The Significance, Advantages, and Value of RWA – Part 1 of a Series on RWA from a Traditional Financial Perspective

- 核心观点:RWA正成为区块链与传统金融融合的核心。

- 关键要素:

- 全球RWA总值已达330亿美元。

- 贝莱德发行BUIDL基金超5亿美元。

- 香港半年涌现超50个合规项目。

- 市场影响:重塑资产流动性与全球结算格局。

- 时效性标注:长期影响

[Editor's Note]: Since 2025, W Labs has been in contact with some large Chinese-funded institutions in industries such as infrastructure, energy, and luxury goods. Some of them are state-owned enterprises. They have asked us to provide research and analysis on RWA at home and abroad and application examples. As the year draws to a close, we will share some of the research findings that we can make public this year with our readers.

This series of articles contains a lot of content. We will not make a definitive conclusion on whether RWA can become the main direction for the crypto industry to break out of its niche in the future, nor will we judge whether RWA is "adding legs to a snake" or "selling dog meat under the guise of mutton". Instead, we will write down what we have seen and thought, so that everyone can think more about the future trend of the industry.

Amid the global wave of financial technology, Real World Assets (RWAs) have become a central focus at the intersection of the Web3 ecosystem and traditional finance (TradFi). From BlackRock's launch of the BUIDL fund on the Ethereum mainnet (with a TVL exceeding $500 million) to the Hong Kong Monetary Authority's Ensemble sandbox processing $500 million in RWAs, RWAs are reshaping asset liquidity, financing efficiency, and the global settlement landscape.

Hong Kong, as the "Eastern RWA hub," has attracted particular attention: Following the implementation of the Stablecoin Regulation in 2025, over 50 compliant projects emerged within just six months—HashKey Exchange's GF Token (a $150 million money market fund), Ant Financial's Langxin charging pile RWA (a 100 million RMB new energy asset), and even Asseto's DeRings Tower property tokenization (50 million HKD). This surge not only attracted Chinese giants to expand overseas but also bridged the "Belt and Road" supply chain with global capital. However, recent regulatory guidance from mainland China has temporarily suspended some cross-border RWA pilot programs. While this has briefly cooled market enthusiasm, it cannot stop the structural rise of RWA within the regulatory sandboxes of China, the US, and Europe, and with institutional participation—as demonstrated by the FIT21 and GENIUS Acts, stablecoins + RWA have become a "digital Bretton Woods system" in the great power game.

This series of articles systematically analyzes the entire RWA landscape, providing a one-stop research framework from its financial essence, core technologies, collaborative operations, and global project matrix to future trends and entrepreneurial paths. The series consists of four long articles. The first article primarily aims to popularize basic RWA knowledge; the second focuses on global RWA regulatory practices and representative projects; the third focuses on the current regulatory situation in China and Hong Kong and representative projects; and the fourth further elaborates on feasible practical paths for RWA and future industry trends in the current environment. The goal is to ensure that readers, after reading this series, have a comprehensive understanding of the trillion-dollar RWA market. Whether you are an institutional investor, a traditional enterprise, or a Web3 entrepreneur, we will unlock strategic high ground for you, promoting the global circulation of Chinese assets and digital globalization.

What is RWA?

RWA (Real World Assets) refers to assets with value existing in the real world, such as real estate, business loans, government bonds, art, carbon emission rights, oil, and even limited-edition whiskey. These assets are "tokenized" using blockchain technology, transforming them into digital assets that can be freely traded, circulated, and combined globally, much like cryptocurrencies. In the traditional financial system, these assets often face problems such as high barriers to entry, poor liquidity, and geographical restrictions. After tokenization, they become "on-chain assets," breaking down traditional barriers and possessing the following characteristics:

- It supports fast trading, allowing investors to operate just like buying and selling stocks;

- It can be used as collateral to obtain a loan;

- These can be combined to form a diversified investment "basket";

- Holders are entitled to a share of the income, including rent and interest.

- To achieve global circulation, without being limited by national borders or time.

RWA's tokenization not only enhances asset liquidity and accessibility but also provides users with more flexible investment options, lowers the barrier to entry, and promotes innovation and financial inclusion in the financial market. Through blockchain technology, RWA injects digital vitality into traditional assets, becoming an important bridge connecting the real world and the digital economy, and is widely used in multiple fields such as finance, art, and energy.

Why is it erupting now?

The current surge in Real-World Asset (RWA) tokenization is driven by multiple factors, including technological advancements, regulatory optimization, institutional participation, and market demand. Technologically, blockchain platforms such as Ethereum and Polygon are maturing, smart contracts and oracle technologies are enhancing the security and scalability of on-chain assets, and on-chain identity authentication is reducing the trust costs of traditional finance.

The regulatory environment is gradually becoming clearer. The pace of regulation in the US has slowed, and policies are becoming more transparent. The Hong Kong Monetary Authority has launched a digital asset "regulatory sandbox," and Singapore supports on-chain bond and fund projects, providing a compliant environment for RWA's development. The entry of traditional financial giants such as BlackRock, JPMorgan Chase, and Citigroup brings capital, resources, and compliance experience, propelling RWA from the blockchain geek community to the mainstream financial market.

On the demand side, the global high-interest-rate environment and declining returns on traditional assets have prompted investors to seek new asset allocations. RWA meets this demand by providing high liquidity and global participation opportunities through tokenization. Furthermore, blockchain technology has moved from the "tech enthusiast" stage to a period of large-scale adoption by "pragmatists." Stablecoins are being integrated into the real economy in scenarios such as cross-border e-commerce, freelance settlements, and global payments, highlighting RWA's increasingly prominent role as blockchain infrastructure.

Market size and growth rate

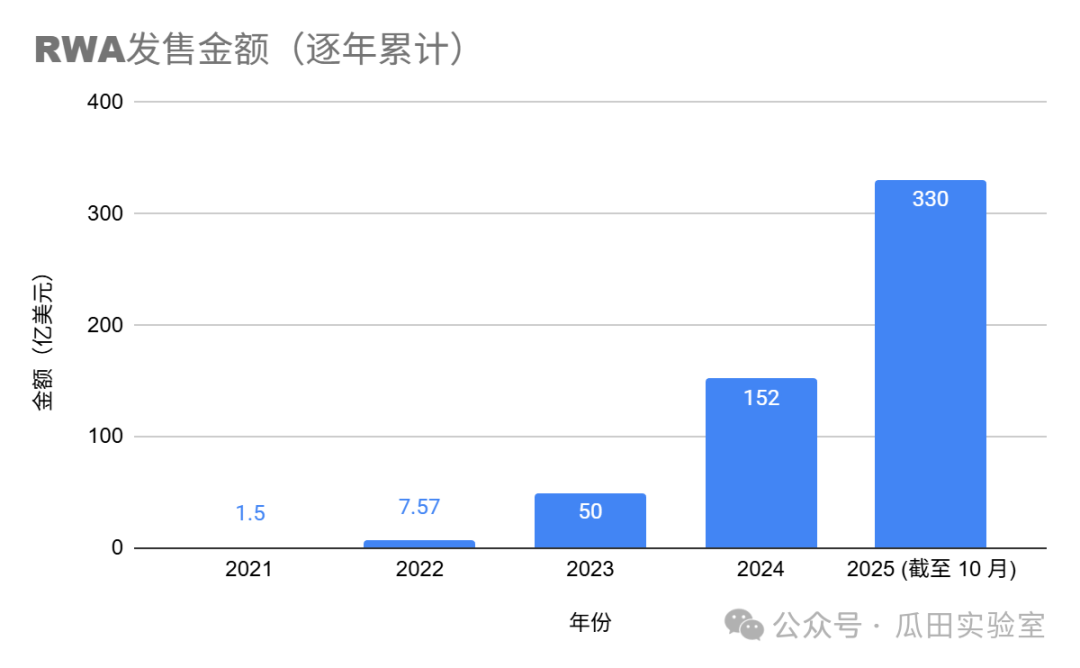

RWA's global expansion is rapidly gaining momentum, moving from Hong Kong to Europe, Dubai, and North America, showcasing a trend towards diversification in institutional design, technological pathways, and business models. To date, RWA's global assets have reached $33 billion. Major consulting and financial institutions have also made bold predictions about RWA's future growth and scale.

- The Boston Consulting Group predicts that the RWA market size may reach $16 trillion by 2030, and the on-chain RWA asset size may increase to $18.9 trillion by 2033, with a compound annual growth rate of approximately 53% over the next 8 years.

- Deloitte predicts that the real estate tokenization market will reach $4 trillion by 2035, with an average annual growth rate of about 27%.

- According to McKinsey's forecast, by 2030, approximately $16 trillion in global assets will circulate on-chain through RWA, with 20%-30% potentially originating from Chinese assets, highlighting its enormous potential. McKinsey's 2024 report further indicates that the global market capitalization of tokenized financial assets is expected to reach $2-4 trillion by 2030.

- BlackRock CEO Larry Fink has repeatedly emphasized that RWA is one of the most transformative applications of blockchain, with the potential to reshape the global asset management industry. In his annual shareholder letter, he stated, "Tokenization will be the next stage for financial assets, with every stock and every bond operating on a unified ledger."

Regarding stablecoins, the total amount of payments settled using stablecoins reached $16.16 trillion in 2024, exceeding the combined total of VISA and Mastercard, marking the formation of a new payment system independent of traditional banks and the SWIFT network. Traditional cross-border payment processes are complex, requiring multiple intermediaries, taking up to two weeks, and incurring high costs. Stablecoins, with their price stabilization mechanisms and real-time on-chain settlement capabilities, enable peer-to-peer, trustless transactions, ideally completed in seconds, without relying on traditional clearing and settlement systems.

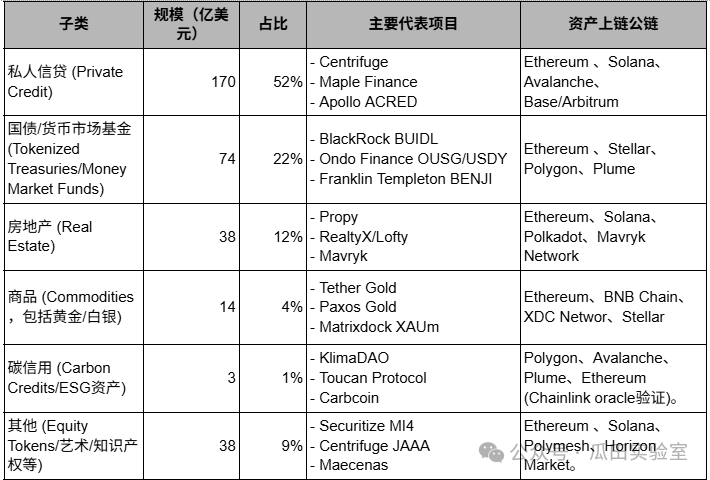

Currently, RWA primarily focuses on highly liquid fixed-income instruments, with the potential of sectors like real estate, stocks, art, and infrastructure yet to be fully explored, indicating the market is still in its early stages. Institutional participation is the core driver of RWA market growth. Regulated institutions and native DeFi protocols jointly drive market supply. Major participants include asset management companies like BlackRock and Franklin Templeton, banks like JPMorgan Chase, Citigroup, and Standard Chartered, custodians like Bank of New York Mellon, and DeFi protocols such as Maple, Centrifuge, Ondo Finance, and MakerDAO. The involvement of these institutions indicates that RWA is moving from the crypto space into mainstream finance. For example, the European Investment Bank has already issued digital bonds on Ethereum.

According to the latest data from RWA.xyz and CoinGecko, the total issuance of RWA (as of September 2025) has reached $33 billion, with the largest categories being private credit, government bonds, and commodities. However, compared to the scale of traditional finance and physical assets, the potential of areas such as real estate, stocks, art, and infrastructure has not yet been fully explored.

What problems can RWA solve?

RWA is a cross-disciplinary field that integrates Web3, traditional finance, and the real world, and its emergence has a positive impact on all three fields.

1. Solving problems in the Web3 domain

- Insufficient liquidity: Web3 assets (such as NFTs and some tokens) often suffer from low liquidity due to market fragmentation. RWA introduces high-value real-world assets (such as government bonds and real estate) onto the blockchain, increasing liquidity and trading depth. For example, tokenized government bonds (such as BlackRock's BUIDL) can be used as collateral in DeFi protocols, improving capital efficiency.

- Asset Simplification: In the past, the asset classes in the DeFi ecosystem were quite limited, consisting almost entirely of cryptocurrencies. These assets, such as Ethereum, USD stablecoins, and Bitcoin, not only experienced extreme price volatility but also exhibited high correlation with each other, leading to a homogenization of the entire financial system. Introducing real-world assets effectively alleviated this problem, significantly expanding asset types and enhancing overall stability.

- The lack of real returns: Many DeFi protocols rely on internal speculative cycles for their returns, such as liquidity mining through lending, lacking support from the real economy. In contrast, real-world assets can generate returns such as rental income, bond interest, and commodity appreciation, all driven by real economic activity and therefore possessing greater sustainability.

- Unstable value anchoring: Many crypto assets are highly volatile and lack a stable value foundation. Stablecoins (such as USDT and USDC), as representatives of RWA, provide stable value by anchoring to fiat currencies, enhancing the credibility and usability of the Web3 ecosystem.

- Limited User Adoption: Web3 applications are often limited to tech enthusiasts. RWA introduces familiar asset classes (such as stocks and bonds), lowering the barrier to entry for ordinary users and promoting mass adoption.

2. Solving problems in traditional finance

- Inefficient transactions: In traditional finance, asset transactions (such as real estate and bonds) involve multiple intermediaries and have long settlement cycles (T+2 or longer). RWA utilizes blockchain to achieve real-time settlement (T+0), such as automating bond interest payments through smart contracts, reducing costs and time.

- High entry barriers: Many high-value assets (such as private equity funds and real estate) have high capital requirements for retail investors. RWA lowers the investment threshold and expands market participation by fragmenting ownership (such as tokenized property shares).

- Insufficient transparency: Traditional financial markets often lack real-time transparency. RWA leverages the public ledger of blockchain to provide transparent tracking of asset ownership and transaction history, thereby enhancing trust.

3. Solving real-world problems

- Poor asset liquidity: Real-world illiquid assets (such as artwork and private credit) are difficult to convert into cash quickly. RWA improves liquidity by tokenizing these assets (such as issuing NFT artworks on Ethereum) and bringing them to the global market.

- Insufficient financial inclusion: Globally, many people lack access to banking services or investment opportunities. RWA empowers emerging market investors by enabling borderless participation through decentralized platforms such as Polygon and Stellar.

- Environmental and social issues: The tokenization of RWAs such as carbon credits (e.g., Toucan Protocol) promotes transparency and efficiency in carbon emissions trading and supports sustainable development goals.

4. Solutions tailored to China's national conditions

China's real estate market has entered a phase of "competition for existing assets." Under this trend, how to revitalize idle existing assets and promote more efficient capital allocation has become a core issue for the industry in exploring new development paths. The rise of RWA (Real-World Assets) has opened up innovative solutions for real estate finance. It goes beyond simply "digitizing real estate on the blockchain," but rather redesigns the equity structure, utilizing blockchain and smart contract technologies to transform large-scale assets that were originally difficult to divide, had cumbersome transaction processes, and suffered from information asymmetry into composable, manageable, and tradable digital equity units. Smart contracts embed rules that clearly define the correspondence between rights and responsibilities and cash flow, while the secondary market provides support for price discovery and exit mechanisms.

Compared to traditional asset digitization, RWA fundamentally redefines the composition of asset rights. Leveraging the immutability of blockchain and the automated execution of smart contracts, high-value, low-liquidity physical assets can be divided into freely tradable small units of equity, significantly enhancing asset liquidity and market depth. For example, a commercial property valued at 10 million yuan can be tokenized through RWA into 10,000 tokens, each representing one ten-thousandth of the ownership. The investment threshold is reduced from 10 million yuan to 1,000 yuan, and these tokens can be freely traded on the secondary market.

The type of enterprise significantly impacts the level of understanding of RWA (Real Estate Asset Management). Financial real estate asset management companies and leading developers have an advantage in understanding RWA. A CRIC survey shows that 60% of respondents believe the core value of RWA lies in "improving asset liquidity," 20% focus on "lowering investment thresholds," and approximately 15% value "broadening financing channels," while the importance placed on "improving transparency" and "optimizing operational efficiency" is relatively low. However, the automatic execution of smart contracts, the transparent management of blockchain, and the ability for refined operations can actually bring profound changes to operational efficiency, risk management, and asset management models.

Advantages and Value of RWA Tokenization

RWA (Real-World Asset) tokenization uses blockchain technology to transform traditional assets such as stocks, bonds, real estate, and gold into digital tokens, enhancing liquidity, transparency, and global accessibility, thus injecting vitality into financial innovation. Its core technological advantages mainly include:

- Smart contracts offer automation, transparency, and high efficiency. They automatically execute transaction terms, ensuring transparent operations without human intervention. The code is immutable, and combined with decentralized node verification, it eliminates trust risks and enhances security. For example, when an asset price reaches a target, the contract automatically triggers transfer or liquidation. Furthermore, the automated allocation capabilities of smart contracts significantly improve asset management efficiency.

- The stability of the over-collateralization mechanism. RWA tokenization converts assets into tradable tokens, which serve as collateral to support the issuance of stablecoins. Smart contracts automatically liquidate based on asset value, ensuring platform liquidity and solvency, and preventing the risk of over-issuance.

- Oracles provide real-time data assurance. They bridge on-chain and off-chain data, transmitting asset prices, ownership, and other data in real time. Aggregating information from multiple sources ensures accuracy and supports legally compliant data, guaranteeing the legality of transactions.

- Global circulation: On-chain assets support 24-hour global trading, simplifying cross-border investment processes and enhancing market diversity and liquidity.

- User empowerment: Through the "user as shareholder" model, RWA integrates marketing and financing to enhance user loyalty and brand exposure.

- Supply chain support: RWA creates an ecosystem loop, optimizes supply chain finance, and helps enterprises accumulate funds and facilitate ecosystem circulation.

The combination of these technological advantages with finance also brings the following additional benefits to RWA issuers:

- Increase efficiency and profitability: The new funds will be used to expand production, explore markets, and increase profits.

- Solving liquidity issues: Unlocking the potential of high-value assets in advance through fragmentation.

- Integrated marketing: User participation in investment enhances consensus and sales channels.

- Brand Exposure: The RWA project itself generates traffic, enhancing brand awareness.

- Convenient management: Optimize asset management and promote asset-light models and the conversion of overseas assets.

- Ecosystem innovation: Supporting a closed-loop supply chain finance system to alleviate cash flow pressure.

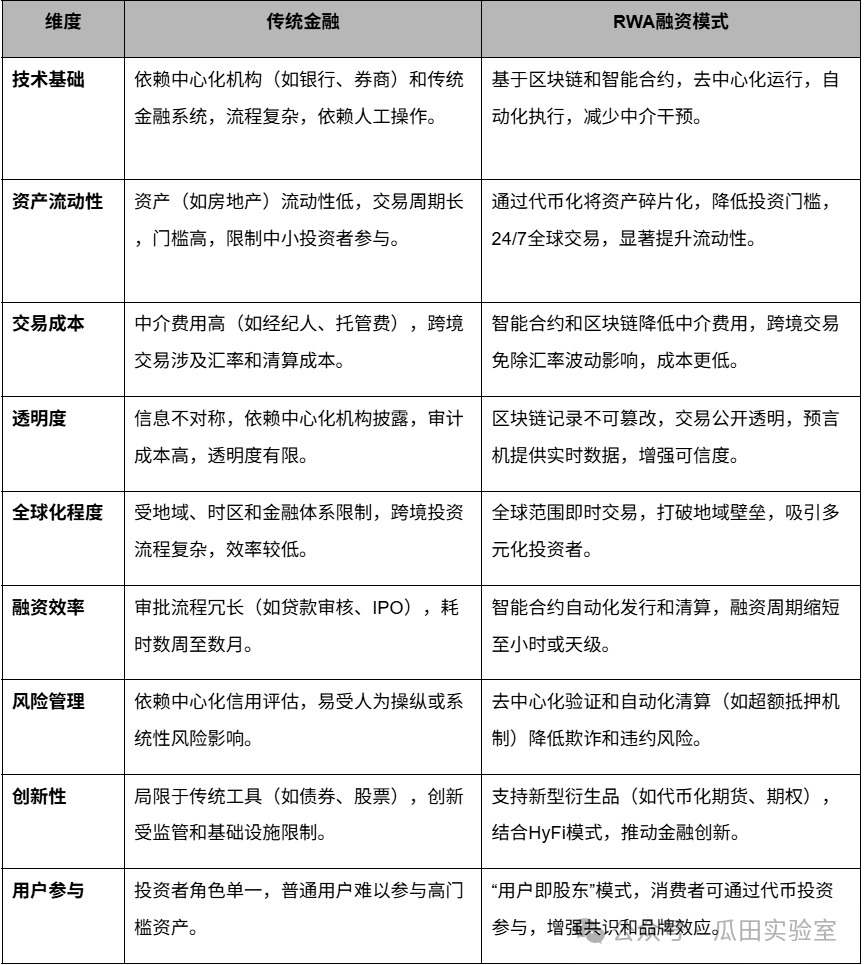

RWA vs. Traditional Financial Models

Real-World Asset (RWA) financing and traditional finance both aim to provide funding for businesses and projects, relying on tangible assets to ensure value and complying with regulatory requirements. However, they differ significantly in technology, efficiency, and innovation. Traditional finance relies on centralized institutions, resulting in complex processes, high intermediary fees, low asset liquidity, and geographical and exchange rate limitations for cross-border transactions, making it suitable for mature markets but limiting its globalization efficiency. RWA financing, based on blockchain and smart contracts, enables fragmented trading through asset tokenization, lowering investment barriers, supporting 24/7 global circulation, and significantly improving liquidity. Automated execution of smart contracts reduces intermediary costs, the immutability of blockchain enhances transparency and credibility, and oracles provide real-time data support. RWA also promotes new derivatives and a "user-as-shareholder" model, fostering financial inclusion and brand recognition. Despite regulatory and technological security challenges, RWA far surpasses traditional finance in financing efficiency, globalization, and innovation, demonstrating the disruptive potential of the Web3 era's financial system, particularly suitable for revitalizing illiquid assets and optimizing supply chain finance.

Technical challenges facing RWA:

Real-world asset (RWA) tokenization, as an innovative path bridging traditional finance and Web3, still faces multiple severe technical challenges. These issues not only restrict the large-scale implementation of RWA but may also trigger systemic risks. According to Chainlink & ConsenSys' (2025) "RWA Technical Challenges Report," 35% of global RWA projects were suspended due to technical failures in 2024, resulting in losses exceeding $800 million. The main pain points are concentrated in five areas: oracle reliability, off-chain execution limitations, the conflict between privacy and transparency, insufficient standardization, and security risks, all of which urgently require systemic solutions.

- Oracle problems: Blockchains cannot directly access off-chain data and rely on oracles to provide information such as asset value and status. Single or centralized oracles are vulnerable to attacks, leading to smart contract errors. It is necessary to ensure the authenticity of data sources and solve the "trust transfer" problem.

- Off-chain execution limitations: Smart contracts are limited to on-chain logic, and breaches of contract require reliance on the traditional legal system, causing execution delays and weakening the advantages of automation.

- Privacy versus transparency: Blockchain's openness facilitates auditing but may leak sensitive business or personal information. Zero-knowledge proofs, while protecting privacy, increase technical complexity and cost.

- Insufficient standardization: Different token standards and compliance frameworks lead to fragmented asset liquidity, forming "islands" that hinder the global flow of value.

- Technological immaturity and security risks: Blockchain technology remains imperfect in terms of user experience, security, and compliance. Issues such as private key management, smart contract vulnerabilities, phishing attacks, cross-chain bridge attacks, oracle manipulation, and regulatory arbitrage can all pose systemic risks. Ignoring technical details can easily lead to the collapse of business strategies and ecosystem plans due to user complaints, compliance incidents, or security breaches.

To address these technical challenges, we can focus in the short term on digitizable assets, improving oracles, compliance frameworks, and privacy technologies to enhance market trust. In the long term, we can combine IoT and AI to develop advanced oracles that automatically monitor non-standardized assets (such as real estate and art), gradually integrating the physical world into the digital ecosystem.

Tokenizable asset classes

Returning to the topic of tokenizable underlying asset classes, theoretically any real-world asset can be tokenized and issued with RWAs, but physical assets with the following characteristics have an advantage:

Value can be quantified:

- Assets need to have a transparent and open pricing mechanism, and their real-time value can be easily obtained through authoritative data sources (such as exchanges and official databases).

- Example: Gold and government bond prices are publicly quoted by the market, making them suitable for price feeding via oracles.

The cash flow rules are clear:

- Asset income (such as interest, dividends, and rent) needs to have clear calculation and distribution rules to facilitate automated execution of smart contract coding.

- Example: Government bonds have fixed interest rates and interest payment dates, making them easy to allocate on-chain.

Low-chain execution requirements:

- Changes in asset ownership should be primarily accomplished through digital records, reducing reliance on physical delivery or complex legal enforcement.

- Example: ETF share transactions are recorded digitally and do not require physical delivery.

Highly standardized:

- Assets must comply with unified standards (such as standard contract terms) to facilitate batch processing and cross-platform interoperability, and prevent "asset silos".

- For example, gold futures contracts have standardized expiration dates and delivery rules.

Compliance support:

- Asset tokenization must comply with local regulatory requirements (such as securities laws and anti-money laundering regulations) to ensure legal circulation.

- Example: Tokenization of US Treasury bonds must comply with the regulations of the US Securities and Exchange Commission (SEC).

Technical feasibility:

- A reliable oracle is required to provide off-chain data (such as price and status). The blockchain platform must support smart contracts and security mechanisms to prevent vulnerabilities, attacks, or data tampering risks.

- Example: Chainlink oracles provide reliable price data for DeFi protocols.

What types of assets are currently being tokenized or are in the process of being tokenized in the market? The most common types include:

- Commodities: Precious metals such as gold are being tokenized and combined with blockchain technology to enhance liquidity and operational efficiency. In 2022, the market capitalization of commodity tokens reached $1.1 billion, accounting for 0.8% of fiat-backed stablecoins. Gold, due to its safe-haven properties and stable appreciation, is particularly suitable as a tokenized anchor asset, supporting global reserves and investment.

- Currency: Stablecoins (such as USDT and USDC) link fiat currency assets like the US dollar and US Treasury bonds to DeFi, and their market capitalization has surged from $5.2 billion in 2020 to over $300 billion today. Central Bank Digital Currencies (CBDCs), as digital fiat currencies issued by the state, provide legal tender status and are distinct from cryptocurrencies.

- Real Estate: RWA tokenization breaks down real estate into tradable tokens, increasing the liquidity of owners' capital, lowering the investment threshold, and enabling ordinary people to participate in commercial or residential real estate investment.

- Art and collectibles : NFTs provide immutable proof of ownership and traceability, while FTs support fragmented crowdfunding of artworks, lowering barriers to entry, increasing transparency and efficiency in revenue distribution, and enhancing investment accessibility and experience.

- Intellectual Property (IP): Tokenization simplifies the identification and tracking of IP such as copyrights and patents, prevents plagiarism, and improves transaction transparency, such as the protection of Dell's "assemble on demand" patent.

- Stocks, bonds and securities: Tokenization lowers barriers to entry into capital markets, allowing small investments in assets such as U.S. Treasury bonds, overcoming the high costs and long cycles (T+1) of traditional transactions, enabling 24/7 real-time settlement, and facilitating global capital flows.

- Carbon credits and green finance : Carbon emission reduction certificates can be tokenized and traded or destroyed on-chain, supporting a transparent and counterfeit-proof global carbon market, aligning with ESG and sustainable development trends, and introducing green financial products to DeFi.

summary

This article primarily explores the concept, development background, technological advantages, application potential, and challenges of RWA (Real World Assets). As an innovative fusion of blockchain and traditional finance, RWA is reshaping the global asset management landscape. It tokenizes real-world assets such as real estate, bonds, and art, injecting digital vitality, breaking down geographical barriers and entry thresholds, and enabling 24/7 global trading, fragmented ownership, and automated smart contract profit distribution. The current surge in popularity stems from technological advancements (such as Ethereum scaling), regulatory approval (US and European sandboxes), and the influx of industry giants (BlackRock's BUIDL fund reaching $2.9 billion). The market is projected to grow from $860 million in 2023 to $33 billion in 2025, dominated by private lending and government bonds, and is expected to reach trillions by 2030, with stablecoin payments far exceeding traditional systems.

The multidimensional value of RWA is evident: it injects real returns and stability into Web3, alleviating the speculative cycle of DeFi; it accelerates T+0 settlement, improves transparency, and reduces intermediary costs in traditional finance; and it empowers emerging markets and financial inclusion in the real world, lowering investment barriers by fragmenting high-value physical assets. Compared to traditional models, RWA's decentralization and globalization far surpass the inefficiency of centralization, facilitating a "user-as-shareholder" ecosystem and a closed-loop supply chain. However, new physical assets always face challenges: oracle data tampering, reliance on off-chain execution, the privacy-transparency paradox, and a lack of standardization have led to numerous RWA project failures. Addressing these challenges requires short-term improvements to compliance modules and long-term integration with AI, IoT, and other related fields. In summary, RWA is not only a technological tool but also a bridge to inclusive finance, connecting the real economy with the digital future and driving the transformation of finance from "trust intermediaries" to "code-driven autonomy," with unlimited potential.

In the next article, we will explore the global RWA regulatory framework and analyze some mainstream international RWA issuance/trading platforms and cases in detail. Please stay tuned.