The Twilight of the Cathedral: When Crypto Ideals Descend into a Speculative Casino

- Core Viewpoint: Using the metaphor of "Cathedral vs. Casino," the article provides a profound analysis of the crypto industry's alienation from its early idealistic construction (the cathedral) towards the current speculative frenzy represented by Meme coins (the casino). It argues that this "casino-ization" is systematically driving away builders, distorting community spirit, hindering long-term capital investment, and ultimately risks destroying the industry's future.

- Key Elements:

- Sign of Industry Alienation: Developer Peter Steinberger faced a network siege and harassment after refusing to cooperate with speculators who forcibly launched a Meme token based on his open-source AI project, highlighting the sharp conflict between builders and speculators.

- Origins of Idealism: Early communities, like that of Dogecoin, were guided by values of "fun, kindness, and giving," demonstrating the positive power of consensus through charitable fundraising and similar actions.

- Catalyst of the Speculative Wave: The massive global central bank liquidity injections from 2020-2021 flooded the crypto market with hot money, causing the narrative of short-term wealth pursuit to overwhelm that of value creation.

- Transformation of Community Nature: "Community-driven" has been distorted into "the tyranny of the mob." Groups are now bound merely by shared holdings, engaging in moral coercion against spiritual leaders like Vitalik Buterin and twisting their benevolent acts into speculative signals.

- Catastrophic Data Scale: In 2025, the crypto world created 11.9 million new tokens while 11.6 million projects died. The number of failed projects grew by over 4000 times compared to 2021, indicating that "industrialized token launches" have led to a flood of junk.

- Technology Lowers the Barrier to Malice: Public chains like Solana and tools like pump.fun have drastically reduced the cost and difficulty of launching tokens, providing a technological breeding ground for the scaling of speculative disasters.

- Systemic Cost to the Industry: The prevalence of speculation leads to the persecution of builders, the erosion of spiritual leadership, the deterrence of long-term capital (e.g., a16z), and provides grounds for harsh regulatory crackdowns (such as invoking the *RICO Act*), endangering the industry's very foundation.

Not long ago, I read an open letter from IOSG founder Jocy to Chinese Crypto OGs. In the letter, Jocy quoted a line from Warren Buffett: "For the next 100 years, ensure the cathedral is not swallowed by the casino."

Jocy used this metaphor to describe the dilemma of the crypto industry: on one side is the grand cathedral built with code and ideals; on the other is a massive casino filled with speculation and hype.

Just days after this letter was published, a developer named Peter Steinberger saw his open-source AI project, Clawd bot, which he built in his spare time, go viral overnight.

But on the very day the project exploded in popularity, a group of cryptocurrency speculators, without Peter's knowledge, quickly launched a meme coin named CLAWD, whose market cap was pumped to as high as $16 million. Subsequently, Peter posted on Twitter stating he would absolutely not issue any cryptocurrency, would not participate in any meme coin, and pleaded with "Crypto Folks" to stop harassing him.

The speculators believed Peter's statements caused the coin's price to crash. They hijacked his GitHub account during a project renaming process and launched a frenzied online siege and personal harassment campaign against him, demanding that Peter take responsibility for the scam they themselves had created.

This was probably the moment in recent times when I least wanted to admit I am a crypto industry professional.

The entire crypto industry is experiencing a great collapse. The prosperity of the casino is not only failing to give back to the cathedral but is actively destroying those trying to build it.

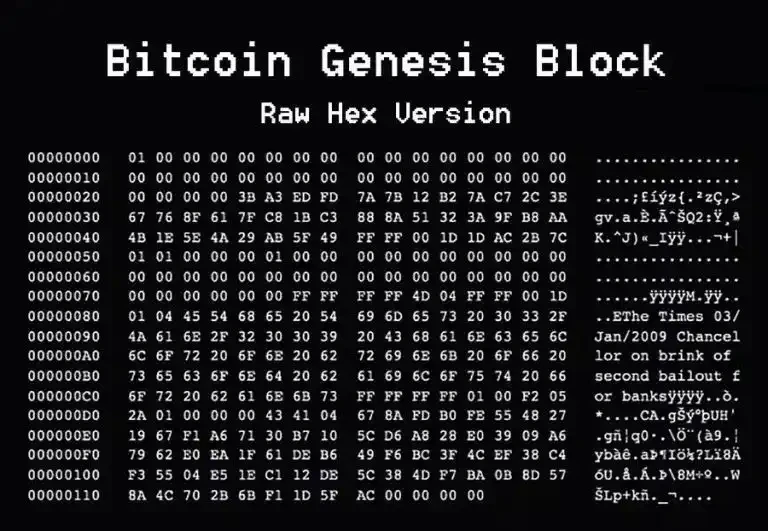

From 2009 when Satoshi Nakamoto mined Bitcoin's genesis block to 2026, what exactly has happened in these seventeen years? How did that cathedral built with code and ideals get step-by-step transformed into a casino filled with the clatter of dice and cries of despair?

The Cathedral's Bells

To answer this question, let's first return to the starting point of everything, back to the era when the bells still rang clear.

For a long time after Bitcoin's birth, the industry's mainstream narrative was about building. Early participants were mostly cypherpunks, libertarians, and tech geeks, obsessed with the decentralized utopia envisioned by Satoshi Nakamoto and trying to add bricks and mortar to this cathedral with lines of code.

Even the industry's most famous memecoin, Dogecoin, initially shone with an idealistic glow.

In December 2013, two software engineers, Billy Markus (IBM) and Jackson Palmer (Adobe), decided to create an "absurd" cryptocurrency to satirize the increasingly rampant cryptocurrency speculation at the time. Markus slightly modified Bitcoin's code, changed the font to a comical comic style, and replaced Bitcoin's icon with a Shiba Inu meme popular on the internet then. Thus, Dogecoin was born.

"It was literally created as a joke," Markus recalled years later in an open letter. "We had no expectations or plans."

But this joke unexpectedly gave birth to one of the most unique communities in the crypto world. Early Dogecoin users weren't concerned with price fluctuations; they were passionate about tipping culture, using Dogecoin worth less than a cent to "like" content they enjoyed on social media. They used this almost free method to spread joy, kindness, and creativity.

In 2014, they raised $30,000 worth of Dogecoin for the underfunded Jamaican bobsled team, helping them reach the Sochi Winter Olympics; they raised funds for water-scarce regions in Kenya to build wells; they also sponsored a NASCAR driver named Josh Wise, letting a car emblazoned with the Shiba Inu logo race in America's most popular motorsport event.

"Fun, kindness, learning, giving, empathy, fun, community, inspiration, creativity, generosity, silliness, absurdity," Markus defined the true value of Dogecoin in his open letter. "If the community embodies these things, that's the real value."

This is one of the most moving snapshots of the Cathedral Era. In that era, people believed the power of consensus could turn a joke into a force for good.

This passion for building reached its peak during the DeFi Summer of 2020. Ethereum builders used smart contracts to construct a permissionless, trustless decentralized finance world. From the decentralized exchange Uniswap to lending protocols like Compound and Aave, financial applications like Lego bricks were assembled. The entire crypto world's TVL skyrocketed from under $700 million to $117.6 billion in just a year. A new financial paradigm was rising on the horizon.

Until 2021, the flavor began to turn somewhat sour. That year, under the impact of the COVID-19 pandemic, global central banks embarked on an unprecedented money-printing spree, with the US alone rolling out a massive $5 trillion economic stimulus plan. Trillions in hot money flooded the market, seeking any asset to speculate on. Cryptocurrency became the wildest main course in this liquidity feast.

Bitcoin's price rose 788% in a year; Ethereum rose 1264%. According to surveys, US young adults aged 25-34 invested half of their stimulus checks into cryptocurrencies and stocks.

Money had never been so cheap; the dream of getting rich overnight had never felt so real.

The cathedral's bells were gradually drowned out by the sound of dice rattling in the casino.

The Tyranny of the Mob

French social psychologist Gustave Le Bon made a surgically precise assertion in his work *The Crowd*:

"Once an individual becomes part of a group, he is no longer responsible for his actions. At this point, everyone reveals the instincts that would be restrained when alone... The crowd is impulsive, fickle, and irritable. It is entirely governed by unconscious motives."

In the post-2021 crypto world, when communities are no longer united by shared vision and values but merely bound by the fragile common interest of holding the same asset, "community-driven" rapidly degenerates into "the tyranny of the mob."

The first to be sacrificed was Dogecoin's spiritual totem—its creator, Billy Markus.

As Dogecoin was pumped hundreds or thousands of times during the 2021 frenzy, Markus's social media inbox was flooded with private messages. People frantically demanded he "do something" to make their Dogecoin more valuable.

They didn't care that Markus had already sold all his Dogecoin in 2015 after being laid off, getting only a used Honda in return; they didn't care that Markus's mother was about to lose her house because she couldn't pay the mortgage.

They only cared about themselves.

"When I see pump-and-dumps, greed, scams," Markus wrote in his open letter, "I'm not angry, just disappointed."

If the attacks on Markus were merely the prelude to this tyranny, then the siege against Vitalik Buterin (V神) pushed this farce to its first climax.

In May 2021, SHIB, without any communication, directly sent 50% of the project's total token supply to Vitalik's public wallet address, nominally worth up to $8 billion at the time. Their calculation was shrewd: Vitalik is the crypto world's acknowledged "god." As long as he didn't sell, it provided the strongest credit endorsement for SHIB; if he sold, a large number of tokens would be burned, which was also bullish.

This was a carefully designed moral trap. They placed Vitalik in a dilemma where any choice he made seemed to serve the speculators' interests.

But Vitalik responded with the most decisive rejection of this sacrifice. He donated $1.3 billion worth of SHIB to the India COVID-Crypto Relief Fund, burned most of the remaining tokens, sold large amounts of other animal meme coins he had "received," and made genuine donations to charities.

He acted like a patriarch cleaning house, trying to use successive sell-offs to warn believers沉迷于 Meme 狂热. From 2021 to 2025, he repeatedly sold and donated received meme coins, turning them into funds for animal welfare, biotech research, and disaster relief. He even publicly appealed multiple times: "I wish meme coin creators would donate directly to charities instead of sending coins to me."

But his resistance seemed so powerless against the collective speculative desire. Followers quickly found new explanations for his actions: "Vitalik is helping us burn tokens, that's bullish!" "Vitalik is doing marketing, he actually supports us!"

In the group logic described in *The Crowd*, any fact can be twisted to serve the collective emotion and fantasy.

If the sacrifice of Vitalik still carried a touch of religious absurdity, then by 2026, when the iron fist of tyranny struck Clawd bot developer Peter Steinberger, it had evolved into a blatant kidnapping.

Speculators no longer needed a god's endorsement; they could directly "create" a god and tie him to their chariot. When Peter refused to endorse the CLAWD scam they launched, he transformed from a celebrated hero into a traitor who must be eliminated. Account hijacking, verbal attacks, private message harassment... every means was employed to force his compliance.

In the name of community, they practiced tyranny, with the price chart as their only doctrine.

When an industry's community degenerates from a collaborative network based on shared ideals into a violent machine based on shared holdings, what scale of disaster can it create?

11.6 Million Bullets

The answer is: a collectively suicidal prosperity.

According to the annual report released by crypto data analytics firm CoinGecko, in 2025, the crypto world created 11.9 million new tokens. This means that on average, over 32,000 new "assets" were born every single day. The corresponding data point is that in the same year, 11.6 million crypto projects died.

For comparison, at the peak of the 2021 bull market, the number of failed projects that year was 2,584. In four years, this number grew by 4,489 times.

When token issuance becomes an industry, what we get is not a diversity of value, but the industrialization of garbage.

This disaster resulted from the combined effects of technological progress, macro liquidity, and human greed. On one hand, new-generation public chains like Solana increased transaction speeds by 100 times while reducing costs by 1000 times. The emergence of tools like pump.fun, which allow token creation for a few dollars, lowered the barrier from creating a blockchain to a single mouse click. Technological progress unexpectedly provided the perfect breeding ground for disaster at scale.

On the other hand, the unprecedented global liquidity injection of 2020-2021彻底改变了市场的风险偏好. When money becomes cheap and traditional value investment yields are pitifully low, people疯狂追逐波动性. Whether an asset has intrinsic value became less important than whether it could provide enough volatility to satisfy the渴望快速致富.

Thus, we witnessed the most absurd scene in the crypto world: the entire industry is racing to meme-ify.

Those social applications claiming to颠覆 Web2, those blockchain games宣称要构建元宇宙, those star projects顶着 Layer2 扩容方案光环—the sole value of their tokens is to be traded by retail investors on secondary markets.

When the functionality of a Layer2 token is essentially no different from a Shiba Inu coin, we must admit: within the casino, everything is a meme.

These 11.6 million tokens that went to zero are like 11.6 million bullets fired at the future of the crypto world. Each one declares to the world that this industry is not trustworthy. And when an industry's incentive mechanisms完全向投机而非创新倾斜, what price will those who truly want to build the cathedral pay?

The Death of the Builders

They are experiencing a triple death.

The first death is the social death of body and spirit.

The ordeal of Clawd bot developer Peter Steinberger is just one缩影 of countless builders'困境. When a developer invests months or even years of effort to create a truly valuable, popular product, what they might receive is not flowers and applause, but a swarm of sharks smelling blood.

They turn your project, your name, your reputation into chips in their casino. If you comply, you become an accomplice to the scam; if you resist, you become an enemy that must be eliminated.

The second death is the idol death of spiritual leaders.

Vitalik's resistance is a Don Quixote-esque tragedy. He tried to use个人力量 to对抗一个行业的沉沦. He sold repeatedly, donated repeatedly, appealed publicly repeatedly, but was met with the mob's mockery and escalating entrapment.

When an industry's spiritual leader's善举 are only interpreted by gamblers as bullish signals, the industry loses its last fig leaf of morality.

In this twilight of idols, the lighthouse of spirit is彻底熄灭.

The third death is the capital death of顶层设计.

When the casino image of meme coins becomes the industry's most鲜明标签, even the smart money attempting long-term value investment starts to hesitate. In 2025, Eddy Lazzarin, Chief Technology Officer of the顶级加密风投 a16z crypto, known for betting on the future, publicly stated on social media: "Meme coins are hurting many builders' long-term visions. It looks at best like a risky casino."

This is not just a高管抱怨; it's a dangerous signal. It means the industry's顶层设计者 are losing confidence in the future. When capital is no longer willing to fund cathedral projects requiring long-term投入 but only chases short-term赌场游戏, the source of innovation is彻底切断.

More致命的是, the泛滥 of meme coins provides the perfect ammunition for global regulators. It labels the entire industry with fraud, money laundering, and high-risk speculation, tarnishing projects and enterprises that have worked for years towards compliance. In 2025, class-action lawsuits against platforms like pump.fun began citing the US *RICO Act*—a law originally designed to combat organized crime.

We once looked to the stars, dreaming that code could change the world; now we are mired in the mud, searching for the next 100x coin in animal and celebrity头像. When builders are exiled, when spiritual leaders are消解, when capital and regulation both亮起红灯, what do we have left?

The Bells, the Dice, the Sighs, All Echo in Our Ears

Seventeen years ago, Satoshi Nakamoto quoted a *Times* headline in the genesis block, wanting to create a fair financial world without货币超发 or银行作恶.

Seventeen years later, when a developer is besieged for creating something valuable, we must admit this industry is proving, at the fastest possible speed, that it does not deserve a future.

When this狂热退潮, what will be left is a vast信任废墟. Upon this废墟, do we choose to continue playing this game of survivor bias gambling, or do we choose to rediscover our初心, to identify, follow, and become those who still坚持敲响大教堂钟声 amidst the ruins?

This will be an unavoidable question for every participant in the crypto world. The sound of bells, dice, and sighs will continue to echo over this industry for a long time.

A very long time.