After cutting off the Twitter noise, I finally stopped my "suicidal trading" in the crypto market.

- 核心观点:长期持有比特币以太坊是唯一正解。

- 关键要素:

- 垃圾币长期必然流失价值。

- 早期持有者收益碾压交易者。

- 法币贬值推动加密货币上涨。

- 市场影响:加速资金向主流资产集中。

- 时效性标注:长期影响

Original author: WSM

Original article translated by: Deep Tide TechFlow

Having trouble concentrating? Then you're destined for "NGMI" (Not Gonna Make It).

Do you really want to get rich, or do you just want to watch your portfolio shrink in the face of Bitcoin, Ethereum, and the US dollar while you're having fun?

There are many people richer than me, but the "blueprint" you're about to see is exactly the same. And what does their wealth have to do with mine? In my personal investment journey, I've surpassed even my wildest dreams—self-reliant, of average intelligence, and reasonably sane. And my last trade was three years ago. The crypto world in 2025 is incredibly boring; the only thing to do now is "hold forever," because it's already part of your net worth.

Bitcoin and Ethereum have no top because fiat currencies have no bottom. The devaluation of fiat currencies is by design—and it's not necessarily a bad thing. Too many cryptocurrency players think they've uncovered a grand conspiracy, as if this wasn't the intended outcome.

Humanity's all-time high (ATH) is always in the present. Nostalgia often makes us overlook an objective reality: on a holistic level, humanity has never lived in such a prosperous era as it does now.

Contrary to popular belief, CryptoTwitter is an information silo. I've never thought Twitter was a good thing; I only use it to gauge market sentiment. The difference between the two is significant.

The reason I'm still using Twitter is because I'm in startup mode (I've only been tweeting for 30 days). And my thinking is the same as it was 4.5 years ago:

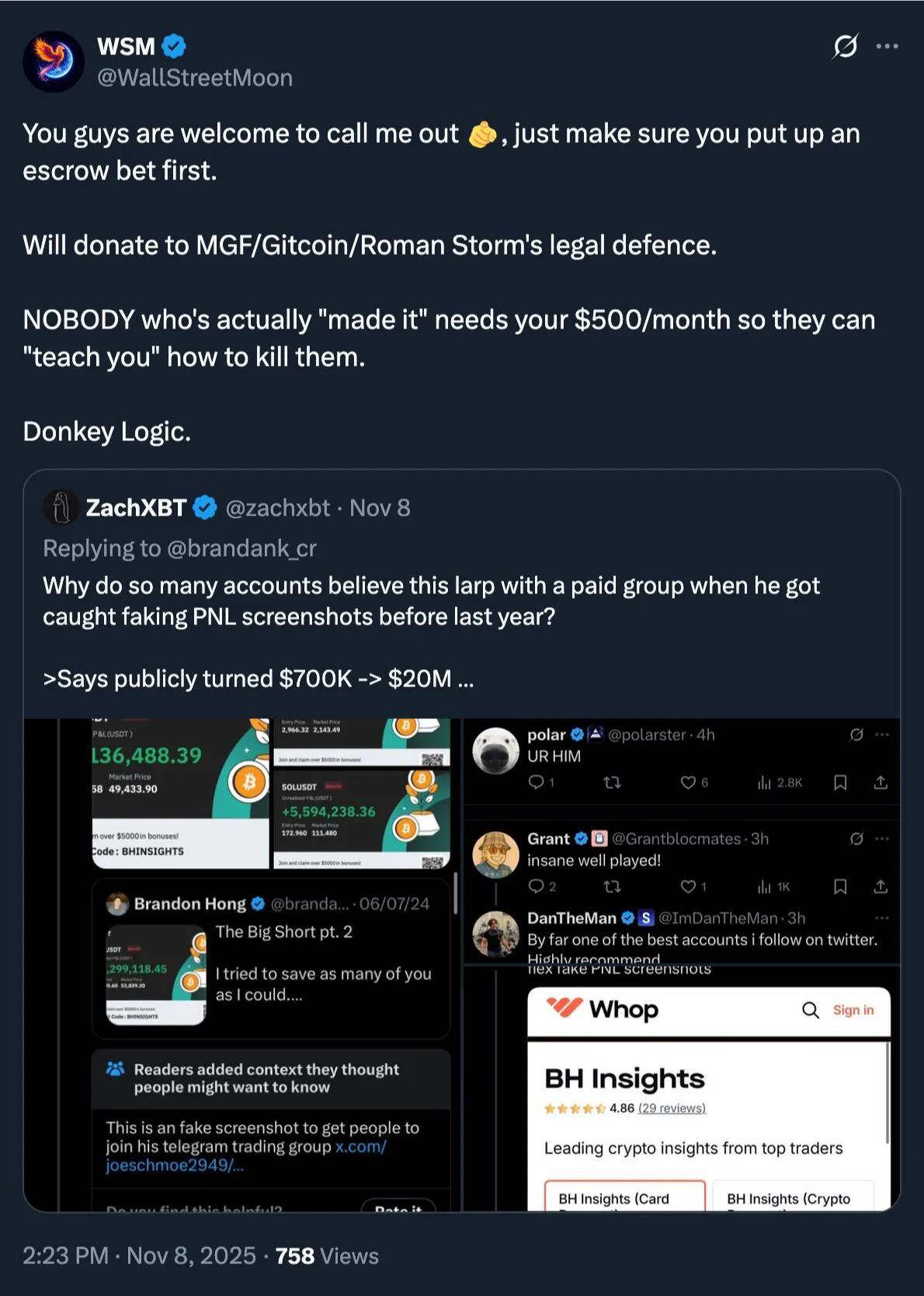

By the way, I've seen far too many screenshots of "LARP" (LiveActionRolePlay) on CryptoTwitter (CT).

It's unbelievable that anyone would believe these things:

The vast majority of crypto participants do not use Twitter at all and do not care about the content on Twitter.

Why should they care?

Who would log into Twitter to listen to your idiot spouting nonsense?

If you're really that smart, why didn't you buy Bitcoin when it was just a few cents and then do nothing?

If you're really that smart, why are you still trading in 2025?

A 12.6 million-fold return on Bitcoin isn't enough to allow you to retire?

A 16,666x return on Ethereum isn't enough?

With countless 10x, 100x, and 1000x returns, airdrop rewards, and DeFi dividends, how can you still be stuck on this app?

No trader has been able to outperform early cryptocurrency holders—not a single one, zero.

So, who is the real "fool"? Hmm? Fool?

Freeze the prices of Bitcoin and Ethereum at today's level, exit the market and never touch them again. Is that enough? That's the only measure of an "early" investor.

Where are those people on Twitter who run paid Discord groups with five referral links, charging $500 a month, and listening to your nonsense?

You've sold your future and ruined your fortune. You're nothing more than a washed-up worker masquerading as a "Key Opinion Leader" (KOL), surviving on paid group chats. People on your timeline are "celebrating" your gold-certified job offer, the so-called "Work to Earn."

There's nothing wrong with that, but you pretend to be an "expert," make others believe you are, and then charge for publishing your so-called "expert" opinions. And what's the result?

You've sent innocent people into the meat grinder of RektCity™. All your assets have been liquidated compared to Bitcoin and Ethereum. No cryptocurrency can even justify its existence, as they've all been utterly crushed by the tokenized fiat currency, Tether.

If you can't even beat fiat currency—which is precisely the original purpose of cryptocurrency—then what is the point of your existence?

Nevertheless, you still dare to make outrageous statements, wanting to target Ethereum (Ether), which is ranked second—and has already surpassed Tether (Tether).

You continue your incessant chatter, confidently predicting the demise of Bitcoin, the number one dominant player.

chatter.

chatter.

chatter.

This is baseless and baseless accusation.

The Bitcoin white paper has been around for 17 years. Will a hero come to the rescue? No, no hero will.

You have no intention of competing with Bitcoin, let alone challenging the "Holy Trinity" of the crypto market.

In fact, if you had enough of the Holy Trinity to achieve financial freedom, you would stop all trading right now.

Those speculators addicted to gambling are beyond saving because they have no ultimate goal. They gamble simply for the sake of gambling, because their dopamine receptors have been overstimulated to the point of numbness—a complete addiction.

Shitcoins should actually use centralized databases on Amazon Web Services (AWS). This would be faster, cheaper, more secure, and more honest, because they are inherently fully centralized—unlike Bitcoin and Ethereum. Most projects are just pretending to be decentralized (LARP), with only a few admitting their true nature. Adopting a centralized approach might reduce many financial losses due to attacks on blockchains or smart contracts.

The real reason for the existence of junk coins is to provide teams with an opportunity for a "devil's swap":

- You give them : your precious Bitcoin, Ethereum, or US dollars.

- What you get : garbage coins they minted for free.

Stop and think about this. Any "devil's deal" from the start means the team is dumping a supply of garbage coins they've created out of thin air on your head. They're trading your valuable assets for nothing.

Next, your junk coin will have to endlessly compete with the Holy Trinity (Bitcoin, Ethereum, and the US dollar) on the open market. Every day you wake up, you, as a holder of junk coins, will worry about whether other holders will suddenly "wake up" and sell their junk coins to buy the Holy Trinity to realize their value.

This is why all worthless cryptocurrencies "bleed satoshis" in the long run. Ethereum is the only asset that has outperformed Bitcoin since its ICO and has consistently held the second-best performance. We will explore this further in another article.

The teams behind these junk coins don't care what happens to their tokens; they've already acquired the Bitcoin, Ethereum, and US dollars they want through "devilish deals." The fact that these junk coins are plummeting is irrelevant to them.

But this is important to you. Because you're holding these worthless coins and watching your money keep flowing out.

Capital preservation is the most important principle in investing. Without capital preservation, you will eventually go bankrupt, because even the best investment skills cannot overcome the "risk of bankruptcy".

Like Reddit, Twitter rewards "donkey consensus," a form of groupthink. That's the crux of the problem. A post being popular, getting likes, and trending doesn't mean it's correct.

When have we ever won together? Never.

The Pareto distribution won't allow all donkeys to win. Wealth will always concentrate in the hands of a few, regardless of the circumstances. Cryptocurrency itself is indeed a revolutionary transfer of wealth, but only a very small minority will benefit. Think about it.

And who are the ultimate winners? Bankers and governments, not cypherpunks.

What about those "smart people"? They are particularly prone to missing opportunities. They care too much about the empty fame brought by "contrarian thinking" rather than simply buying Bitcoin or Ethereum.

Beware of those who think themselves clever and have a bunch of complicated theories telling you what can't be done —they're too clever for their own good. I call them "Jeremiahs" (meaning pessimists).

Smart people often work for those who are "dumber" but have a higher risk tolerance. The only way to get rich is through ownership , nothing else. By providing smart people with job security and "golden handcuffs," you can turn them into your "employees." That's the truth.

Steve Jobs didn't write the code for iOS, but he became incredibly wealthy through his Apple shares, far surpassing any genius engineer.

Ultimately, it's all about money, right?

Back then, some people warned you like they were preaching, that buying Bitcoin was like getting leprosy; others said Ethereum was a scam, as if buying it would kill you.

So-called "institutional investors" didn't outperform retail investors in the last cycle. They're buying at even higher prices now, and their entry points were terrible. It takes a special kind of courage to go all-in on an emerging industry like cryptocurrency.

It's too late for you.

Can you say "GM (Good Morning)"? -- Shut up.

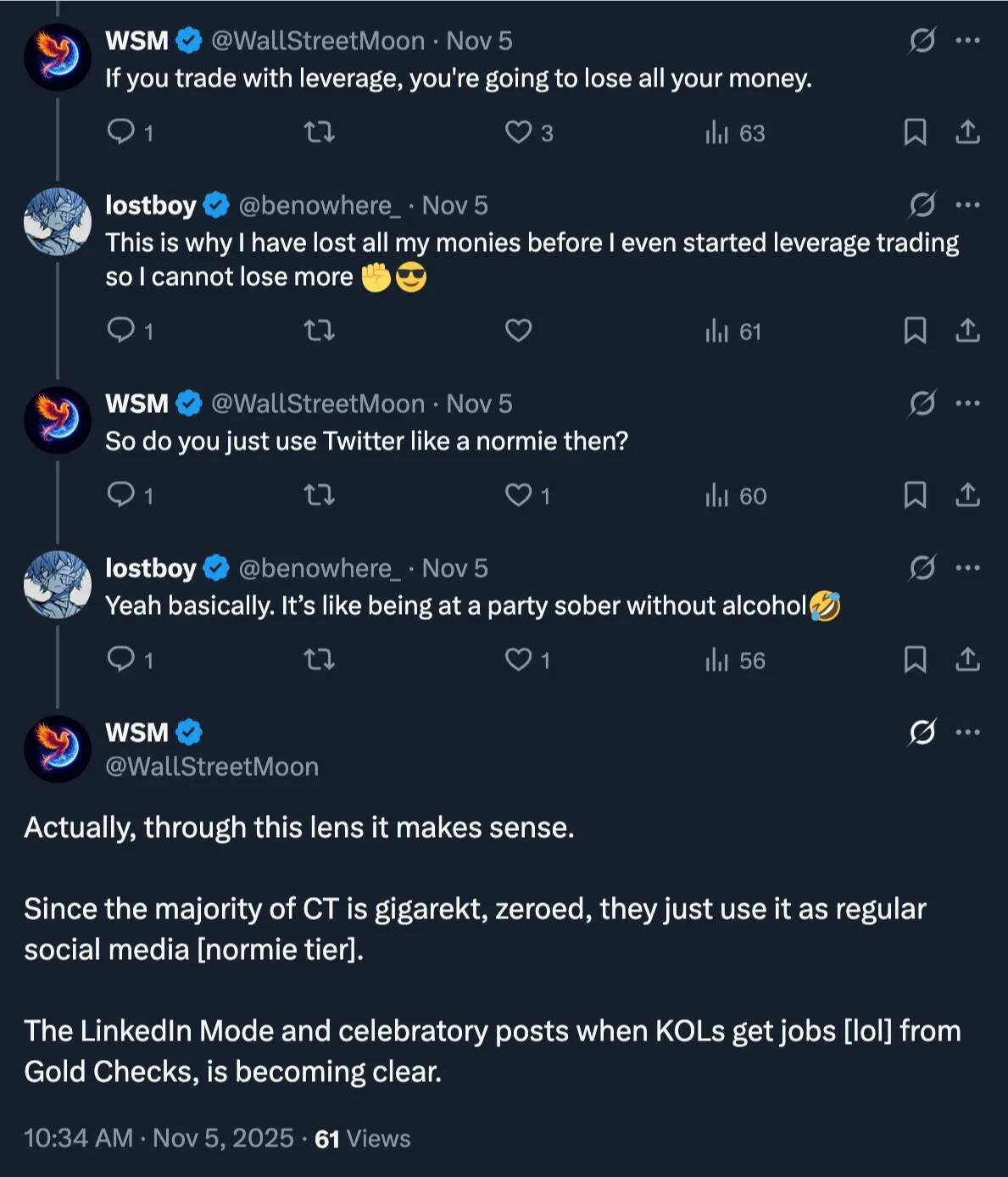

CryptoTwitter has now become like LinkedIn, and the reason is quite simple—all the high-quality content has been "siphoned away," leaving only concentrated "exit liquidity" and speculators everywhere.

People fight tooth and nail for scraps, which is why "timeline trading" has become a new trend.

Even "vicarious trading" has become a phenomenon—you lose so much money that you can only watch others trade, like watching a streamer play a game instead of playing yourself.

When even the leftovers were gone, people began to devour each other.

This round of the rugpull is exceptionally fierce because there is no more surplus value to be extracted from the market. Those excuses and "meta-narratives" have long since vanished. Now, attempting to package crime as "cool" is merely a result of the further contraction of the Pareto base distribution after market efficiency has improved.

Imagine it's 2025. Which truly successful and already "made enough" rich person would sit on Twitter and waste their competitive advantage, teaching you how to beat them?

Use your brain.

No one will teach you how to kill them. Never.

In fact, I recently had an epiphany while chatting with some users (in no particular order):

I never believe self-deprecating jokes. You should always believe in yourself:

@AzFlin [post deleted] wrote a retrospective about all the "smart people" who got "fleeced" on StreamFinance. It's a joke to me:

A donkey is licking a conman's feet.

When I say that BNB is a “sub-asset” of Ethereum, this is true:

- BNB : Originally an ERC20 token based on Ethereum.

- BSC (Binance Smart Chain): is a fork of Ethereum (Geth).

- PancakeSwap : A forked version of Uniswap.

- OPBNB : A fork of OPStack, which is based on Ethereum.

By 2025, people will no longer be able to afford the "suicidal" goal of owning 21 bitcoins. Indeed, this minimum threshold—21 bitcoins—has always been the standard for entering the "million-biter club."

Satoshi Nakamoto would probably be rolling around in his grave in anger:

It completely shocked the people in the trenches .

Here are some of my personal thoughts on the state of the crypto industry in 2025:

Some of us naively thought we were changing the world when we first entered the crypto space in 2017. By 2019 and with DeFiSummer, we had matured and our sole objective was to crush the enemy .

Cryptocurrency is an extreme PVP (player versus player) game: it is a negative-sum game, not a zero-sum game.

Meanwhile, the middlemen sit back and enjoy the ride, watching with glee as traders battle it out in the arena. They bear zero risk yet reap all the profits, watching you get wiped out. Even worse, they provide referral links, leading more victims to the "liquidation graveyard™" and generating unlimited profits for themselves. There's a reason why almost all exchange founders have become billionaires.

They outperformed everyone else because they were among the early adopters—some even holding positions at multiple levels of the wealth ladder. They were virtually incapable of failure.

The ladder to wealth:

- CEX (Centralized Exchange) Founder

- Layer1 Blockchain Founder

- Founders of various projects

- Early adopters

- Top elite traders

- Those who lagged behind [were liquidated].

- Ordinary traders [get liquidated]

If you use leverage in the crypto market, you will eventually lose all your money.

It's not a question of "whether or not," but rather "when."

The crypto market is too small compared to traditional markets; your opponents are criminal activity and insider trading. And most people are still trading manually, with emotional control like a child. It's utterly insane.

I've never considered myself a "trader" because the proven winning strategy is to buy early and hold , watching my opponents kill each other in the market. How can you possibly outperform an early adopter?

Everything seemed to be going smoothly for the transaction until it suddenly collapsed.

Those who try to "optimize" their Bitcoin and Ethereum holdings through trading (gambling)? There's only one outcome: liquidation .

City of Explosion™

Their "corpses" float on the river, and you can win forever without doing anything.

I'm exhausted from winning; it's torture to have "too much success."

All the "monsters" who dominated the market in previous cycles have already converted their wealth into Bitcoin, Ethereum, and US dollars, and exited the market years ago . They knew the rules of the game. They're no longer here.

And why would they come back? What makes you think they'd tweet for you? Do you have their private phone numbers? Would you hang out with them? Have you met their family and children?

Use your brain.

Once you have enough Bitcoin, Ethereum, and US dollars—your "makeitstack"—there's nothing more to do. You just need to wait patiently as these assets become part of your net worth.

What else can you sell them for? You've reached the end of the game.

Imagine never having to look at price charts again – wouldn't that be wonderful?

Most of the "monsters" still in the market today were born in the fires of 2017. They are almost all founders, or later became founders. That's why they're still here. And all of this is inseparable from Ethereum—their initial capital was raised on Ethereum through ICOs (Initial Coin Offerings).

Ethereum has brought more adoption to the crypto space than any other cryptocurrency. Everything you see in the crypto market today stems from Ethereum's research and development (R&D), which has driven adoption and growth across the entire crypto industry.

Did you enter the crypto market because of Bitcoin, or because of other narratives stemming from the development of Ethereum? Most people actually belong to the latter.

Ethereum is the DeFi lab for the entire crypto market. Even Solana and other projects have benefited greatly: they witnessed the success of the Ethereum mainnet, learned what could be improved, underwent real-world market testing, and then launched their own technologies to try and solve those bottlenecks. I will discuss in another article why "better technology" has no impact on price.

I don't even need to mention Ethereum's price performance, because you'll blush when you hear it: a 16,666-fold increase since the ICO.

Ethereum didn't perform poorly; the real problem is you, because you were late.

As an ordinary person, under normal market conditions, you have countless opportunities to buy Ethereum for less than $300, $200, or even $100, and you can buy in large quantities. You can certainly put your entire net worth into Ethereum at multiple opportunities. If you don't "believe" in Ethereum, then switch to Bitcoin—the effect is the same, or do what I did and buy both.

Back then, Reddit's "boomfags" were making memes mocking Ethereum for acting like a stablecoin at $300. It traded sideways at that price for a long time. Even after Vitalik (Ethereum's founder) "cured his cancer," Ethereum remained stuck at $300.

How can you let those "veteran newbies" on Reddit beat you?

That's utterly humiliating.

You've been defeated by Reddit!

Reddit has truly defeated us!

Reddit is worse than encrypted Twitter because its like/dislike system encourages emotionally charged "clingy" users to steer the discussion in their favor . And if the bearded moderators themselves are "clingy," they might even ban or delete your comments out of fear.

Yes, I definitely outperformed the "veteran investors" on Reddit. Otherwise, I'd be rambling incoherently myself, right? I don't reveal my strengths to strangers online, but I always try to help those close to me while keeping my own trading journal. You should do the same. Money is the most powerful tool to solve all your immediate problems.

I'm going to show you a landmark deal, one that may never happen again in my lifetime. I think it was a perfect combination of timing, location, and people. Too many people, because of their pride, are unwilling to admit that luck is also a crucial factor in success.

But I prefer luck to relying on technology. It's always the same. Who would pray the market gets harder?

"Oh, if this market were a little tougher, I could brag about how great my skills are on encrypted Twitter."

That's enough.

Buy the dip during the March 2020 pandemic-induced market crash.

During the market crash triggered by the COVID-19 pandemic in March 2020, I decisively bought at the bottom, while panic was rampant on encrypted Twitter. I had known about the outbreak in Wuhan for some time ( spending so much time online was definitely helpful ) and had prepared in advance. The worst-case scenario was simply that I had stockpiled a bunch of canned goods and had to pay some interest.

When opportunity knocks, it's honestly quite frightening. This is the biggest "nuclear explosion" I've ever seen in the crypto market. But so what? I'm still young; even if I fail, I can start over. After all, humanity has survived far worse disasters.

So I went all in: $4,000 for Bitcoin, $100 for Ethereum, and invested all the remaining fiat currency and stablecoins I had.

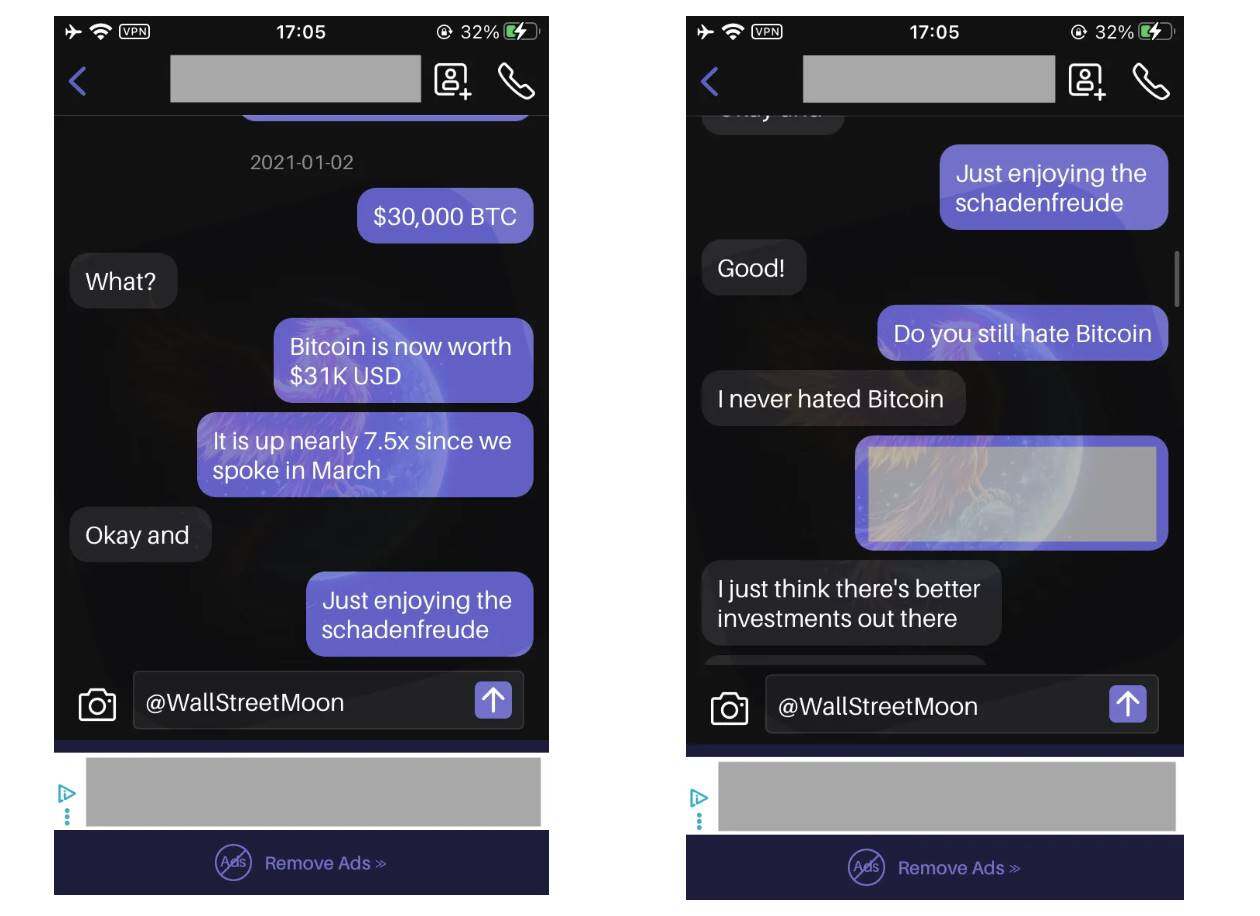

I also tried to persuade a "friend" to be more rational and seize the opportunity to enter the market, but she was arrogant. I don't blame her, given the high level of uncertainty at the time. However, later, I did offer a slightly sarcastic remark:

"A better investment? Where? Show it to me."

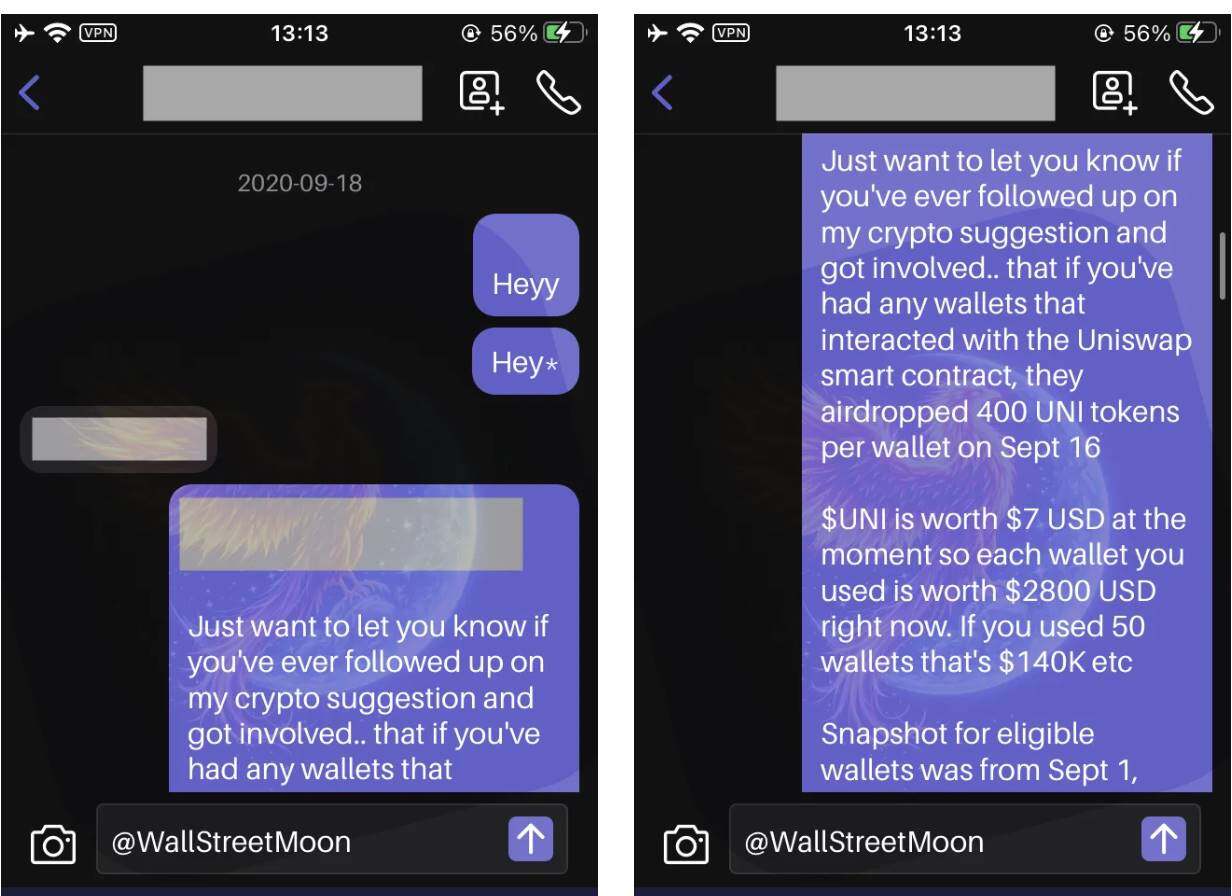

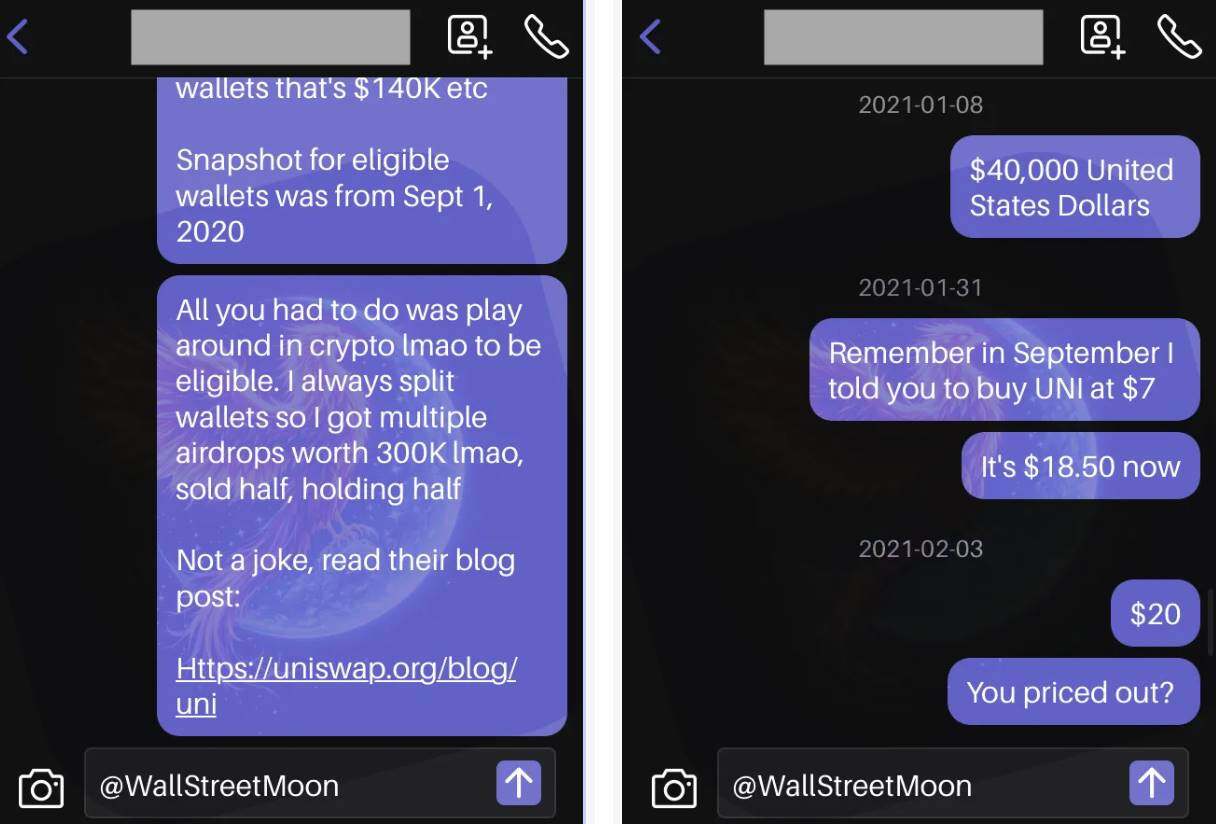

During DeFi Summer, I told my friends that they would regret it for the rest of their lives if they missed this opportunity because the market wouldn't repeat those prices. Once the newbies realized it, the opportunity was over.

At that time, even veteran crypto players from the previous bull market were struggling with post-traumatic stress disorder (PTSD) from the 2018 bear market (including myself). They simply couldn't have any hope for the future.

I left it at that—you can bring people to the door, but only they themselves can take that step. As a friend, I hope those I care about succeed. This isn't just empty talk; money is the most powerful comfort in solving real-world problems . I disagree with other viewpoints because I've stood on both sides of this path.

A 7-figure Uniswap airdrop

Okay, actually it wasn't really seven figures; the airdrop was only worth about $300,000 at the time. But by holding onto those airdrops and adding to my position with profits from other trades, I eventually grew it to seven figures.

Initially, I cut my losses by selling half of my airdrop because I doubted Hayden Adams (the founder of Uniswap). But later, after doing my own research and doing the math, I had confidence in the market and was convinced it would punish those who treated the Uniswap airdrop as "free money." Not so many "fools" would escape the market's wrath. The Pareto principle will prevail.

If you understand what I mean by "you sold your airdrop and bought a PS5," then we're in the same boat (Twitter isn't my home). Those who didn't believe me and drove $UNI down to such a low price are pathetic and don't deserve to own it!

If you had held $UNI until today, each wallet would have earned a whopping $3,000 (at the current time). Not bad, right?

Yes, in the past we would manually analyze token economic models and make rational investment decisions, instead of blindly following trends and chasing recommendations from celebrities or KOLs on Twitter timelines as we do now.

The sourness and odor were practically overflowing from the screen.

Have you been squeezed out of the market by price?

...And I've only just begun.

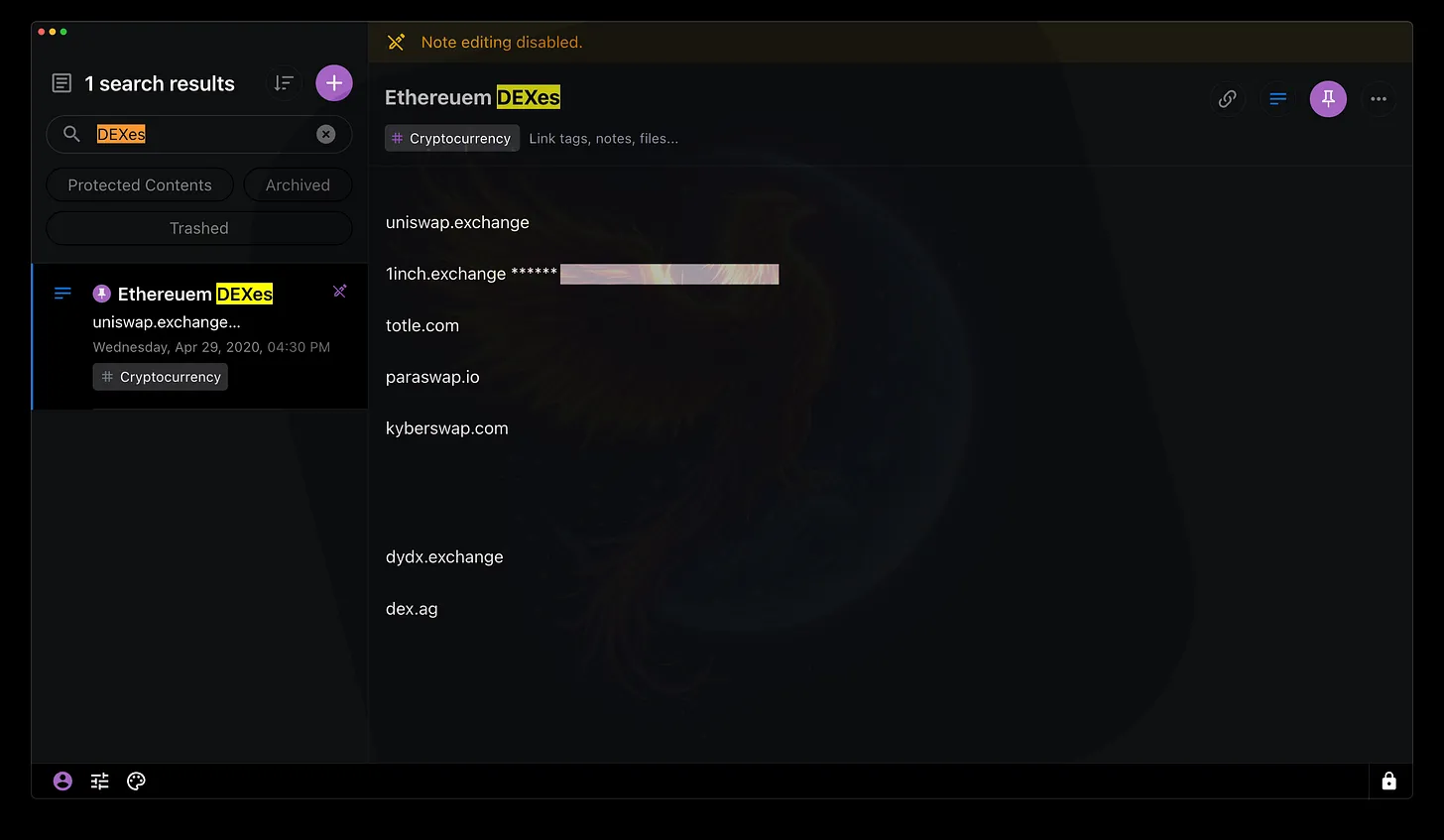

1-inch airdrop

If you participated in the DeFi Summer, you could easily have received a 1inch airdrop. Under certain conditions, you might even have found that 1inch outperformed Uniswap.

They didn't just send out one airdrop, they sent out two! And the announcement of the first airdrop was even on Christmas Day. As an adult, the joy of receiving a generous airdrop on Christmas Day is simply off the charts.

Although it's been a long time, I can't remember the other decentralized exchanges (DEXs) I participated in back then, but without a doubt, Uniswap and 1inch were among the best.

Now that it's 2025, if I were to recommend a DEX, I would only choose the following:

- Uniswap

- 1 inch

- Matcha

- Cow (a newer platform, use with caution)

There may be better options, but I always prefer "established" projects because I value safety more than risking getting "beaten up".

Beware of "fresh and eye-catching" things

I see far too many people on my Twitter timeline excitedly testing all sorts of new protocols and applications, like "guinea pigs." All I want to say is: don't do that.

I once suffered significant losses while testing limit orders on a DEX. At the time, these features were still in the testing phase, and on-chain limit orders were simply unreliable. You had to monitor them personally or use questionable bots, which required you to hand over your private key access. For me, that was simply impossible.

At the time, I was testing a platform called VeloxGlobal . I just wanted to get a good night's sleep, guys. I was spending 16 to 18 hours a day researching, I was exhausted. I just wanted orders to execute automatically while I slept. And what happened? Well, some routing errors occurred.

Matcha's limit order feature is terrible, but at least it just fails and doesn't execute, which is better than Velox directly "donating" your funds.

The only Ethereum wallet I trust in 2025

- MetaMask

- Rabby

I have more confidence in the security of MetaMask's core code, while Rabby focuses more on the security of user interaction. Both have their advantages and are excellent.

I often see people complaining about MetaMask on Twitter, but these criticisms have absolutely nothing to do with security. If you're going to bring up Infura's data tracking issues (it wasn't discovered until 2022? LOL), you would have known long ago if you had just been monitoring outbound connections with a firewall, and you could have easily changed the RPC.

What is the relationship between MetaMask airdrops and security?

Also, some of you may not even know that MetaMask has a blue logo.

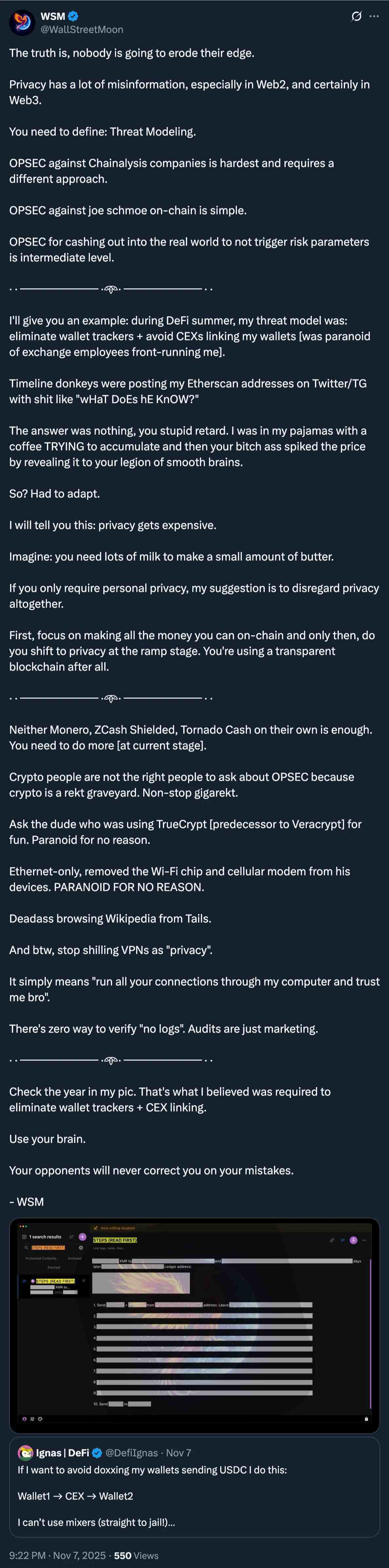

Operational safety (OPSEC) is a completely different field, and perhaps I should write a separate article to explore it.

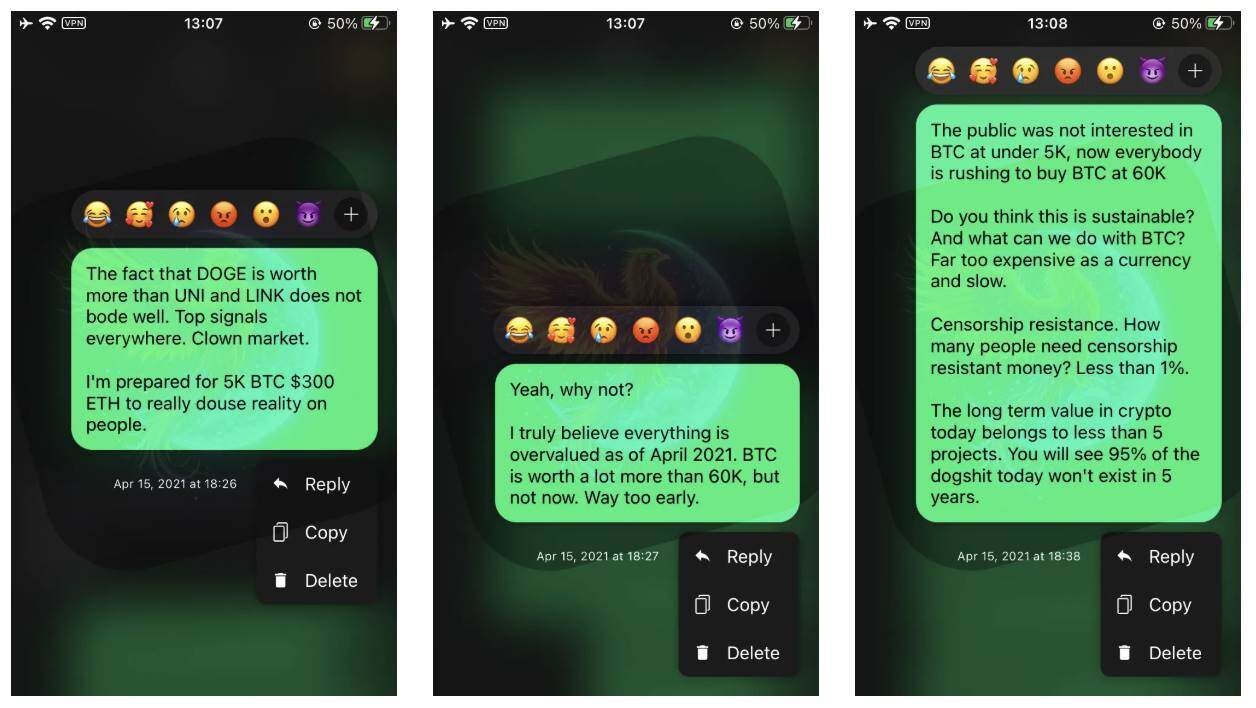

Top-selling in April 2021

April 2021 marked the peak of that year's bull market cycle after a risk adjustment. If you held on until November 2021, you would have ultimately been "harvested" by the market. Bitcoin subsequently plummeted by approximately 53%, barely managing to reach a weak new high, while the vast majority of altcoins went virtually to zero. You should have switched to stablecoins back in April 2021.

Those KOLs (Key Opinion Leaders) who kept touting "Bitcoin will break $100,000 by the end of 2021"? Unfollow them immediately! This is what I call "donkey consensus." The cryptocurrency market is a zero-sum game; the Pareto Principle dictates that it's impossible for everyone to profit together.

Some "friends" I hadn't contacted in a long time suddenly reappeared in April 2021, at the absolute peak of the bull market, asking me if I should enter the market. I frankly told them not to touch it, that the market was severely overvalued, and that waiting for the "nuclear explosion" was the wise choice.

I predicted the top before GCR (a well-known crypto trader), not to say that I'm better than him (after all, I'm not a trader), but to illustrate that too many people rely on getting "inside information" (alpha) from others instead of trusting their own judgment.

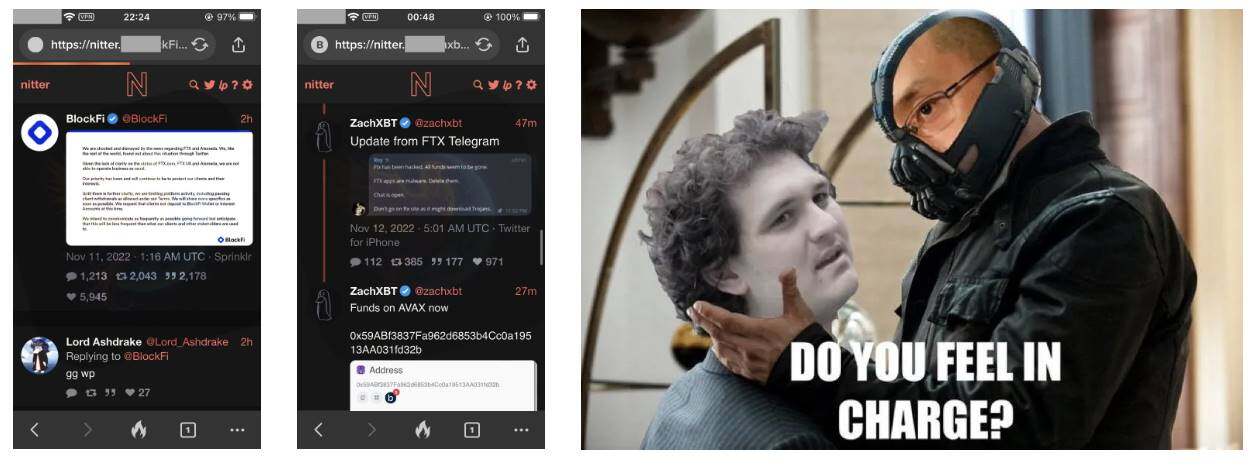

The ensuing market massacre

The Pareto principle begins to reap the "corpses":

I awakened my "Sharingan" after the 2018 bear market; the market's illusions could no longer fool me. I've aligned myself with the Pareto principle and haven't lost a single day since 2020. In the cryptocurrency world, everything is merely a tool to acquire more Bitcoin, Ethereum, and US dollars (BTC, ETH, USD) .

If you're still promoting the concept of "community" in 2025, you're destined to be hammered by the market. So-called communities are nothing more than adhesives binding together those who are willing to take over losses.

Those who actually profit won't tell you (why would they?), but the sheer schadenfreude you feel when everyone else is wiped out by the market and you're the sole survivor is indescribable. We're all playing the same game, using the same tools, but ultimately only a few survive. That's the nature of the cryptocurrency market as a zero-sum game, a fact your so-called "community" deliberately ignores. Where do you think the money comes from?

You are in a video game where the "holy trinity" of Bitcoin, Ethereum, and the US dollar is the final "graduation gear".

Imagine Pareto as a "god of trickery" sitting at the top. When Pareto discovers that too many "donkeys" are profiting in the market, he triggers a massive liquidation event to reset the market structure.

- Mt.Gox

- Bitconnect

- OneCoin

- Luna

- FTX

- Cross-chain bridge vulnerability

- Centralized exchanges (CEXs) hacked

- Various scams

- Project developers absconded (Rugpulls)

Regardless of the method used, Pareto will incorporate these events into the simulation. Even extreme events like "splitting the sky" are not impossible.

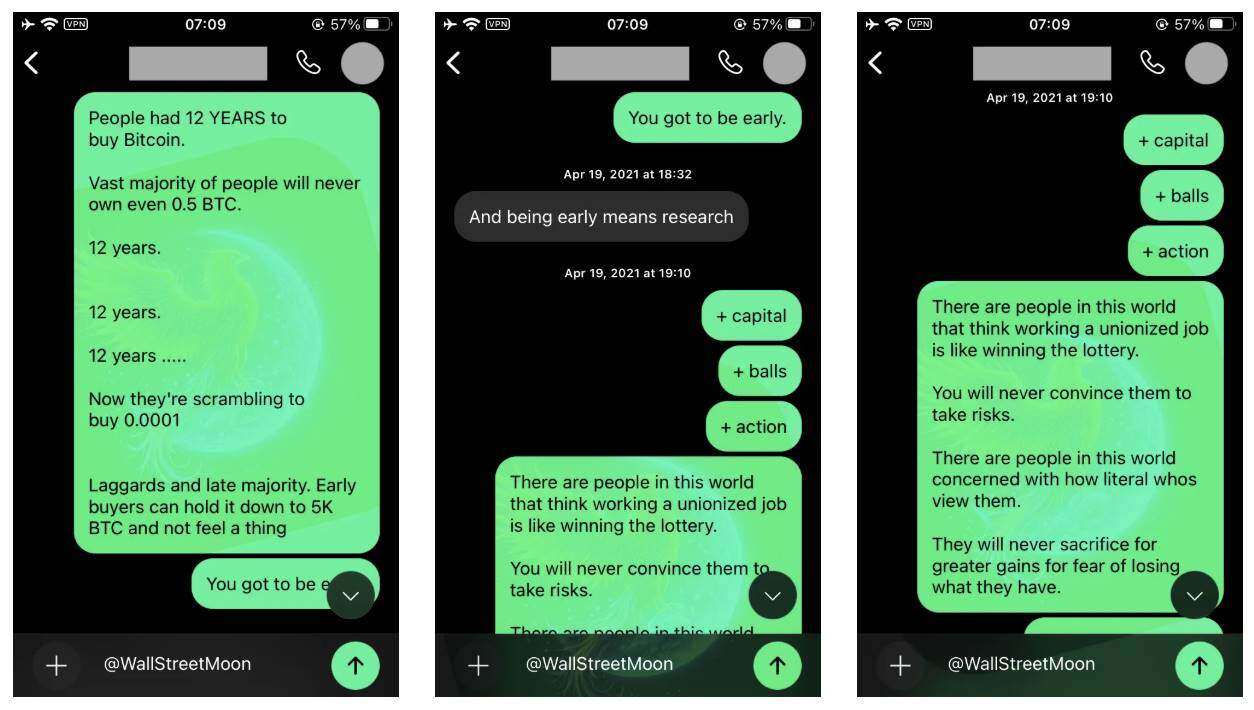

"The latecomers and the majority. Early buyers can easily hold up Bitcoin at $5,000 without any fluctuation."

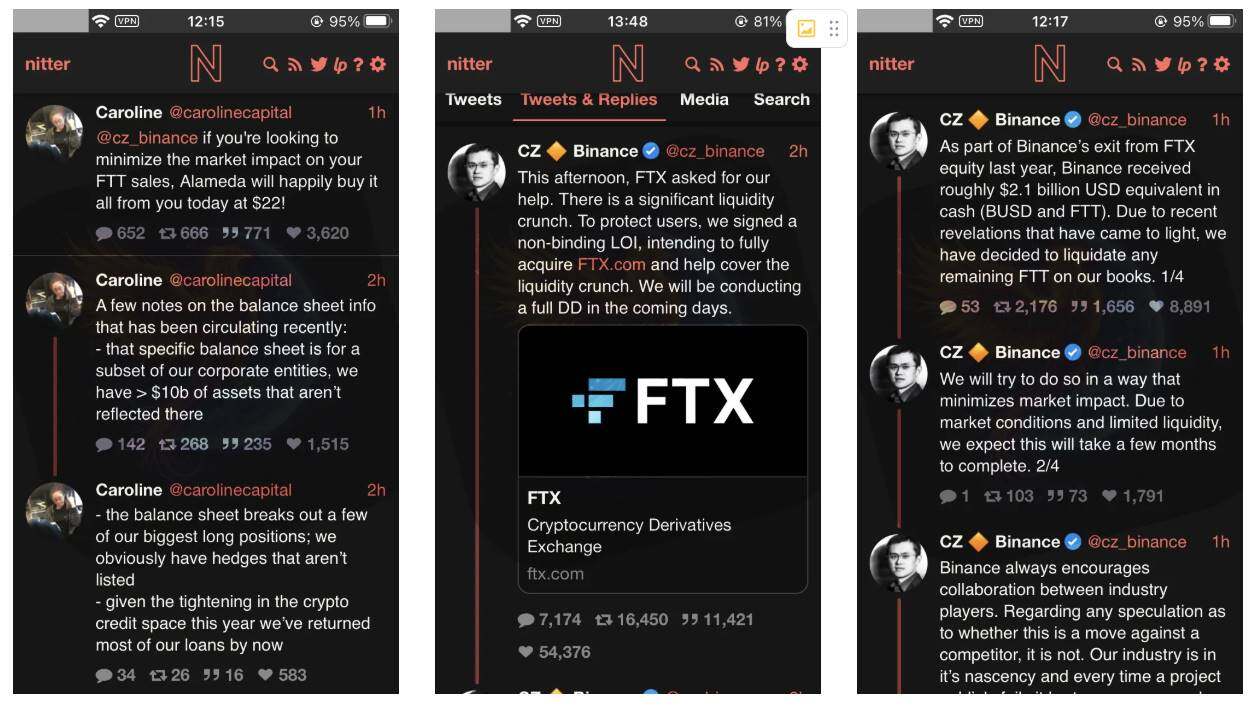

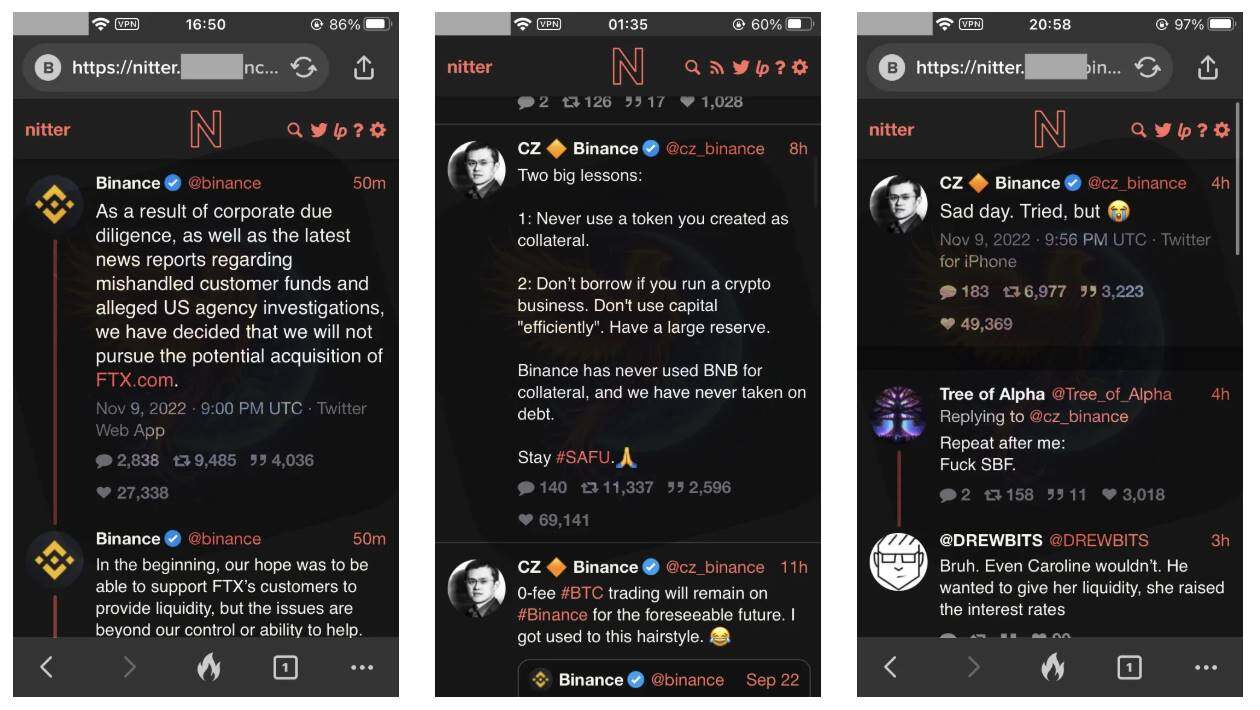

Why choose to buy the dip when FTX crashed?

There's a reason why I chose to buy the dip when FTX crashed in November 2022, rather than when Luna crashed.

Simply put, DoKwon (the founder of Luna) didn't have the market influence he thought he did. Luna's collapse didn't have a significant enough impact on Bitcoin's price. Luna's "contagion effect" didn't even manage to pull Bitcoin's price down to July 2021 levels—it was a minor incident.

However, I sympathize with everyone affected by Luna, and even publicly address the KOLs who pushed this issue:

There's no so-called "secret formula" here. I don't do technical analysis (TA) because I think it's just "a man's version of astrology." So what's my secret? It's simple: I only look at historical cycles. Based on past bear market performance, Bitcoin typically falls by more than 80% from its all-time high (ATH).

Therefore, starting from approximately $69,000 in November 2021 or approximately $64,000 in April 2021, I derived a target range for re-entry: $10,000 to $14,000.

Anyone who tells you they know the "exact bottom" is lying (LYINNNNNGGGGGGG)! No one can perfectly catch the absolute top and absolute bottom. That's why I use "ranges" as a reference, and I build positions in batches within those ranges ("feathering" the range).

No, it's not risky. We live in a simulation, and I believe in the Pareto Principle. Furthermore, the only data we can refer to is historical data. Pareto will reward its "children"—Bitcoin, Ethereum, and the US dollar—after weeding out the "small fish" in the market.

Believe it or not, but if you don't believe it, you'll be left behind.

Although I only recently started tweeting, I've been quietly reading all along. Looking back at my earliest tweets, my purpose was clear: I use Twitter to gauge market sentiment, not to acquire knowledge. Information is free; you should do your own research, not rely on others to filter information for you. They might be wrong, or worse, they might be deliberately misleading you for some purpose.

The interface mentioned below is called Nitter , a localized third-party Twitter client that was still usable before Elon Musk shut down the Twitter API. A few servers may still be running today, but they are extremely unstable, so by 2025, you'll essentially be forced to use native Twitter.

I couldn't sleep. I was incredibly excited all night, my eyes glued to the screen, constantly monitoring price fluctuations. I'd been waiting for this moment for over a year and a half. I had to stay awake to ensure I could successfully reinvest all my funds back into Bitcoin and Ethereum.

To be honest, I was even secretly praying that another North Korean hack would come along and drive the price down to below $10,000.

Sorry, guys.

At that time, Bitcoin's price hadn't quite fallen into my target range ($10,000-$14,000). But many people made a mistake here: they gambled everything on a "target number" they arbitrarily set in their minds. However, the market doesn't care about you, and it certainly won't operate according to your expectations. There's no guarantee that Bitcoin will crash like in previous cycles. I see this as a Pareto principle test for market participants, weeding out those who are "unworthy."

When CZ (Changpeng Zhao) "ended" SBF (Sam Bankman-Fried, founder of FTX), I thought to myself, if this isn't the bottom of the market, then what is? So I had to set aside my biases and conclude that this was the best time for me to re-enter the market.

In the long run, is there really such a big difference between a $15,000 Bitcoin and a $10,000 Bitcoin? Of course, the difference seems significant in terms of numbers, but in reality, it won't have a decisive impact on your life.

Looking back now, the FTX crash actually marked the market bottom, which was purely a matter of luck. I never tried to "target" this event. After all, who can know which specific event will become the turning point? The only thing I know is that the chain reaction of the Luna crash was not enough to create enough market panic; Pareto needed more "sacrifices," and the collapse of FTX just happened to be the catalyst for that "purge."

Three classic trades

So what actually happened? Here are what I consider to be the three most significant "holy trinity" trades in the crypto market:

- Buy the dip during the COVID-19 crash .

- Sell at the bull market high in April 2021 .

- Buy back in when FTX crashed .

This is the endgame. These might be the three most profitable trades of my life, and all I had to do was act ahead of time and then do nothing. Really, just patience.

So what should I do next in my life? The answer is: do nothing.

I want you to understand that the content posted by KOLs (Key Opinion Leaders) and "experts" on Twitter is mostly garbage. Why are they still on Twitter? Because they are almost all "LARP" (LiveActionRolePlayers), they haven't truly "successful." They still need to sell you something: courses, paid groups, shitcoins, referral links. They need you to be their exit liquidity.

Believe in yourself. Once you've made your money, live your own life. Social media is a cancer; it infects your mind.

Remember, there are only two types of people who have a legitimate reason to be on CryptoTwitter: founders and brands .

"A God-like Deal": Yet another seven-figure story

To illustrate the concept of "planning ahead and being patient" more clearly, let me share another story. However, this time I won't take credit for it, because I personally would never have been able to buy into this project. I "gifted" all the profits this time, because spiritually speaking (laughs), I don't consider it mine. But even so, I still received a seven-figure return.

I won't go into any personal details here, because it's neither important nor something you need to know. I simply want to support her journey. Seeing her passion for AxieInfinity warms my heart.

When I mention AxieInfinity , I'm referring to 2020, before the $AXS token and the Ronin network existed. AxieInfinity was still running on the Ethereum Mainnet, and there wasn't the phenomenon of millions of Filipino players flooding Discord and pushing every possible feature to its limits. There were also no "ambassadors" back then, unlike today where they dominate timelines.

The early player base consisted mostly of ordinary people with no profit motive. They participated because they genuinely loved the community, the friends, and the game itself. In AxieInfinity's Adventure Mode, you could farm $SLP infinitely, as it was practically worthless at the time. AxieInfinity was still relatively unknown back then.

You could build a super-strong team for just $100, because the cheapest Axie at the time only cost around $2. Some players couldn't even afford the cost of breeding Axies because Ethereum's mainnet gas fees were too high. And I was fully capable of single-handedly "disrupting" the entire economic system. This isn't bragging, just trying to recreate the atmosphere of the early days of AxieInfinity.

There were some truly outstanding individuals in the community back then; from what I've seen so far, it was a vibrant and passionate group. This reminds me of the early days of cryptocurrency in 2017. I sincerely hope that everyone involved is doing well.

You were very kind to her and patiently answered all her "naive questions" (she even pretended to be a boy to avoid seeming strange).

To be honest, I initially just wanted her to have something to do through crypto games so I could focus on "real cryptocurrency" (laughs). It wasn't supposed to be a serious investment. Ironically, the single-transaction return (%) of this deal actually outperformed mine in the 2021 cycle (although the absolute return wasn't).

What she had no idea was that I had bought a significant amount of $AXS for a few cents. Why? I simply wanted to give it to her later as a sign of my support. I never imagined $AXS would exceed $5, let alone reach an all-time high of $164.90 (ATH). I had read its tokenomics white paper and did not agree with its value proposition.

This is another important investment rule: only act within your circle of competence . That's why I avoided "meme coins" and NFTs, because I neither understood them nor their community culture.

After I transferred $AXS to Binance (the most liquid exchange), I completely forgot about it. I'm not exaggerating to tell a story or show off. The reason $AXS was able to reach such a high price was entirely due to my forced "HODL" (Hold-on-Demand) holding. If I remember correctly, I probably would have sold it back in April 2021.

You might ask, "How could I forget about my investments?"

When the market is booming, money starts to lose its meaning, becoming nothing more than a series of numerical fractions. Add to that my use of multiple wallet applications, centralized exchanges (CEXs), decentralized protocols, hardware wallets, accounts, hundreds of addresses, and various security keys, emails, notes, laptops, desktops, and mobile phones… and it's incredibly easy to forget things. I probably even have at least one Bitcoin scattered somewhere (laughs).

This investment in $AXS was an unexpected stroke of luck from the start, but it turned out to be a winning proposition. It's not just a dramatic story about investing, but also a lesson in patience, the circle of competence, and the power of chance.

By December 2021, I was hearing about the AxieInfinity craze in the mainstream news. The so-called "scholarship program" was still being heavily promoted (laughs), and the whole market was going crazy. So I decided to look into it further and check out the price of $AXS.

My God, what the hell?

This reminds me of my initial purchase.

It's worth noting that I exited the market back in April 2021. At that point, I was simply using Bitcoin's price as a bellwether, constantly monitoring the market for the right time to re-enter.

I immediately called her and told her to come see me as soon as possible, because she was now a multimillionaire . Of course, she initially thought I was joking. So, I recorded a screen recording and sent it to her, showing all the buy records line by line, as well as the current market price of $AXS on CoinGecko and CoinMarketCap.

That day was incredibly exciting.

Next, I'll omit some details because this is a private video, and I don't care about proving anything to strangers online. Some people, having lost so much, can't accept that someone else achieved a 546x all-time high (ATH) return on $AXS, even after the pullback, still yielding approximately 320x, so they choose to comfort themselves by calling it "LARP" (Live Action Role Play). But you're just too late. In the cryptocurrency world, some have achieved 10,000x returns.

From a probabilistic point of view, please consider the following points:

- This is a screen recording , not a screenshot.

- People only record or take screenshots when it's something they'd drool over.

- If this is fake, I need a perfect replica of Binance's user interface from 2021 .

- I also need to perfectly replicate the user interface of CoinGecko from 2021 .

- Similarly, I had to perfectly replicate the 2021 CoinMarketCap user interface .

- No one will record the screen line by line unless it's to show someone their earnings.

- This video does not exist anywhere on the internet.

- If this is fake, then I have to keep this video for four whole years, just to show it to strangers on the internet four years later.

- You can also see the Calculator app on macOS, which displays a seven-figure amount by copying and pasting.

- Use your brain to think about it. Jealousy will only make things worse, and the facts are right in front of you.

Wisdom proverbs

I haven't even mentioned those other wildly successful investments. I've been involved in some projects you've never heard of, but I'm not going to reveal my expertise to strangers online. However, there's a general blueprint behind all my actions, which can be summarized as follows:

What is the true revelation?

- Everyone's talking nonsense. The only "Alpha" you need is yourself.

- Traders are afraid of early entrants because the advantages of being an early entrant are unbelievably large.

- Do nothing. Just sit back, popcorn, and watch the newbies get shaken out by the market fluctuations. The Pareto Principle will automatically tip the scales in your favor.

- Stop waiting for someone to feed you.

- Breaking even (protecting your principal) is a major victory.

- Always remember to consolidate your assets into the "divine trinity": Bitcoin, Ethereum, and the US dollar, to protect your wealth. If you don't, you will lose all your money.

The above advice only applies if the assets you buy are reasonably decent. If you buy a "donkeyshitter," you will lose all your money.

All of this sounds simple in theory, but it's very difficult in practice, I understand.

"Just get in early, bro."

"Just find the best projects, bro."

"Just buy 21 bitcoins, bro."

As I said, Twitter is not my home turf.

You buy "shitcoins" so you can sell them off.

And me? I don't want you to own anything at all. I want you to be completely excluded from market prices, so that when prices rise, you can only regret and resent it forever.

To succeed, you need the spirit of a warrior—to eliminate the "coward" within yourself. Those "donkeys" you waste time befriending online are not your friends.

Think about those who truly depend on your success. You don't have the luxury of rest. Stop giving your money to the market.

One investment argument I've repeatedly validated is this: if I've reached the point where I should buy a certain coin or token, then there will inevitably be others in the world who will eventually reach the same conclusion and buy after me. But I'm one step ahead of them. These people become my free promoters. They'll help me spread the word (as they always do). That's why I never need to promote any tickers; the market does it all automatically. The Pareto Principle will allow me to win this simulation.

It was quite comical when the groups that actually manipulated the market (pump and dump), or what crypto Twitter (CT) likes to call the "cabals," started accumulating tokens from projects I already held in "godpositions." They ultimately became my exit liquidity. You can't punish an early entrant because their purchase price was far below your cost.

Fatal Blow

Killshot.

Yes, I have to avoid wallet trackers and the connections between centralized exchanges (CEXs) and decentralized exchanges (DEXs). I have always been a strong advocate for financial privacy, especially for Monero, which I have supported through donations over the years.

However, do not invest in privacy coins; use them only as tools. They are a very poor investment choice.

Take control of the situation

When I say "early," I mean very early. Some teams make mistakes, and I won't teach you those, but those mistakes give me the opportunity to force them to the negotiating table. Airswap is a great tool for achieving this, and of course, there are other strategies as well.

“You’ve made me too powerful. Let’s talk about a fair over-the-counter (OTC) price. Otherwise, I’ll send your price chart into the Shadowlands.”

Before anyone rushes to comment, no, this isn't "illegal." Putting pressure on the team is perfectly legal. It's an open market with extremely fierce competition. During the DeFi Summer (decentralized finance boom), many unknown projects directly "thrown their tokens into the void," meaning they deposited most of their tokens into UniswapV2 liquidity pools and then hoped for a market reaction. That was their marketing strategy. Another approach was through centralized exchanges with lower liquidity.

CryptoTwitter was too busy pandering to so-called "key opinion leaders" (KOLs) to capitalize on these golden opportunities. By 2025, they're still sucking up to these KOLs while complaining about why they've never made any money.

Either the team buys back their tokens from me, or I dump those tokens into their UniswapV2 liquidity pool. Don't think I don't plan to clean out those "riffraff" and take the opportunity to accumulate more tokens; in most cases, directly creating an "FSH" (sharp drop) candle is not the optimal strategy. Over-the-counter (OTC) trading is a better option because there is no slippage, making it a win-win situation for both parties. The tools and information I use are no different from others; it's just that I interpret them differently.

To you "donkeys" who are still cheating each other and running away for petty gains in 2025, my feeling is: utter contempt.

You are like the lowest of the low in the coral reef, utterly uncompetitive.

Unable to compete in open markets, you resort to deceiving those who "trust" your supposedly brilliant analysis, trying to convince them that a token called DogCumInuV4 (which you're packaging and marketing) will outperform Bitcoin.

Final Thoughts

This place is no longer what it used to be, so I won't name names. But I spend most of my time elsewhere, which gives me a natural advantage over most crypto Twitter users. In that faraway place, everyone is inherently competitive, rather than obsessed with so-called "muhcommunity," which also motivates you to become a better investor.

We took action, and we took it hard: precise strikes, showing no mercy.

"You can buy my chips at a premium, otherwise you can only console yourself."

Listen, this article is already about 6,300 words long, but I haven't even gotten to the core points yet. If I wanted, I could easily write over 100,000 words on my market arguments, but I doubt only two people would read this far. This is intentionally a long piece—to filter out the "minor issues."

If my views resonate with you, you can follow me on Twitter @WallStreetMoon. I'm currently gathering a small group of token holders for a deep dive into a project, and beyond that, I have absolutely no intention of engaging in any pointless interactions on Twitter. I prefer people who are willing to take the time to seriously explore the content of my posts.

I do almost no marketing because I despise people who need to be spoon-fed. Their indecisiveness is a world apart from that of the 2017/2020 generation. I'm confident we'll be fine without them.

Never reveal your true strength.