- Global regulatory frameworks (such as MiCA, Hong Kong's stablecoin regulations) are becoming increasingly clear, and compliance itself is becoming a significant component of asset value.

- Industry consensus is shifting; future growth points lie in productive assets such as computing power and infrastructure revenue rights, requiring the overcoming of challenges related to liquidity, cross-chain costs, and legal compliance.

At the beginning of 2026, the crypto market presents a "tale of two extremes." While the overall market has been fluctuating, the RWA sector has bucked the trend, demonstrating a resilient rebound and gradually reaching a critical inflection point for industry transformation. This is not a short-term, stimulus-driven spike but the result of increasingly clear policy boundaries, continuous institutional investment, and the maturation of underlying infrastructure since 2024. It marks the RWA sector's genuine transition from the proof-of-concept phase to large-scale implementation.

As of mid-January 2026, according to statistics from rwa.xyz, the total RWA market size has climbed to $22.9 billion, a significant increase from $19.22 billion in mid-November 2025. Looking at the holder structure, the industry's growth exhibits stable rather than explosive characteristics. The number of holders rose from approximately 600,000 in mid-December 2025 to 650,000 by the end of January 2026, representing an 8%-9% increase in just over a month. Notably, while the number of monthly active addresses has declined since peaking at nearly 100,000 about a year ago, the total value locked continues to rise. This performance indicates that RWAs are increasingly viewed as allocation assets on balance sheets rather than tokens for high-frequency trading.

Asset distribution and on-chain patterns further highlight the institutionally-driven nature. In terms of on-chain value locked, Ethereum dominates with approximately $13.6 billion in RWA value, accounting for about 60% of the global on-chain RWA total. BNB Chain follows with $2.3 billion, while Solana and Liquid Network hold $1.1 billion and $1.5 billion respectively. Stellar, with $1 billion, has also entered the major league. Clearly, RWA assets favor payment chains with predictable execution, well-developed regulatory tools, and institutional custody support, with value ultimately concentrating in scenarios with the lowest settlement risk.

In terms of asset classes, U.S. Treasuries remain the core pillar, with a size of $9.8 billion, accounting for nearly 45%-50% of the total market and serving as the primary entry point for institutional on-chain investment. Commodities rank second at $4.1 billion, with gold-backed tokens (such as Tether's XAUT coin) being the core assets. Private credit has reached $2.4 billion; although starting from a smaller base, it is growing rapidly and accounts for about 20%-30%. Institutional alternative investment funds, corporate bonds, and public equities stand at approximately $2.3 billion, $1.6 billion, and $900 million respectively, forming the main landscape of the current RWA market. This trend was also confirmed at the industry level during the 2026 World Economic Forum (WEF) in Davos. Tokenization became the central theme of crypto discussions at the forum. Related WEF discussions defined 2026 as a "turning point" for digital assets, explicitly stating that blockchain has moved beyond the pilot stage into real production environments. The focus of discussion has shifted from early ideological debates to infrastructure construction, scalability, and enterprise-level deployment.

When RWA Becomes Part of Financial Engineering

Looking beyond the surface-level growth in size and institutional entry, a deep dive into the asset structure of RWA reveals a clear and realistic trend: the current growth in RWA primarily stems from highly financialized assets. Here, "Real" refers more to the compliant on-chain migration of financial assets rather than directly empowering real-world production activities.

U.S. Treasuries, money market instruments, repurchase agreements (repos), and commodity funds constitute the main body of on-chain RWAs. These assets are not new; they already exist within the traditional financial system, featuring mature risk pricing, highly predictable cash flows, and clear regulatory pathways. The role of blockchain here is not to reinvent these assets but to provide them with a 24/7, composable, and automated operating environment. These assets are essentially on-chain "low-risk yield instruments," serving three core scenarios: underlying asset allocation for the stablecoin system, efficient management of institutional funds, and interest rate anchoring for the DeFi ecosystem. This layout is fundamentally an efficiency upgrade within the financial system—a reconstruction and circulation of traditional financial assets on-chain—rather than an extension or expansion into real-world economic scenarios.

Within the current total RWA size of approximately $22.9 billion, U.S. Treasuries lead with about $9.8 billion, constituting the largest single category. Commodities account for about $4.1 billion, with gold-backed tokens (like Tether's XAUT) becoming the single largest asset within the entire RWA market. Private credit stands at about $2.4 billion, and institutional alternative investment funds at about $2.3 billion. Corporate bonds, public equities, and non-U.S. government debt are concentrated in the $800 million to $1.5 billion range. The dominance of Treasuries, money market instruments, and repos is precisely because they are the easiest for institutions to incorporate into existing risk management frameworks. They have clear cash flows, extremely low default probabilities, mature valuation systems, and readily available infrastructure for compliance and custody. The role of blockchain here is not to reshape the assets themselves but to reduce settlement friction and improve distribution efficiency.

This characteristic aligns perfectly with the core needs of institutions: corporate treasury departments pursue yield and operational efficiency—tokenized Treasuries offer 4%-6% returns with 24/7 access, significantly advantageous over the traditional market's T+2 settlement cycle; private credit instruments typically offer yields significantly higher than traditional fixed-income assets, making them highly attractive to institutions managing large idle capital. Asset management companies use tokenization to lower distribution costs and expand their investor base. Banks focus on building infrastructure under compliance premises. This demand-driven approach further reinforces the current financialized nature of RWA.

How RWA Reached This Point

Looking back at the development path of RWA, one can clearly see the phased changes in asset structure. The core logic behind this is the shift in participant composition. The entry of different types of capital directly determines the allocation direction of RWA.

During 2020–2022, RWA primarily referred to private credit, trade finance, and SME loans. MakerDAO directed on-chain stablecoin capital to real-world businesses through RWA Vaults; Centrifuge tokenized receivables; Goldfinch attempted to build an on-chain credit network without crypto collateral. That was a phase characterized by high yields, high risk, and a strong "real-world" narrative. The core goal was to provide financing channels for small and medium-sized entities in the real economy, connecting on-chain capital with offline production.

The turning point came in 2023. As native DeFi yields systematically declined while stablecoin scale continued to expand, the on-chain world urgently needed a scalable, sustainable source of real yield. Market demand shifted accordingly. U.S. Treasuries, as low-risk, stable-yield financial assets, quickly filled this gap. With 4%–6% annualized returns, 24/7 accessibility, and T+0 settlement, they became the ideal entry point for institutions into the on-chain world. The asset structure gradually tilted from productive assets towards financial assets, and institutional capital's attention gradually increased.

As institutions gradually became the dominant force, the asset composition presented on-chain by RWA also changed accordingly: repurchase agreements (repos) have gradually taken a dominant position among currently mapped assets, while the relative proportion of private credit has continued to decline. This structural adjustment essentially reflects the shift in participant composition: when the dominant capital came from the DeFi ecosystem, RWA leaned more towards the private credit model; when institutional capital became the main force, asset allocation naturally concentrated towards repos.

The Success of Repo Also Reveals Its Boundaries

The value of repos to the RWA industry is undeniable. Their low-risk, highly standardized, and highly liquid nature makes them easily gain regulatory approval, becoming a core vehicle for building on-chain financial infrastructure. They perfectly fit the current needs of institutions, serving both as safe underlying assets for stablecoins and as benchmarks for on-chain interest rate anchoring, promoting the smooth integration of RWA with the traditional financial system. It can be said that repos are the "financial foundation" for the large-scale development of the RWA industry, laying a compliant and stable foundation for its growth.

However, the strengths of repos are also their boundaries. Repos do not create new economic activity nor improve financing accessibility in the real world. They primarily reduce settlement costs and enhance operational efficiency within the existing financial system through blockchain technology, rather than addressing "real economic financing problems." Essentially, this is a self-circulation within the financial system.

This is not a negation of repos but a definition of their role. Repos are the financial foundation of RWA but are unlikely to be the final form. What truly needs RWA are not the already highly liquid financial assets, but those productive assets with real output capacity that suffer from insufficient liquidity and low financing efficiency.

Infrastructure, energy projects, computing power resources, receivables, and private credit all have clear cash flows but are often constrained by the high barriers and inefficiencies of the traditional financial system. What they need is not higher interest rates but more suitable financing structures. The core pain point for traditional financial institutions currently is insufficient asset liquidity, which is precisely what the tokenization of such assets aims to solve: Physical assets like solar power stations and real estate have high value but rigid transaction models. The traditional "all-or-nothing" transaction model limits asset utilization efficiency. Tokenization enabling fractional ownership can significantly enhance the liquidity of such assets, breaking the bottlenecks of traditional finance.

Ultimately, yield is not the goal but the natural outcome after an asset is utilized. Repo yields come from the interest rate environment, while productive asset yields come from real demand. When the asset itself is not effectively utilized, even the most sophisticated yield design is unsustainable.

Therefore, the true value of RWA is not to make already liquid assets liquid once more, but to allow assets that were previously illiquid to truly enter the global financial system for the first time.

Compliance is Becoming Part of the Asset's Value Itself

As institutional participation deepens, a key shift is occurring in the RWA narrative: compliance is no longer just a constraint; it is itself becoming part of the value.

Since 2025, clearer regulatory frameworks have become an important catalyst accelerating RWA development. In Europe, the MiCA regulation, effective since the end of 2024, continues its implementation phase, providing clear legal boundaries for tokenized financial activities. In Asia, Hong Kong saw multiple regulatory actions materialize in 2025. For instance, the Stablecoin Ordinance took effect on August 1, establishing a licensing regime for fiat-backed stablecoins. In June, the government released a new version of its digital asset policy statement, explicitly supporting digital asset development including RWA tokenization, and promoting compliant digital asset innovation through regulatory sandboxes and pilots. Overall, these institutional advancements reflect a trend in major global markets moving from observation towards scalable implementation.

At the 2026 Davos Forum, tokenization was repeatedly mentioned as a "turning point" for digital assets. The focus of discussion is no longer "whether it should be incorporated into the financial system" but "how it should be integrated." Institutions like BlackRock, BNY Mellon, and Euroclear have already begun substantive deployments in tokenized funds, private debt, and structured products. In this context, there cannot be only roadmaps without assets; only narratives without law; only consensus without structure; only sentiment without rules. The future value of tokens will stem not only from market consensus but also from compliance certainty.

Simultaneously, when returning to the essence, the core issue of RWA is not the "on-chain" aspect itself. Tokenization is a technical problem, while the financing structure is the fundamental problem. How assets are priced, how risks are allocated, how cash flows serve investors, and how defaults and governance are executed—these structural designs are far more important than "whether there is a token." As the industry consensus states: "RWA is not about putting assets on-chain. It’s about rethinking how capital reaches production."

Moving Towards 2026: The Next Phase of RWA

Looking ahead, industry consensus is gradually converging. On the asset side, the focus will shift from financial asset dominance to deep cultivation of productive assets, with computing power assets, infrastructure revenue rights, and commodities becoming new growth engines. On the product side, there will be an upgrade from single tokenized products to structured financing models, meeting the risk and return needs of different entities. On the narrative side, the focus will shift from a pure yield narrative to risk transparency and governance optimization, strengthening the trust foundation for institutions and retail investors. On the implementation side, the move will be from pilot projects to large-scale applications. As investment barriers lower and compliance tools improve, the number of RWA holders is expected to achieve further breakthroughs in 2026.

Despite the rapid development momentum, the RWA industry still faces multiple challenges: mechanisms for asset authenticity and continuous auditing are not yet perfected; the quantification and control of operational risks lack unified standards, hindering large-scale implementation; insufficient secondary market liquidity affects asset pricing and exit efficiency; differences in legal structures and cross-border compliance pose obstacles to cross-regional deployment. Furthermore, on the technical level, cross-chain transaction costs amount to $1.3 billion annually, price discrepancies of 1%-3% exist for the same asset on different chains, and the conflict between privacy needs and regulatory transparency remains unresolved. These are core obstacles to industry advancement.

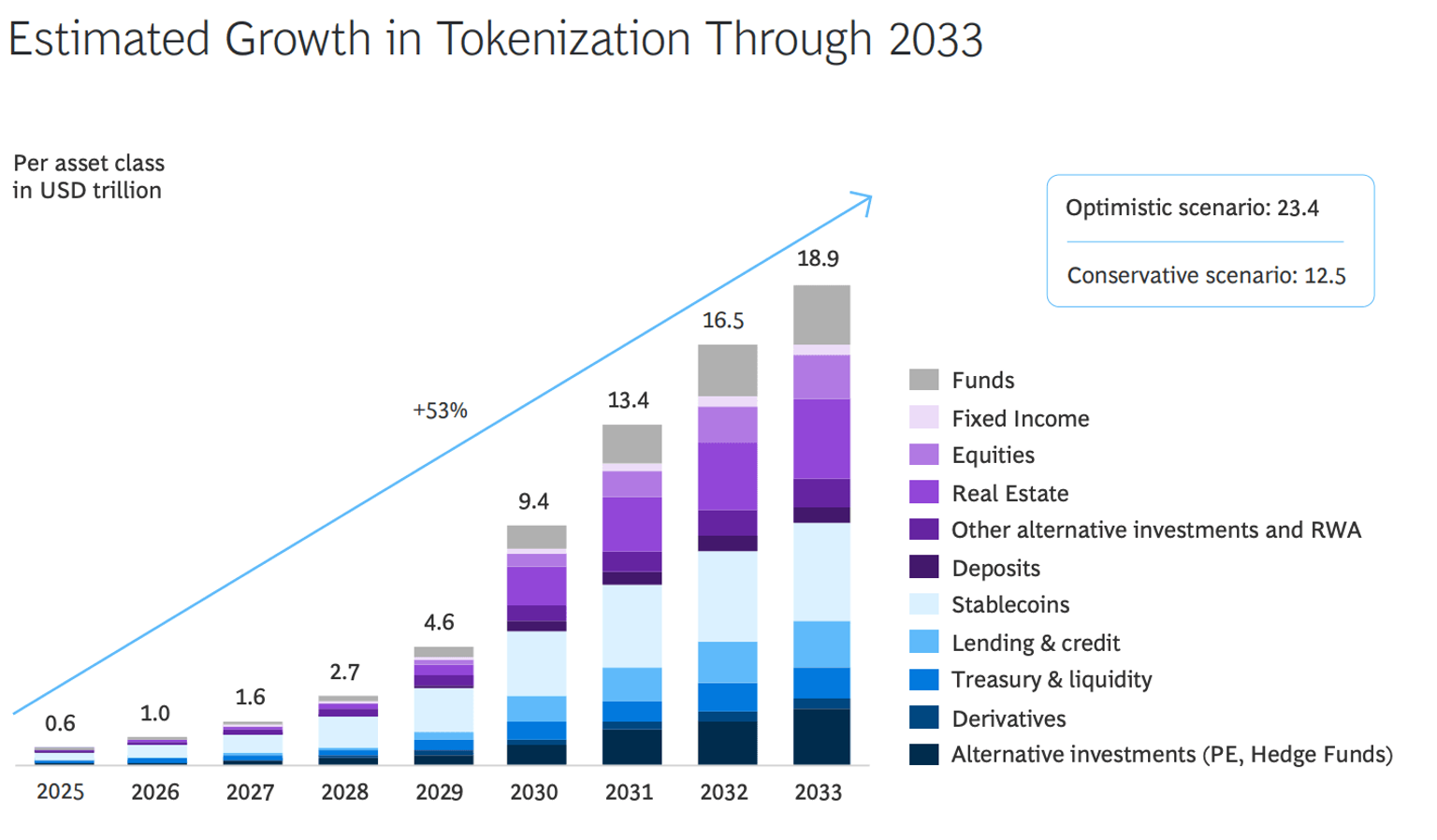

However, the direction is clear. As predicted by Boston Consulting Group (BCG), the RWA market size is expected to reach $18.9 trillion by 2033, indicating significant growth certainty. RWA has become the primary lens through which the global financial world engages with the crypto space—no longer a disruptive force but a lasting infrastructure reshaping capital markets. In 2026 and beyond, the development of RWA will no longer be defined by yield levels but by the depth of its integration with real-world production. Only by rooting itself in the real economy and activating the liquidity of productive assets can RWA truly unleash its core value of redefining the connection between finance and production.