Starting with the hijacking of Blue War: What exactly makes the security costs of crypto bigwigs so high?

- 核心观点:加密富豪因资产特性面临高绑架风险。

- 关键要素:

- Coinbase CEO年安保费620万美元。

- Michael Saylor安保预算升至200万美元。

- 全球加密绑架案激增,财富数字惊人。

- 市场影响:推高行业头部人士安保成本与风险意识。

- 时效性标注:长期影响。

Lan Zhanfei, a travel blogger with over 20 million followers on Douyin, was robbed.

Lan Zhanfei is a familiar name in the short video community. He started as a game streamer and later shifted to travel content, amassing 26.63 million followers on Douyin and a respectable number on Weibo. He once jokingly said in a live stream that if he seriously pursued monetization, he could earn nine figures a year.

After the news that Lan Zhanfei was kidnapped at knifepoint in a five-star hotel in South Africa by a Chinese man and two black men, who allegedly planned the incident six months in advance, went viral on social media, people in the cryptocurrency community generally expressed a "familiar sense of lingering fear".

In recent years, kidnappings targeting cryptocurrency holders have surged from France to the UAE, from the US to South America. The fact that these assets are not bank-dependent, can be easily transferred on a personal basis, and that the wealth of cryptocurrency tycoons is often staggering makes them prime targets for certain criminal groups, rather than random victims. This also explains why the security budgets of cryptocurrency moguls are so high that they leave traditional businesses in awe.

In the following content, let's take a look at the security budgets of the big names in the cryptocurrency world.

Coinbase CEO

In the crypto world, Coinbase CEO Brian Armstrong's security budget is probably among the highest.

Coinbase disclosed in its April 2025 annual proxy statement to the SEC that it spent $6.2 million on Brian's personal security in 2024. Since 2020, Coinbase's total security expenditure on him has exceeded $20 million.

In other words, Brian spends nearly $20,000 a day.

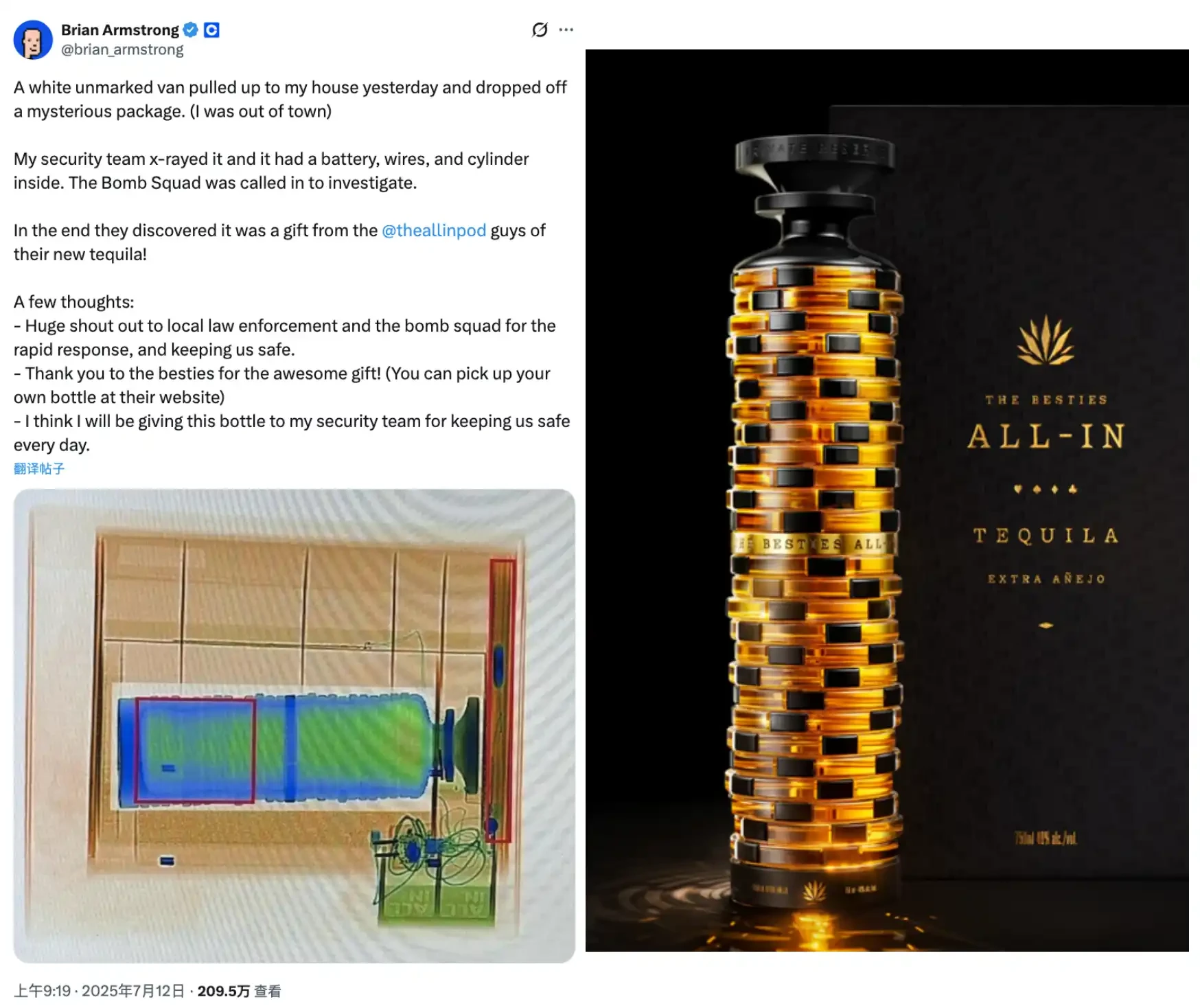

Brian's security procedures are meticulous to the point of being obsessive: they include certified armed guards, secure accommodations, and comprehensive security measures at his residence. All packages delivered to Brian's home must undergo X-ray screening, and if any suspicious items are found, the security team immediately initiates bomb disposal procedures.

This meticulous process underwent a dramatic "blunder" test on July 12, 2025.

Brian wasn't home that day when a white, unmarked van delivered a package. As part of standard procedure, the security team X-rayed the package, and the screen revealed the outlines of batteries, wires, and a cylindrical object—features that closely matched the typical construction of an improvised explosive device (IED). Security personnel immediately contacted local law enforcement, and a bomb disposal team quickly arrived at the scene to begin their investigation.

After careful inspection, the truth came to light: the package contained a tequila gift set from The All-In Podcast (@theallinpod) podcast, and the batteries and wires shown on the X-ray were actually part of the design for the bottle's light-up device.

Although it was a false alarm, it indirectly proves that Coinbase's $6.2 million annual security fee for Brian is very useful.

Michael Saylor

As the "largest holder of Bitcoin," Michael Saylor, executive chairman of Strategy (formerly MicroStrategy), had his security budget increased from $1.4 million to $2 million in October 2025.

This adjustment comes against the backdrop of a surge in violence against corporate executives in 2024-2025, including the assassination of the CEO of UnitedHealth Group and the attack on security personnel at Rudin Management.

In 2013, Michael Saylor's annual security costs were only $58,000, prompting some investors to question why a software company CEO would spend so much on bodyguards. However, since his aggressive Bitcoin buying spree began in 2020, his company is expected to hold over 580,000 BTC by 2025. This has caused Saylor's personal risk to skyrocket, and his security budget has grown to its current $2 million.

Today, Saylor is accompanied by private bodyguards, an armed driver, and a private jet when attending events. In May and September 2025, he was spotted by netizens "surrounded by bodyguards" at several Bitcoin bars in New York. Although the exact size of his team has not been disclosed, according to a Goldman Sachs Ayco investigation, the standard setup for such executives typically includes at least one bodyguard and an armed driver.

Saylor faces unique threats, including digital-level attacks. In January 2024, his security team was deleting approximately 80 AI-generated deepfake videos daily, impersonating Saylor and promoting Bitcoin scams to lure users into scanning QR codes for fake "Doubling Your Bitcoin" events. Saylor himself warned on social media: "There is no such thing as a risk-free way to double your Bitcoin... My team deletes about 80 fake AI-generated YouTube videos every day... Don't believe it, verify it."

This combination of constant digital threats and physical security needs explains why this Bitcoin billionaire requires such a massive security investment.

Vitalik Buterin

In stark contrast to the high-profile security arrangements for Brian Armstrong and Saylor, Ethereum co-founder Vitalik Buterin's lifestyle represents the pinnacle of "contrast art."

Since obtaining Singapore permanent residency in 2023, he has lived a minimalist life there: renting an apartment in Bukit Timah for about S$5,000-7,000 a month, taking the MRT, working in a coffee shop, and even hand-washing his clothes to save US$4 on laundry fees. Despite his net worth of over US$1.1 billion, he looks no different from an ordinary resident on the streets of Singapore, without bodyguards or entourage.

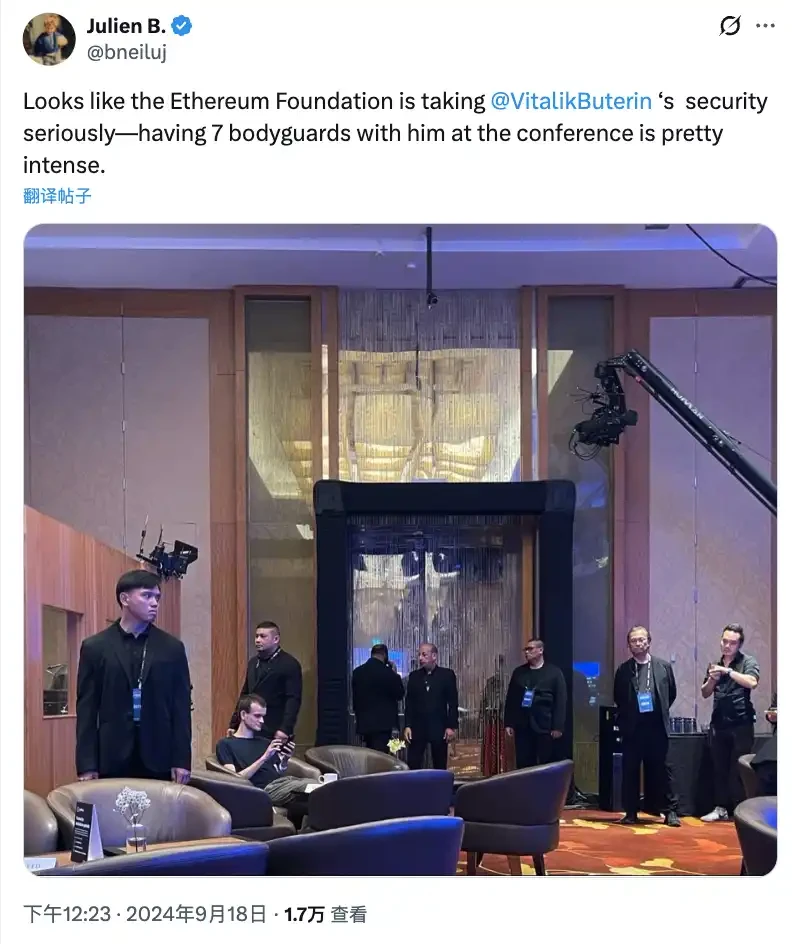

However, when attending events, the organizers or event coordinators usually assign Vitalik a team of bodyguards to ensure his safety.

For example, during Devcon events in Thailand in December 2024, Bodyguard VIP Thailand provided customized personal security plans for a group of cryptocurrency guests, including Vitalik Buterin, with top-tier local bodyguards. Also, in September 2024, a photo taken by an attendee at a crypto conference showed Vitalik surrounded by several bodyguards and security measures.

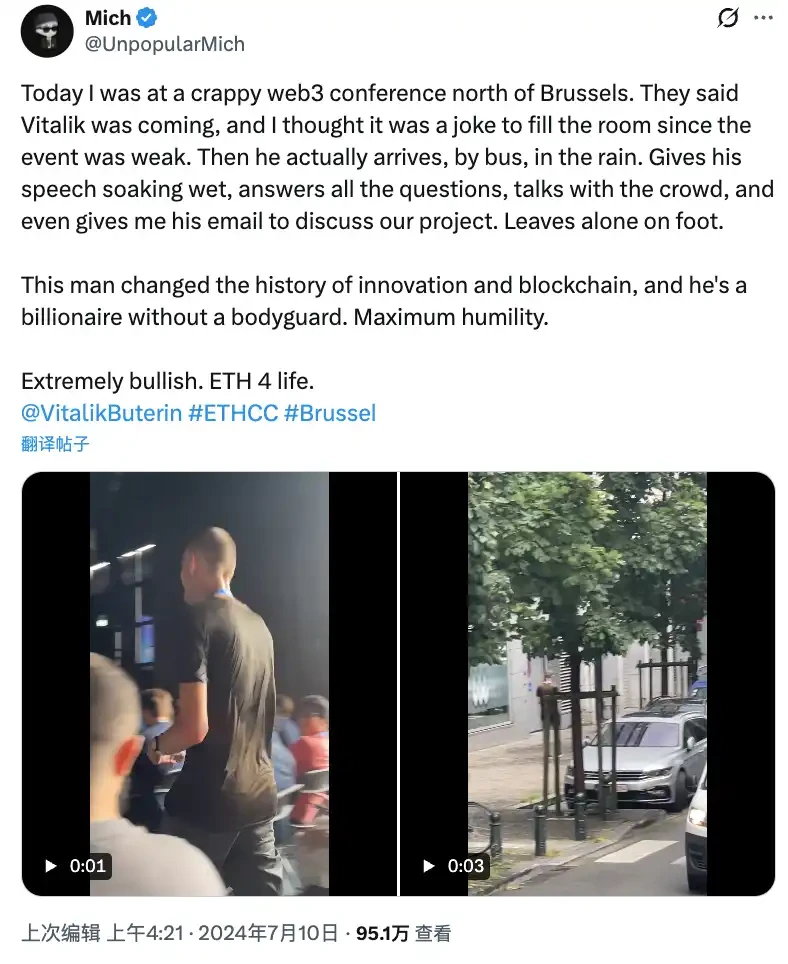

However, it seems that most of the time, people do not see Vitalik with bodyguards. For example, at the ETHCC conference in Brussels in July 2024, Vitalik arrived alone by bus in the rain, his clothes were still wet when he gave his speech, and he left on foot after the speech, without any bodyguards accompanying him.

Vitalik's biggest threat is also digital. In 2023, he suffered a SIM swap attack, which reset his Twitter password and led to the release of phishing NFT minting links, resulting in the theft of approximately $700,000 in assets from Vitalik's followers. This incident has prompted him to continue publicly discussing the dangers of SIM swap attacks and reminding users to unlink their X accounts from their phone numbers.

Justin Sun

Justin Sun, who is usually quite high-profile, also has a noteworthy security detail, with many burly bodyguards always by his side.

Especially during Sun Ge's trip to Hong Kong in June 2023, some people offered huge rewards for slapping him and throwing eggs at him. Therefore, against this backdrop, the four bodyguards that Sun Ge brought with him when he appeared have been the subject of much discussion among netizens. One of the bodyguards, who looked very reliable but had fierce eyes, was even rated as number one.

Later, Brother Sun said on social media that he mistakenly thought the bodyguard was Filipino, but it turned out to be a Nepalese Gurkha, one of the world's most famous mercenary groups.

Brother Sun's security awareness is also very advanced, which is reflected not only in his security measures but also in his protection of the privacy of his wealth.

On August 11, 2025, Sun Ge sued Bloomberg in the United States for violating a confidentiality agreement when compiling the Billionaires Index by disclosing detailed cryptocurrency holdings that he provided to verify his wealth. He argued that such detailed disclosure would increase the risk of "theft, hacking, kidnapping, and physical harm to him and his family" through wallet clustering analysis. He even cited Bloomberg's own report as evidence in court: in 2025, there were 51 cases globally where crypto investors were violently coerced into handing over their private keys.

Zhao Changpeng

In contrast, fewer details about Binance founder CZ's security have been revealed.

Until the US court ruling documents came out in 2024, media outlets discovered that among the 160 letters of support, a "classmate" named Xin Wang claimed to be CZ's friend from his youth, as well as his bodyguard. In the letter, Xin Wang recalled his acquaintance with Zhao Changpeng at McGill University, describing the young CZ as a "nerdy, bespectacled kid," while now he has grown into an "older version" but retains "quiet, pragmatic kindness."

This bodyguard is clearly not an ordinary security guard. His colleague is the CEO of Bayview Acquisition Corp, which advises financial institutions on mergers and acquisitions. He is licensed to practice law in California, England, and Wales, and was appointed as an independent board member of Binance in April 2024. Such multiple roles are quite rare in the crypto security field.

Anthony, an early co-founder of Ethereum

Ethereum's other co-founder, Anthony Di Iorio, took a completely different security approach from Vitalik, with 24/7 security measures.

Perhaps it's because Anthony was born into a wealthy family, or perhaps it's because as an early participant in Ethereum, his ETH holdings easily made him a high-value target, and the self-custodial nature of cryptocurrency assets makes traditional financial insurance unable to cover potential threats to personal safety.

Therefore, since 2017, he has employed a private bodyguard team, whose personnel accompany Di Iorio wherever he goes or wait for him at his destination. In 2018, Forbes estimated his net worth at $750 million to $1 billion, placing him among the top 20 richest people in the cryptocurrency field. That year, he purchased one of Canada's most expensive apartments, a three-story duplex penthouse, for $22 million, partially using cryptocurrency for payment, which caused quite a stir.

So in 2018 his security team apparently increased its budget, and witnesses observed him traveling with a "small entourage including bodyguards," a 24/7 security setup that continued until he retired from the entertainment industry.

In 2021, he announced his decision to "liquidate" his investment and leave the blockchain industry, citing personal safety and other factors, and to no longer fund any blockchain projects. He admitted at the time, "I don't feel safe in this industry... I think I would be safer if I focused on bigger issues."

So he sold his company Decentral, severing his main ties with blockchain startups and focusing on philanthropy to avoid being labeled a "crypto person."

Circle CEO

Circle CEO Jeremy Allaire manages the $78 billion USDC stablecoin and a $20 billion publicly traded company, making him a key figure in the crypto financial infrastructure.

According to Circle's S-1 initial public offering filing dated April 1, 2025, the company invested $800,000 in Allaire's personal security in 2024.

In a year when numerous "crypto kidnapping" cases erupted in France, Dubai, Argentina, and other places, this amount did not seem outrageous. Multiple reports, citing Circle's prospectus, confirmed this figure.