The shutdown is over, but the flood is coming: How will the backlog of data impact the market after 43 days of "information vacuum"?

- 核心观点:政府停摆导致经济数据真空与洪峰。

- 关键要素:

- 43天停摆中断关键数据发布。

- 未来数周将密集补发积压数据。

- 数据延迟失真加剧市场波动。

- 市场影响:迫使资产重新定价,波动加剧。

- 时效性标注:短期影响

Written by: Frank, MSX Research Institute

The 43-day shutdown marked the longest government shutdown in U.S. history.

On the evening of November 12, Eastern Time, following the passage of the temporary federal government funding bill by the U.S. House of Representatives, Trump also signed it into law, marking a temporary end to this political drama. According to estimates by the Congressional Budget Office, the six-week shutdown could reduce U.S. GDP by 1.5 percentage points, resulting in a net loss of approximately $11 billion.

Source: White House website

However, a more hidden and intractable problem has emerged: the shutdown disrupted the US statistical system. From employment to inflation, from GDP to retail sales, a large number of key economic data that should have been released daily, weekly, and monthly were missing, especially core employment data such as non-farm payrolls, which are key data for the Federal Reserve to formulate monetary policy and directly affect decisions on major measures such as interest rate cuts.

Now that the government has reopened, the U.S. Bureau of Labor Statistics (BLS) and other agencies are catching up on the backlog of economic data, which may be released in quick succession in the coming weeks. This means that after more than a month of information vacuum, investors are about to face a rare "data deluge".

The end of the shutdown is merely a political conclusion. For the market, the real test will come in the coming month, including being forced to repric the economic, inflation, and interest rate paths in a very short period of time. This will determine the pricing logic of US stocks, gold, cryptocurrencies, and even global assets for some time to come.

I. What did the market lose during the 43 days of "blindly flying through data"?

Widespread flight delays, disruptions to food aid programs, the stagnation of public services, and the unpaid furloughs of hundreds of thousands of federal employees... It's fair to say that over the past 43 days, the shutdown has permeated every aspect of the United States' economy and people's livelihoods.

However , the biggest shock to global financial markets is a more insidious and dangerous situation: the market has lost its ability to "judge the state of the economy."

It's important to understand that while the government can shut down, the economy doesn't completely stop; it continues to function daily. For example, businesses hire employees, consumers shop, factories produce, prices fluctuate, and exports and imports and exports rise and fall. However, the agencies responsible for recording, summarizing, and publishing these changes simultaneously cease operations during the shutdown.

From the Bureau of Labor Statistics (BLS) to the Bureau of Economic Analysis (BEA) of the Department of Commerce, and the data statistics team of the Treasury Department, almost all federal agencies responsible for publishing core macroeconomic indicators have suspended operations due to the shutdown.

Without data, the market can only rely on guesswork. The last available official federal employment data before the shutdown showed an unemployment rate of 4.3% and 22,000 new jobs in August, continuing the trend of slowing job creation quarter by quarter. All the core data for September and October that should have been released afterward disappeared from the schedule.

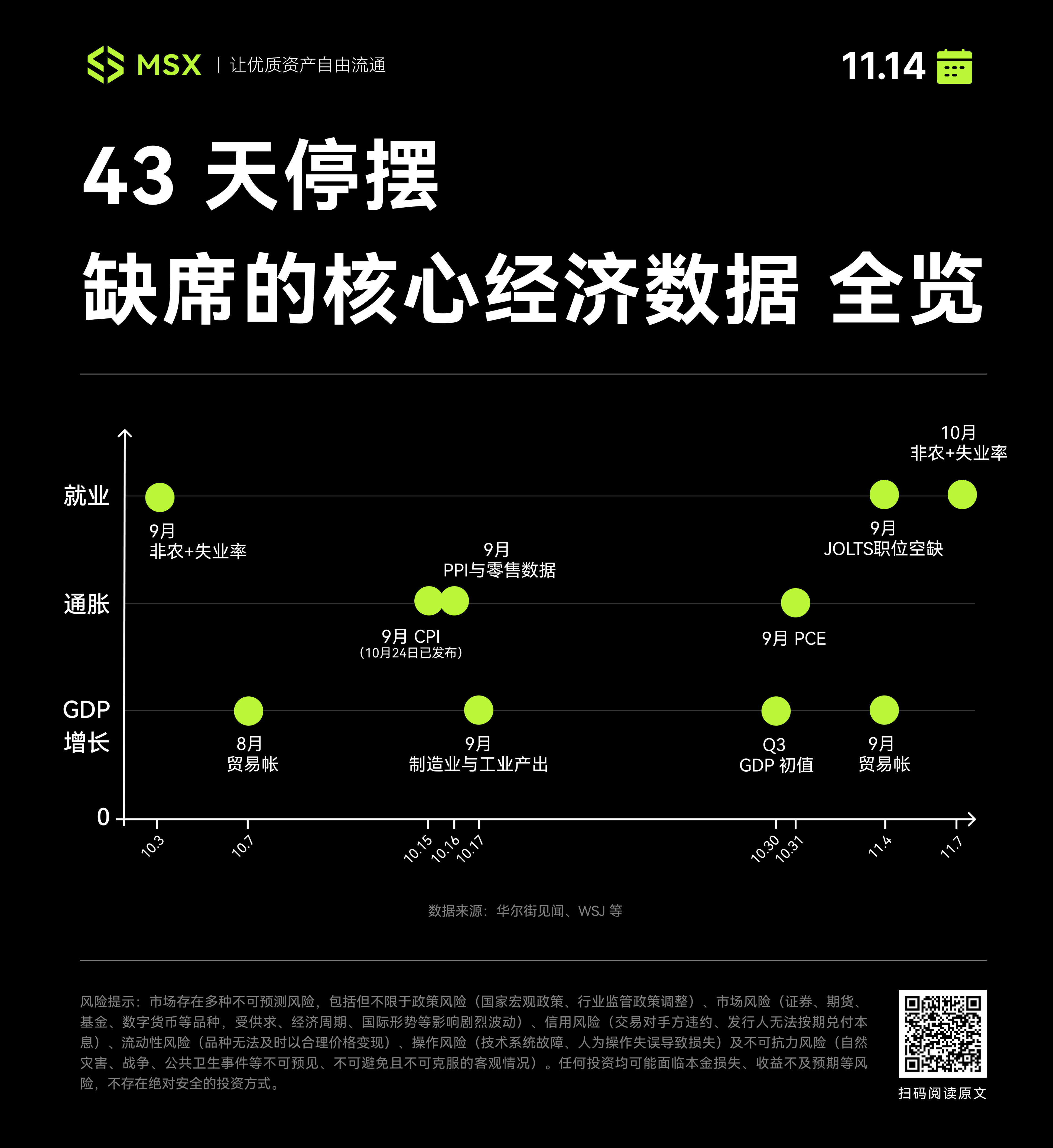

According to MSX Research Institute, from October 1 to November 13, due to the US government shutdown, at least 12 core macroeconomic indicators failed to be released as planned, covering the three pillars of employment, inflation, and GDP/growth, including all key indicators such as non-farm payrolls, unemployment rate, CPI, PPI, retail sales, trade balance, industrial output, PCE, and preliminary GDP.

Some of the data can still be recovered. For example, the September non-farm payroll data, which was supposed to be released on October 3, had already been collected, but the shutdown interrupted the process. It will likely be released once the government restarts the process.

Even more serious is another part of the data that may be "permanently lost," such as the October non-farm payrolls and unemployment rate. Because data could not be collected throughout October, these may be missing forever. White House Press Secretary Levitt recently stated that due to the prolonged shutdown of federal agencies, two important reports on October inflation and employment "likely will never be released."

This also means that September and October 2025 may become a rare "statistical blind spot" in the US macroeconomic data series.

The only exception was that, for the purpose of adjusting social security benefits, the September CPI report was released on October 24 after a nine-day delay, becoming the only "observation window" during the entire shutdown and the only official economic data that has been approved for release so far.

However, this has not alleviated the market's "data thirst." What's more troublesome is that even though the shutdown has ended, there is still no timetable for when federal agencies can catch up. The White House has refused to provide a clear plan, and the BLS has not yet announced a reissue plan. The market is still in a semi-blind state.

II. From "Information Vacuum" to "Data Flood"

Regardless, with the government reopening, various agencies will inevitably have to reprocess the backlog of important economic reports and start frantically "catching up" on their work.

For this reason, the release schedule of US economic data will be unprecedentedly packed in the coming month. The 43-day information vacuum will not end gently; on the contrary, huge uncertainties and volatility will be released in a very short period of time.

According to projections by institutions such as Goldman Sachs and Morgan Stanley, the next month's calendar of key economic data "catch-up" will be extremely challenging, potentially the most crowded, chaotic, and impactful period of macroeconomic data in US statistical history.

From this calendar, we can see two clear "eyes of the storm".

First, the initial shock came from the backlog of data in September.

Both the Wall Street Journal and Goldman Sachs pointed out that since the data collection for the September jobs report was completed before the shutdown, the BLS is expected to be released quickly after operations resume (as early as next week).

However, Goldman Sachs has an even more aggressive prediction: the September non-farm payrolls (November 18) and October non-farm payrolls (November 19, if they are released) may bombard the market back-to-back.

If this scenario comes true, the market will face an extremely awkward, yet potentially real, situation: investors will have to digest two months' worth of employment reports within 24 hours, potentially with completely different directions. It's worth noting that non-farm payrolls are one of the most sensitive macroeconomic data points in the entire market. Two bombshell reports could directly reshape expectations for the economy and the Federal Reserve's path in 2025.

Secondly, the second point of impact came from the "black hole" and "severe delay" in the October data.

To put it bluntly, compared to the easy reissue in September, October is the core of the storm. After all, this shutdown covered the entire month of October, and its data collection delay far exceeded that of 2013 (16 days) and 2019 (35 days). According to Morgan Stanley's estimates, key inflation data such as retail sales, PPI, and CPI in October may not be released until December 18th or 19th.

what does that mean?

This means that at the December 9-10 policy meeting, when Federal Reserve policymakers are setting the interest rate path for 2026, they themselves will not see much more key inflation data from October.

In short, this "make-up" calendar is less a return to normal and more a "volatility map." The market, along with the Federal Reserve, will fall from the old blind spot of "information vacuum" into a new blind spot caused by "data flood," and will be forced to digest potentially contradictory data in a very short period of time.

The market is almost certain to experience significant volatility in the coming month.

III. What impact might this have?

Overall, for the market, the "relief" brought about by the end of the shutdown is only a temporary emotional recovery. What truly determines the market trend is how investors' expectations of the US economy and the Federal Reserve's policy path will be reshaped when this "data flood" is released in a concentrated manner.

Given this context, one fact that must be taken seriously is that this shutdown not only resulted in missing data but may also have led to data distortion. After all, the data for the October employment report was never collected, and a crucial portion of the November report's data, which should have been collected in the first ten days of the month, was not ensured.

Therefore, all data released in the coming month will not only be delayed, but may also be biased, making market interpretation much more difficult.

Given this situation, as the market digests the surge in data, three distinct scenarios are highly likely to emerge, each of which will directly reshape the direction of risky assets:

- "Stagflation" Alarm: If the supplementary data for September non-farm payrolls, Q3 GDP, and September PCE are all "overheated," indicating stubborn inflation and a strong economy, then the market will undoubtedly reprice "a more hawkish Fed" in a lightning-fast manner, and the expectation of interest rate cuts will be significantly postponed. This means that the USD/USD yield will soar, and QQQ (tech stocks) and Crypto, as risk assets, will be under pressure together.

- "Recession" panic: If backlogged data (especially non-farm payrolls) shows a sudden shutdown in the job market and Q3 GDP falls far short of expectations, the market will quickly turn to "recession trading," betting on an emergency rate cut by the Federal Reserve. This would mean a sharp drop in the USD/USD yield, and QQQ and Crypto might experience a short-term impulsive rebound due to the "bad news is good news" phenomenon.

- "Conflicting Data": If the September and October data are completely opposite (e.g., September is very hot and October is very cold), or if the employment and inflation data contradict each other, the market will fall into cognitive confusion, volatility will reach its peak, and the prices of various risky assets may fluctuate violently (V-shaped reversal, W-shaped reversal). This is the most likely scenario in this round, and also the most difficult to deal with.

However, judging from the statistical pace, barring any unforeseen circumstances, the US employment and inflation chain will be largely restored to its original state by early January at the latest. At that time, we will have a fairly clear understanding of the employment market situation, and the economic situation in the fourth quarter may also be truly revealed.

Of course, all of this is on the premise that there will be no government shutdown during this period... The uncertainty of American politics means that the "pause button" may be pressed again at any time in the future.

In conclusion

For Washington, the end of the shutdown is a temporary conclusion to a political game; for the markets, it is the end of halftime—in the coming weeks, the economic realities that have been building up for 43 days will be dealt a double blow, and the second half of the game will be forced to play on "fast forward."

For investors with cash on hand ready to enter the market, or traders closely watching the Federal Reserve, the real game has just begun.