Microsoft's "Pool Conundrum": $625 Billion Slowly Injected, $37.5 Billion Opened This Quarter, Will the Water Level Rise or Fall?

- Core Viewpoint: Microsoft's latest earnings report shows strong demand for its AI and cloud businesses, but the market is concerned that its massive capital expenditures (CapEx) to achieve growth will erode short-term profits, leading to a stock price decline despite exceeding earnings expectations.

- Key Elements:

- Capital Expenditures (CapEx) hit a record $37.5 billion, a sharp 66% year-over-year increase, far exceeding market expectations. Management hinted that demand still outpaces supply, indicating continued future investment.

- Commercial Remaining Performance Obligations (RPO) doubled year-over-year to $625 billion, showing enterprise customers are locking in long-term AI budgets. However, approximately 45% of this increase is believed to be driven by a single partner, OpenAI.

- Azure cloud service growth was 39%, remaining high but slightly lower than the previous quarter. Growth is constrained by physical capacity bottlenecks like data centers, leading to delivery delays.

- The company's business structure is diverging: B2B (Azure/AI) shows strong growth, while C2C segments (e.g., Xbox, Windows OEM) are performing flatly, lacking a buffer to hedge against B2B volatility.

- GAAP net profit saw a one-time increase of approximately $7.6 billion due to the accounting revaluation of its investment in OpenAI. This gain does not reflect improved operational cash flow and should be excluded to assess true operating performance.

Written by: DaiDai, Maidian

You must have done this kind of math problem in elementary school: There's a swimming pool. The inlet pipe is desperately filling it with water, while the drain valve at the bottom is wide open, letting water out. When will the pool be full/empty?

Did you ever think this problem was logically absurd? Interestingly, Microsoft's latest Q2 FY2026 earnings report is playing out this simple yet real capital game: On one side, there's $625 billion in RPO (Remaining Performance Obligation, locking future orders into a 'safe'), and on the other side, there's $37.5 billion in CapEx this quarter (real money being poured into data centers and GPUs).

However, looking at it calmly, while the $625 billion RPO shows terrifying potential for 'inflow', it's subject to delays in revenue recognition due to 'pipe diameter' constraints like data center construction cycles. The $37.5 billion CapEx outflow this quarter, on the other hand, represents real, tangible 'opening of the drain valve'. The result is a very 'counter-intuitive' scene: the company beat on both revenue and earnings, guidance wasn't bad, yet the stock price fell about 6% in after-hours trading.

On the surface, Azure grew 39%, RPO doubled year-over-year to $625 billion, and demand seems very solid. But what the market is really nervous about is that Microsoft is ramping up production capacity at a pace akin to an 'arms race'—this quarter's CapEx was $37.5 billion, up +66% YoY, and management is still emphasizing that 'demand exceeds supply'.

Ultimately, the reason Wall Street chose to sell off despite the double beat comes down to anxiety about the 'water level' in this problem: If the speed of inflow (revenue conversion) cannot cover the speed of outflow (depreciation and expenses) in the short term, even if the pool is huge, the buoyancy of the valuation will decline.

1. Earnings Snapshot: 'Top-Tier Growth' vs. 'Top-Tier Investment' – Why is Wall Street Panicking?

A key premise is that Microsoft is transitioning from a 'software giant' to an 'AI infrastructure maniac'.

Translating Nadella's statement on the earnings call that 'the AI business is now larger than some of our largest franchises' into investor language is quite straightforward: AI is no longer just a nice-to-have; it has usurped the throne as the new primary engine for both growth and expenditure.

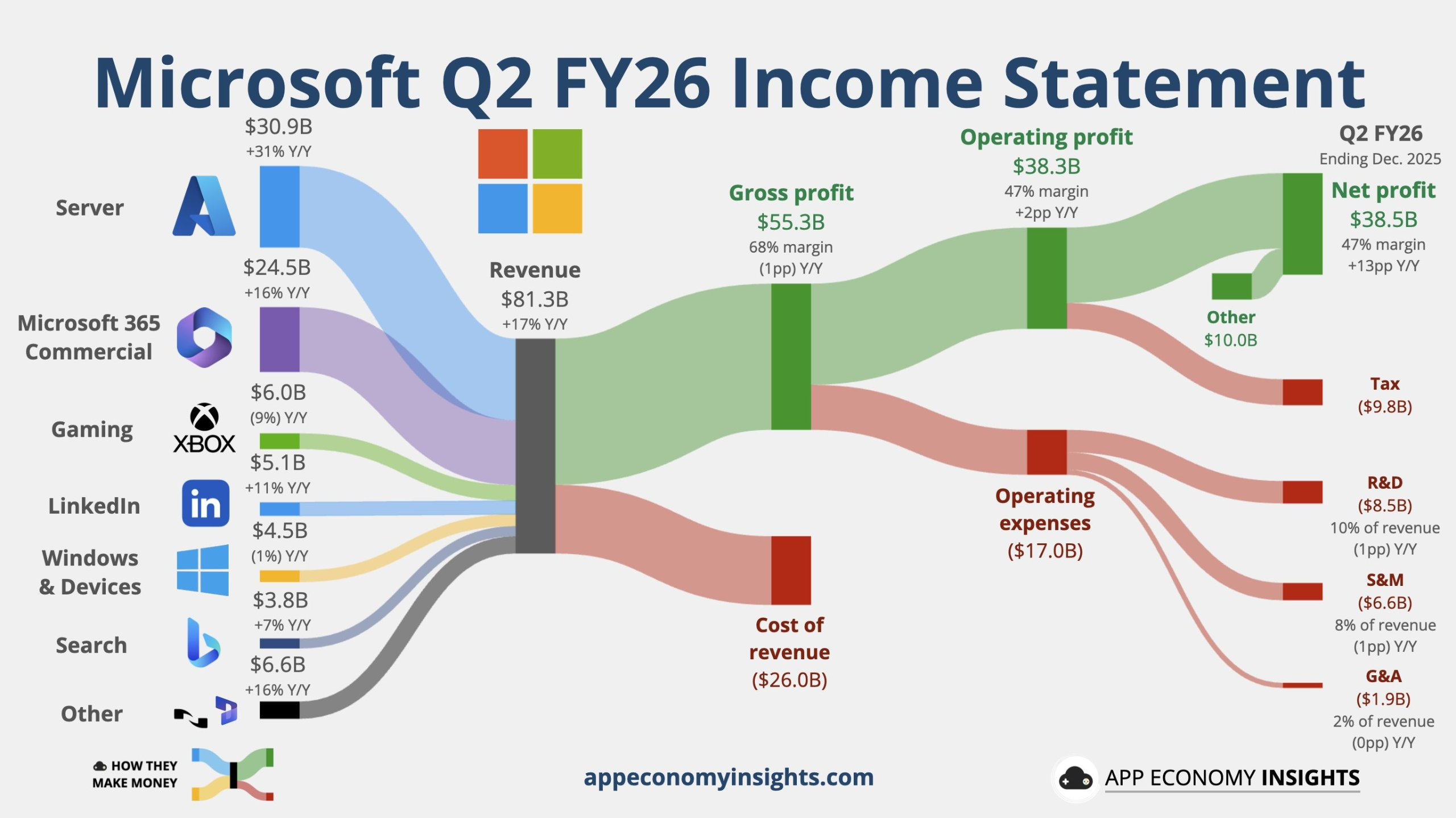

First, looking at the core financials for Q2: Revenue was $81.3 billion, up 17% YoY, beating analyst estimates of $80.31 billion. Operating income was $38.3 billion, up 21% YoY, also beating estimates. Net Income under GAAP was $38.5 billion, up 60% YoY; under non-GAAP it was $30.9 billion, up 23% YoY (up 21% in constant currency).

Earnings Per Share (EPS) under GAAP: Diluted EPS was $5.16, up 60% YoY, beating the $3.92 analyst estimate. Under non-GAAP: Diluted EPS was $4.14, up 24% YoY (up 21% in constant currency). Capital Expenditure (CapEx) reached $37.5 billion, up 66% YoY, not only a record but also above the $36.2 billion analyst estimate.

Source: ECONOMY INSIGHTS

Unexpectedly, Microsoft had some 'new things' this time: Reuters noted the company disclosed core usage metrics for M365 Copilot for the first time. CEO Nadella stated M365 Copilot now has 15 million annual users, pushing the narrative that 'AI is not a concept, it's a paid product' a step forward.

It was precisely due to the higher-than-expected disclosed infrastructure spending (including data center build-out) and weaker-than-expected performance in gaming-related sales that Microsoft's stock fell about 6% after hours.

MSFT Chart

This after-hours sell-off feels more like the market solving a problem: 'Growth is strong, but at what cost?'

The market is now focused not just on revenue, but on the 'price paid for that revenue'. Management repeatedly emphasized it's 'not a lack of demand, but supply falling short of demand'. Consequently, this quarter's CapEx surged to $37.5 billion, a 66% YoY jump, with hints of further increases next quarter.

A subtle point: Azure's 39% growth isn't bad, but within the context of an 'AI myth valuation', it might only be considered 'just enough'. Barron's perspective is typical—a beat is a beat, but Azure growth slightly decelerated from last quarter (40%), and the company's guidance range for next quarter was somewhat cautious. This caused trading desks, already positioned for very optimistic expectations, to take some chips off the table. The market was spooked by this spending pace, worrying that before capacity is released, profit margins might first be dragged down by depreciation, leading to a phase of 'severe mismatch' in ROI.

Data center expansion becoming a physical bottleneck constraining Azure growth

2. B2B Deification, B2C Mediocrity: Every Step of Growth Lands in the 'Expensive Zone'

Microsoft's current structure is highly bifurcated: B2B is absurdly strong, B2C is mediocre. This isn't accidental; it's the inevitable resource tilt of the AI era—B2B opportunities are larger, but the costs are also higher.

1. $625 Billion RPO: Is it a 'Safe' for Performance, or a 'Stress Test' for Delivery?

Commercial RPO doubling YoY to $625 billion is, for a company of Microsoft's scale, almost a vote of confidence from enterprise customers with contracts: AI and cloud budgets are not 'pilots' but have entered longer-term binding cycles. Correspondingly, Microsoft's business model is also shifting—from one-time software revenue, gradually moving towards a more continuous, consumption-based revenue model akin to 'computing power, utilities'—the greater the workload and deeper the usage, the stronger the revenue stickiness.

But the market's interpretation of this kind of 'order locking' is shifting from 'growth certainty' to another kind of scrutiny: RPO is visibility into future revenue, not equivalent to certainty in current cash flow. The longer the contract, the longer the realization chain: computing power supply, delivery cadence, customer onboarding speed, and backend costs (depreciation/energy/chips) will all determine whether it ultimately becomes a 'moat' or a 'burden on its back'.

In other words, the RPO anchor can prove demand, but it cannot replace a more practical question: With orders so full, can Microsoft timely supplement capacity, convert contracts into recognized revenue, and prevent profit margins from being eroded?

2. The Three 'Tight Constraints' Behind the Growth

(1) Capacity as the Ceiling: Supply Falling Short of Demand is Good News, but 'Delivery Delays' are Hard Costs

Microsoft Chairman and CEO Satya Nadella stated: 'We are still in the early stages of AI diffusion, but Microsoft has already built an AI business larger than some of our largest traditional businesses. We continue to drive frontier innovation across the entire AI technology stack, creating new value for customers and partners.'

Despite this, management still acknowledged order delivery delays. This 'inability to handle all orders' might sound like humblebragging in the short term, but long-term it implies two things: first, revenue recognition is postponed; second, competitors get a window to fill the gap. Data center construction cycles + GPU supply are classic physical world constraints—no matter how strong the demand, it must first pass the 'power on, rack up, go live' hurdle.

This is also why the market juxtaposes 'strong demand' with 'falling stock price': when capacity becomes the bottleneck, the growth logic shifts from the 'demand side' to the 'supply side', and supply-side catch-up often means higher capital expenditures and heavier depreciation burdens.

Satya Nadella, CEO of Microsoft. Image source: jason redmond/AFP/Getty Images

(2) Lack of B2C Hedge: B2B Carries the Banner, B2C Struggles to be a Buffer

The structural divergence this quarter is even sharper: B2B is driven by Azure/AI, while B2C is relatively flat—Xbox content revenue -5%, Windows OEM only +1%. This means if the B2B realization cadence slows (even if just delayed), the company can hardly count on B2C to 'cushion the fall'. Market sensitivity to a single main growth driver will rise significantly.

To put it bluntly: As Microsoft increasingly resembles an 'AI cloud infrastructure company', its valuation volatility will also increasingly resemble that of an infrastructure stock—focusing on utilization rates, delivery, and capital expenditure payback periods, not just a quarterly beat.

(3) The Efficiency Audit Begins: It's Not That Spending is Bad, But the Market Wants to See the 'Echo'

This quarter's CapEx was up +66% YoY, but Azure growth was only slightly above guidance (you mentioned 2 percentage points higher in your text). This is the core of the 'counter-intuitive' after-hours move: the market isn't denying growth, but is repricing the speed of ROI realization.

The market's implicit questions are very practical:

- How many more '$37.5 billion' quarters are needed to maintain close to 40% growth?

- Will this spending lead to the sequence of 'capacity release → revenue acceleration → profit recovery', or the mismatch of 'depreciation arrives first → profits pressured first → realization lags'?

- Within this framework, Microsoft's valuation narrative is also changing: spending heavily for a quarter or two, the market is still willing to view it as getting ahead; but if high-intensity investment extends over more quarters, it becomes harder to explain Microsoft using a 'light-asset software company' logic, instead leaning closer to the 'heavy capital, long payback period' pricing of infrastructure—growth is still valuable, but the discount rate will be higher.

3. Tearing Off OpenAI's '$7.6 Billion Paper Wealth': The Four 'Life-or-Death Metrics'

1. Excluding the $7.6 Billion Net Income Noise: 'Accounting Revaluation' or 'Operational Realization'?

The jump in GAAP net income this quarter had a most conspicuous variable not from core operations, but from net gains related to the OpenAI investment. Microsoft states it plainly in the report—the net gain from the OpenAI investment increased net income by approximately $7.6 billion and EPS by $1.02.

The issue is, this looks more like an 'accounting revaluation' than 'selling more products'. Media explanations are more blunt: A restructuring/recapitalization by OpenAI last year triggered Microsoft to recognize a one-time accounting gain under GAAP (GeekWire disclosed it as approximately $10 billion pre-tax accounting gain, ~$7.6 billion after tax). It 'inflates' the GAAP profit number but is not equivalent to an improvement in operating cash flow of the same magnitude.

2. Cutting Through the Noise: Reconstructing Market Expectations with Four 'Verification Lines'

(1) Azure Growth Rate: Is it truly 'Supply Constrained', or is Demand Starting to Blunt?

This quarter's Azure growth of +39% YoY (constant currency +38%) is a classic case of 'the number isn't bad, but expectations were higher'.

The key is: The market is currently giving Microsoft face by using the 'supply constrained' narrative—meaning it can sell, just delivery is slow. Once you stop hearing management repeatedly emphasize 'supply constraints / capacity bottlenecks', then any step-down in growth becomes easier to interpret as 'demand-side cooling'.

(2) The $37.5 Billion Arms Race: Is it 'Buying the Future', or 'Overdrawing the Income Statement'?

This quarter's CapEx reached $37.5 billion (up +66% YoY), with about two-thirds directed towards chips/computing hardware, even exceeding the Visible Alpha consensus estimate ($34.31 billion).

This is the core of the 'counter-intuitive' after-hours sell-off: The market isn't denying growth, but is asking—your growth is strong, but your growth is 'too expensive'.

Management said CapEx will be slightly lower next quarter, but more importantly, 'does capacity release lead to a jump in revenue / order fulfillment?' Reuters also mentioned the CFO hinting that memory chip costs would pressure cloud margins—this means the market will track the 'cost curve' as an equally important variable. Spending money isn't scary; what's scary is spending for a long time with a weak echo.

(3) The RPO Reservoir: How Solid is the $625 Billion Really?

Commercial RPO reached $625 billion, up +110% YoY. This is one of Microsoft's hardest foundational metrics: proving enterprise customers are willing to sign longer contracts, binding budgets to Microsoft.

Microsoft expects the amount of customer commitments to convert into actual sales in the coming years to have more than doubled compared to the same period last year, primarily due to a new agreement with OpenAI valued at $250 billion. Microsoft stated that its cloud business contract backlog more than doubled year-over-year to $625 billion. This scale is higher than the $523 billion reported by cloud competitor Oracle in December. However, approximately 45% of the remaining performance obligations are contributed by OpenAI alone, highlighting Microsoft's high dependence on this startup. OpenAI previously committed to a total investment of about $1.4 trillion in AI but has not disclosed specific financing plans.

But this time, the market's interpretation of RPO is more 'nuanced'—because about 45% of the RPO increase is believed to be driven by OpenAI. This shifts the narrative from 'strong order-locking ability' towards another question: What proportion of your certainty comes from a single mega-client / single partner?

(4) OpenAI Monetization: Don't Listen to the Valuation Story, Listen for the Sound of 'Money Coming In'

This quarter's $7.6 billion led many to mistakenly think 'OpenAI contributes significant profits'. But what really needs tracking is whether it can consistently bring scalable commercial revenue and its impact on Microsoft's margins in terms of costs / profit-sharing—this determines whether it's a 'super teammate' or a 'drain'.

Valuation re-rating is the story; cash flow realization is settling the bill.

In Conclusion

Returning to that simplest, yet most brutal, math problem: When both the inlet and outlet are turned up higher, whether the water level rises depends on which side slows down first.

From this earnings report, Microsoft has clearly proven one thing—there's no problem on the inflow side. After all, $625 billion in remaining performance obligations means enterprise customers have locked in their AI-related budgets for the coming years, and the certainty of demand is being front-loaded.

But on the other side, the outflow remains wide open. The $37.5 billion in single-quarter capital expenditure won't disappear immediately; it will continue to test the patience of the income statement through subsequent depreciation, energy, and delivery costs. This is why the market chose to hesitate after the double beat.

Microsoft still occupies the most advantageous position. As long as, over the next few quarters, the inflow starts to outpace the outflow, at that moment, the change in water level will become self-explanatory.