Federal Reserve vs. Treasury: The Currency War Hidden Behind the Bitcoin Crash

- 核心观点:比特币成为新旧货币体系博弈战场。

- 关键要素:

- 摩根大通压制比特币与MSTR。

- 财政部推动稳定币与比特币整合。

- MSTR成新旧体系转换桥梁。

- 市场影响:加剧比特币价格波动与监管博弈。

- 时效性标注:中期影响。

Author | @HodlMaryland

Compiled by Odaily Planet Daily ( @OdailyChina )

Translator | Dingdang ( @XiaMiPP )

Editor's Note: Against the backdrop of recent Bitcoin price declines, this article attempts to offer a more "structural" and conspiratorial perspective: perhaps Bitcoin's volatility is not simply a matter of market sentiment or liquidity changes, but rather reflects a deep-seated power struggle between two monetary systems within the United States. The author argues that Bitcoin is being drawn into a power conflict between the Treasury and the Federal Reserve, the stablecoin system and the banking system, and the old financial order and the new digital currency architecture. Of course, this view is not the whole picture, but merely an extrapolation within the current macro narrative. We can use it as a perspective for reference. Perhaps there are always deeper forces driving the price.

A struggle for monetary power is unfolding openly—but almost no one realizes the stakes involved. The following is my personal, subjective, speculative interpretation.

Over the past few months, a gradually clearer thread has emerged between politics, markets, and the media. Scattered news stories have suddenly come together, market anomalies no longer seem random, and institutional behavior has exhibited an unusual level of aggression. Beneath the surface, a deeper shift appears to be taking place.

This is not a typical monetary cycle.

This is not a partisan conflict in the traditional sense.

This is not what is known as "market volatility".

What we are witnessing is a direct clash between two competing monetary systems:

The old order...centered around JPMorgan Chase, Wall Street, and the Federal Reserve.

The new order... centers on a digital architecture pegged to government bonds, stablecoins, and Bitcoin.

This conflict is no longer just talk; it's happening, and it's accelerating. For the first time in decades, it's spilling over into the public eye.

The following attempts to depict the real battlefield... a battlefield that most analysts cannot see because they are still interpreting a world that is breaking through its old limitations using a framework from 1970–2010.

I. JPMorgan Chase emerges from the shadows

Most people mistakenly believe that JPMorgan Chase is a bank.

JPMorgan Chase is the arm of the global financial system, the institution closest to the core mechanisms of the Federal Reserve, influencing global dollar settlements and acting as a major executor of the traditional monetary architecture.

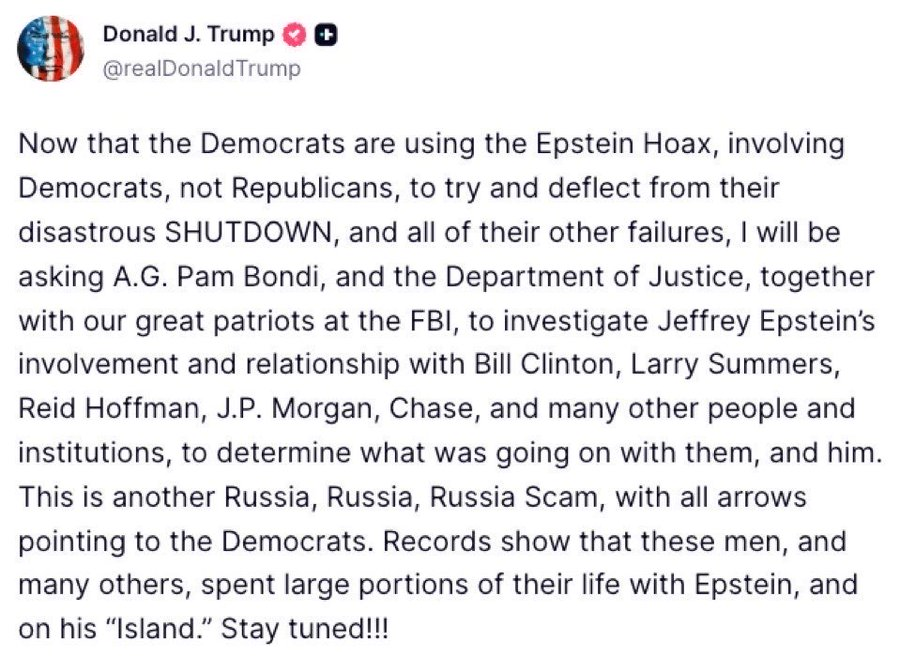

So when Trump mentioned the Epstein network in his post and specifically named JPMorgan Chase (rather than just individuals), it wasn't a rhetorical game. He pulled the most deeply embedded institutions in the system into the narrative.

at the same time:

- JPMorgan Chase is currently the main facilitator of strong short-selling pressure on Strategy (“MSTR”), precisely at a time when the macro narrative of Bitcoin threatens the interests of old currencies.

- A client attempted to transfer MSTR shares out of JPMorgan Chase but encountered settlement delays, suggesting potential custody pressure... These kinds of problems usually only occur when internal systems are under pressure.

- JPMorgan Chase is strategically at the heart of the Federal Reserve ecosystem, both structurally and politically. Weakening its position is tantamount to weakening the old monetary system itself.

None of this is normal, but it's all part of the same story.

II. The government's silent shift: returning monetary power to the Ministry of Finance

While the media focuses on the noise of the culture war, the real strategic agenda is on the monetary level .

The government is quietly pushing to bring the center of currency issuance back to the U.S. Treasury Department, using methods including:

- Stablecoins deeply integrated with government bonds

- Programmable settlement track

- Using Bitcoin as a long-term collateral asset

This transformation is not a minor tweak to the existing system, but a replacement of the system's core power structure.

Currently, the Federal Reserve and commercial banks (led by JPMorgan Chase) virtually monopolize the issuance and circulation of all US dollars. If the " Treasury + stablecoin " model becomes the core support for issuance and settlement, the banking system will lose power, profits, and control.

JPMorgan Chase understands this perfectly well. They understand exactly what stablecoins mean. They also understand what will happen once the Treasury becomes the issuer of a "programmable dollar."

So they fought back—not through news and public opinion, but through market strategies:

- Derivatives pressure

- Liquidity bottleneck

- Narrative suppression

- Hosting delay

- Political influence

This is not a policy dispute; it is a battle for survival.

III. Bitcoin: An Unintentional Battlefield

Bitcoin is not the target... it's the battlefield.

The US government hopes to quietly accumulate strategic Bitcoin before explicitly moving towards a digital settlement system based on national debt. Announcing it too early would trigger a liquidity squeeze, drive up Bitcoin prices, and exacerbate the cost of long-term accumulation.

The problem is that the old system is using mechanisms similar to those used to suppress gold trading to suppress Bitcoin signals:

- Derivative products proliferate

- Large-scale short selling

- Cognitive warfare

- Liquidity shocks at key technical levels

- Creating hosting bottlenecks at major prime brokerage firms

JPMorgan Chase has honed its techniques for suppressing the gold market for decades, and now these techniques have been replicated in Bitcoin.

The reason is not that Bitcoin directly threatens bank profits, but that Bitcoin strengthens the Treasury’s future monetary architecture and weakens the Federal Reserve’s monetary system.

Therefore, the government faces a difficult choice:

- This allows JPMorgan Chase to continue suppressing Bitcoin, enabling it to accumulate further in a low price range.

- Announcing the strategy ahead of time can trigger a price surge in Bitcoin, but it also means missing out on opportunities to accumulate before the political situation stabilizes.

This is why governments remain silent on Bitcoin. Not because they don't understand it, but because they understand it all too well.

Fourth, both sides are fighting on a fragile foundation.

This struggle takes place on a monetary system that has been in place for sixty years and relies on:

- Financialization

- structural levers

- The lower interest rate is considered

- Asset-driven growth

- Reserves Concentration

- Institutional oligopoly

Historical relevance is failing everywhere because the system itself is no longer coherent. Traditional financial commentators who still treat all of this as a "normal cycle" are unaware that the cycle itself is disintegrating.

The system is breaking down. The underlying structure is unstable. Incentives are becoming fragmented.

JPMorgan Chase's old order and the Treasury's new order are both vying for dominance on the same fragile infrastructure. Any miscalculation could trigger a chain reaction of turmoil.

That's why all the movements look so strange, chaotic, and rushed.

V. MSTR: The "Conversion Bridge" Under Direct Attack

Now let's discuss a key point that most commentators overlook.

MicroStrategy (MSTR) is not just an ordinary corporate Bitcoin holder. It has become a conversion mechanism—a bridge connecting existing institutional capital with the emerging “Bitcoin-Treasury” monetary system.

MSTR's structure, leveraged Bitcoin strategy, and preferred stock products essentially convert fiat currency, credit, and government bond assets into long-term Bitcoin exposure. Therefore, for institutional and retail investors who cannot (or do not wish to) directly hold spot Bitcoin but wish to escape the suppressed yields under YCC (Yield Curve Control), MSTR has become a de facto entry point.

This means that if the government envisions a future where digital dollars issued by the Treasury coexist with Bitcoin reserves, then MSTR will be a key corporate node driving this transition.

JPMorgan Chase was fully aware of this, therefore, when JPMorgan Chase:

- Enabling strong short selling

- Manufacturing delivery delays

- Suppressing MSTR liquidity

- Amplifying negative narratives

It wasn't attacking Michael Saylor; it was attacking the "conversion bridge" that enabled the government's long-term strategic accumulation.

There's even a possibility (still highly speculative, but increasingly plausible): the US government might intervene in the future, perhaps even making a strategic investment in MSTR. As recently suggested by ( @joshmandell6) :

- In exchange for a portion of MSTR's equity through government bond injections;

- Enhance the credit rating of MSTR preferred stock instruments, thereby strengthening their functionality within the system.

This move carries considerable risk, both politically and financially, but it will send an undeniable signal to the world:

The United States is protecting a key node in its emerging currency architecture.

This possibility alone is enough to explain why JPMorgan Chase launched such a fierce attack.

VI. Key Window: Control of the Federal Reserve Board

Next, time became extremely tight.

As @caitlinlong recently pointed out, Trump needs to have real control over the governance of the Federal Reserve before Powell leaves office. The current balance of power is against him—he is trailing the board by about three to four votes.

Multiple bottlenecks are emerging simultaneously:

- Lisa Cook's lawsuit against the Supreme Court could drag on for months and delay key personnel changes.

- The Federal Reserve Board vote in February 2025 could solidify a hostile governance structure for a long time.

- If the Republican Party performs poorly in the upcoming midterm elections, it will be difficult for the government to reallocate monetary power.

That's why economic growth momentum is crucial now, rather than waiting six months.

This is why the Treasury's issuance strategy has changed. This is also why stablecoin regulation has suddenly become a central battleground. This is why suppressing Bitcoin is so important. And this is why the battle surrounding MSTR is not a trivial matter, but a structural one.

If the government loses Congress, Trump will become a lame-duck president—unable to reshape the monetary system and instead constrained by the very institutions he tries to circumvent. By 2028, that window will be completely closed.

Time pressure is a real issue.

VII. A broader strategic vision

Looking at it from a distance, the whole pattern becomes clearer:

- JPMorgan Chase is waging a defensive battle in an attempt to maintain its global hub centered on the Federal Reserve-banking system.

- The government is carrying out a covert currency migration, bringing the power of issuance back to the Treasury Department and achieving this through stablecoins and Bitcoin reserves.

- Bitcoin is a proxy battlefield, where price suppression protects the old system while covert accumulation empowers the new system.

- MSTR is a conversion bridge, an entry point that threatens JPMorgan Chase's control over capital flows.

- Federal Reserve governance is a bottleneck, while political timing is a constraint.

- Everything is happening on an unstable monetary infrastructure, and any mistake could lead to unpredictable systemic consequences.

This is not just a financial story, nor is it a political story.

This is a monetary transformation on a civilizational scale. For the first time in sixty years, this conflict is no longer hidden.

VIII. Trump's Strategy

The government's strategy is gradually taking shape:

- JPMorgan Chase overstepped its bounds in its repressive actions.

- Quietly accumulating Bitcoin

- Protects and may enhance the MSTR conversion bridge

- Rapidly reshaping Federal Reserve governance

- Positioning the Treasury as the issuer of the digital dollar

- Waiting for the right geopolitical moment (possibly the Mar-a-Lago Agreement) to announce the new framework.

This was not a gentle reform, but a complete reversal of the 1913 order—returning monetary power from the financial system back to the political system.

If the bet succeeds, the United States will enter a new monetary era based on transparency, digitalization, and a hybrid Bitcoin collateral framework.

If it fails, the old system will be further consolidated, and the next generation may not have a window of opportunity for reform.

In any case, the war has begun.

Bitcoin is no longer just an asset... but a dividing line between two futures.

But both sides overlooked one point: they will ultimately lose to absolute scarcity and mathematical truth.

As these two behemoths vie for control, be prepared for the unexpected and ensure the safety of your wallet.