A Guide to Understanding HeyElsa: The Intent-Based AI DeFi Execution Layer

- Core Viewpoint: HeyElsa (ELSA) is an intent-based AI DeFi execution layer designed to abstract complex on-chain operations through natural language interaction, lowering the barrier to entry for users. Its core value lies in serving as a coordination and execution infrastructure built atop existing DeFi protocols.

- Key Elements:

- Its core function is to deconstruct the user's "intent" expressed in natural language into executable on-chain actions, and then complete route planning, simulation verification, and final execution.

- It is positioned as an execution coordinator and infrastructure provider for multiple DeFi modules, not as a replacement for specific protocols, serving both ordinary users (conversational apps) and developers (Widget/API).

- The ELSA token is used to pay execution fees, unlock advanced features, and for ecosystem incentives, with a total supply of 1 billion tokens deployed on the Base network. Its circulation is affected by a long-term unlocking schedule.

- Key risks include dependency on underlying protocols, potential centralization in execution decision coordination, and uncertainties arising from the token circulation schedule and intense market competition.

- Its differentiation lies in providing end-to-end execution capability, an infrastructure-first distribution strategy, and exploring support for emerging agent payment standards like x402 to enable automated settlement.

Understanding HeyElsa: An Intent-Based AI DeFi Execution Layer

Many people are discouraged by the complex operational processes when they first encounter DeFi. Switching wallets, comparing routes, confirming authorizations—each step requires judgment and patience. While artificial intelligence is frequently mentioned in the crypto space, few projects genuinely address the user's "how-to" question.

HeyElsa (ELSA) emerged in this context. It doesn't attempt to rewrite DeFi rules but instead changes how it converses with users. Users no longer need to understand every technical detail; they simply state their goal in natural language, and the system breaks down the "intent" into executable on-chain actions.

Behind the scenes, Elsa handles route planning, simulation, and execution. As DeFi's complexity continues to compound, this execution-centric interaction model is bringing more users back into the on-chain world.

TL;DR Quick Summary

- HeyElsa is an intent-centric AI DeFi execution layer focused on improving the efficiency of on-chain operations.

- Users interact via natural language, eliminating reliance on traditional multi-layer interfaces.

- The ELSA token supports execution fees, feature access, and ecosystem incentive mechanisms.

- Elsa serves both general users and developers, covering application interfaces, modular Widgets, APIs, and emerging agent payment standards like x402.

- Execution security, token unlock schedules, collaborative execution models, and the evolution of proxy frameworks like ERC-8004 are key factors worth continuous attention.

ELSA Token Overview

What is HeyElsa's Core Functionality?

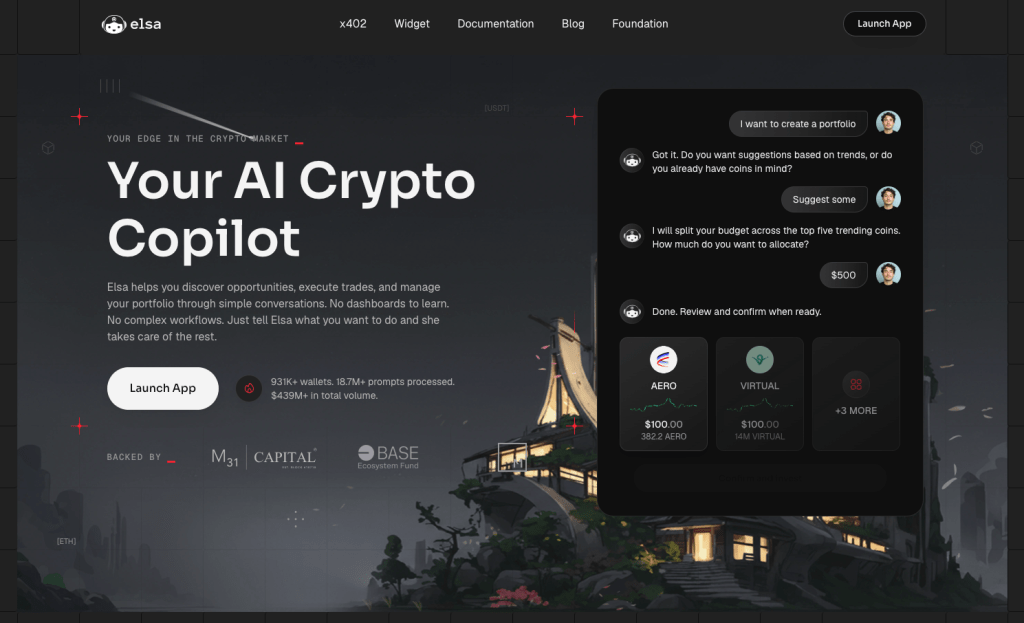

HeyElsa, often abbreviated as Elsa, positions itself as an execution layer atop existing DeFi protocols, specifically handling complex on-chain execution problems for users. It does not replace decentralized exchanges, cross-chain bridges, or staking platforms but coordinates the interaction between users and these protocols.

Image Source: HeyElsa.ai

Image Source: HeyElsa.ai

From an architectural perspective, Elsa primarily performs four core functions:

- Understanding User Intent: Parsing user operation goals via natural language.

- Planning Execution Paths: Decomposing and planning the one or multiple on-chain actions required to achieve the goal.

- Pre-execution Simulation and Risk Control Verification: Simulating outcomes and applying pre-set strategies and risk control rules.

- On-chain Execution: Completing actual transactions on supported blockchains and protocols.

By integrating these steps into a coherent execution workflow, Elsa aims to reduce operational friction and decision-making burden, allowing users to focus more on the outcome itself rather than cumbersome interfaces.

The native token ELSA is designed to support this execution framework, establishing a collaborative relationship among users, developers, and the platform through fee mechanisms, feature access, and incentive arrangements. For users interested in trading or gaining market exposure, ELSAUSDT spot trading is now available on XT.com.

Positioning within the DeFi Ecosystem

Directly competing with individual protocols is not Elsa's goal. Its positioning leans more towards a foundational coordination layer, primarily reflected in three aspects:

- Execution Coordinator for Multiple DeFi Modules

- Abstraction Layer for Multi-step On-chain Operations

- Execution Infrastructure Provider for Third-party Platforms

This positioning also reflects the overall trend in DeFi development. As the number of protocols increases, the key to user experience gradually shifts from "which protocol to choose" to "how to complete operations efficiently." The ELSA token is designed around this execution framework to foster tighter incentive alignment among users, developers, and the platform.

ELSA Token Economic Model (Tokenomics)

Key Token Parameters

Project Description Token Name ELSA Deployment Network Base Total Supply 1,000,000,000 Supply Type Fixed Total Supply

Token Utility Design

According to project disclosures, the ELSA token is primarily used to support multiple functions within the ecosystem, including:

- Paying for execution and infrastructure-related fees

- Unlocking advanced or premium feature permissions

- Incentivizing users, developers, and partners who contribute value to the ecosystem

Overall, ELSA leans more towards being a functional token within the execution framework rather than an independent product. Its long-term value is closely tied to actual execution scenarios, integration depth, and usage frequency.

Token Allocation and Unlock Structure

Allocation Party Percentage Unlock and Vesting Mechanism Community 40% Partial release at TGE, followed by long-term linear unlocking. Foundation ~34% Linear release after a lock-up period. Liquidity 8% Full release at TGE. Team 7% Multi-year linear unlocking after a lock-up period. Early Contributors ~10% Linear release after a lock-up period.

This allocation structure ensures early liquidity while emphasizing a long-term, gradual token release schedule. As with most utility tokens, continuous monitoring of circulating supply changes is crucial, especially around key milestones like the end of lock-up periods and the progression of linear unlocks.

HeyElsa Ecosystem Structure and Core Applications

User-Facing Execution Layer

Elsa's core interaction model revolves around "conversational execution." Users no longer need to select transactions or configure parameters step-by-step; instead, they interact with the system by describing the desired outcome.

Currently supported primary user execution scenarios include:

- Token Swaps and Route Selection

- Cross-chain Transfers and Bridging Operations

- Staking and Yield-Related Operations

- Multi-step Execution Strategies Expressed as a Single Intent

Automation is a key theme in Elsa's design. Users can pre-set preference conditions, such as priority chain, slippage limits, or risk tolerance levels. Elsa automatically applies these constraints during the execution planning phase, striving for more consistent and standardized decision logic across different scenarios.

This model is better suited for users who prioritize efficiency and clear outcomes. While some advanced users may still prefer manual operations, Elsa targets users who want stable execution results with fewer steps.

Developer and Partner Infrastructure

In addition to end-user products, Elsa also plays the role of execution infrastructure. The platform provides developers and partners with:

- Embeddable Execution Components (Widgets)

- API Interfaces for Intent Creation, Simulation, and Execution

- Reusable Routing and Execution Security Logic

This allows wallets, applications, or platforms to quickly integrate execution capabilities without building a complete routing engine or strategy verification layer from scratch, significantly reducing development costs.

Comparison: User Application Layer vs. Infrastructure Layer Dimension User Application Widget / API Primary Audience General Users Developers & Platforms Interaction Method Conversational Programmatic Execution Logic Built-in Embedded Distribution Path Direct to Users Through Partners

Beyond the traditional API model, Elsa is also exploring programmatic payment mechanisms for AI agents. Some execution interfaces already support native HTTP-based payment flows, enabling automated clients to pay per request rather than relying on subscriptions or account systems.

This design aligns with emerging standards like x402. Such standards enable machine-to-machine payments and settlements through standardized web responses. In practice, this means AI agents or developer tools can complete execution requests, fee settlements, and automatic retries within a single flow, providing foundational support for more advanced automated execution scenarios.

How to Participate and Acquire ELSA

Ways to Participate

Users can participate in the Elsa ecosystem by directly using its execution functions, including completing on-chain operations, experiencing supported execution flows, and participating in subsequent ecosystem-related activities as they are gradually launched.

Basic platform functions do not mandate holding ELSA tokens. However, as a functional asset within the ecosystem, ELSA may play a more significant role in unlocking advanced features, settling execution fees, or incentive mechanisms in the future, depending on product and ecosystem development progress.

Acquiring ELSA

Depending on personal trading habits and usage scenarios, users can acquire ELSA through various channels:

- Decentralized trading on the Base chain via Uniswap.

- Acquisition through centralized trading platforms, including XT.com, which has opened walletSafetyDeveloperblockchainDeFiCross-chainUSDTBaseAIXT.COM