JPMorgan Chase sided with Wall Street: hoarding silver, positioning itself in gold, and shorting the dollar's credit.

- 核心观点:摩根大通正从西方纸黄金体系转向东方实物资产。

- 关键要素:

- 摩根大通将巨额白银从“可交割”转为“不可交割”。

- 伦敦市场实物交割困难,租赁利率飙升。

- 全球央行持续购金,实物需求强劲。

- 市场影响:加速实物贵金属定价权东移。

- 时效性标注:长期影响。

Original author: sleepy.txt, Beating

JPMorgan Chase, the most loyal "gatekeeper" of the old dollar order, is now tearing down the high walls it once swore to defend to the death.

According to market rumors, JPMorgan Chase will relocate its core precious metals trading team to Singapore at the end of November 2025. While this geographical relocation may seem superficial, its core purpose is a public defection from the Western financial system.

Looking back over the past half-century, Wall Street was responsible for constructing a vast illusion of credit using the US dollar, while London, as the "heart" of Wall Street's financial empire across the Atlantic, maintained the dignity of pricing through its deeply buried gold vaults. The two were interdependent, together weaving a network of absolute control over precious metals in the Western world. JPMorgan Chase, however, should have been the last and most solid line of defense.

Like a hidden thread running through the grass, its presence is deeply ingrained. Amidst the official silence regarding the rumors, JPMorgan Chase completed a remarkable asset maneuver, quietly transferring approximately 169 million ounces of silver from the "deliverable" category to the "non-deliverable" category in COMEX vaults. Roughly calculated based on publicly available data from the China Banking Association, this equates to nearly 10% of the global annual silver supply, effectively locking it up on paper.

In the brutal world of business competition, scale itself is the strongest form of assertiveness. Many traders see this mountain of over 5,000 tons of silver as a bargaining chip that JPMorgan Chase has prepared in advance to vie for pricing power in the next cycle.

Meanwhile, thousands of kilometers away, The Reserve, Singapore's largest private vault, launched its second phase of construction at just the right time, increasing its total capacity to 15,500 tons. This infrastructure upgrade, planned five years in advance, gave Singapore the confidence to absorb the massive wealth flowing out from the West.

JPMorgan Chase, with its left hand, locked up the liquidity of physical assets in the West, creating panic; with its right hand, it built a safe haven in the East, reaping the benefits.

What prompted this giant's defection was the undeniable fragility of the London market. At the Bank of England, the time to take delivery of gold was stretched from days to weeks, while silver leasing rates soared to a record high of 30%. For those familiar with the market, this indicated at least one thing: everyone was scrambling to buy, and physical assets in vaults were becoming increasingly scarce.

The most astute bookmakers are often also the vultures with the keenest sense of impending doom.

In this harsh winter, JPMorgan Chase demonstrated the keen sense of a top-tier market maker. Its exit marks the impending end of the half-century-long, Midas touch-making game of "paper gold." As the tide recedes, only those holding onto substantial physical assets will secure their ticket to the next thirty years.

The End of Alchemy

The seeds of all this trouble were sown half a century ago.

In 1971, when President Nixon severed the umbilical cord between the dollar and gold, he effectively pulled the last anchor from the global financial system. From that moment on, gold was relegated from a rigidly redeemed currency to a financial asset redefined by Wall Street.

In the following half-century, bankers in London and New York invented a sophisticated "financial alchemy." Since gold was no longer currency, they could create countless "contracts" representing gold out of thin air, just like printing banknotes.

This is the vast derivatives empire built by the LBMA (London Bullion Market Association) and COMEX (New York Mercantile Exchange). In this empire, leverage is king. Every piece of gold lying dormant in the vault corresponds to 100 delivery orders circulating in the market. And on the silver gambling table, the game is even more insane.

This system of "paper wealth" has been able to operate for half a century, entirely relying on a fragile gentleman's agreement: the vast majority of investors are only interested in making a profit from the price difference and should never try to take out that heavy piece of metal.

However, the people who designed this game overlooked a "gray rhino" that rushed into the room—Silver.

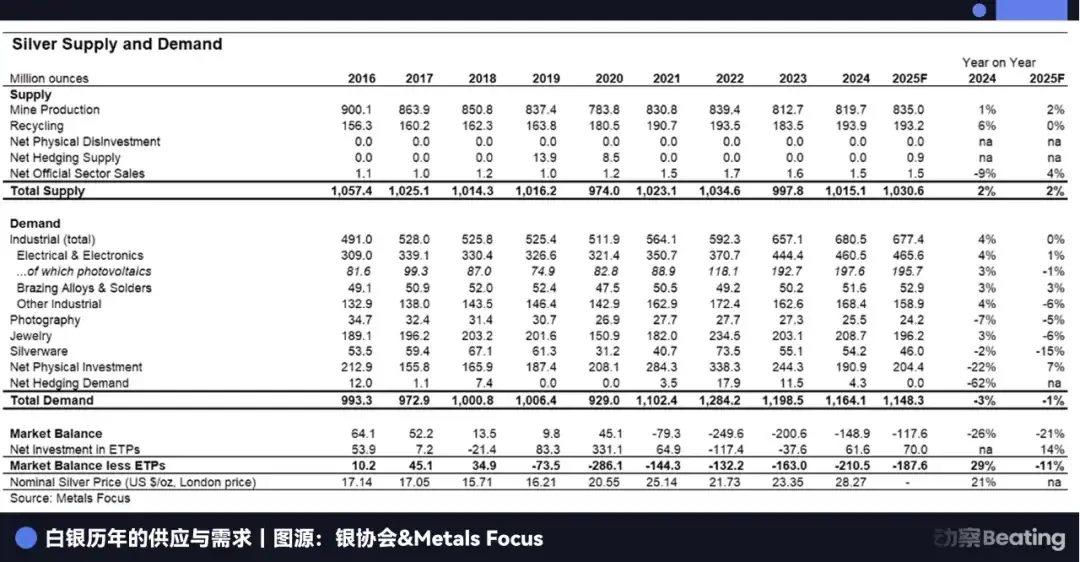

Unlike gold, which is a perpetual treasure buried deep underground, silver plays the role of a "consumable" in modern industry. It is the lifeblood of photovoltaic panels and the nerves of electric vehicles. According to data from the Silver Institute, the global silver market has been in a structural deficit for five consecutive years, with industrial demand accounting for nearly 60% of total demand.

Wall Street can type out an infinite amount of dollars with a keyboard, but it cannot conjure an ounce of silver for conducting electricity out of thin air.

When physical inventory is completely devoured by the real economy, the multi-million dollar contracts on paper become baseless. In the winter of 2025, this veil was finally lifted.

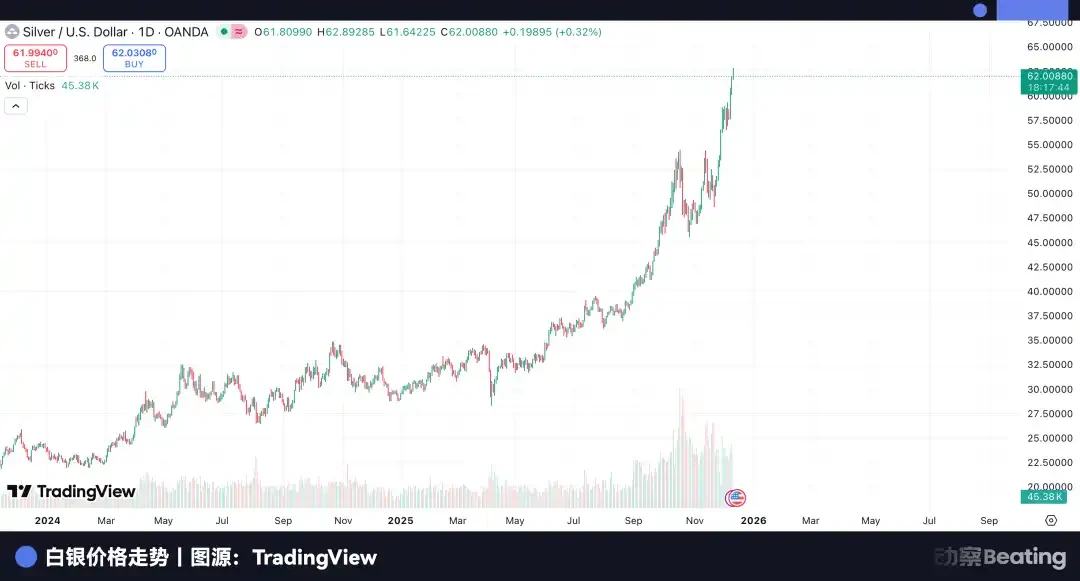

The first red flag was the abnormal price movement. In normal futures trading, forward prices are usually higher than spot prices; this is called a "converged market." However, in London and New York, the market experienced an extreme "spot premium." If you wanted to buy a silver contract for six months later, all was well; but if you wanted to take silver bars home now, you not only had to pay a high premium but also face a long wait of several weeks.

Long queues formed outside the Bank of England's vaults, COMEX registered silver inventories fell below the safety threshold, and the ratio of open contracts to physical inventory surged to 244%. The market finally understood the terrifying reality: physical commodities and paper contracts were splitting into two parallel universes. The former belonged to those who owned factories and vaults, while the latter belonged to speculators still slumbering in their old dreams.

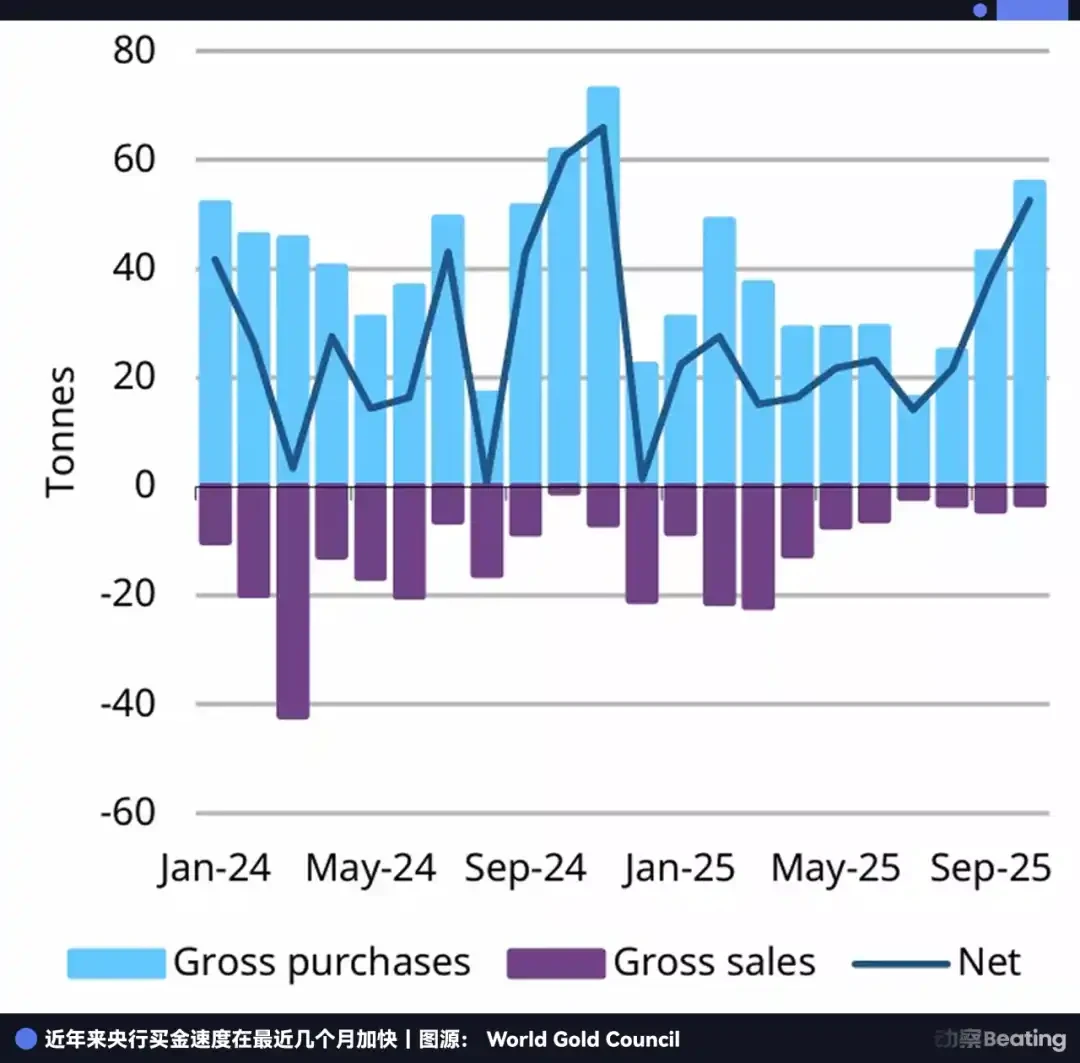

If the silver shortage is due to the devouring by industrial behemoths, then the gold outflow is due to a national-level "bank run." Central banks around the world, once the most steadfast holders of the dollar, are now at the forefront of the run.

Despite the historically high gold prices in 2025 prompting some central banks to tactically slow their gold purchases, strategically, "buying" remains the only action. The latest data from the World Gold Council (WGC) shows that in the first 10 months of 2025, global central banks made net purchases of 254 tons of gold.

Let's take a look at this list of buyers.

Poland, after a five-month hiatus from gold purchases, suddenly returned to the market in October, buying 16 tons in a single month and pushing its gold reserves to 26%. Brazil increased its holdings for two consecutive months, with total reserves climbing to 161 tons. China, since resuming purchases in November 2024, has appeared on the buyer's list for the 13th consecutive month.

Those countries are willing to exchange their precious foreign exchange reserves for heavy gold bars and bring them back to their countries. In the past, people trusted US Treasury bonds because they were "risk-free assets"; now, people are frantically buying gold because it has become the only shield against "dollar credit risk".

Despite the continued arguments of mainstream Western economists who claim that the paper gold system provides efficient liquidity and that the current crisis is merely a temporary logistical problem.

But you can't hide fire with paper, and now you can't hide gold with paper either.

When the leverage ratio reaches 100:1, and the single "1" is resolutely moved back home by central banks around the world, the remaining "99" paper contracts face an unprecedented liquidity mismatch.

The London market is currently caught in a classic short squeeze, with industrial giants scrambling to buy silver to maintain production, while central banks are locking up gold as a safety net for national wealth. When all counterparties demand physical delivery, the pricing model based on credit becomes ineffective. Whoever controls the physical commodity controls the power to define prices.

JPMorgan Chase, the "magician" who was once most adept at manipulating paper contracts, clearly saw this future earlier than anyone else.

Rather than becoming a martyr to the old order, it prefers to be a partner in the new one. This habitual offender, which has been fined $920 million over the past eight years for market manipulation, is not leaving with a change of heart, but rather with a precise bet on the flow of global wealth over the next thirty years.

It's betting on the collapse of the "paper contract" market. Even if it doesn't collapse immediately, that infinitely amplified leverage will eventually be cut off round after round. The only truly safe thing is that piece of metal that you can see and touch in the warehouse.

Betrayal of Wall Street

If we compare the paper gold and silver system to a glittering casino, then over the past decade, JPMorgan Chase has not only been the bodyguard maintaining order, but also the dealer most adept at cheating.

In September 2020, JPMorgan Chase paid a record $920 million settlement to settle charges brought by the U.S. Department of Justice against it for manipulating the precious metals market. In thousands of pages of investigative documents released by the Justice Department, JPMorgan traders were described as masters of deception.

They typically employ an extremely cunning hunting tactic: traders will instantly place thousands of contracts on the sell side, creating the illusion that prices are about to collapse, inducing retail investors and high-frequency trading bots to panic sell; then, at the moment of collapse, they will cancel the orders and aggressively buy up the bloodied chips at the bottom.

According to statistics, Michael Nowak, the former global head of precious metals at JPMorgan Chase, and his team artificially created tens of thousands of sudden crashes and surges in gold and silver prices over eight years.

At the time, the outside world generally attributed all of this to Wall Street's usual greed. But five years later, as the piece of the puzzle of the 169 million ounces of silver inventory is laid out on the table, a more somber idea has begun to circulate in the market.

In some interpretations, JPMorgan Chase's "manipulation" back then can hardly be seen as simply making more money from high-frequency trading spreads. It was more like a slow and protracted accumulation of shares. On one hand, they violently suppressed the price on the paper market, creating the illusion that the price was being held down; on the other hand, they quietly collected the shares in their own hands on the physical market.

This former guardian of the old dollar order has now transformed into the most dangerous gravedigger of that old order.

In the past, JPMorgan Chase was the biggest short seller of paper silver, acting as a ceiling for gold and silver prices. But now, with the physical assets being swapped out, they have suddenly become the biggest long sellers.

Market gossip is never lacking, and rumors circulate that JPMorgan Chase itself is behind the recent surge in silver prices from $30 to $60. While there's no evidence for this claim, it's enough to suggest that, in many people's minds, JPMorgan Chase has transformed from a manipulator of paper silver to the largest bullish force in real assets.

If all these projections come true, then we will witness the most spectacular, and also the most ruthless, coup in business history.

JPMorgan Chase knows better than anyone that the U.S. regulatory fist is tightening inch by inch, and that paper contract game, which not only costs money but could even be deadly, has come to an end.

This also explains why it has such a strong affinity for Singapore.

In the United States, every transaction can be flagged as suspicious by AI-driven regulatory systems; but in Singapore, in those private strongholds not belonging to any central bank, gold and silver are completely depoliticized. There is no extraterritorial jurisdiction, only the ultimate protection of private property.

JPMorgan Chase's breakthrough is by no means a lone battle.

At the same time that the rumors were brewing, a consensus had quietly been reached at the top of Wall Street. Although there was no physical mass relocation, the giants completed a remarkable synchronized strategic shift. Goldman Sachs aggressively set its 2026 gold price target at $4,900, while Bank of America even directly called for a sky-high price of $5,000.

In an era dominated by paper gold, such a target price would have sounded like a pipe dream; but if we shift our focus back to physical gold, looking at the pace of central bank gold purchases and changes in gold reserves, this figure begins to be a topic of serious discussion.

Wall Street's smart money is quietly shifting its focus, reducing its short positions in gold and increasing its physical asset holdings. While it may not sell off all its US Treasury bonds, gold, silver, and other physical assets are being gradually added to its portfolios. JPMorgan Chase has acted the fastest and most decisively because it not only wants to survive but also to win. It doesn't want to sink with the paper gold empire; it wants to take its algorithms, capital, and technology to a place that offers not only gold but also a future.

The problem is that the place already has its own owner.

When JPMorgan Chase's private jet lands at Singapore Changi Airport, looking north, it will find an even larger competitor that has already built high walls there.

Waves rushing and flowing

While London traders were still anxious about the depletion of liquidity in paper gold, thousands of kilometers away on the banks of the Huangpu River in Shanghai, a vast physical gold empire had already completed its initial accumulation.

Its name is Shanghai Gold Exchange (SGE).

In the Western-dominated financial landscape, SGE is a complete outlier. It rejected the virtual games built on credit contracts common in London and New York, and from its inception, it has adhered to an almost obsessive ironclad rule: physical delivery.

These four words, like a steel nail, precisely struck the Achilles' heel of the Western paper gold game.

On the New York COMEX, gold is often just a fluctuating number, with the vast majority of contracts being closed out before expiration. But in Shanghai, the rules are "full payment" and "centralized clearing."

Every transaction here requires real gold bars to be stored in a vault. This not only eliminates the possibility of unlimited leverage but also makes the barrier to "shorting gold" extremely high, because you must first borrow real gold in order to sell it.

In 2024, SGE delivered an astonishing performance, with a total gold trading volume of 62,300 tons, up 49.9% from 2023; and a trading value soaring to 34.65 trillion yuan, an increase of nearly 87%.

When the physical delivery rate on the New York COMEX was less than 0.1%, the Shanghai Gold Exchange had become the world's largest reservoir of physical gold, continuously absorbing the world's gold reserves.

If the inflow of gold represents a nation's strategic reserves, then the inflow of silver represents the "physiological desire" of Chinese industry.

Wall Street speculators can use paper contracts to gamble on prices, but as the world's largest manufacturing base for photovoltaics and new energy, Chinese factory owners don't need contracts; they must have real silver to start production. This rigid industrial demand has made China the world's largest precious metal black hole, continuously devouring the West's reserves.

This route of "moving gold from the west to the east" is both busy and secretive.

Take the journey of a gold bar as an example. In Ticino, Switzerland, some of the world's largest gold refineries (such as Valcambi and PAMP) are operating day and night. They are carrying out a special "rejuvenation" task, melting and refining 400-ounce standard gold bars transported from London vaults, and then recasting them into 1-kilogram "Shanghai Gold" standard bars with a purity of 99.99%.

This is not only a recasting of the physical form, but also a change in the attributes of currency.

Once these gold bars are melted down to 1-kilogram sizes and stamped with the "Shanghai Gold" mark, it becomes virtually impossible for them to return to the London market. Shipping them back would require remelting and recertification, which is extremely costly.

This means that once gold flows eastward, it's like a river flowing into the sea—there's no turning back. The waves surge and flow, the mighty river never ceasing its course.

Armored convoys bearing the logos of Brink's, Loomis, or Malca-Amit were the transporters of this great migration on the tarmac of airports around the world. They continuously filled the vaults of Shanghai with these recast gold bars, making them the physical cornerstone of the new order.

By controlling the physical commodity, one gains control over the narrative. This is precisely the strategic significance behind SGE CEO Yu Wenjian's repeated emphasis on establishing the "Shanghai Gold" benchmark price.

For a long time, global gold pricing power has been firmly locked in the 3 p.m. fixing price in London, because that reflects the will of the US dollar. But Shanghai is trying to break this logic.

This is a strategic hedging exercise at the highest level. As China, Russia, Middle Eastern countries, and others begin to form an invisible alliance of "de-dollarization," they need a new common language. This language is neither the renminbi nor the ruble, but gold.

Shanghai is the translation center for this new language. It is telling the world that if the US dollar is no longer trustworthy, then trust the real gold and silver in your own warehouse; if paper contracts may default, then trust the Shanghai rule of cash on delivery.

For JPMorgan Chase, this is both a huge threat and an opportunity that cannot be ignored.

To the west, it can no longer turn back, for there is only dwindling liquidity and tightening regulation; to the east, it must confront the behemoth that is Shanghai. It cannot directly conquer Shanghai, because the rules there do not belong to Wall Street, and the walls there are too thick.

The final buffer zone

If Shanghai is the "heart" of the Eastern empire of physical assets, then Singapore is the "front line" of this East-West confrontation. It is not merely a geographical transit point, but also the last line of defense carefully chosen by Western capital in the face of the rise of the East.

Singapore, this city-state, is investing almost frantically in transforming itself into the "Switzerland" of the 21st century.

Located next to the runway at Changi Airport, Le Freeport is the best window into Singapore's ambitions. This free port, with its independent judicial status, is a perfect "black box" both physically and legally. Here, the flow of gold is stripped of all cumbersome administrative oversight. From the moment the plane lands to the moment the gold bars are stored, the entire process is completed in a completely closed, tax-free, and extremely private loop.

Meanwhile, another mega-vault, The Reserve, has been under construction since 2024. This 180,000-square-foot fortress is designed to hold a total capacity of 15,500 tons. Its selling point is not only its one-meter-thick reinforced concrete walls, but also a privilege granted by the Singapore government—a complete exemption from Goods and Services Tax (GST) on investment-grade precious metals (IPM).

For market makers like JPMorgan Chase, this is an irresistible temptation.

But if it were merely about taxes and cash reserves, JPMorgan Chase could have chosen Dubai or Zurich. Its decision to locate in Singapore reveals a deeper, more complex geopolitical calculation.

On Wall Street, moving the core of their business directly from New York to Shanghai would be tantamount to "defection," and in the current turbulent international political climate, it would be suicide. They desperately needed a foothold, a safe haven that would provide access to the vast physical market in the East and make them feel politically secure.

Singapore is the perfect choice.

It controls the Strait of Malacca, connecting London's dollar liquidity with the physical needs of Shanghai and India.

Singapore is not only a safe haven, but also the largest transit hub connecting two divided worlds. JPMorgan Chase is attempting to establish a never-ending trading loop here: fixing in London, hedging in New York, and accumulating in Singapore.

However, JPMorgan Chase's plan is not without flaws. In the struggle for pricing power in Asia, it cannot avoid its strongest competitor—Hong Kong, China.

Many people mistakenly believe that Hong Kong has fallen behind in this round of competition, but the truth is quite the opposite. Hong Kong possesses a core trump card that Singapore cannot replicate: it is the only channel for the RMB to go global.

Through the "Shanghai-Hong Kong Gold Connect," the Chinese Gold & Silver Exchange Society of Hong Kong (CGSE) is directly connected to the Shanghai Gold Exchange platform. This means that gold traded in Hong Kong can directly enter the mainland China delivery system. For capital that truly wants to embrace the Chinese market, Hong Kong is not "offshore," but rather an extension of "onshore."

JPMorgan Chase chose Singapore, betting on a hybrid model of "dollar + physical assets," attempting to build a new offshore center on the ruins of the old order. Meanwhile, established British banks such as HSBC and Standard Chartered continued to heavily invest in Hong Kong, betting on the future of "renminbi + physical assets."

JPMorgan Chase thought it had found a neutral safe haven, but in the meat grinder of geopolitics, there is never a true "middle ground." Singapore's prosperity is essentially a result of the spillover of the Eastern economy. This seemingly independent luxury yacht has actually long been locked in the gravitational field of the Eastern continent.

As Shanghai's allure grows stronger, as the territory of RMB-denominated gold expands, and as China's industrial machinery continues to devour physical silver in the market, Singapore may no longer be a neutral safe haven, and JPMorgan Chase will have to make another fateful choice.

Restart of the cycle

The rumors surrounding JPMorgan Chase may eventually be addressed with an official explanation, but that's no longer important. In the business world, astute capital is always the first to sense any shifts in the market.

The epicenter of this tremor is not in Singapore, but deep within the global monetary system.

For the past fifty years, we have become accustomed to a world of "paper contracts" dominated by the credit of the US dollar. It was an era built on debt, promises, and the illusion of unlimited liquidity. We once thought that as long as the printing presses were running, prosperity could last forever.

But now, the wind has completely changed.

When central banks around the world spare no expense to repatriate their gold reserves, and when global manufacturing giants begin to vie for the last piece of industrial silver, what we are witnessing is a return to an ancient order.

The world is slowly but steadily returning from an ethereal fiat currency system to a tangible, physical asset system. In this new system, gold is the measure of credit, and silver is the measure of production capacity. One represents the baseline of security, and the other represents the limits of industry.

In this long migration, London and New York were no longer the only destinations, and the East was no longer just a manufacturing hub. New rules of the game were being established, and new centers of power were emerging.

The era in which Western bankers defined the value of gold and silver is slowly fading away. Gold and silver remain silent, yet they answer all the questions of this era.