Range Judgment Realized, Strategy Fully Executed | Invited Analysis

- Core View: Bitcoin fluctuated within the predicted range this week, validating the strategy's effectiveness.

- Key Elements:

- Price retreated after being rejected at the $94,500 resistance zone.

- Quantitative model signals guided the completion of the short trade.

- Currently finding support at $86,500, suggesting a potential technical rebound.

- Market Impact: Provides a strategic reference for short-term trading in ranging markets.

- Timeliness Note: Short-term impact

Odaily invited market analyst Cody Feng, a Master of Financial Statistics from Columbia University in the United States. Since his university days, he has focused on quantitative trading in U.S. stocks and gradually expanded into digital assets like Bitcoin. Through practical experience, he has built a systematic quantitative trading model and risk control framework. He possesses keen data-driven insights into market volatility and is dedicated to continuous growth in the professional trading field, pursuing steady returns. Each week, he will delve into changes in BTC's technicals, macro environment, and capital flows, review and showcase practical trading strategies, and preview noteworthy upcoming events for reference.

Bitcoin Mid-Week Review(01.05~01.11)

Conclusion First:

This week, Bitcoin's overall price action largely operated entirely within the $84,000~$94,500 oscillation range we outlined at the beginning of the week. The price was precisely rejected at the $93,000~$94,500 resistance zone and subsequently retreated to the middle-lower part of the range, validating our core level judgments through live market action.

In this trade, we established a short position around $94,000 and exited fully around $91,000, capturing approximately a 3.4% return (spot) within the range, achieving a high-probability, low-drawdown profit realization in a ranging market.

1. Validation of This Week's Core Range and Key Levels

At the start of the week, we clearly stated that the focus should be on the battle between bulls and bears at the upper and lower boundaries of the $84,000~$94,500 range.

The actual price action showed that Bitcoin clearly encountered resistance after rebounding to the $93,000~$94,500 pressure zone, with multiple failed attempts to break higher, followed by a pressured decline, confirming the effectiveness of this area as a near-term "ceiling."

Regarding support levels, the price showed clear signs of finding a bottom and stabilizing after dipping to the $86,000~$86,500 area, where buying interest emerged. The more critical $84,000 support line has not been tested yet, with the overall structure still maintained within a wide-ranging framework.

2. Execution of Plan A (From Entry to Exit)

Based on the range-bound judgment, our Plan A formulated at the week's start was effectively executed.

When the price rebounded to the $93,000~$94,500 zone and showed signs of upward exhaustion, with both our (momentum and spread trading) models simultaneously signaling a top, we immediately established a short position at $93,771. The price subsequently declined as anticipated.

When the "Spread Trading" model signaled a bottom, we finally exited the entire position at $90,584, completing a full, emotion-free short trade. The entire trading process was not a post-hoc analysis but followed a sequence of pre-trade planning, in-trade execution, and post-trade validation.

3. Trading Outlook for the Latter Half of the Week

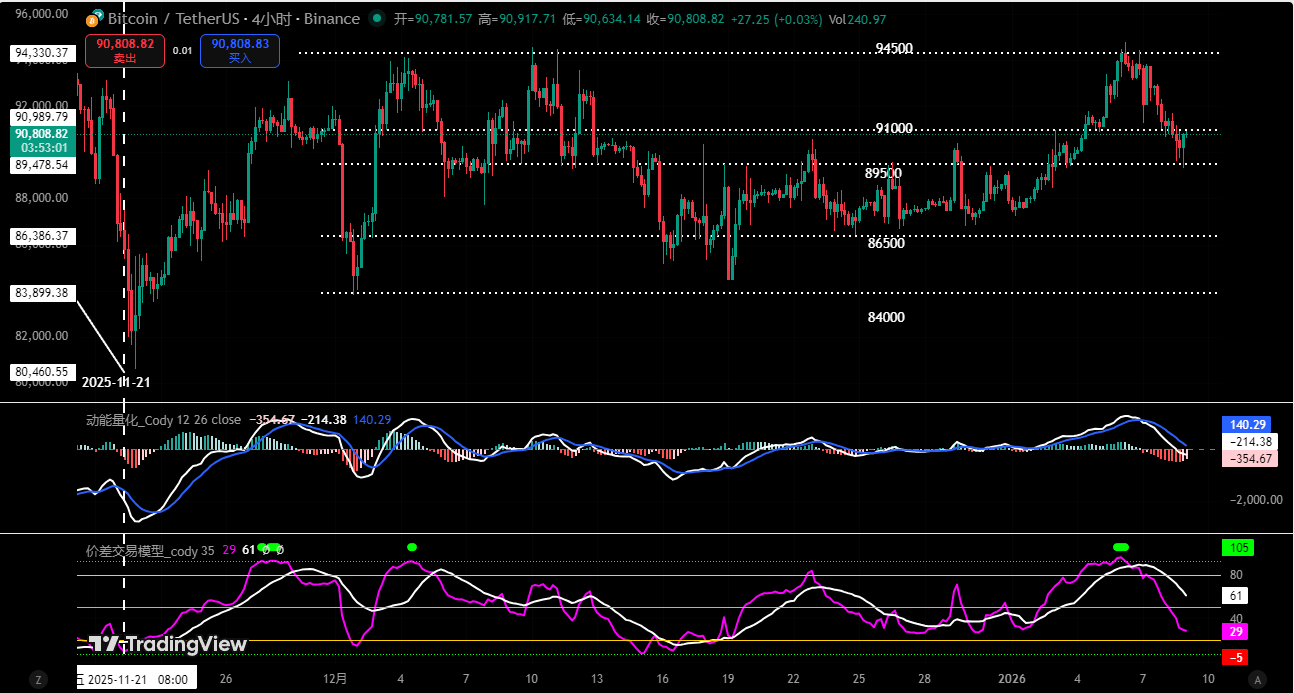

Bitcoin 4-Hour Chart: (Momentum Quant Model + Spread Trading Model)

From the 4-hour technical structure perspective (see chart above), Bitcoin has currently found effective support around $86,500. Multiple technical indicators have entered oversold territory, indicating short-term selling pressure has been released. The market has a need for a technical rebound correction (oscillatory bounce), but this is insufficient to confirm a reversal of the downtrend.

Based on this, we anticipate the price may first rebound to test the $92,000~$93,000 area, which also coincides with the middle-upper part of the previous consolidation range and is expected to form resistance again.

For short-term operations, a range-bound mindset remains primary: If the price rebounds to this zone and shows signs of momentum exhaustion or failure to break higher, consider establishing shorts on rallies. If the price effectively breaks above $94,500, decisive stop-loss is necessary, followed by a reassessment of the market structure.

4. Summary

Overall, Bitcoin continues to operate within the wide-ranging structure defined at the week's start: lower support provides room for bounces, while upper resistance caps the upside. At present, rather than betting on a one-sided trend, it's more prudent to respect the range structure, focusing on high-probability levels and strict risk control.

In ranging markets, formulating flexible strategies and achieving stable profits is far more important than predicting direction.

Disclaimer: The above content is solely personal market analysis and does not constitute any investment advice. Cryptocurrencies are highly volatile; please conduct your own independent judgment and strictly control risks.