Trump Reshapes the Power Structure of the Federal Reserve: A Key Variable for Bitcoin's Price Movement in the Next Six Months

- 核心观点:美国正步入财政主导货币时代。

- 关键要素:

- 特朗普团队正深度重构美联储与财政部权力边界。

- 微策略等机构逆势大额增持加密货币。

- 近期ETF资金流出主因是套利盘平仓,非机构撤退。

- 市场影响:市场波动加大,流动性结构改变。

- 时效性标注:中期影响

Tonight will see the Federal Reserve's most anticipated interest rate cut decision of the year.

The market is widely betting that an interest rate cut is almost a certainty. However, what will truly determine the trend of risk assets in the coming months is not another 25 basis point cut, but a more crucial variable: whether the Federal Reserve will inject liquidity back into the market.

Therefore, this time, Wall Street is not focusing on interest rates, but on balance sheets.

According to predictions from institutions such as Bank of America, Vanguard, and PineBridge, the Federal Reserve may announce this week a $45 billion monthly short-term debt purchase program starting in January, as a new round of "reserve management operations." In other words, this means the Fed may be quietly restarting an era of "disguised balance sheet expansion," allowing the market to enter a period of ample liquidity before interest rate cuts.

But what truly makes the market nervous is the context in which this is happening—the United States is entering an unprecedented period of monetary power restructuring.

Trump is taking over the Federal Reserve in a way that is far faster, deeper, and more thorough than anyone anticipated. It's not just about replacing the chairman; it's about redefining the boundaries of power in the monetary system, reclaiming control over long-term interest rates, liquidity, and the balance sheet from the Fed to the Treasury. The central bank's independence, which has been considered an "ironclad rule" for decades, is quietly being shaken.

This is why, from the Fed's interest rate cut expectations to ETF fund flows, from MicroStrategy and Tom Lee's contrarian buying, all seemingly disparate events are actually converging on the same underlying logic: the United States is entering a "fiscal-led monetary era."

What impact will all of this have on the crypto market?

Micro-strategies are making their move.

Over the past two weeks, the entire market has been discussing the same question: Will MicroStrategy be able to withstand this round of decline? Bears have simulated various scenarios of the company's "collapse".

But Saylor clearly doesn't think so.

Last week, MicroStrategy increased its Bitcoin holdings by approximately $963 million, or 10,624 BTC to be exact. This was its largest purchase in recent months, exceeding even its total purchases over the past three months.

It's worth noting that the market had been speculating whether MicroStrategy would be forced to sell its tokens to avoid systemic risk when its mNAV approached 1. However, when the price actually fell to almost 1, MicroStrategy not only didn't sell, but actually increased its position significantly.

Meanwhile, the ETH camp also staged a similarly impressive contrarian move. Tom Lee's BitMine managed to raise a large amount of cash by continuously tapping into ATMs despite the sharp drop in ETH prices and a 60% correction in the company's market value. Last week, they bought $429 million worth of ETH in one go, pushing their holdings to $12 billion.

Even though BMNR's stock price has fallen by more than 60% from its peak, the team is still able to raise money through ATMs (share issuance mechanism) and continue to buy stocks.

CoinDesk analyst James Van Straten put it more bluntly on X: "MSTR can raise $1 billion a week, whereas in 2020 it would have taken them four months to achieve the same scale. The exponential trend continues."

In terms of market capitalization impact, Tom Lee's move was even more significant than Saylor's. BTC's market capitalization is five times that of ETH, so Tom Lee's $429 million buy order is equivalent to "twice the impact" of Saylor's $1 billion BTC purchase in terms of weight.

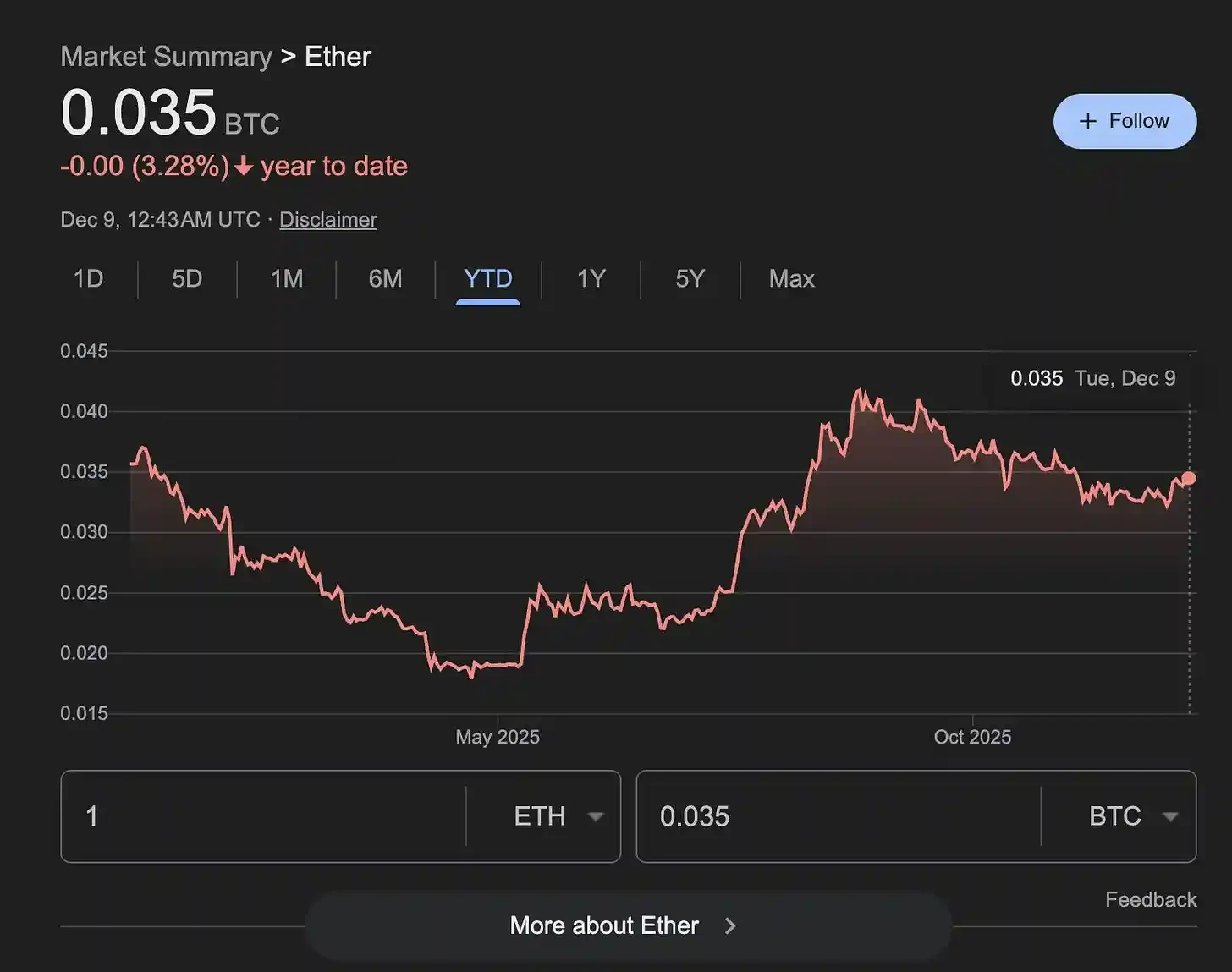

No wonder the ETH/BTC ratio has started to rebound, breaking free from a three-month downtrend. History has repeated itself countless times: whenever ETH leads the recovery, the market enters a short but powerful "alt market rebound window."

BitMine currently holds $1 billion in cash, and the ETH pullback presents the perfect opportunity for him to significantly lower his average cost. In a market where liquidity is generally tight, having institutions capable of sustained buying power is itself part of the price structure.

The ETF activity is not an outflow of funds, but rather a temporary retreat of arbitrageurs.

On the surface, the outflow of nearly $4 billion from Bitcoin ETFs over the past two months, with prices falling from $125,000 to $80,000, has led the market to a hasty and crude conclusion: institutions have withdrawn, ETF investors are panicking, and the bull market structure has collapsed.

However, Amberdata offered a completely different explanation.

These outflows are not due to "value investors running away," but rather "leveraged arbitrage funds being forced to liquidate." The primary source is the collapse of a structured arbitrage strategy called "basis trading." Funds originally earned a stable interest rate spread by "buying spot/shorting futures," but starting in October, the annualized basis dropped from 6.6% to 4.4%, remaining below the break-even point 93% of the time. The arbitrage turned into a loss, forcing the strategy to be dismantled.

This triggered a "two-way action" of ETF selling and futures covering.

Traditionally, capitulation selling is characterized by extreme emotional conditions following a continuous decline, where market panic reaches its peak, investors cease attempting stop-loss orders, and instead completely abandon all holdings. Typical characteristics include massive redemptions across almost all issuers, soaring trading volumes, a flood of sell orders regardless of cost, and extreme sentiment indicators. However, this ETF outflow clearly does not conform to this pattern. Although there was an overall net outflow, the direction of the funds was not consistent: for example, Fidelity's FBTC maintained continuous inflows throughout the period, while BlackRock's IBIT even absorbed some incremental funds during the most severe phase of net outflows. This indicates that only a few issuers, rather than the entire institutional group, truly withdrew.

More crucial evidence comes from the distribution of outflows. In the 53 days from October 1st to November 26th, Grayscale funds contributed over $900 million in redemptions, accounting for 53% of the total outflows; 21Shares and Grayscale Mini followed closely, together accounting for nearly 90% of the redemptions. In contrast, BlackRock and Fidelity—the most typical institutional allocation channels in the market—saw net inflows overall. This is completely inconsistent with a genuine "panic-driven institutional retreat," and instead resembles a kind of "localized event."

So, which type of institutions are selling? The answer is: large funds that engage in basis arbitrage.

Basis trading, in essence, is a direction-neutral arbitrage structure: funds buy spot Bitcoin (or ETF shares) while simultaneously shorting futures, profiting from the contango yield. This is a low-risk, low-volatility strategy that attracts significant institutional participation when the futures premium is reasonable and funding costs are controllable. However, this model relies on a crucial premise: the futures price must consistently be higher than the spot price, and the interest rate spread must be stable. Starting in October, this premise suddenly disappeared.

According to Amberdata's statistics, the 30-day annualized basis compressed from 6.63% to 4.46%, with 93% of the trading days falling below the 5% break-even point required for arbitrage. This means that such trades are no longer profitable and may even start to lose money, forcing funds to exit. The rapid collapse of the basis caused a "systemic liquidation" for arbitrageurs: they had to sell their ETF holdings and simultaneously buy back the futures they had previously shorted to close the arbitrage trade.

This process is clearly visible in market data. Open interest in Bitcoin perpetual contracts decreased by 37.7% during the same period, a cumulative reduction of over $4.2 billion, with a correlation coefficient of 0.878 with basis changes, indicating almost simultaneous movement. This combination of "ETF selling + short covering" is a typical path for exiting basis trading; the sudden surge in ETF outflows was not driven by price panic, but rather an inevitable result of the collapse of the arbitrage mechanism.

In other words, the ETF outflows over the past two months are more like a "liquidation of leveraged arbitrage positions" rather than a "retreat of long-term institutions." This is a highly professional and structured dismantling of trades, rather than panic selling caused by a collapse in market sentiment.

More importantly, after these arbitrageurs were cleared out, the remaining capital structure actually became healthier. Currently, ETF holdings remain at a high level of approximately 1.43 million Bitcoins, with the majority coming from institutional investors focused on asset allocation rather than short-term funds chasing interest rate differentials. As the leverage hedging of arbitrageurs is removed, the overall market leverage ratio decreases, volatility has fewer sources, and price action will be more driven by genuine buying and selling forces rather than by forced technical maneuvers.

Marshall, head of research at Amberdata, described this as a "market reset": after arbitrageurs withdrew, new funds flowing into ETFs became more directional and long-term, structural noise in the market decreased, and subsequent market movements will reflect real demand more. This means that although it appears to be a $4 billion outflow, it may not necessarily be a bad thing for the market itself. On the contrary, it could lay the foundation for the next, healthier rally.

If Saylor, Tom Lee, and ETF funds represent the attitudes of micro-level investors, then the changes happening at the macro level are deeper and more dramatic. Will there be a Christmas rally? To find the answer, we may need to look at the macro level further.

Trump "takes control" of the monetary system

For decades, the independence of the Federal Reserve has been regarded as an "ironclad rule of the system." Monetary power belongs to the central bank, not the White House.

But Trump clearly doesn't agree with that.

Increasing signs indicate that the Trump team is taking over the Federal Reserve in a much faster and more thorough manner than the market expected. This is not merely a symbolic "replacement of a hawkish chairman," but a complete rewriting of the power distribution between the Fed and the Treasury, a change to the balance sheet mechanism, and a redefinition of how interest rates are priced.

Trump is attempting to restructure the entire monetary system.

Joseph Wang, former head of the New York Fed trading desk (who has studied the Fed's operating system for many years), also explicitly warned: "The market has clearly underestimated Trump's determination to control the Fed, and this change could push the market into a higher-risk, higher-volatility phase."

From personnel arrangements and policy directions to technical details, we can see very clear traces.

The most direct evidence comes from personnel appointments. The Trump campaign has placed several key figures in core positions, including Kevin Hassett (former White House economic advisor), James Bessent (a key Treasury policymaker), Dino Miran (a fiscal policy advisor), and Kevin Warsh (former Federal Reserve governor). These individuals share a common characteristic: they are not traditional "central bankers," nor do they insist on central bank independence. Their goal is clear: to weaken the Federal Reserve's monopoly on interest rates, long-term funding costs, and systemic liquidity, and to return more monetary power to the Treasury.

The most symbolic point is that Bessent, widely considered the most suitable successor to the Federal Reserve Chairman, ultimately chose to remain at the Treasury Department. The reason is simple: in the new power structure, the Treasury Department's position has more influence than that of the Federal Reserve Chairman.

Another important clue comes from changes in term premiums.

This indicator may be unfamiliar to ordinary investors, but it is actually the most direct signal for the market to judge "who controls long-term interest rates". Recently, the spread between 12-month US Treasury bonds and 10-year Treasury bonds has once again approached a high point. This round of rise is not due to a good economy or rising inflation, but rather the market is reassessing: in the future, the Treasury Department may not be the one determining long-term interest rates.

The continued decline in 10-year and 12-month Treasury yields indicates strong market bets that the Federal Reserve will cut interest rates, and at a faster and more significant pace than previously expected.

The SOFR (Single-day Freight Forwarder) experienced a precipitous drop in September, indicating a sudden collapse in US money market interest rates and a significant easing of the Federal Reserve's policy rate system.

The initial rise in yield spreads was due to market expectations that Trump's inauguration would lead to an "overheated" economy; later, after tariffs and massive fiscal stimulus were absorbed by the market, the spreads quickly fell back. Now, the spreads are rising again, reflecting not growth expectations, but uncertainty about the Hassett-Bessent system: if the Treasury controls the yield curve in the future by adjusting debt duration, issuing more short-term debt, and compressing long-term debt, then traditional methods for judging long-term interest rates will become completely ineffective.

A more subtle but crucial piece of evidence lies in the balance sheet system. The Trump team has frequently criticized the current "ample reserve system" (where the Federal Reserve expands its balance sheet and provides reserves to the banking system, making the financial system highly dependent on the central bank). However, they are also keenly aware that current reserves are already significantly tight, and the system actually needs to expand its balance sheet to maintain stability.

This contradiction of "opposing balance sheet expansion, yet being forced to expand it" is actually a strategy. They use this as a pretext to question the Federal Reserve's institutional framework and push for the transfer of more monetary power back to the Treasury. In other words, they don't want to immediately shrink the balance sheet, but rather use the "balance sheet controversy" as a breakthrough to weaken the Federal Reserve's institutional position.

If we put these actions together, we see a very clear direction: the term premium is being compressed, the duration of US Treasury bonds is being shortened, and long-term interest rates are gradually losing their independence; banks may be required to hold more US Treasury bonds; government-funded institutions may be encouraged to leverage their purchases of mortgage-backed securities; and the Treasury may influence the entire yield structure by increasing the issuance of short-term debt. Key prices previously determined by the Federal Reserve will gradually be replaced by fiscal tools.

The likely outcome is that gold will enter a long-term upward trend, stocks will maintain a slow upward trend after a period of consolidation, and liquidity will gradually improve due to fiscal expansion and repurchase mechanisms. The market may appear chaotic in the short term, but this is simply because the power boundaries of the monetary system are being redefined.

As for Bitcoin, which is of utmost concern to the crypto market, it is on the periphery of this structural change, neither the most direct beneficiary nor the main battleground. On the positive side, improved liquidity will provide a floor for Bitcoin's price; however, looking at the longer-term trend over 1-2 years, it still needs to undergo a period of re-accumulation, waiting for the framework of the new monetary system to truly become clear.

The United States is moving from a "central bank-led era" to a "fiscal-led era".

In this new framework, long-term interest rates may no longer be determined by the Federal Reserve, liquidity will come more from the Treasury, the independence of central banks will be weakened, market volatility will be greater, and risky assets will usher in a completely different pricing system.

When the underlying structure of a system is being rewritten, all prices will behave more illogically than usual. But this is a necessary stage in the loosening of the old order and the arrival of the new order.

The market trend in the next few months will likely emerge from this chaos.