Eight Meme Coins to Watch in 2026: Understanding Their Investment Significance from a Community Perspective

- 核心观点:Meme币是观测市场情绪与流动性的关键指标。

- 关键要素:

- Meme币能更早反映散户投机情绪变化。

- 社区活跃度与传播力是其核心驱动力。

- 部分Meme币已向生态应用扩展。

- 市场影响:可作为市场风险偏好回升的早期信号。

- 时效性标注:中期影响

In the crypto market, each cycle has different signals. Bitcoin typically reflects market confidence in the macroeconomy, while Ethereum reflects the development of infrastructure and application ecosystems. Meme coins, however, have a more unique role, often showing changes in retail investor sentiment and speculative activity earlier than others.

When risk appetite recovers, Meme coins are often among the first assets to attract attention. Even without changes in fundamentals, they can quickly gain popularity through community power, social media dissemination, and sentiment-driven factors. By the end of 2025, while Meme coins may not represent a large percentage of the total market capitalization, they will have captured a significant share of social discussions and user interactions.

Entering 2026, Meme tokens should no longer be dismissed as a joke. For investors, they are important indicators for observing the return of retail investors, the warming of market sentiment, and the rotation of liquidity. Paying attention to these projects is not about chasing short-term trends, but about understanding where market focus lies and how changes in sentiment affect prices.

This article will focus on Meme Coin, which still has influence in community power, market discussion, and trading behavior, to help beginners more clearly identify which assets have sustained value rather than being short-lived hype.

TL;DR Quick Summary

- Meme coins often reflect changes in retail investor sentiment and speculative risk appetite earlier than fundamentals.

- In 2026, Meme Coin will no longer be a joke, but will serve as a reference indicator for measuring retail investor participation and liquidity rotation.

- Strongly performing Meme coins typically have deep liquidity or a highly active and well-coordinated community.

- Paying attention to Meme Coin can help identify changes in market risk appetite and narrative popularity earlier.

- This list focuses on a project's impact and market relevance, rather than short-term price predictions.

Screening criteria and evaluation methods

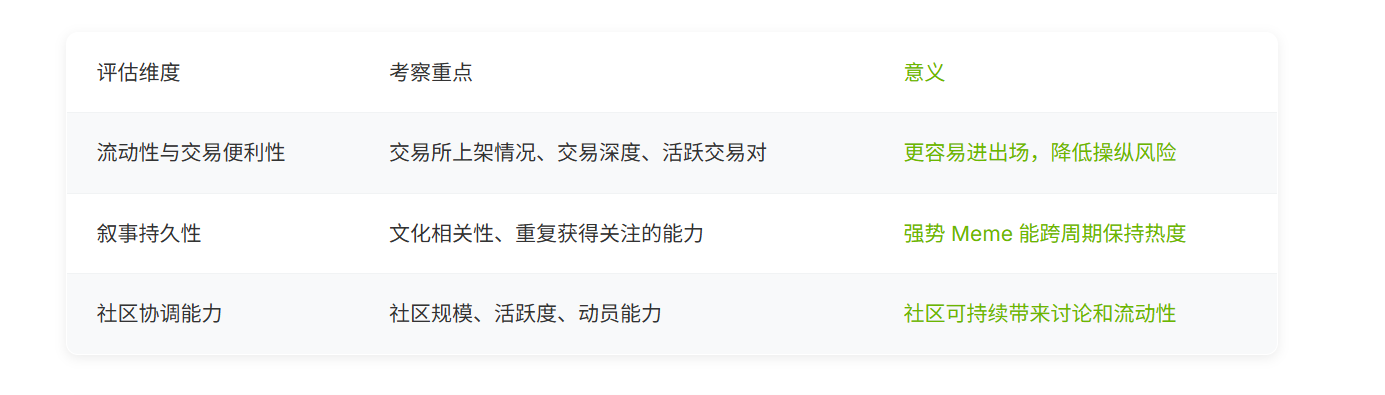

To avoid focusing solely on short-term hype, this list prioritizes evaluation from three dimensions that significantly impact the speculative cycle.

Risk Warning: Meme Coin is not primarily based on fundamental value. This list focuses on influence, visibility, and market relevance in 2026, rather than short-term price predictions.

The 8 most anticipated meme projects of 2026

The following projects are evaluated based on three core criteria: what they represent, why they are important in 2026, and what factors will affect their performance.

Dogecoin (DOGE)

Market positioning: In the early stages of meme sentiment, it is often regarded by retail investors as a highly liquid entry asset.

Image source: Dexerto

Image source: Dexerto

Dogecoin is the original Meme coin and the most well-known representative in the industry. Its value does not come from technological innovation or scarcity, but rather from widespread recognition. DOGE enjoys high liquidity on major trading platforms, has low barriers to entry, and is highly accessible.

Entering 2026, when speculative funds flowed back into the market, Dogecoin was often among the first meme assets to attract attention. During periods of improved market sentiment, Dogecoin was frequently used to gauge retail investor activity and was therefore considered an important sentiment indicator.

Community Signal:

DOGE boasts one of the largest and longest-standing communities in the crypto industry. Its users span Reddit , X, and a broader mainstream audience, leveraging years of meme culture, a tradition of tipping, and celebrity endorsements to cultivate strong user loyalty. This continuity allows DOGE to maintain its influence even during market downturns.

DOGE boasts a significant advantage in community size, currently possessing over 3.8 million followers and 2.4 million Reddit users. This large user base allows DOGE to consistently maintain a leading position in market awareness and discussion. Furthermore, its GitHub updates are relatively consistent, focusing on long-term maintenance and project continuity rather than frequent technical iterations (Source: CoinCarp).

DOGE boasts a significant advantage in community size, currently possessing over 3.8 million followers and 2.4 million Reddit users. This large user base allows DOGE to consistently maintain a leading position in market awareness and discussion. Furthermore, its GitHub updates are relatively consistent, focusing on long-term maintenance and project continuity rather than frequent technical iterations (Source: CoinCarp).

Common factors driving DOGE fluctuations:

- Social media buzz generated by KOLs and media exposure

- Rumors related to payment or integration with large platforms

- Increased discussion and mainstream attention surrounding ETFs

Why it matters: WhileDogecoin doesn't lead technological innovation, it consistently captures market attention. Significant changes inDOGE usually indicate a resurgence in retail investor participation.

Shiba Inu (SHIB)

Market positioning: Starting with Meme, and gradually expanding into a large-scale ecosystem project.

Image source: Bitcoinist

Image source: Bitcoinist

Initially launched as an alternative to Dogecoin, Shiba Inu has evolved into one of the most ambitious meme ecosystems. With its own Layer 2 network, multiple tokens, and DeFi products, Shiba Inu strikes a balance between meme culture and practical value.

Entering 2026, SHIB's importance lies in demonstrating how Meme coins can gradually develop into an ecosystem while maintaining a community foundation, rather than relying solely on market speculation. Even with the overlap between Meme and altcoin narratives, SHIB remains one of the most watched projects.

Community Signal:

The " Shib Army " is one of the most collaborative meme communities in the crypto industry. It's active in token burning, product promotion, and listing efforts, and excels at amplifying discussion on social media. This high level of coordination helps SHIB maintain long-term visibility, rather than relying solely on short-term hype.

Common factors driving SHIB volatility:

- New products or ecosystem components launched

- Token burning and supply changes

- Meme-driven sector rotation

Why it matters:Shiba Inu demonstrates how a meme brand can extend into a broader ecosystem with community support. SHIB performance often reflects whether retail users are willing to believe that meme projects can provide real-world use cases beyond the narrative.

Pepe (PEPE)

Market positioning: In high-risk market phases, it often reflects short-term speculative sentiment.

Image source: Borsa & Finanza

Image source: Borsa & Finanza

Pepe represents the purest form of meme culture. It doesn't promise practical value, nor does it deliberately cultivate a serious image. It is precisely this simplicity and directness that makes it particularly important in an emotion-driven market.

PEPE has become a bellwether for speculative sentiment. When investors are willing to take on higher volatility and narrative-driven risks, PEPE often quickly returns to the center of market discussion, accompanied by strong market performance.

Community Signal:

PEPE 's community is highly decentralized, with members primarily consisting of traders and internet-native meme enthusiasts. Its strength lies not in systematic development, but in its natural spread and rapid social coordination during periods of heightened emotion.

Common factors driving PEPE volatility:

- Social media suddenly heated up and meme spread.

- Signs of concentrated buying or selling by large investors

- Listed on exchanges, trending, or experiencing a surge in liquidity

Why it matters:The PE ratio reflects market sentiment more than structural factors. When the PE ratio rises, it often indicates increased market acceptance of high-risk assets and a recovery in retail investor sentiment.

Official Trump (TRUMP)

Market positioning: Meme assets whose market popularity and price fluctuations are highly dependent on news timing and media attention.

Image source: The Wall Street Journal

Image source: The Wall Street Journal

Official Trump Coin belongs to a special category of meme coins, built around political identity and celebrity influence. Its market performance is driven more by real-world events than by on-chain development or technological updates.

Entering 2026, Trump became a prime example of how attention-driven assets perform during media cycles. Its price often fluctuates with news headlines rather than based on fundamental changes.

Community Signal:

Trump 's community and political supporters significantly overlap with users new to crypto assets. Its discussions draw more from mainstream social media platforms and media narratives than from native crypto forums. This audience structure makes it vulnerable to public events.

Common factors driving Trump volatility:

- Political news and media reports

- Celebrities publicly support or promote activities

- Discussions related to regulation, law, or ethics

Why it matters: Trump is inherently highly volatile and heavily reliant on off-chain events. The Official Trump Coin demonstrates the power of narrative focus in the crypto market, illustrating how media attention can significantly amplify the performance of meme assets.

Floki (FLOKI)

Market positioning: Meme projects that emphasize product development and brand expansion, rather than speculative attributes.

Image source: Finance Feeds

Image source: Finance Feeds

Floki positions itself as an ambitious Meme coin, hoping to build a more complete ecosystem on top of the brand through aggressive marketing strategies and a diversified product portfolio, such as games, DeFi, and NFTs.

Entering 2026, FLOKI's key lies in its execution capabilities. Its importance lies in validating whether a meme project can maintain its visibility while relying on continuous development to move beyond short-term hype and ultimately achieve genuine application value.

Community Signal:

The “ Floki Vikings ” community is highly active and has a distinct marketing focus. They play a significant role in disseminating announcements, promoting collaborations, and amplifying brand narratives, and maintain a strong presence in multiple regions.

Common factors driving FLOKI volatility:

- Product launches and roadmap progress

- Large-scale marketing campaign

- Community-driven collaborations or promotions

Why it matters: FLOKI typically performs better when a practical narrative aligns with meme popularity . It reflects whether the execution capabilities can truly support the long-term development of a meme brand.

Bonk (BONK)

Market positioning: Meme assets that frequently reflect the overall sentiment and activity of the Solana ecosystem.

Image source: Know Your Meme

Image source: Know Your Meme

Bonk is the representative meme coin of the Solana ecosystem and a symbol of its recovery phase. Its early distribution focused on developers and users, forming a relatively natural foundation for its spread within the Solana community.

Entering 2026, BONK remains highly correlated with Solana sentiment. As Solana attracts more users, projects, and funding, BONK typically benefits simultaneously as a cultural symbol and a speculative asset, making it an extension of the ecosystem's popularity.

Community Signal:

BONK 's community essentially covers Solana's mainstream user base. Developers, the NFT community, and various applications all use BONK as a cultural token, and this ecosystem synergy allows it to maintain high visibility during Solana's active market periods.

Common factors driving BONK volatility:

- Solana Price Trends and Ecosystem Expansion

- Integration with Solana applications and products

- Meme rotation effect in low-cost networks

Why it's important:BONK often exhibits a high beta characteristic in its sentiment towards Solana, and its price fluctuations often correspond to the overall attention given to the Solana ecosystem. Therefore, it is one of the important reference indicators for observing the popularity of Solana .

Dogwifhat (WIF)

Market positioning: Meme assets that are highly sensitive to short-term attention and react extremely quickly.

Image source: Inside Bitcoins

Image source: Inside Bitcoins

Dogwifhat gained attention through its rapid spread, concise positioning, and humorous style. As a Meme coin within the Solana ecosystem, it performs particularly well in an environment of low transaction barriers and high dissemination efficiency.

WIF continues to attract market attention because it reacts extremely quickly to changes in social media trends. Rather than relying on a long-term narrative, it depends more on timing and sentiment, resulting in significant short-term fluctuations.

Community Signal:

WIF 's community is relatively informal, with a relaxed style and a strong meme culture, and it relies heavily on the Solana user base. Its activity primarily stems from short-term social sharing rather than long-term organized coordination.

Common factors driving WIF volatility:

- KOLs or content mentioning within the Solana community

- Exchange listings or trending topics revealed

- Short-term meme popularity and social cycle

Why it matters: WIF emphasizes timing rather than long-term consensus. When Dogwifhat rises, it often indicates that short-term speculative interest in the market is rapidly increasing, making it a typical example of attention-driven trading behavior.

Baby Doge Coin (BABYDOGE)

Market positioning: A long-term meme project with a large historical community base.

Image source: CryptoSoHo

Image source: CryptoSoHo

Baby Doge Coin is one of the largest meme coins in terms of community size. It gained widespread attention in its early market cycle through its deflationary mechanism and philanthropic narrative, attracting a large number of users to join the community.

Entering 2026, BABYDOGE is more accurately viewed as a potential comeback project than an absolute market leader. Its impact depends on its ability to reactivate large-scale social engagement.

Community Signal:

BABYDOGE boasts a large community of fans and a clear advantage on social media platforms. Although current engagement has declined somewhat, such large communities are typically among the first to become active when retail investor sentiment recovers.

Common factors driving BABYDOGE volatility:

- Collaborative social media campaigns

- Announcement of Adjustments to Deflation or Burn Mechanism

- The market's renewed focus on BSC ecosystem Meme coin

Why it matters:BABYDOGE 's core competitiveness lies in its community size, not technological innovation. When retail investor sentiment recovers, established meme projects with a large fan base are often the first to show signs of recovery.

Other potentially popular meme projects in 2026

The following projects are not market leaders, but they tend to re-emerge when attention shifts back to high-risk, narrative-driven assets. Historically, these tokens are often the first to experience volatility when market speculative sentiment recovers.

This watchlist is not a ranking, but rather a guide to help investors understand where meme liquidity and sentiment typically reactivate, and what triggers bring them back into focus.

Key Trends in the Meme Market in 2026

The following trends explain why the aforementioned tokens are prone to resurgence in popularity under specific market conditions.

Key Insight: Historically, when Meme consistently outperforms mainstream cryptocurrencies, it usually indicates a recovery in retail investor sentiment and is an early sign that the market is entering a risk-averse phase.

Key points to observe and understand from Meme assets

Meme coins are not based on discounted cash flow or long-term fundamentals; they are more like attention assets.

Following Meme coin can help in understanding changes in market sentiment, including:

- The direction of retail investor interest returning

- The rotation path of liquidity during the speculative phase

- Which narratives are most likely to evoke emotional resonance?

Discipline is equally important for beginners:

- Control position size

- Plan your profit-taking and exit strategies in advance.

- Avoid choosing tokens with poor liquidity or those that are not audited.

Meme coins won't define the future of the crypto market, but they do consistently reflect sentiment cycles. Understanding these signals can help us anticipate potential market directions earlier.

Frequently Asked Questions about Meme Coins

1. Will Meme Coin still be relevant in 2026?

It makes sense. Meme remains an important indicator for observing retail investor sentiment, attention flows, and speculative intentions.

2. Why does Meme coin often launch earlier than other altcoins?

Because Meme coins are primarily driven by sentiment and dissemination, they typically react to market changes faster than fundamental or application data.

3. Is Meme Coin suitable for long-term investment?

In most cases, they are not suitable. They are better suited for observation and participation as short-term, sentiment-driven assets, rather than for long-term investments that rely on fundamentals.

4. What factors allow a Meme coin to remain active despite multiple cycles?

High mobility, cultural resonance, and a vibrant and harmonious community are key supports.

5. How should beginners view and participate in Meme Coin?

It is recommended to control the size of your position, plan your exit strategy in advance, and avoid tokens with poor liquidity or those that are not audited.

6. What does Meme coin's strong performance usually mean?

A sustained surge in Meme coin prices often indicates increased retail participation and may signal that the market is entering a phase of broader risk appetite.

Quick Links

- The 5 most noteworthy L1 public chains in 2026: The main evolution from DeFi to RWA

- The 6 most noteworthy DeFi protocols to track in 2026: Who is truly handling on-chain fund flows?

- The global market after a 43-day data vacuum: AI stalls, Crypto fluctuates, what's next in December?

About XT.COM

Founded in 2018, XT.COM is a leading global digital asset trading platform with over 12 million registered users, operating in more than 200 countries and regions, and boasting an ecosystem traffic exceeding 40 million. The XT.COM cryptocurrency trading platform supports over 1300 high-quality cryptocurrencies and over 1300 trading pairs, offering diverse trading services including spot trading , leveraged trading , and contract trading , and is equipped with a secure and reliable RWA (Real World Asset) trading market. We are committed to the philosophy of "Explore Crypto, Trust Trading," dedicated to providing global users with a safe, efficient, and professional one-stop digital asset trading experience.