Bitcoin Mining Outlook 2026: Seven Trends Defining the Industry's Future

- Core Viewpoint: The Bitcoin mining industry will accelerate its maturation and professionalization in 2026. Driven by an improving macro environment, technological upgrades, and deep capital involvement, it will exhibit seven key trends: vertical integration, AI transformation, efficiency competition, sovereign nation participation, cloud hashrate proliferation, and financialization, deeply integrating into the global energy and financial landscape.

- Key Elements:

- Improving Macro and Regulatory Environment: The Federal Reserve is expected to cut interest rates. If the U.S. "CLARITY Act" passes, it will clearly define Bitcoin as a digital commodity under CFTC oversight, providing certainty for large-scale institutional capital inflows.

- Accelerated Industry Vertical Integration: Leading mining companies are gaining control over the entire chain—from self-built energy sources to hardware R&D and operations—to reduce production costs and enhance strategic flexibility.

- Strategic Shift Towards AI/HPC: Miners are leveraging existing power and data center infrastructure to retrofit for AI computing power, creating a crucial diversified revenue stream during bear markets or post-halving cycles.

- Intensifying Energy Efficiency Race: ASIC miner efficiency has dropped below 10 J/TH, accelerating the retirement of older equipment. Technological upgrades have become key to miner survival.

- Deepening Sovereign Nation Involvement: Energy-rich nations (e.g., Turkmenistan, Bhutan) are using legislation or state-owned investments to turn mining into a means of monetizing surplus energy and accumulating strategic reserve assets.

- Emerging Trend of Mining Financialization: Production tools like hashrate and mining rigs are evolving into priced, financeable financial assets. Miners are using financial instruments to manage risks, driving the industry towards de-Beta-ization.

From over a decade ago when a single PC could mine at home to the profound transformation the industry has undergone today, its breadth and depth would have been almost unimaginable just a few years ago.

Looking back at 2025, the industry witnessed Bitcoin surging to a historic high of $126,000 in October, but also endured the chill of the hash price plummeting to a record low in December. Hot money poured in, with even the Trump family completing a public listing via American Bitcoin. The network's total hashrate grew by 30% for the year, significantly intensifying competition within the Bitcoin mining sector.

As 2026 begins, here are the key trends shaping the industry for the year ahead.

Loose Macroeconomic Conditions and Friendly Regulatory Environment

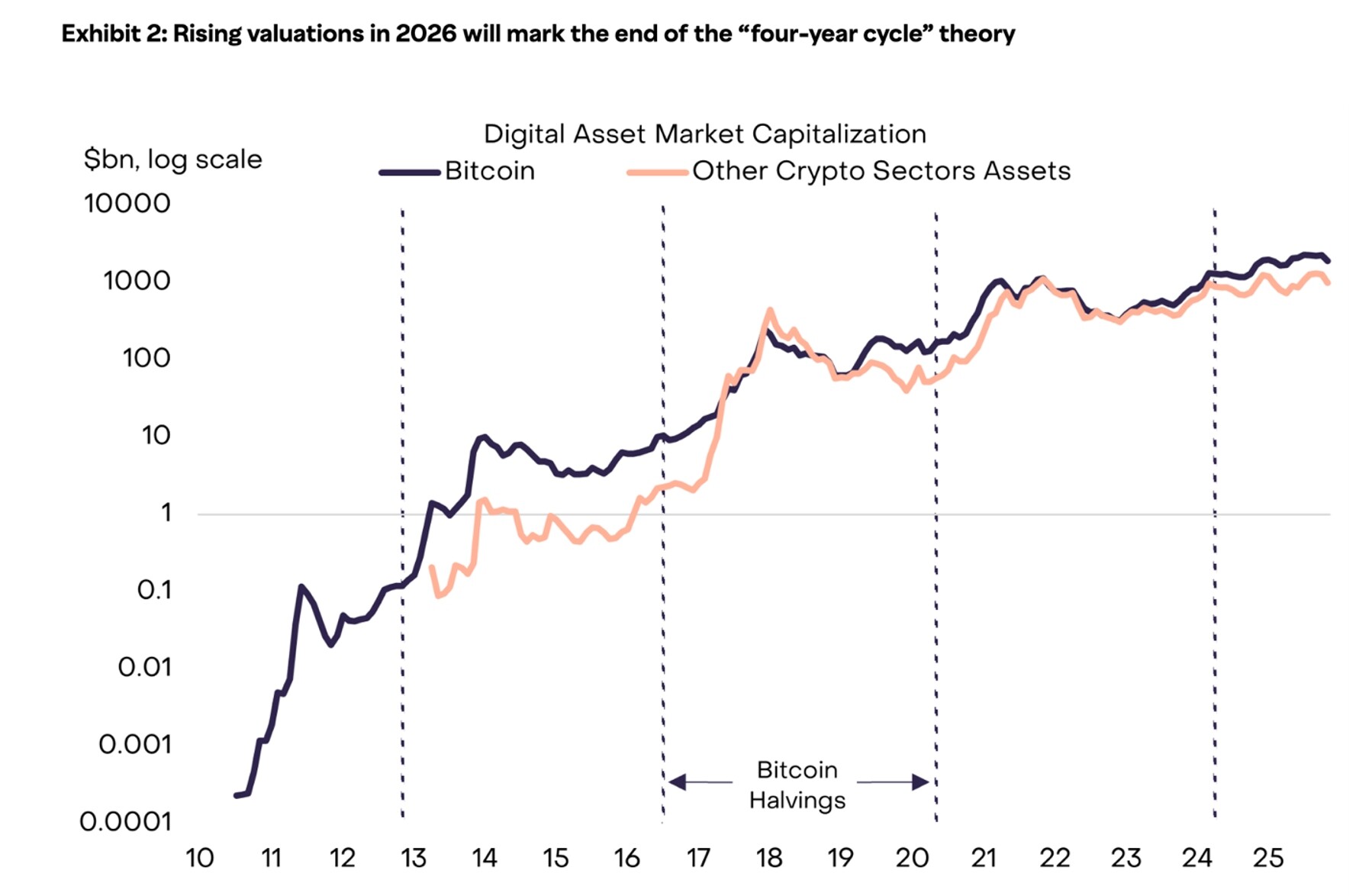

Compared to the past few years, the macro environment for Bitcoin mining has undergone a fundamental shift. Monetary policies in major global economies are trending towards easing, coupled with increasingly friendly regulatory frameworks, creating a favorable backdrop for Bitcoin's price trajectory.

According to the 2026 outlook from the prominent US digital asset management firm Grayscale, the Federal Reserve is expected to cut interest rates at least twice in 2026, with a probability of 74%. This loose monetary environment will directly stimulate strength in value-storage assets like gold and silver. Bitcoin, as a "portable, transferable, and scarce" digital gold, is further solidifying its position as a crucial anchor for institutional capital allocation.

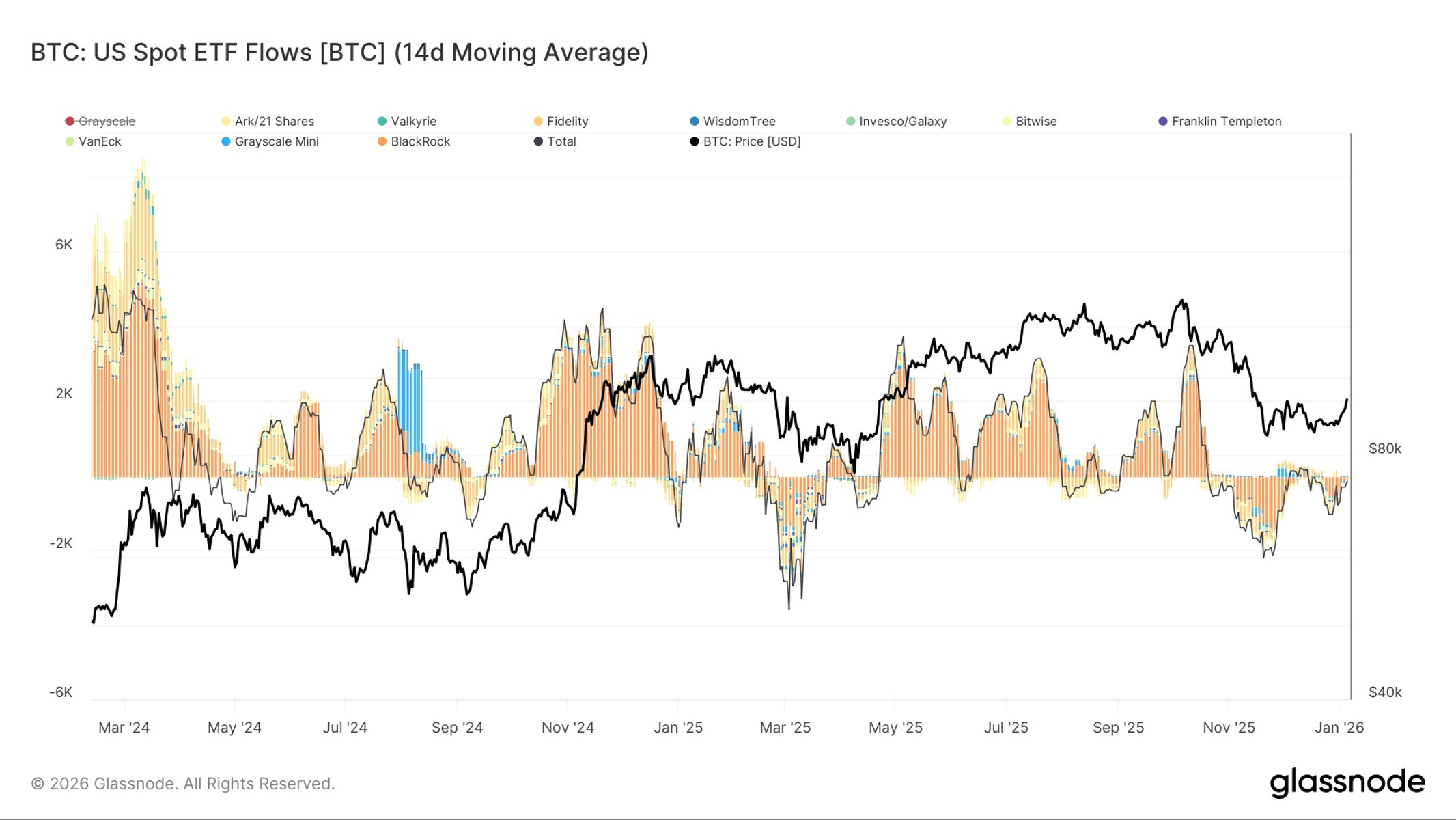

The current Bitcoin price is down 44% from its October 2025 peak and 24% from Trump's inauguration day. Crypto research firm K33 Research points out that the primary reasons for the decline are leverage imbalances and localized bubbles, not a deterioration in fundamentals. The divergence between price and fundamentals has, in fact, created an excellent accumulation window, with institutional investors showing a strong willingness to return. According to Bloomberg statistics, net inflows of approximately $1.2 billion were achieved in just the first two days of this year.

On the regulatory front, the US's crypto-friendly direction was solidified following the 2025 election. The most important piece of legislation this year, the "CLARITY Act" (Digital Asset Market Clarity Act), is expected to be voted on in the Senate by the end of January. If passed, this bill would clearly define Bitcoin and Ethereum as "digital commodities" under CFTC oversight, marking Bitcoin's formal entry into the mainstream financial system. Banks could more safely custody Bitcoin, institutions could trade it more freely, cryptocurrency companies including miners could access lower-cost financing, and participation from pension funds and long-term capital would significantly increase.

Those sovereign governments that were once skeptical of cryptocurrencies are now actively building institutional frameworks to embrace them. For mining companies, this regulatory certainty translates directly into confidence for long-term capital investment. When you are deploying infrastructure worth tens of millions to hundreds of millions of dollars, knowing that the policy ground beneath you won't suddenly collapse is of immense value.

Against this macro backdrop, even if future easing temporarily slows due to recurring inflation, supply-constrained assets like gold, Bitcoin, and certain commodities are still expected to receive structural support. This means that Bitcoin's long-term investment thesis is no longer highly dependent on a single monetary policy path but is gradually being built upon the more solid value foundation of its status as a "scarce asset."

Vertical Integration: Controlling Every Step of the Value Chain

A key trend within the mining industry itself is the acceleration of vertical integration. By 2026, the most successful mining companies will no longer compete solely on hashrate but will be enterprises that control the entire chain of energy, hardware, and operations, thereby reducing the production cost per Bitcoin.

Recall the days when mining companies were merely data center operators, relying on the grid for power and ASIC manufacturers for equipment. Today, leading miners are simultaneously becoming energy companies, hardware developers, and infrastructure operators.

Energy is the largest operational cost for miners, typically accounting for 60%–70% of total expenses. Therefore, owning one's own power generation sources can significantly reduce long-term costs and improve predictability (free from grid price volatility).

Many mining companies are beginning to invest in or partner to build energy facilities, such as off-grid self-built power from wind, solar, and battery storage, or collaborating with renewable energy developers. For instance, setting up mining farms next to large solar or wind farms, sharing power sources, and sometimes using mining as a "curtailment absorption" solution to improve the economics of renewable energy assets. Others are directly operating gas-fired power plants, exploring self-generation for mining.

The same applies to hardware. ASIC (Application-Specific Integrated Circuit) miners were originally just sold to miners, mining farms, and data centers. However, during 2024–2025, many ASIC manufacturers also pivoted to self-mining. When market demand for new miners slows (due to rising difficulty, electricity costs, or falling prices), manufacturers may hold large inventories. To avoid profit erosion from price cuts, they deploy these miners themselves to mine directly, converting inventory into Bitcoin reward revenue. This strategy is particularly pronounced during Bitcoin bull markets.

This integration not only improves gross margins but also brings strategic flexibility. Controlling energy allows for optimal global site selection; controlling hardware enables phased hashrate upgrades. This has become the dividing line between industry leaders and those struggling to keep up.

The AI Transformation Wave

The most noteworthy trend of 2025 was the strategic pivot of mining companies towards AI and High-Performance Computing (HPC), a trend that will intensify further in 2026.

The AI boom in the US has created a voracious demand for energy. A Morgan Stanley report indicates that by 2028, the US could face a 20% electricity supply gap due to AI data center consumption, equivalent to the power used by 33 million households. Mining companies, fortuitously, possess ready-made infrastructure and power contracts, giving them a natural supply advantage. These data centers, often ranging from tens of megawatts to several gigawatts, can be retrofitted to host AI GPU clusters. When bear markets or halvings compress mining profitability, pivoting data centers to AI workloads becomes a crucial revenue diversification strategy.

For grid stability, Bitcoin miners can help by rapidly adjusting their power usage, a flexibility that traditional AI data centers cannot provide.

Of course, the transition is not without challenges. As our VP of IR, Charley Brady, explained to Seeking Alpha, a data center may require hundreds of millions of dollars to support AI workloads, needing GPUs and AI chips, which are more expensive than ASIC miners used for Bitcoin mining. However, miners already own land, permits, and grid connections, so retrofitting a data center for AI is much faster than building from scratch, offering a structural advantage.

Furthermore, AI data centers require significant investment to upgrade existing cooling systems and network infrastructure, which is why miners transitioning to AI/HPC often take on substantial debt. Media outlet CCN estimates that numerous listed mining companies have raised over $4.6 billion through debt/convertible bonds for growth.

The Era of Energy Efficiency Supremacy

The technological arms race in mining hardware has reached a critical point. 2026 will be the year where efficiency reigns supreme.

Recall three years ago when 20 J/TH was considered top-tier. Today, ASIC manufacturers have launched models with energy efficiency below 10 joules per terahash (J/TH). The average mining efficiency of leading publicly listed mining companies is now below 20 J/TH.

The harsh reality is that if miners are still using equipment from several years ago, mining economics have become unsustainable unless electricity costs drop below 3 cents/kWh or even lower.

2026 will witness an accelerated wave of old equipment retirement. This is undoubtedly painful for small miners unable to bear the capital expenditure for upgrades and new machines, but it is an inevitable result of technological progress. Of course, these old machines aren't worthless; there are still regions with lower or even free electricity. Moreover, some OS solutions offered by mining companies can reduce miner power consumption by underclocking. For the US market specifically, by 2026, US tax law will allow for full depreciation of mining equipment, significantly improving after-tax cash flow.

Sovereign Nations Enter the Mining Arena

The most noteworthy geopolitical trend is the deep involvement of sovereign nations in Bitcoin mining.

For energy-rich countries, mining is an effective way to monetize energy or surplus electricity: unburnable natural gas, hydropower during the wet season, flared associated gas, and renewable energy exceeding grid absorption capacity can all be converted into Bitcoin.

At the beginning of 2026, the "Virtual Assets Law" of the Central Asian nation Turkmenistan came into effect. This law establishes clear rules for cryptocurrency mining, digital asset issuance, and the operation of digital asset trading platforms, bringing order to a previously unregulated industry for the first time. Starting January 1st, mining and trading have been brought into the open.

Other countries that have benefited earlier from Bitcoin mining include Bhutan, where the government, through a state-owned investment arm, utilizes surplus hydropower for Bitcoin mining, accumulating Bitcoin reserves since 2019. Turkmenistan's neighbor, Kazakhstan, once became the world's second-largest Bitcoin mining country, accounting for 18% of the global network hashrate, second only to the US. Japanese power companies (partially state-owned or state-controlled) also launched Bitcoin mining pilots last year. In Africa, El Salvador has experimented with using volcanic geothermal energy for mining.

More strategically, Bitcoin is being viewed as a strategic reserve asset similar to gold. For nations seeking to reduce dollar dependence or hedge against local currency depreciation, domestic mining provides a channel to accumulate Bitcoin without purchasing it on the open market.

Cloud Mining: The Gateway for Individual Participation

Finally, let's discuss how individuals can participate in mining. The reality is: mining with a single ASIC in one's garage is becoming increasingly impractical. Rising difficulty, high residential electricity prices, and the low uptime efficiency of individual mining operations compared to industrial requirements are pushing retail participants out of direct mining.

But this doesn't mean individuals are excluded; rather, the mode of participation is evolving. Models like cloud mining and online hashrate trading platforms are growing further, a trend that will accelerate in 2026.

These platforms allow users to purchase hashrate shares without worrying about hardware, electricity, cooling, or maintenance, enjoying the efficiency benefits of scaled mining farms while avoiding operational complexity.

The industry itself is also less chaotic than a few years ago. Leading platforms are maturing, with improved transparency, clearer fee structures, and more flexible contracts, making cloud mining a viable path for legitimate retail participation. While there have been fraudulent cases historically, legitimate operators have established credible track records.

I believe this is a natural evolution of industry maturation. Just as investing in gold doesn't require owning a gold mine, participating in the Bitcoin mining economy doesn't require building a mining farm. This "intermediated democratization" both expands industry accessibility and allows professional miners to focus on efficiency optimization.

The Financialization of Mining

Entering 2026, Bitcoin mining is gradually transitioning from a singular hashrate operation model towards a more capital-intensive, financialized stage. Hashrate, mining rigs, and mining facilities are no longer just production tools; they are evolving into financial assets that can be priced, financed, and traded. This shift is not without precedent: in traditional mining, Barrick Gold financialized its future gold production through hedging, and Franco-Nevada securitized future mine revenues through royalty and streaming agreements.

A similar logic is replaying in the Bitcoin mining industry. Miners are beginning to view future Bitcoin production as cash flows that can be discounted. Through hashrate contracts, miner leasing, hosting agreements, and more complex structured arrangements, operational risks and price risks are being split and recombined. With the maturation of RWA (Real World Asset) structures and the continuous improvement of Bitcoin derivative instruments, the pricing and financing efficiency of mining assets are significantly enhanced.

This trend also helps drive the gradual de-beta-ization of the Bitcoin mining market. Miners do not fully bear the high volatility of Bitcoin prices but actively manage risks and smooth returns through financial instruments, evolving mining from a high-leverage, high-volatility activity towards a hybrid form of infrastructure and financial asset.

Looking Ahead

Bitcoin mining in 2026 has evolved from a geek experiment into a global industry integrating institutional capital, national strategy, and cutting-edge technology. The seven trends—macro easing, vertical integration, AI transformation, efficiency competition, sovereign entry, cloud mining proliferation, and mining financialization—all point in the same direction: Bitcoin mining is maturing, professionalizing, and deeply integrating into the fabric of the global economy, becoming infrastructure within the global energy and financial landscape.

The foundation being laid today will support Bitcoin for decades to come. And 2026 is destined to be a pivotal year in this journey.