What is Summer.fi (SUMR)? A DeFi Platform Integrating Yield and Automation

- Core View: Summer.fi is a platform designed to lower the barrier to entry for DeFi and cater to the needs of users at different levels. It offers automated yield strategies and advanced tools through its dual-product architecture (Lazy Summer Protocol for beginners and Summer.fi Pro for advanced users), with the SUMR token serving as the core incentive and governance mechanism for the ecosystem.

- Key Elements:

- The platform offers two complementary products: Lazy Summer Protocol focuses on automated, low-maintenance "lazy vaults," while Summer.fi Pro provides professional users with advanced strategy tools like leverage and looping.

- The core protocol, Lazy Summer Protocol, aims to achieve approximately 20% higher risk-adjusted annual yields compared to standard deposits like Aave V3 through its automated rebalancing mechanism.

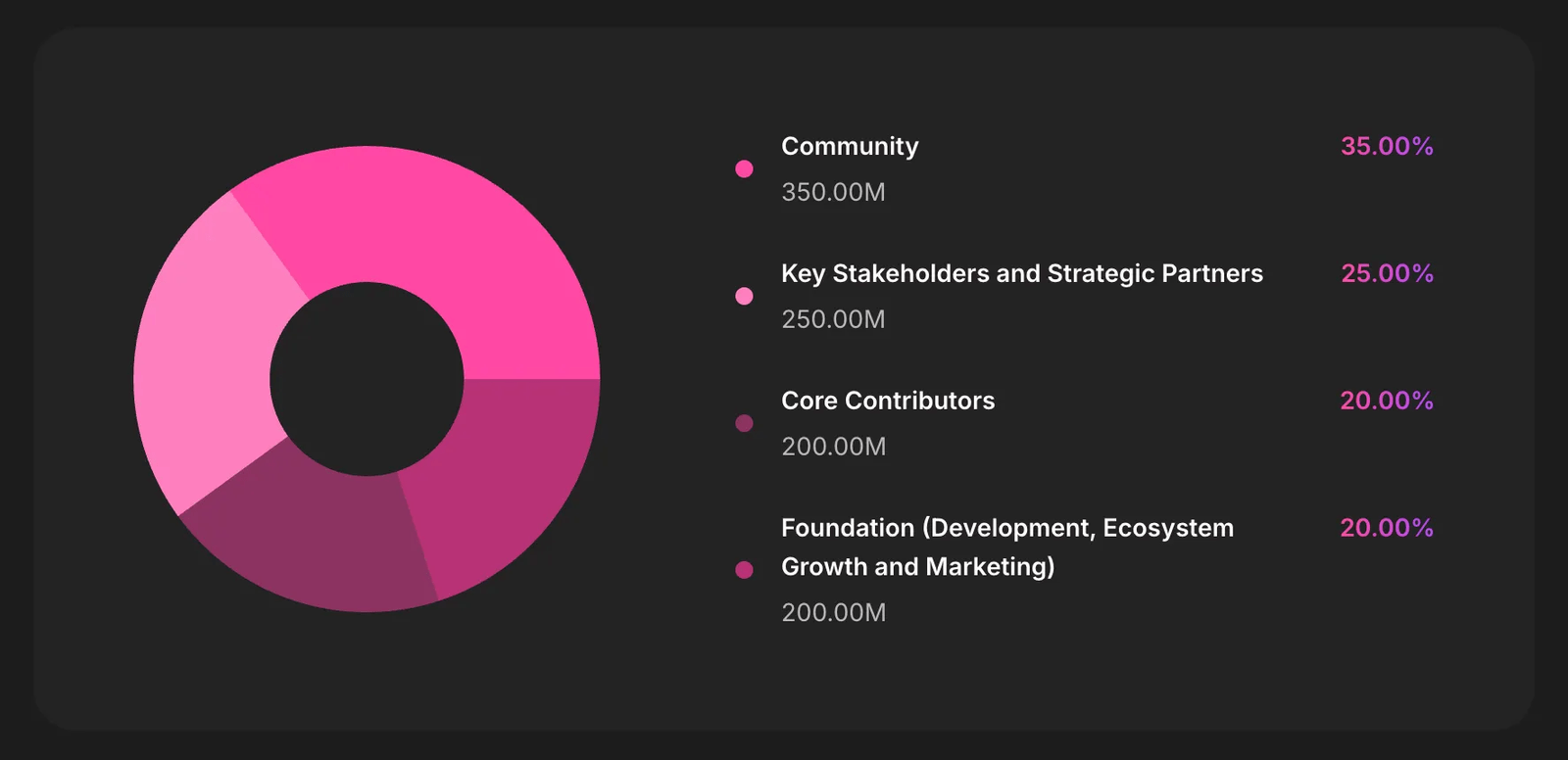

- The SUMR token has a maximum supply of 1 billion, with an initial circulating supply of approximately 450 million. 35% is allocated to community incentives, emphasizing value alignment tied to long-term performance goals.

- The platform faces challenges such as smart contract risk, market volatility, regulatory uncertainty, and industry competition. Its value depends on the sustained adoption and development of the protocol.

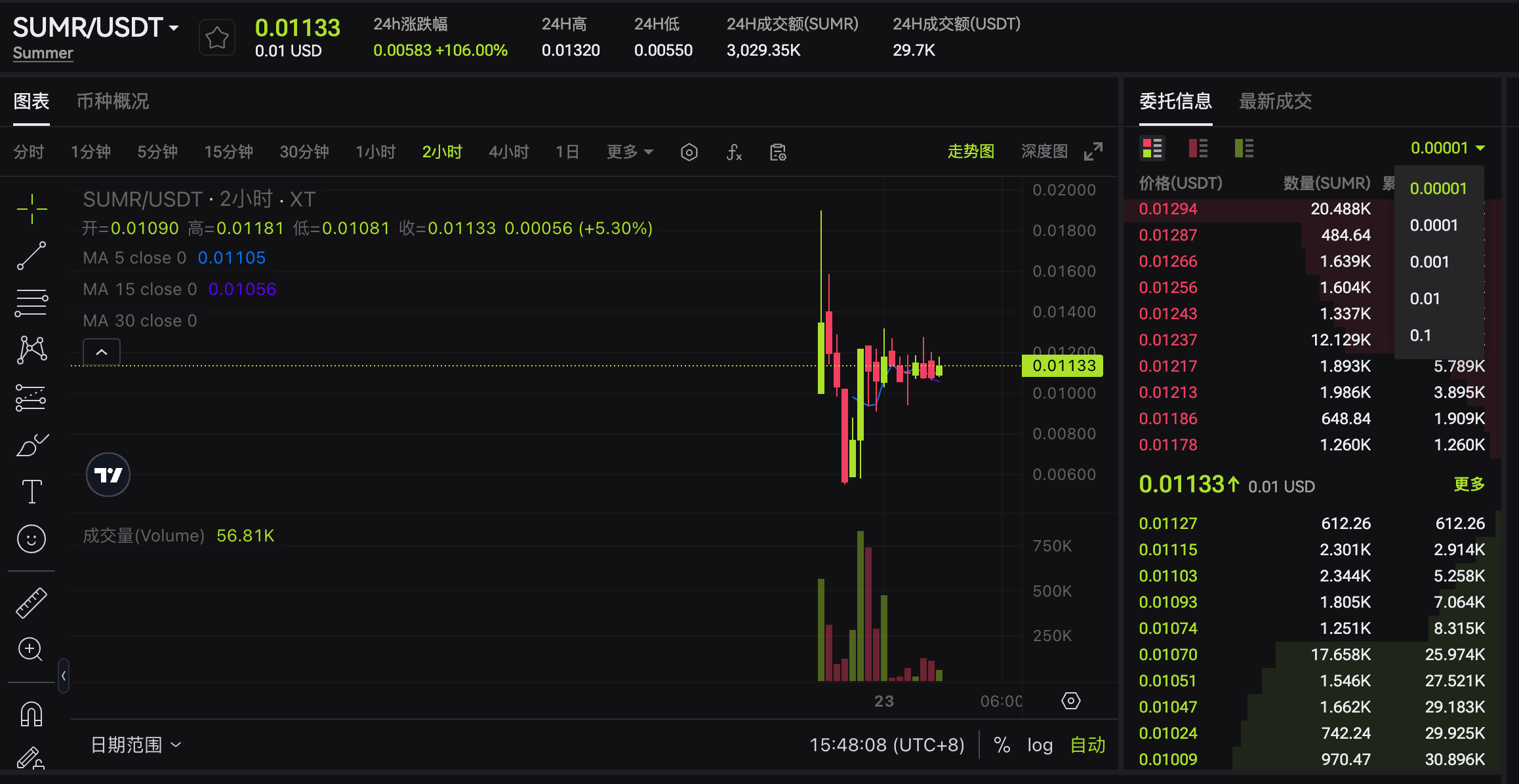

- The SUMR/USDT trading pair is already listed on the centralized exchange XT.com, providing users with a convenient spot trading entry point.

What is Summer.fi (SUMR)? A DeFi Platform Integrating Yield and Automation

As decentralized finance (DeFi) continues to mature, an increasing number of users are seeking ways to obtain sustainable yields without the need for frequent management of complex on-chain positions. Meanwhile, advanced users demand greater flexibility, capital efficiency, and cross-protocol operational capabilities.

Summer.fi is positioned precisely at the intersection of these two demands, aiming to meet the participation needs of users at different levels by providing a unified DeFi interface that combines automation, transparency, and user autonomy. Through its dual-product architecture and the SUMR token, Summer.fi strives to lower the barrier to entry for DeFi while retaining the depth and complexity required by professional market participants.

$SUMR/USDT is now listed for spot trading on XT.com, providing an accessible channel for users to conveniently participate in the SUMR token via a centralized exchange.

Spot Trading: SUMR/USDT

More Related Information: SUMR/USDT Price

What is Summer.fi ($SUMR)?

Summer.fi is an application designed to simplify and enhance the user experience of participating in decentralized finance, with a core focus on scenarios such as lending, leverage, and yield generation. Its ecosystem consists of multiple independent yet collaborative entities and contributors working together to drive the platform's development, adoption, and long-term evolution. To truly understand Summer.fi, it is necessary to distinguish between its different products and functional modules, which helps clarify the protocol's operation, evolution path, and its interaction with the community and governance structure.

Summer.fi provides a unified front-end interface that integrates two complementary yet distinctively focused products: the Lazy Summer Protocol and Summer.fi Pro. Each caters to users with different experience levels and needs, while together they build a DeFi ecosystem capable of adapting to diverse financial goals and risk preferences.

Lazy Summer Protocol

The Lazy Summer Protocol targets DeFi users who prefer a "set it and forget it" approach. This product focuses on passive yield acquisition, achieving minimal manual intervention through automated strategies.

The protocol offers Lazy Vaults, which are carefully designed composite asset pools aimed at achieving risk diversification and maximizing risk-adjusted returns. The system automatically performs asset rebalancing to ensure user positions remain in a relatively optimal state over time, allowing users to continuously participate in yield opportunities without actively managing their assets.

Simultaneously, a clean and intuitive user interface further lowers the barrier to entry, enabling a broader user base to easily participate in DeFi.

The Lazy Summer Protocol is particularly suitable for DeFi beginners and users seeking fully automated, low-maintenance asset growth.

Summer.fi Pro

Summer.fi Pro is an advanced product built for more experienced DeFi users, emphasizing a higher degree of control and strategic flexibility. It provides a suite of advanced tools that support direct interaction with multiple protocols, including:

- Multiply Vaults: Used to amplify asset exposure;

- Looping Strategies: Achieving compound growth of assets;

- Protocol Aggregation: Accessing multiple DeFi platforms through a single interface.

Furthermore, automation features enable users to efficiently manage positions across different protocols and blockchains, thereby enhancing overall capital efficiency.

Summer.fi Pro is better suited for seasoned DeFi participants, active yield strategy users, and those employing more complex financial strategies.

How Summer.fi (SUMR) Works: Core Mechanism Analysis

As one of the core protocols, the Lazy Summer Protocol is a permissionless passive yield product designed to achieve secure, optimized returns while minimizing user operational costs, and to reduce risk through diversified allocation.

The protocol consists of a set of permissionless smart contracts, a Keeper system, and an SDK/API toolkit. These components work together to enable users to conveniently lend or stake their assets into top-tier DeFi protocols currently offering the best risk-weighted yields.

The protocol manages user assets in an automated and transparent manner, reallocating funds from underperforming protocols to better-performing ones, with the goal of consistently achieving optimal risk-adjusted returns.

The product will be distributed via industry-leading SDKs and APIs, allowing existing financial and FinTech digital products to easily integrate the Lazy Summer Protocol.

Users benefit from an automatically rebalanced portfolio, achieving risk diversification and reducing exposure to any single protocol. Simultaneously, users save time and costs by not having to track real-time yields or manage multiple positions themselves.

According to official information, the automatic rebalancing mechanism continuously optimizes yields among supported protocols, with its annualized performance potentially outperforming standard deposits on mainstream platforms like Aave V3 and Compound V3 by up to approximately 20%.

SUMR Tokenomics: Supply and Distribution

- Max Supply: 1,000,000,000 SUMR

- Initial Circulating Supply: Approximately 450,000,000 SUMR (upon transferability)

Token allocation is heavily weighted towards community incentives and long-term value alignment:

- 35% Community: For user rewards, governance participation, and community activity incentives.

- 25% Strategic Partners: Investors and supporters (linearly unlocked over 24 months).

- 20% Core Contributors: Protocol development team (tied to performance milestones).

- 20% Foundation: For ecosystem expansion, security audits, and liquidity support.

Note: A significant portion of the core contributor allocation is bound to challenging performance targets (e.g., TVL exceeding $300 million, achieving non-DeFi scenario integrations, etc.), ensuring the team's rewards are highly aligned with the protocol's scale and long-term success.

How to Buy $SUMR | Participation Guide

$SUMR/USDT is now listed for spot trading on XT.com, providing a convenient and user-friendly way for users to participate in the SUMR token via a centralized exchange. By trading on XT, users can enter the market without dealing with complex on-chain operations, making participation accessible to a wider user base.

Spot Trading: SUMR/USDT

More Related Information: SUMR/USDT Price

Beyond trading, users can stay engaged by continuously following the latest developments and progress within the Summer.fi ecosystem. As the protocol evolves, new features, integrations, and participation opportunities may emerge in the future, providing more avenues for users to explore long-term engagement methods and potential investment opportunities within the ecosystem.

Competitive Advantages of the SUMR Token

In the highly competitive DeFi landscape, SUMR stands out by emphasizing automation, capital efficiency, and risk-adjusted returns, rather than relying on short-term incentives. Its underlying protocol significantly reduces user operational complexity while maintaining transparency and permissionless access.

The combination of passive and advanced products enables Summer.fi to serve multiple user groups within the same ecosystem. This dual-track model helps improve user retention and build a more resilient platform capable of adapting to different market environments. Furthermore, the performance-linked token distribution mechanism strengthens long-term alignment among contributors, users, and the overall ecosystem.

Key Risks and Challenges for the SUMR Token

Like all DeFi-related assets, SUMR faces market volatility and the influence of overall crypto market cycles. Despite undergoing audits and following industry best practices, smart contract risk cannot be completely eliminated. The effectiveness of automated strategies also depends on market conditions and the actual performance of underlying protocols.

Regulatory uncertainty in certain jurisdictions may affect user access or protocol integration in the future. Additionally, competition from other yield optimization platforms could pressure adoption and growth if its differentiating advantages diminish.

Outlook for SUMR

The long-term prospects of SUMR are closely tied to the continued adoption of automated DeFi strategies and the platform's ability to expand beyond the native crypto user base. If Summer.fi can expand its integrations through its SDK and API and consistently maintain robust risk management practices, its ecosystem has the potential to grow alongside the overall development of DeFi.

SUMR is not positioned as a purely speculative asset, but rather as a utility and value-alignment token within a yield-focused, structured ecosystem. Its value proposition depends more on the sustained usage and long-term development of the protocol.

Frequently Asked Questions (FAQ)

What is SUMR used for? SUMR is the token of the Summer.fi ecosystem, used for incentive mechanisms, governance participation, and long-term value alignment.

Is Summer.fi suitable for beginners? Yes. The Lazy Summer Protocol is specifically designed for users seeking a passive, low-maintenance DeFi experience.

How is Summer.fi different from other yield platforms? Summer.fi combines automated portfolio rebalancing with a variety of tools for both beginners and advanced users within a single interface.

Where can I trade SUMR? SUMR can be traded for spot on XT.com via the SUMR/USDT trading pair.

Is SUMR a low-risk investment? Like all crypto assets, SUMR carries market risk and its price can be volatile. Users should participate based on their own risk tolerance and understanding.

About XT.COM

Founded in 2018, XT.COM is a leading global digital asset trading platform with over 12 million registered users, operations spanning more than 200 countries and regions, and an ecosystem traffic exceeding 40 million. The XT.COM cryptocurrency trading platform supports 1300+ high-quality tokens and 1300+ trading pairs, offering diverse trading services including spot trading, margin trading, futures trading, and features a secure and reliable RWA (Real World Assets) trading market. We consistently uphold the philosophy of "Explore Crypto, Trust Trading," and are committed to providing global users with a safe, efficient, and professional one-stop digital asset trading experience.