BTC ETFs are facing selling pressure, but it's not a bear market yet.

- 核心观点:当前市场是牛市周期中期调整。

- 关键要素:

- ETF资金流出,但持仓结构显示长期资本未离场。

- 稳定币供应持续增长,表明加密原生资本在观望。

- 调整模式与年初类似,属恐惧性回调而非崩溃。

- 市场影响:市场将波动盘整,积蓄力量。

- 时效性标注:中期影响。

Market Context: Is it a fading trend or a necessary adjustment?

Over the past few weeks, anyone even slightly following the cryptocurrency market has likely noticed a clear trend: weakness. Chart patterns have flattened, momentum has waned, and market sentiment has shifted from exuberance to caution. At first glance, the situation seems simple— "ETF funds are flowing out, and the market is falling." However, if today's signals are viewed within a broader cyclical perspective, the situation becomes much more complex.

One of the main reasons for the current slowdown in Bitcoin prices is undoubtedly the outflow of funds from spot Bitcoin ETFs. Unlike volatility driven by retail investors, ETF fund flows primarily originate from large asset allocators—family offices, pension funds, and institutional investors allocating capital across multiple global markets. Bitcoin's price briefly touched the $120,000 range in October, followed by a sharp drop in early November, which, in the eyes of traditional capital, altered the risk-reward balance. With the return of safer investment options such as bonds and gold regaining its market dominance, some funds naturally withdrew from the Bitcoin market.

Despite these fluctuations, the market structure does not signal the start of a new multi-year bear market. Instead, this movement resembles a mid-cycle correction—similar to what happened between January and April of this year—rather than a collapse in market sentiment that occurred during a true bear market cycle from 2021 to 2023.

ETF Positions: The Most Important Signal at Present

When evaluating ETF performance, two metrics are more important than any other:

- Total BTC held by ETFs (structural capital)

- Daily net inflow/outflow (short-term sentiment)

Overall, the first indicator shows a significant decline in total holdings to the right of the dataset. This change is significant because ETF funds operate very differently from short-term stablecoin liquidity. When institutions (especially asset managers like BlackRock) buy Bitcoin through ETFs, these holdings are typically held in custody and effectively removed from the circulating supply. These purchases resemble long-term structural demand, effectively pushing up the floor price of Bitcoin over time.

In contrast, stablecoin buyers are typically exchanges, market makers, or cryptocurrency-native funds. Their funds are held on-chain, waiting for market conditions to improve. They rotate their holdings, observe, and act opportunistically, but rarely liquidate their entire portfolio. This is why stablecoin market capitalization continues to grow, while ETF allocations have declined.

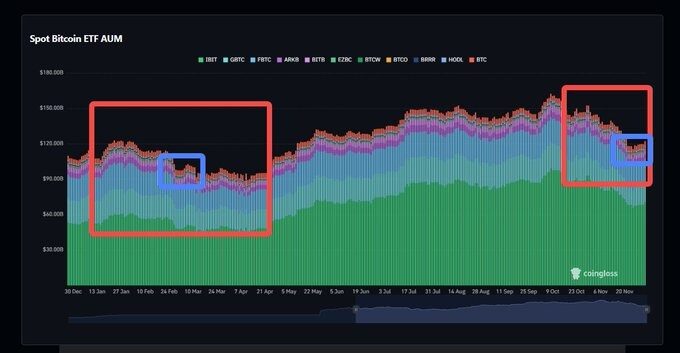

Interestingly, by comparing the recent decline in ETF holdings with previous market trends, a familiar pattern emerges. The circled areas in the chart—the decline in December 2024 and the correction from January to April—show almost identical patterns: a sharp correction followed by a relatively slow period of stabilization.

More notably, the previous correction lasted approximately four months, while the current correction has only lasted about a month. Therefore, although the momentum of capital inflows has slightly picked up since November 25, this still appears to be in the early stages of re-accumulation rather than a final reversal.

Net inflow: A signal worth noting, but it's too early to celebrate.

The second ETF indicator—the daily net inflow/outflow line—provides a short-term tactical perspective. Again, the shift here, though subtle, is significant. Inflows have slightly turned positive again since November 25th. However, the inflows remain small and inconsistent in strength. Historically, ETF inflows not only recover but also accelerate significantly before a major trend reversal.

Currently, there are no signs of accelerated upward movement in the market. Instead, the current situation resembles institutional investors "testing the waters," similar to savvy investors operating near structural price inflection points. Moreover, just like in the previous cycle, even with positive inflows, Bitcoin still experienced multiple pullbacks before the next bull market resumed.

Therefore, although the direction is improving, there is still a lack of conviction.

Stablecoin liquidity: a supporting parallel indicator

On the other hand, the supply of stablecoins continues to grow slowly. This is crucial because stablecoins represent idle cryptocurrency purchasing power—funds waiting for signals on-chain rather than flowing out of the ecosystem. These funds operate differently from ETF allocations. They do not require traditional compliance processes or board approvals and are less affected by macro asset rotation like bonds or gold.

On the contrary, it is patience capital.

The slow but steady rise in stablecoin prices indicates that native cryptocurrency investors have not left—they are watching, waiting, and preparing.

This is one of the most obvious reasons why the current market structure is inconsistent with a full-blown market crash. In a true bear market, funds don't stay in stablecoins—they completely exit the entire ecosystem.

What does this mean for the cycle?

Based on the above analysis, the market has not signaled the start of a new long-term bear market. On the contrary, the market seems to be experiencing:

Mid-cycle adjustment + valuation reset.

It shares many characteristics with the pullback in early 2025:

- Fear rather than euphoria

- Reduce ETF exposure

- Stablecoin accumulation

- drastically corrected lateral movement

The market is still searching for direction, but early signs suggest that this phase is closer to consolidation than a crash.

What needs to be done next?

To confirm a market recovery, one last signal is needed—and that signal is not Bitcoin.

It is the flow of funds in the Ethereum ETF.

If Ethereum begins to show a consistent 10-day average inflow of $1 billion or more per day, this would indicate a return of confidence, not just curiosity. This would mark a shift from hesitation to conviction and could confirm the end of the pullback.

Prior to this, the most reasonable expectation is that the market will continue to fluctuate, further test support levels, and gradually accumulate strength before finally taking the next decisive step.

Final view

Despite the uncertainties, the current structure points to continuation rather than reversal. The cycle is not over, but rather readjusting. Traditional capital is rotating cautiously, while cryptocurrency-native capital is on the sidelines. The market is approaching a point where it must give way to a clearer direction.

in other words:

This is not the beginning of a bear market.

This is a time in a bull market where only those with unwavering conviction remain clear-headed, while everyone else waits for evidence.