Berachain's $25 million "get-out-of-jail-free card": Coin price drops 93%, VC returns it at the original price?

- 核心观点:Berachain融资协议暴露VC特权问题。

- 关键要素:

- Nova Digital获2500万美元全额退款权。

- 代币价格暴跌93%至1.02美元。

- 其他投资者称未被告知该条款。

- 市场影响:加剧对加密融资公平性质疑。

- 时效性标注:中期影响

Original article | Odaily Planet Daily ( @OdailyChina )

Author | Dingdang ( @XiaMiPP )

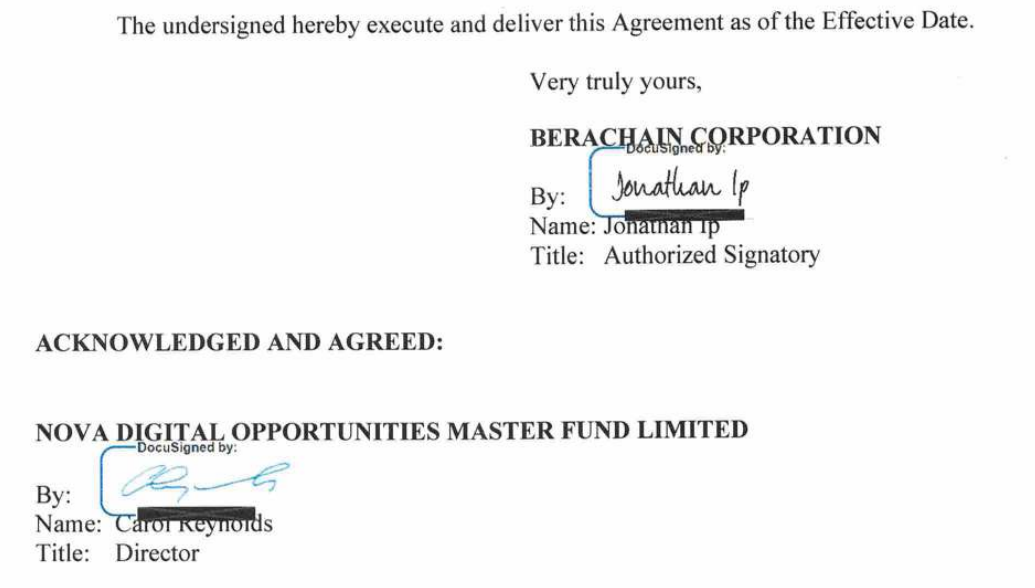

On November 24, crypto media outlet Unchained published an investigative report revealing a supplemental agreement signed by Berachain with Brevan Howard's Nova Digital fund during its 2024 Series B funding round. The document shows that Nova has the right to demand a full refund of its $25 million investment from the foundation at any time within one year of the TGE (i.e., from February 6, 2025 to February 6, 2026).

Less than 24 hours later, Smokey the Bera, co-founder of Berachain, responded with a lengthy article, calling the report "incomplete and inaccurate." The incident continues to unfold, and Odaily has compiled a key timeline of events.

From the "Bear Chain Myth" to the "Valuation Cliff"

Berachain is an emerging public blockchain that uses a "bear" cultural narrative, is built on the Cosmos SDK, and supports the full EVM. In 2024, the project completed a Series B funding round totaling approximately $42 million, with a valuation exceeding $1.2 billion. Nova Digital, as one of the co-lead investors, invested $25 million at a price of $3 per BERA , with Framework Ventures, a well-known crypto VC, also participating as a co-lead investor.

On February 6, 2025, BERA was listed on major exchanges such as Binance and Upbit, and its price reached a high of $15.50. However, the good times did not last long, and now the price is only $1.02, a drop of 93% .

Normally, without the protection of the "supplementary agreement," Nova, like all early-stage firms, would have suffered a paper loss of approximately 66%, amounting to about $16.67 million . But now, they hold a "get-out-of-jail-free card" that allows them to exit at any time.

This is what truly stings the community.

What exactly does the "no loss, only profit" clause say?

According to documents disclosed by Unchained, the investment agreement between Berachain and Nova, in addition to the standard SAFT agreement, also included a supplementary agreement containing refund rights. The core contents of this agreement include:

- Nova is required to deposit $5 million into Berachain within 30 days of the TGE (token generation event) as a liquidity commitment.

- Then, within one year after TGE (ending February 6, 2026 ), Nova may request the Berachain Foundation to refund the full $25 million at any time.

Unchained stated that they could not verify whether Nova actually deposited the $5 million, nor could they determine whether the refund right had been exercised.

This is equivalent to handing Nova a "win-win" lottery ticket: when the price of the coin soars to $15.5, they can enjoy a five-fold profit; when it falls to $1, they can simply walk away, leaving the retail investors, community contributors, and ordinary investors who ultimately bear the losses without any "supplementary agreement" to protect them.

Smokey's response: Compliance requirements vs. community concerns

Berachain co-founder @SmokeyTheBera has issued a statement clarifying that Unchained's report was "incomplete and inaccurate," and that some of the information came from "disgruntled former employees."

Smokey stated that the supplementary agreement was not to guarantee Nova's principal would not be lost, but rather a risk mitigation clause required by Nova's compliance team. If Berachain ultimately fails to complete its TGE listing, locking BERA would not meet Nova's liquidity strategy requirements, thus necessitating a "failure protection" clause. Nova remains one of Berachain's largest or most significant holders, holding not only the BERA locked in the Series B round but also a substantial amount of BERA tokens purchased on the open market. They have consistently increased their exposure throughout the market cycle and provided genuine liquidity support.

In other words, Smokey emphasizes that this is a compliance requirement rather than "privilege protection" .

But the controversy didn't end there. Another point of contention is:

Were the other Series B investors aware of this? Does this constitute a violation of the Most Favored Nation (MFN) clause?

Smokey stated that no MFN (Most Favored Nation) was issued to any investors during the Series B funding round, therefore there was no issue of "concealing information from other investors."

However, Framework Ventures co-founder Vance Spencer publicly stated that he was "completely unaware" of the matter and said he would be "very disappointed" if true. This directly contradicts Smokey's claim that "all investors use the same set of documents."

Fair, but not unequal

In a cautious funding environment, it's not uncommon for projects to offer additional "insurance" to attract large VCs. Berachain may have offered this additional "insurance" to attract large VCs (such as Nova) to participate in its funding round.

Project teams use refund rights to mitigate downside risk for venture capitalists in exchange for funding to support development and provide liquidity. Nova, as the lead investor, pledged liquidity (by depositing $5 million), which helped stabilize the market after the project's launch. However, this essentially made Nova's investment "zero-risk": if BERA performed well, they profited; if it performed poorly, they could get a full refund, while ordinary investors had no way out. This controversy once again exposes the information asymmetry and power imbalance within the crypto funding structure.