How to Assess Market Risk Through Macro Assets? XT Commodities Sector Explained

- Core View: The crypto market does not operate in isolation; its price fluctuations are often influenced by leading signals from traditional macro markets (such as commodities, stock indices, and forex). The commodities sector launched by XT exchange aims to provide users with crypto-native tools, via USDT perpetual contracts, to observe and participate in these macro markets, thereby aiding in understanding the impact of the global financial environment on crypto assets.

- Key Elements:

- Macro markets (e.g., oil prices, stock indices, exchange rates) are leading indicators for inflation, liquidity, and risk appetite. Their changes often transmit to the crypto market ahead of sentiment.

- The XT commodities sector offers USDT-settled perpetual contracts covering gold, crude oil, U.S. stock indices, and major forex pairs, allowing users to trade without holding the physical assets.

- Different macro assets reflect different signals: precious metals are sensitive to inflation and interest rates, stock indices gauge global risk appetite, and forex reflects monetary policy divergence and capital flows.

- This sector is not a replacement for crypto trading but serves as a supplementary perspective, helping traders distinguish whether market movements are driven by internal crypto ecosystem factors or external macro conditions.

- Macro futures contracts are highly sensitive to events like economic data releases and central bank decisions, and their leveraged nature amplifies volatility risks. Understanding their drivers and risks is essential before participation.

Many investors have experienced this: the crypto market shows no clear negative news, yet prices suddenly drop in sync; or during a seemingly calm period, volatility begins to quietly amplify. Looking back, one often finds that the changes didn't originate from the crypto market itself.

In the broader financial system, commodities, stock indices, and foreign exchange markets have long served as "risk thermometers." Sustained rises in crude oil prices may signal renewed inflationary pressures; declines in major US stock indices often reflect tightening liquidity or a cooling risk appetite; and unusual movements in major currencies are frequently closely tied to shifts in monetary policy expectations. These signals typically manifest in the crypto market ahead of sentiment.

The XT Commodities Zone exists precisely based on this logic. Through USDT-settled perpetual contracts, users can observe and participate in the price movements of these key macro assets without holding the physical commodities, stocks, or fiat currencies. The prices of gold, crude oil, major US stock indices, and core currencies reflect not crypto narratives, but deeper economic and policy factors.

When market risks begin to brew, macro assets often signal first. The XT Commodities Zone provides a perspective for understanding global financial changes within a crypto-native environment.

TL;DR Quick Summary

- The XT Commodities Zone provides trading and observation access to commodity, stock index, and forex markets via USDT-settled perpetual contracts.

- These macro markets are often used as key references for gauging inflation trends, economic growth expectations, and global risk sentiment.

- Price movements in macro assets are typically driven by economic and policy factors distinct from crypto narratives.

- Perpetual contracts offer users a way to express macro views without holding the underlying physical assets.

- Understanding the underlying economic logic and risk factors is crucial before participating in macro-related contracts.

Why Understanding Macro Markets is Key to Interpreting Crypto Trends

Crypto Assets Do Not Operate in Isolation from the Broader Financial System

The crypto market is often described as an independent ecosystem composed of on-chain activity, token narratives, and digital asset liquidity. However, in reality, crypto assets do not operate in isolation from the wider financial system. Price movements of digital assets are often influenced by forces originating outside the crypto ecosystem, reflecting changes in the global financial environment rather than a single crypto narrative.

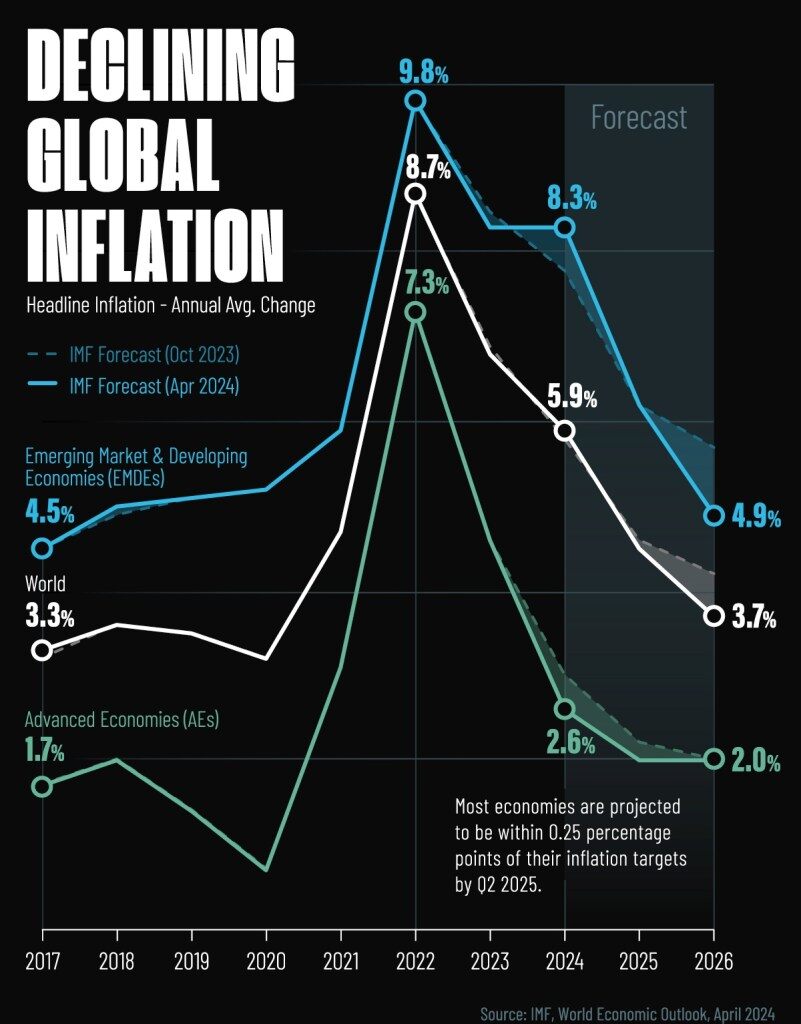

How Interest Rates, Inflation, and Liquidity Shape the Market Risk Environment

Key macro variables such as interest rate policy, inflation expectations, and global liquidity are primarily driven by traditional financial markets. Central bank decisions, major economic data releases, and geopolitical events typically first ferment in macro markets before gradually transmitting to the crypto market. When liquidity tightens or risk sentiment deteriorates, both crypto and traditional assets often face simultaneous pressure.

Image Source: Visual Capitalist

How Macro Assets Serve as Leading Indicators of Market Sentiment

From commodities, stock indices to forex, what does each indicate? Market Category Primary Signal Meaning Commodities Inflationary pressures, supply constraints Stock Indices Investor confidence, earnings expectations, financial conditions Forex Market Relative economic strength, monetary policy divergence

Professional traders typically observe macro markets alongside crypto markets to more accurately understand the context of price fluctuations. For example, rapid rises in oil prices, surging bond yields, or significant stock market corrections often alter overall risk appetite, with impacts not confined to a single market. It is this deepening linkage between crypto and macro markets that provides the real-world context for the XT Commodities Zone.

How to Use Macro Assets to Calibrate Crypto Position Decisions Macro Asset / Market Primary Market Signal Trading & Observation Reference (XT Trading Pair) US Stock Indices Risk appetite, earnings expectations, financial conditions NAS100 USDT, SP500 USDT, DJ30 USDT Strength typically supports risk appetite; weakness often suggests reducing crypto risk exposure. Bond Yields / Interest Rates Cost of capital, liquidity tightness/looseness Rising yields typically pressure risk assets; stock indices often weaken before crypto markets. US Dollar Strength (DXY proxy) Global liquidity, funding pressure EURUSDT, GBPUSDT, AUDUSDT can serve as leading signals for liquidity changes. Gold Safe-haven demand, currency credit risk During risk-off phases, GOLDUSDT, XPTUSDT often see capital inflows first. Silver Inflation sensitivity, cyclical industrial demand SILVERUSDT typically exhibits higher volatility than gold during reflation phases. Crude Oil / Energy Inflationary pressure, geopolitical risk Sustained volatility in OILUSDT may affect crypto risk appetite via inflation and interest rate pathways. Platinum / Palladium Industrial demand, supply concentration XPTUSDT, XPDUSDT lean more towards reflecting cycles and supply shocks. Credit Pressure (Implied) Financial instability, risk aversion Capital shifts to gold, away from stock indices, often precede crypto deleveraging. Forex Risk Sentiment Carry trade health, capital flows Weakness in AUDUSDT, EURUSDT may release risk signals ahead of the stock market. Overall Risk Environment Cross-asset confirmation Synchronous movements in stock indices, precious metals, and forex help increase the credibility of crypto position judgments.

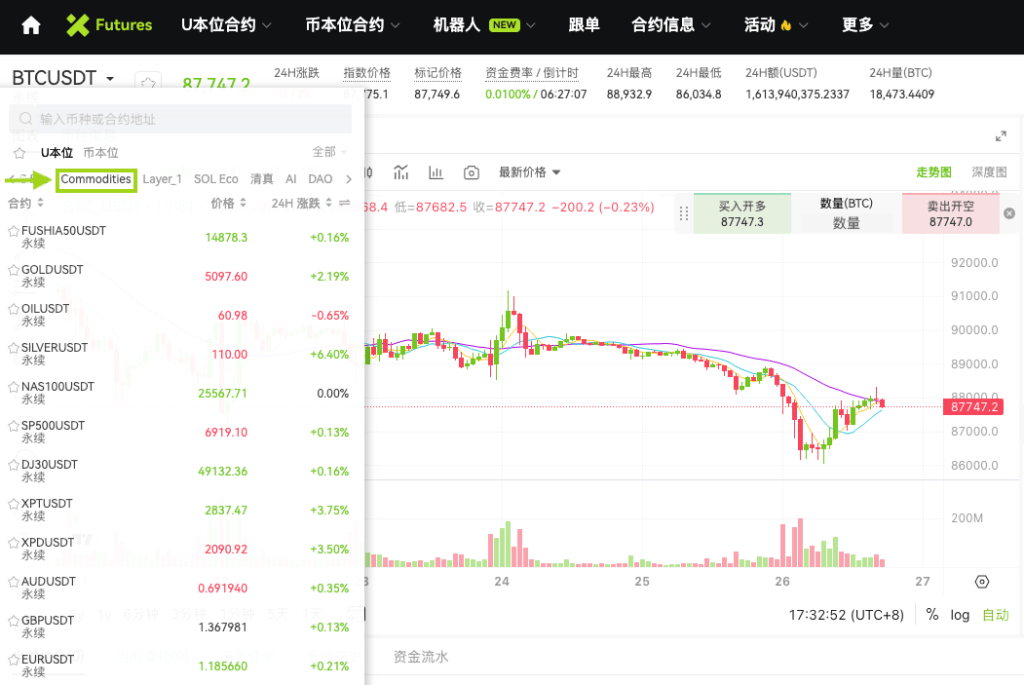

What Macro Market Access Does the XT Commodities Zone Provide?

The XT Commodities Zone is a dedicated category under XT Futures, aiming to provide users with direct participation and observation access to global macro markets within a crypto-native trading environment.

Three Types of Macro Assets Constituting the XT Commodities Zone

This zone primarily covers three core macro asset types:

- Commodities, including precious metals and energy products.

- Global major stock indices.

- Major forex trading pairs.

These assets are widely used to reflect inflation trends, economic cycle changes, and global risk sentiment, making them indispensable references in macro analysis.

Contract Design and Settlement Methods in the XT Commodities Zone

All trading products within the XT Commodities Zone share the following unified characteristics:

- Settled in USDT.

- Perpetual contract format, with no expiry date.

- Prices reference mature, mainstream global markets.

As long as margin requirements are met, positions can be held continuously. Profit/loss settlement and margin management are conducted in USDT, allowing users to efficiently manage macro market exposure within a stablecoin system while maintaining trading flexibility and continuity.

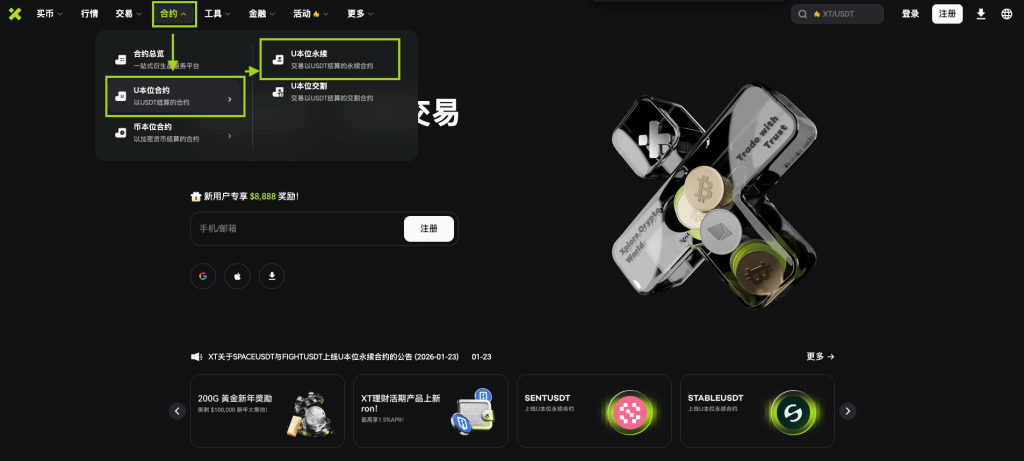

How to Access the XT Commodities Zone

Desktop

From the XT.com homepage, navigate to Futures > USDT-Margined Contracts > USDT-Margined Perpetual.

After selecting any trading pair, click the arrow icon to the right of the category menu to expand and enter the Commodities Zone.

On desktop, the XT Commodities Zone is integrated into the market navigation of XT Futures. All assets are grouped by macro category, including commodities, stock indices, and forex pairs, helping users efficiently browse and compare global macro markets within the same interface.

Using Perpetual Contracts to Participate in Macro Markets

The Core Role of Futures Instruments in Macro Trading

In macro trading, futures contracts are widely used to express directional views, position around major macro events, and manage short-term market risks. Unlike traditional futures, perpetual contracts have no expiry date, allowing traders to maintain market exposure to specific macro assets without frequent rollovers.

High Sensitivity of Futures Contracts to Macro Changes

Futures prices in macro markets typically react swiftly to economic data releases, central bank policy decisions, geopolitical changes, and unexpected events. This high sensitivity makes futures contracts an important tool for observing short-term macro expectation shifts or expressing phased macro views.

Core Features and Risk Considerations

Perpetual contracts feature continuous pricing, support for long and short positions, and USDT settlement, offering high trading flexibility. However, their leveraged nature also amplifies market volatility risks, especially around key events like inflation data releases and interest rate decisions, where price swings can be more intense. Understanding the sources of volatility, operational mechanisms, and differences from crypto-native contracts is a crucial prerequisite for rational trading before participating in macro-related perpetual contracts.

Asset Coverage of the XT Commodities Zone

The XT Commodities Zone covers multiple core macro asset categories, with different assets influenced by their respective economic drivers and reflecting distinct market signals.

Asset Category Trading Products Primary Drivers Precious Metals GOLDUSDT, SILVERUSDT, XPTUSDT, XPDUSDT Inflation expectations, real interest rates Energy OILUSDT Global economic growth, supply-demand structure, geopolitics Stock Indices NAS100 USDT, SP500 USDT, DJ30 USDT Earnings expectations, liquidity environment, risk sentiment Forex AUDUSDT, GBPUSDT, EURUSDT Monetary policy divergence, capital flows

Different asset categories react to market changes via distinct pathways. Precious metals are typically used to reflect changes in inflation expectations and monetary conditions; energy markets are highly sensitive to global economic growth and supply structure; stock indices embody investor confidence and overall liquidity conditions; forex pairs more often reflect monetary policy differences between economies and cross-border capital flows.

Understanding which factors typically drive these assets helps traders more accurately interpret the macro logic behind price movements, thereby gaining a clearer judgment framework in complex market environments.

Commodities & Energy: Inflation, Growth, and Supply-Demand Structure

Precious Metals

Precious metals are frequently mentioned during periods of rising inflationary pressure, uncertain monetary conditions, or changes in real interest rates. Gold, represented by GOLDUSDT, is typically viewed as an asset with strong "monetary properties," its price noticeably influenced by currency strength, inflation expectations, and central bank policy orientation.

When real interest rates fall, or confidence in fiat currency purchasing power weakens, gold often attracts attention due to its store-of-value properties. Conversely, when real yields rise, the opportunity cost of holding a non-yielding asset increases, potentially pressuring gold prices.

Silver shares some monetary properties with gold, but its industrial attributes are more prominent. Therefore, SILVERUSDT is typically more sensitive to manufacturing demand and economic growth cycles than gold, and its price volatility may be greater during reflation or economic recovery phases.

🚀 #XTFutures New Listing Alert 🚀

🔥 #XT will list SILVERUSDT USDT-Margined Perpetual Futures on December 08, 2025, at 08:00 UTC, with leverage ranging from 1x to 50x.

Trade Now ⤵️financeinvestfutures contractcurrencyUSDTAIRWAXT.COMWelcome to Join Odaily Official Community