Gate Research Institute | In-depth Research on the Oracle Sector: Ecosystem Expansion, Economic Value Capture, and Financial Bridges

- 核心观点:预言机是Web3生态核心信任基础设施。

- 关键要素:

- 总锁仓量突破1021亿美元。

- Chainlink市值占比超87%。

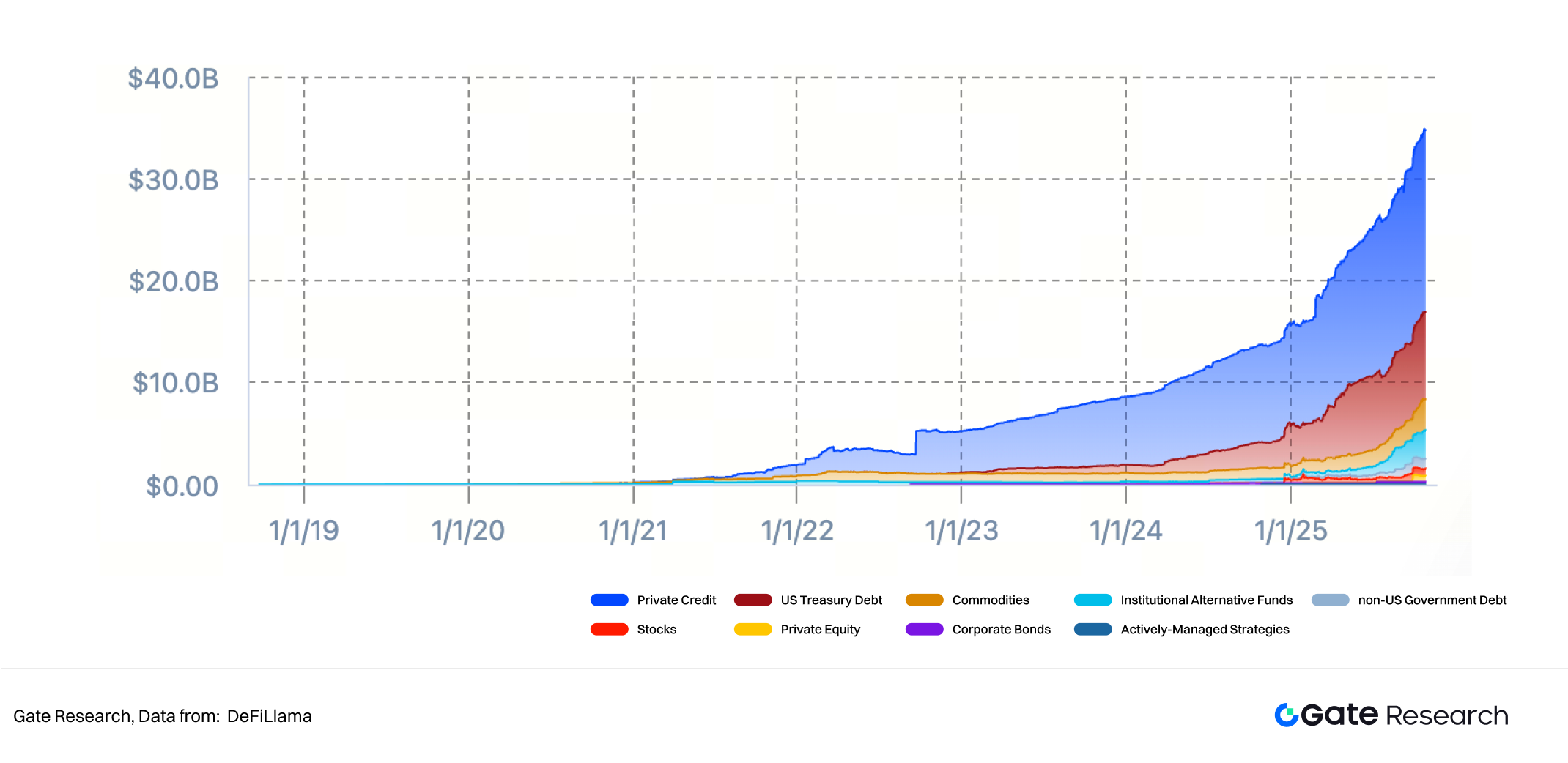

- RWA资产规模超350亿美元。

- 市场影响:推动链上金融与传统金融融合。

- 时效性标注:长期影响

summary

● Oracles are a key infrastructure connecting the blockchain with the real world: they can securely and transparently bring off-chain data (such as prices, events, asset states, etc.) onto the chain, enabling smart contracts to perceive and interact with the real world, and becoming the "trust engine" and "data settlement layer" of the Web3 ecosystem.

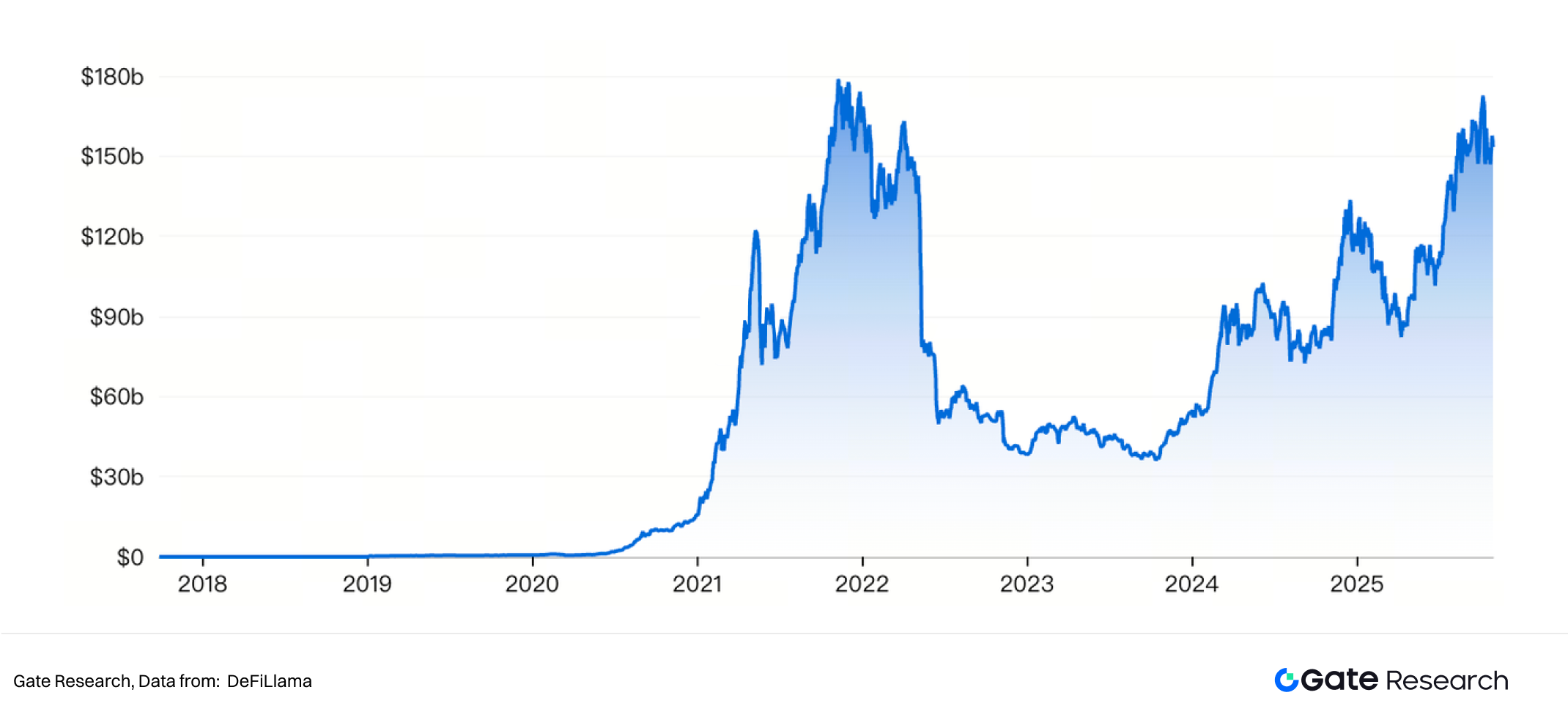

● Market Explosion: Oracles have evolved from the price input layer of DeFi protocols to the underlying trust foundation of the entire Web3 ecosystem. As of October 2025, the total value locked (TVS) in the oracle sector has exceeded $102.1 billion, with a total market capitalization of over $14.1 billion and annual calls reaching hundreds of billions, making it an important component of the on-chain data economy.

● Oligopolistic Structure and Shifting Competitive Focus: The current market has formed an oligopolistic structure dominated by Chainlink (with a market capitalization of over 87% and TVS accounting for 61.58%). The focus of competition is shifting from simply price feed efficiency to service quality, economic model sustainability, and cross-chain communication integration capabilities. Meanwhile, emerging protocols such as Pyth Network and RedStone are rapidly rising in low-latency and high-frequency data scenarios, forming differentiated competitive advantages.

● DeFi, RWA, and institutional adoption are becoming core drivers: the growth of oracles has formed a "multiplier effect." DeFi (total TVL of approximately $168.3 billion) remains the primary native battleground; RWA (asset size exceeding $35 billion) is becoming the institutional growth engine with the greatest incremental potential; while emerging applications such as cross-chain communication (CCIP), prediction markets, and AI + Oracle constitute the second growth curve for the future.

● Value Capture Model Transformation: From Call Volume Driven to Service Staking Model. The industry is shifting from an early revenue structure reliant on call volume to an economic cycle centered on node staking, security budgets, and service fees. This model provides oracle tokens with long-term sustainable value support and establishes their macro-financial status as a "decentralized trust layer."

● Future Valuation Anchor: The long-term value of oracle tokens (such as LINK) is increasingly determined by protocol revenue, TVS growth quality, and staking ratio. Valuation logic is shifting from "narrative-driven" to fundamental indicators such as MCap/TVS. Current estimates suggest a long-term reasonable valuation range for LINK of $26–$35; the introduction of a Smart Value Recovery (SVR) mechanism could amplify the overall valuation by approximately 1.2–1.5 times, potentially reaching $40–$45.

● Macro-financial connectivity and the emergence of the "information rate": Oracles are becoming a key hub connecting real-world finance and on-chain finance. By synchronizing macro-data such as bond yields, exchange rates, and interest rate curves in real time, and exploring CCIP settlement paths with institutions such as SWIFT and Visa, oracles are driving the digitalization of real-world finance and giving rise to a new data-centric revenue concept—the information rate.

Keywords: Gate Research, Oracle, Chainlink, Pyth Network

1. Introduction

In the closed system of a blockchain, smart contracts ensure the determinism of the computation process and consensus on the results, but they cannot actively access off-chain information. This design guarantees the system's security, but it also brings inherent limitations—the on-chain world cannot directly "understand" changes in the real world, such as asset price fluctuations, weather events, or payment status. Oracles are a key infrastructure that emerged in this context: they are trusted transmission layers connecting the blockchain and the real world, securely, transparently, and verifiably introducing external uncertain information onto the chain, thereby giving smart contracts the ability to perceive and interact with the real world.

By 2025, the strategic role of oracles had been completely reshaped. They were no longer merely price input layers for DeFi protocols, but rather the "trust engine" and "data settlement layer" of the entire Web3 ecosystem. In an increasingly complex environment of multi-chain parallelism and cross-chain communication, oracles served as the reliable data input for core modules such as DeFi, stablecoins, RWA (Real-World Assets), cross-chain communication, prediction markets, and PayFi. According to data from DefiLlama and CoinGecko, as of October 2025, the overall valuation of the oracle sector exceeded $14.1 billion, the total value locked (TVS) of mainstream decentralized oracles surpassed $100 billion, and the annual call volume reached hundreds of billions, serving thousands of on-chain protocols. Among them, Chainlink remained firmly in a dominant position in the industry, while emerging projects such as Pyth, UMA, and RedStone continued to innovate and make breakthroughs in low-latency data distribution, privacy computing, and "decentralized publishing networks."

Figure 1: Market Value of the Oracle Sector

From an ecosystem perspective, oracles are the underlying engine driving the expansion of on-chain applications and the foundational connection layer for DeFi, RWA, and the emerging data economy. From an economic model perspective, oracle token value capture is undergoing a structural transformation—transitioning from early "gas-type revenue" relying on call volume to a "service staking model" centered on staking security and the service economy. From a macro-financial perspective, the role of oracles is evolving from a "data relay layer" to a "decentralized trust layer," becoming a key fulcrum for the integration of digitalization and crypto-finance in the existing financial system. It provides traditional financial institutions (TradFi) with a verifiable, compliant, and secure mechanism for putting assets and data on-chain, reshaping the trust logic of global financial infrastructure. Therefore, this report will systematically reveal the inherent logic and value evolution path of the oracle sector from three mutually supportive dimensions:

1. Ecosystem Demand Perspective: Analyzing how DeFi, RWA, prediction markets, and AI scenarios drive the continued growth of oracles;

2. Economic Model Perspective: Analyzing how oracles form a value capture mechanism through data consumption, node staking, and token circulation;

3. Macro-financial perspective: Exploring the opportunities and potential risks of oracle expansion under the trend of integration between on-chain finance and traditional finance.

Through this analytical framework, we believe that the long-term value of oracles far exceeds their single function of "price feed" or "cross-chain verification," but lies in their shaping of a new economic layer centered on "verifiable data." Future competition will no longer be about who provides faster data, but about who can become the "trusted source of truth" supporting the operation of trillions of digital assets. In this sense, oracles are not only the data gateway to the Web3 world, but also the ultimate cornerstone of trust for the next generation of financial systems.

2. Oracle Overview: The Trust Engine Connecting On-Chain and the Real World

2.1 Definition and Core Role of Oracles

Blockchain is inherently a deterministic and closed system. To ensure that global nodes reach consensus after executing the same transaction, smart contracts cannot directly access off-chain data (such as prices, weather, IoT information, or enterprise databases). Therefore, smart contracts are "blind" and "deaf" to real-world information, a limitation known as the "oracle problem."

Oracles are a core infrastructure designed to solve this "information silo problem." They are not tools for predicting the future, but rather secure middleware that acts as a "data notary" and "information translator." Their core responsibility is to securely and reliably transmit off-chain, non-deterministic external data, after verification and processing, to the deterministic blockchain environment for use by smart contracts.

Oracles are not only "data input ports," but also the foundational layer and trust engine for the on-chain economy. Through a trustworthy mechanism, they map the uncertainties of the real world into verifiable states on the chain, thereby greatly expanding the application boundaries of smart contracts. It can be said that if blockchain is the "skeleton" of the Web3 world, and smart contracts are the "muscles," then oracles are the "value neural network" that connects and drives all of this, giving it the ability to perceive.

Typical functions include:

● Price Feed : Provides real-time exchange rates for crypto assets for DeFi protocols;

● Verifiable Random Number (VRF) : Used for NFT minting, on-chain games, and lotteries;

● Proof-of-Reserve : Verifies the custodial reserves of stablecoins or assets;

● Cross-chain data transmission : Enables smart contract information exchange between different public chains;

● AI/IoT Data Input : Supports uploading off-chain model or physical device data to the blockchain.

2.2 Basic Principles and Technical Architecture of Oracles

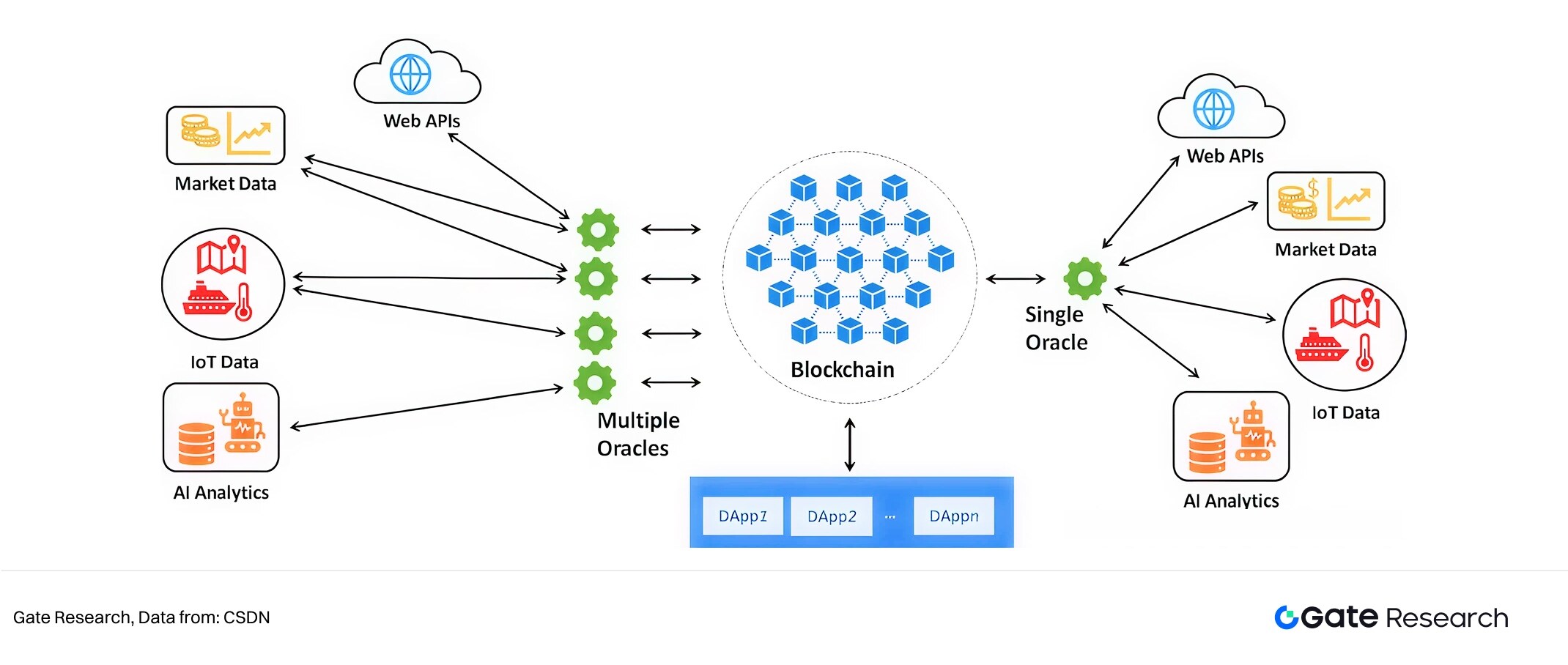

A typical oracle system's workflow aims to securely and accurately transform off-chain information into usable on-chain data, and typically includes the following core components and technical mechanisms:

1. Data Source Layer : Oracle nodes (or systems) first need to obtain information from raw off-chain data sources. These data sources are extremely diverse, including exchange market data APIs, financial data providers, IoT device sensors, government public databases, sports results websites, and even event results that require manual input. The quality and diversity of data sources are the first line of defense for oracle reliability.

2. Off-chain processing and verification (Aggregation & Verification Layer) : After obtaining the raw data, especially in decentralized oracle networks (DONs), multiple independent nodes will perform verification and aggregation tasks.

○ Multiple source acquisition: To prevent a single data source from being manipulated or malfunctioning, nodes typically acquire the same data from multiple specified data sources.

○ Verification and Consensus: Nodes sign the acquired data and aggregate and verify data from different nodes and data sources using consensus algorithms (such as median, weighted average, and outlier removal). This step aims to eliminate erroneous or malicious input and generate a single, highly reliable final value.

○ Economic Incentive Mechanisms: To ensure nodes act honestly, staking and slashing mechanisms are typically introduced. Nodes need to stake native tokens as collateral, receive rewards for providing reliable data, and have their tokens forfeited for malicious behavior or outages.

3. Data on-chain and transmission layer : The final data, after verification and aggregation, is formatted and submitted to the chain through a blockchain transaction, usually stored in a specific smart contract deployed by the oracle service provider.

4. Contract Interaction and Consumption (Contract Layer) : DApp smart contracts that require data read the necessary data by calling the interface provided by the oracle contract, and trigger the corresponding logic execution based on this data.

Figure 2: Oracle Technology Architecture

2.3 The Development and Classification of Oracles: From Centralized to Diversified Trust

The development of oracles is an evolutionary history of continuous pursuit of security, decentralization, efficiency, and feature richness. Its evolution is not only reflected in the iteration of technical architecture, but also in the deepening market demand for "trustworthy on-chain data".

2.3.1 Development Stages: From Single-Point Trust to Decentralized Networks

The development of the oracle track can be roughly divided into three key stages:

Phase 1 (approximately 2014-2017): The Era of Centralized Oracles

● Features: Early solutions typically involved a centralized server operated by the project team or a single entity, which retrieved data from external APIs via scripts and published it directly onto the blockchain.

● While this model is simple to implement and highly efficient, it suffers from a fatal single point of failure and trust risks. If the centralized entity acts maliciously, is attacked, or ceases service, all DApps relying on its data will face paralysis. Therefore, this model has been largely phased out by the market and is only suitable for low-value or internal testing scenarios.

Phase Two (approximately 2017-2021): The Birth and Establishment of Decentralized Oracle Networks (DONs)

● Features: Marked by the rise of Chainlink. Its core innovations include: a decentralized network architecture comprised of numerous independent, geographically dispersed node operators; an economic incentive mechanism where nodes must stake native tokens as collateral, rewarding honest behavior and penalizing malicious behavior (providing incorrect data); and multi-data source aggregation, where nodes obtain the same data from multiple data sources and aggregate it using an on-chain consensus algorithm (such as median) to resist errors or manipulation from a single data source.

● DONs greatly enhance the security and reliability of oracles through decentralization and economic incentive mechanisms, enabling them to support DeFi applications with a value of hundreds of billions, and have become the industry's recognized "gold standard".

Phase 3 (approximately 2021 to present): Specialization, efficiency optimization, and functional expansion

Building upon DONs, the market is evolving towards greater specialization, efficiency, and functionality. On one hand, new models optimized for specific scenarios are emerging, such as first-party oracles (Pyth Networks, where data sources directly run nodes) and optimistic oracles (UMAs, using a "propose-dispute" model). On the other hand, the functionality of oracles is no longer limited to simple data price feeds, but has expanded to provide more complex services such as off-chain computation, cross-chain interoperability, and verifiable randomness (VRF), evolving into a general-purpose decentralized computing platform.

2.3.2 Multi-dimensional classification: Understanding different paradigms of oracles

To gain a more comprehensive understanding of the diversity and system differences of oracles, they can be categorized from multiple dimensions, including degree of centralization, data source, data flow, system architecture, and verification mechanism. These different dimensions reflect the trade-offs oracles make between security, performance, trust models, and costs, and also reflect their adaptation paths in diverse Web3 applications.

Figure 3: Oracle Classification

In summary, oracles can be categorized in many ways, but these categories are not mutually exclusive; rather, they overlap. For example, Chainlink combines a decentralized structure, a software data source, and both input-based and publish-subscribe architectures, while ensuring data trustworthiness through node consensus and cryptographic signature mechanisms. Pyth Network, on the other hand, simplifies off-chain dependencies with a "first-party data provider" model, striking a balance between speed and trust. Understanding these paradigms helps researchers weigh security, cost, latency, and verifiability in different applications, and thereby build optimal oracle architectures for specific needs (such as high-frequency liquidation, RWA auditing, or AI prediction).

2.4 Industry Size and Market Structure of Oracles

2.4.1 Market Size: From Functional Components to Infrastructure Ecosystem

Over the past five years, the oracle market has evolved from a "supporting infrastructure" to a "core data layer." Oracles are no longer just responsible for on-chain data input, but have become the underlying support for key modules such as DeFi, RWA, derivatives, and cross-chain communication.

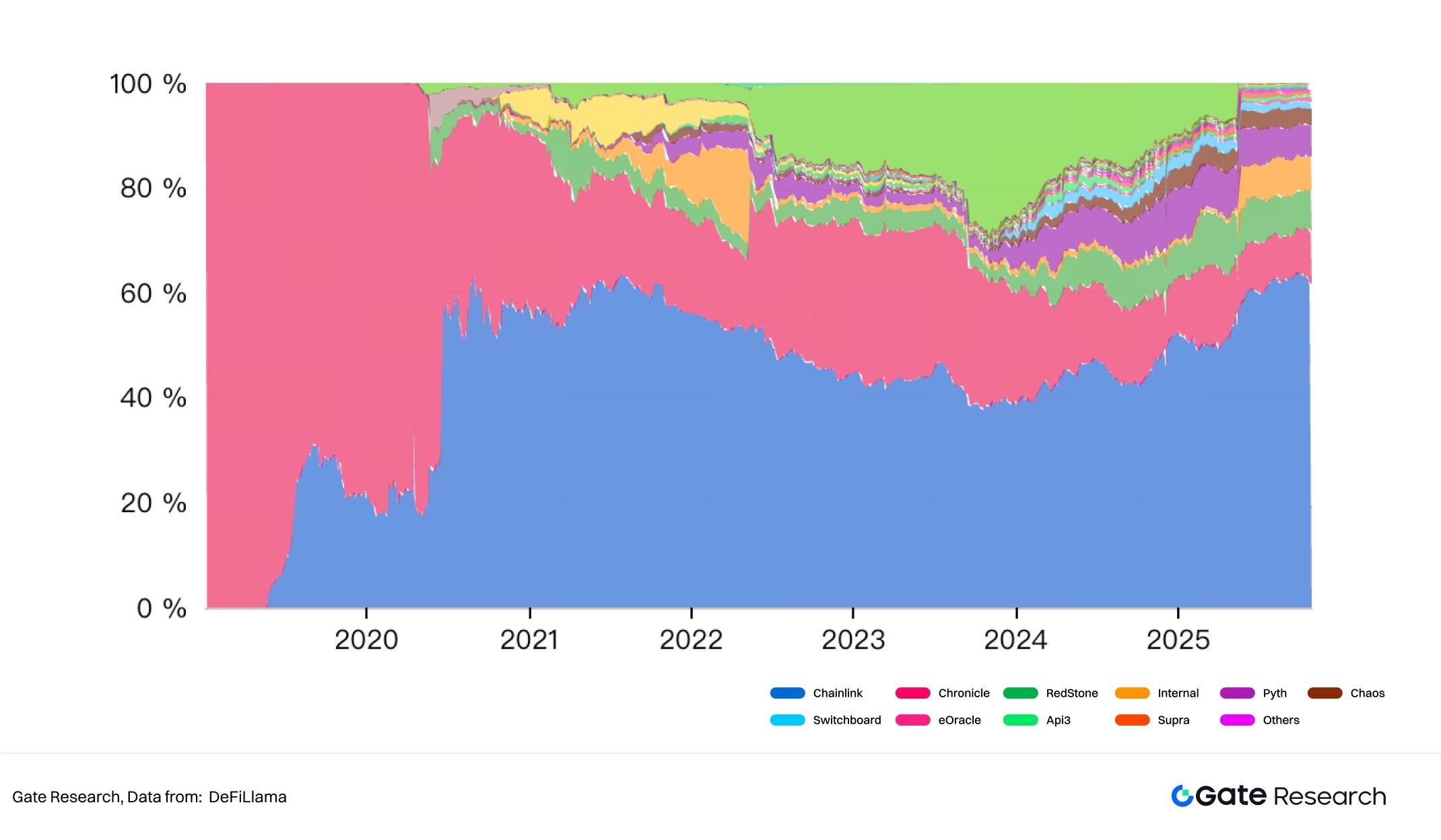

As of October 2025, according to DefiLlama Total Value Secured (TVS) and CoinGecko market capitalization data, the total value locked in oracle protocols was approximately $102.179 billion, with a total market capitalization of approximately $14.1 billion, representing a growth of over 43% compared to the same period in 2024 ($9.8 billion). Within the blockchain infrastructure sector, the oracle segment's market capitalization has approached 20%, making it one of the fastest-growing sub-sectors.

Figure 4: Market Capitalization Share of Different Sectors in Blockchain Infrastructure

2.4.2 Market Structure: Dominance by Leading Players and Multi-Level Expansion

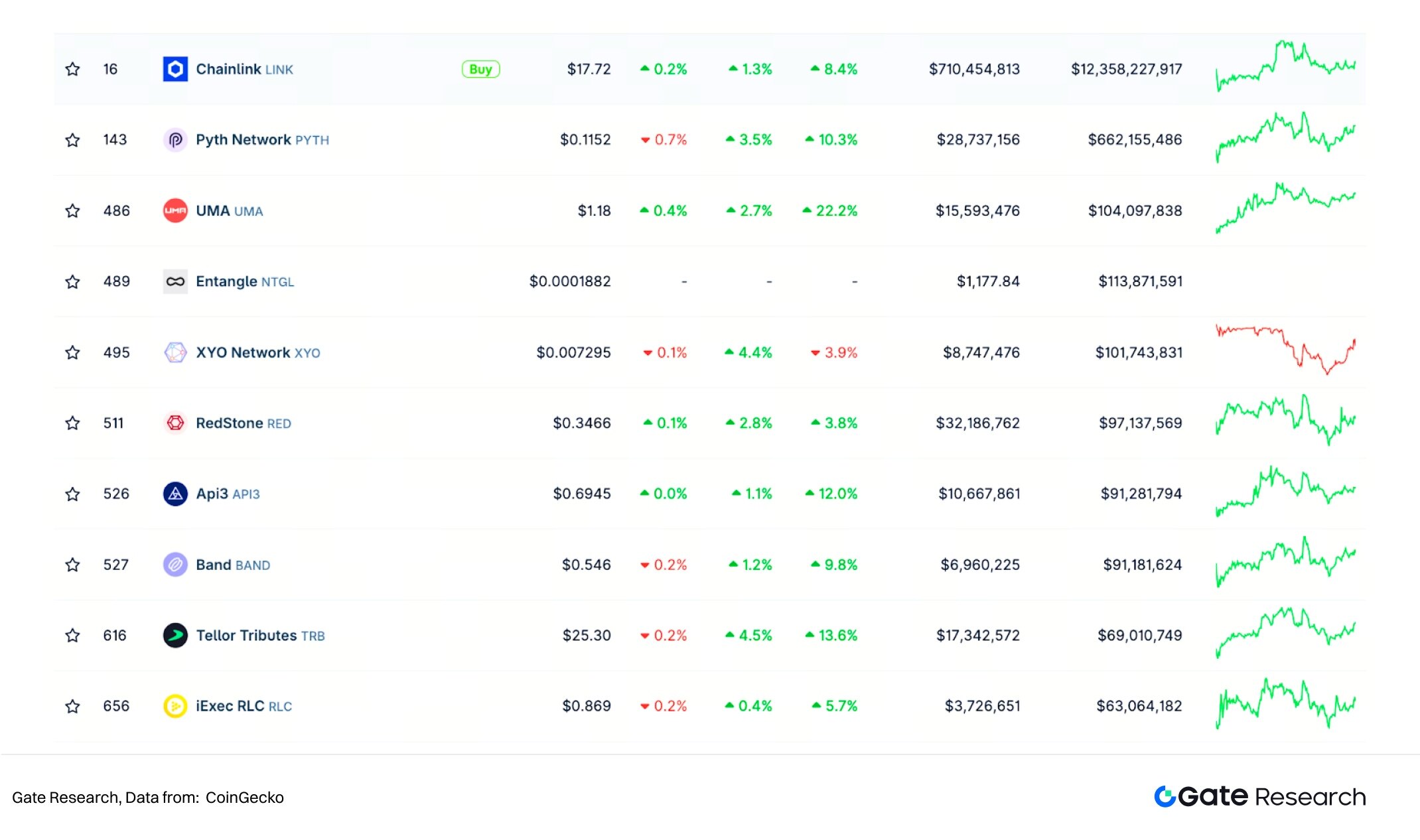

From a competitive structure perspective, the current oracle market has formed an oligopoly centered around Chainlink, and on this basis, a multi-layered, specialized competitive system has gradually developed. The overall industry structure exhibits typical characteristics of "leading monopoly + emerging breakthroughs": Chainlink relies on multi-chain compatibility and enterprise cooperation to build a solid moat and firmly occupy the core of the market; Pyth Network has native performance advantages in high-frequency transaction public chains (Solana, Sui, Aptos), quickly occupying specific niche markets; API3 and RedStone focus on data transparency and native API access, strengthening their first-party data source capabilities and achieving differentiated competition.

In terms of market capitalization, Chainlink dominates the industry with over 87% market share, at approximately $12.3 billion. This is followed by protocols such as Pyth Network (approximately 4.6%), UMA (approximately 0.73%), and XYO (approximately 0.71%). Chainlink has built a solid ecosystem barrier through its deep integration in core scenarios such as DeFi, cross-chain communication (CCIP), and proof-of-reserves (PoR). Meanwhile, emerging protocols like Pyth, UMA, and RedStone are continuously expanding their competitive advantages through innovations in high-speed data distribution, privacy computing, and first-party data source mechanisms.

Figure 5: Market Capitalization of Top Oracle Protocols

In terms of locked-up capital, the total value of collateral in the industry has exceeded $102.1 billion. Chainlink holds a dominant position with a market share of 61.58% (TVS of $62.922 billion); Chronicle (10.15%) and RedStone (7.94%) follow in second and third place, respectively. Pyth Network ranks fifth with 5.84%, and API3 ranks ninth with 0.55%. Overall, although Chainlink still dominates the market, the penetration rate of emerging protocols is accelerating significantly, and the industry structure is evolving from a unipolar to a multipolar model.

Figure 6: Top Oracle Protocol TVS Percentage

From an on-chain ecosystem perspective, the use of oracles is showing a clear trend towards multi-chain adoption and ecosystem integration. This is based on a weighted analysis of data from multiple sources, including DefiLlama and Dune Analytics.

● The Ethereum ecosystem remains the core platform for oracle applications, relying on the extensive deployment of Chainlink's official Data Feeds, which aggregates the main sources of calls and revenue (of the more than two thousand protocols integrated with Chainlink, Ethereum has 1,339 deployments).

● Solana 's growth momentum is reflected in the continuous increase in the high frequency of Pyth Network updates and calls. With its high throughput and low latency characteristics, it has rapidly risen in high-frequency derivatives and real-time data scenarios.

● Layer 2 networks (such as Arbitrum, Base, Optimism, etc.) have become the fastest growing frontier in the expansion of oracle protocols, and their call volume curves can be observed in Chainlink CCIP and L2 statistics;

● Emerging public chains (such as Sui, Aptos, and Sei) tend to build built-in or vertically integrated oracle systems through deep integration with RedStone and Pyth.

Overall, the market is gradually evolving from single-chain reliance to a multi-chain collaborative landscape. Dominant protocols are reshaping the competitive landscape through the integration of data layers and cross-chain communication layers, and oracles are evolving from basic functional components into the most strategically significant "data hub infrastructure" in the blockchain ecosystem. In summary, the oracle market in 2025 has evolved from a "single-point price feed tool" to a "cross-ecosystem data coordination layer." With the influx of institutional funds and the advancement of RWA, the industry will enter its second protocol upgrade cycle, and the future focus of competition will shift from single-point price feed efficiency to service quality, economic model sustainability, and cross-chain communication integration capabilities.

3. Ecosystem Needs Perspective: Oracle-Driven On-Chain Application Expansion

As the functionality of oracles expands, their on-chain applications are becoming increasingly diverse, ranging from simple price feeds to triggering multiple types of events and cross-chain data coordination. Oracles have become a driving force for on-chain innovation.

3.1 The Ecosystem Role of Oracles: The "Input Layer" for On-Chain Applications

The core value of oracles lies not only in "data transmission," but also in their fundamental input role within the entire Web3 technology stack. In a typical Web3 architecture, information flow unfolds in the following layers:

User Layer (Wallet / DApp) → Application Layer (DeFi, RWA, Prediction Markets, On-Chain AI) → Protocol Layer (Smart Contracts) → Oracle Layer (External Data Input) → Off-Chain Reality Layer (Prices, Events, Assets)

Therefore, oracles become the "truth interface" of the entire decentralized system, and their reliability directly determines the trustworthiness of on-chain applications.

● DeFi : Are liquidation and collateral valuation safe and reliable?

● RWA : Is the mapping of real-world assets accurate and reliable?

● Cross-chain assets : Are state verification and transaction traceability guaranteed?

● Market prediction : Is settlement fairness guaranteed?

● On-chain AI computing : the authenticity of data input and the credibility of decisions.

In other words, oracles play a role in Web3 similar to the "external data TCP/IP protocol" in the blockchain world. They are the underlying prerequisite for building a trusted computing economy and the underlying infrastructure for promoting the robust operation of on-chain innovation.

3.2 Ecological Demand Pattern: Five Main Themes of Oracle Growth

As the "value hub" connecting the real world and on-chain smart contracts, the growth potential of oracles is closely linked to the expansion of the entire Web3 ecosystem, especially depending on the maturity and widespread adoption of high-value application scenarios. By 2025, the demand for oracles had evolved from the early single DeFi price input to a "multiplier effect" pattern driven by multiple high-growth sectors.

3.2.1 Structural Driving Forces for the Expansion of the Oracle Ecosystem

The growth of the oracle market is driven by three key factors:

1. DeFi Scale Expansion and Strengthened Systemic Dependence (TVL-Driven): In October 2025, the total value locked (TVL) in DeFi reached a peak of approximately $168.373 billion, returning to the historical high of the DeFi Summer, indicating continued growth in on-chain capital. With over 80% of DeFi protocols relying on oracle data sources, DeFi has become the earliest and most core application arena for oracles. High-frequency scenarios such as lending and clearing, derivatives pricing, and asset valuation have built a natural closed-loop ecosystem for oracles, enabling them to form a stable value capture mechanism and competitive barrier within the DeFi system. Whether it's mainstream protocols like Aave, Synthetix, or GMX, their system security and asset anchoring are inseparable from reliable oracle data. This makes oracles the underlying infrastructure for DeFi risk control and on-chain asset pricing.

Figure 7: DeFi TVL

2. Institutional Growth of RWA and the Demand for Off-Chain Data On-Chain: The rapid development of RWA is becoming the second major core engine driving the demand for oracle services. As of October 2025, the scale of observable on-chain RWA assets exceeded $35 billion and continues to grow steadily. Key data related to RWA, such as valuation, interest rates, repayment status, and credit ratings, all originate from off-chain systems and must rely on highly reliable oracles for on-chain processing. Therefore, the institutional expansion of RWA is building a long-term and rigid demand structure for the oracle market: the requirement for high-precision, low-latency data synchronization is continuously increasing; the demand for multi-source verification and audit proofs is constantly strengthening; and the reliance on standardized interfaces for off-chain financial data (such as government bond interest rates, fund net asset values, and bill repayments) is deepening. In other words, the rise of RWA is driving trillions of dollars of liquidity from traditional finance into the oracle ecosystem, accelerating its evolution from "on-chain data services" to "cross-system data infrastructure."

Figure 8: RWA Total Asset Size

3. The Explosive Growth in Demand for Low-Latency and Cross-Chain Communication from Emerging Application Scenarios: Next-generation applications are placing higher performance and architectural demands on oracles. With the rise of emerging scenarios such as AI and prediction markets, the demand for low-latency, high-precision data and cross-chain messaging on-chain has increased significantly. These applications not only require oracles to provide price information quickly and accurately, but also to possess multi-chain synchronization and trusted verification capabilities. Prediction markets, for example, represent a typical application of oracles in the "event verification" field. Platforms like Polymarket and Kalshi rely on oracles to confirm real-world event outcomes, such as election results, sporting events, or macroeconomic data. With the rapid growth of transaction volume in this field—as of October 2025, the cumulative transaction volume of Kalshi and Polymarket had reached $33.94 billion—oracle event verification and messaging capabilities are becoming a crucial force driving ecosystem expansion. Consequently, the role of oracles is evolving from "information feeders" to "cross-chain event coordinators," further strengthening their stickiness and infrastructure status within the Web3 ecosystem.

Figure 9: Cumulative trading volume of Kalshi and Polymarket

Overall, the ecosystem demand for oracles is forming a spiral growth path from DeFi → RWA → high-performance new applications. In this process, oracles are no longer just data input interfaces, but have become a key foundation driving the financialization, assetization, and interoperability of Web3. In the future, their market growth logic will shift from single transaction needs to the construction of systemic data infrastructure, becoming the central layer for the trusted operation of the on-chain economy.

3.2.2 The Correlation Matrix Between Oracles and Ecosystems: From Dependence to Multiplier Effect

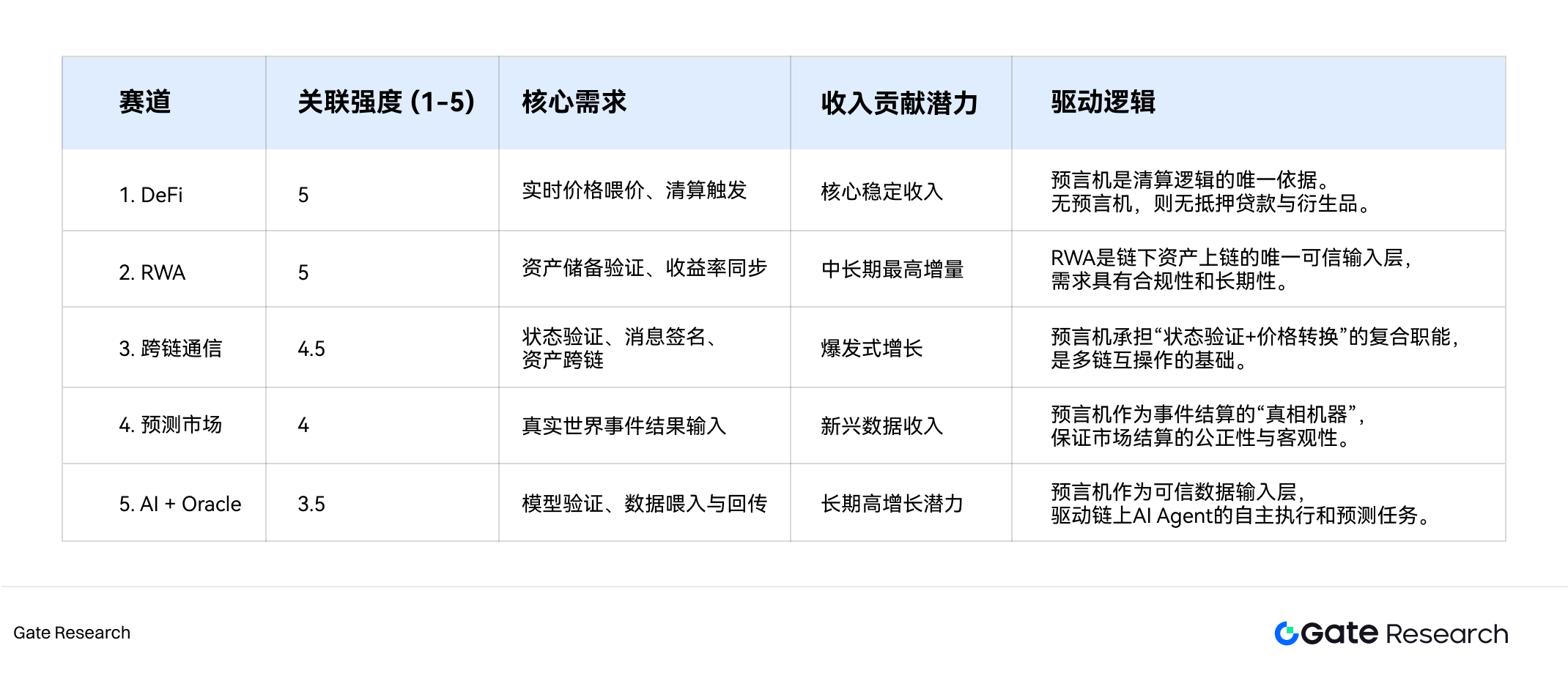

Based on the aforementioned three driving factors, and combined with the current oracle usage, revenue contribution potential, and strategic synergy, this report divides the main service targets of the oracle ecosystem into five core tracks: DeFi, RWA, cross-chain communication, prediction markets, and AI+Oracle. Among them, DeFi is the native main battlefield for oracles, RWA is the institutional growth engine, while cross-chain communication, prediction markets, and AI+Oracle constitute emerging growth curves.

The value of oracles is highly correlated with the size and depth of the sectors they serve. To quantify this relationship, this report constructs a "correlation strength matrix" to assess the dependence of different sectors on oracle services. The model sets four equally weighted dimensions (each accounting for 25%): data dependence, call frequency, revenue contribution potential, and strategic synergy. The final scoring formula is as follows:

Relationship Strength = (Data Dependence + Call Frequency + Revenue Contribution Potential + Strategic Synergy) / 4

Based on this model, the quantitative evaluation results for the five major tracks are as follows:

Figure 10: Correlation strength between oracles and different track ecosystems

3.2.2.1. DeFi: The Native Battlefield of Oracles (Relevance Strength: 5.0)

In all DeFi applications, price input is the decisive factor in triggering smart contract logic. Whether it's the liquidation logic of lending protocols like Aave and Compound, the asset pegging of synthetic asset platforms like Synthetix, or the collateral verification (including PoR) of stablecoin systems like MakerDAO, price input directly determines whether the protocol can accurately trigger liquidation and rebalancing mechanisms.

Core logical characteristics :

● High-frequency updates: Updates at minute-level or even higher frequencies to cope with rapid market fluctuations;

● Price stability sensitive: even minor deviations could trigger large-scale liquidation or systemic risk;

● High node fault tolerance: Multi-node aggregation and strict reputation mechanism result in an error rate of less than 0.05%.

Data Support and Economic Contribution : Currently, almost all contributors to the top ten TVS oracles are from DeFi protocols. Taking Chainlink as an example, of its more than two thousand protocols, 1,043 are DeFi. It provides over 100 million price updates monthly for top protocols such as Aave v3; in Q3 2025, it recovered over $1.6 million in MEV through Aave liquidation activities, a more than 15-fold increase quarter-over-quarter, with an average recovery rate of approximately 80%.

3.2.2.2. RWA: The strongest growth driver in the medium to long term (correlation strength: 5.0)

RWA is the fastest-growing Web3 sector in 2024–2025, representing the migration of trillions of dollars of traditional financial assets to on-chain. Since the authenticity, valuation, and returns of RWA exist off-chain, oracles have become the core driving force with the greatest incremental potential and institutional value in this sector.

The core challenge of RWA lies in establishing a unique and trusted input layer for the transition from off-chain assets to on-chain value. Oracles play two key roles in this process:

● Proof of Reserves (PoR) : Verifies the actual existence of custodied assets (such as government bonds) to ensure the token's value is pegged;

● Yield Feed : Synchronizes off-chain interest rates, net asset value, or repayment status to the on-chain protocol to ensure accurate yield distribution.

The market potential is enormous: the need for daily updates to interest rates and net asset values drives RWA projects to call oracles more frequently and with greater value density. This provides oracle networks with high-value, long-term, and stable service revenue; for every additional $100 million in RWA assets, annual oracle revenue is expected to increase by approximately $30,000 to $50,000. Industry estimates suggest that the daily synchronization volume of off-chain reserve data served by Chainlink PoR may reach hundreds of millions of dollars, reportedly accounting for over 25% of Chainlink's overall revenue.

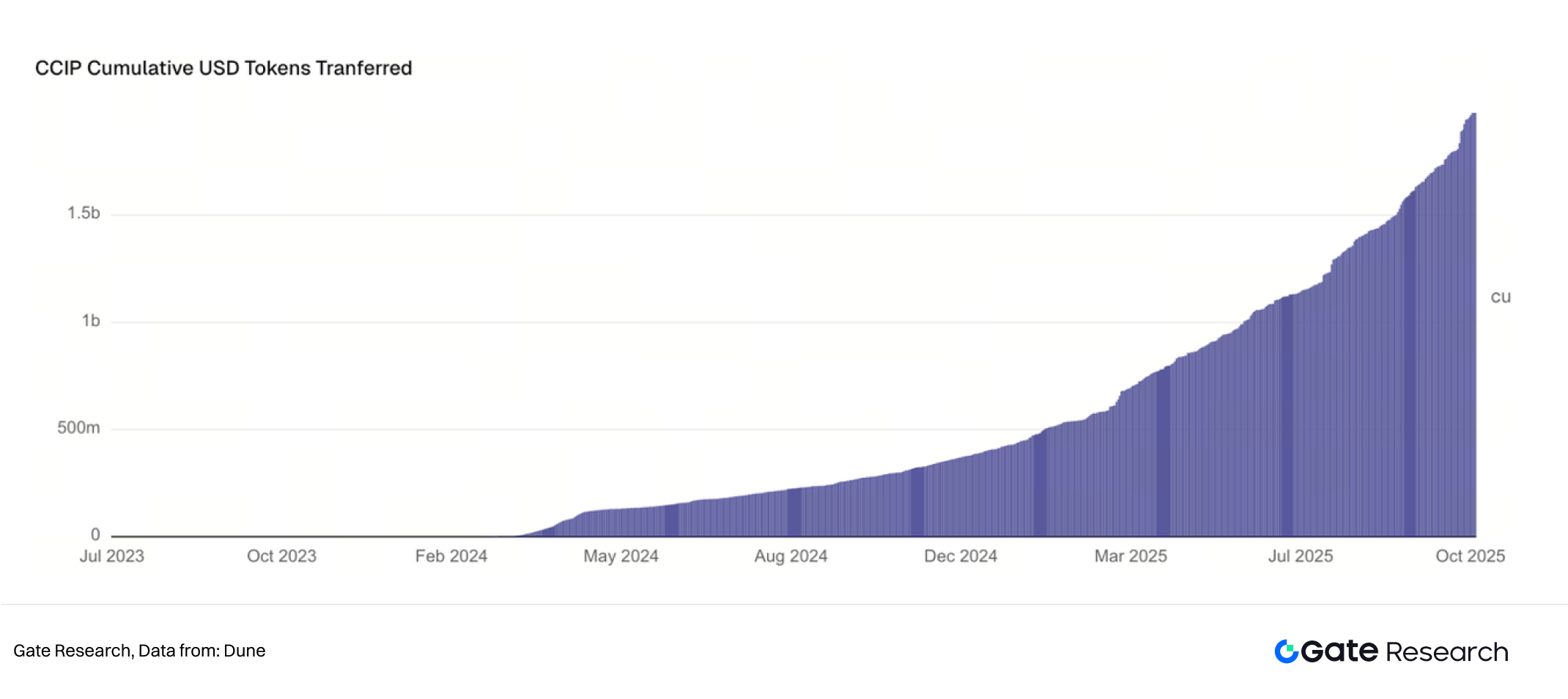

3.2.2.3. Cross-chain communication: A new frontier for oracles (Correlation strength: 4.5)

With the maturation of modular blockchains and multi-chain ecosystems, oracles have evolved from the "price layer" to the "message layer." In cross-chain interoperability architectures, oracles not only handle price feeds but also undertake core functions such as cross-chain message transmission, asset status verification, and transaction settlement execution, becoming a pillar of trust in the multi-chain ecosystem.

A typical example of this model is Chainlink's CCIP (Cross-Chain Interoperability Protocol). CCIP is based on a distributed oracle node network and integrates three major functions: "state verification + message signing + price conversion". Its working mechanism includes: the application layer initiates a cross-chain request → the oracle node verifies the source chain event → the CCIP network generates a cross-chain proof → the target chain updates its state based on the trusted proof.

Data Support: Through testing and collaboration with traditional financial institutions such as SWIFT, the CCIP model has verified that oracle networks can support bank-level cross-system settlements, opening up multiplier-level growth potential for the oracle sector to enter the traditional financial clearing market and becoming an important engine for Chainlink's future value growth. Chainlink points out that its cross-chain protocol CCIP has expanded to more than 65 networks (public chains + L2), and its cross-chain message volume and the number of service chains have maintained significant growth. As of October 2025, the cumulative transaction volume of CCIP service tokens is nearly US$2 billion.

Figure 11: Total CCIP Transfers

3.2.2.4. Predicting Markets: The Real-World Implementation of the Information Economy (Relevance Strength: 4.0)

Prediction markets are a direct application of oracle technology in information verification and event settlement, and are considered a testing ground for the "information economy" of Web3. Platforms such as Polymarket price future event outcomes through economic incentives, while oracles are the "truth machines" that ensure fair market settlement.

Symbiotic Relationship and Core Functions: Prediction markets have a rigid dependence on oracles because oracles must provide the final, credible results of real-world events (such as elections, sports scores, and macroeconomic indicators) during the settlement phase to complete the clearing and distribution of users' assets. The two form a natural upstream-downstream symbiotic relationship:

● Oracle: Acts as a "truth input layer", providing secure and reliable external data on-chain to ensure that "facts" are auditable.

● Prediction Market: Acts as the "truth pricing layer," aggregating collective wisdom through market competition and transactions, and paying data access fees to achieve value settlement.

Emerging high-value revenue scenarios: The application boundaries of oracles continue to expand, gradually entering the "information verification economy," covering non-financial fields such as real-time news verification and AI-generated data inspection, with enormous potential. Taking Polymarket as an example, its trading volume grew from $360 million in early 2024 to approximately $21 billion in 2025, significantly increasing the demand for event settlement data. High-value events (such as political elections) will drive a large number of clearing calls, bringing substantial fee revenue to oracle networks.

3.2.2.5. AI + Oracle: A Collaborative Direction for Data Trustworthiness (Relevance Strength: 3.5)

The combination of AI and oracles represents a new trend in the on-chain data ecosystem, namely, realizing verifiable AI and a machine economy. In this technological wave, oracles have evolved from data intermediaries into the core trust interface between smart contracts and AI agents.

Collaborative Logic: AI models are typically computed off-chain. If their predictions or decisions are to be securely relied upon by smart contracts, oracles must act as a trusted data input layer to address the issues of the authenticity, auditability, and security of AI outputs.

● Core role: Oracles are responsible for recording the inference results, data analysis, or action instructions of AI models on the blockchain in a trustworthy and signed manner .

● Typical Case: Bittensor (TAO) is responsible for model training and inference, while Chainlink Functions is responsible for feeding high-value inference results into on-chain smart contracts in a secure manner, realizing AI-driven on-chain automation.

A new payment model for the "machine economy": As AI agents autonomously execute transactions, predictions, or automated tasks on-chain, they will generate a rigid demand for continuous and diverse data. This brings a new and sustainable payment model to oracle networks—data subscriptions for the machine economy. Analysis suggests that each AI agent's external data subscription costs an average of approximately $0.5–2 per day, thus creating a long-term and predictable revenue stream.

Overall, the growth of oracles is no longer linearly dependent on a single sector, but rather exhibits a multiplicative relationship with the total on-chain assets, cross-chain call volume, and the marketization process of RWA. The core logic is that every tokenized, on-chain, or cross-chain asset and event generates new demands for trusted data access. This ecosystem structure forms a clear "multiplier effect" growth pole: DeFi and RWA constitute the "trust hub" of oracles, providing stable and high-value cash flow; cross-chain communication (CCIP) and prediction markets expand their "state verification" boundaries, representing a medium-term revenue explosion point; while AI + Oracle represents commercial expansion, ushering in a new era of "AI calling the blockchain," and is the long-term, largest growth potential driving the continued explosive growth of total revenue in the oracle sector.

4. Economic Demand Perspective: The Value Capture Mechanism of Oracles

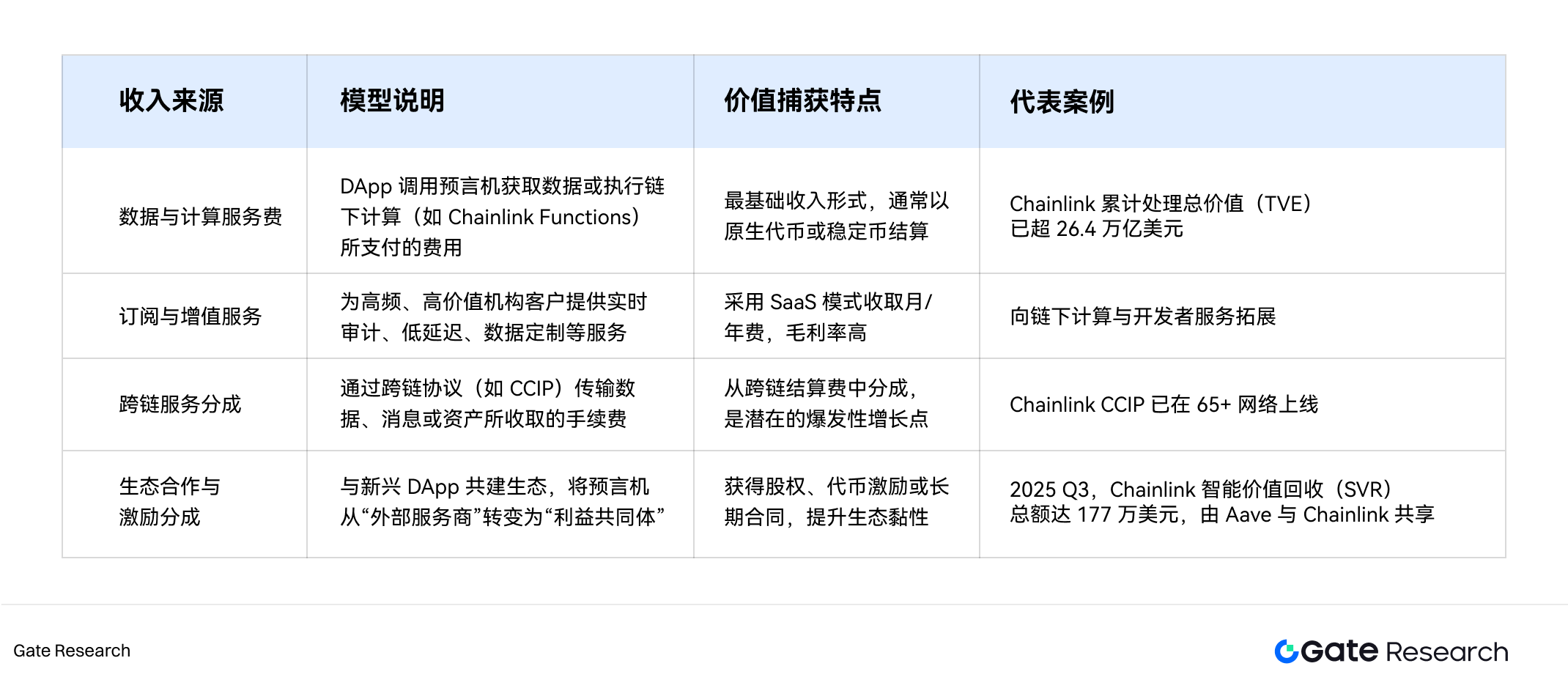

As oracles have evolved from simple data price feed tools into a "data infrastructure layer" supporting DeFi, RWA, AI, and cross-chain communication, their economic nature has transformed into an economic system driven by data demand. As a commercial entity, the long-term sustainability of an oracle network depends on its ability to build a positive-cycle economic model. This model must address two core issues: how to capture value (protocol revenue) and how to ensure network security (token economics).

4.1 Value Capture: From Data Services to the Data Economy

4.1.1 The Value Logic of Oracles

Oracles are essentially off-chain data relay services, but with the maturity of decentralized networks, they have evolved into a "data market" with a complete economic system. Their core participants include:

● Data Provider (Publisher) : Provides off-chain price or event information;

● Node Operator : Responsible for data aggregation and on-chain signing;

● Consumers of the agreement : such as Aave and Synthetix, pay fees to obtain trusted data;

● Token holders : Provide network security and earn rewards by staking.

Unlike traditional Layer 1 blockchains, the value capture of oracles does not derive from transaction fees or block rewards, but rather relies on an economic equation of "data consumption rate × number of calls". Its core economic function can be simplified as follows:

Token Value = f(On-chain call volume, data unit price, protocol commission, staking ratio, inflation dilution rate)

Therefore, the key to the growth of oracles lies in the improvement of ecosystem scale and call density, rather than simply technological upgrades.

4.1.2 Value Capture Mechanism

As its business has diversified, the revenue streams for oracles have gradually expanded, transforming it from a "single data provider" to a "comprehensive platform service provider." The main revenue structure is as follows:

Figure 12: Oracle Revenue Sources

4.2 Token Economy: Building a Moat for "Cryptoeconomic Security"

Oracle tokens (such as LINK and PYTH) are not only a medium of payment but also a core tool for ensuring network security and providing economic incentives. Their economic design follows a fundamental principle: the cost to corruption of attacking a reliable oracle network must far outweigh the potential benefits from corruption. This principle forms the basis of oracles' "crypto-economic security."

Oracle network tokens simultaneously perform three functions:

● Payment layer : Serves as the settlement medium for on-chain data services and invocations;

● Security layer : Provides economic guarantees through a staking mechanism;

● Governance layer : Coordinates the behavior of nodes, publishers, and consumers, and distributes protocol revenue.

4.2.1 Implementation Mechanism: Staking and Penalties

In oracle networks, node operators need to stake a large amount of native tokens as "margin" to qualify for providing data services.

● Staking Mechanism : Nodes lock up economic interests by staking native tokens to ensure that their behavior is consistent with cybersecurity goals.

● Rewarding : Nodes can receive service fees paid by users and tokens distributed by the protocol after providing accurate and timely data.

● Slashing : If a node submits incorrect data, delays response, or engages in malicious behavior, its staked assets will be automatically forfeited, ensuring the system's economic deterrent effect.

This design enables oracle networks to achieve self-correction of data quality and economic security without the need for centralized arbitration.

4.2.2 Value Flywheel: The Symbiotic Growth of Security and Demand

The economic model of oracles constructs a self-reinforcing positive flywheel mechanism:

1. Increased ecosystem demand → High-value DApps such as DeFi and RWA are experiencing a continuous rise in demand for data services;

2. Increased protocol revenue leads to higher call volume and service fees, resulting in a stable cash flow;

3. Increased Staking Value → Nodes increase their staking to earn rewards, thus increasing the total locked value of the network;

4. Enhanced network security → Increased cost of attacks, higher system trust levels;

5. Attracting high-value users → Improved security, in turn, attracts more institutions and financial scenarios to connect, creating new demand growth.

This mechanism enables the co-evolution of security and profitability, making oracles one of the few infrastructures in the Web3 ecosystem with a sustainable business model.

4.3 Chainlink (LINK): The Universal Trust Layer and Value Capture Logic of the Data Economy

Oracle tokens are not only a medium of payment, but also the core of cybersecurity and incentive mechanisms. They are all designed according to the same principle—the cost of attacking a network must outweigh the potential gains.

4.3.1 Project Evolution and Technical Architecture

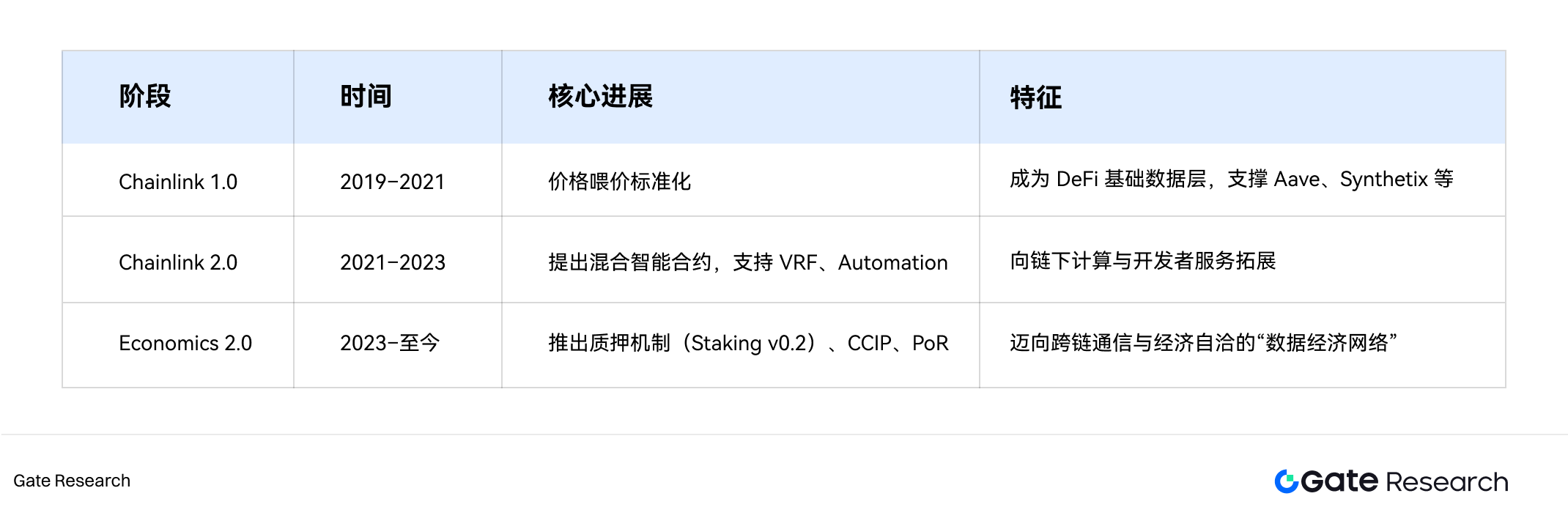

Founded in 2017 by Sergey Nazarov and Steve Ellis, Chainlink aims to provide trusted and verifiable external data inputs for smart contracts. Over the years, Chainlink has evolved from a price oracle into a general-purpose data infrastructure covering cross-chain communication, off-chain computation, and data verification.

Figure 13: Chainlink Evolution Stages

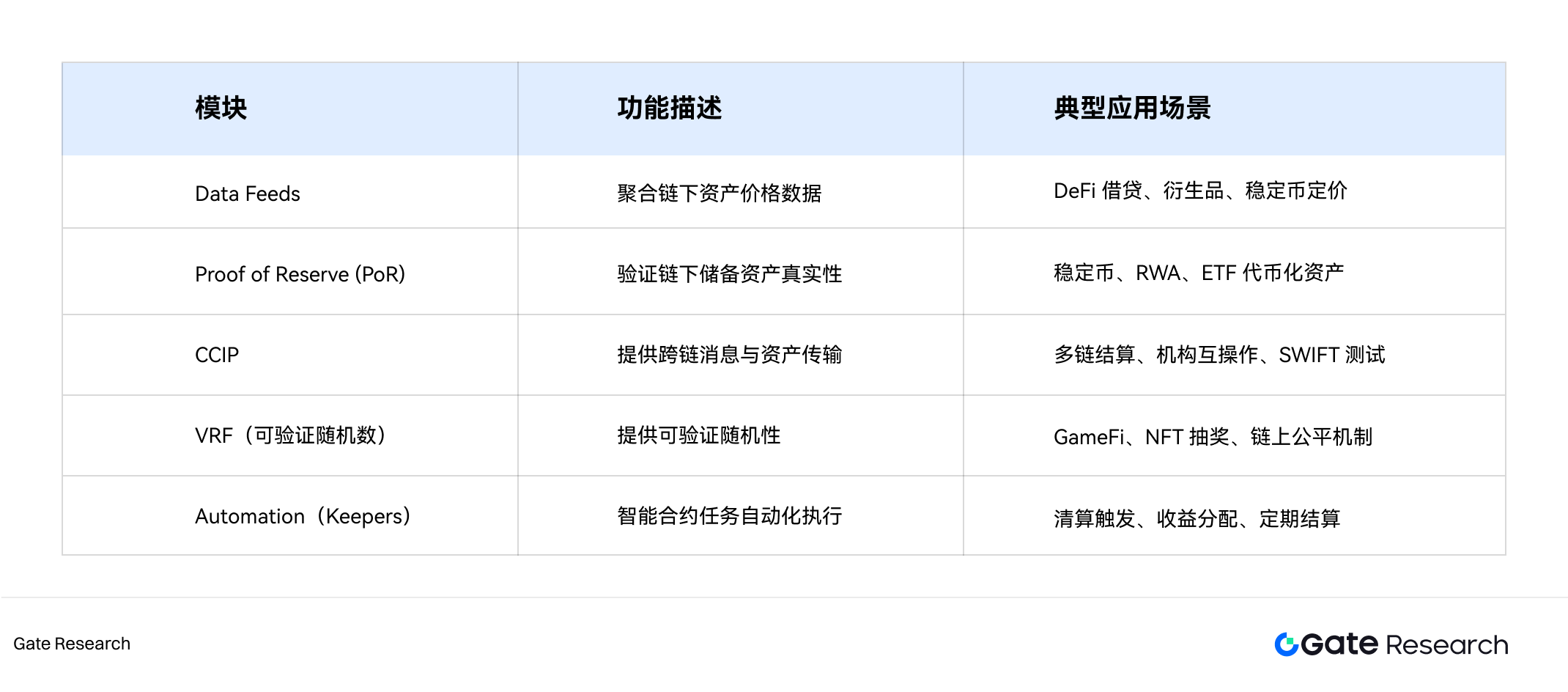

Currently, Chainlink is no longer just a price data network, but a universal data transmission protocol spanning oracles, cross-chain bridges, random numbers, and computation layers, becoming the underlying trust layer of the Web3 data economy. Chainlink builds its data ecosystem through a modular design, with each layer capable of independently serving as a service module in different scenarios, resulting in strong composability and ecosystem stickiness.

Figure 14: Chainlink Technology Module

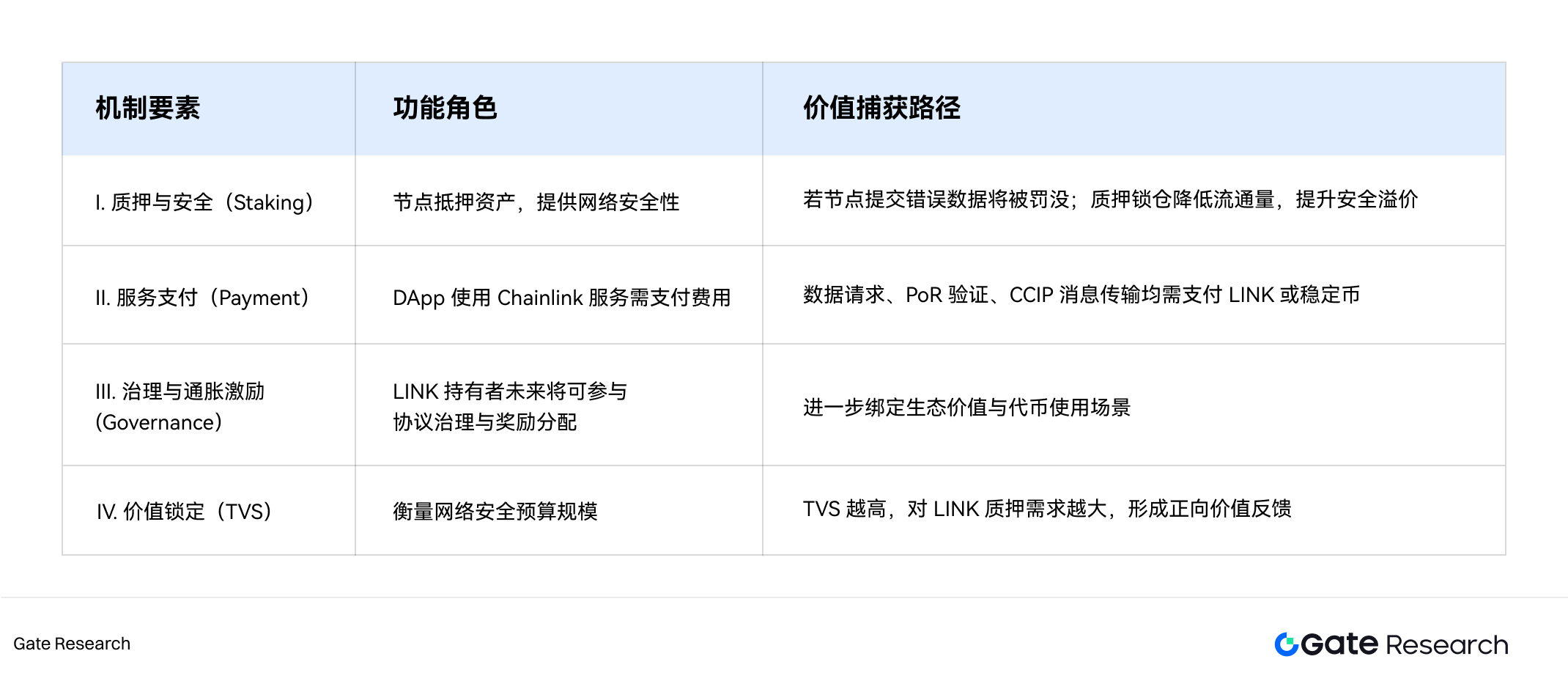

4.3.2 LINK Token Economic Model and Value Capture Mechanism

LINK is the economic core of the Chainlink network, encompassing functions such as a payment medium, collateral, and security budget, serving as the energy source supporting the entire decentralized data infrastructure. Its value capture logic can be divided into four dimensions:

Figure 15: LINK Value Mechanism

1. Evolution of the mechanism from incentive subsidies to service pledging

The LINK token economic model has undergone a transformation from inflation-driven incentives to service staking-driven incentives.

● v1 phase (2019–2022): mainly relies on inflation issuance and node reward mechanism, with revenue coming from LINK rewards and call subsidies. On-chain usage is limited and price fluctuations are significant.

● v2 phase (2023 to present): Introduced Staking v0.2 and the data payment model. Node rewards consist of actual call fees (ETH, USDC, etc.) and LINK rewards, which are directly linked to on-chain economic activities, forming a stronger deflationary support logic.

As of October 2025, the community had staked over 40.875 million LINK tokens (representing 5.8% of the circulating supply), with a total staked value exceeding $700 million (DeFiLlama data), creating a robust economic security buffer.

Figure 16: Total Value of LINK Pledged

2. LINK's Income Sources and Economic Distribution

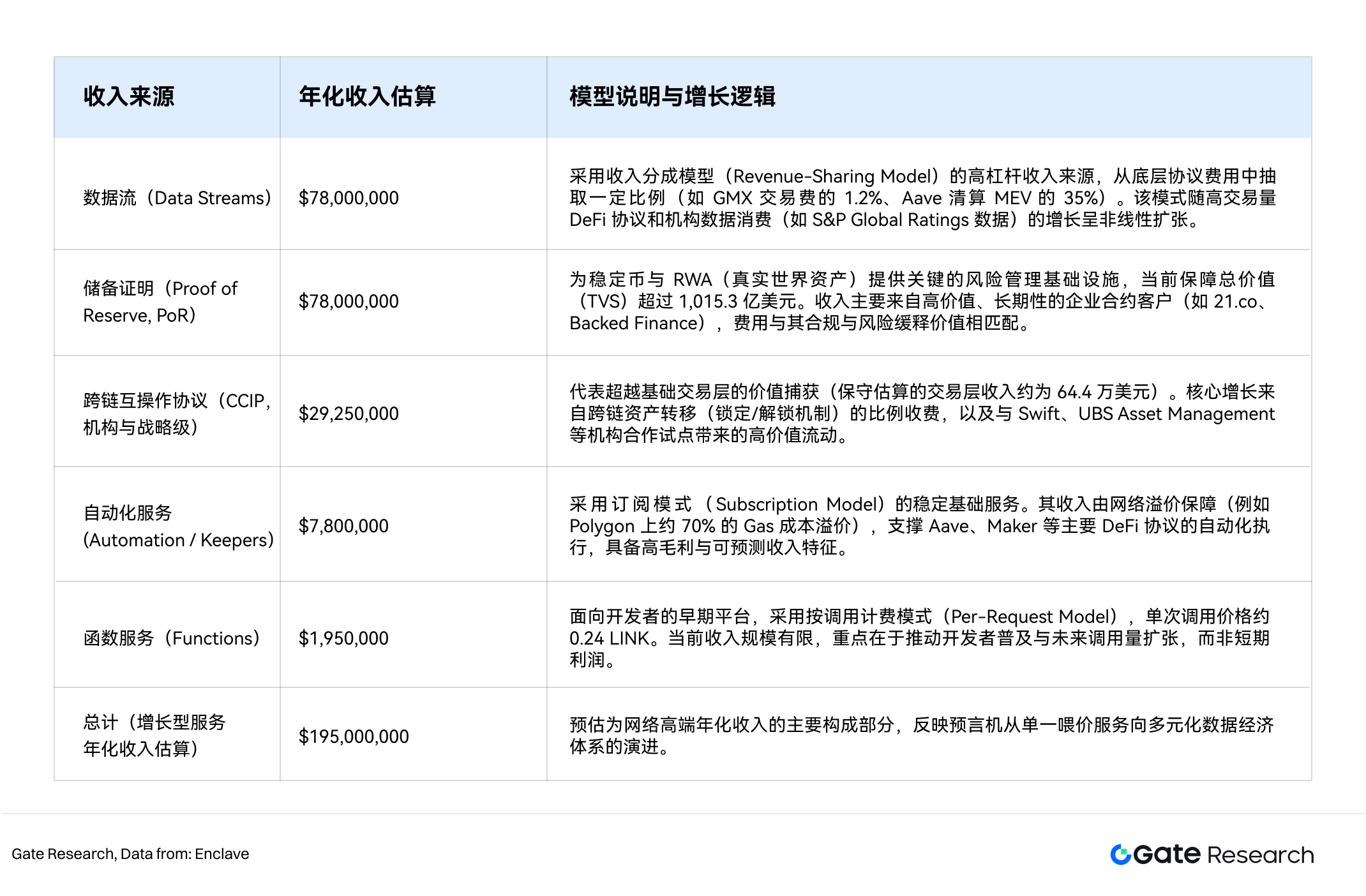

Chainlink's core revenue structure has expanded from a single price feed service to a multi-dimensional data economy system, with recovered revenue used to enhance LINK staking rewards and network sustainability. According to Enclave estimates, network revenue will reach approximately $195 million in 2025, specifically comprised of:

Figure 17: Chainlink Revenue Composition

3. Deepening the LINK value capture mechanism: Smart Value Recycling (SVR)

LINK's value capture system has evolved from a single-function token into a multi-layered structure with deflationary support, a security premium, an ecosystem premium, and a sustainable revenue stream. Among these, the Smart Value Recapture (SVR) mechanism is a key innovation driving its economic model towards a sustainable closed loop. Overall, LINK's value capture can be summarized as a "three-layer structure": security budget anchoring, protocol revenue capture, and Smart Value Recapture (SVR).

SVR's core innovation lies in transforming Chainlink from a mere "data provider" into a co-capturer of on-chain Oracle Extractable Value (OEV). This mechanism, through a "dual aggregator architecture," combines oracle price updates with liquidation execution opportunities. When a DeFi protocol undergoes liquidation, OEV generated by price fluctuations is recovered through bidding and auctions, thereby converting on-chain value that would otherwise flow to third-party arbitrageurs into intrinsic returns for the protocol and its tokens.

In terms of revenue distribution, the OEV recovered by SVR is allocated in a ratio of approximately 60%:40%: 60% is returned to DeFi protocols to enhance liquidation security budgets and risk mitigation capabilities; 40% is allocated to the Chainlink network and nodes to further increase LINK staking returns and security budget size. According to data from the third quarter of 2025, SVR recovered over $1.6 million in OEV in the Aave protocol, effectively improving node yields and promoting the sustainability of the LINK token economic cycle.

The introduction of SVR marks a significant upgrade in LINK's economic model, moving from a "service fee" model to a multi-dimensional architecture of "security participation + revenue sharing + value recovery." This mechanism not only allows the Chainlink network to capture direct cash flow from real-world on-chain economic activities for the first time, but also strengthens the bond between LINK and the cybersecurity budget, forming a self-consistent economic closed loop centered on security and incentives.

4.3.3 LINK Token Valuation Logic and Intrinsic Value Anchoring

As Chainlink's network economic model matures, LINK's valuation logic is shifting from the traditional "narrative-driven" approach to an intrinsic value system centered on security budgets and protocol cash flow. Its price is no longer solely driven by market sentiment, but is structurally linked to network usage intensity, TVS (Total Value Span), and the ability to capture real revenue. This framework can be abstracted as follows:

Token Value ∝ (Usage Volume × Fee per Use × Capture Rate) + (Staked Value × Security Multiplier)

in:

● Usage Volume : The number of data calls and cross-chain communications;

● Fee per Use : The fee paid for each call (in LINK or equivalent stablecoins);

● Capture Rate : The percentage of protocol revenue converted into LINK for burning, staking, or distribution;

● Security Multiplier : The capital multiplier effect of the security budget, reflecting the amplification effect of LINK pledged value on TVS.

From a valuation perspective, the Market Cap/Total Value Secured ratio has become an important benchmark for assessing LINK's fair price. From 2020 to 2025, this ratio decreased from approximately 2.0 to 0.12, indicating a shift in market valuation focus from speculation to fundamentals. Specifically:

Figure 18: Chainlink Market Cap to TVS Ratio

● TVS growth rate outpaces market capitalization growth : RWA and CCIP drive rapid growth in TVS, while token price growth lags behind.

● The value of the safety budget is underestimated : The current MCap/TVS level of 0.12 is significantly lower than the long-term average range (0.3–0.5), indicating that the market has not yet fully priced in the safety budget and cash flow value of LINK;

● Potential for revaluation : If TVS maintains an average annual growth of 30-40% over the next two years, and the staking rate and protocol revenue increase in tandem, the MCap/TVS ratio is expected to rebound to the 0.3-0.4 range, corresponding to a LINK token price center of approximately $26-35 (based on the current TVS value of approximately $62.922 billion).

Meanwhile, the introduction of the SVR (Staking & Value Recovery) mechanism adds a "yield multiplier" dimension to LINK's valuation, freeing it from reliance on a single fee model. This mechanism converts potential on-chain liquidity into protocol cash flow by recovering OEV (Oracle Extractable Value) generated in DeFi liquidations, and distributes it directly to stakers. Its economic effects include:

● Improved APY: OEV profit sharing increases the actual return for pledgees;

● Enhance cash flow sustainability : Expand revenue streams from service calls to DeFi activities themselves;

● Strengthen valuation support : SVR creates a dual demand for the use and lock-in of LINK, raising the lower limit of valuation.

It is estimated that when the annualized SVR recovery exceeds US$10 million, it will have a magnification effect of about 1.2–1.5 times on the overall valuation of LINK, which is equivalent to pushing the MCap/TVS ratio to the range of 0.35–0.45, and the price potential of LINK could reach US$40–45.

In summary, LINK's long-term value anchor can be expressed as:

LINK Value = f(TVS Growth, Protocol Revenue, Staking Ratio)

When TVS expansion, protocol cash flow, and staking ratio resonate, LINK will have the potential for structural revaluation. With the integration of new scenarios such as RWA, AI Agent, and prediction markets, LINK is expected to become an infrastructure token with the triple attributes of "real returns + security budget + cross-chain settlement". Its long-term reasonable valuation center is expected to be in the range of $25-$35, with an upside potential of over $40.

Overall, from an economic model perspective, the core competitiveness of oracles has shifted from "data accuracy" to "the economic sustainability and secure verifiability of data services." Chainlink has built a systemic moat through a "security budget + fee model," enabling oracles to evolve from cost centers into sustainable and profitable infrastructure.

5. Macro-financial perspective: Opportunities and risks of integrating real-world finance with on-chain finance

Oracles have evolved from simple data price feed tools into "financial nerve centers" supporting DeFi, RWA, AI, and cross-chain communication. Their expansion is driving deep integration of global financial infrastructure, reshaping asset pricing, clearing, and regulatory systems, and ushering in a new phase of real-world financial digitalization.

5.1 Opportunity: The Emergence of Financial Digitalization and Information Rates

Digitalization of Real-World Finance: The Central Hub of Data Trust

Oracles enable on-chain financial contracts to execute logic that is closer to the real world by synchronizing key macro and micro data in real time, providing a reliable bridge for traditional financial institutions (TradFi) to embrace decentralized finance (DeFi).

At the RWA asset pricing and settlement level, oracles can synchronize key macroeconomic indicators such as bond yields, foreign exchange prices, interest rate curves, and stock indices to the blockchain in real time, enabling the RWA protocol to automatically adjust yields and risk premiums based on real financial variables.

At the institutional collaboration and settlement level, traditional financial infrastructure institutions such as SWIFT, DTCC, and Visa have integrated with Chainlink's CCIP and other oracle services to explore the automation of interbank information exchange and asset settlement. Chainlink has partnered with 24 financial institutions, including SWIFT, Deutsche Bank, and ANZ, to simplify corporate action processing and explore a "hybrid structure" financial system: on-chain for contract execution and fund settlement, and off-chain for identity verification and regulatory compliance.

Regarding the on-chain processing of macroeconomic data, oracles securely synchronize macroeconomic data such as CPI, GDP, and federal funds rate to the blockchain, enabling on-chain risk models to dynamically reflect changes in the real economic cycle and promoting real-time interaction between regulatory and market information.

The financialization of data: "information interest rate" and capital repricing

Oracle networks have become the vehicle for realizing the "information yield"—high-quality, low-latency, and verifiable data itself can generate revenue and become a tradable capital element.

This mechanism is reshaping the logic of capital pricing. The value of on-chain assets no longer depends solely on the "narrative," but is directly related to the accuracy and verifiability of the data. Through data aggregation, verification, and distribution, oracles construct a capital market at the data layer, improve the efficiency of smart contract execution, and reduce the systemic risk of on-chain financial systems.

For institutions, high-quality oracle data translates to more accurate risk pricing, more flexible interest rate curves, and more robust liquidation parameters. Institutional investors can then leverage data quality for arbitrage and efficiency optimization, realizing the value transformation of information into capital.

5.2 Risks: Model Consistency and Systemic Vulnerabilities

As the "public layer" of financial data infrastructure, the security and governance stability of oracles determine the resilience of the entire financial system. The new risks brought about by this integration are mainly concentrated in three areas: technology, governance, and regulation.

Technical and Algorithmic Risks: Model Consistency Trap

When markets rely excessively on a single data source or algorithmic model, any errors or delays in that oracle's data can have a systematically amplified impact, triggering collective misjudgments or chain reactions in the financial markets, creating a so-called "model consistency trap." While decentralized structures enhance the system's resistance to attacks, node collusion, data contamination, and algorithmic bias remain potential sources of risk. Especially in scenarios involving large-scale asset liquidations or cross-chain bridge transactions, any data error could trigger systemic financial events.

Governance and Centralization Risks: Hidden Dangers of Data Monopoly

The oracle ecosystem also faces the risk of centralization at the governance level. If services are concentrated in a few networks or large node operators, it could create a de facto "data monopoly." Once this monopoly extends to the CCIP or RWA asset layer, it will undermine the spirit of decentralization and pose a challenge to the openness of the global financial system.

Without unified industry standards and transparent governance mechanisms, the oracle ecosystem may be dominated by a few companies, and its long-term stability will depend on the openness and resistance to manipulation of the governance structure.

Regulatory and compliance risks: Interoperability barriers across jurisdictions

Differences in data governance, privacy protection, and financial compliance across jurisdictional boundaries are core challenges facing the globalization of oracles. Significantly different regulatory standards for on-chain financial data exist across regions, leading to compliance risks in cross-border oracles applications. Looking ahead, financial regulation is shifting from "risk prevention" to "transparency promotion," with compliance and standardization revolving around three pillars:

● Data verifiability: Ensure that the source and signature of the data are traceable;

● Privacy protection and minimal disclosure: Achieving verification transparency while protecting privacy;

● Cross-jurisdictional interoperability: Provides a compliance basis for data flow between global financial institutions.

Overall, oracles have risen to become the core hub connecting real-world finance and on-chain finance. They have not only promoted transparency and automation in the financial system but also accelerated the global interconnection of capital markets, building a unified settlement framework across chains, markets, and assets. At the same time, risks such as data monopolies, algorithmic biases, and centralized governance may weaken the core spirit of decentralized finance and introduce new systemic vulnerabilities.

6. Outlook: From Data Pipelines to Trust Layers

The evolution of oracles is essentially an upgrade from a "data pipeline" to a "trust layer" that provides "verifiable truth" to the entire digital world. This upgrade means that future financial and commercial activities will depend not only on the efficiency of on-chain settlement but also on the authenticity and verifiability of on-chain data. Whether it's DeFi clearing systems, RWA asset certificates, or the interaction between corporate compliance reports and central bank digital currencies, oracles will play a crucial role in information transmission and verification. As more real-world financial institutions, governments, and enterprises connect to the on-chain system, the marginal value of oracle networks will grow exponentially.

For investors, the long-term value of oracle projects should be centered on "real-world use" and "economic security." Investment decisions should focus on three key indicators: First, protocol revenue (i.e., real data fees paid by DApps, financial institutions, etc.) is the most sustainable valuation basis; second, the growth quality of TVS (Total Value Secured) should be analyzed in depth—paying attention to whether its service targets are concentrated on blue-chip DeFi protocols, rather than high-leverage or short-cycle projects; and third, the economic security model (including staking mechanisms, slash penalties, and node incentive structures) determines the underlying resilience of the network to resist attacks and maintain data reliability.

For institutions, it is recommended to actively explore the deployment model of "first-party oracle nodes." By directly running nodes, institutions can securely and authoritatively put their transaction data, pricing models, or asset information on the blockchain. This not only enhances market transparency but also allows them to gain data dominance in the future digital economy. This means that financial institutions can transform from data consumers to data issuers and verifiers, thereby gaining greater influence in the regulatory and innovation landscape.

For developers, oracles should be considered a core foundational component of DApps. Developers should fully leverage their advanced features, such as off-chain computation, verifiable randomness (VRF), and automation, to build next-generation applications capable of deep interaction with the real world. For example, bringing weather, logistics, legal rulings, or IoT data on-chain can foster entirely new business models such as insurance, supply chain finance, carbon credits, and AI smart contracts.

Ultimately, the competition in the oracle race is essentially a struggle for the "right to define facts in the digital world." Whoever becomes the safest, most reliable, and most network-effect-driven "source of truth" will become an irreplaceable cornerstone of the future value internet. Just as Google defined information retrieval standards in the internet era, and AWS laid the foundation for computing power standards in the cloud computing era, the leaders in the oracle era will define the standards for "trustworthy data" and occupy a decisive position in the next round of financial infrastructure revolution.

Author: Ember

7. References

1. https://oakresearch.io/en/analyses/fundamentals/zoom-on-different-types-crypto-oracles

2. https://blog.csdn.net/thefist11cc/article/details/116227623

4. https://defillama.com/protocol/chainlink?staking_tvl=true&fees=false

5. https://blog.chain.link/quarterly-review-q3-2025/

6. https://blog.chain.link/sibos-2025-recap/

7. https://defillama.com/oracles

8. https://blog.chain.link/chainlink-reserve-strategic-link-reserve/?utm_source=chatgpt.com

11.https://www.chaincatcher.com/article/2199984

12. https://www.theblock.co/data/decentralized-finance/prediction-markets-and-betting

13. https://metrics.chain.link/

14. https://svr.llamarisk.com/

15. https://blog.chain.link/chainlink-smart-value-recapture-svr/

16. https://www.techflowpost.com/article/detail_14964.html

17. https://www.tokenmetrics.com/blog/chainlink-link-price-prediction

18. https://coinlaw.io/chainlink-statistics#Blockchain-Networks-Supported

19.https://www.chainlinkecosystem.com/ecosystem

20. https://enclaveresearch.com/chainlink-market-cap-tvs-ratio/

21. https://enclaveresearch.com/chainlink-network-other-services-revenue-estimate-for-2025/

22. https://dune.com/linkpool/chainlink-revenue

23. https://dune.com/linkpool/chainlink-ccip

24. https://www.coingecko.com/en/categories/infrastructure#key-stats

25. https://www.coingecko.com/en/categories/oracle#key-stats

Gate Research is a comprehensive blockchain and cryptocurrency research platform that provides readers with in-depth content, including technical analysis, insights into hot topics, market reviews, industry research, trend forecasts, and macroeconomic policy analysis.

Disclaimer

Investing in the cryptocurrency market involves high risks. Users are advised to conduct independent research and fully understand the nature of any assets and products they intend to purchase before making any investment decisions. Gate assumes no responsibility for any loss or damage arising from such investment decisions.