HYPE Buying Power Far Exceeds Expectations: Decrypting PURR's ATM Dynamic Expansion Mechanism

- Core Viewpoint: The article points out that the market's focus on PURR (HYPE's DAT) is misplaced. Its core advantage is not a fixed capital balance, but rather its ATM issuance mechanism, which can dynamically convert market momentum and trading volume into nearly unlimited buying power, thereby redefining its behavioral logic.

- Key Elements:

- PURR issues new shares via ATM (At-The-Market) offerings. Its issuance capacity is linked to trading volume, theoretically allowing it to continuously secure new funds while maintaining market momentum.

- ATM issuance pricing is based on VWAP (Volume-Weighted Average Price), enabling sales at a price slightly below the current market price during uptrends, avoiding direct dilution at a discount.

- Based on S-1 filings and market data estimates, at current trading volume levels, PURR can obtain approximately $8 million in new "ammunition" daily through ATM issuance.

- HYPE, as the underlying asset, possesses characteristics such as protocol revenue conversion and deflationary supply, avoiding the structural trap where most DATs fail due to a lack of intrinsic value in their assets.

- PURR's issuance activities occur when there is an mNAV (Market-to-Net Asset Value) premium. This is fundamentally different from the traditional DAT path of issuing at a discount, which leads to a death spiral.

Original Title: PURR's HYPE Bid Is Not What You Think

Original Author: @ericonomic

Original Compilation: Peggy, BlockBeats

Editor's Note: In the discussion about DAT PURR for HYPE, the market often focuses on just one question: how much "ammunition" it has left to buy HYPE. However, this article attempts to point out that the key is not the balance, but the mechanism. By interpreting the S-1 filing and the logic of DAT issuance, the author reveals a commonly overlooked fact: with mNAV premium and real liquidity present, ATM issuance can allow "firepower" to expand dynamically with trading volume, rather than being consumed linearly.

This also redefines PURR's behavioral motivation: buying is not just about spending funds; it could be about maintaining momentum and amplifying future financing capacity. The article further explains why most DATs fail and how HYPE avoids typical pitfalls in terms of asset attributes and structural design.

The following is the original text:

Most people pay attention to PURR (formerly known as Hyperliquid Strategies or HSI) for one reason only: it is one of HYPE's DATs (and currently the largest one), continuously accumulating HYPE.

So, the mental model is simple: "PURR still has a few million dollars in quota left, which it can use to continue holding or push up the price."

This model is useful. But it's also incomplete.

Because in the background, there exists a mechanism that can quietly transform "remaining firepower" into almost unlimited ammunition.

Once you see this, you won't view PURR as just a "wallet with a balance" anymore. You'll start to see it as something else.

Bob Diamond, Chairman of HSI

Before continuing, if you want a deeper understanding of PURR and its relationship with HYPE, I recommend reading my previous article, especially point 3, where I specifically discussed this issue. Some of the data there is slightly outdated, but we will revisit this point later.

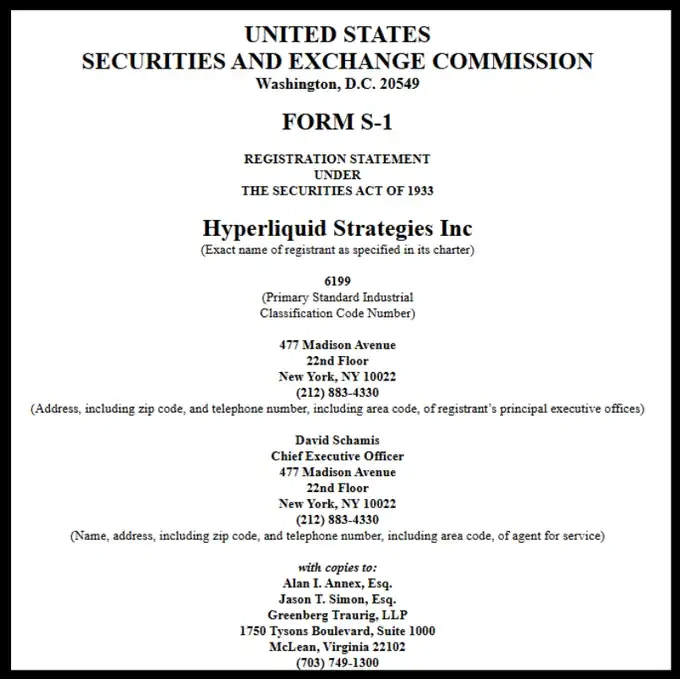

As before, all information in this article comes from the officially released S-1 filing. Additionally, I will incorporate some interview content and make reasonable assumptions in the text.

HSI's S-1 Filing

Let's get straight to the point.

Besides "PURR may still hold over $100 million in funds to buy HYPE," what else do you need to know?

The core is really just this: their "firepower" might not just be over $100 million; it may not be limited to a fixed-size treasury; rather, it can be dynamically amplified by mNAV and market liquidity.

To understand this, we need to start with the basic mechanism of DATs.

The Basic Mechanism of DATs

Bobby starts doing the math

A Digital Asset Treasury (DAT) is a type of company whose core objective is the continuous accumulation of crypto assets. Their funding sources typically come in three main forms:

Investors seeking crypto asset exposure at a discount provide cash, and the DAT issues shares to them in exchange, rather than giving them crypto assets directly;

Holders wishing to "exit" their crypto asset positions surrender the crypto assets, and the DAT pays them cash, usually at a price below the current market price;

Issuing and selling new shares (this is crucial).

PURR's case is slightly more complex because it is the result of a merger of multiple companies; but to simplify the discussion, we can first assume its funding primarily came through methods (1) and (2).

One point needs to be clear: their core objective, at least in theory, should be to maximize shareholder returns, not to "pump" a particular crypto asset.

But in reality, most DATs end up following the old "pump-and-dump" path, failing almost like a rug pull.

This is precisely where the Market Net Asset Value (mNAV) ratio comes in. mNAV is an indicator used to judge whether a company's stock is trading at a discount or a premium.

A simple example: Suppose there is a DAT with HYPE as its core asset: holding $1 billion worth of HYPE; no liabilities, no extra cash; a total of 500,000 shares issued, priced at $2000 per share.

Then its mNAV is calculated as: (500,000 × 2,000) / 1,000,000,000 = 1

mNAV = 1 means the company's stock price is fairly valued.

If the stock price is higher, mNAV > 1, it means the company is trading at a premium;

If the stock price is lower, mNAV < 1, it means it's trading at a discount.

Now, let's return to the previously mentioned point (3), which is the most critical and easily overlooked part of the DAT mechanism: where and how does a DAT issue new shares? This is where the story truly diverges.

The Fork in the Road: How DATs Issue New Shares

Two Paths for Issuing New Shares

Some DATs choose to issue additional shares and sell them at a discount via OTC to specific buyers, often with short lock-up periods.

This tends to trigger the classic "death spiral": when the lock-up ends, buyers sell off en masse; the stock price falls; if they want to continue raising funds, they have to offer even larger discounts; mNAV declines further; and the cycle repeats.

Another type of DAT chooses to issue new shares via an ATM (At-The-Market) offering when mNAV is at a premium.

ATM issuance refers to: the company gradually issuing and selling new shares in the public market, while strictly adhering to liquidity and trading volume constraints.

The pricing of these ATM shares is not discounted OTC, but is anchored to the market price (typically based on VWAP, Volume Weighted Average Price).

There is a subtle but very important difference in mechanism, especially crucial in practical operation.

Since ATM issuance references VWAP, not the latest transaction price, during a strong uptrend, the spot price often briefly exceeds the VWAP. At this point, new shares can be absorbed by the market at a level slightly below the spot price without offering any explicit discount or special terms.

For example: If PURR quickly rises intraday from $10 to $12, while the VWAP is still at $10.80, then ATM shares are effectively sold at about 10% below the spot price. Even though, by the rules, they are still "issued at market price."

As higher-priced volume accumulates, the VWAP naturally shifts upward and catches up to the spot price.

As you might expect, PURR chose the second path. And this is where things start to get really interesting.

The Next Question: When Can PURR Issue New Shares, and How Many?

Based on some interview content, David Schamis (@dschamis) mentioned that when PURR trades above 1x mNAV, they would consider initiating an ATM offering.

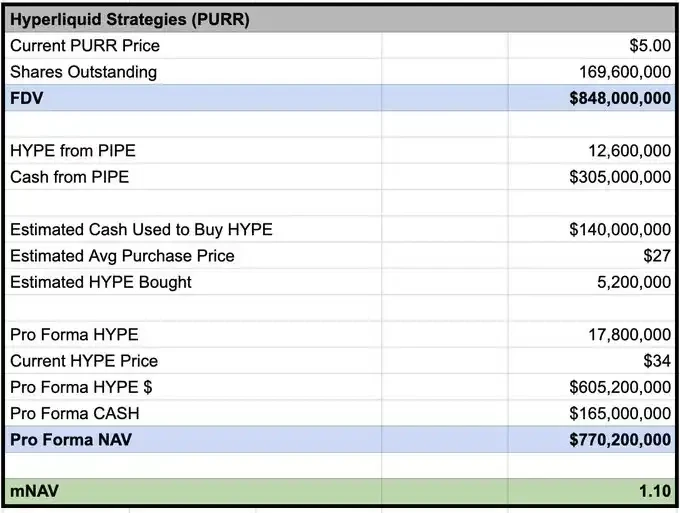

According to calculations by @Keisan_crypto, PURR's current mNAV is approximately 1.10, meaning if they are willing, they already meet the conditions to issue new shares.

Keisan's mNAV calculation based on 03/02 price

But the question is: How many can they issue? Most people stop here. And the real advantage starts right here.

The S-1 Mechanism Most People Didn't Understand

According to the S-1 filing disclosure, as the intermediary selling shares on behalf of the company in the market, Chardan has a beneficial ownership cap of 4.99%. At current prices, this means it can only temporarily hold PURR stock worth approximately $50 million at most.

But this does not mean they can only issue a maximum of $50 million in new shares.

What it truly means is: at any given point in time, Chardan cannot "hoard" shares exceeding this scale. As long as shares are continuously sold into the market and distributed, they can keep issuing more new shares.

Additionally, in practice, Chardan is also bound by trading rules and market manipulation restrictions. Typically, this limits the daily ATM issuance volume to about 20% or less of the day's trading volume.

Taking the most recent trading day as an example: PURR's daily volume was about 7 million shares (approximately $42 million); at this pace, Chardan could sell about $8.4 million worth of shares via ATM per day.

PURR Price Chart

The Key Conclusion (The punchline)

In other words: if trading volume can be maintained at current levels, PURR could potentially add about $8 million in "firepower" per day for buying HYPE.

Again, this does not mean they will blindly sweep the order book and buy at any price; but the incentive structure here is completely different from a PIPE.

PIPE financing: Funds are received in a lump sum, there's no urgency, they can hold cash and wait for sell-side pressure to appear slowly.

ATM issuance: The incentive structure changes.

If issuance capacity expands with trading volume and momentum, and higher PURR volume can keep the ATM window open, then maintaining HYPE's strong momentum might actually expand future issuance and financing capacity.

Under this structure, actively buying during an uptrend is no longer irrational. It can be a means to maintain liquidity, boost trading volume, and maximize the funds raised via ATM over time.

This is not "blindly hitting bids." It means: under specific conditions, quickly absorbing sell-side pressure, or even adding positions with the trend, can be a strategically rational choice.

This is precisely what most people miss.

They model PURR as a buyer with a constantly decreasing balance; but if the ATM is active (mNAV premium) and real liquidity exists, then the real constraint is no longer: "How much money is left?" but becomes: How much liquidity can you continuously provide to the market while maintaining momentum and trading activity, without becoming "the entire market"?

If Almost All DATs Fail, Why Might This Time Be Different?

Because most DATs fail due to structural issues and poor asset selection, not because "the idea of a DAT is inherently wrong."

They typically fail because:

1. Poor Issuance Mechanism

Discounted OTC + short lock-up periods essentially create their own "forced sellers";

2. Underlying Asset Lacks Self-Sustaining Ability

If the asset has no (or minimal) intrinsic yield, it must rely on price appreciation to sustain the cycle; once the price stagnates, the narrative collapses immediately;

3. Inflationary Supply Narrative

If the underlying asset is inflationary (or has heavy emissions), it's fighting against a structural headwind;

4. Catastrophic Perception at the Shareholder Level

Issuing shares when mNAV < 1 is self-harm: severe dilution, destroys sentiment, and makes the next round of financing worse.

HYPE avoids most of the above failure paths: protocol revenue ultimately translates into demand and value capture for HYPE; under continuous usage, the supply is deflationary, not structurally inflationary; there are no large holders or VCs still in lock-up.

This combination is crucial. Because it determines whether this is a story that only works if "numba go up," or a structure that can "continue operating even if the market fluctuates, as long as the fundamentals remain sound."

Of course, failure paths still exist: mNAV compression, trading volume drying up, ATM suspension, or the HYPE narrative weakening. But structurally, HYPE is one of the few assets where the DAT cycle is not inherently a "scam machine."

I've Been "Midcurve" Here Before Too

Finally, some will argue: PURR is a bad investment because it continuously issues shares, and issuance suppresses the stock price.

I used to think this way often (classic midcurve). But remember: when traditional finance truly understands how this "barbell structure" works, things could get very exaggerated.

Historical examples:

MSTR: 3.3× mNAV

Metaplanet: 8.3×

BMNR: 5.6×

And frankly, these are not great assets. Imagine what a "good" one could achieve.

Bobby starts printing money.

Turn on the money printer, Bobby.

Hyperliquid.