Silver Moon in the Sky, How Long Will Silver Keep Rising?

- Core View: The silver market is experiencing a historic bull run driven by structural supply-demand imbalances, strategic global capital flows (particularly Chinese capital flight), and concerns over currency devaluation. Its price surge is a signal of stress on the US dollar-dominated global financial system.

- Key Factors:

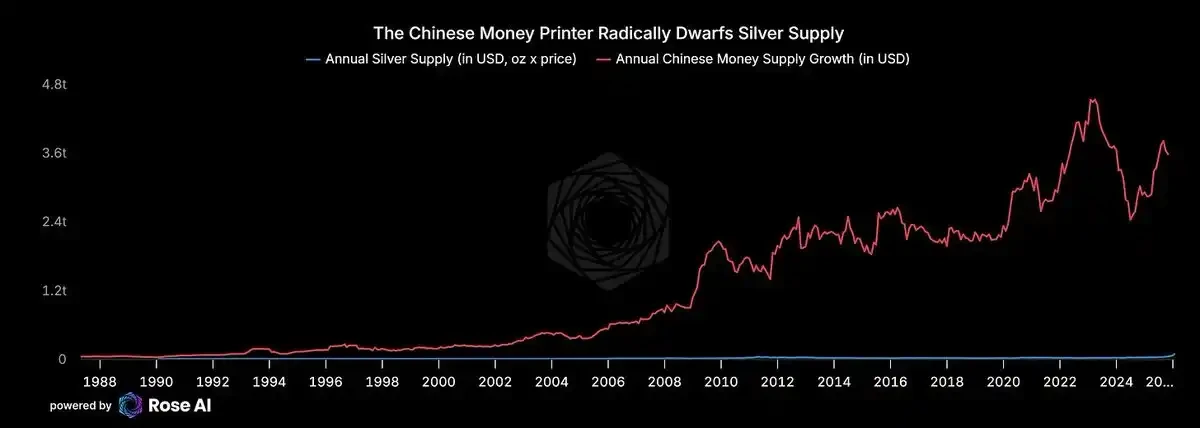

- Core Driver: Chinese capital flight seeking asset preservation. Its massive savings scale (increasing by approximately $3 trillion annually) represents disruptive purchasing power for the silver market, which is only worth hundreds of billions of dollars.

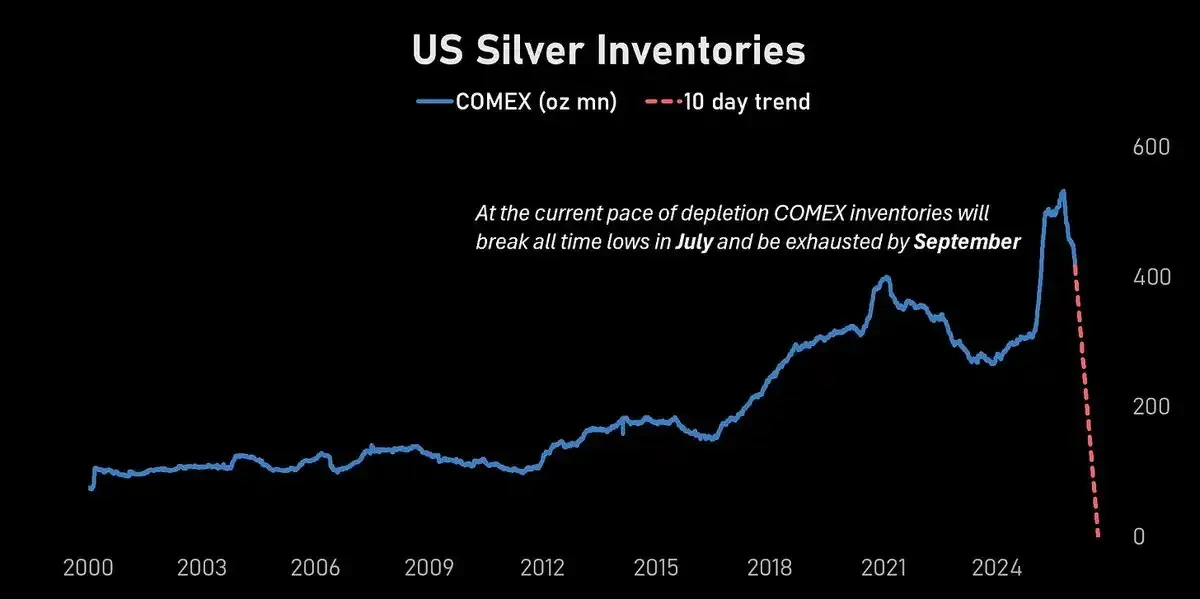

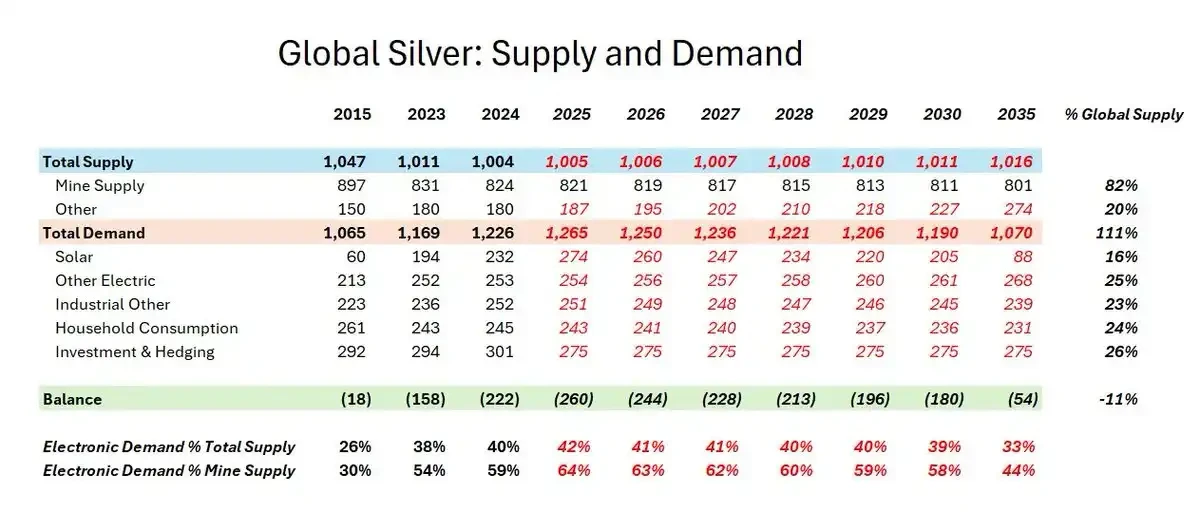

- Supply-Demand Structure: Solar/AI industries bring rigid demand growth, while mine supply is inelastic and growing slowly. COMEX inventories are being depleted at a record pace and could be exhausted within months.

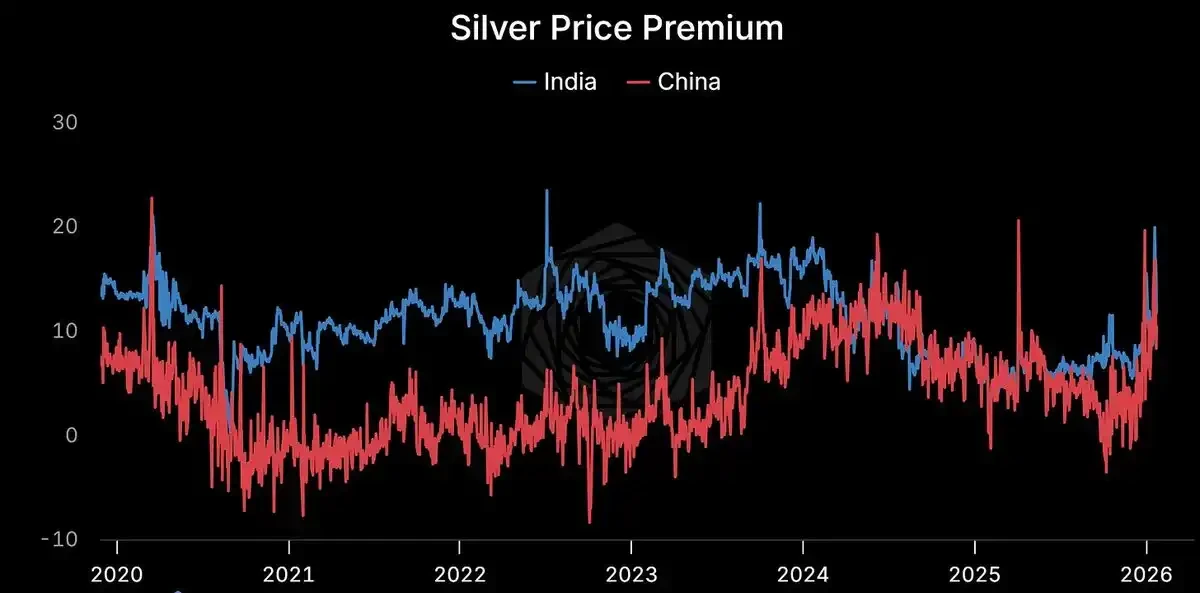

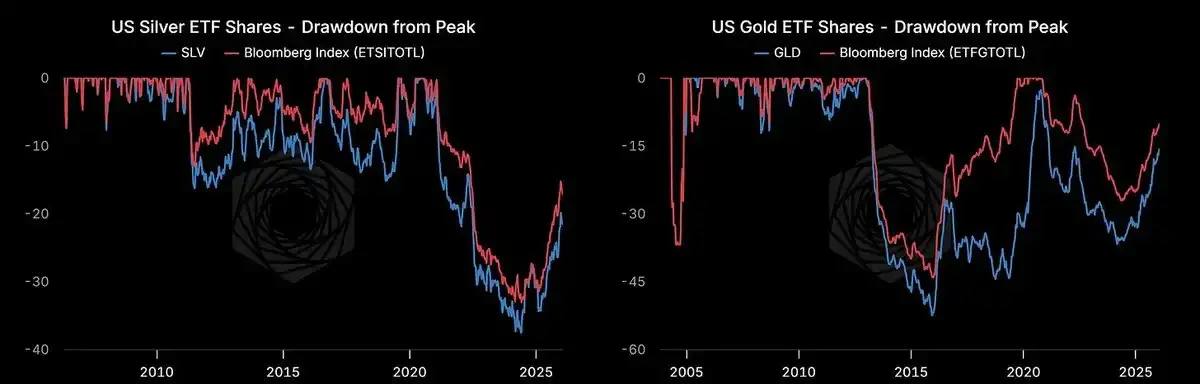

- Market Signals: The Shanghai silver premium over COMEX consistently exceeds 10%, indicating strong physical demand. Western speculative positioning is not extreme, and there is still room for ETF inflows.

- Main Risks: A strengthening US dollar could trigger panic selling among weak-handed holders. High prices are eroding solar industry profits and accelerating the R&D and application of substitute materials like copper.

- Trading Logic: The author maintains long exposure to silver but manages risk through options, monitoring key signals such as the Shanghai premium, COMEX inventory, and US dollar trends to gauge market direction.

Original Title: Silver Moon

Original Author: @abcampbell, Ex Bridgewater

Original Compilation: SpecialistXBT, BlockBeats

Editor's Note: This article analyzes how irreversible industrial demand, rigid supply bottlenecks, and strategic capital flows have become the driving forces behind silver's surge. It also calmly points out potential risks such as a US dollar rebound and technological substitution, providing investors with a "barometer" to observe the market's true strength.

The following is the original content:

It has been a month since we last discussed silver.

A month ago, silver's year-to-date gain was 45%.

Remember when I said things were about to get "scary"?

The past year has seen silver trading evolve from obscurity to a conspicuous bull market, and then to a seismic shift capable of altering historical trajectories. The drivers we identified years ago—rigid demand from solar power, rigid supply due to mining dynamics, Veblen-esque speculative flows, strategic investor purchases for dollar diversification, capital flight from emerging markets with fragile banking systems, and strategic hoarding—have now all materialized and are operating at full throttle.

Yet, this rally feels less like a party and more like a doomsday clock ticking. Not for silver itself, but for the US dollar and the global order it underpins. It is a signal of the world our children will inhabit, starkly different from that of our parents.

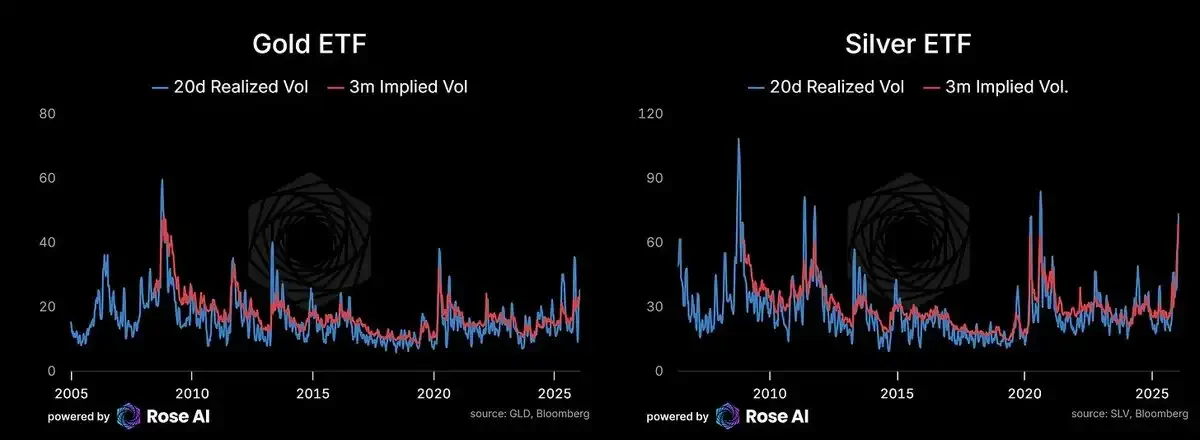

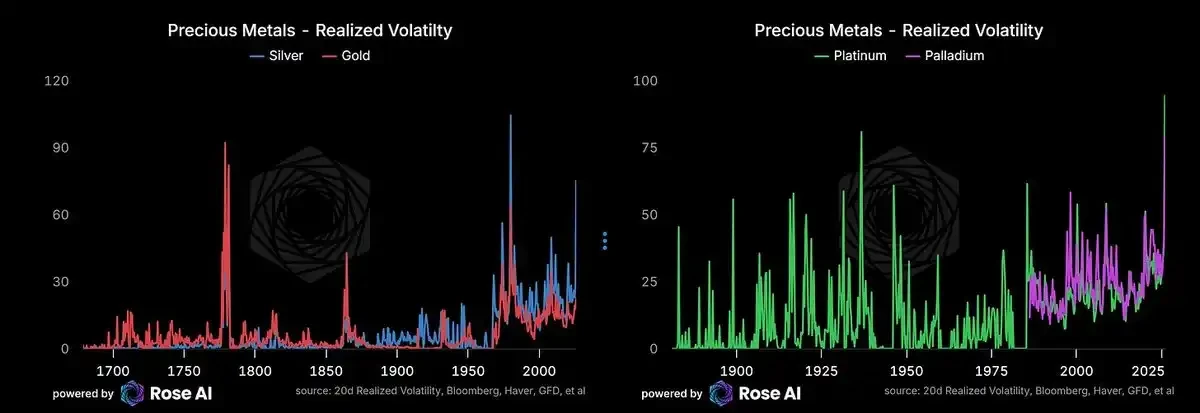

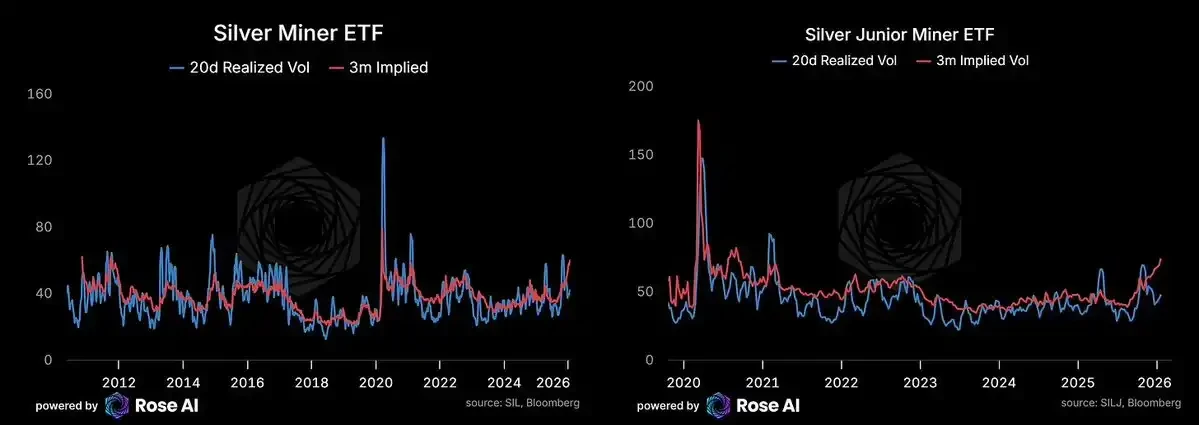

The options market is pricing daily volatility exceeding 4% for the coming months, and 3% for the foreseeable future. This is being confirmed by realized volatility. In recorded history, silver volatility has been higher only twice: during the 1981 Hunt Brothers squeeze and during the American Revolutionary War (when volatility stemmed from the collapse of local currencies against the pound, not the metal's price itself).

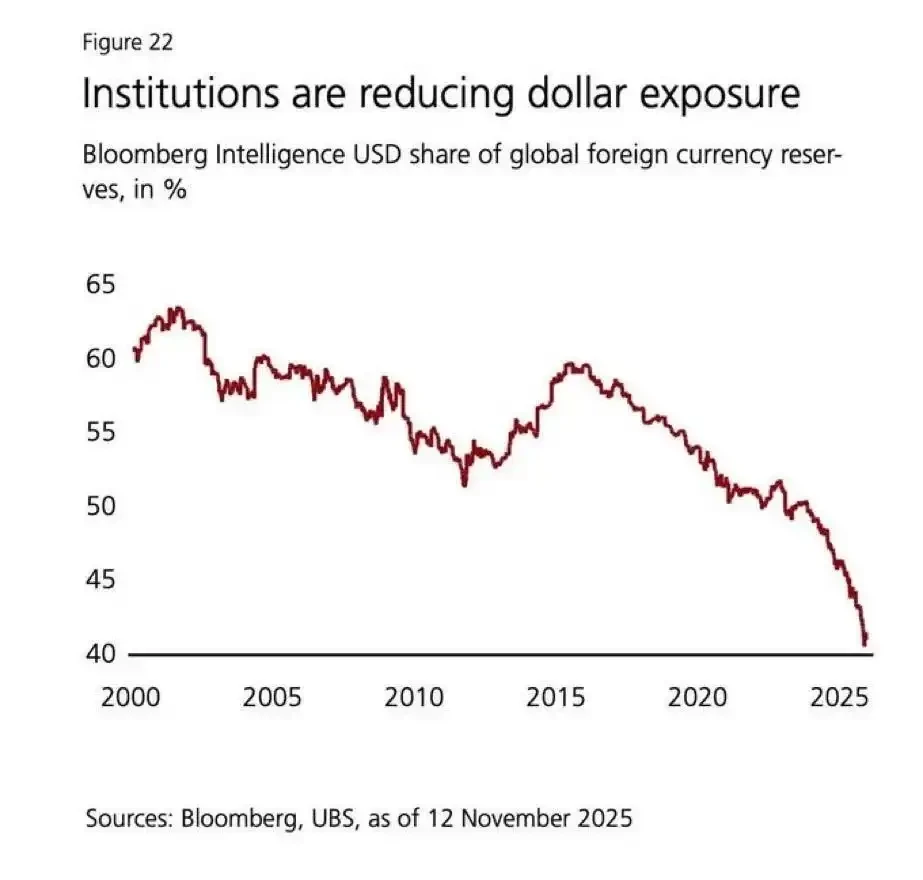

Gold volatility has also risen—consistent with the broader currency debasement trade, diversification flows out of emerging market currencies, and the trend of nations seeking alternatives to Treasuries in their reserve portfolios.

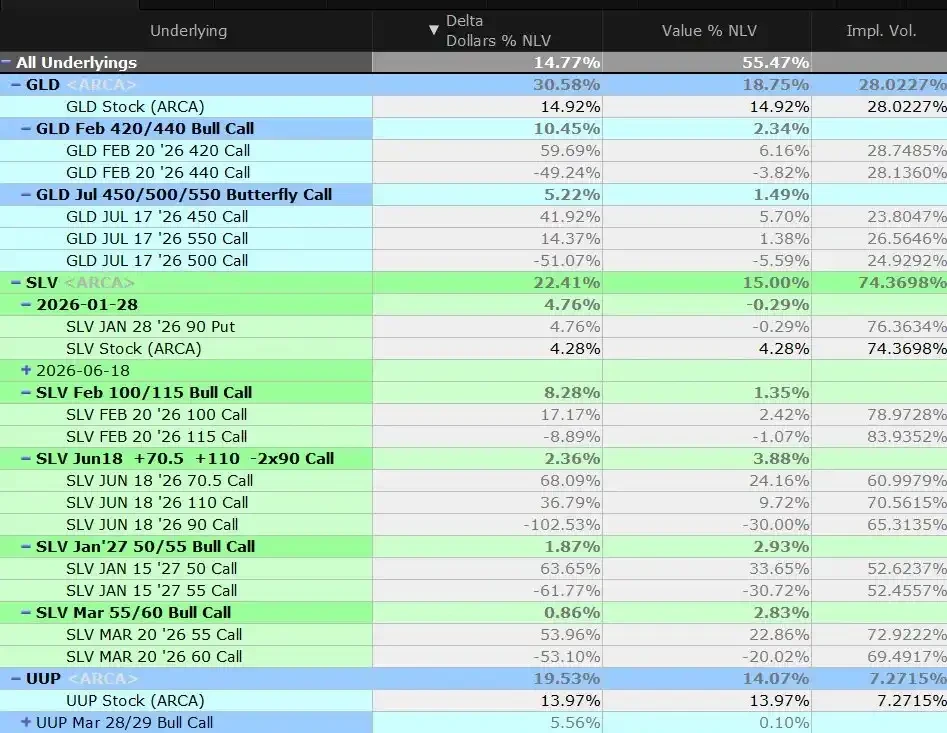

In short: We have reconfigured our gold position and closed just over half of our butterfly spread as spot broke through the middle strike last week. We remain net long.

Concurrently, we maintain shorts on US equities, US bonds/credit, and a small long dollar position to hedge some of the implicit dollar short risk in our metals exposure.

What's Driving It

In a market with structural supply deficits driven by solar/AI demand, Chinese capital flight remains the core short-term driver.

Recall why we entered this trade—seeking assets that could appreciate due to Chinese capital flight. Global annual silver supply, including recycling, is only about 1 billion ounces. At $100/oz, that's a $100 billion market. China's "printing press" creates about $3 trillion in new bank deposits annually. Now that the secret that real estate is no longer a safe store of wealth is out, even a minor shift in savings behavior is enough to overwhelm the silver market.

This is precisely what you're seeing.

If you were a wealthy Chinese household, would you want more money in a zombie banking system with trillions in implicit losses? Or would you rather buy physical silver at elevated prices and risk a 30% drawdown? The answer is obvious when your alternative is depositing in a technically insolvent bank.

Chinese property bonds are selling off again. Stocks in our "Worst Chinese Banks" basket are also turning down.

Indian and Middle Eastern money is also flowing in. If you were an Indian oligarch, would you want to hold wealth in a currency that has depreciated over 20% against the dollar since 2020?

European institutions are finally waking up. If you were a European pension fund with 40% of assets in US bonds and stocks (many illiquid and overvalued—think private equity, venture capital, private credit), you've been underweight metals for years. Now, you have both political diversification reasons, and your investors are asking why you missed this move.

Official buying seems inevitable. Asian demand appears insatiable. The rebalancing trades that suppressed retail demand late last year are over. ETF inflows are strong but still below historical peaks.

At this point, the question seems not *if* governments will establish strategic silver reserves, but *when* they will start.

Why We Remain Long

The premium persists.

Shanghai: $114/oz. COMEX: $103/oz. Premium over 10%. Persistent. Structural.

When physical and paper prices diverge this much, one side is wrong. History tells us it's usually not the physical side.

COMEX inventories are plummeting.

At the current drawdown rate, COMEX inventories will hit record lows in July and be functionally exhausted by September.

Hard to see that far in a market with 70% annualized volatility. But the direction is clear.

ETF flows still have room.

US silver ETF shares are rising but still about 20% below their 2021 peak. We are not yet at the mania stage.

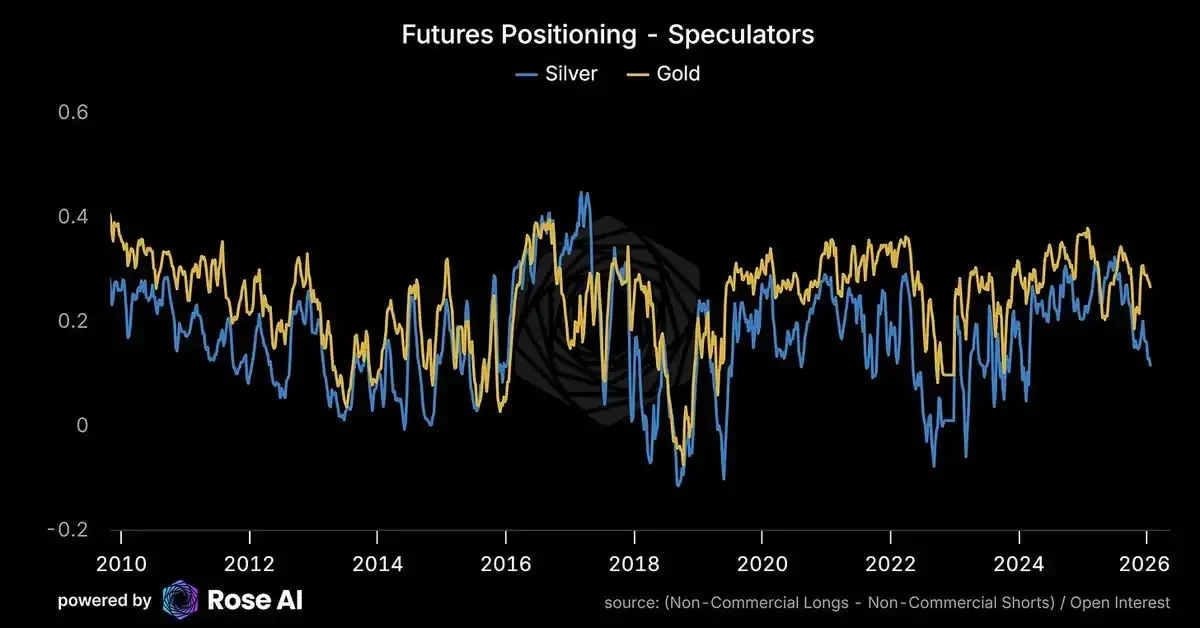

Speculative positioning is not crowded.

Western speculators actually reduced longs and attracted shorts as prices broke to new highs. Positioning is not extreme.

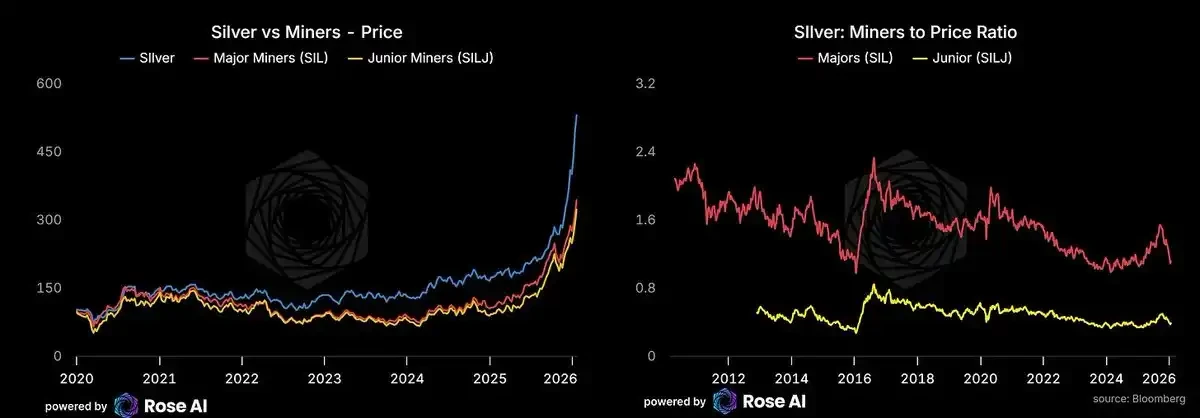

Mining stocks are lagging.

Mining stocks are catching up but still underperforming the underlying commodity. If energy prices stay low (watch the Strait of Hormuz), miners could see a catch-up rally. We are long junior miners via stocks, not options—miner option vol is expensive relative to realized vol.

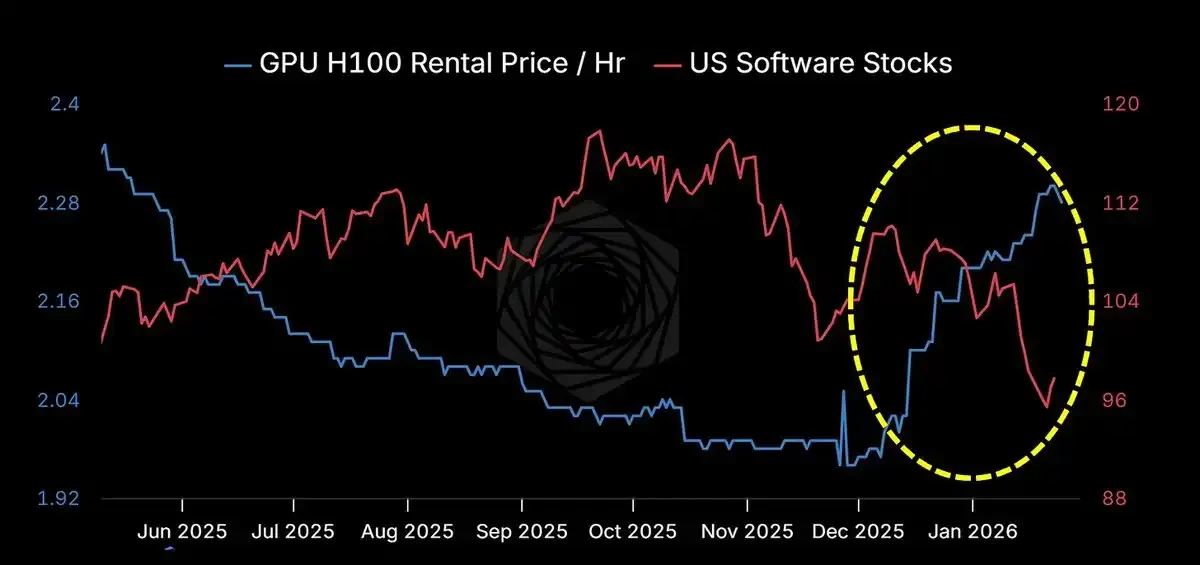

AI Accelerates, Then Accelerates Again

Claude Code and its imitators/forks (Codex, Ralph Wiggins, Clawdbot) are showing what "agents" really look like. The key isn't complex workflows, but crossing the trust threshold: you give a machine full access to your computer, files, and apps. Hackers and enthusiasts are scrambling to buy Mac Minis. I've built an agent framework (hoping to release this month). RAM is sold out. Rental prices are soaring, while traditional SaaS businesses are withering. Maybe software ate the world, and then GPUs ate software.

Cash flow manifestation takes time, but the machine age is here. More machines mean more data centers. More data centers mean more power demand. More power demand means more solar.

More solar means more silver.

Potential Risks

A stronger dollar is a near-term risk.

The recent rally has been exacerbated by dollar weakness. If the US economy continues strong growth, the substantial rate cut expectations embedded in the 2-year curve could be removed, pushing the dollar higher. The dollar weakness of the past few days undoubtedly exacerbated the latest leg up.

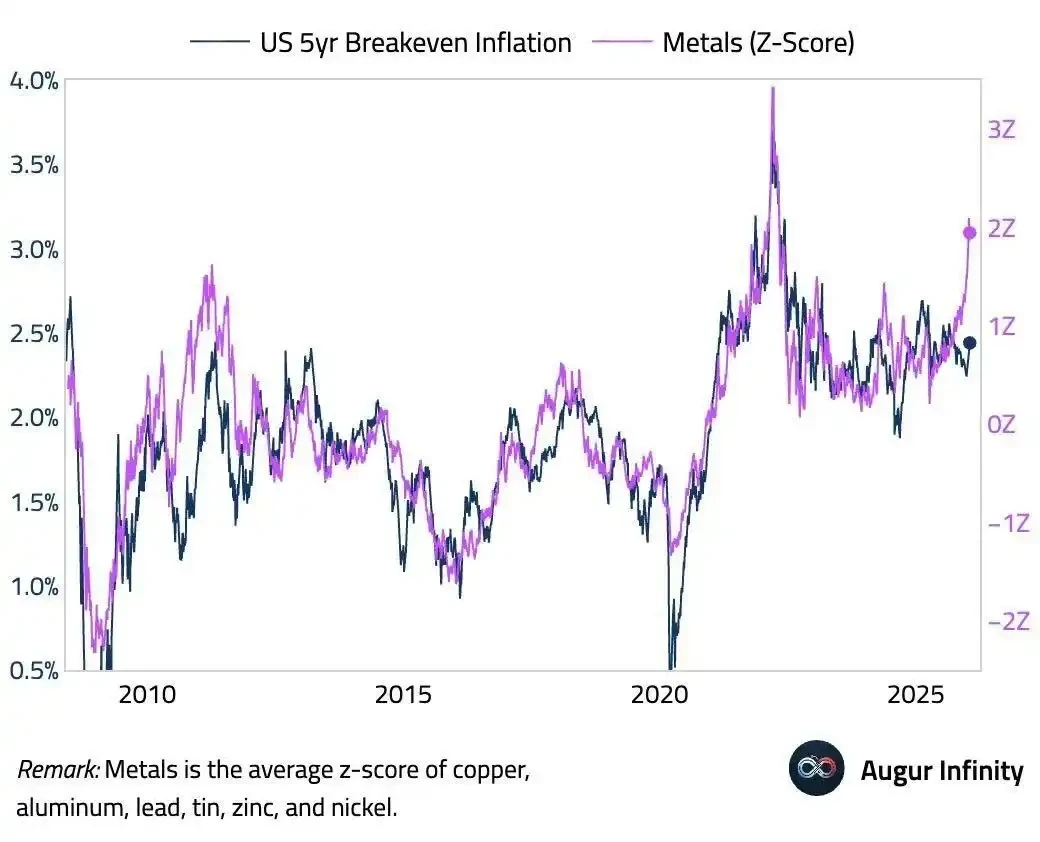

Strong dollar + high prices = weak hands panic selling. Speculators who chased above $100 are different from Chinese families accumulating since $30. Weak hands capitulate on sharp reversals. If the chart below is correct, we are seeing an extreme dislocation between metals prices and breakeven inflation. This could realign via higher rates/dollar and lower metals prices.

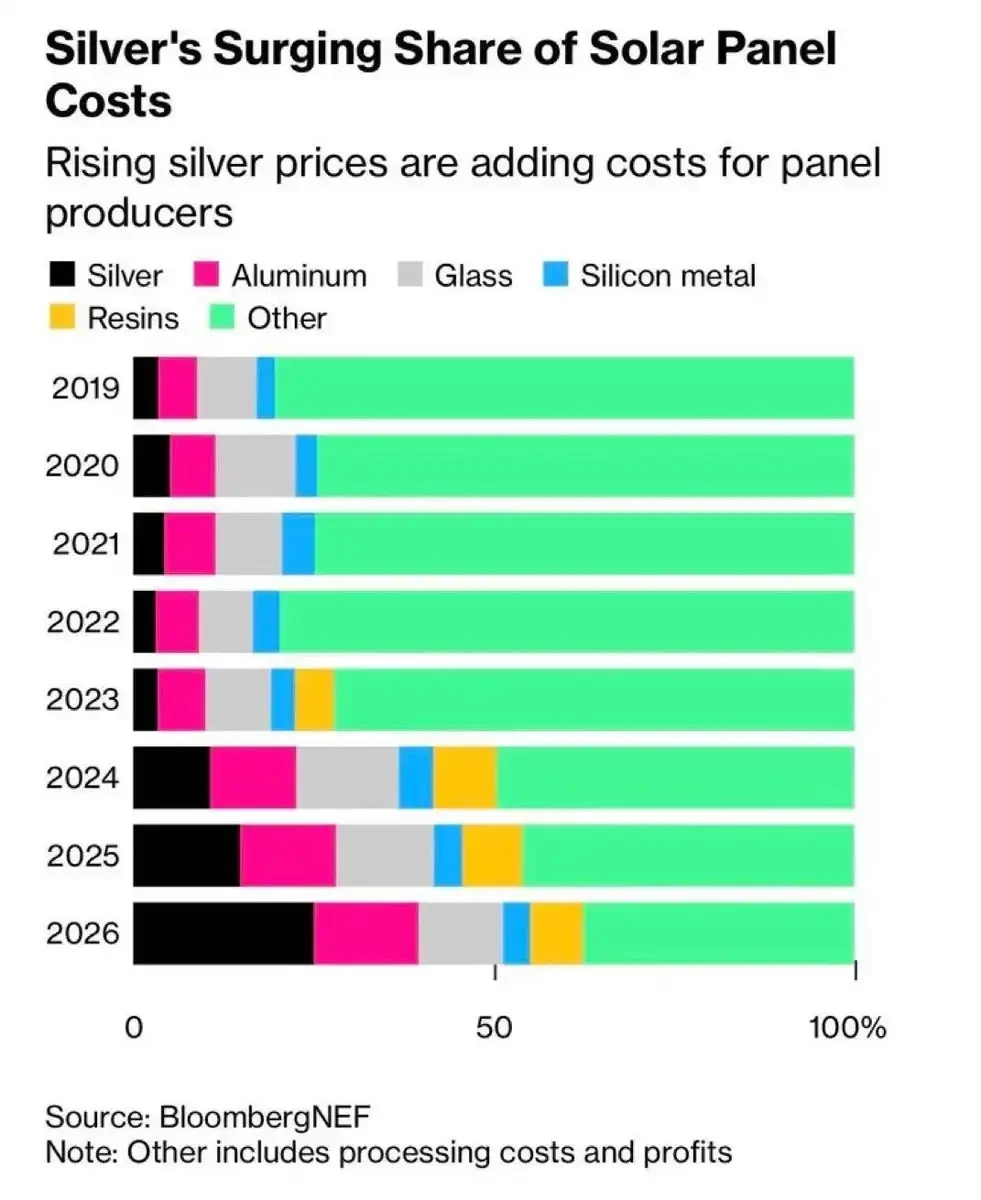

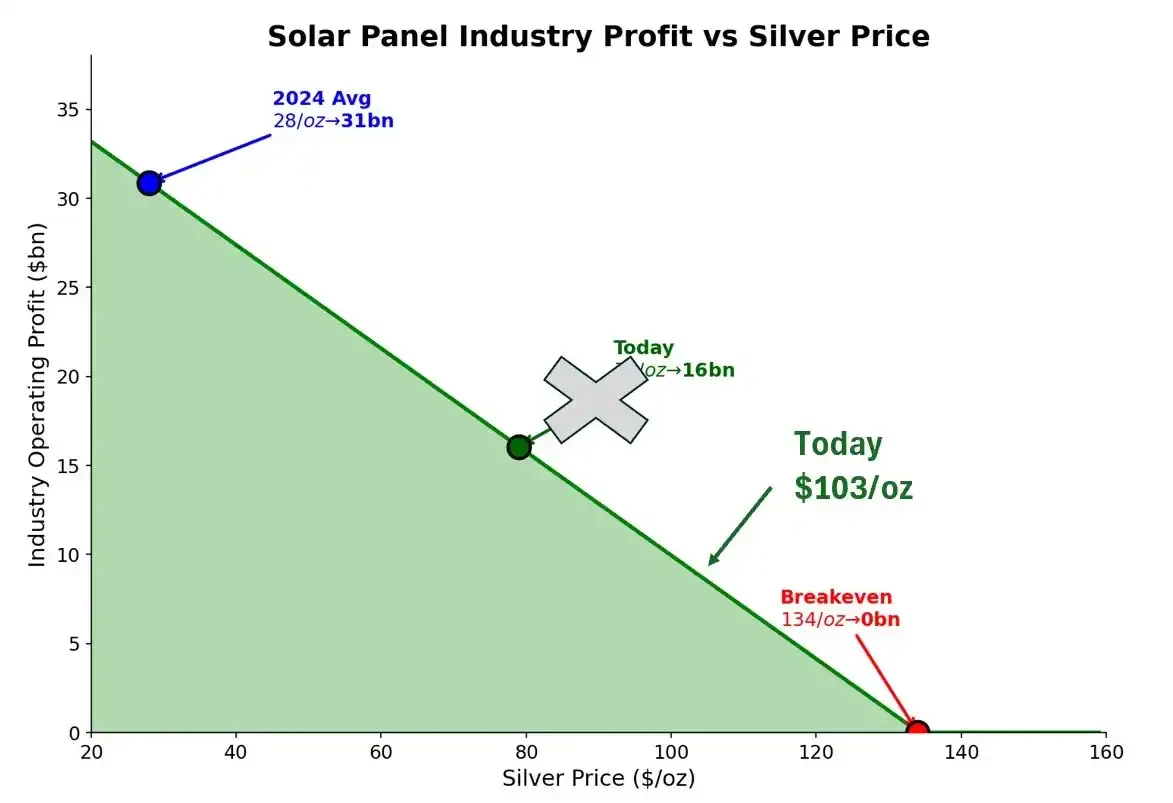

Silver prices are beginning to erode solar industry profits.

At $103/oz, this is no longer a negligible margin of error for panel manufacturers. We are approaching the pain threshold.

At $28/oz (2024 average), industry profits were $31 billion. At today's $103, profits could shrink to $8-10 billion. The breakeven point is $134/oz—just 30% above current prices. In a market with 70% annualized volatility, that's not a comfortable cushion.

Copper substitution is accelerating.

Current prices are $22 below $125 (where copper substitution payback periods fall below one year). At that point, every board meeting will discuss switching.

Economics scream "switch now." But physics tells us it will still take years to reach 50% conversion. That's the window.

Where will marginal supply come from?

Not miners—supply is rigid, takes years. Not shorts—this is a physical market, you can't issue more metal like overpriced stock. That leaves only recycling and melting jewelry. If anyone knows good silver recycling companies, contact me.

What We're Watching

Signals:

Shanghai premium persists = structural demand, not noise

COMEX inventory drawdown rate = if it accelerates, near-month squeeze risk rises

Dollar direction = stronger US economy lifts DXY, washes out weak hands

Mining stock catch-up = when miners start outperforming spot, retail is arriving

Official statements = first central bank announcing silver reserves triggers a buying frenzy

Framework:

Watch flows, not price.

If Eastern physical demand keeps buying while Western speculators flee on dollar strength, that's accumulation. Buy the dip.

If Eastern premium collapses and COMEX inventories stabilize, the squeeze is unwinding. Take profits.

Trading Strategy

Prices are high. Upside volatility is still in demand.

We closed half our butterfly spread as spot broke the middle strike. This structure was designed for this move, and we've profited.

Remaining positions:

Long gold via stocks and call spreads

Long silver via stocks, call spreads, and rolled butterfly

Long junior miners via stocks (not options—too expensive)

Long dollar via UUP to hedge metals exposure

Short SPY, HYG, TLT via puts and stocks

We are long COMEX front month (March), short June—betting on inventory drawdown. May need to roll.

Net exposure: Stay long, but via options. Roll strikes up as spot rises. Wait for official and institutional buyers to catch up to price action.

Core Conclusion

As prices go parabolic, we are gradually reducing delta exposure. But until we see some combination of:

a) China actively addressing its property debt crisis

b) US pivoting to fiscal responsibility

c) A more peaceful world (Ukraine, Taiwan, Iran)

d) Non-US Western elites striking some deal with America

... we stay long. With some downside protection layered on.

The drivers that brought us here—capital flight, currency debasement, solar demand, supply constraints—haven't changed. They are accelerating.

Silver at $103 is not the end. It may not even be the midpoint.

We are starting to see these same dynamics spill over into other metals. Copper, in particular, is getting heavy attention from investors who missed the silver move and are doing back-of-the-envelope math. The setup is less dramatic than silver—copper lacks the same monetary/Veblen characteristics—but the AI power demand story is real, and supply constraints are similar. We are long copper too. More on that later.

The silver moon is out, folks.