2025 Investment Questionnaire: Nearly 60% of respondents reported overall profits, with seasoned investors making up over 60% of the attendees.

- 核心观点:2025年加密市场盈利者超半数,但新人减少。

- 关键要素:

- 盈利者占比57%,亏损者约27%。

- 主要盈利赛道为Meme币和主流币。

- 超60%投资者入圈超3年,新韭菜减少。

- 市场影响:市场结构老化,流动性或受影响。

- 时效性标注:中期影响。

Original article by Odaily Planet Daily ( @OdailyChina )

Author|Wenser ( @wenser2010 )

Another Christmas has arrived, but compared to the usual booming "Christmas rally," this year's Christmas season has been somewhat quiet for the cryptocurrency market.

BTC fluctuated repeatedly between $85,000 and $90,000; ETH, on the other hand, lost its previous high and appeared somewhat sluggish; mainstream coins such as SOL and BNB have been in a slump since the "October 11th crash" and are getting further and further away from their new high prices; as for altcoins? For many people, we can only say "sorry, we are not familiar with them".

In our previous article, "4 Key Words to Represent the Four Seasons of Crypto in 2025," we briefly reviewed the industry's development over the past year using four quarterly keywords. Due to the limitations of the article's theme and length, the experiences of many industry participants were only briefly mentioned. The reason for this was that we conducted a questionnaire survey for more than half a month on the topic of "annual investment review," which is of general interest to everyone. We collected "annual investment memoirs" from various groups, including community users, crypto KOLs, well-known traders, media professionals, and crypto investors.

Here we see that despite the market's volatility between new highs and troughs, some remain at the table and reap substantial profits. Of course, behind this success lies the fate of those who suffer losses and exit the market. Through this questionnaire and data, we gain insight into the true state of cryptocurrency investment and trading today. We will also take this opportunity to briefly review this year's "most regrettable missed opportunities," providing readers with lessons learned for next year's endeavors.

2025 Investment Memoir: Some will eventually grow old, but others are still young.

The following is information from the Odaily Planet Daily 2025 Annual Investment Review questionnaire survey. We will conduct a detailed analysis from aspects such as the target audience, investment performance, and areas of focus.

Survey participants: Newbies vs. seasoned veterans? Over 60% have been in the industry for more than 3 years.

Let's start by describing the demographics of the people surveyed.

According to the survey results, over 60% of investors have been in the industry for more than 3 years, making them seasoned veterans.

The largest group, accounting for approximately 41%, consists of individuals who have been in the community for 4-6 years.

Those who have been in the community for 6-8 years account for approximately 12% of the total.

The group that has been there for more than 8 years accounts for approximately 9% of the total population.

Compared to the "3rd grade and above group", the number of "newbies" is relatively small. The total number of people who have been in the circle for less than 1 year and those who have been in the circle for 1-3 years is 21, accounting for about 38% of the valid questionnaires.

After reading the questionnaire, my first thought was— "No wonder the cryptocurrency market is so illiquid; there are fewer and fewer new investors!" (Note from Odaily Planet Daily: Due to the limited number of questionnaires, the above conclusions are only the results of a single survey and do not represent the overall demographic structure of the industry.)

Investment Performance: Huge Profits vs. Huge Losses? Over 57% of the Group Profitable

This is probably the question that most people are most concerned about: after working hard all year, did I make a profit or a loss? Am I the only one who lost a lot?

Seeing the survey results, I can only say that I underestimated everyone's earning power.

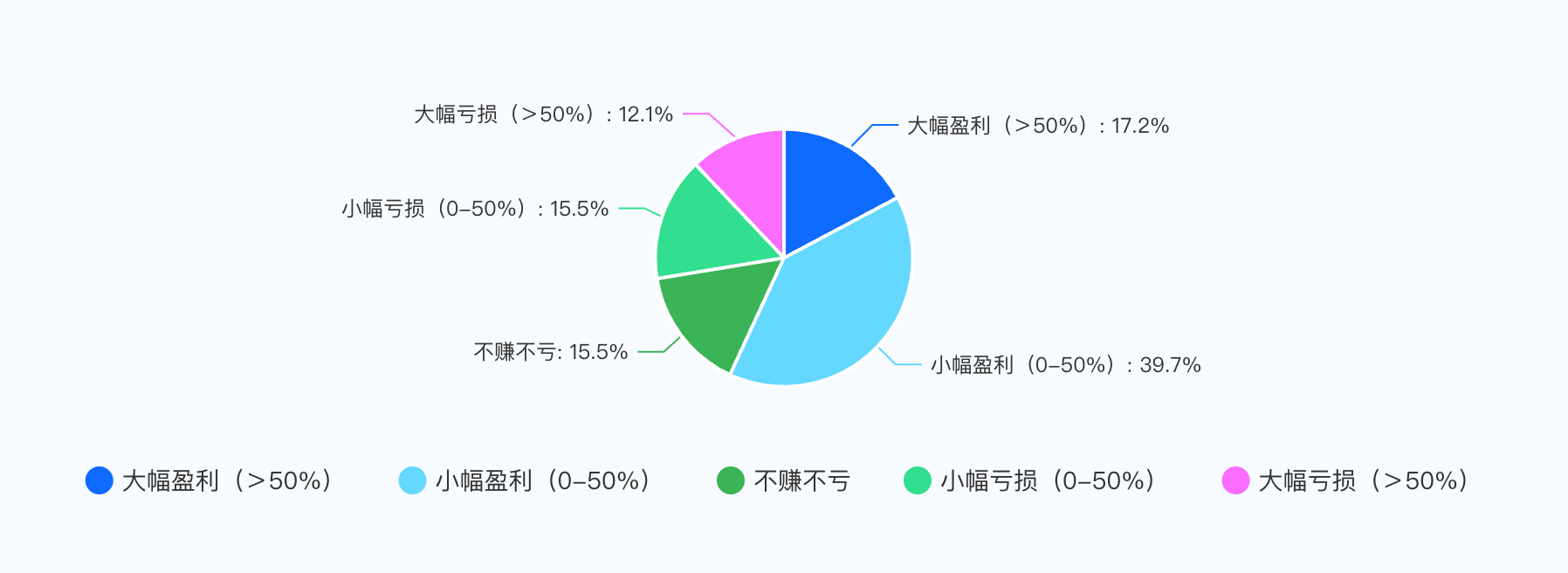

Percentage of employees who achieved significant profits (+50% or more): 17.2%;

Percentage of employees who achieved small profits (0-50%): 39.7%;

The percentage of people who broke even (equivalent to playing for free for a year) was 15.5%.

Percentage of employees experiencing minor losses (0-50%): 15.5%;

The percentage of employees experiencing significant losses (over 50%) was 12.1%.

In other words, nearly 60% of the participants were profitable, about 15% broke even, and over 27% faced some degree of loss, representing about 30%, far lower than the sentiment reflected in market opinions and community discussions. This volatile market, with its many winners, indirectly confirms that the current crypto market is indeed dominated by experienced investors. Newcomers are either still struggling in the market or have already suffered significant losses and left.

Having written this far, I can only sigh helplessly: "So many people in the group talk about losing money, but it turns out I'm the only one who actually lost money?!"

Profitability Track: Meme Coin vs. Mainstream Coins? Is Meme Coin still YYDS?

As for specific profit areas/tracks/projects/tokens, the survey results are somewhat complicated.

Unsurprisingly, Meme Coin (the "Earth Dog" project) remains the best way to make money, with about 34% of survey participants mentioning that they mainly make money from projects in this area (a small number of people even mentioned Inscription, but it's unclear whether they are genuine or just faking it).

About 26% of investors mainly profited from mainstream cryptocurrencies such as BTC, ETH, BNB, and SOL. Considering that BTC, ETH, BNB, and SOL have all reached new price highs at different times this year, such performance is not surprising. Of course, this also depends on whether investors take profits in time. Otherwise, if they keep holding onto their profits, they will only be able to hide and cry in secret.

About 16% of people voted for DeFi. Considering that this year is the "big year for stablecoins" and there are many "high-end wealth management schemes", this result is not surprising. In addition, with the popularity of on-chain Perp DEX, DeFi has ushered in a "second spring" in a certain period.

Approximately 12% of investors still derive their main profits from airdrop interactions. To be honest, this result was somewhat unexpected. After all, with the current market liquidity tightening, many crypto project teams are becoming increasingly stingy with their community airdrop allocations in order to maintain control and facilitate price manipulation. In many projects, airdrops have become the norm. However, regardless of market changes, airdrops remain the best way for many investors to achieve high-value returns with low-cost investment. Whether the market is hot or cold, there are always some "airdrop masters" who stick to their posts, providing the market and projects with various active data and trading volume, which deserve everyone's respect.

Finally, I was surprised that, aside from individual projects like Trump and Aster, there are still people listing NFTs as a profitable sector. I can only say that they underestimated the investment capabilities of traders. Making money in the NFT field, which is nearing its end or even death, is simply amazing. However, considering that OpenSea's CMO is still actively recruiting, it shows that no matter how the market changes, some NFT collectors and traders remain optimistic about this sector, providing liquidity to the market with their own money. As a member of this "NFT veteran," it's somewhat touching.

In addition, for individual projects, some people have given answers such as "WET, Gold, PING, Binance Alpha, DOGE", but these results are not very representative or of great reference value. Therefore, they will not be analyzed separately here, but only mentioned for explanation.

Loss-Making Sectors: Meme Coin vs. Futures? Data Verifies Profit and Loss Originate from the Same Source

While some are triumphant, others are naturally disappointed.

Regarding specific loss-making sectors and projects, the survey results once again demonstrate the harsh reality of the market.

Approximately 28% of investors suffered heavy losses on Meme coins and altcoins, including Binance-affiliated assets such as Giggle and ASTER, as well as Base ecosystem altcoins (such as PING) and popular coins like HYPE.

Secondly, another major cause of losses is "black swan events"—some people have suffered heavy losses on FIL due to problems with their staking service providers; others have lost money betting on Polymarket; in addition, impermanent loss of DeFi protocols and buying BTC, ETH, and SOL at high prices are also common reasons for losses in the industry.

About 26% of investors suffered losses in contract trading, which was slightly lower than I expected. As one of the few "active trading venues" in the market this year, opening contracts for mainstream and altcoins is still the choice of many investors. However, considering Trump's volatile statements after taking office, his frequently changing policies, and the large-scale liquidation black swan event including the "October 11 crash", losses were inevitable.

Furthermore, NFT, GameFi, and L2-related projects, which are considered "representatives of major failures," are also the root cause of losses for many investors. Approximately 22% of people suffered heavy losses because they failed to change their investment strategies in time and stubbornly held onto assets in a particular sector.

Finally, compared to previous investments that were largely confined to the cryptocurrency sector, the mainstreaming of crypto this year has led many investors to choose DAT (Digital Asset Management) stocks. However, during this period of market downturn and volatility, losses have naturally followed: some who bought leading DAT stocks like MSTR and BMNR are still stuck with losses; others have suffered heavy losses on Circle (CRCL), the "first stablecoin stock." Former cryptocurrency traders have transformed into "prestigious US stock traders," but this change in status does not guarantee successful investment performance; it may also represent an additional avenue for loss.

Reflections on Losses: Timely Profit Taking vs. Decisive Loss Cutting? Profit Taking is an Essential Life Lesson.

After discussing the losses, we also included specific questions about the reasons for the losses in the questionnaire, in an attempt to find common problems among everyone.

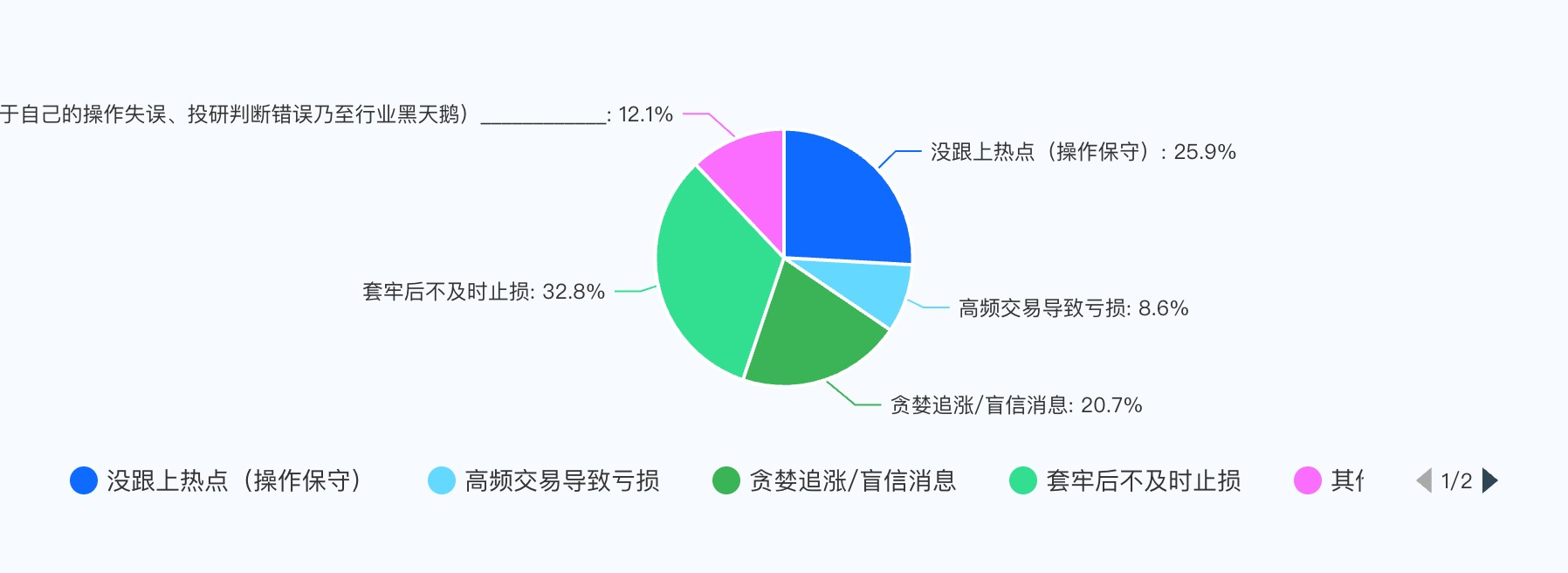

About a third of people attribute their losses to "failing to cut losses in time after being trapped," which is a common problem among cryptocurrency investors, including myself. It's about not understanding that 90% to 99% of altcoins in the crypto market will eventually go to zero. Only a very few tokens can recover from a trough and then surge again, and even then, it's most likely just a pump-and-dump scheme by large investors to better profit from the market. This story tells us that timely loss-cutting and stopping wishful thinking are essential.

At the operational level, slow reaction, conservative operations, blind faith in rumors, and chasing highs and selling lows are another major cause of losses, with over 45% of investors making mistakes in these areas leading to investment losses. Based on my personal observations, "becoming a first-mover advantage," waiting for others to take over, may be a crucial key to consistent success in the market. However, this is often closely related to information acumen, access to information sources, personal risk tolerance, and adequate capital and equipment preparation, and is difficult to achieve overnight.

Finally, about 12% of people attributed their losses to operational errors, misjudgments, or industry black swan events. In such a volatile market, these losses are often indeed due to factors beyond their control. Investors can only silently accept their losses, adjust their mindset, and try again next year.

What surprised me most was that the percentage of people who lost money due to high-frequency trading was far lower than I expected. Only 8.6% of people attributed their losses to this. On the one hand, most people may indeed engage in less high-frequency trading; on the other hand, people may not have a clear understanding of the standards for high-frequency trading. Some people may buy and sell more than ten times within an hour, but then wait and see for the next week. Others may trade 3-5 times a day, with trading time accounting for more than 20 days a month. Many people may think that the latter does not count as high-frequency trading, but in fact, compared to most people, they can already be considered "high-frequency players".

Commonly Used Products: Perp DEX vs. Prediction Markets? Over 40% of the population has never used prediction markets.

When asked about commonly used popular products, the relevant data was quite intriguing.

The percentage of people who have used Perp DEX is about 40%, of which about 40% are Hyperliquid users; about 22% have used Lighter; about 12% have used Aster; and about 15% use other platforms, including established platforms such as DYDX and GMX. It has to be said that the enduring appeal of DeFi may have been validated once again.

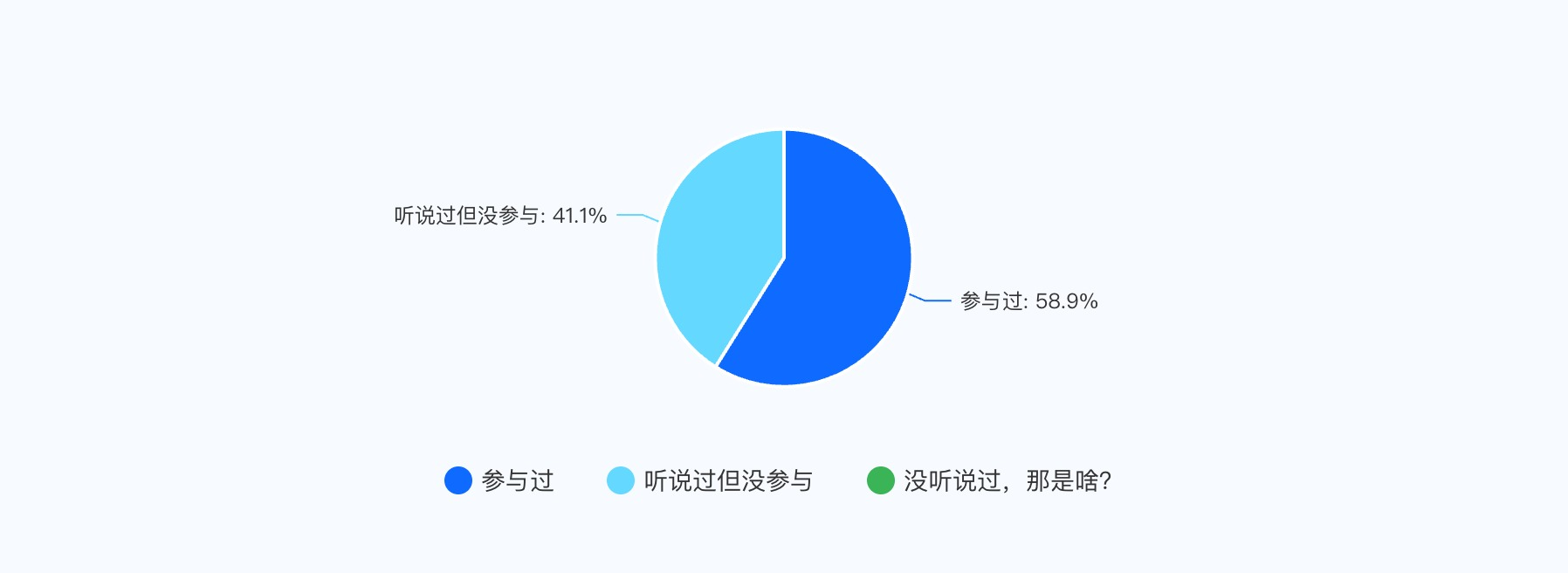

As for prediction markets, nearly 60% of investors participate in their use; more than 40% of investors have heard of prediction markets but have not participated in betting. Based on this small sample data, prediction markets still have considerable room for growth. In 2026, prediction market platforms such as Polymarket, Kalshi, The Clearing Company, as well as the BSC ecosystem and Base ecosystem, may continue to experience a period of explosive user growth.

Looking ahead: Bullish on the sector vs. investment advice? RWA, AI, and Meme rank in the top three; dollar-cost averaging is the key.

At the end of the questionnaire, we also set two "open-ended questions": one was "What sectors are you optimistic about in 2026?"; the other was "What investment insights/advice can you share?"

In terms of promising sectors, RWA, AI, and Meme Coin ranked in the top three.

RWA was mentioned in 31% of the responses. It's worth noting that RWA here combines elements of stock tokenization, stablecoins, and PayFi.

The percentage of mentions of AI was approximately 25%. With the increasing penetration rate of AI models and applications and the rapid development of AI-related technology companies, the combination of AI and cryptocurrency remains one of the directions that the mainstream market is highly looking forward to.

The reason why Meme Coin is still favored by many people may be due to its low entry barrier and high risk and high return compared to mainstream coins. However, I personally hold a pessimistic view. After all, it is inevitable that altcoins will be drained of liquidity. It is difficult for Meme Coin, a sector that is extremely dependent on on-exchange liquidity, to return to its former "flourishing" stage.

Prediction markets are a "consensus" among many. The two oligopolies, Polymarket and Kalshi, with valuations exceeding $10 billion, and the rapidly growing industry scale have made more people see the development potential of prediction markets. The "everything can be predicted" feature, coupled with various popular sports events and political elections in 2026, may further fuel the popularity of prediction markets.

Regarding specific investment advice, most people agree with the principle of "dollar-cost averaging" and suggest "buying only BTC," but only they know how many people can actually do it.

Furthermore, it's interesting that crypto KOL @_FORAB shared that he recommends investing in mainstream cryptocurrencies every Friday afternoon, which is quite clever in terms of timing; while "a certain group member" who doesn't recommend public execution suggested trading after 4 pm because "that's when foreigners wake up," seemingly regarding "foreigners" as "withdrawing liquidity."

Ironically, six survey participants offered their own "investment advice"—"buy high and sell low," which can be described as a "guide to becoming a novice investor"; others offered their own judgment—"L1 and L2 are dead, stay away from contracts or set stop-loss orders, look for low-market-cap RWA tokens"; still others bluntly reminded: "Take profits in time; don't get carried away; dare to act on extreme emotions."

We would like to express our gratitude to all investors who participated in this survey; we would also like to thank the following users who left their IDs for sharing their annual investment memories with Odaily readers: @wanzwa6, @_FORAB, @airn_619, @muzz201o, @0xJerrrry, @bcxiongdi, @GaoNew3, @anchor9960, @cryptoshouyi, @Meiko5200, @a6825272, @qinxiaofeng888, @Asher_0210, @azuma_eth, @ethanzhang_web3, @0xmz2987, @gold7108.

In any case, everyone who is still active in the crypto market is now essentially a "comrade-in-arms" to each other.

The "Big Opportunities" We Missed in 2025: A Review of the Most Heartbreaking Projects of the Year

In closing, I'd like to briefly review the "big opportunities to get rich this year" that countless people missed. As the year went by, numerous opportunities to get rich were presented to us, but due to limitations such as capital, speed, understanding, and even unforeseen circumstances, we missed these opportunities time and time again.

Looking back at the end of 2025, we may be able to see more clearly whether it was "the inability to earn money beyond our understanding" or "a misstep due to mere chance." Whether there are some regrets or more anticipation, the new year is approaching, bringing new opportunities and challenges for us to conquer, explore, succeed, or fail.

Q1 Missed Big Opportunities: Trump, Melania, Swarms, Pippin, TST, Mubarak, Hype, Virtual, IP, Kaito

In the first quarter, Trump's official meme coin, Trump, before Trump took office, can be described as an "epic opportunity to get rich overnight." Many Chinese traders used it to achieve trading profits of $1 million or even over $10 million per coin, making it a prime example of "one step to A8." Subsequently, after a brief period of ripple effects from AI Agent concept coins, the "Binance-affiliated meme coin craze" led by CZ began to emerge, with test coin concepts and celebrity memes once again becoming the focus of the market. The surge in HYPE, the IP airdrop and subsequent 10x increase, and KAITO's pioneering "mouth-based" concept coin also presented good opportunities for wealth creation.

Q2 Missed Big Opportunities: Circle (CRCL) IPO, PUMP, LAUNCHCOIN, USELESS, MYX, HUMA, SAHARA

In the second quarter, DAT gradually joined the crypto battle. Circle's "10x growth miracle" debuted on the US stock market, breaking the previous skepticism and pessimism of the crypto natives towards this compliant stablecoin. Although it was still unable to hide its decline due to subsequent market influences, the "crypto IPO boom" it triggered laid the foundation to some extent for the subsequent expansion of the DAT Treasury Company and the stock tokenization platform. In addition, the chaos on the Launchpad platform, the development of the AI field, and the frequent emergence of miraculous projects on Binance Alpha also injected new vitality into the market liquidity. Many projects took advantage of this to complete TGE and seized the rare "vacuum period of the best time for token issuance in the market".

Q3 Missed Big Opportunities: WLFI, Plasma (XPL), ASTER, AVANT (Avantis)

In the third quarter, two projects were particularly regrettable: Plasma (XPL), which offered nearly 10,000 USDT worth of tokens for a deposit of just 1 USDT; and ASTER, which offered a substantial amount of tokens for trading tens of thousands of USDT. While the former required quick reflexes or KYC verification, its high returns still left many regretting their decision. The latter, however, caused many to sell too early, missing out on millions of USDT worth of ASTER tokens. Ultimately, one can only lament that it was a matter of timing and fate.

Q4 Missed Big Opportunities: Binance Life, 4, Giggle, ZEC

The fourth quarter was more of a "man-made bull market" that was a last gasp. Whether it was Binance Life and other BSC ecosystem Meme coins, which were strongly promoted by Binance figures such as CZ and He Yi, or ZEC, which was revitalized after the "October 11 crash", they were all "man-made products" after the market had reached new highs. Therefore, it is difficult to simply judge them as "big opportunities". However, for the market at that time, it was undoubtedly "the last wealth-creating glow of the year in the crypto market".

Finally, to borrow a phrase from a fellow group member, "You always think opportunities are endless, and they really are." Looking back, many people probably didn't expect there would be so many wealth-creating opportunities in 2025, and seizing just one could be enough to change one's destiny.

2025, the year of crypto mainstreaming, is coming to an end; what kind of magnificent waves await us in the crypto market in 2026?

See you next year.