Global RWA Regulatory Practices and Representative Projects – Part Two of a Series on RWA from the Perspective of Traditional Finance

- 核心观点:RWA代币化重塑全球金融版图。

- 关键要素:

- 美国、欧盟、香港形成三大合规体系。

- 合规发行需KYC/AML与资产托管分离。

- 机构资金主导,TVL年增超800%。

- 市场影响:解锁万亿级传统资产链上流动性。

- 时效性标注:长期影响

The tokenization of Real World Assets (RWAs) is reshaping the global financial landscape, bringing traditional assets such as real estate, bonds, art, and even supply chain receivables onto the blockchain, enabling 24/7 cross-border flow and fragmented investment. However, unlike purely crypto-native assets, RWAs are essentially "on-chain securitizations," with their underlying cash flows tightly tied to real-world legal rights. Therefore, they must be issued within a compliant framework to avoid risks associated with illegal fundraising, securities violations, and cross-border capital controls.

While non-compliant platforms offer lower technical barriers to entry, they are prone to triggering regulatory red lines—for example, the US SEC considers most tokenized real estate as unregistered securities, and mainland China views unlicensed RWAs as illegal public offerings—leading to project failures or asset freezes. Conversely, compliant platforms, through KYC/AML transparency, separation of custody and liquidation, regular audits, and information disclosure mechanisms, ensure the authenticity of underlying assets and investor protection, thereby attracting funds from banks, asset management companies, and other institutions, truly unlocking a trillion-dollar liquidity blue ocean.

Currently, three major compliance systems have emerged globally, led by Hong Kong (SFC Virtual Asset Sandbox + Stablecoin Regulation), the EU's MiCA, and the US (SEC Reg A+/D Exemption + Wyoming SPDI License). Secondary tracks are also emerging, including Singapore (MAS Payment Services License + Fund-Level RWA Exemption) and the UAE (ADGM Digital Asset Framework). This article and a subsequent one will analyze the regulatory logic, representative projects, and replicable paths of these jurisdictions, providing practical guidance for mainland Chinese companies expanding overseas and global institutions entering the market.

Recommended reading: " The Significance, Advantages, and Value of RWA – Part 1 of a Series on RWA from a Traditional Financial Perspective "

Global RWA Market Regulatory Situation

2025 has become a crucial turning point for global RWA (Real-World Asset) regulation. The successive implementation of the US GENIUS stablecoin act and Hong Kong's Stablecoin Ordinance signifies a shift in regulation from fragmentation to a unified framework. The core of the US GENIUS act is to modernize the payment system and strengthen the dollar's hegemony, which is expected to create trillions of dollars in demand for US Treasury bonds. Hong Kong, on the other hand, innovates with the principle of "value-anchored regulation," covering all Hong Kong dollar-pegged stablecoins and achieving cross-border jurisdictional extension.

United States: Institutional-led + Regulatory Sandbox-driven compliance innovation

The US Real-World Asset (RWA) market is characterized by "institutional leadership and regulatory sandbox-driven compliance innovation," distinguishing it from retail-driven or policy-experimental models in other parts of the world. Traditional asset management giants such as BlackRock, Fidelity, and Franklin Templeton view RWA as an "on-chain ETF," with 86% of market allocation coming from institutional funds, highlighting Wall Street's systemic restructuring of on-chain finance.

US RWA regulation remains primarily SEC-led, with the CFTC providing supplementary support for commodity-based assets. While no dedicated federal legislation has yet been enacted, the flurry of legislation expected to be implemented in 2025 signifies a shift in regulatory focus from "enforcement-first" to "rule-oriented." The SEC continues to use the Howey Test to determine the security status of tokenized assets, emphasizing KYC/AML transparency and investor protection. Exemption frameworks (such as Reg A+ exempting state laws) lower issuance thresholds, boosting liquidity (TVL increased by 800%) and bridging TradeFi and DeFi. Simultaneously, the Crypto Task Force sandbox mechanism will launch a pilot program in May 2025, supporting end-to-end RWA issuance and custody testing. At the state level, Wyoming's SPDI charter and Reg A+ exemption effectively bypass blue sky laws, reducing compliance barriers for small and medium-sized issuers. However, the fragmentation of federal and state regulations still constitutes obstacles to cross-border trade and innovation; while institutional participation is high, compliance costs remain exorbitant.

The passage of three bills in 2025 marks a historic shift in RWA regulation, moving from "grey enforcement" to "clear rules," directly unlocking compliance pathways for trillions of dollars worth of on-chain assets .

- GENIUS Act (July): Regulates stablecoin collateral, supports RWA as a backing asset, and strengthens the on-chain anchoring of the US dollar; RWA becomes the "official backing" of stablecoins , allowing tokenized government bonds, private credit, REITs, etc. to serve as USDC/USDT reserves.

- The Clarity Act clarifies the classification of digital asset securities/commodities, reducing uncertainty associated with the Howey Test; when real estate/bond tokenization is explicitly classified as a "commodity-based RWA," only CFTC filing is required instead of SEC registration, reducing compliance costs by 60% and allowing smaller issuers to enter the market.

- Anti-CBDC Surveillance State Act: Restricting central bank digital currency monitoring, "de-monitoring" of the private RWA ecosystem : Funds such as BlackRock BUIDL can bypass real-time CBDC tracking, protecting institutional privacy , attracting high-net-worth and sovereign funds, and consolidating the dollar's on-chain hegemony in reverse.

The advantages of the US RWA compliance framework lie in its robust investor protection, controllable innovation space, and global reach of dollar liquidity. Stringent disclosure and custody separation mechanisms significantly reduce fraud risk, attracting continuous institutional investment. The parallel implementation of exemption pathways and sandboxes balances efficiency and compliance, driving tokenized treasuries to become the benchmark for DeFi's "risk-free rate." The combination of a dollar-backed stablecoin and RWA, endorsed by the GENIUS Act, further solidifies the US's pricing and standard-setting power in global on-chain finance. Although a breakthrough in unified federal legislation is still pending, the US model provides a replicable template for RWA's transition from pilot to mainstream, and is expected to unlock the potential of $30 trillion in traditional assets on-chain.

Europe: Unified Innovation within the MiCA Framework

The EU's regulation of Real-World Assets (RWAs), centered on the "Markets in Crypto-Assets Regulation (MiCA)," marks a shift from fragmented national rules to a unified cross-border framework. As of November 2025, MiCA was fully in effect, providing clear boundaries for RWA tokenization and propelling the market from pilot phases to large-scale deployment. The EU accounts for approximately 25% of the global RWA market TVL, projected to reach €50 billion by the end of 2025, primarily benefiting from MiCA's "passport" mechanism, allowing a single mandate to cover 27 countries. Unlike the securities-oriented approach of the US SEC, MiCA emphasizes technological neutrality and consumer protection, classifying RWAs as Asset Reference Tokens (ARTs, such as real estate/commodity-backed tokens) or Electronic Money Tokens (EMTs, such as euro-pegged stablecoins).

MiCA was approved in April 2023 and will enter full-speed implementation in 2025. Core requirements include: white paper disclosure, reserve auditing, and KYC/AML transparency. Representative projects include Centrifuge's RWA credit pool (Germany, MiCA + ELTIF 2.0 compliant, TVL exceeding €1 billion), Tiamonds' gemstone tokenization (Luxembourg, MiCA issuance license obtained in 2025), and Societe Generale's euro stablecoin project (France, issued under the ARTs framework), among others.

The EU framework is characterized by uniformity, risk orientation, and an innovation sandbox: MiCA's "single ruleset" eliminates national barriers; the DLT pilot program allows exemptions from traditional clearing requirements and supports end-to-end testing; DORA embeds ICT risk management to ensure RWA custody separation. Its advantages include:

(1) High cross-border efficiency and reduced compliance costs in multiple countries (compared to the fragmented state-level system in the United States, saving 30%-50%).

(2) Strong investor protection, mandatory disclosure and transparent reserves attract TradeFi funds, with institutional allocation expected to rise to 65% by 2025;

(3) Innovation-friendly and technology-neutral design compatible with standards such as ERC-3643, promoting RWA to expand from real estate (accounting for 40%) to private lending.

The Middle East: An Innovation Hub Under the VARA Framework

The regulation of Real-World Assets (RWA) in the Middle East centers on a "multi-zone sandbox + global reach driven by oil wealth" model, focusing on the United Arab Emirates (UAE) as a regional pioneer, supplemented by pilot programs in Saudi Arabia (KSA) and Bahrain. As of November 2025, the Middle East RWA market's TVL (total value) reached approximately $25 billion, with the UAE accounting for over 70% ($17 billion). This is primarily due to the comprehensive legislation of VARA and the Anglo-American law-based sandboxes of DIFC/ADGM, driving the tokenization of real estate (45%), gold, and funds. Unlike the unified passport of the EU's MiCA, the Middle East emphasizes "competitive free zones." The UAE's 72 free zones (such as DIFC and ADGM) attract global institutions through tax exemptions and expedited authorization, while the Saudi SAMA sandbox under the Vision 2030 framework focuses on Islamic financial RWA.

The Middle East's RWA regulation is fragmented but efficient, with the UAE leading a legislative push in 2025: VARA (Dubai Virtual Asset Regulatory Authority) updated its Virtual Asset Issuance Rulesbook in May, classifying RWAs as Asset Reference Virtual Assets (ARVAs), requiring issuers to have a capital of AED 1.5 million (approximately USD 408,000) or 2% reserve assets, and mandating monthly independent audits and KYC/AML penetration. DFSA (Dubai Financial Services Authority) released the Tokenization Regulatory Sandbox Guidelines on March 17, explicitly including RWA testing for the first time, allowing end-to-end pilots under the Innovation Test License (ITL) (excluding crypto/fiat tokens). ADGM (Abu Dhabi Global Markets) launched the first tokenized US Treasury bond fund (Realize T-BILLS Fund), and SCA (Securities and Commodities Authority) regulates security-type RWAs such as bonds/stocks. Saudi Arabia's SAMA sandbox supports controlled experimentation, and CMA (Capital Markets Authority) will include asset-backed tokens in the Capital Markets Law; Bahrain's CBB provides a clear sandbox focusing on digital banking RWAs. Representative projects include Tiamonds' gem tokenization (VARA permissioned), Centrifuge's credit pool expansion to the Saudi SAMA Sandbox, and Goldman Sachs UAE's three RWA pilots (real estate/Sukuq), etc.

The Middle East framework is characterized by its multi-jurisdictional flexibility, sandbox priority, and innovative outreach: VARA/DFSA/ADGM provide a "one-stop" authorization path, and the ERC-3643 standard embeds transfer restrictions and escrow separation; the SAMA sandbox emphasizes Islamic compliance (such as Sukuq tokenization). Overall advantages include...

(1) Low threshold and fast speed, sandbox exemption partial disclosure, attracting startups (compared to the US Reg A+ state-level review, saving 40% of time).

(2) Oil funds leverage, with sovereign wealth funds accounting for 60% of the allocation, driving liquidity (UAE TVL increased by 300% annually).

(3) Global bridging, compatible with the Anglo-American legal system and TradFi, compatible with ERC standards, which is conducive to cross-border DeFi.

Singapore: An Asian Testing Ground Under a Flexible Sandbox

Singapore's Real-World Asset (RWA) regulation is centered on a "sandbox-driven + cross-border collaborative gradual commercialization" model, led by the Monetary Authority of Singapore (MAS), and positioned as an innovation hub for RWA in the Asia-Pacific region. The Singapore RWA market focuses on fund tokenization (40%), bonds, and real estate, supporting multi-currency trials. Unlike the free zone competition of Middle Eastern VARAs, Singapore emphasizes "regulatory + technology neutrality," integrating TradeFi and DeFi through Project Guardian (launched in 2022) to achieve end-to-end testing. The MAS classifies RWAs as Capital Markets Products (CMPs) or Asset-Backed Tokens (ABTs), excluding pure commodities (regulated by the Commodity Trading Act).

MAS RWA regulation relies on the existing securities framework, with accelerated commercialization in 2025: The DTSP (Digital Token Service Providers) framework came into effect on June 30, expanding territorial jurisdiction to overseas services and emphasizing AML/CFT and user protection, but is limited to "very limited" licenses (annual fee of S$10,000, no transition period). Project Guardian expanded to 15+ trials, covering six cryptocurrency assets; the Global Layer 1 (GL1) initiative (launched in November) partnered with BNY Mellon, JP Morgan, DBS, and MUFG to standardize blockchain platforms. MAS Sandbox Plus (updated in August) exempted some disclosures and supported fund-level RWAs; IRAS tax rules treat tokens as securities for taxation. Representative projects include: the InvestaX platform (MAS CMS/RMO licensed, tokenized VCC fund, AUM exceeding US$1 billion); Franklin OnChain US Government Money Fund (Guardian pilot); and Deutsche Bank and Memento's ZK Chain RWA infrastructure, etc.

The Singapore framework is characterized by its feature-driven approach, sandbox-first approach, and standardized infrastructure: Under the SFA (Securities and Futures Act), RWAs are considered securities, requiring licenses from CMS (Capital Markets Services) and RMO (Recognized Market Operator); the ERC-3643 standard embeds KYC/AML transfer restrictions and decoupling from custody; and the GL1 toolkit addresses interoperability. Advantages include...

(1) Innovation-friendly, sandbox exemption lowers the threshold (compared to the fragmented US Reg A+, the testing cycle is shortened by 50%).

(2) Institutional attraction: Guardian's collaboration covers global banks, with institutional allocation accounting for 70%;

(3) Cross-border radiation, multi-currency support and MoU to improve liquidity (TVL increased by 300% year-on-year).

Hong Kong: A Compliance Bridgehead in the Asia-Pacific Region under the SFC Dual-Track Sandbox

Hong Kong, with its unique financial hub status and open regulatory environment, serves as a bridge connecting mainland China and the global RWA (Real World Asset) market, positioning itself as the "Wall Street of Asia," with a vibrant trading market and innovation-driven growth at its core. Hong Kong's RWA regulation is centered on a "SFC dual-track sandbox + stablecoin legislation as an Asia-Pacific outbound bridgehead," jointly led by the Securities and Futures Commission (SFC) and the Hong Kong Monetary Authority (HKMA), positioning itself as a compliance hub connecting mainland China and the world for RWA. Unlike Singapore's MAS, which is characteristic-oriented, Hong Kong emphasizes the securitization path, uniformly incorporating RWAs into the Securities and Futures Ordinance (SFO) framework, classifying them as "structured products" or "collective investment schemes" (CIS), and achieving end-to-end testing through a dual sandbox.

On June 26, 2025, the Hong Kong SAR Government released the "Hong Kong Digital Asset Development Policy Declaration 2.0," which introduced the "LEAP" framework, focusing on optimizing legal regulation, expanding the types of tokenized assets (such as government bonds, real estate, and precious metals), promoting cross-sector cooperation, and talent development. The "Stablecoin Ordinance," which came into effect on August 1, 2025, adopts the principle of "value-anchored regulation," differing from the EU's MiCA functional regulation and Singapore's tiered licensing model. It implements comprehensive regulation of Hong Kong dollar-pegged stablecoins, regardless of the issuing entity's location, extending cross-border jurisdiction. The ordinance requires strict reserve management, redemption mechanisms, and risk control, with the first batch of licenses expected to be issued in early 2026. These policies provide a clear compliance path for RWA tokenization, enhancing its global competitiveness.

Hong Kong launched the world's first Registered Virtual Assets (RWA) platform on August 7, 2025, managed by the Hong Kong Web3.0 Standardization Association. This platform provides a unified framework for the digitization and tokenization of assets such as real estate and debt, enhancing transparency and liquidity. HSBC is promoting blockchain settlement services, China Asset Management (Hong Kong) issued the Asia-Pacific's first retail tokenized money market fund, and Chinese institutions such as China Merchants International have tokenized funds on Solana and the Ethereum blockchain, showcasing technological innovation. Real estate RWA is leading the way, green finance pilots (such as carbon credit tokenization) align with ESG trends, and tokenization of precious metals and renewable energy is also being explored.

Hong Kong and mainland China have adopted a dual-track strategy for RWA development. Mainland China adheres to a "permissioned blockchain priority" and a "prohibition of public token sales," strictly following the regulations of the China Securities Regulatory Commission (CSRC) and the requirements of KYC, AML, and the Personal Information Protection Law, piloting tokenization in real estate, commodities, green finance, and intellectual property. Hong Kong, on the other hand, provides a platform for subsidiaries of Chinese banks to issue RWAs on public blockchains through an open regulatory environment. However, in September 2025, the CSRC suspended some RWA business in Hong Kong, reflecting the mainland's cautious attitude towards financial stability. This dual-track model reduces systemic risk in mainland China while attracting foreign investment and expanding global influence through Hong Kong, forming a viable path of "Mainland China assets—Hong Kong issuance—global investors."

Hong Kong's status as a free port for capital, its historical "front shop, back factory" model, and its role as a hub for offshore RMB business make it a potential "digital bridge between the RMB and the US dollar." Compared to Singapore's pursuit of stability as the "Switzerland of Asia," Hong Kong attracts global investors with its active market, establishing its leading position in the Asia-Pacific RWA market.

Hong Kong-Singapore-Dubai: Global Collaboration in the Asian Compliance Triangle

Hong Kong, Singapore, and Dubai form the "iron triangle" of RWA compliance in Asia. While their regulatory logics differ, they are highly complementary, jointly driving trillions of dollars in on-chain asset flows across the Asia-Pacific region. Hong Kong's SFC focuses on securitization bridging (SFO structured products + dual sandboxes), strictly adhering to professional investor thresholds. Its advantages lie in its mainland China access channels and mBridge cross-border settlement, with tokenized green bonds leading the way. Singapore's MAS takes a collaborative approach (Project Guardian + GL1 standardization), offering flexible sandbox exemptions and focusing on multi-currency funds and Asia-Pacific MoUs. Dubai's VARA promotes a competitive sandbox model (ARVA simplified framework + oil funding), with explosive growth in real estate and Sukuk tokenization, and Tokinvest's fragmented horse racing projects igniting liquidity.

The differentiated positioning of the three regions forms a synergistic closed loop: Hong Kong provides the RMB/HKD anchor entry point, Singapore exports technical standards and interoperability, and Dubai injects high-net-worth individuals and Islamic finance. Accelerated collaboration among the three regions in 2025—the HashKey-UBS-Realize cross-chain bond pilot program integrates the core regulatory frameworks of the three regions (SFC-VATP, MAS-GL1, VARA-ARVA); mBridge + Guardian + ADGM jointly build the RWA clearing layer, reducing the settlement time for a single tokenized government bond from T+2 to minutes; this "Asian triangle," anchored by a regulatory sandbox and with multiple anchors including USD/HKD/DED, is expected to contribute 30% of global RWA liquidity by 2030, becoming an Eastern accelerator for TradeFi on-chain.

Regulatory challenges

The tokenization of RWA (Real-World Assets) is rapidly emerging globally, but its regulation faces multiple challenges, requiring a balance between innovation and risk. The following is a summary of the main difficulties, covering cross-border compliance, off-chain custody, pricing of non-standard assets, and broader legal and technical challenges.

The complex dilemmas of cross-border compliance

The global nature of RWAs has led to a "Babylonian dilemma." For example, US investors purchasing German commercial real estate tokens must simultaneously meet the SEC's Howey test, German BaFin banking license requirements, and EU GDPR data protection regulations. In 2023, an Asian real estate group issued a STO in Singapore to finance the acquisition of European hotels; however, due to the lack of a Luxembourg CSSF license, the tokens were forcibly redeemed, resulting in a $27 million loss for investors. An IOSCO report shows that only 27% of jurisdictions clearly define the legal status of RWAs, highlighting regulatory arbitrage and potential conflicts.

Potential risks of off-chain custody

The binding of off-chain assets to on-chain tokens poses a "black box" risk. The Puerto Rican "Casa del Blockchain" project failed due to developer misappropriation of funds, resulting in tokens losing their value and exposing custody vulnerabilities. While mainstream solutions, such as Goldman Sachs using State Street's SPV to custody government bonds, lack mature mechanisms for non-standard assets like art and private jets, the ISDA warns that custodian bankruptcies could lead to a "digital-physical de-anchoring," triggering a systemic crisis.

Valuation challenges of non-standard assets

Pricing non-standardized assets is like groping in the fog. In 2023, Banksy's painting "Love in the Trash Can" was tokenized into 10,000 NFTs, valued at $16 million, but secondary market trading volume accounted for only 3%, with a turnover rate of only 0.03%. How to value these physical objects and how to increase liquidity have become a challenge in the standardized on-chain world. In addition, the traditional market maker-exchange system has not yet been fully established on RWA, and valuation models for complex assets such as cultural relics and intellectual property still need to be improved.

Broader regulatory and technological challenges

- Legal and compliance risks: The legal recognition of mapping on-chain tokens to off-chain assets is low, and the validity of smart contracts as alternatives to traditional contracts is questionable; complex SPV structures are difficult to penetrate regulatory oversight and are prone to hidden risks; RWA's securities attributes require compliance with rules in multiple jurisdictions, and cross-border conflicts exacerbate the difficulty for investors to protect their rights.

- Asset quality and transparency: The authenticity of underlying assets is hard to guarantee, and there is a high risk of fictitious assets or double collateralization; oracles are centralized and easily manipulated (controlled by a few institutions or nodes), and the complexity of information disclosure confuses investors.

- Technical security risks: Smart contract vulnerabilities, lost private keys, and unstable blockchain performance may lead to asset losses.

- Liquidity and speculation risks: Insufficient depth in the secondary market, valuations are easily manipulated, and redemption mechanisms may trigger a run on the bank; hype surrounding "new concepts" and the lure of high returns fuel speculation, and misunderstandings about the security of decentralization exacerbate the risk of scams.

How to break this deadlock?

Solving these regulatory challenges requires collaborative progress in regulation, technology, and markets. For example, regulatory sandboxes (such as Hong Kong's Ensemble) dynamically adjust rules through on-chain audits; Chainlink's CCIP oracles verify off-chain data in real time; and Maecenas' hybrid custody (on-chain transactions + off-chain auctions) improves liquidity. Only through global collaboration and strengthening legal, technological, and market mechanisms can the regulatory dilemma of RWA be further resolved.

mainstream international RWA platforms

Due to differences in RWA regulatory frameworks and market variations across regions, several major RWA markets have seen the emergence of benchmark RWA projects. Due to space limitations, we will select some relatively mature platforms with a certain scale, established business models, and successful implementation cases for analysis. These projects are primarily located in the United States (including Canada), the European Union, and Hong Kong (discussed in the next article).

Ondo Finance (USA): An institutional benchmark for RWA tokenization in the US.

Within the global RWA ecosystem, Ondo Finance is undoubtedly one of the leaders in the US market. Since its founding in 2021, this New York-based platform has been committed to "bringing Wall Street assets onto the blockchain." Through a rigorous and compliant process, it transforms traditional financial products such as US Treasury bonds, stocks, and ETFs into tradable and collateralizable blockchain tokens, successfully bridging traditional finance (TradFi) and decentralized finance (DeFi). As of November 2025, Ondo's total on-chain assets under management (TVL) have exceeded $1.74 billion, with the token ONDO having a market capitalization of approximately $2.5 billion. It has secured over $46 million in funding from top institutions such as Pantera Capital and Coinbase Ventures, demonstrating strong market recognition and growth momentum.

Ondo's core advantage lies in its highly institutionalized design philosophy. The platform strictly adheres to the US SEC's Reg D and Reg A+ exemption mechanisms and is deeply integrated with new regulations such as the GENIUS Act passed in 2025, ensuring that each token is backed by a 1:1 real asset reserve and is subject to daily third-party audits. This compliant foundation not only alleviates the concerns of institutional investors—currently, 86% of its funding comes from traditional financial institutions—but also gives its products inherent DeFi composability: users can directly stake Ondo tokens in protocols such as Aave and Compound to obtain liquidity, truly realizing the vision of "on-chain government bonds as cash."

Technically, Ondo demonstrates exceptional cross-chain and interoperability capabilities. The platform already supports multiple mainstream public chains, including Ethereum, BNB Chain, Stellar, and Sei, and integrates Chainlink oracles to ensure real-time price updates. In August 2025, Ondo launched its own PoS Layer 1 chain—Ondo Chain—optimized for institutional-grade RWA issuance, supporting high-frequency settlement and privacy computing to further reduce cross-border transaction costs. Furthermore, its lending sub-protocol Flux Finance (a compliant version based on Compound V2) and the investment fund Ondo Catalyst (with a scale of $250 million) together form a complete ecosystem, providing one-stop coverage from asset tokenization to capital allocation.

In terms of asset allocation, Ondo has tokenized over $1.74 billion in assets, with US Treasury bonds accounting for 58% (approximately $1 billion), forming its absolute core; stocks and ETFs account for 24% (approximately $400 million), enabling fragmented investment in US stocks through Ondo Global Markets; money market instruments such as the yield-generating stablecoin USDY account for 15%; and the remainder consists of small-scale pilot programs in credit and real estate. This structure clearly reflects the typical characteristics of the US RWA market: anchored to low-risk, highly liquid government bonds, gradually expanding to higher-yield assets.

The following are key project case studies from Ondo Finance, showcasing its successful implementation across various asset classes:

The above examples clearly demonstrate that Ondo Finance is not merely a simple asset on-chain tool, but a systemic financial infrastructure with compliance as its moat, USD assets as its anchor, and DeFi as its amplifier. Its success not only validates the feasibility of RWA under the US regulatory framework but also provides a replicable "institutional entry template" for other regions globally. In the future, as the Ondo Chain ecosystem matures and more traditional asset management giants enter the market, Ondo is expected to propel the RWA market from tens of billions to trillions of dollars, becoming a cornerstone player in the new era of on-chain finance.

Securitize (USA): A benchmark for compliant issuance and market infrastructure for RWA tokenization.

In the rapidly evolving RWA tokenization landscape, Securitize stands out as a core infrastructure provider in the US market. Founded in 2017 and headquartered in New York, the company has grown into a leading global digital securities issuance platform, focusing on transforming traditional assets such as real estate, private equity, bonds, and funds into compliant blockchain tokens, enabling institutional investors to achieve 24/7 global access and fragmented ownership. As of November 2025, Securitize manages over $2.8 billion in on-chain assets, including over $4 billion in issued tokenized assets. The platform has processed over $10 billion in trading volume, attracting partnerships with giants like BlackRock and Morgan Stanley, and raising a total of $47 million in funding, highlighting its strategic position in bridging TradeFi and DeFi.

Securitize's unique value lies in its embedded compliance architecture, making it a "compliance guardian" for RWA projects. The platform is deeply integrated with the US SEC's Reg D, Reg A+, and Reg S exemption mechanisms and complies with the 2025 GENIUS Act regulations on stablecoins and RWA collateral, ensuring that every token undergoes KYC/AML verification, 1:1 asset reserve audits, and transfer restrictions (implemented through the ERC-3643 standard). This design not only lowers the issuance threshold—allowing SMEs to quickly launch tokenized funds without cumbersome traditional securities registration—but also provides investors with ironclad protection: daily third-party reporting and automated smart contract execution avoid "off-chain black box" risks. Currently, institutional investors account for 85% of the portfolio, and Securitize's secondary market platform allows qualified users to trade tokens instantly, further enhancing asset liquidity. The annualized yield (APY) remains stable at 4%-6% among bond-type products.

Securitize emphasizes multi-chain compatibility and seamless interoperability, supporting mainstream networks such as Ethereum, Polygon, Avalanche, and Solana. It integrates Chainlink oracles for real-time synchronization of off-chain data (such as asset valuations) and manages compliant transfers through its proprietary Transfer Agent service. In 2025, Securitize launched an upgraded market infrastructure supporting cross-chain bridging and API integration, enabling traditional asset management companies to easily "go on-chain" their products, reducing transaction fees by more than 60% compared to traditional brokers. Its ecosystem also includes a one-stop toolchain, forming a closed-loop service from asset verification to distribution and continuous disclosure, driving RWA's transformation from pilot to large-scale deployment.

Securitize is highly diversified, with over $2.8 billion in tokenized assets. Private equity and funds comprise 45% (approximately $1.26 billion), focusing on high-growth startups; bonds and money market funds account for 30% (approximately $840 million), primarily in short-term Treasury bonds; real estate and credit account for 20% (approximately $560 million), supporting fragmented property investments; and the remainder consists of non-standard assets such as art and commodities. This distribution reflects the institutional preferences of RWA in the US: a pillar of equity and bonds, emphasizing stable returns and global reach, rather than high-volatility speculation.

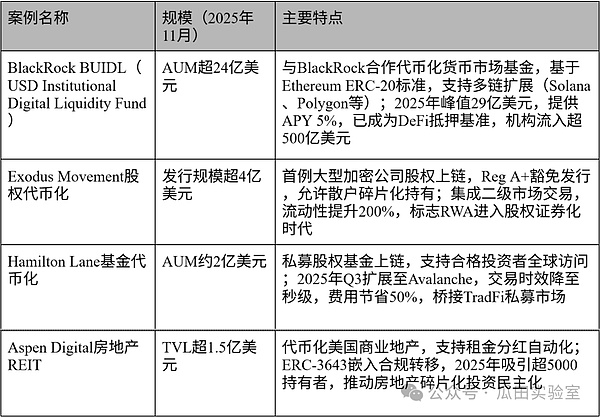

The following are key project examples from Securitize:

Securitize has demonstrated exceptional execution capabilities in a complex regulatory environment, setting a new paradigm for "compliance equals competitiveness" in the industry. Its success stems from a deep integration of law and technology. It is projected that by 2030, with the entry of more industry giants, Securitize will help the RWA market expand to $16 trillion, becoming a cornerstone infrastructure of the digital securities era.

RealT (USA): A pioneer in retail-level real estate fragmentation within RWA.

In the wave of RWA (Real-World Asset) tokenization, RealT, with its mission of "making American real estate affordable for ordinary people," has become a retail-level benchmark for fragmented real estate investment in the United States. Founded in 2019 and headquartered in Michigan, the platform focuses on converting single-family homes and small apartment buildings in cities such as Detroit, Chicago, and Miami into blockchain tokens. Each token represents a real share of the property and automatically distributes rental income. As of November 2025, RealT has tokenized over 450 properties, with total assets under management (AUM) exceeding $520 million, cumulative dividends exceeding $32 million, over 120,000 platform users (90% of whom are retail investors), and total funding of approximately $25 million, successfully transforming the traditionally high-barrier real estate market into an "on-chain REIT" experience.

RealT's core appeal lies in its exceptional retail friendliness and compliance transparency. The platform strictly adheres to the US SEC's Reg D and Reg A+ exemption mechanisms, ensuring that each property is held through an SPV (Special Purpose Vehicle), with tokens (ERC-20 standard) pegged 1:1 to the underlying assets, and title and insurance managed by a third-party custodian (such as First Integrity Title). Users can purchase a property share with a minimum investment of just $50, and rental income is automatically distributed to their wallets daily via USDC. This design completely breaks down the liquidity barriers of traditional real estate—where previously hundreds of thousands of dollars in down payments were required, now transactions can be completed in seconds on-chain—while embedding KYC/AML and transfer restrictions (ERC-3643 compatible) through smart contracts allows retail investors to enjoy institutional-level transparency: every rental, maintenance, and tax transaction is traceable on the blockchain, and audit reports are published in real time.

RealT employs a two-tier architecture: Ethereum mainnet + Polygon Layer 2. It integrates Chainlink oracles to synchronize property valuations and rental data, supporting cross-chain bridging and DeFi collateralization (such as Aave). In 2025, the platform launched RealT RMM (Rental Money Market), allowing users to borrow USDC using tokenized properties as collateral, with a stable annualized yield of 7%-9% (rent + capital appreciation). Its one-stop DApp covers the entire process from property selection and due diligence to profit sharing, with transaction fees 95% lower than traditional real estate agencies, offering a user experience comparable to an "investment version of Airbnb on the blockchain."

In terms of asset allocation, RealT focuses heavily on single-family homes and small multi-family properties, with Detroit accounting for 55% (approximately $286 million, with rental yields as high as 12%), Chicago for 25%, and Miami and Atlanta combined for 20%. This "lower-middle-tier cities + high rental returns" strategy accurately captures the trend of soaring rents in the United States while avoiding the regulatory complexities of the high-end market, perfectly matching the risk appetite of retail investors.

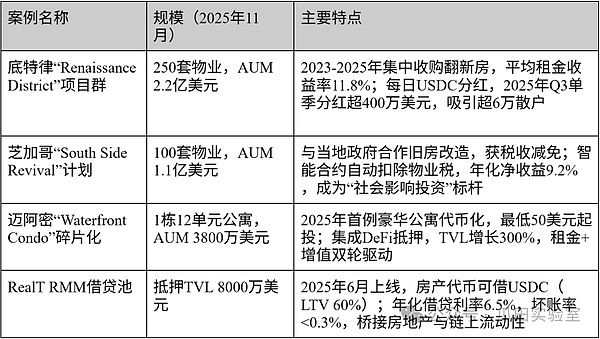

The following are RealT's main project examples:

RealT not only validated the feasibility of RWA in the real estate sector through the above cases, but also pioneered the paradigm of "real estate as income-generating NFTs." Its success stems from its precise targeting of retail pain points—low barriers to entry, daily dividends, and on-chain transparency. It is projected that by 2030, with more middle-class cities joining, RealT will drive the global real estate RWA market to exceed $2 trillion, becoming an entry-level infrastructure for ordinary people to put their wealth on the blockchain.

Propy (USA): RWA's global on-chain closed-loop platform for real estate transactions and ownership.

In the RWA (Real-World Asset) tokenization field, Propy, with its mission of "making cross-border home buying as simple as buying NFTs," has become a leading practitioner of on-chain real estate transactions globally. Founded in 2017 and headquartered in Palo Alto, California, this US company utilizes a three-layer technology stack of blockchain + NFT + smart contracts to achieve end-to-end on-chain processing from property search, due diligence, payment to closing and tokenized profit sharing. As of November 2025, Propy has facilitated over $4.5 billion in on-chain real estate transactions, with a total tokenized property value exceeding $1.2 billion, covering 40 US states and overseas markets such as Dubai, Portugal, and Thailand. It boasts over 650,000 users, has raised over $50 million in total funding (including a $46 million Series A round in 2024), and became the first blockchain company to obtain real estate brokerage licenses in 21 US states.

Propy's core competitiveness lies in its end-to-end compliant transaction loop. The platform strictly adheres to the real estate laws of various US states and the SEC Reg D/Reg A+ framework. Every transaction is facilitated by a licensed broker, and title is delivered through a dual system: Propy's proprietary PRO token (ERC-20) and NFT title certificate. The NFT records complete title documentation, historical transactions, and tax returns, while the ERC-20 token can be used for rental income or fractional transfer. The Propy Title Agency, launched in 2025, further reduces transfer time from an average of 45 days to as fast as 24 hours, and lowers transaction fees by 70%. This model not only meets the cross-border property investment needs of high-net-worth clients (especially buyers from Asia and the Middle East) but also ensures, through KYC/AML transparency and Chainlink oracles, that each NFT corresponds to a genuine and legally traceable title.

On the technical front, Propy has built a multi-chain + AI-driven real estate operating system: the mainnet is based on Ethereum and Polygon, supporting Solana and Base extensions; it integrates an AI due diligence robot (automatically checking for title defects, flood risks, and tax history); the PropyKeys feature, launched in 2025, allows users to mint ordinary real estate into address-bound NFTs with a single click, achieving "on-chain Homestead". The platform also partners with First American, the largest title insurance company in the United States, to provide title insurance of up to $2 million, giving on-chain real estate transactions the same legal validity as those in the traditional market.

In terms of asset allocation, Propy primarily focuses on single-family homes in the United States and luxury properties overseas. The U.S. accounts for 72% (approximately $860 million, with Florida and California being the most active), luxury apartments in Dubai and Europe account for 18%, and vacation properties in Thailand and Southeast Asia account for 10%. This combination of "U.S. compliance core + global high-end properties" benefits from both U.S. legal protection and captures the high-net-worth demand in emerging markets.

The following are Propy's main project examples, showcasing its complete closed-loop capabilities from trading to tokenization:

Through these cases, Propy has not only solved the three major pain points of real estate transactions—trust, speed, and cross-border—but has also pioneered a new paradigm of property rights as NFTs and transactions as settlements. Its success stems from the perfect combination of the strictest US real estate regulations with the transparency of blockchain. It is projected that by 2030, Propy will drive more than 10% of global cross-border real estate transactions to be on-chain, becoming a true "on-chain Zillow + on-chain Notary" in the RWA era.

Polymath (Canada): A pioneer in the compliance infrastructure for RWA security tokenization

In the early wave of RWA (Real-World Asset) tokenization, Polymath was undoubtedly the "godfather of security tokens." This Canadian-American project, founded in 2017 (now headquartered in New York), was the first to propose and implement a complete standard and issuance framework for Security Tokens, earning it the reputation of being an "ERC-20 compliant version." Despite team restructuring and market downturns in 2023-2024, Polymath made a strong comeback in 2025, with its flagship product, Polymesh (a Layer 1 public chain built specifically for regulated assets), becoming the preferred underlying platform for institutional RWA issuance. As of November 2025, over $8.5 billion in tokenized securities (including private equity, bonds, and fund shares) have been issued on the Polymesh chain, with a total TVL of $720 million. It has provided compliance infrastructure for over 420 projects and raised over $110 million in total funding (including a $60 million round led by Animoca Brands in 2025), re-establishing its dominant position in the RWA "compliance foundation" field.

Polymath's core value lies in its commitment to compliance from day one. Unlike most public chains that operate on a "get on board first, pay the fine later" basis, Polymath's self-developed Polymesh is the world's first Layer 1 blockchain specifically designed for regulated assets: nodes must complete KYC/KYB and obtain permission to participate in consensus. On-chain identity and compliance are native modules, and every transaction enforces rules such as whitelists, blacklists, freezes, and tax withholding, fully compliant with securities regulations in multiple countries including the US SEC, EU MiCA, and Swiss FINMA. Polymesh 2.0, launched in 2025, further integrates zero-knowledge proof (ZK) compliance, allowing institutions to meet transparent regulatory requirements while protecting privacy, completely resolving the traditional blockchain dilemma of "anonymity vs. compliance."

On the technical front, Polymath provides a one-stop SaaS toolchain for security tokens: from Token Studio (a no-code issuance interface) to Polymesh Wallet (institutional-grade multi-signature + compliant transfer agent), and then to Polymesh Private (a permissioned subchain for private asset transactions). The platform supports the predecessor to the ERC-3643 standard (ST-20) and was fully upgraded to the Polymesh Asset Protocol in 2025, enabling cross-chain asset mirroring with Ethereum, Polygon, and Solana. Institutional users can complete the entire process from asset due diligence and investor KYC to token issuance and exchange listing within hours, at a cost of only 5%-10% of traditional securities issuance.

In terms of asset class distribution, Polymath is highly focused on institutional-grade regulated assets: private equity and fund units account for 52% (approximately $3.7 billion), bonds and structured products account for 28%, real estate and credit account for 15%, and others (art, carbon credits) account for 5%. This structure perfectly matches the core requirements of global asset management institutions for "compliance, auditability, and legal recourse".

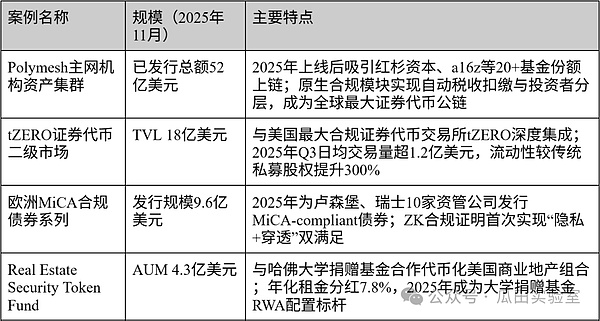

The following are key project examples of Polymath, showcasing its dominant application as an RWA compliance infrastructure:

Polymeth not only established the technical standard for security tokens but also redefined the "native blockchain form of regulated assets." Its success stems from its forward-looking embrace of global securities regulations and the reconstruction of the underlying public chain. It is projected that by 2030, Polymeth will become the settlement layer and compliance foundation for over 90% of institutional RWAs, truly realizing the ultimate vision of "Wall Street on Chain."

Blocksquare (EU): The white-label infrastructure for RWA real estate tokenization and the world's largest distributed network

In the RWA (Real-World Asset) tokenization arena, Blocksquare, with its mission of "enabling anyone to launch their own real estate tokenization platform with a single click," has become the world's largest provider of distributed, fragmented real estate infrastructure. Founded in 2018, this Slovenian company (an EU member state) helps real estate developers, funds, and local governments launch compliant on-chain REITs within weeks through an open-source protocol and white-label SaaS model. As of November 2025, the Blocksquare network has tokenized over €480 million worth of properties (approximately $530 million), covering 28 countries and 510 community pools, with a cumulative issuance of over 128,000 real estate tokens, over 180,000 users, a platform token BST market capitalization of approximately $180 million, and cumulative funding exceeding $15 million (including an $8 million strategic round led by Kraken Ventures in 2025), earning it the reputation of "the Shopify of real estate."

Blocksquare's core competitiveness lies in its dual engine of white labeling and distributed compliance. The platform provides a complete one-stop toolchain: Oceanpoint (a no-code issuance dashboard), Marketplace Protocol (a decentralized trading protocol), and Staking & Governance (a BST staking and dividend mechanism). Any institution can launch its own branded tokenized platform simply by connecting to the API, while all underlying compliance logic (KYC, AML, whitelisting, tax withholding) is handled uniformly by Blocksquare. This makes it perfectly compatible with EU MiCA regulations (receiving Luxembourg CSSF regulatory sandbox approval in 2025), while also being compatible with major global frameworks such as US Reg D, Swiss DLT law, and Dubai VARA. Blocksquare 2.0, launched in 2025, further reduces issuance costs to 1/10 of traditional REITs, with an average launch cycle of only 21 days.

Technically, Blocksquare uses a Polygon mainnet + Layer 2 scaling architecture. All real estate assets exist in the form of dual tokens: sBST (staked BST) and NFTs. NFTs record ownership shares and legal documents, while sBSTs are used for rental income and governance. The platform integrates Chainlink oracles to synchronize property valuations and rental data in real time, and achieves truly decentralized liquidity aggregation through distributed community pools (one independent pool for each city or project). As of 2025, there were 510 active community pools globally, with daily rental income exceeding $65,000, all automatically recorded on the blockchain.

In terms of asset allocation, Blocksquare focuses heavily on a mix of commercial and residential properties: 58% are European commercial properties (approximately $310 million, with rental yields of 6%-9%), 22% are residential properties in the US and Canada, 15% are hotel/resort properties in Asia Pacific and the Middle East, and 5% are in emerging markets (Africa and Latin America). This strategy of "EU compliance core + global property coverage" allows them to benefit from the MiCA passport while also capturing rental premiums in high-growth markets.

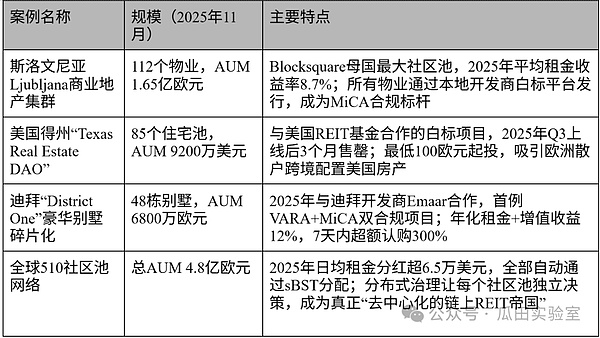

The following are Blocksquare's key project case studies, showcasing its white-label model and global deployment capabilities through its distributed network:

Blocksquare not only lowered the technical and compliance barriers to real estate tokenization, but also pioneered a global expansion paradigm of "white label + distributed community pool". Its success stems from the perfect combination of the EU's most favorable regulatory environment and open-source infrastructure. It is projected that by 2030, the Blocksquare network will tokenize over €500 billion worth of properties, becoming the "on-chain operating system" for the real estate industry in the RWA era.

Swarm Markets (EU): Germany's RWA portal for fully compliant and interoperable DeFi and TradeFi transactions.

In the RWA (Real-World Asset) tokenization arena, Swarm Markets, with its mission of "enabling retail investors to legally trade on-chain bonds, stocks, and commodities," has become Europe's most aggressive compliant DeFi-RWA hybrid platform. Founded in 2021 and headquartered in Berlin, this German company is the world's first decentralized exchange to obtain a complete securities brokerage and custody license from the German BaFin (Federal Financial Supervisory Authority), fully bridging the two-way flow between traditional securities and DeFi protocols. As of November 2025, Swarm Markets' on-chain TVL has exceeded $410 million, with a cumulative trading volume exceeding $6.8 billion. It supports over 20 types of real-world assets, including stocks, bonds, gold, and crypto ETFs, with over 150,000 registered users (72% of whom are from Germany and the EU). The platform's token, SMT, has a market capitalization of approximately $230 million, and it has raised over $30 million in total funding (including an $18 million Series B round led by Circle Ventures and L1 Digital in 2025). It is considered a "compliant DeFi model" by MiCA regulations.

Swarm Markets' biggest breakthrough lies in its world's first "regulated DeFi" architecture. The platform holds a full BaFin license (§32 KWG banking license + §15 WpIG securities institution license), allowing users to trade on-chain tokenized stocks (Apple, Tesla), German government bonds, and gold ETFs simultaneously on the same interface with only one KYC transaction. Users can also directly collateralize these RWA tokens with protocols like Aave and Compound to obtain liquidity—something completely impossible in traditional finance. Swarm 2.0, launched in 2025, further achieves "zero slippage" physical settlement: users can exchange on-chain German government bonds for real bonds and deposit them into traditional brokerage accounts, and vice versa, truly achieving a 1:1 swap between TradeFi and DeFi assets.

Technically, Swarm employs a hybrid architecture of Polygon + Layer 2 settlement + permissioned nodes. All RWAs exist as ERC-3643 compliant tokens, with off-chain reserves provided by a German licensed custodian bank (Solaris SE). The platform's front end is as smooth as Uniswap, while the back end is fully regulated by BaFin: real-time reporting of every transaction, investor tiering, and automatic tax withholding are all included. Launched in Q3 2025, Swarm Bridge allows users to "on-chain" stocks/bonds in traditional brokerage accounts into RWAs within one minute, with reverse redemptions also completed in seconds, at a cost only 1/20th of that of traditional brokerages.

In terms of asset allocation, Swarm is highly focused on European institutional assets: 48% in equities and ETFs (approximately $197 million, including Tesla, LVMH, and DAX indices), 32% in bonds and fixed income (mainly German and Eurozone government bonds), 15% in commodities and gold, and 5% in crypto ETFs and structured products. This "European blue-chip + fixed income" combination not only meets the demand of EU investors for safe assets but also amplifies returns through DeFi.

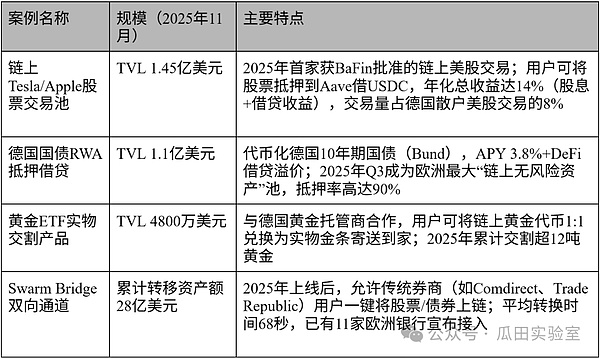

The following are key project examples from Swarm Markets, showcasing its disruptive applications of "regulated DeFi":

Swarm Markets has pioneered a new paradigm of "native DeFi for regulated assets." Its success stems from its exceptional execution within Germany's most stringent regulatory environment. In the future, Swarm will become the main RWA-DeFi portal shared by retail and institutional investors in Europe, truly enabling on-chain trading freedom for "anyone, any asset, any time."

Centrifuge (EU): The Open Source and Institutional-Grade Leader in RWA Private Credit Tokenization

In the RWA (Real-World Asset) tokenization race, Centrifuge is undoubtedly the "King of Private Lending" and the "King of Open Source Infrastructure." Founded in 2017, this German-American project (with dual headquarters in Berlin and San Francisco) was the first to put non-standard credit assets such as corporate accounts receivable, invoices, and supply chain finance on-chain, providing SMEs with two-way off-chain and on-chain financing through Real-World Asset Pools. As of November 2025, Centrifuge has tokenized and raised over $5.8 billion in real-world credit assets (the highest amount ever raised on an on-chain RWA), with a stable on-chain TVL of $980 million, over 320 active pools, serving over 1200 SMEs and institutions globally, and over 420,000 users. Its platform token CFG has a market capitalization of approximately $420 million, and it has raised over $110 million in total funding (including a $45 million Series C round led by ParaFi and Coinbase Ventures in 2025). It is regarded as a "benchmark for on-chain private lending" by giants such as BlackRock and Goldman Sachs.

Centrifuge's core competitiveness lies in its two-layer architecture: Centrifuge Chain (which became independent as Substrate-based Layer 1 in 2023 and has now been upgraded to a Polkadot parachain) serves as the compliance settlement layer, specifically designed for RWA with native NFTs (representing credit assets) + the Tinlake protocol (structured financing pools); the upper layer is completely open source and permissionless, allowing anyone to deploy asset pools. This allows it to simultaneously meet stringent institutional compliance requirements (KYC/AML transparency, SPV isolation, third-party auditing) and DeFi's native composability (pools can be directly integrated with Aave, MakerDAO, and Curve). Centrifuge V3, launched in 2025, further introduced the RWA Market (on-chain secondary market) and Credit Vaults (automated credit assessment), shortening the financing cycle for SMEs from 90 days to as little as 3 days, and reducing costs to one-fifth of traditional banks.

Technically, Centrifuge is the most thoroughly open-source player in the RWA field: its core protocol Tinlake and Centrifuge Chain code are 100% open source, with community governance accounting for over 70%. The platform supports multi-chain asset mirroring (Ethereum, Base, Arbitrum, Polkadot) and integrates Chainlink oracles and zero-knowledge proofs to achieve privacy-compliant financing. Centrifuge Prime, launched in Q3 2025, provides high-net-worth individuals and institutions with a "one-click investment in global RWA credit portfolios" product, offering a stable annualized return of 8%-14% and a bad debt rate of only 0.7% (far lower than the industry average of 3.2%).

In terms of asset allocation, Centrifuge is highly focused on private credit and accounts receivable: invoices and trade finance account for 62% (approximately $3.6 billion), real estate development loans account for 18%, consumer credit and supply chain finance account for 15%, and new energy and carbon credits account for 5%. This "real cash flow for SMEs" orientation makes it the part of RWA that is closest to the real economy.

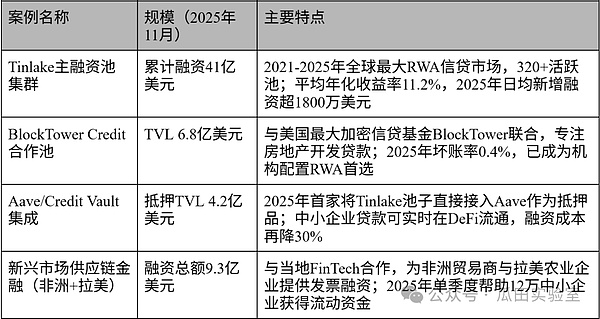

Centrifuge's key case studies:

Through the above examples, Centrifuge not only solved the century-old problem of "difficult and expensive financing" for SMEs, but also pioneered the ultimate RWA paradigm of "real cash flow equals liquidity." Its success stems from the perfect combination of open-source spirit and institutional execution. It is projected that by 2030, Centrifuge will tokenize and raise over $500 billion in global private credit assets, becoming the on-chain "central bank" for SMEs and the real economy in the RWA era.

Summary - RWA's global footprint is complete, and the trillion-dollar race has officially begun.

This article primarily explores the regulatory frameworks, characteristics, and laws and regulations of major RWA markets globally, and provides an in-depth introduction to mainstream RWA platforms and projects in North America and Europe. From Polymath's initial introduction of the "Security Token" concept in 2017 to BlackRock's BUIDL achieving over $2.4 billion in sales in 2025, the tokenization of Real-World Assets (RWA) has completed an astonishing leap from "experimental toys" to "institutional main battleground" in just eight years. In November 2025, the global RWA on-chain TVL (TVL) had firmly surpassed $250 billion, an increase of more than 15 times compared to the end of 2023, officially entering the trillion-dollar race.

Looking at the global landscape, a five-polar world order has clearly taken shape, with each pole having its own characteristics and complementing the others:

- The United States, anchored by the dollar, Treasury bonds, and private credit, and relying on the three SEC laws (GENIUS/CLARITY/Anti-CBDC) and Wall Street credit, has built a dollar RWA hegemony characterized by "institutional dominance and the highest liquidity," with Ondo, BlackRock BUIDL, Securitize, Centrifuge, RealT, and Propy being the strongest representatives.

- With its MiCA "single passport" and DLT pilot program, the EU has created the "most unified, standardized, and cross-border friendly" RWA continent. Swarm Markets and Blocksquare's white label model is pushing European commercial real estate and SME lending to the global stage.

- The Middle East (Dubai-Abu Dhabi) has created a new high ground with "the fastest speed and the lowest threshold" by using the VARA Sandbox and oil sovereign wealth, with RWA leading the world in real estate and Islamic finance.

- With Project Guardian and the GL1 toolkit, Singapore plays the role of "technology standard exporter + Asia-Pacific hub", becoming the testing ground for multi-currency and cross-chain implementation.

- Hong Kong, with its SFC dual sandbox and mBridge, has become "the most important bridgehead connecting the mainland and the world to go global," and its green bonds and supply chain finance in the Greater Bay Area are unique.

Several international benchmark projects further outline the complete picture of RWA: from compliant infrastructure (Securitize, Polymath), white-label distribution (Blocksquare), retail democratization (RealT, Propy), private lending development (Centrifuge), regulated DeFi (Swarm), to dollar-based institutional flywheels (Ondo, BlackRock), each segment has seen the emergence of leading global players. Most of these projects were established around the time of the 2017-2018 STO boom, and after years of exploration and development, experiencing ups and downs, they have finally ushered in a high point for the RWA market recently.

The next five years (2026-2030) will be a decisive period, and three major trends are irreversible:

- The regulatory race is drawing to a close, and compliance passports will determine the winner: if the United States introduces a federal uniformity law, the European Union fully implements MiCA, and the Asian triangle (Hong Kong-Singapore-Dubai) completes mutual recognition, the world will ultimately form a pattern of "three poles + regional passports".

- The influx of institutional funds has begun in full swing: by 2025, institutional allocation has reached 70%, and is expected to exceed 90% by 2030. Traditional assets worth 30-50 trillion US dollars will be rapidly put on the blockchain, with government bonds, real estate, private lending, and stock ETFs becoming the top four main battlegrounds.

- RWA will become the new underlying asset of DeFi: tokenized government bonds will completely replace stablecoins as the on-chain "risk-free rate of return", real estate and credit pools will become the main collateral, and the annualized yield of DeFi will be fully integrated with the yield curve of traditional finance.

RWA is no longer a "niche narrative" in the crypto world, but rather an infrastructure-level restructuring of the global financial system.

In 2025, we will stand on the shore where the tide truly rises;

By 2030, RWA will no longer be “on-chain finance”, but “finance” itself.

In our next in-depth research article, we will focus on the Hong Kong market, providing an in-depth analysis of Hong Kong's policies, market landscape, and real-world cases. Stay tuned.

Reference List

- DefiLlama (2025). Real World Assets (RWA) Dashboard. https://defillama.com/rwa

- RWA.xyz (2025). Real World Assets Analytics. https://rwa.xyz

- Dune Analytics (2025). RWA Dashboard by Messari & Dune. https://dune.com/messari/rwa

- Chainlink (2025). Real World Assets On-Chain Data. https://data.chain.link/real-world-assets

- IOSCO (2023). Crypto-Asset Roadmap 2023-2024. https://www.iosco.org/library/pubdocs/pdf/IOSCOPD747.pdf

- Ledger Insights (2023-2025). Various RWA reports and case studies. https://www.ledgerinsights.com

- BaFin (2025). Swarm Markets Regulatory Announcements. https://www.bafin.de

- VARA (2025). Virtual Asset Issuance Rulebook (May 2025 Update). https://rulebooks.vara.ae/rulebook/virtual-asset-issuance-rulebook

- MAS (2025). Project Guardian Updates & GL1 Toolkit. https://www.mas.gov.sg/schemes-and-initiatives/project-guardian

- SFC Hong Kong (2025). Guidelines on Tokenised Securities Activities (March 2025 Update). https://www.sfc.hk/en/News-and-announcements/Policy-statements-and-announcements/Circular-on-tokenised-securities-activities

- Securitize (2025). BlackRock BUIDL & Securitize Markets Reports. https://securitize.io/learn/press/blackrock-launches-first-tokenized-fund-buidl-on-the-ethereum-network

- Ondo Finance (2025). Monthly Transparency Reports & OUSG/USDY Updates. https://docs.ondo.finance/general-access-products/usdy/faq/trust-and-transparency

- Centrifuge (2025). Tinlake & Centrifuge V3 Monthly Reports. https://centrifuge.io/transparency

- BlackRock (2025). BUIDL Fund Quarterly Reports (via Securitize). https://securitize.io/blackrock/buidl

- Propy (2025). Propy Title Agency & PropyKeys Statistics. https://propy.com/browse/propytitle/

- Blocksquare (2025). Oceanpoint & Community Pools Dashboard. https://marketplace.oceanpoint.fi/

- Swarm Markets (2025). BaFin-Licensed Trading Volume Reports. https://swarm.com/transparency

- RealT (2025). Property Portfolio & RMM Updates. https://realt.co/investor-dashboard

- Polymath / Polymesh Foundation (2025). Polymesh 2.0 & Asset Issuance Reports. https://polymesh.network/reports

- Boston Consulting Group & BlackRock (2025). Tokenized Funds: The Third Revolution in Asset Management Decoded (2030 Outlook). https://web-assets.bcg.com/81/71/6ff0849641a58706581b5a77113f/tokenized-funds-the-third-revolution-in-asset-management-decoded.pdf