Data: BTC falls below $100,000, who is secretly buying the dip?

Original article | Odaily Planet Daily ( @OdailyChina )

Author | Dingdang ( @XiaMiPP )

Since the price of Bitcoin fell below $100,000, market panic has been spreading. Alternative data shows the cryptocurrency fear and greed index is 14. Yesterday, it even reached 10, the lowest level since February 27th, indicating the market remains in a state of "extreme panic."

CryptoQuant reported that long-term Bitcoin holders have recently significantly reduced their positions, selling a total of approximately 815,000 Bitcoins. This is the highest level since January 2024. Against a backdrop of weakening demand, this sustained selling pressure is having a downward impact on prices. However, if we only focus on the panic created by these figures, the market may easily overlook a more subtle but equally crucial fact: Bitcoin is also being absorbed by another force.

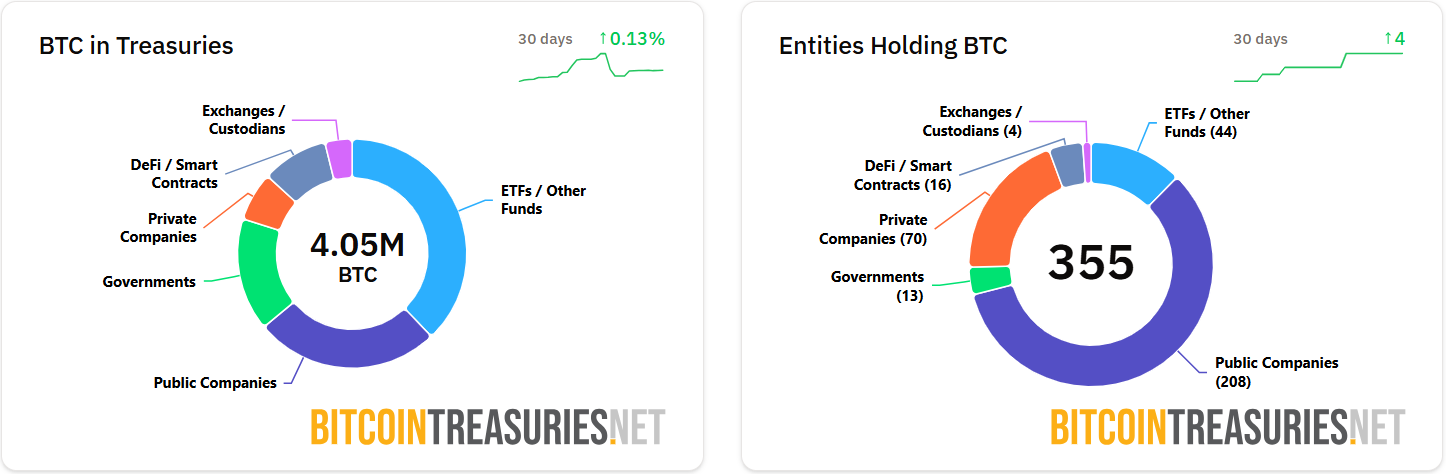

According to data monitoring by bitcointreasuries.net , four more entities added Bitcoin to their reserves in the past month, bringing the total number of entities holding BTC globally to 355. Institutional holdings increased by 4.05 million BTC in the past month, worth approximately $400 million . Looking at a longer timeframe, in the third quarter, listed companies net purchased 195,000 BTC, representing an investment of $20.5 billion.

Especially noteworthy is Strategy, a staunch Bitcoin believer. The company currently holds 641,000 Bitcoins, worth approximately $67 billion, far exceeding the second-ranked MARA Holding, with a profit of 41%. Strategy's core strategy is to hold Bitcoin indefinitely, never selling it, using it as the primary reserve asset to combat fiat currency inflation. The company buys Bitcoin almost weekly, having purchased 1,442 Bitcoins in the past month alone.

On November 14th, according to Lookonchain monitoring, Strategy transferred 58,915 BTC (worth $5.77 billion) to a new wallet, sparking speculation that it might be preparing to sell, and even impacting Polymarket. On Polymarket, the probability of MicroStrategy selling Bitcoin in 2025 increased significantly. However, the company's management clarified that the wallet switch was simply transferring Bitcoin to another custodian and did not constitute a sale. Strategy's leverage ratio is actually very low; it currently holds $64 billion worth of Bitcoin with only $8 billion in debt, a leverage ratio of approximately 13%, and its debt is all long-term and does not require short-term repayment .

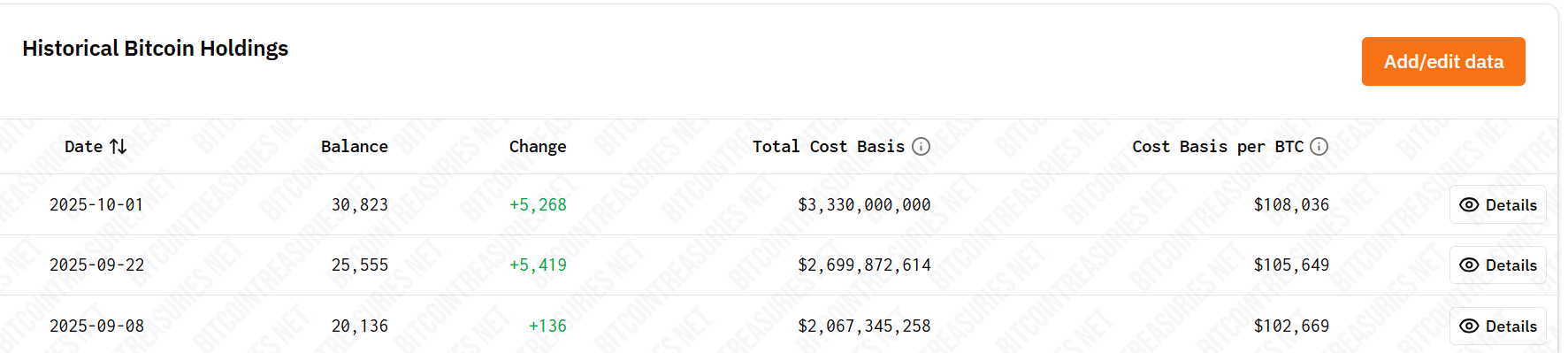

Metaplanet, a Japanese listed company, holds 30,000 BTC, ranking as the world's fourth-largest Bitcoin reserve entity. In September, the company announced it would invest $ 1.25 billion to increase its Bitcoin holdings by October. Since September 20th, Metaplanet has accelerated its buying pace, purchasing over 5,000 BTC in a single week. Its most recent purchase was on October 1st, acquiring 5,268 BTC. However, it has not increased its holdings for almost a month, and the current amount fulfilled is only about one-tenth of its promised amount . Contrary to the market's common understanding that "stopping buying equals bearish sentiment," another possibility is that large institutions are entering a new observation period, waiting for the optimal entry window.

American Bitcoin, a Bitcoin mining company associated with the Trump family, released its Q3 2025 financial report on November 15th. The report disclosed that it increased its holdings by approximately 3,000 BTC during the quarter, bringing its total Bitcoin holdings to approximately 3,418 as of September 30th, 2025. As of November 13th, its Bitcoin holdings had increased to 4,090 BTC . The company mined 563 BTC in Q3, and had 2,385 BTC pledged or otherwise secured during the same period.

Data from El Salvador's Ministry of Finance website shows that El Salvador continues to add one Bitcoin per day , currently holding 6,380.18 Bitcoins, worth approximately $630 million, with an increase of eight Bitcoins in the past seven days. In a global market slump, this consistent yet small investment appears remarkably resolute.

Beyond institutional buying, some investors are also seeking opportunities amidst the market's emotional lows. On November 16th, Vida, founder of Equation News, stated that he increased his BTC holdings for long-term allocation and added a small amount of Meme coin for short-term speculation, representing only 0.7% of his personal net worth—a "light trial." He believes that current market sentiment has deviated from fundamentals and is clearly in a state of excessive panic; the manageable correction in US stocks, BTC's position near the key 1-week supertrend support, and the fact that some altcoins often have a higher probability of rebounding during periods of despair are all signals worth paying attention to in the short to medium term .

However, he also emphasized that ideal "deep buying opportunities" usually occur when large institutions are forced to liquidate, and the probability of this happening in the next year remains low.

In their latest research report, Bernstein analysts stated that Bitcoin's approximately 25% pullback from its early October high is more likely a "short-term correction" than the top of this cycle . Over the past six months, long-term investors holding positions for more than a year have sold approximately 340,000 BTC (about $38 billion), but this was almost entirely absorbed by approximately $34 billion in funds from spot ETFs and corporate treasuries. The institutional holdings in Bitcoin ETFs have also increased from 20% at the end of 2024 to the current 28%, indicating a more stable portfolio structure.

CryptoQuant analyst Axel Adler Jr. also believes that after a brief slowdown and absorption of recent volatility, the market structure is becoming healthier overall. After experiencing significant short-selling pressure, the Bitcoin Position Index (which measures the aggressiveness of bullish and bearish forces in the futures market) has returned to the neutral range .

Meanwhile, QCP stated in its latest market update that sentiment indeed turned sharply bearish after BTC broke below $100,000 for the first time and fell below the 50-week moving average. Currently, the key levels to watch are the $92,000 support and the $88,000 CME gap, and whether they can trigger a short-term rebound. If these key levels hold, the market may see a "final confirmation" of this decline; conversely, it may enter a deeper cycle reset phase. QCP also cautioned that the combined effect of the US government's reopening and delayed release of a large amount of economic data means that short-term market volatility may remain high, with BTC implied volatility already above 50 and option skew continuing to favor the bearish side.

at last

The market is undergoing a major emotional reshuffle—panickers are choosing to leave, and the real bottom is often quietly built up amidst this seemingly weak chaos by the most patient and deepest buying.

We obviously cannot arbitrarily declare that "the bottom has been reached", but what we can confirm is that this is not a hollow downward cycle without buying, support, or inflows.

- 核心观点:市场恐慌中机构正持续吸筹比特币。

- 关键要素:

- 恐慌指数达14,创数月新低。

- 机构月增405万枚BTC,价值4亿美元。

- MicroStrategy持64.1万枚BTC,杠杆率仅13%。

- 市场影响:机构买入或缓解抛压,支撑长期价值。

- 时效性标注:中期影响