The battle to predict the future of the market: to the left is the casino, to the right is the news.

- 核心观点:预测市场面临交易博弈与信息产品化的路径抉择。

- 关键要素:

- Kalshi、Polymarket交易额近100亿美元,融资估值超百亿。

- Kalshi面临多州监管诉讼,Polymarket和解后重返美国市场。

- 平台与CNN等媒体合作,探索“新闻+预测”新形态。

- 市场影响:推动行业向主流金融与信息领域融合。

- 时效性标注:中期影响。

Original article by Odaily Planet Daily ( @OdailyChina )

Author/ Wenser ( @wenser2010 )

In November, the prediction market experienced a boom: Kalshi's trading volume surged to $5.8 billion, and Polymarket reached $3.74 billion, both breaking records, with the combined trading volume approaching the $10 billion mark.

Capital enthusiasm is high, with Kalshi completing a $1 billion Series E funding round at a valuation of $11 billion; Polymarket, after receiving $2 billion in funding from ICE, is seeking a new round of funding of $12 billion to $15 billion.

Beneath the surface of this apparent boom, undercurrents are stirring. Kalshi faces dual pressure from regulators in seven states, including Nevada, and user lawsuits; Polymarket, after settling with the CFTC, has relaunched its US operations, launching a localized version of its app . Meanwhile, CNN and CNBC have partnered with Kalshi, propelling the convergence of prediction markets and news into a new phase.

To the left lies the game of strategy; to the right lies information. The prediction market faces not only the influx of capital, but also regulatory scrutiny and the ultimate questioning of its business model.

Predicting Market Developments: Kalshi Embroiled in Market-Making Scandal, Polymarket Recruits Internal Trading Team

To predict the future of the market, let's first look at the current power struggle between the two giants, Kalshi and Polymarket. Their recent moves have clearly diverged:

Kalshi: The interplay of compliance and mainstream appeal

- Regulatory pressure is mounting : Nevada and other states are tightening their scrutiny of "sports betting" licenses, and a class-action lawsuit has been filed against Kalshi Trading, a market maker associated with the company, further complicating the path to compliance.

- Breakthrough in media : Deep collaborations were established with CNN and CNBC , integrating their real-time forecast data into mainstream news platforms and bringing it into the public eye.

- Product on-chainization : Under regulatory pressure, we actively cooperate with Solana , Sei Network and others to promote tokenization and on-chain deployment, and explore the balance between compliance and innovation.

Polymarket: On-Chain Transparency and Market Return

- Return to the US : After a three-year hiatus, the US version of the app is officially launched, with the sports section as the first offering, and predictions for all categories to be gradually opened up.

- Ecosystem Expansion : The MetaMask mobile app was launched, leveraging its large user base to broaden transaction entry points and diversify channel offerings.

- Building a Market-Making System : Recent news indicates that Polymarket is recruiting new members for its internal market-making team, potentially allowing them to trade against platform users. Sources reveal that they have recently spoken with several traders, including sports betting traders, to invite them to join this new department. It's clear that Polymarket, currently operating with a "zero commission" strategy, is seeking a diversified revenue model, similar to the "market-making scandal" that Kalshi is embroiled in mentioned above.

Fueled by capital, both companies quickly rose to become industry giants with valuations in the tens of billions of dollars, leveraging their first-mover advantage and product strength. However, after becoming unicorns, they also stood at a crossroads: one path led to the "casino," relying on transactions and games for expansion; the other path pointed to "news," integrating information decision-making and becoming a "probability sensor" for future events.

Predicting the future shape of the market: to the left, encouraging competitive transactions; to the right, becoming a news product.

In our article, "Why Prediction Markets Are Not Gambling Platforms," we systematically demonstrated the key difference between prediction markets and gambling platforms. Prediction markets play a unique and important role in terms of price mechanisms, economic value, user structure, and regulatory authority.

After seven years of ups and downs, this once marginalized field has now become the focus of attention for both traditional finance and the crypto world. Currently, the industry's two giants and the capital behind them must answer four core questions:

- Where is the new market for incremental users?

- How will new product forms evolve?

- How to create a new profit model?

- How should the new regulatory boundaries be defined?

Their recent actions are their initial response. And their path revolves around two main themes: transactions and news .

Trading is ultimately the main theme, from liquidity entry points to distribution channels.

For prediction markets, the most important aspect is that users place bets with their own "real money," which involves the influence of multiple factors such as the direction of objective facts, personal subjective opinions, and market trends, thus generating price fluctuations of "Yes or No" in the betting events.

Volatility, on the other hand, signifies trading opportunities, as well as the risks and benefits behind those trades.

The reason Kalshi and Polymarket attract so many prominent investment firms is primarily due to the ever-increasing liquidity and attention on their platforms, which often overlap significantly. Like traditional internet technology companies and banks in traditional financial markets, Kalshi and Polymarket need to rack their brains to attract more liquidity.

In this regard, on-chain liquidity in the crypto market is more efficient and attractive than that in traditional financial markets because it is not limited by national or geographical boundaries, nor does it have the lengthy chain and strict controls of the SWIFT transfer system. For prediction market platforms, whose overall market user base is currently only in the tens of millions, the crypto market, with its population of up to 600 million, undoubtedly represents at least a tenfold increase in market size.

The launch of the MetaMask mobile application on Polymarket, the integration of the Ton ecosystem with the Polymarket platform, the integration of Solana and Sei ecosystems with Kalshi, and so on—all these events are essentially about seizing the "encrypted entry point" to the prediction market— just like Coca-Cola expanded its retail network channels in the US market back then.

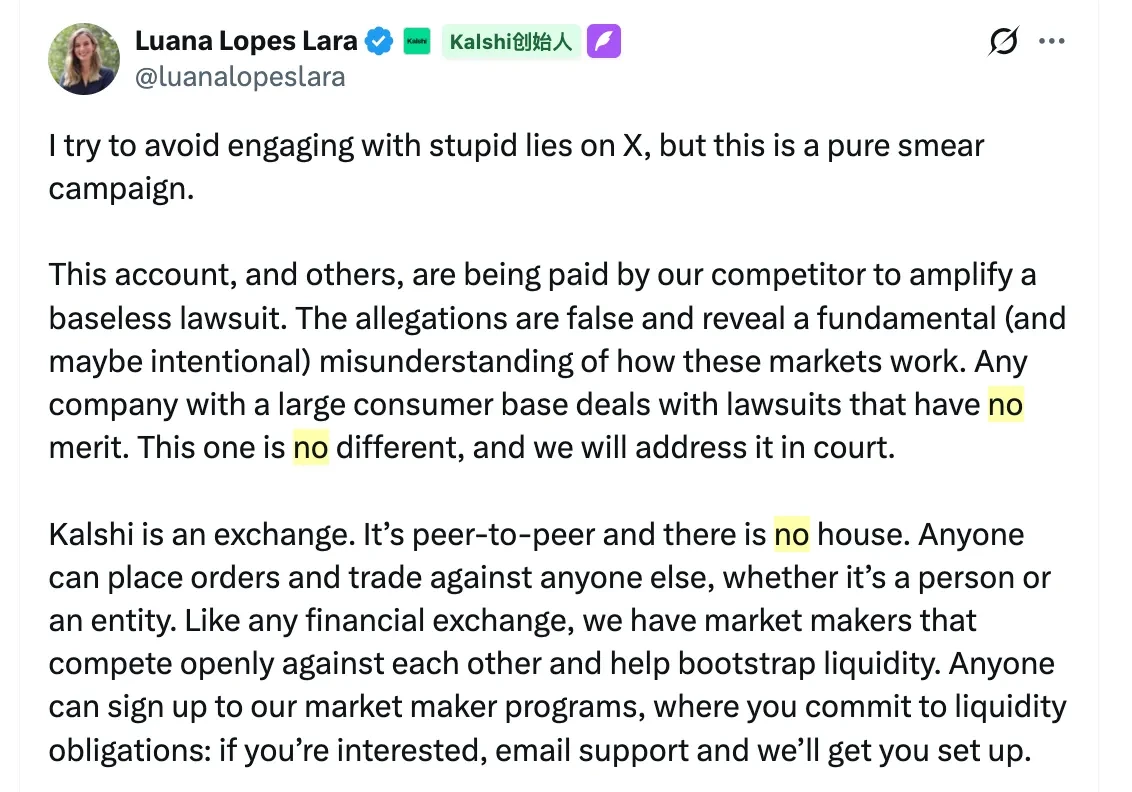

Furthermore, the internal market-making teams that Kalshi and Polymarket have already established or are in the process of establishing are also part of enriching the liquidity of prediction market betting events. As Kalshi co-founder Luana Lopes Lara said , "Kalshi is an exchange. It's peer-to-peer and there is no house."

However, regulators are unlikely to turn a blind eye to the various methods used during the unchecked expansion of prediction markets. After all, this involves the more crucial question of "who will the prediction markets pay taxes (or protection fees) to?" This is evident from the bans issued by Connecticut on prediction market platforms such as Kalshi, Robinhood, and Crypto.com .

This leads to another path that the market prediction industry must take – innovative news products.

News is like packaging, from traditional media to institutional information.

Back in September 2024, Shane Coplan, founder and CEO of Polymarket, announced the integration of Bloomberg Terminal with Polymarket, which he considered a landmark event for the prediction market.

"(This means that prediction markets have) entered the mainstream news and financial sphere. What was once a fringe science fiction concept of information flow is now becoming the new normal, with hundreds of thousands of people developing a habit of relying on Polymarket predictions as a source of truth to understand what is happening in the world. And it's still early days."

A year later, the prediction in this article has indeed come true.

Furthermore, Ethereum founder Vitalik Buterin has previously stated that prediction markets could be highly beneficial in addressing the issue of "accuracy of public information." After all, in a post-truth era, news often follows rumors and debunking reports, while prediction market betting events provide real-time, dynamic data feedback. This is precisely the biggest driving force behind the deep integration of traditional media outlets like CNN and CNBC, as well as institutional information platforms such as Google Finance and Yahoo Finance, with prediction market platforms.

For prediction markets, they also need the packaging of "news products" as a shell to cope with the pressure from regulatory agencies regarding "gambling industry accusations"; and Polymarket's prediction last year that Trump would win the US election successfully verified the prediction market's amazing accuracy in terms of news facts and its more valuable news reference.

Moreover, as Jeff Yass, a major market maker at Kalshi and founder of the US options market maker SIG, said , the value of prediction markets also lies in preventing large-scale wars, quantifying decisions for policymakers, and innovating insurance, among other things. This is also the direction for innovation in news products.

In the near future, forecasting markets may permeate all aspects of social life, stimulating direct economic transactions and becoming an important basis for influencing world events, sporting events, political elections, and personal decision-making.

In conclusion: Predicting the future of the market is, in itself, a bet.

Beyond the above discussion, the article concludes by stating that predicting market trends is itself a unique and interesting betting event. Just as the question of whether Polymarket can return to the US market in 2025 garnered over $46.48 million in bets on Polymarket, prediction market platforms and prediction market betting events form a conjugate loop. In the near future, prediction markets may combine with AI agents, bringing us more trading strategies and accurate predictions of future trends.

At that time, no single person will be the prophet of the future; rather, the prophet will reside in the trading votes of each and every one of us who are betting.

Recommended reading

Is Polymarket about to launch its own cryptocurrency? A review of 5 major crypto prediction markets.