Meta's Big Bet on AI: Spending $135 Billion, Is Zuckerberg in 2026 Worth Believing?

- Core Viewpoint: Meta's Q4 2025 results and Q1 2026 guidance both exceeded expectations. The core reason for its stock surge is the market's belief that its massive AI investment has directly translated into improved advertising business efficiency, strengthening its core cash flow. This makes the market willing to accept its aggressive capital expenditure plan of up to $135 billion for 2026.

- Key Elements:

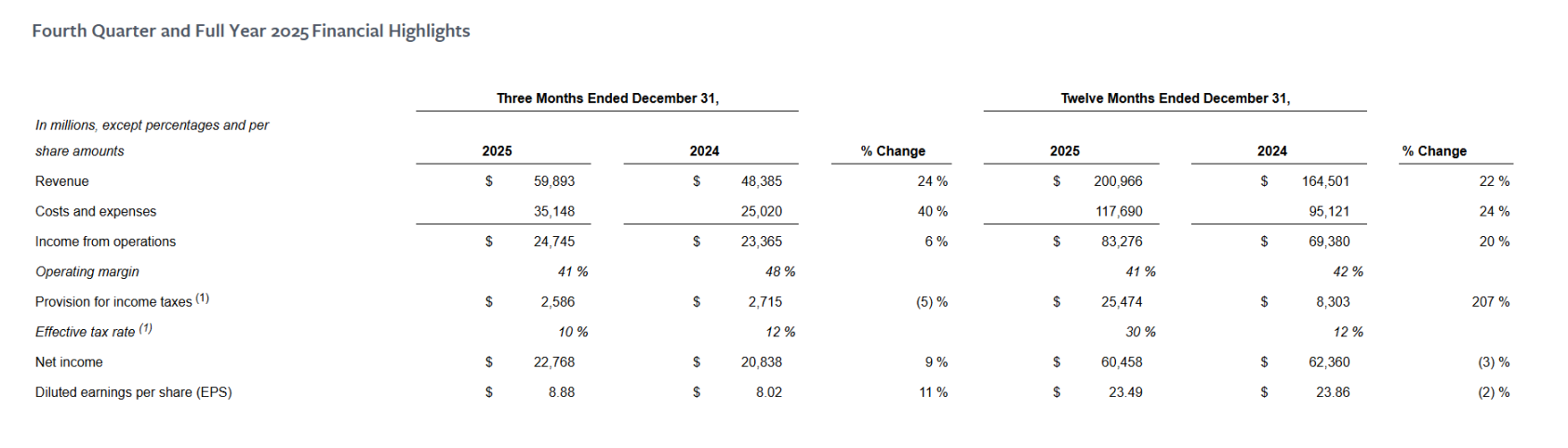

- Strong Financial Performance: Q4 2025 revenue was $59.893 billion (YoY +24%), exceeding expectations. Q1 2026 revenue guidance is $53.5-56.5 billion (YoY +26%-34%), significantly higher than market expectations.

- Advertising Business: Volume and Price Both Rise: Q4 ad impressions grew 18% YoY, average price per ad increased 6% YoY, and ARPU grew 16% YoY, indicating AI effectively enhances advertising efficiency and monetization capability.

- AI Investment Yields Direct Returns: AI is deeply integrated into recommendation and advertising systems, boosting conversion rates. The incremental cash flow generated is offsetting the massive capital expenditures, a model distinct from other tech companies primarily focused on selling models or cloud services.

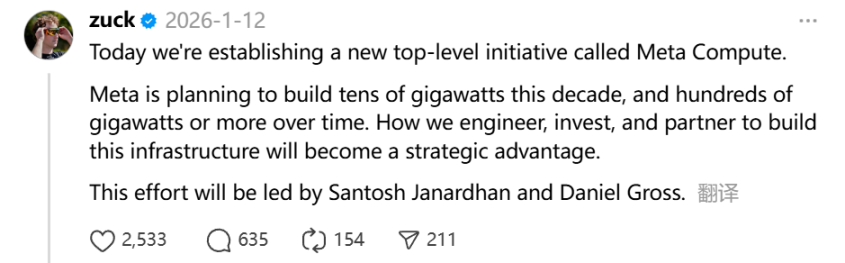

- Strategic Focus Clearly Shifts to AI: Plans for 2026 capital expenditures are nearly $135 billion (about double last year's), launching the top-priority strategic project "Meta Compute." Simultaneously, resources for the metaverse division (Reality Labs) are being compressed to make way for AI.

- Management Provides Financial Backstop: Despite significantly increased investment, operating profit for 2026 is expected to be higher than 2025. The cost growth path (computing power, depreciation, etc.) is highly transparent, alleviating market concerns about uncontrolled spending.

$135 billion — that's the amount Meta (META.M) plans to spend in 2026.

Better-than-expected Q4 2025 results and Q1 2026 guidance provided some relief to shareholders who had been suffering from doubts about the company "falling behind." However, the full-year 2026 capital expenditure (CapEx) soaring to $135 billion — nearly double last year's figure — inevitably raises concerns: Is this another aggressive gamble?

Surprisingly, the market seems to be buying into it. Meta's stock price surged over 10% in after-hours trading and continued to rise overnight.

Meta Stock Price Data Source: Yahoo Finance

The answer lies within this earnings report: At least for now, it shows the market that AI investments are not just future visions but are already tangibly improving the current core cash cow — the advertising business. Therefore, Wall Street is starting to bet on Meta's narrative reversal and is willing to pay for this massive investment plan.

Ultimately, "daring to spend big, daring to go all-in" has always been the essence of Meta and Zuckerberg. This also means that winning could lead to a massive narrative reversal; losing, at least under the current financial structure, is unlikely to spiral into an uncontrollable disaster.

1. Earnings Report Snapshot: Results & Guidance "Both Beat Expectations"

By the numbers, this is an earnings report significant enough to shift market sentiment.

Key financial metrics for Q4 2025 almost universally exceeded expectations: Revenue reached $59.893 billion, up 24% year-over-year, surpassing market expectations of $58.6 billion; Net profit was $22.768 billion, up 9% year-over-year; Diluted earnings per share (EPS) was $8.88, up 11% year-over-year, beating the market expectation of $8.23.

It can be said that Meta delivered a solid, stable Q4 report card, both in terms of growth resilience on the revenue side and the pace of profit release.

Extending the view to the full year, the growth logic holds: Full-year 2025 revenue was $200.966 billion, up 22% year-over-year; Operating profit was $83.276 billion, up 20% year-over-year, with core metrics still expanding at double-digit rates.

The only seemingly "counter-trend" figure was the full-year net profit of $60.458 billion, down 3% year-over-year. However, this change was not due to deterioration in core operations but primarily stemmed from one-time tax factors — influenced by the "Big and Beautiful Act," the company recognized approximately $16 billion in one-time non-cash income tax expenses.

Excluding this factor, full-year net profit and EPS would have still achieved considerable growth, explaining the apparent contradiction between the annual data and the strong quarterly performance.

Source: Meta

Meanwhile, operational metrics also showed a typical pattern of "volume and price rising together":

- Family Daily Active People (DAP) reached 3.58 billion, up 7% year-over-year, meeting market expectations;

- Ad impressions increased 18% year-over-year; Average price per ad increased 6% year-over-year;

- Average Revenue Per User (ARPU) was $16.73, up 16% year-over-year;

This set of data collectively points to one conclusion: Meta's advertising engine has not stalled; instead, it continues to evolve in efficiency and monetization capability.

Furthermore, what truly further stimulated the shift in market sentiment was not just the already delivered better-than-expected results, but also management's optimistic guidance for the future: According to Meta's forecast, Q1 2026 revenue will reach $53.5–$56.5 billion, corresponding to year-over-year growth of 26%–34%, significantly higher than the market's previous expectation of around 21% growth. This guidance implies management's judgment that the high growth momentum of Reels will continue, while Threads' commercialization progress is better than the market's previously cautious expectations.

Against the backdrop of a solid advertising foundation, this guidance directly strengthens market confidence in the sustainability of AI-driven advertising efficiency improvements.

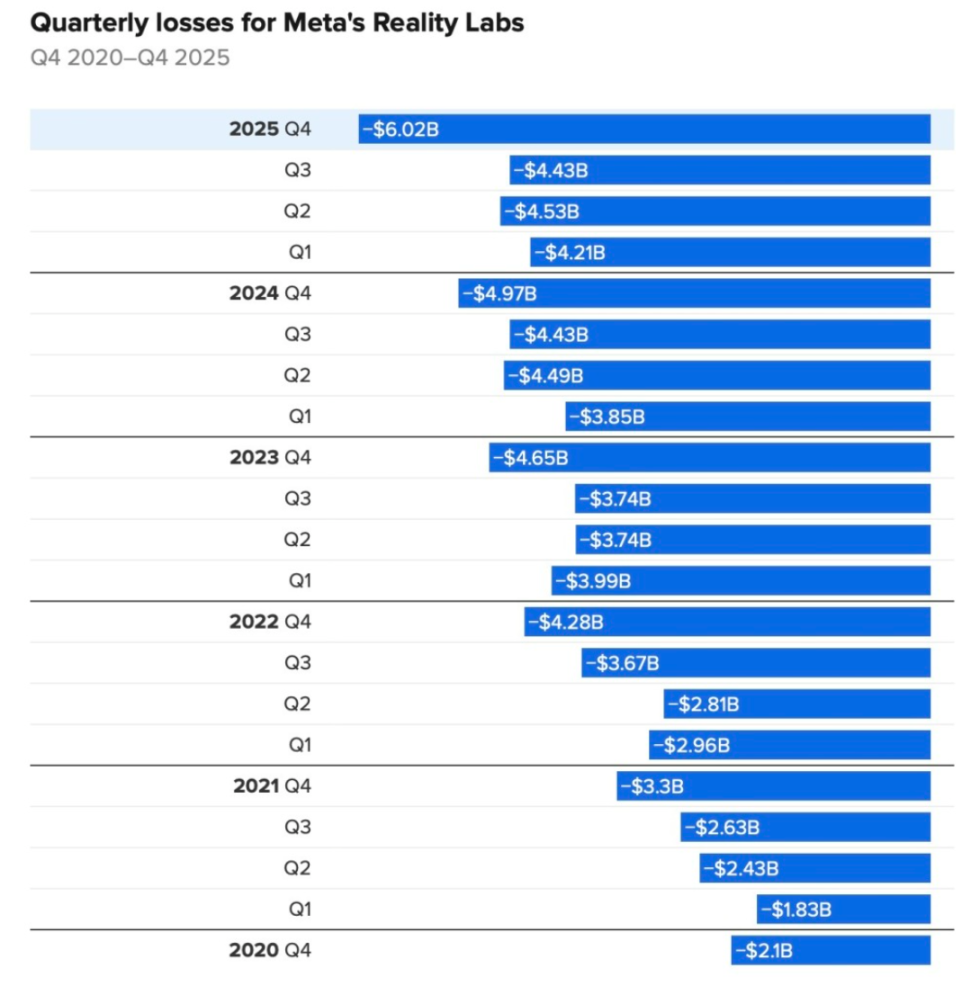

Details of Reality Labs' Losses Over Five Years

Of course, it's worth mentioning that the "metaverse" remains a cash-burning endeavor for Meta. Its metaverse division, Reality Labs, recorded an operating loss of $6.02 billion in Q4, widening by 21% year-over-year, with revenue of $955 million, growing 13% year-over-year. Since the end of 2020, the cumulative operating loss for this division has approached $80 billion.

But unlike before, the role of Reality Labs in the current earnings report is no longer the core variable shaping the company's overall narrative; it is gradually being marginalized.

2. Social Foundation Remains Solid, AI Deepens the "Moat"

At least on the core business front, AI has genuinely started creating tangible monetary value for Meta's (META.M) commercialization.

It can be said that, to some extent, unlike Google (GOOGL.M) or Microsoft (MSFT.M), Meta is currently the most direct player whose "AI investments directly feed back into core operating cash flow," as verified by its financial reports.

First, this is reflected in the systematic improvement of advertising efficiency, benefiting from AI being directly embedded into the recommendation and ad delivery systems, leading to a 6% year-over-year increase in the average price per ad and an 18% surge in impressions in Q4. Management has repeatedly emphasized that upgrades to AI recommendation algorithms and ad delivery systems have significantly improved ad conversion rates and delivery efficiency.

Among these, Instagram Reels' watch time in the US market grew over 30% year-over-year, becoming a core engine driving ad inventory and monetization capability.

Second is the accelerated commercialization of WhatsApp. Meta plans to fully introduce ads into WhatsApp Status within this year, which is seen as the company's next potential multi-billion-dollar revenue growth point and a key step in expanding AI recommendation and ad systems to more traffic scenarios.

Overall, against the backdrop of ongoing external competition from platforms like TikTok, Meta's social foundation has not weakened. Instead, by deeply embedding AI into its recommendation and advertising systems, it has further deepened its moat.

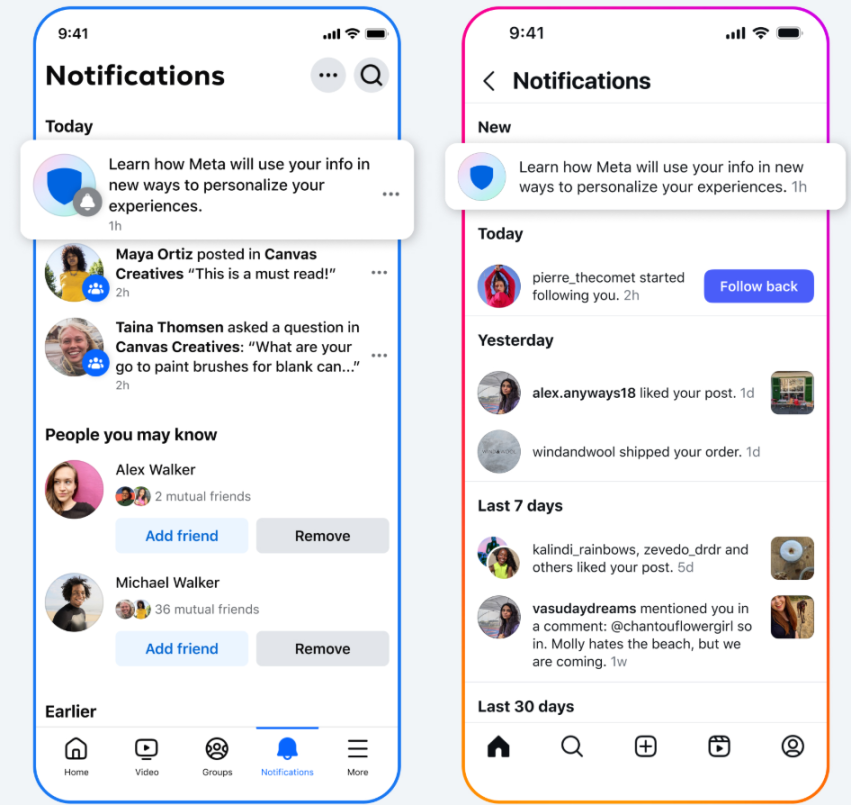

Source: Meta

Looking back over the past year, Meta's moves in the AI direction have been nothing short of aggressive — from spending tens of billions to acquire a stake in Scale AI and bringing in Alexandr Wang to lead the "Meta Superintelligence Lab (MSL)," to continuously poaching top talent with high salaries, restructuring the AI organization, spending billions to acquire Manus, launching Meta Compute, and planning to build tens of gigawatts of computing and power infrastructure within this decade...

This series of actions reminds many of a familiar script: aggressive investment, grand narrative, long payback period. In other words, we seem to be seeing "the Zuckerberg of the metaverse era" again.

But unlike the metaverse period, management has this time provided clear downside expectations, stating that even with significantly increased infrastructure investment, 2026 operating profit will still be higher than 2025's, and the cost growth path for the massive 2026 investment is highly transparent, primarily concentrated in computing power, depreciation, third-party cloud services, and high-end technical talent.

In short, within Meta's strategic framework, AI is not just a future-oriented technological narrative but a practical tool that is continuously improving core operating cash flow. The logic is not complicated: when AI is deeply embedded into recommendation and ad delivery systems, even marginal improvements — for example, getting 3.6 billion users to stay a few dozen seconds longer each day, or increasing ad conversion rates by 1% — are rapidly amplified into substantial, repeatable cash flow increments given Meta's current traffic scale and advertising base.

It is precisely under this high-leverage structure that the efficiency gains brought by AI are tangibly offsetting, or even covering, the annual capital expenditure of $135 billion. In other words, Wall Street is no longer afraid of Meta burning cash, partly because it has already seen the tangible monetary returns from AI.

Interestingly, from a broader perspective, in Silicon Valley's AI arms race, besides the mainstream path of busy exporting computing power, models, and tools — essentially "selling shovels and tools" to the world — another path is the Meta model: internalizing AI as the heart of its own commercial system, directly amplifying its existing traffic and monetization engines.

It is this model, which does not rely on selling new products externally but achieves returns by enhancing its own monetization efficiency, that distinguishes Meta's AI investment path from the monetization logic of other large tech companies centered on large models or cloud services. This is also why the market is beginning to re-evaluate Meta's valuation basis:

AI here is not a distant story waiting to be realized, but a real variable that can already be continuously and quantifiably fed back into core operating cash flow through the advertising system.

This is perhaps the fundamental reason why the market is willing to reprice Meta.

3. An All-In Gamble: A War That Cannot Be Lost?

"Superintelligence" has become one of the most frequently mentioned keywords by Zuckerberg and Meta's management.

Zuckerberg did not hide his ambition during the earnings call: "I look forward to advancing personal superintelligence for global users." This has become a long-term Meta strategy encompassing talent, computing power, and infrastructure.

First, looking at the capital expenditure numbers, as mentioned above, Meta has embarked on an all-out, aggressive gamble. Full-year 2026 operating expenses will reach $162–$169 billion, a year-over-year increase of 37%–44%, significantly higher than the market buy-side's previous expectation range of approximately $150–$160 billion.

Meanwhile, Meta is also using actions to send "trade-off signals" to the market. Just this month, media reports disclosed its plan to cut another approximately 10% of Reality Labs' workforce, affecting about 1,500 people. This means metaverse-related businesses are being further compressed to free up resources for AI and core operations.

More strategically significant is Meta's reclassification of computing power and infrastructure. Zuckerberg personally posted on January 12th, stating, "We've started a new top-level strategic project called Meta Compute." According to disclosed information, Meta plans to invest at least $600 billion cumulatively in US data centers and related infrastructure by 2028.

However, Meta's CFO Susan Li later clarified this figure, stating that the investment is not solely for AI server procurement but covers the construction of data centers in the US, computing and power infrastructure, as well as the costs of new employees and supporting resources needed to sustain US business operations.

Objectively speaking, whether measured by talent density, computing scale, or infrastructure intensity, Meta's investment in the AI direction is now on par with, or even exceeds in some dimensions, that of its main competitors.

Of course, this path is inherently a double-edged sword. Once revenue growth, advertising efficiency, or progress on new models fails to keep pace with cost expansion, market tolerance will quickly diminish, and both valuation and profit expectations could face a backlash.

In other words, this is not an experiment that allows for repeated trial and error, but a strategic war that, once begun, is difficult to turn back from.

In Conclusion

As early as a blog episode in September 2025, Zuckerberg bluntly stated that it would be very unfortunate if they ultimately wasted hundreds of billions of dollars. But on the other hand, the risk of falling behind in the AI wave might be even higher for Meta.

"For Meta, the real risk is not whether the investment is too aggressive, but whether we will hesitate at critical moments." In today's context, these words can almost be seen as a footnote to all of Meta's strategic moves over the past year.

Of course, history is not easily forgotten. In the previous metaverse narrative, Zuckerberg also chose to place early bets and push forward with full force, but the final outcome did not meet the market's initial expectations.

The difference this time is that Meta holds the world's densest, most commercially viable user traffic portals in its hands; and AI is reshaping the efficiency of connections between people and content, and between people and commerce, in unprecedented ways.

As for whether $135 billion represents a historic strategic sprint or another costly lesson, the answer still requires time to reveal.