How to trade US stocks using 100x leverage contracts?

- 核心观点:美股永续合约成为加密市场新方向。

- 关键要素:

- 美股市场规模远超加密货币。

- 三大平台提供24/7美股交易。

- 最高支持100倍杠杆交易。

- 市场影响:推动传统金融与DeFi融合。

- 时效性标注:中期影响

Money always flows to where there is more money, and liquidity is always seeking deeper liquidity.

Bitcoin's market capitalization is $1.7 trillion, while the total market capitalization of the US stock market exceeds $50 trillion. The market capitalization of tech giants like Apple, Microsoft, and Nvidia alone could easily surpass half of the entire cryptocurrency market.

More and more savvy crypto enthusiasts seem to have reached a subtle consensus: trading cryptocurrencies is really not as profitable as trading US stocks.

US stocks are deeply intertwined with the global economy, geopolitics, and technological innovation, making their volatility and topicality far richer than any single cryptocurrency. This global attention is something Meme Coin and altcoins can never match.

Major perp DEXs in the crypto industry, such as Hyperliquid, Trade.xyz, Ostium, and Lighter, have already launched perpetual contract trading for US stocks.

The US stock market, which incorporates on-chain perpetual contracts—a financial tool already commonplace in the cryptocurrency market—has become even more exciting and attractive.

After all, in the traditional financial world, ordinary people need to overcome many obstacles to trade US stocks: opening an overseas brokerage account, waiting for a long review process, enduring limited trading hours, and accepting leverage limits of 2x or up to 4x.

But now, the rules of the game are being rewritten. Perpetual contracts are integrating with the US stock market with unstoppable momentum. And US stock perpetual contracts may well be the next key investment direction for smart money.

This article will delve into the core mechanisms of three platforms: Trade.xyz, Ostium, and Lighter, comparing their differences in trading experience, risk control, and data performance.

Which DEX offers more stocks and higher leverage?

Let's start by looking at some of the most basic questions that traders care about: the types of stocks supported, the available leverage ratio, and the fee structure.

trade.xyz

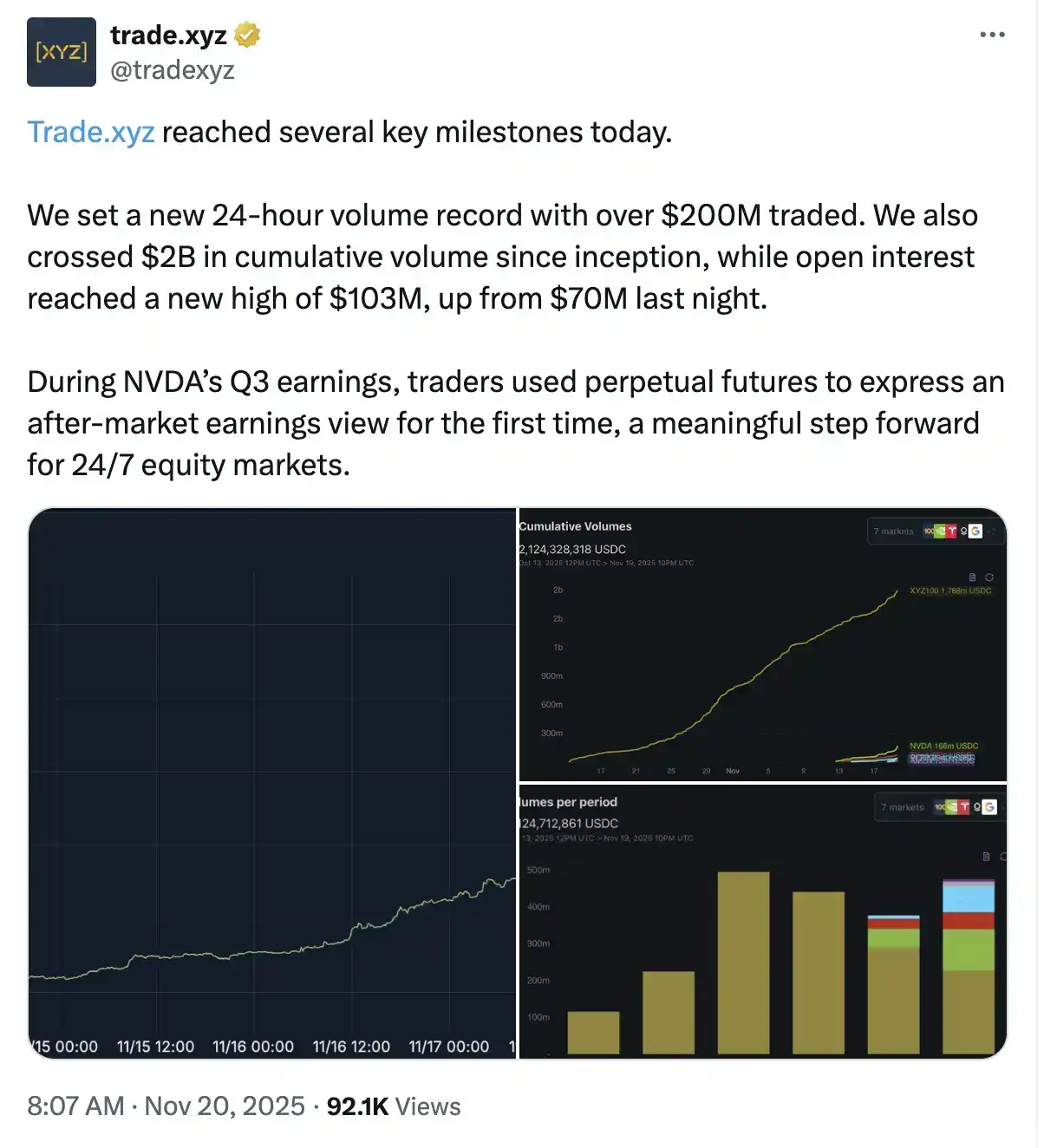

trade.xyz is the first perpetual DEX deployed based on the Hyperliquid HIP-3 protocol, and also the largest perpetual DEX on HIP-3, launching in October 2025. Its biggest innovation is enabling 24/7/365 US stock trading, focusing on US stock indices (XYZ100) and individual stock perpetual contracts. Currently in a growth phase, it offers ≥90% reduction in trading fees, with actual taker fees of only approximately 0.009%.

The team is relatively mysterious, mainly composed of Hyperunit team members (@hyperunit), operating anonymously or discreetly, with no detailed founder information disclosed. There are community rumors that the Hyperunit team originated from Hyperliquid. Currently, it has not received external funding and is a Pre-TGE project. Related reading: " $2 Billion in Transactions in 10 Days: Another Blockbuster from Hyperliquid ."

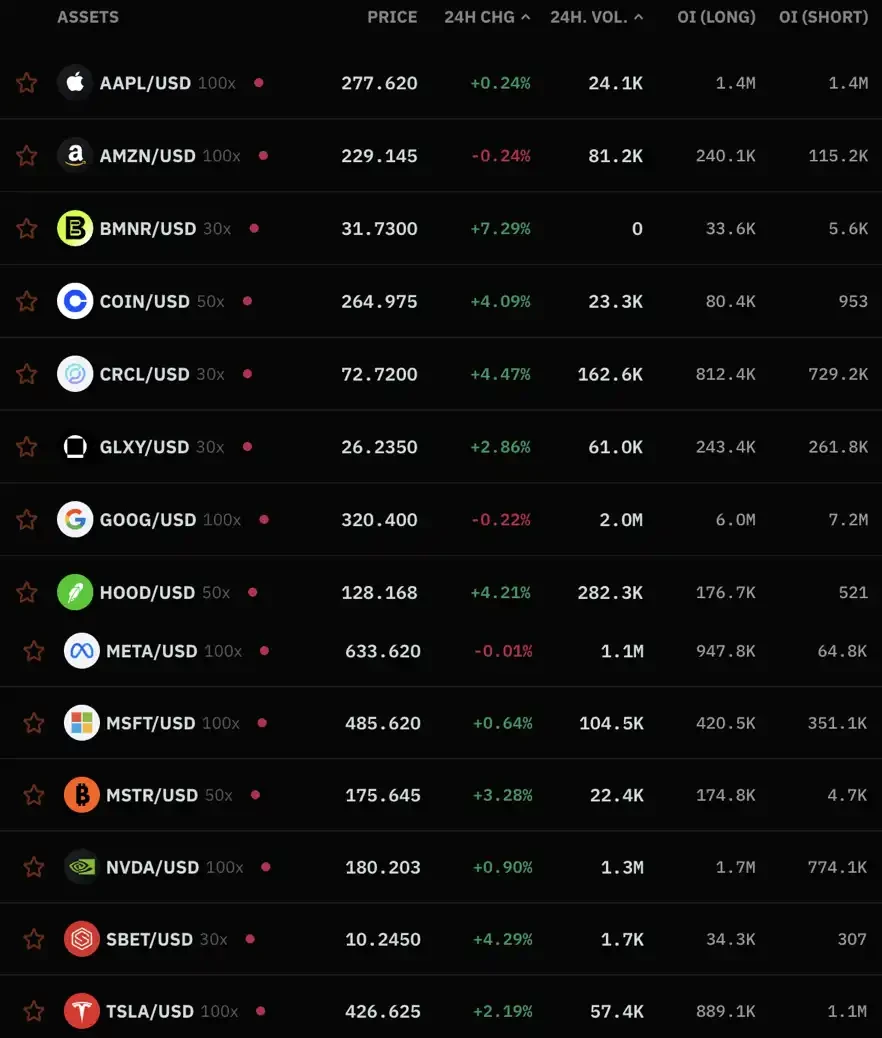

As shown in the figure, trade.xyz currently supports 11 US stock assets, with most stocks offering 10x leverage, while the index product XYZ100 (tracking the Nasdaq) can be leveraged up to 20x. The trading model used is CLOB.

The overall fee structure is also quite favorable: under the current growth model, fee discounts are reduced by ≥90%, and the actual fees are: ≤0.009% (approximately 9 cents/1000 USD) for order takers and ≤0.003% for order placers.

Lighter

Lighter is a custom ZK-rollup perpetual trading platform based on Ethereum, officially launched in early 2025, and is known for its zero transaction fees and provable fairness. The platform uses zero-knowledge proof technology to verify all order matching and settlement processes. It just launched US stock trading functionality on November 26th.

Founder Vladimir Novakovski boasts a strong background: a Russian immigrant, a gold medalist in the US International Mathematical Olympiad and Physics Olympiad, and a 15-year fintech veteran who joined Citadel as a trader after graduating from Harvard at 18. He co-founded the AI social platform Lunchclub (which raised $30 million). Lighter just completed a $68 million Series B funding round in November 2025, valuing the company at $1.5 billion. The round was led by Founders Fund (Peter Thiel) and Ribbit Capital, with other investors including top-tier institutions such as a16z crypto, Lightspeed, and Coatue.

As shown in the figure, Lighter supports five types of US stock assets, all with a uniform leverage of 10x. It also uses the CLOB trading model.

Lighter's US stock trading fees adhere to its biggest selling point and feature: zero commission. Retail traders pay 0% for both takers and pending orders. For high-frequency traders and professional traders, the fees are 0.002% for Makers and 0.02% for Takers. Lighter also calculates funding rates, capped at ±0.5% per hour, based on a TWAP premium.

Ostium

Ostium is an open-source, decentralized, perpetual futures exchange built on Arbitrum, focusing on real-world asset (RWA) trading, including US stocks, indices, commodities, and forex. Key features include leverage up to 200x.

Ostium Labs was founded in 2022 by former Bridgewater Associates members, with two founders being Harvard classmates. On October 6, 2023, it completed a $3.5 million seed funding round, led by General Catalyst and LocalGlobe, with participation from well-known institutions such as Balaji Srinivasan, Susquehanna International Group (SIG), and GSR. Currently in the Pre-TGE stage, it operates a points system to reward active users.

As shown in the image, Ostium offers the most comprehensive selection of US stocks, currently supporting 13 different assets. Leverage is also quite aggressive, varying depending on the liquidity and trading volume of each asset. Mainstream tech stocks such as Apple, Amazon, Meta, Microsoft, Nvidia, and Tesla support up to 100x leverage. Crypto-related stocks such as Coinbase, Robinhood, MicroStrategy, SBET, and Circle support 30-50x leverage.

Unlike the CLOB model of the previous two, Ostium uses the Arbitrum AMM pool-to-pool model for its trading.

In terms of fee structure, the opening fee is a fixed 0.05%, and there is no closing fee; the oracle fee is $0.10 per transaction, which may be refunded after closing depending on the type of transaction, as detailed in the fee rules ; there is also a rollover fee similar to the funding rate, calculated based on block compound interest and holding costs, with asymmetrical rates for long and short positions.

How can Wall Street trade US stocks while you're asleep?

After comparing the three companies' assets, leverage, and fees, there is another crucial factor that determines the "difference in trading experience": US stocks are not traded 24 hours a day, while on-chain perpetual contracts are.

Therefore, when external prices stop, the solutions for how oracles continue to operate and how to handle transactions during market closures vary completely across platforms.

trade.xyz

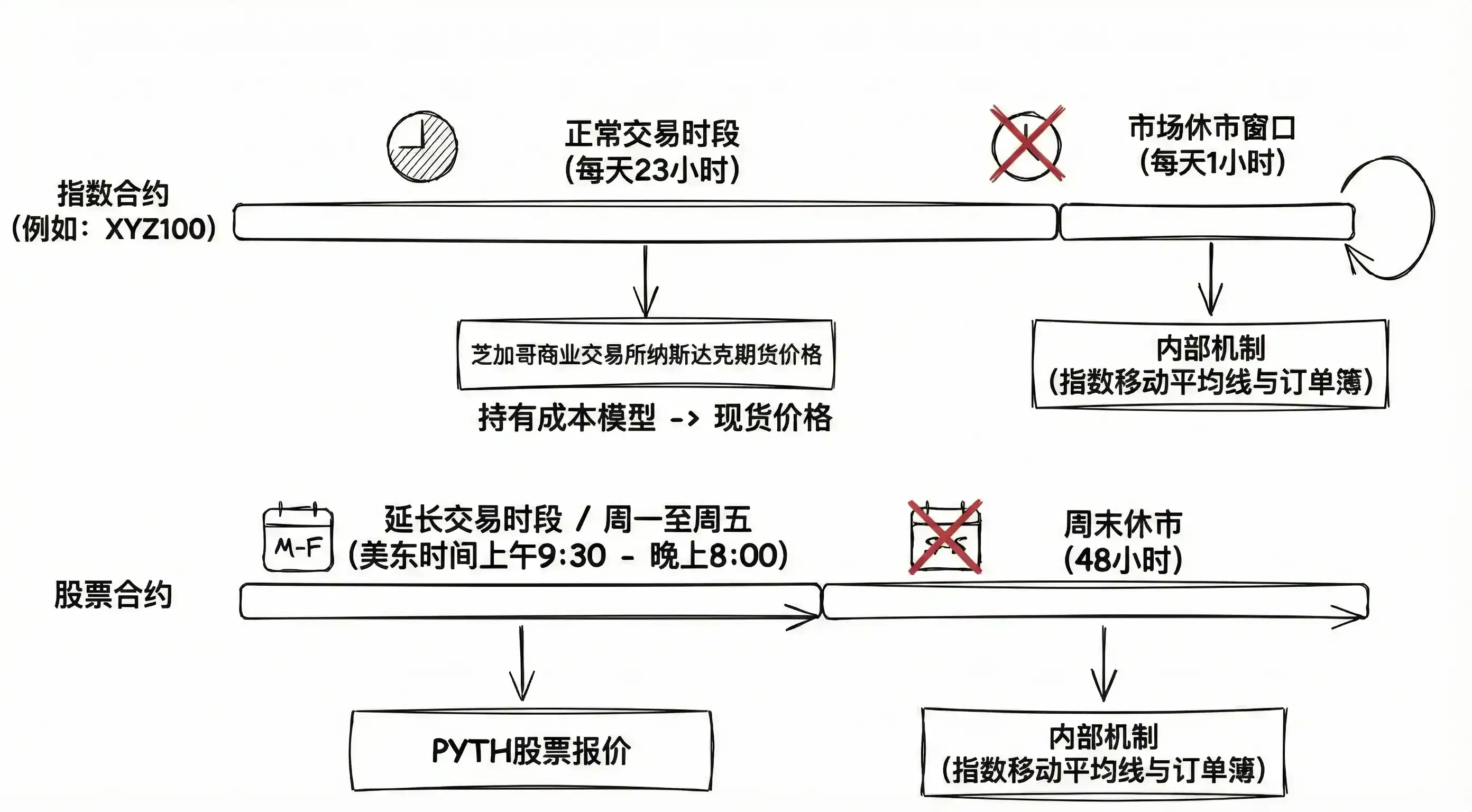

For trade.xyz, its processing method can be summarized as "different assets, different time periods".

Index products (such as the XYZ100 tracking the Nasdaq) do not rely directly on US stock spot prices, but instead use CME's NQ futures—these futures trade 23 hours a day, thus providing a more continuous price source. trade.xyz uses a cost-holding model to reverse-engineer the futures price into the "corresponding spot index price," allowing index contracts to keep prices updated almost around the clock.

However, the situation is not so simple for individual stocks. Unlike futures, stocks do not have near-24-hour liquidity, so trade.xyz mainly relies on Pyth's price data source to cover extended periods such as pre-market, after-hours, and overnight.

Only when there is absolutely no external data input, such as during the daily one-hour trading window for futures or the 48-hour weekend shutdown for stocks, will the system switch to trade.xyz's internal pricing mechanism: based on the on-chain order book, it smooths prices using an exponentially weighted average (EMA) with an eight-hour time constant, and adjusts the impact spread based on bid-ask depth, ensuring that prices still reflect on-chain supply and demand even without external data. Once external data resumes, the oracle immediately switches back to external prices.

This design allows oracles to self-regulate based on the on-chain order book when external data is lacking, maintaining responsiveness to market supply and demand.

Ostium

Ostium is a pull-based RWA oracle system that has been built in-house, with detailed processing for different asset trading sessions, futures contract rollovers, and opening gaps. The data sources, exchange session information, and node aggregation logic are all built by the development team and then run by a node network like Stork.

The overall cost is relatively high, so trading on Ostium involves an oracle fee of $0.1 per transaction. This fee will still be charged if the transaction fails due to reasons such as low slippage, but it can be refunded after the transaction is successfully completed and fully settled. See the fee rules for details.

For ordinary users, this means that prices won't fluctuate wildly during market closures, but you can still place orders in advance—limit orders and stop-loss orders can be placed, but they will only be executed after the market reopens and the price conditions are met. Market orders, on the other hand, cannot be submitted during market closures. This mechanism is somewhat like "strictly adhering to the rhythm of traditional markets," and even incorporates special market closure times for holidays, making price feeds more closely resemble the real market.

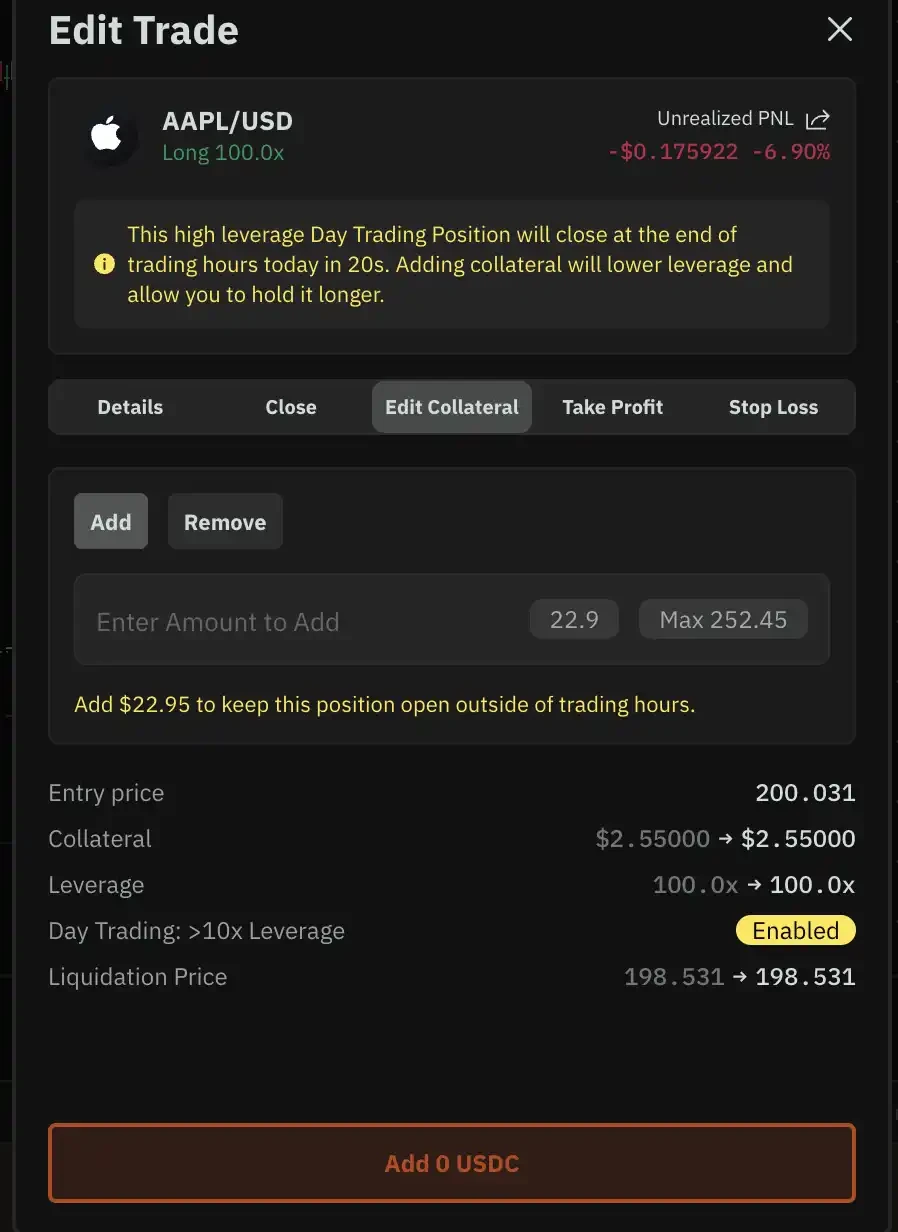

Additionally, while Ostium offers relatively aggressive leverage, up to 100x, this is only for intraday trading. Once the trading window expires or overnight trading begins, leverage requirements are strictly tightened.

Example of intraday trading positions

Specifically, leverage can be activated or adjusted at any time during normal market hours (9:30 AM to 4:00 PM Eastern Time). Once the intraday window (9:31 AM to 3:45 PM Eastern Time) is exceeded or the position is held overnight, leverage requirements will be tightened. The specific tightening level varies depending on the type of instrument. All intraday trades with leverage exceeding the limit will be forcibly liquidated 15 minutes before the market closes, at 3:45 PM Eastern Time, to mitigate overnight risk.

Lighter

Lighter's strategy is more direct.

During the market closure, Lighter chose to freeze the market in a relatively safe state: entering reduce-only mode, which means that you can only reduce your position, not increase your position or adjust leverage, in order to continue to amplify the risk.

During trading hours, its RWA assets are no different from ordinary crypto assets, with prices updated and orders matched normally; however, once the market closes, the index price stops updating, and the mark price can only fluctuate around the current point by a maximum of 0.5% to avoid drastic deviations.

Funding fees are still being charged as normal, but new active trades cannot be executed.

How do we profit from dividends?

When it comes to US stock perpetual contracts, there's an unavoidable question: stocks pay dividends, but what about the contracts?

Cryptocurrencies like Bitcoin never pay dividends; their price is simply their price. However, companies like Apple and Microsoft pay their shareholders every quarter. In the traditional stock market, the share price automatically drops on the ex-dividend date—for example, if a stock is worth $100 and pays a $2 dividend, it becomes $98 after the ex-dividend date.

This is where the problem arises in perpetual contracts: if nothing is done, wouldn't short sellers be making a free $2 profit? Just by opening a short position before the dividend payout, they can sit back and wait for the stock price to drop and make money—isn't that a sure-fire way to profit from arbitrage?

Let's take a look at how these three platforms each demonstrate their unique strengths in this issue.

trade.xyz

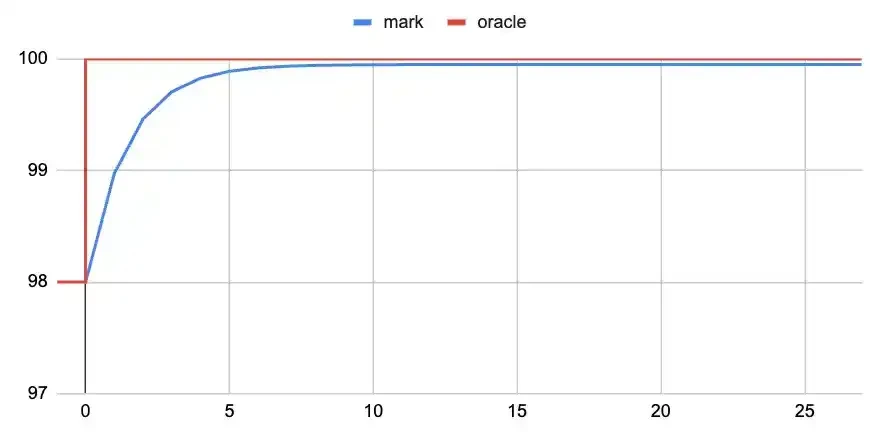

Trade.xyz's solution is to include the dividend in the funding rate. Assuming the oracle price is $100, it jumps to $98 at future time T due to a $2 dividend payout. For each hour prior to T, the token price must exhibit a smooth discount curve.

At time T-1, to prevent arbitrage, the funding fee paid by the short seller must be exactly equal to the profit gained from the price falling from the mark price to $98. According to the funding rate formula: Funding Rate = (Mark Price - Oracle Price) / Oracle Price + Cutoff Function (...)

Because the mark price is lower than the oracle price, the funding rate becomes negative. A negative funding rate means that the short seller has to pay the long seller. Going back to T-2 and T-3, the mark price will gradually slide from 99.95, 99.90... all the way down to 98.975. Every hour, the short seller has to pay a funding fee to the long seller.

Image source: https://oldcoinbad.com/p/non-arbitrage-conditions-for-perpetual

The final result is that the short sellers appear to have made a profit of $2 from the price difference (100→98), but they have paid it all out through funding fees; the long sellers nominally lost $2 (the price dropped from 100 to 98), but they made up for it through funding fees, which is equivalent to receiving dividends.

Ostium

Ostium, however, argues that perpetual contracts track price fluctuations, not the stock itself. Since you don't actually own Apple stock, why should you receive dividends? A contract is a contract; price fluctuations are the only thing that matters.

Therefore, on Ostium: the price will fall as expected on the ex-dividend date, and the price follows the oracle; there will be no compensation for long positions through funding rates; and no additional fees will be charged to short positions.

Wouldn't the bulls be at a disadvantage? Ostium uses another mechanism to balance this: the rollover fee.

What is a rollover fee? Simply put, it's the time cost of holding a position, similar to the financing cost or return of holding real stocks. Its characteristics include: asymmetry between long and short positions: the fees for long and short positions may be different; compound interest per block: calculations are performed every block (approximately every few seconds), but you won't notice; settlement upon closing the position: the fee isn't deducted in real time, but rather calculated together when you close the position.

The rollover fee will be displayed on the Net Margin (L/S) label. Hovering the mouse over it will display a tooltip explaining the fees for different rollover periods.

In other words, if you go long on a stock, the rollover fee may be positive; if you go short, the rollover fee may be negative.

This rollover fee mechanism indirectly reflects holding costs, including the impact of dividends. Although Ostium does not directly handle dividends, through rollover fees and oracle adjustments, the profits and losses for both long and short positions are ultimately relatively fair.

Lighter

The Lighter documentation does not explicitly state how dividends are handled, but based on the mechanism, it should rely on price adjustments made by oracles.

In other words: if the spot price falls on the ex-dividend date, the oracle price will also fall; if the contract mark price does not follow suit, a negative premium will occur; the negative premium leads to a negative funding rate, with the short seller paying the long seller; eventually, a balance is reached.

This approach is actually similar to Trade.xyz, except that Lighter does not emphasize the handling of dividends separately, but rather incorporates them into the overall price tracking mechanism.

It's also worth noting that Lighter has a funding rate cap of ±0.5% per hour. This is to prevent funding rates from skyrocketing during extreme market conditions, protecting traders from being overwhelmed by excessive fees.

Summarize

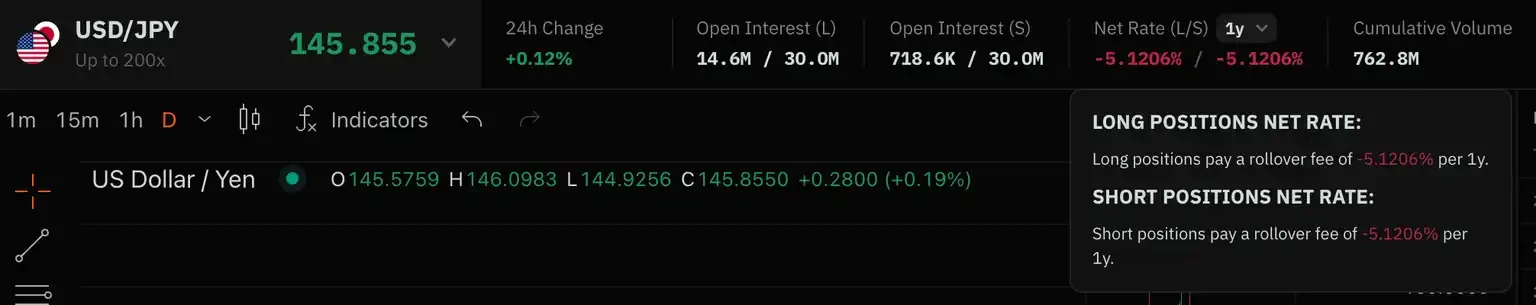

The Product-Market Fit (PMF) of US stock perpetual contracts has been preliminarily validated. Data shows that trade.xyz's cumulative trading volume has exceeded $2 billion, and during NVDA's earnings release period, it even set a single-day trading record of $200 million, with a trading volume of approximately $734 million in the past 24 hours.

Lighter's overall trading volume and open interest (OI) data are impressive, with a trading volume of $7.16 billion and OI of $1.634 billion in the past 24 hours. However, since Lighter only recently launched US stock trading, data on US stock transactions is limited, and there is no highly reliable data source to track.

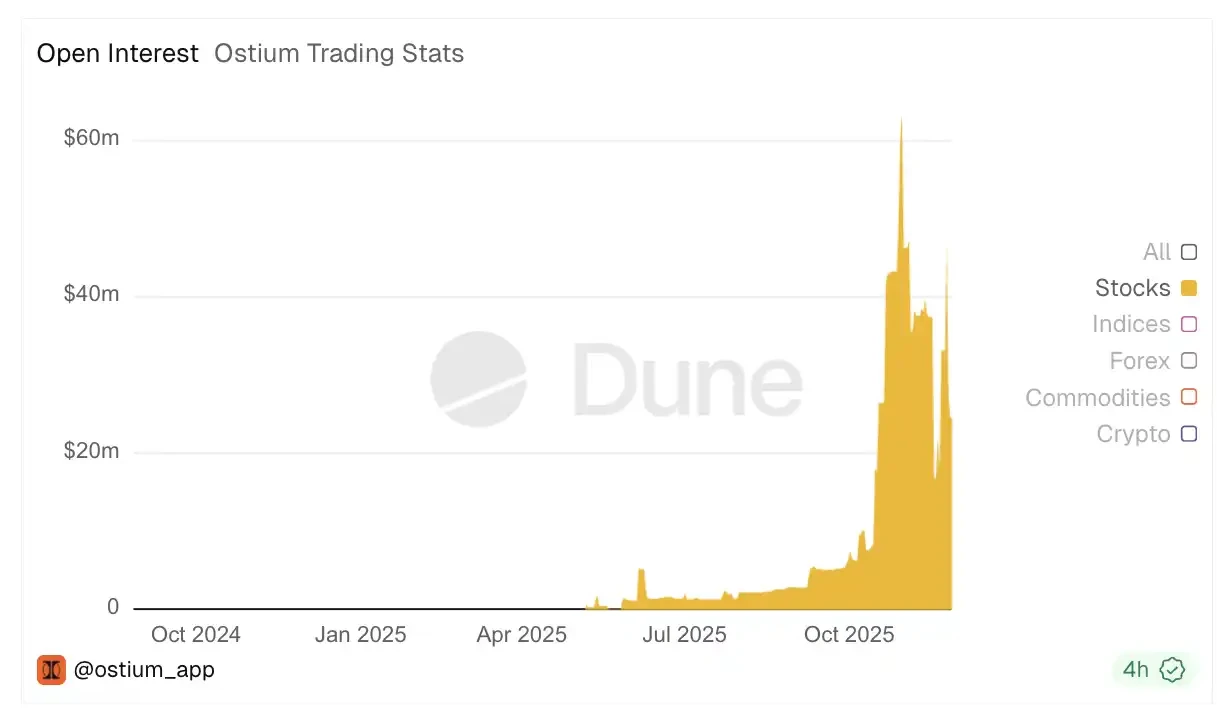

Now let's look at Ostium. The total trading volume is over $27.2 billion, with $138 million traded in the past 24 hours.

According to data from Ostium on Dune regarding US stock futures trading, daily trading volume for US stock futures has now exceeded $50 million. The open interest (OI) curve for US stock futures trading reached its historical peak in October of this year, at approximately $64 million, and has now fallen back to around $45 million. The OI also shows that Ostium's open interest for US stock futures accounts for 20% of its total open interest.

However, amidst the excitement, it's important to remind all US stock perpetual contract traders: the efficiency of financial markets is ruthless; the allure of 100x leverage comes with 100x risk. Those interested in US stock perpetual contracts are advised to start with small positions and low leverage.