Polymarket, OKX, Tether, and others are making a comeback to the US market, with four key paths pointing the way.

- 核心观点:加密巨头通过四种路径重返美国市场。

- 关键要素:

- Polymarket收购合规交易所获准回归。

- 币安因CZ获特赦重启美国业务。

- OKX通过和解罚款重返并计划IPO。

- 市场影响:加速美国加密市场合规化进程。

- 时效性标注:中期影响

Original article by Odaily Planet Daily ( @OdailyChina )

Author|Wenser ( @wenser2010 )

As 2025 draws to a close, the crypto-friendly regulatory environment created by the US government is becoming increasingly stable, and many crypto projects are seizing this opportunity to exert all their efforts to compete for this crucial market. As for the specific paths taken, they can be roughly divided into four types: the "indirect approach" represented by Polymarket, the "point-to-area approach" represented by Binance, the "crypto IPO approach" represented by OKX, and the "starting from scratch approach" represented by Tether.

Odaily will briefly introduce the four main paths to returning to the US market in this article for reference by crypto projects and trading platforms.

Polymarket's "indirect approach": Settling with the US CFTC and acquiring derivatives exchange QCX

As one of the most popular crypto projects and a hot prediction market, Polymarket has a long history with the US market.

In 2020, leveraging the high-profile US presidential election, Polymarket's trading volume exceeded $3 million within just three weeks of its launch.

However, the good times didn't last long. Just about a year later, Polymarket was targeted by the U.S. CFTC (Commodity Futures Trading Commission).

In October 2021, the U.S. CFTC launched an investigation into Polymarket regarding issues such as whether it allowed clients to engage in improper trading of swaps or binary options, and whether it should have registered with the agency . At that time, Polymarket hired James McDonald, a former head of the CFTC's enforcement division and a partner at the law firm Sullivan & Cromwell, to assist in handling the investigation.

In January 2022, three weeks after being fined $1.4 million and ordered to shut down by the US CFTC, Polymarket finally relaunched. However, officials stated that US residents could not trade on the site.

From that point on, Polymarket closed its doors to what is perhaps the world's wealthiest crypto enthusiasts. Many American users eagerly awaited their chance to make their mark in the prediction market. That wait lasted three years.

After successfully predicting Trump's victory in last year's US presidential election, Polymarket was indicted by the US Department of Justice in November of last year for "allowing US users to trade." The Federal Bureau of Investigation (FBI) even issued a search warrant for Polymarket CEO Shayne Coplan and seized his cell phone and electronic devices.

But ultimately, with Trump taking office, the US cryptocurrency regulatory environment became much clearer, and Polymarket finally ushered in its own "regulatory spring".

In July of this year, the U.S. Department of Justice officially ended its investigation into Polymarket; the U.S. CFTC also terminated its investigation at the same time. Subsequently, Polymarket spent $112 million to acquire QCX, a U.S. compliant derivatives exchange, which received CFTC approval to operate on July 9. It has to be said that the timing of this transaction is quite intriguing and raises many questions.

In September of this year, after the CFTC terminated its investigation in the United States, Polymarket finally received a "no action" letter from the CFTC's Department of Market Surveillance and Department of Clearing and Risk, allowing it to return to the U.S. market under certain conditions.

In October, reports surfaced that Polymarket would reopen to US users by the end of November; other sources indicated that Polymarket tokens and airdrops would be implemented after its return to the US market, possibly in 2026.

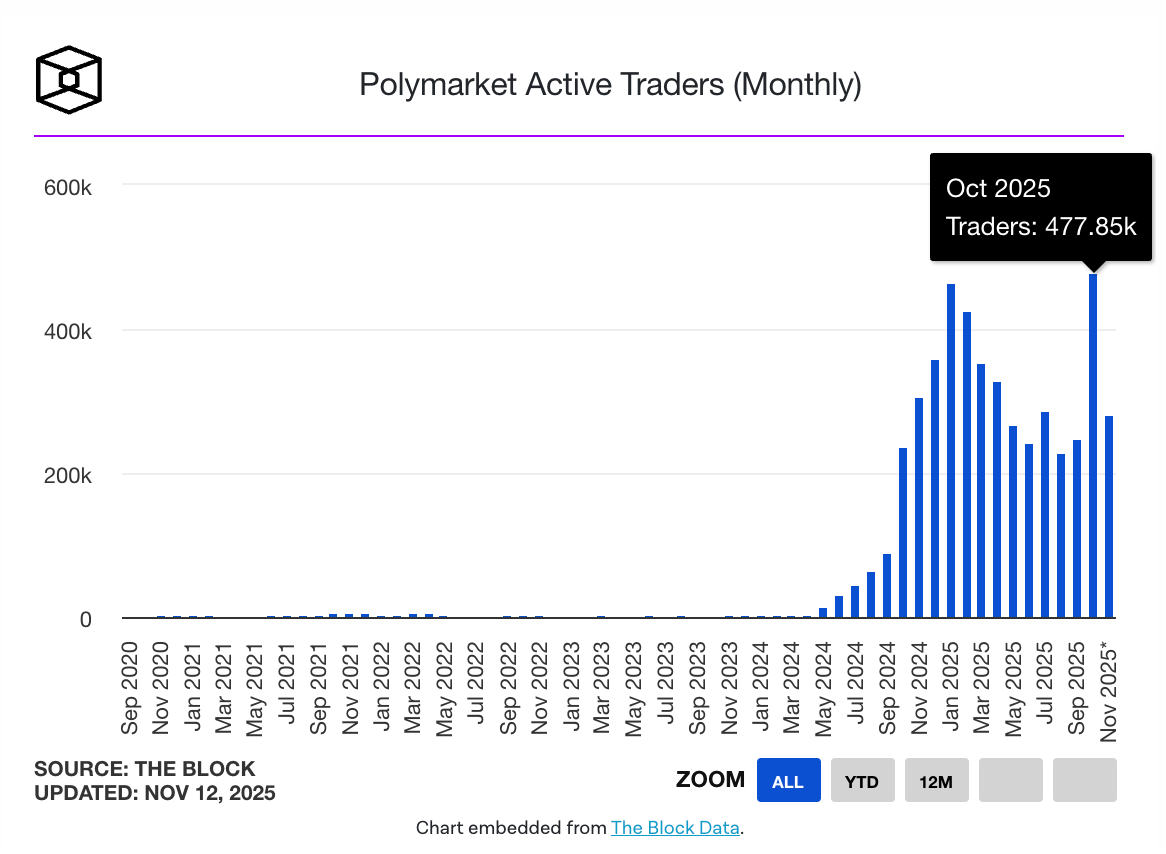

According to data from TheBlock, Polymarket's monthly active users hit a record high of 477,000 last month.

Binance's "point-to-surface" approach: CZ receives Trump's pardon, Binance may integrate Binance.US and return to the US market.

Compared to Polymarket, there is no definite timeline or accurate information regarding Binance's return to the US market. However, CZ's previous pardon by Trump has brought a new turning point to this matter, and the existence of Binance.US also provides a foundation for Binance to integrate its business and return to the United States.

In November 2023, Binance founder CZ resigned as CEO and agreed to pay a $4.3 billion settlement fine after being accused of violating the U.S. Bank Secrecy Act (BSA) for failing to effectively implement anti-money laundering (AML) procedures. The matter ultimately ended with Binance withdrawing from the United States and CZ being sentenced to four months in prison on April 30, 2024.

In December 2024, when asked whether Binance would look for ways to return to the US market, Binance CEO Richard Teng said , "Whether we will re-enter the US market is, I think, a discussion that is premature." "As of now, we are focused on our global deployment and on institutions, sovereign wealth funds, and high-net-worth individuals who will begin to allocate funds to the crypto space."

Less than a year later, the situation changed dramatically when CZ was pardoned by Trump.

In October of this year, according to the Wall Street Journal, Trump exercised his presidential pardon power, pardoning CZ . CZ subsequently publicly expressed his deep gratitude for the pardon and for President Trump's commitment to upholding American fairness, innovation, and justice. He pledged to do everything possible to help the United States become the cryptocurrency capital and to promote the global development of Web3.

In addition, Trump stated publicly that he pardoned Binance founder Changpeng Zhao because he was "innocent" and "persecuted by the Biden administration." Although this was subsequently condemned by Democratic Senators Elizabeth Warren and Adam Schiff, among others (who called the move "naked corruption" and called on Congress to take measures to prevent similar situations from happening again), Trump's pardon is still seen as paving the way for Binance's return to the US market .

In March of this year, Binance executives met with U.S. Treasury officials to discuss easing U.S. government oversight of the company; in April, reports surfaced that Binance was exploring the possibility of a business partnership with the Trump family's cryptocurrency project; some sources indicated that Binance executives in Washington proposed to Treasury officials the removal of the independent ombudsman overseeing the company's anti-money laundering compliance, a move that would be the first step in Binance's return to the U.S. market.

It's worth noting that Binance previously received a $2 billion investment from the UAE sovereign wealth fund MGX. This investment was made in USD1, a stablecoin issued by WLFI, a crypto project of the Trump family. This news was previously confirmed by Eric Trump, the second son of Donald Trump .

Based on current information, whether CZ can return to a core position at Binance will likely determine the speed of Binance's return to the US market. Additionally, Binance has officially returned to the South Korean market through its acquisition of the South Korean cryptocurrency exchange Gopax .

OKX's "Crypto IPO" Journey: Settlement with the US Department of Justice, Return to the US Market in April, Plans for a US IPO

Compared to Polymarket and Binance, OKX's path to returning to the US market is more "steady and pragmatic": on the one hand, OKX has completed its return to the US market through a settlement and fine payment with the US Department of Justice; on the other hand, according to media reports, OKX is not satisfied with just returning to the US and is actively preparing for an IPO.

In February of this year, OKX officially announced that its Seychelles subsidiary had reached a settlement with the U.S. Department of Justice regarding an investigation, acknowledging that due to historical deficiencies in compliance controls, a small number of U.S. clients had traded on the company's global platform. Under the settlement agreement, OKX agreed to pay an $84 million fine and forgo approximately $421 million in revenue earned from U.S. clients during this period, the majority of which came from a small number of institutional clients. The settlement did not involve any allegations of client harm, charges against any company employees, or the appointment of government oversight officers.

In addition, OKX stated that it will strengthen its Know Your Customer (KYC) system and Customer Risk Rating (CRR) system, expand and enhance its Due Diligence (EDD) program, deploy industry-leading Anti-Money Laundering (AML) and sanctions tools, and has assembled a professional investigation team of more than 150 people for this purpose.

In April, OKX announced its official entry into the US market and the establishment of its regional headquarters in California. The company stated that it would launch a centralized trading platform and OKX Wallet for US users. Existing OKCoin users will migrate to the OKX platform, and new user onboarding will be phased in, with a nationwide rollout expected later this year. OKX stated that it will actively cooperate with US regulatory agencies to promote compliant operations in accordance with current regulations, and has established a compliance system covering KYC, Anti-Money Laundering (AML), risk assessment, and transaction monitoring mechanisms.

In June, Yueqi Yang, a crypto journalist for The Information, revealed that OKX was considering an initial public offering (IPO) in the United States, following its return to the US market in April of this year.

Of course, this is the news, but compliance for a crypto IPO may be quite difficult. Currently, there is no further accurate information in the market, and Odaily will continue to follow up. Recommended reading: "OKX US CEO Roshan Robert: OKX is seeking to rebuild its 'super app' in the US."

Tether's "starting from scratch" approach: issuing the USAT dollar stablecoin and hiring a former White House official as CEO.

Compared to the previous three projects and platforms, Tether, the "stablecoin king," chose a more arduous path of "starting from scratch"—issuing a new US dollar stablecoin, USAT, and making ample "compliance preparations" in terms of partners and CEO selection.

In September of this year, according to official news , Tether will launch a dollar-backed stablecoin, USAT, which is planned to be issued under the US regulatory framework; in addition, the company appointed Bo Hines, former executive director of the White House Crypto Council, as CEO of Tether USAT.

According to reports, Tether officially stated that USAT will strictly adhere to the regulatory standards of the U.S. GENIUS Act, be backed by transparent reserves, and aims to provide businesses and institutions with a digital alternative to cash and traditional payment systems. The stablecoin will utilize Tether's Hadron technology platform, with Anchorage Digital, a federally regulated crypto bank, acting as the compliant issuer, and Cantor Fitzgerald serving as the designated reserve custodian.

Tether CEO Paolo Ardoino stated that the launch of USAT is a natural step to ensure the dollar's dominance in the digital age; USAT CEO Bo Hines later added that Tether's return to the US market aims to replicate its success overseas.

In October, Bloomberg, citing sources familiar with the matter, reported that Tether planned to launch a new stablecoin, USAT, on the video platform Rumble, which had received a $775 million investment from Tether and boasted 51 million monthly active users in the United States; this move was aimed at seizing the US market.

According to a recent report by Coindesk, Tether plans to launch its stablecoin, USAT, in the US market in December to comply with federal regulations under the GENIUS Act. The token will be issued by Tether America, a joint venture between Tether and the regulated US crypto bank Anchorage Digital. Tether CEO Paolo Ardoino stated that the company is expanding USAT's user base through investments, aiming to reach 100 million US users.

Conclusion: The US market is one of the few remaining sources of "crypto growth," making it a fiercely contested battleground.

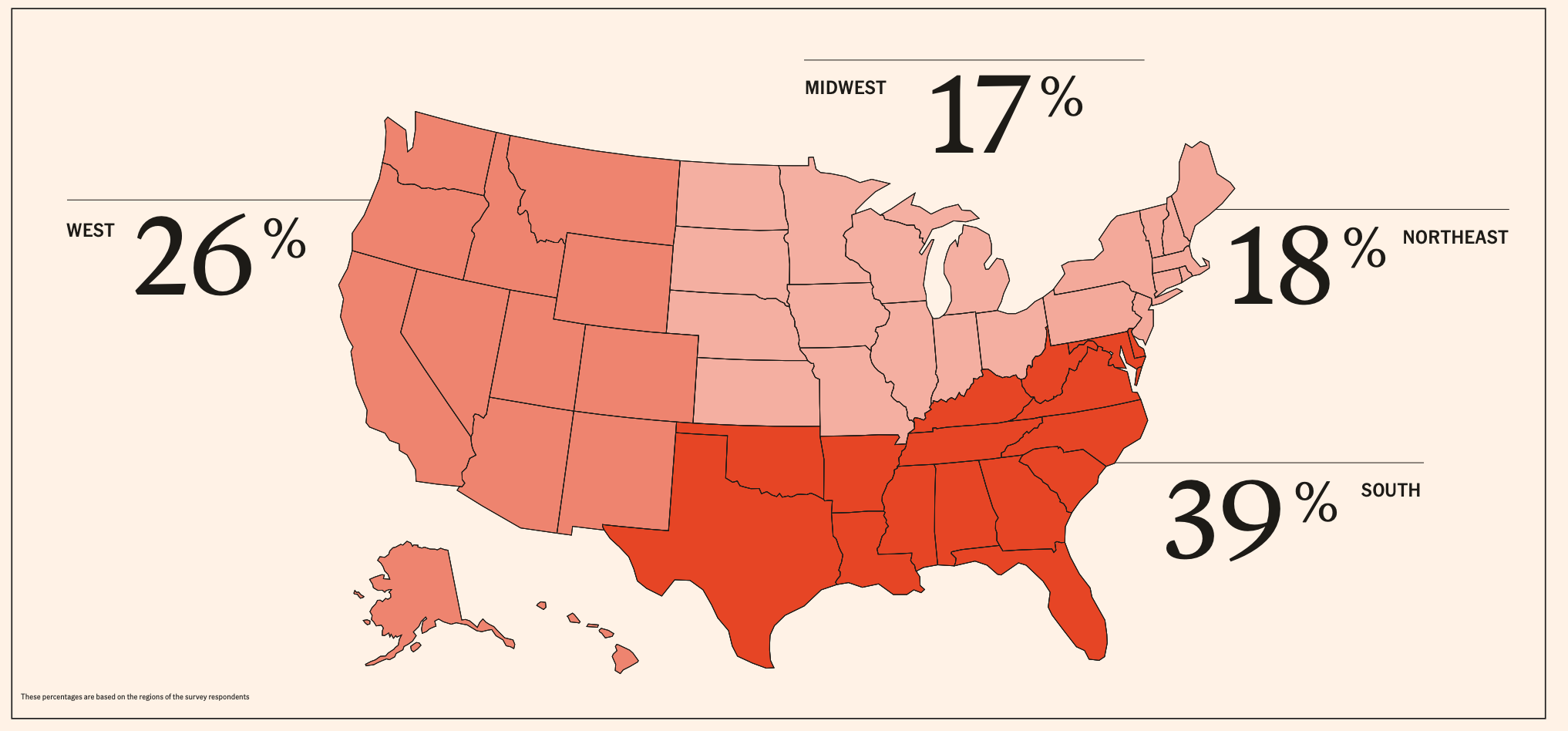

According to the "2025 Cryptocurrency Holders Survey" released by the National Cryptocurrency Association in April of this year, approximately 21% of American adults—equivalent to 55 million people—own some form of cryptocurrency. This means that one in five Americans owns cryptocurrency. Furthermore, 39% of holders use cryptocurrency to pay for goods and services; and 76% said that cryptocurrency has a positive impact on their lives. Looking at the geographical distribution of the crypto population, the penetration rate in the southern and western United States is even closer to 30% to 40%.

In a market environment of increasingly tight liquidity, this undoubtedly means more crypto users, crypto funds, and potential business profits. It's no wonder that many crypto giants are still tirelessly pursuing a return to the US. The reason is simple: profit.

With crypto giants like Circle, Gemini, and Bullish having completed their IPOs, exchanges like Kraken and OKX are naturally waiting for the next round of capital. As for their market performance, users and investors will surely vote with their feet.

In addition, digital asset sales platform Coinlist announced its return to the US market in April this year; Coinbase also recently opened the Monad token sale to US users, marking a milestone event as US users participate in token sales again after seven years since 2018. For the crypto market, a new batch of "American newbies" may already be on their way.