Paradigm bets on Brazil: A new blue ocean for stablecoins

- 核心观点:巴西稳定币Crown获投,押注其明星团队与巴西市场潜力。

- 关键要素:

- 团队背景豪华,有本土成功创业及金融经验。

- 巴西金融科技生态繁荣,Pix系统提供强大基础设施。

- 巴西加密货币采用度高,稳定币需求场景明确。

- 市场影响:或推动拉美法币稳定币赛道发展。

- 时效性标注:中期影响。

Original author: Eric, Foresight News

Brazilian stablecoin company Crown recently completed a $13.5 million Series A funding round led by Paradigm, valuing the company at $90 million. The Block's press release explicitly stated that this is Paradigm's first investment in a Brazilian company. This is Crown's second funding round in two months; in mid-October, Crown completed an $8.1 million seed round led by Framework Ventures, with participation from Coinbase Ventures and Paxos, among others.

This isn't exactly headline news, but two points in the story are worth noting: Why Crown? And why Brazil?

Why is Crown a worthwhile investment?

Analyzing a matter usually requires considering both internal and external factors.

Regarding external factors, I believe that investment opportunities for US-based stablecoin issuers are extremely limited. Tether and Circle have already captured the vast majority of the market, forcing investment institutions seeking greater alpha to target external markets. Furthermore, there are few stablecoins that allow foreign capital investment in companies related to their domestic fiat currencies and have a domestic market presence.

Brazil is a rare "treasure land" in the Americas that meets most of the conditions, and we'll explain why later.

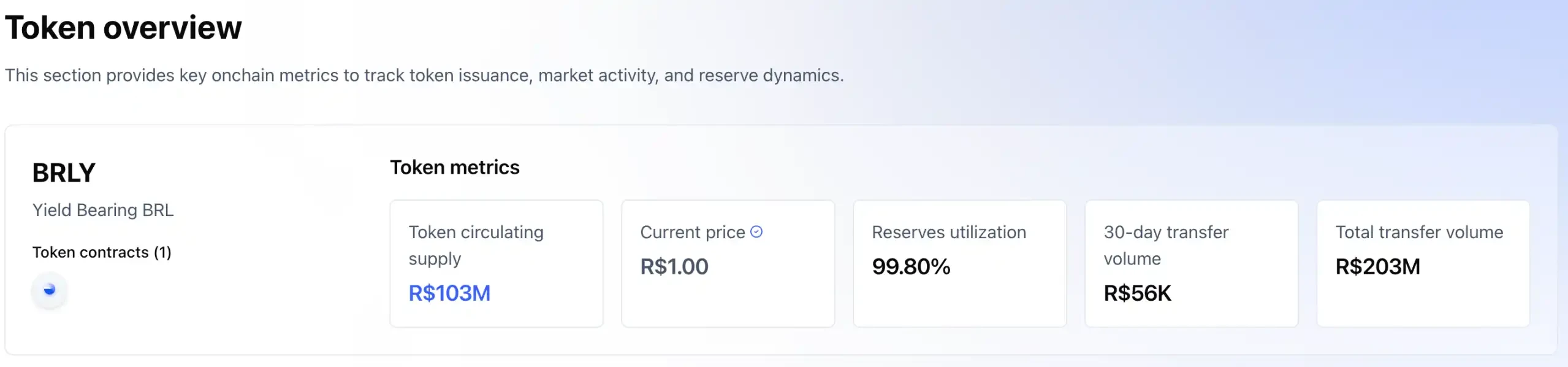

Let's go back to Crown. According to the disclosed data, the total amount of Crown's Real (Brazilian legal tender) stablecoin BRLV is only slightly over 100 million, which is less than $20 million in US dollars. The transaction volume in the past 30 days was only $56,000. It can be seen that the market for Brazilian local currency stablecoins is not large at present, not to mention that Crown is currently only targeting institutional clients.

Clearly, the logic behind investing in Crown is betting that the team behind it can achieve success in this market in the future.

John Delaney, co-founder and CEO of Crown, is a former lawyer specializing in international finance and COO of Xerpa, a prominent Brazilian company that has received investment from Founders Fund. In 2019, Xerpa launched its "Earned Wage Access" platform, allowing employees to access their wages for the days they have worked at any time (instead of waiting until the end of the month), helping to avoid high-interest loans. This has been particularly popular in Brazil's high-interest-rate and financially stressful environment, and is seen as a tool for employee financial well-being. The company charges a fixed, small fee, with no interest involved.

Co-founder and chief engineer Vinicius Correa was an early engineer at Brazilian digital bank Nubank. Nubank boasts a prestigious investor base, having participated in multiple funding rounds totaling $2 billion, including Sequoia Capital, Tiger Global, Goldman Sachs, Founders Fund, Tencent, and Berkshire Hathaway. Nubank went public on the NYSE in 2021 with an IPO valuation of $41.5 billion, and currently has a market capitalization of nearly $80 billion.

Founding Partner and Head of Ecosystem Alex Gorra previously served as Managing Partner of Brainvest, a family office managing $5 billion in assets, and also held management positions at ARX Investments, UBS, Rothschild Bank, and JPMorgan Chase. COO Bruno "BL" Passos previously led a cross-functional team at Hashdex.

Crown's founding team can be described as a truly star team. Both founders have participated in the process of building Brazilian companies from scratch. Although BRLV's current data is not impressive, it has not prevented it from raising more than $20 million in funding within two months.

Furthermore, the Crown team stated in their blog that the launch of BRLV was essentially inspired by the contributions of USDT and USDC in purchasing Brazilian government bonds. Issuing a stablecoin locally in Brazil can also provide purchasing power for government bonds, thereby stabilizing the economy and, in turn, further stimulating the use of stablecoins—a win-win situation. If dollar-denominated stablecoins merely help the US "stay afloat," then Brazilian real stablecoins can be said to genuinely help the country.

Why bet on Brazil?

As far as the underlying fiat currency of stablecoins is concerned, there seem to be many better options than the Brazilian real, but why choose Brazil?

You might not believe it, but this is a country that those born in the 80s and 90s probably last heard of because of football. It has become one of the largest and leading innovation centers in Latin America, with more than 1,500 fintech companies and more than 100 million users.

As a capitalist country, Brazil's banking sector has long been dominated by five major banks (Itaú, Banco do Brasil, Bradesco, Caixa, and Santander), accounting for over 80% of assets, far exceeding the US (approximately 50%). Traditional banking services are rigid, fees are high (credit card annual interest rates often exceed 300%), and bureaucracy is rampant, resulting in tens of millions of low- and middle-income earners and the unbanked (historically reaching 55 million) being excluded from the system.

However, this also created a huge demand gap, and fintech companies like Nubank quickly filled the market gap by offering simple, low-cost services through fee-free credit cards.

While the Central Bank of Brazil couldn't change the traditional banking industry's monopoly, it unexpectedly took the initiative to promote competition and inclusion, even becoming a classic case study in global digital financial regulation. Its biggest contribution was the launch of the Pix instant payment system in 2020. Pix supports free, 24/7 real-time transfers, with transaction volume exceeding one trillion reais by 2025 and user coverage of over 90% of the population. Upon its launch, Pix quickly replaced cash and credit cards, becoming the preferred payment method for 76% of Brazilians, significantly improving financial inclusion and providing low-cost infrastructure for Fintech (such as integrating Pix into payment and credit innovations).

You've probably seen news about various trading platforms and crypto payment tools integrating Pix in Web3 industry news. It's certainly no easy feat for a capitalist country's central bank to spearhead the launch of a payment system powerful enough to shake up the existing banking system, but this "people-benefiting" approach also gives local fintech companies a better future because they can reach a wider user base.

This is precisely why new forms of finance like cryptocurrency are so readily accepted in Brazil. Brazil has a population of over 200 million, a smartphone penetration rate of nearly 90%, over 180 million internet users, and an average online time of over 5 hours per person. Young, digitally native citizens, especially Generation Z, have a strong demand for mobile finance. Last September, Circle directly began supporting the exchange of Brazilian Real for USDC.

The popularity of US dollar stablecoins in Brazil has been analyzed in many articles as being due to the instability of the Brazilian currency. However, according to my research, even if this factor is involved, it only accounts for a small part. Now it seems that if this reason were valid, investment institutions like Paradigm wouldn't be making such heavy bets on Brazilian fiat stablecoins and fintech companies.

Indeed, Brazil experienced several periods of hyperinflation in the 1980s and 90s, even reaching extreme levels with monthly inflation rates as high as 80%. However, in recent years, while the real remains volatile, Brazil has achieved considerable success in stabilizing its currency and reducing inflation. Brazil's inflation rate is projected to hover between 4.5% and 5% by 2025, which, while still above the central bank's target, is significantly lower than that of neighboring Argentina.

While some Brazilian residents do hold dollar-denominated stablecoins to hedge against the devaluation of the real, especially given the backdrop of the Federal Reserve's interest rate hikes in recent years, many more do so for practical purposes such as foreign trade, tax avoidance, facilitating capital flows, and trading cryptocurrencies.

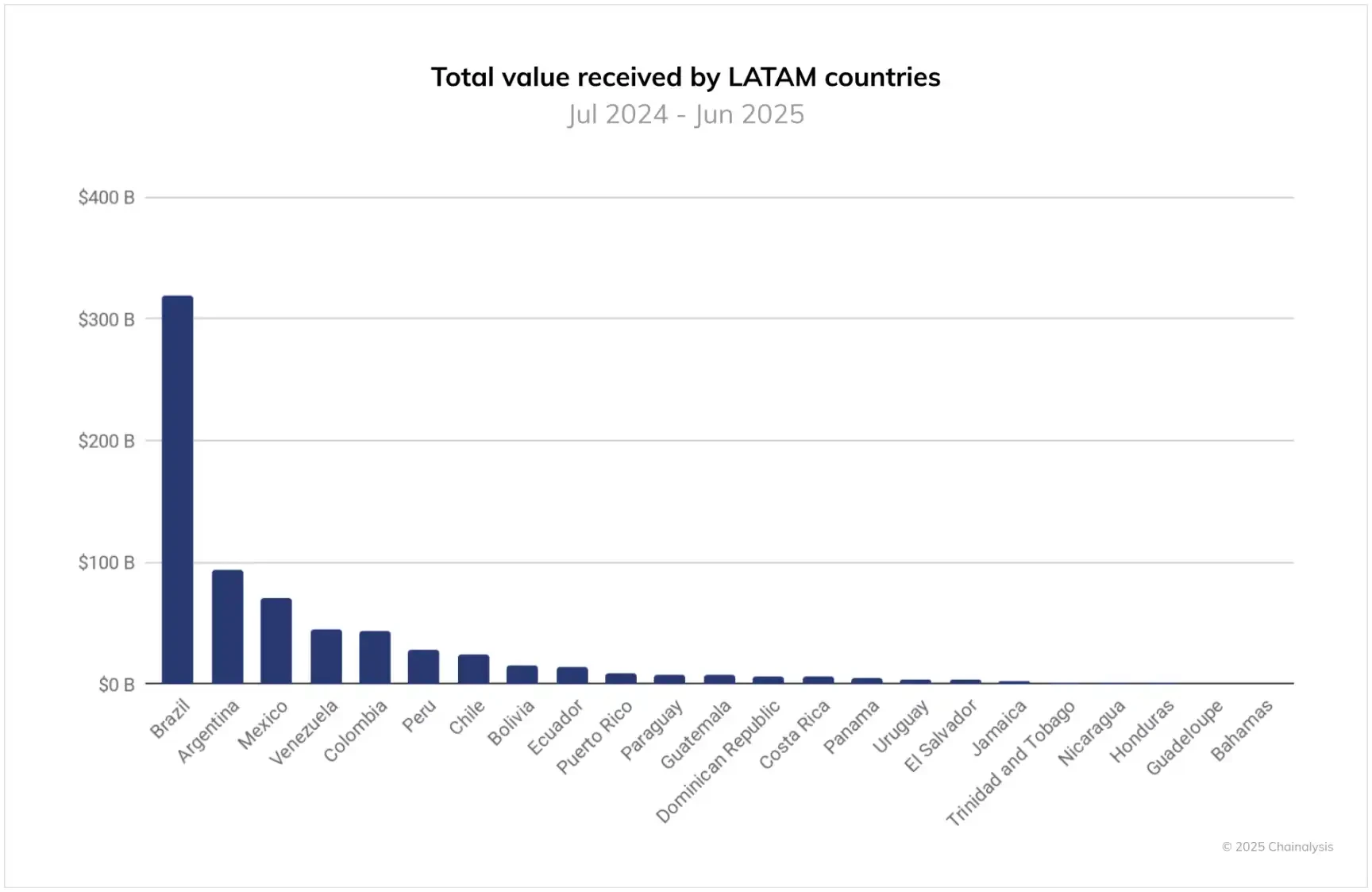

According to Chainalysis data, Brazil ranks fifth globally in cryptocurrency adoption, behind only India, the United States, Pakistan, and Vietnam. Its cryptocurrency inflows from July 2024 to July 2025 reached $318.8 billion, far surpassing other Latin American countries.

According to data provided by cryptocurrency market maker Gravity Team, Brazil has adopted stablecoins as a tool for investment and cross-border payments, and stablecoins currently account for about 70% of indirect fund flows from local Brazilian exchanges to international exchanges.

At this point, some might ask, since we already have a national-level payment tool like Pix, what is the point of stablecoins?

Crown's BRLV has a feature not explicitly stated on its official website but mentioned in press releases: it shares government bond interest yields with stablecoin holders, and in Brazil, this figure is 15%. While it's impossible to distribute all of it to holders, even half is a very attractive yield.

In the future, BRLV can also be integrated into the Pix system. For ordinary people or even the poor, there may be no incentive to exchange for stablecoins. However, for those with money, stablecoins not only do not affect payments, but they can even "earn interest" simply by holding them. In the future, they can also be seamlessly traded with USD stablecoins and even participate in DeFi. In short, all these possibilities will surely make stablecoins have sufficient demand and scenarios in this land.

For most countries with weak national strength, unable to maintain the stability of their own currency in the long term, and with scarce foreign exchange reserves, the US dollar and dollar stablecoins are a lifeline for the people, but Brazil is an exception.