Perhaps the market has not yet entered a bear market phase.

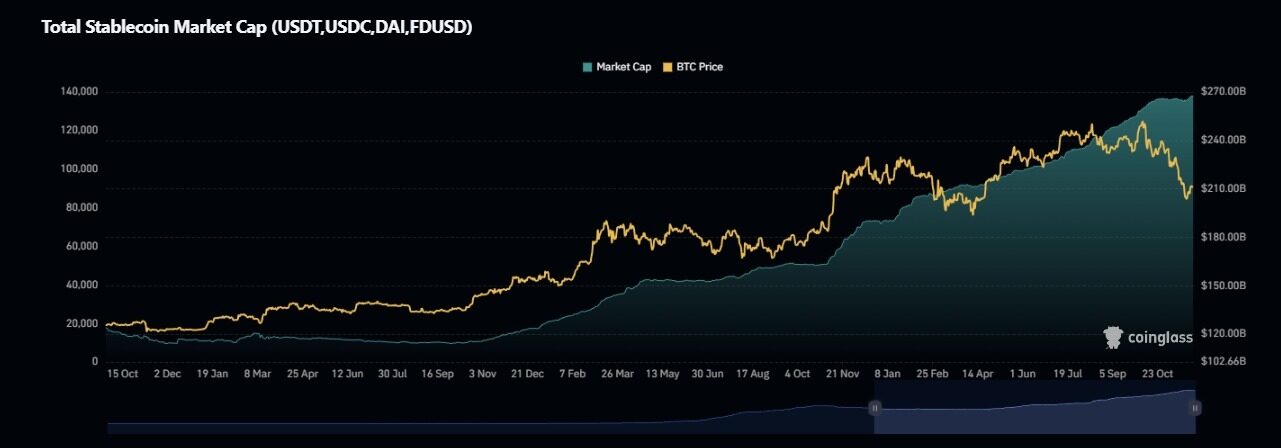

- 核心观点:稳定币市值增长表明市场处于积累阶段。

- 关键要素:

- 稳定币总市值持续攀升至约2674.9亿美元。

- 供应增长意味着新资金流入而非撤离。

- 当前为供应增、价格跌的“等待/定位”阶段。

- 市场影响:预示回调或为洗盘,非熊市开端。

- 时效性标注:中期影响。

Over the past few weeks, the price of Bitcoin has fallen sharply, dropping from the $120,000 range to a low of around $80,000. Market sentiment has naturally shifted accordingly. Discussions on social media have turned from euphoria to panic, and the timeline has changed from "$200,000 is inevitable" to "Is this the top?"

But despite the unusual price movements and news reports that fueled panic, one signal surprisingly remained stable—and even quietly rose:

The total market capitalization of major stablecoins has not collapsed.

Instead, it continues to climb—currently around $267.49 billion.

This detail changes the interpretation of this pullback. It suggests that recent price action may not reflect a complete trend reversal, but rather:

A rotation, a pause—this is neither an exit nor a bear market.

And this difference is crucial.

Why are stablecoins so important?

Stablecoins are often seen as a dull corner of the cryptocurrency space—merely “digital cash”.

But in reality, they serve this purpose: as the monetary foundation of the crypto economy.

Whether you're a retail trader making on-chain token transactions or an institutional investor looking to scale up your investment, almost no one directly buys Bitcoin, Ethereum, or other cryptocurrencies with fiat currency. Instead, the first step is almost always the same:

Exchange real-world currencies for stablecoins (mainly USDT or USDC).

Stablecoins are on-chain equivalents of liquidity, foreign exchange reserve capital, and available funds.

Therefore, when the total circulating supply of stablecoins increases, it usually means one thing:

New funds have flowed into the cryptocurrency system.

When it falls, it sends the opposite signal:

Capital is no longer just about making profits—it's completely leaving this ecosystem.

Unlike Bitcoin or altcoins, whose supply never disappears, stablecoins can possess both of these characteristics: minting and burning.

This mechanism is the key.

Flows behind supply

To understand why stablecoin supply is a reliable macroeconomic signal, you need to understand how issuance works—especially for USDT.

The process is simple but rigorous:

An organization sent funds to Tether's banking partner.

Tether has confirmed receipt.

USDT was minted and put into circulation.

Does minting occur after the only dollars enter their system—meaning does supply growth occur? Without considering this beforehand , this is a response to capital inflows .

Similarly, the reverse is also true:

- If an institution wants to withdraw, they will redeem USDT.

- The issuer will return fiat currency and burn tokens.

- Reduced supply – permanently removing liquidity from the cryptocurrency economy.

Most people overlook the subtle differences:

Buying and selling BTC using USDT does not change the total supply of stablecoins.

It only changes ownership.

Therefore, for supply, the only moment that matters is:

Minting → Real-world currency entering the cryptocurrency system

Funds flowed out of the system and back into the fiat currency system.

Everything else—trading, arbitrage, swaps, hedging—is internal activity.

This is why stablecoin charts reflect the macroeconomic pulse, not price charts.

How to interpret this signal

Once you understand the mechanism, the price movement of stablecoins becomes a cyclical indicator.

Overall, the market can be divided into four possible states:

1 — Increased supply + rising Bitcoin price → Expansion phase

This is the cleanest and healthiest beef leg.

New capital inflows, increased stablecoin supply, and demand are driving up Bitcoin prices.

The characteristics of this stage are:

- Strong inflow

- Higher foreign exchange balance

- Organic growth, not just leverage

You can clearly see this pattern in the early expansion phase of every bull market cycle.

2 — Increased supply + Bitcoin price decline → Accumulation or waiting phase

Things start to get interesting here—and this seems to be the stage the market is currently in.

Even with prices falling, the supply of stablecoins continues to grow.

This usually means:

- The funds haven't flowed out—they're just waiting.

- The institution did not yield, but rather repositioned itself.

- Liquidity has not dried up—it is merely in a wait-and-see mode.

Historically, this structure has formed before major continuation trends—especially in the absence of macro catalysts such as interest rate cuts, ETF flows, or a weakening dollar index.

In previous cycles, this phase lasted for weeks to months—a silent accumulation of potential energy.

3 — Reduced supply + Bitcoin price drop → A true bear market

This is the textbook definition of a cryptocurrency winter.

- Bitcoin falls

- Collapse of confidence

- Investors exchange stablecoins back for cash

- Supply contracts can last for months, and sometimes even years.

This situation occurred after the end of 2021 and continued into the beginning of 2023.

That's not "volatility." That's capital flight.

4 — Decreasing supply + rising Bitcoin price → End of cycle warning

This pattern is rare and dangerous.

This indicates that the price increase was not due to capital inflows, but rather because:

- Speculation has become overheated.

- The leverage effect is accelerating.

- The same liquidity is being actively recycled.

A market that barely survives on such meager momentum will eventually stagnate.

Sometimes slow, sometimes violent.

So what stage are we at now?

Given:

- Stablecoin supply is still growing

- No major burn incidents have been recorded.

- The liquidity did not actually flow out of the system.

- The drop in Bitcoin did not trigger a liquidity outflow.

The current structure is closer to:

Phase Two → Waiting/Location Phase

It's not the third stage. In other words:

This doesn't look like a real bear market; it's more like a pause.

The difference between a pause and a reversal is precisely the difference between early accumulation and panic selling.

What will happen next?

The supply of stablecoins alone cannot predict the timeframe—that's all there is to it .

To further confirm the direction, the following signals are worth noting:

- US Dollar Index (DXY)

- ETF inflows and outflows

- Federal Reserve interest rate decisions and policy tone

If these factors align with current stablecoin trends, then this downturn could, like many previous ones, last excessively long:

This is a reshuffling before moving forward—not the beginning of winter.

Final points

The cryptocurrency price is not fluctuating because the chart appears to be trending upwards.

It moves funds in, out, or remain in the system.

Despite the current market volatility, widespread panic, and falling prices:

The money hasn't left yet; it's still waiting.

As long as liquidity remains within the market, a cycle will not end—it is poised to begin.