De-anchoring, vulnerabilities, regulation, volatility: are stablecoins really "stable"?

Original author: ✧Panterafi

Original article translated by: Deep Tide TechFlow

There has been much discussion about stablecoins, but relatively little has been addressed regarding their risks, which I believe is a core issue worthy of in-depth discussion. This is what I have finally compiled and am willing to share after months of reflection.

summary

- The Future and Past Discussions of Stablecoins

- Main categories of stablecoins

- Comparative analysis of risk indicators

- Current status of Solana ecosystem development

The Future and Past Discussions of Stablecoins

Here, I've highlighted some key discussions and perspectives within the industry regarding the development of stablecoins. These discussions largely revolve around various pathways for decentralized finance (DeFi) to achieve global adoption through stablecoins.

"On-chain forex is key to global adoption" — @haonan

On-chain FX can improve the efficiency of global trade settlement. It can handle cross-border payments, remittances, and conversions to local stablecoins or fiat currencies without being restricted by regulatory barriers. On-chain FX has the potential to replace the current slow system, enabling instant and low-cost currency conversion.

For widespread adoption, on-chain forex trading requires deep Automated Market Maker (AMM) pools capable of supporting, for example, $11 billion in trading volume over 30 days. Simultaneously, managing slippage presents a challenge, and scalable infrastructure and payment systems are also necessary. The stablecoin ecosystem also needs to prioritize robust security in forex swaps.

"Proxy payment can improve the user experience for small online transactions" — @hazeflow_xyz

x402 is an open-source, internet-native payment protocol developed by Coinbase. It utilizes the HTTP 402 status code ("Payment Required") to enable instant, small-amount payments based on stablecoins such as USDC. This significantly improves the user experience for small online transactions.

The multiple advantages of x402

- Autonomous operation: AI agents can independently complete payments for services, data, calculations, or tools in real time without human intervention, thereby enabling economic activities between machines.

- Instant settlement: Transactions are confirmed and completed within seconds, eliminating concerns about refunds or agreement fees, making it particularly suitable for high-frequency, low-amount payment scenarios.

- Seamless integration: Agents can attach stablecoin payments to any web request with minimal setup, overcoming obstacles such as API keys or intermediaries in traditional payments.

- Compliance and Security: Built-in verification and settlement features ensure compliance with regulatory requirements while leveraging stablecoins to maintain price stability in a volatile crypto environment.

- The scalability of the AI ecosystem: It supports proxy markets, allows proxies to autonomously trade resources, and promotes the growth of stablecoin infrastructure, all backed by promoters such as Coinbase or PayAI.

Traditional financial institutions, such as Deutsche Bank, and auditing firms like Deloitte and EY, have faced serious charges for improper auditing or money laundering. In addition, many politicians have been convicted of misappropriating public funds.

Blockchain-based stablecoin systems offer significant advantages in reducing corruption, illicit transactions, and money laundering. Through blockchain, financial regulators can track fund flows, and auditors can gain a clearer understanding of how businesses operate. This transparency may also create new professional roles, such as wallet trackers or data analysts (e.g., the DUNE data analytics platform). New economic models and concepts may also be discovered through more precise fund flow analysis and data insights.

For me, blockchain is not merely a practical revolution from a corporate perspective; it is a social transformation that rebuilds trust by empowering the public to oversee governments and elites. The transparency and controllability of blockchain will provide greater visibility for the public, promoting a return to fairness and trust.

"Stablecoin infrastructure will become invisible" — @SuhailKakar

Suhail Kakar emphasized that blockchain stablecoins will gradually fade from public view. For ordinary consumers, as long as the payment system functions properly, they don't care about the underlying technology. He cited the example of Telegram, which was initially a messaging application, later integrating the TON network, thus providing users with wallets and payment services, but without realizing its connection to cryptocurrency or blockchain.

This is precisely what companies like Circle, Tether, Coinbase, and Stripe are striving to achieve: building a payment infrastructure that allows merchants to accept crypto payments without needing any crypto knowledge. Merchants simply receive US dollars, while the infrastructure handles all blockchain-related transactions, and customers experience a seamless checkout process.

Suhail Kakar believes that cryptocurrency's greatest success will come when people stop talking about it. Its true value will be realized when it becomes the "invisible infrastructure" that underpins the experiences users genuinely need.

"The explosive growth of yield-generating stablecoin protocols" — @Jacek_Czarnecki

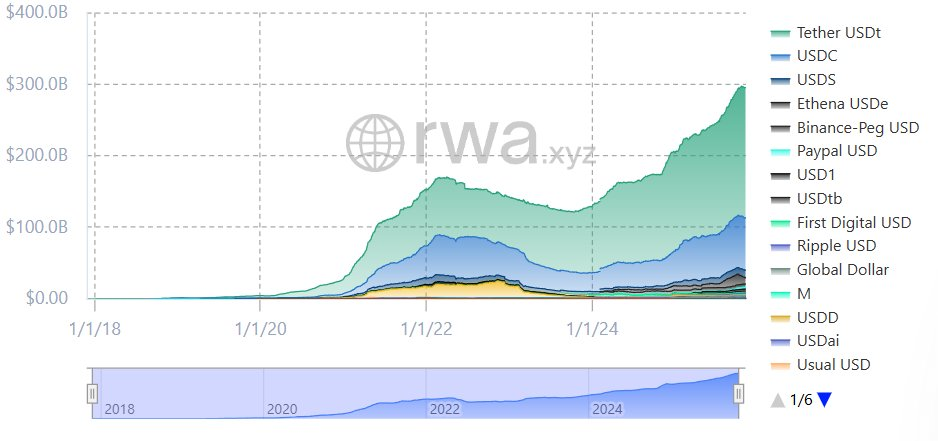

The total market capitalization of yield-based stablecoin protocols surged 13 times in just two years, soaring from $666 million in August 2023 to $8.98 billion in May 2025, and peaking at $10.8 billion in February 2025.

Currently, yield-based stablecoins account for 3.7% of the overall stablecoin market (total size of $300 billion). There are over 100 yield-based stablecoins on the market, with Ethena's sUSDe and Sky's sUSDS/sDAI being the leading players, collectively holding 57% of the market share (approximately $5.13 billion). Since mid-2023, these protocols have distributed nearly $600 million in yields.

The rapid development of yield-generating stablecoins demonstrates that stablecoins are not only payment tools, but can also become a new option for users seeking stable returns.

Drivers of inflows into emerging stablecoins: Two key factors

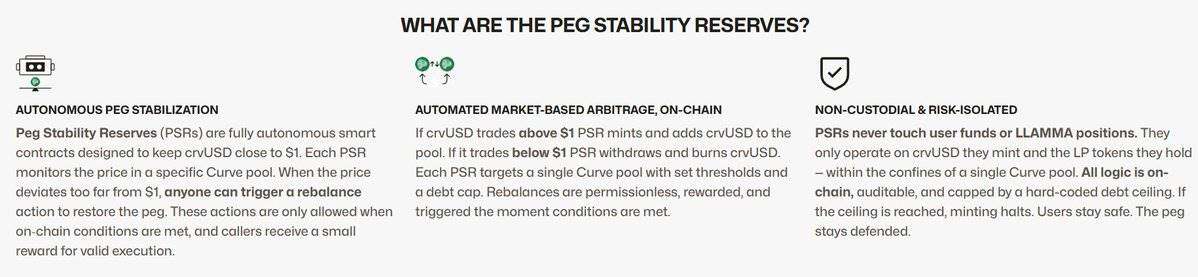

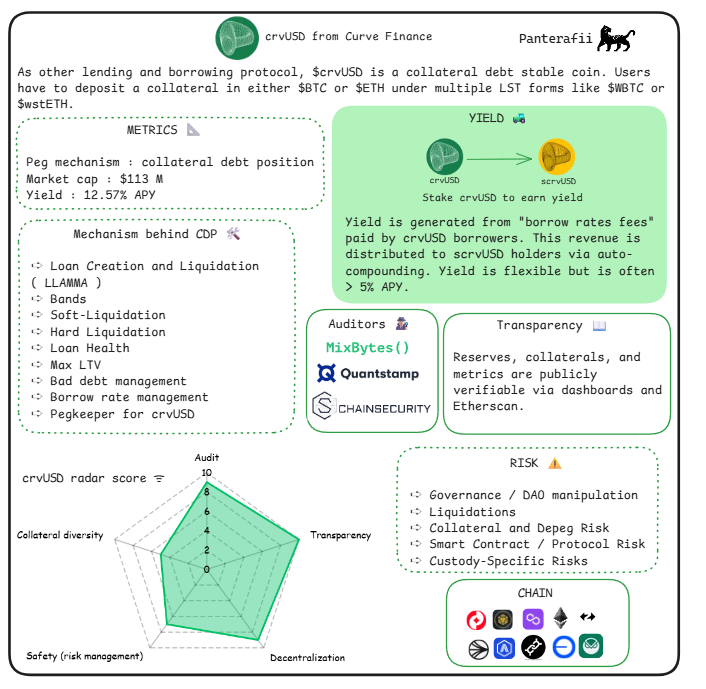

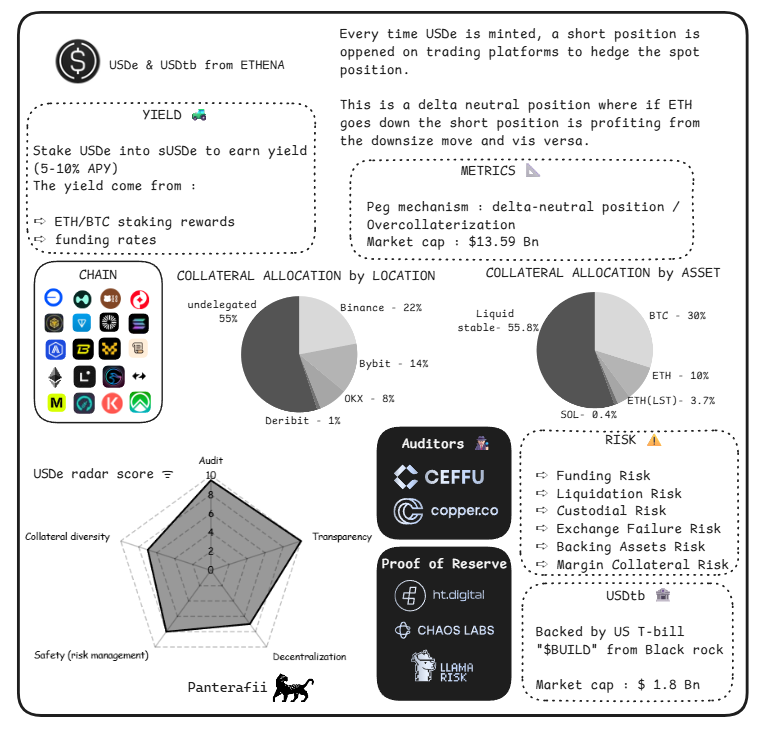

- Innovation in core mechanisms: The recent growth of stablecoins has largely benefited from breakthroughs in their core concepts. For example, Ethena's USDe employs a delta-neutral hedging mechanism, while Curve's crvUSD introduces soft liquidation mechanisms . These technological innovations not only helped the market recover from the Luna crash but also propelled the stablecoin market capitalization to $300 billion.

- Government regulation is driving growth: Government recognition of certain types of crypto assets as financial instruments has opened doors for industry innovation. For example, the US passed the GENIUS Act in July 2025 (requiring 1:1 reserves, AML/KYC compliance, and banning uncollateralized algorithmic stablecoins), Europe has the MiCA regulation , and there are related frameworks in the UK and Asia. These regulatory developments have not only promoted institutional adoption but also increased market trust, laying the foundation for the further development of stablecoins.

"New Revenue Models and White Label Distribution" — @hazeflow

In a low-interest-rate environment, new reward models can be introduced, such as government intervention. Governments can encourage users to use stablecoins by issuing incentives. In a high-interest-rate environment, decentralized stablecoins, in particular, have an advantage, as they can provide returns or incentives through reserve assets. Simply holding stablecoins is enough for users to earn annual returns to offset the effects of inflation. These returns can be converted into cash rebates or other practical benefits through partnerships with businesses.

Stable infrastructure can create a mutually beneficial relationship with businesses like Apple or Microsoft. Businesses can use it to open up new revenue streams, while stablecoins can leverage their large user base to drive their global expansion.

The United States is fertile ground for the development of stablecoins, with a gradually improving regulatory framework and a considerable market size. In terms of practical use, economically poorer countries, due to their weaker currencies, tend to use stablecoins as an alternative tool.

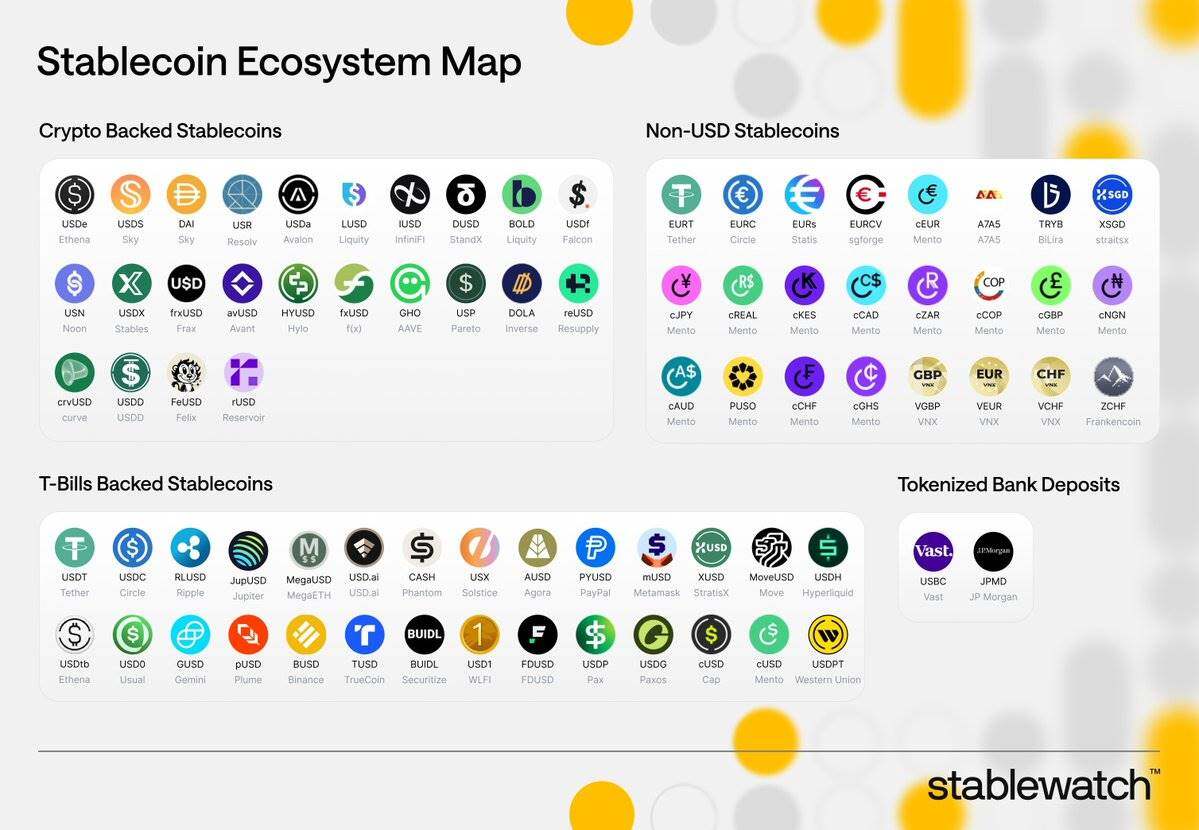

Next, let's delve into the specific characteristics of different types of stablecoins to better understand their risk metrics and return mechanisms. I've specifically written and created relevant visualizations to help you fully understand which mechanisms are more robust and the differences in their yield performance.

Stablecoins are a core pillar of DeFi, but concentrating all idle funds into a single protocol is not the best approach. While diversification is important, the scope of diversification is limited to achieve consistent and stable returns, therefore, careful selection of suitable stablecoin types is crucial.

Stablecoin category

Collateralized stablecoins (over-collateralized using cryptocurrency or real-world assets)

Reward Mechanism

Users borrow stablecoins by over-collateralizing assets (such as ETH and BTC), generating returns when the value of the borrowed stablecoins exceeds the issued stablecoins. These returns come from various sources, including:

- Loan costs

- Interest on real-world assets (RWA, such as U.S. Treasury bonds)

- Agreement profit: The over-collateralized portion acts as a buffer, enhancing the stability of the system.

Example

- USDS (issued by Sky): Revenue is derived from real-world assets and lending.

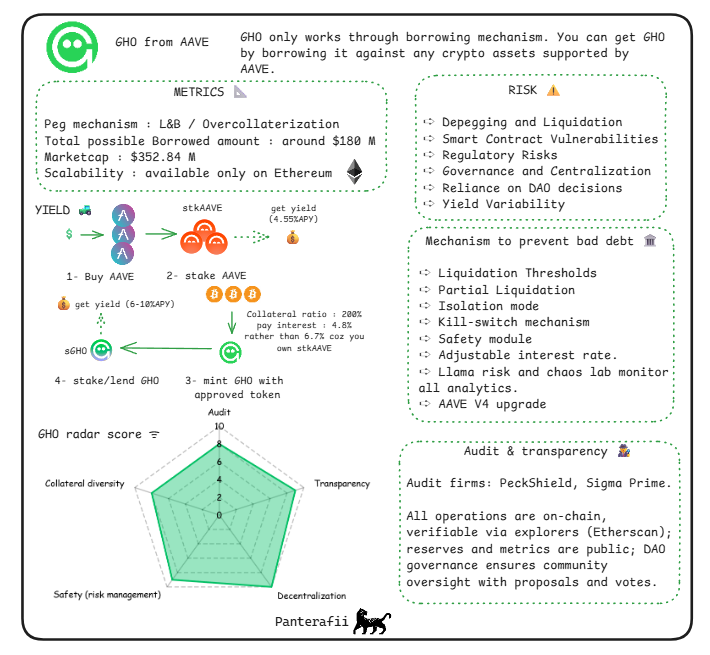

- GHO (issued by Aave): Revenue comes from lending fees.

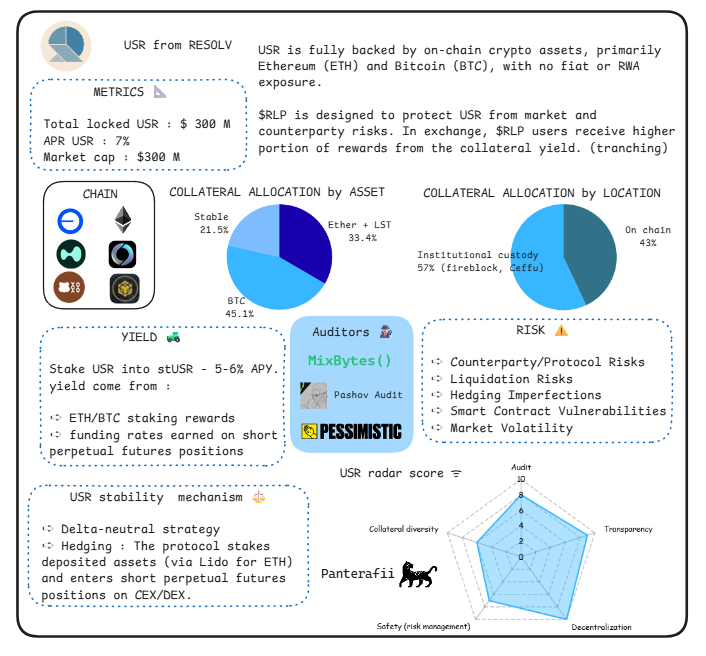

- USR (issued by Resolv): Revenue comes from asset tokenization.

- USDe (issued by Ethena): Revenue comes from staking ETH and futures trading.

- USD0 (issued by Avalon): Earnings come from interest on real-world assets.

- cUSD (issued by Celo): Revenue is supported by natural resources.

How are profits generated?

Interest generated from collateralized assets (such as staking rewards or returns from real-world assets) is typically distributed to token holders or stakers through modules (such as savings rate modules). This mechanism not only provides returns to users but also further enhances the attractiveness and use cases of stablecoins.

Reward Mechanism

Stability is maintained by adjusting the supply (issuance/destruction) through algorithms, with revenue sources including:

- Seigniorage: The cost incurred in minting coins.

- Incentives: such as governance token rewards.

Example

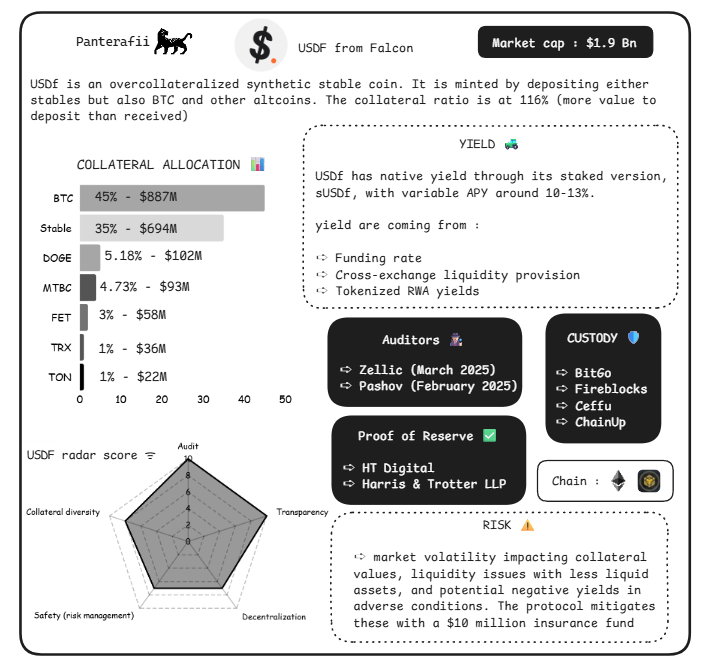

- USDF (issued by Falcon): A hybrid model that provides returns through perpetual futures.

- USDO (issued by Avalon): combines algorithmic mechanisms with real-world assets (RWA).

How are profits generated?

Dynamic adjustment mechanisms create opportunities for arbitrage or rewards, and returns are often further amplified through DeFi integrations such as staking or liquidity provision, providing incentives for users.

Fiat-backed or centralized stablecoins (for comparison)

Reward Mechanism

Backed 1:1 by fiat currency or equivalent assets, the returns primarily come from reserves (such as government bonds). The base returns are typically not distributed to users but are used for business operations.

Example

- USDC (issued by Circle)

- USDT (issued by Tether)

How are profits generated?

The reserve fund's low-risk interest is the main source of income, but it is not highly decentralized, with more of the income being reserved for corporate purposes rather than being directly distributed to users.

Risk indicators

Depeg Risk

A stablecoin de-pegged to its intended $1 peg occurs when it fails to maintain this peg. This is typically caused by extreme market stress, supply-demand imbalances, or a sharp decline in the value of the underlying collateral. This risk is inherent in stablecoin models because they rely on economic incentives, algorithmic mechanisms, or reserves, which can fail during crypto market crashes or broader financial turmoil.

Collateralized stablecoins: If reserves are insufficient or liquidity is lacking, they may become unpegged.

Algorithmic stablecoins: rely on fragile arbitrage mechanisms and may collapse during panic selling.

Important supplementary points

- Types of anchoring mechanisms

- Anchorage can be divided into two types:

- Temporary decoupling: Caused by short-term liquidity tightening, it is usually recoverable.

- Permanent failure: such as the "death spiral" that occurs in low-collateral systems. Metrics that need to be monitored include:

- Anchor Deviation Percentage: Tracks how often the price deviates from ±0.5% within 24 hours.

- Reserve transparency: The reserve ratio is monitored through on-chain audits.

- Redemption speed: Redemption efficiency during stress testing.

- Market contagion effect

The depegging of a stablecoin can trigger a chain reaction in the DeFi ecosystem, similar to a "bank run." Since stablecoins are often used as collateral in lending protocols, this situation can amplify losses.

- Risk mitigation strategies

- Regularly conduct reserve audits.

- Maintain an over-collateralization ratio of over 100%.

- A hybrid model combining fiat currency backing and algorithmic adjustments is employed. However, even well-backed stablecoins are not entirely immune. For example, during periods of high market volatility, arbitrageurs may delay intervention due to high gas fees or network congestion.

- Recent Developments

By 2025, with the widespread adoption of stablecoins, predictive models have incorporated de-pegging risk as a key focus, taking into account collateral volatility, issuance volume, and macroeconomic indicators (such as the impact of interest rate changes on government bond-backed reserves).

- Case Study: TerraUSD (UST) De-anchoring

- In May 2022, the UST stablecoin lost its peg to $1, and its price plummeted to near zero. Due to algorithmic failure and market panic, the ecosystem, worth over $40 billion, collapsed. This event highlighted the vulnerability of algorithmic stablecoins under extreme market conditions.

Smart contract vulnerabilities

Code vulnerabilities or exploitable weaknesses in the protocol can lead to hacking attacks or financial losses. Stablecoin protocols that have been running for a longer time are generally more resistant to these vulnerabilities, while newer stablecoin protocols face higher smart contract risks due to a lack of real-world testing.

Smart contracts, as the core framework of stablecoin protocols, may contain code vulnerabilities, logical flaws, or exploitable weaknesses, leading to unauthorized access, theft of funds, or protocol malfunction. In contrast, protocols with longer operating histories and thorough testing are generally more robust due to extensive auditing and real-world validation; while emerging protocols, with their unverified code, are at higher risk.

Important supplementary points

- Audit and Testing Practices

The importance of the following measures is emphasized:

- Multiple independent audits (such as those conducted by Quantstamp or Trail of Bits).

- Use formal verification tools.

- We will continue to conduct vulnerability bounty programs to identify potential issues before and after deployment. Relevant metrics include the number of audits, the time since the last major update, and whether there have been any vulnerability incidents in the past.

- Oracle dependency

Stablecoin protocols typically rely on external data sources (oracles) to obtain price information for collateral, which can become a vulnerable point for manipulation. For example, through a flash loan attack, an attacker can briefly distort prices, triggering unnecessary liquidations (and thus causing a temporary de-pegging).

- Ecosystem-wide impacts

Smart contract vulnerabilities do not exist in isolation. A hack of one protocol can affect integrated stablecoins, triggering a chain reaction of liquidations across the entire stablecoin protocol (because these protocols back each other up or use similar collateral), ultimately leading to a crisis of trust and decreased adoption. For example, the SVB (Silicon Valley Bank) default caused USDC to temporarily de-peg, which in turn impacted the entire DeFi ecosystem.

Case Study: Ronin Network Hack

In March 2022, attackers exploited a vulnerability to steal $620 million worth of ETH and USDC from Axie Infinity's cross-chain bridge.

Regulatory risks

Stablecoins are facing increasingly stringent government scrutiny, involving anti-money laundering (AML) requirements, knowledge-based identity verification (KYC) requirements, securities classification, and transparency regarding fiat currency backing. This could lead to operational restrictions, asset freezes, or even outright bans, especially for stablecoins integrated with real-world assets (RWA) or conducting international business. In jurisdictions with evolving crypto policies, this risk is further amplified, impacting their global availability.

Important supplementary points

- Global regulatory differences

- EU: Under the Crypto Asset Market Regulation (MiCA), stablecoin issuers must hold reserves in licensed banks and maintain liquidity buffers.

- The United States focuses on classifying some stablecoins as securities and having them regulated by the U.S. Securities and Exchange Commission (SEC).

- Emerging markets: Capital controls may be implemented, restricting cross-border capital flows. Agreements must comply with the regulatory requirements of their respective jurisdictions to reach local users, increasing development complexity. Furthermore, the agreement must be placed in a suitable jurisdiction for legal operation, and the EU is not a preferred option.

- Compliance indicators

The following metrics need to be monitored:

- The issuer's license status.

- Frequency of reserve reports.

- The degree of connection with sanctioned entities. Non-compliance may result in delisting from exchanges, leading to a loss of user trust and user base.

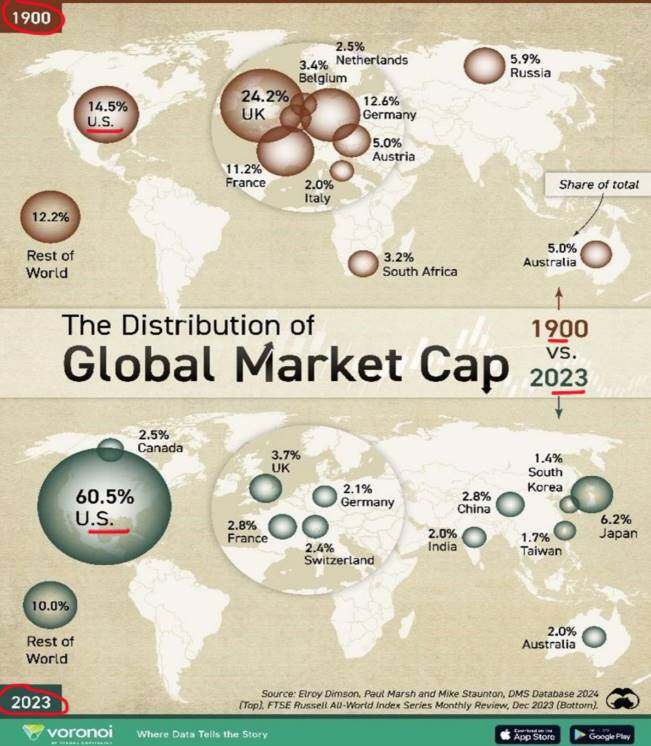

- Geopolitical factors

- Stablecoins pegged to the US dollar are at risk of changes in US policy, such as the expansion of technology export controls or sanctions to crypto entities.

- Most stablecoins are pegged to US dollar assets, but what would happen if the US financial system collapsed or its financial influence over Asia or the European Union weakened?

- Potential Solution: The Swiss franc, as a relatively strong currency, may be a new option. Developing a stablecoin backed by the Swiss franc could have advantages in terms of diversification, trust, and foreign exchange swaps.

- positive aspects

Regulation can enhance legitimacy, but over-regulation can stifle innovation and force users to turn to unregulated alternatives.

Case Study: Tornado Cash Sanctioned

In August 2022, the U.S. Office of Foreign Assets Control (OFAC) imposed sanctions on Tornado Cash, blacklisting its address and prohibiting U.S. citizens from interacting with it, while freezing $437 million in assets.

Liquidity risk

Liquidity risk refers to the significant price slippage experienced by users when buying or selling stablecoins due to insufficient market depth. This risk is particularly severe in markets with low trading volume, during panic selling, or on exchanges with low traffic. In contrast, mature stablecoins with high TVL (Total Value Locked) and deep liquidity pools outperform their counterparts because their long-term development creates network effects that reduce slippage risk.

Key points:

Measurement metrics:

- Use on-chain data to assess liquidity health, such as TVL (which can be queried via DefiLlama), the 24-hour volume-to-market capitalization ratio, and the slippage rate of major decentralized exchanges (DEXs) during periods of high volatility.

- A healthy ratio is when daily trading volume reaches 5-10% or more of the circulating supply.

Market depth issues:

- In a bear market, redemption demand may exceed the minting capacity, thereby depleting liquidity reserves.

Chain liquidation risk:

- Similar to a bank run, when large-scale withdrawals occur, it creates a self-fulfilling prophecy—what was originally just a "perceived lack of liquidity" eventually evolves into a real liquidity crisis.

Improvement measures:

- Integration with Automated Market Makers (AMMs) and liquidity incentives (such as liquidity mining rewards, Merkl, Turtle, etc.) can enhance market resilience.

- However, over-reliance on incentive mechanisms may lead to "artificial liquidity," which can evaporate rapidly during a crisis.

Case Study: FTX Crash

In November 2022, FTX's collapse triggered an $8 billion liquidity gap, leading to withdrawal disruptions and eventual bankruptcy. This crisis was exacerbated by a massive outflow of funds, becoming a classic case of liquidity risk.

Counterparty risk

Stablecoins typically rely on third parties, such as custodians managing real-world assets (RWAs), oracles providing price data, or cross-chain bridges enabling cross-chain functionality. These third parties can be potential failure points, posing risks due to bankruptcy, fraud, or operational errors.

Important supplementary points

- Risk of failure of custody institutions and oracles

- Custodian: The custodian may face default risk, which could lead to the inability to redeem the reserve assets.

- Oracles: Oracles such as Chainlink may provide inaccurate data during network outages, leading to incorrect collateral pricing.

- Evaluation indicators

- The diversity of custodians.

- Insurance coverage.

- The degree of decentralization of oracles. A high reliance on centralized APIs can increase risk. For example, Curve's crvUSD stablecoin uses price data from multiple stablecoins to calibrate oracle prices, thus ensuring price accuracy.

Managing counterparty risk requires review from multiple dimensions, including the decentralization of the custodian, the reliability of oracle data, and the degree of decentralization, in order to reduce potential crises caused by single points of failure.

Interdependence risk

In asset tokenization scenarios, chain dependencies between counterparties can amplify problems. For example, a hacking attack on a related protocol could lead to the freezing of stablecoin redemption functionality.

Legal protection risks

In bankruptcy proceedings, holders may be classified as unsecured creditors, receiving very little in return. This underscores the importance of having diversified reserves. The operational models of some stablecoins demonstrate their reliance on certain types of collateral, which are not even directly held by them (typically short-term government bonds with near-zero default risk). However, other protocols may over-rely on ETH-LST, BTC-LST, or SOL-LST, raising concerns about yield volatility.

Case Study: Celsius Network Bankruptcy

In June 2022, Celsius Network went bankrupt due to illiquid investments and counterparty defaults, freezing $4.7 billion in user funds.

Risk of return volatility

Stablecoin yields typically derive from lending protocols or government bond investments, but these yields fluctuate with changes in market conditions, lending demand, and interest rates. This volatility reduces predictability for users seeking stable passive income.

Important supplementary points

- Factors affecting returns

- In a low-volatility environment, borrowing demand decreases and yields decline; while during a bull market, yields may rise.

- For stablecoins pegged to real-world assets (RWA), external interest rates (such as the Federal Reserve Funds rate) are also an important factor affecting returns.

- Risk assessment indicators

- Monitor the historical revenue range.

- Analyze the correlation between returns and the Crypto Market Volatility Index (CVIX).

- Pay attention to the utilization rate of the agreement (a loan-to-value ratio of over 80% usually means higher returns, but the risk also increases accordingly).

- Sustainability issues

- High returns may imply potential risks, such as excessive leverage.

- Sustainable profit models prioritize “Delta-neutral” strategies (such as Ethena) to achieve more stable returns by minimizing directional risk, which is part of the reason for their success.

- User impact

- Fluctuations in returns can lead to opportunity costs: users may miss out on other opportunities with higher returns.

- If the return is lower than the interest rate on fiat currency savings, there is also the risk of inflation erosion.

Case Study: Declining Revenue for Aave and Compound

In the winter of 2022, due to weak lending demand, the yields of Aave and Compound fell from 10%+ to less than 2%.

Detailed Risk Analysis

Smart contract vulnerabilities (due to complex lending modules), regulatory risks (relevant real-world asset exposures related to U.S. government-backed securities trigger scrutiny), and yield volatility (dynamic savings rates may decline).

Sky Dashboard Metrics

Specific risk analysis : Loan mechanism loopholes (excessive collateralization may trigger a chain reaction of liquidation), failure to generate returns (if loan demand decreases, returns may drop to zero).

GHO Dashboard Indicators

Specific risks include : insufficient collateral risk (if real-world assets depreciate), liquidation threshold risk (high volatility of the underlying ETH/BTC), and security module failure (insurance-like buffers may be insufficient).

USR Dashboard Indicators

Specific risks : The yield generated through automatic compounding staking rewards makes it susceptible to ETH punitive slashing events or periods of low yields, unlike fully overcollateralized stablecoins.

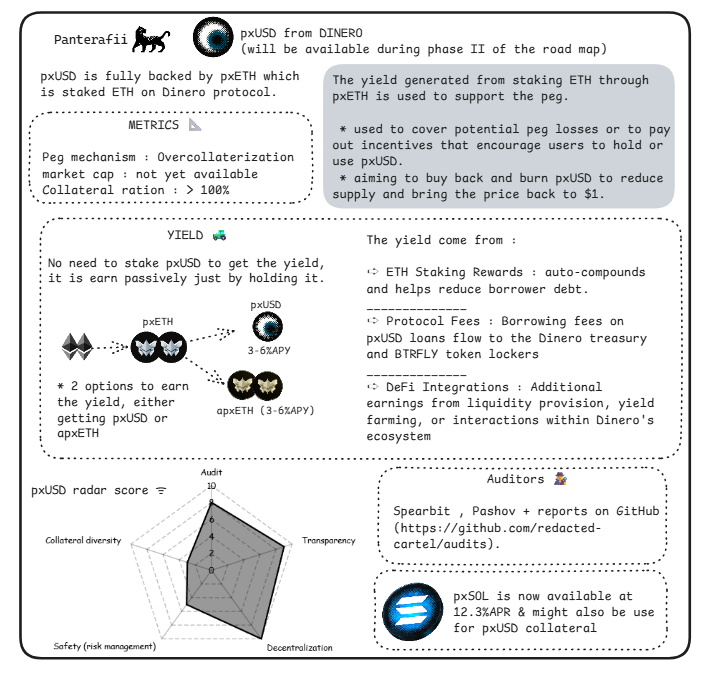

Dinero Dashboard Indicators

Specific risks : crvUSD's CDP model (150-167% health ratio, backed by BTC/ETH LST) focuses on lending, making liquidation cascades during market volatility a major risk. Its returns come from flexible fees, typically with an annualized yield (APY) of over 3.5%.

crvUSD Dashboard Indicators

Specific risks include : market volatility of the underlying asset (futures could lead to rapid losses), regulatory compliance issues (as a stablecoin pegged to PPI), and counterparty risk on exchanges.

Falcon dashboard indicators

Specific risks : The USDA’s converter aims to prevent de-pegging by allowing minting/burning at limited costs (such as $1 million TVL and $1 billion TVL being the same), but this also introduces autonomy risks, such as governance operating without intervention, making it vulnerable to hacking or the failure of collateral backed by its 85% steakUSDC.

Angle analytics metrics

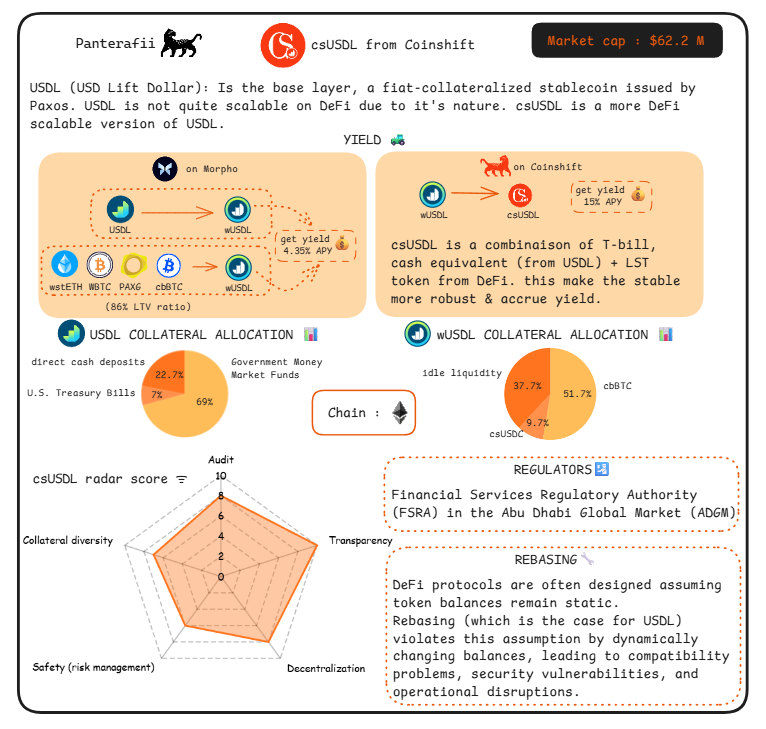

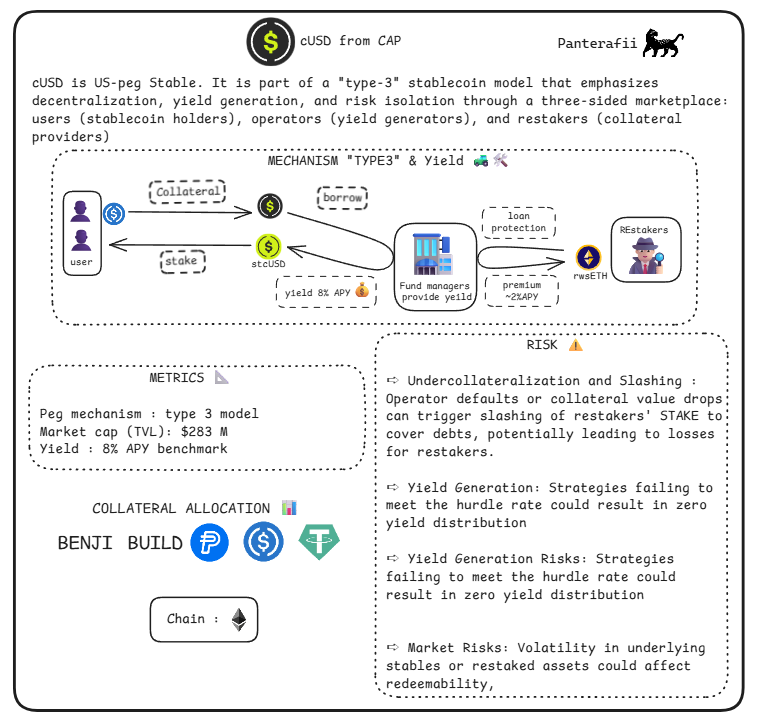

Specific risks : csUSD’s three-party market (holders, generators, and restakers) achieves its uniqueness through yield redistribution (derived from Treasury bonds/T-bills and liquidity staking tokens LST), but this mechanism is risky when the balance changes, potentially leading to compatibility issues with DeFi protocols.

Coinshift analytics metrics

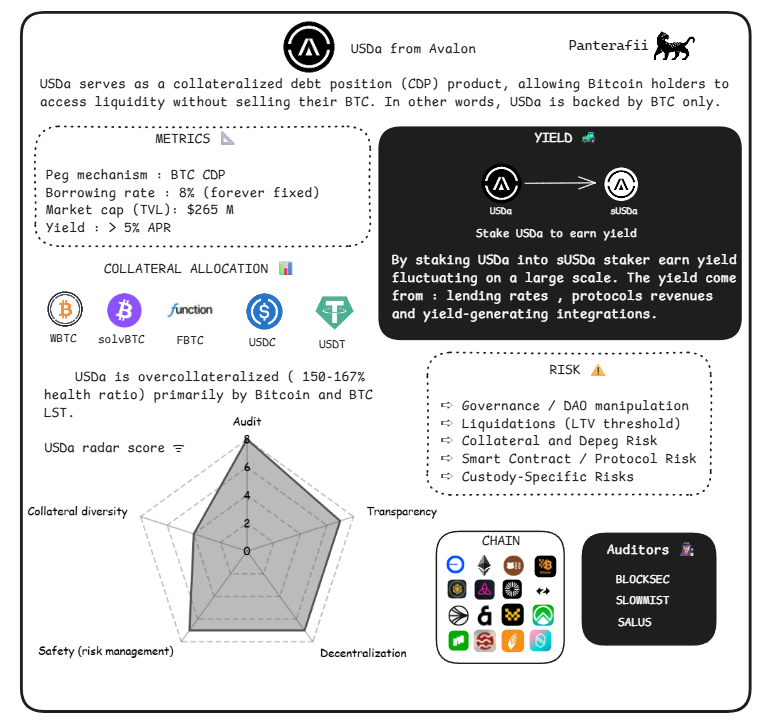

Specific risks : The USDA’s fixed lending rate (8%) and its BTC-only CDP model (with returns derived from an annualized yield of over 5%) expose it to the risk of BTC price volatility. Unlike diversified collateral, it does not mention an overcollateralization buffer mechanism.

Avalon analytics metrics

Specific risks : GPU CDPs are illiquid assets.

USDai Analysis Indicators

Specific risks include : sharp increases in interest rates (potential devaluation of futures positions), fluctuations in funding rates (negative rates erode returns), and the risk of perpetual futures (market crashes leading to liquidation).

Ethena analysis metrics

Specific risks : Custody-specific risks (Real-world assets RWA managed by "Hashnote").

Usual analytical indicators

Specific risks : Hybrid mechanisms may exacerbate the risk of anchoring failure amid economic changes.

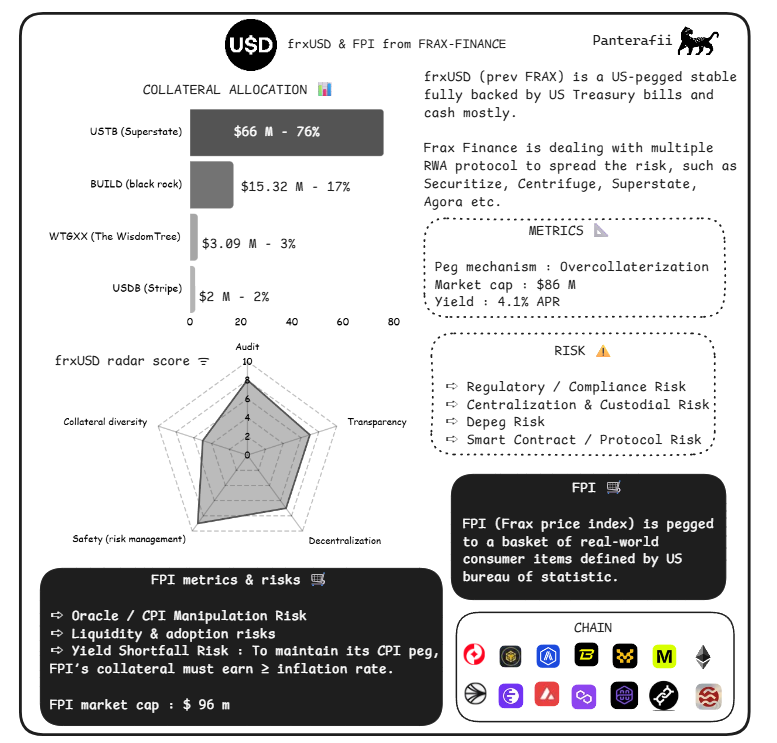

Frax analysis metrics

Paxos Transparency Report

Specific risks : cUSD emphasizes decentralization, yield generation, and risk isolation through a three-party market (holders, generators, and restakers). This brings unique risk reduction to restakers, whose yield (based on an 8% annualized yield) depends on the effectiveness of the loan protection mechanism, and they will face risks if it fails.

Solana Stablecoin Ecosystem Status

The Solana ecosystem is experiencing rapid growth in stablecoins, with market rumors suggesting it may launch ETF products to further drive ecosystem growth.

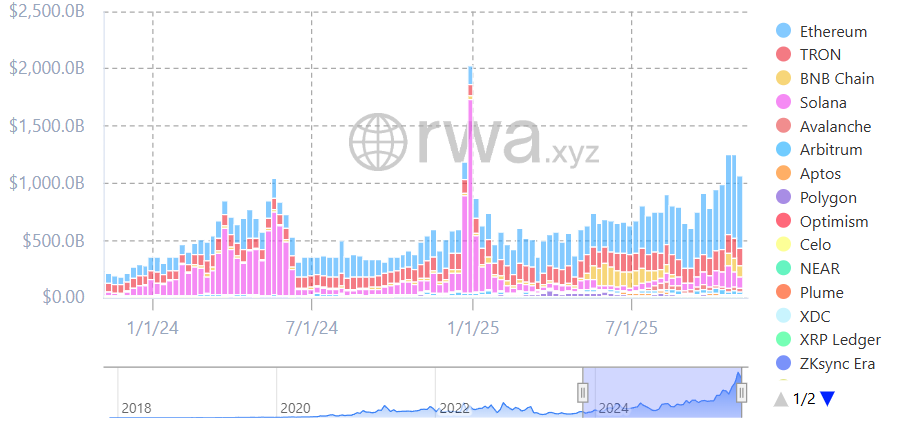

Chart: Stablecoin transaction volume

Solana ranks among the top five in on-chain stablecoin transaction volume.

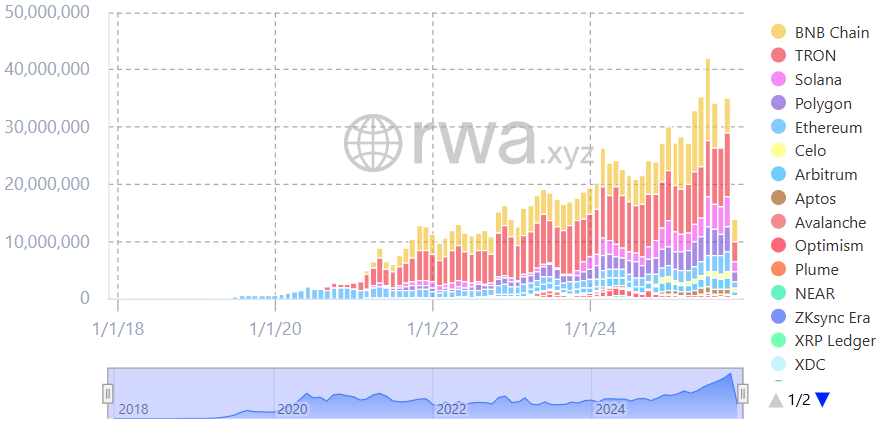

Image: Active Stablecoin Addresses

Solana ranks among the top three networks of active stablecoin addresses.

Some native stablecoins with innovative algorithmic mechanisms are emerging, including jupUSD launched by Jupiter, USX launched by Solstice, and hyUSD launched by Hylo.

These stablecoins all employ clever algorithmic mechanisms to maintain their peg, and they deserve continued attention.

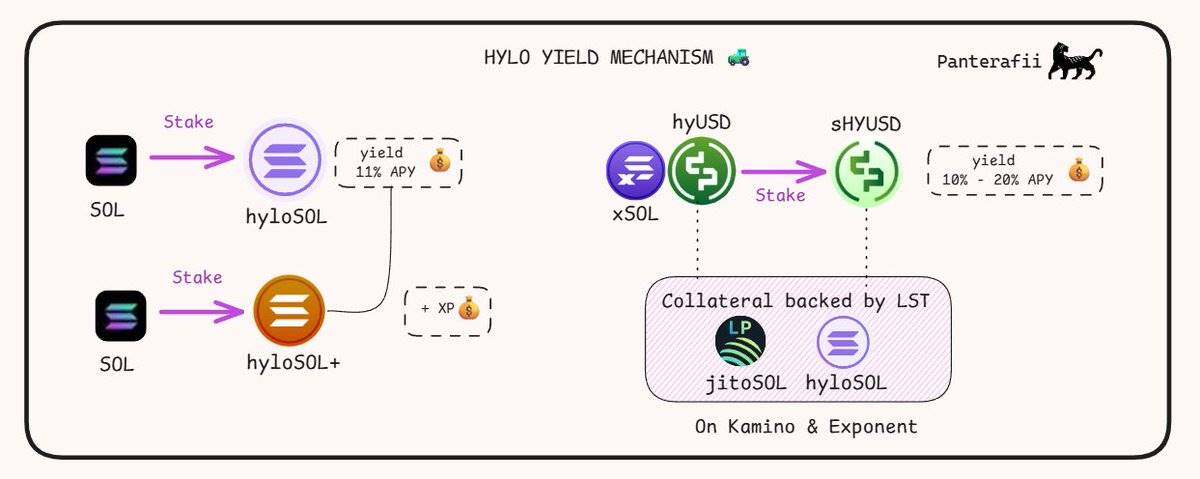

The following is an introduction to the Hylo hyUSD payout mechanism:

- hyloSOL: Hylo's LST (liquidity staking token), which generates yield through staking SOL.

- hyloSOL+: A point-farming LST that only earns XP points, with the actual profits going to hyloSOL holders.

- hyUSD: Hylo's stablecoin, backed by multiple LSTs and supported through the Solana DeFi strategy, but it does not generate yield itself.

- sHYUSD: A staking version of hyUSD that generates yield through LST's DeFi strategy.

- xSOL: A buffer asset used to absorb volatility and adjust the peg price of hyUSD. This asset is a leveraged position in the SOL price, does not generate returns, but earns XP points.

Conclusion

Sometimes, the relationship between yield and collateral doesn't always align. This is exactly what happened when Terra Luna crashed, with the APY stabilizing at around 20%, but yields significantly falling short. Therefore, focusing on the correlation between yield and collateral is crucial, as it's often the root cause of problems.

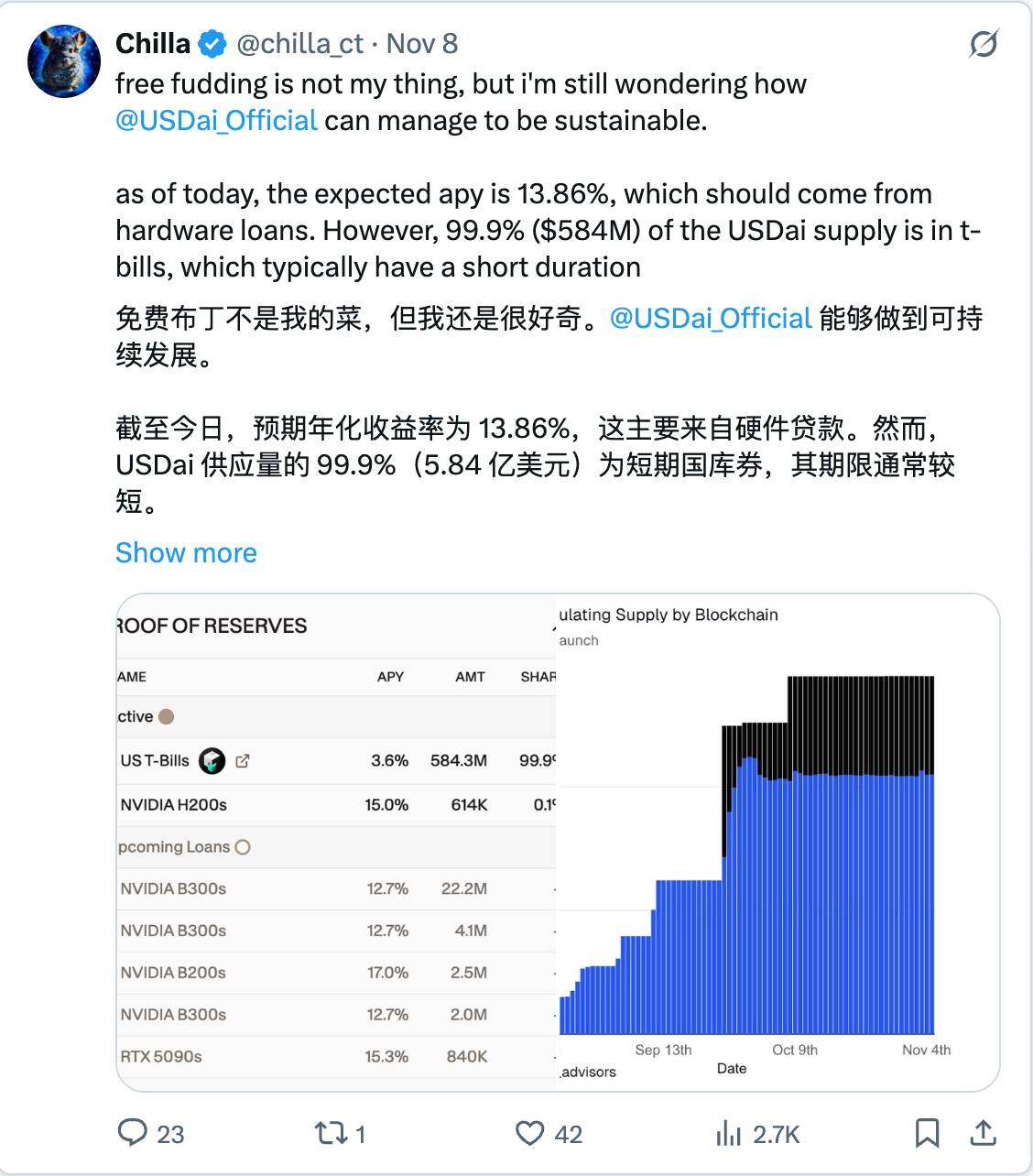

Regarding the USDai stablecoin, one of our friends raised an interesting point:

USDai has responded to this issue, stating that there are delays in GPU loans. Borrowers are seeking USDai, while lenders are struggling with issues related to the shipment of collateral. "An NVIDIA B200 graphics card was detained at French customs after leaving Taiwan," is a typical example.

I hope you enjoyed this article. I firmly believe that DeFi will one day become a core driving force in the financial system. Here, I share some innovative ideas about strategies, concepts, and protocols.

Thank you for reading, and have a wonderful day!

- 核心观点:稳定币需关注多重风险与创新机遇。

- 关键要素:

- 脱锚、合约漏洞等五大核心风险。

- 收益型稳定币两年增长13倍。

- 链上外汇与代理支付提升效率。

- 市场影响:推动DeFi全球化与监管适配。

- 时效性标注:中期影响