A Complete Guide to RWA Types: Bonds, Real Estate, Commodities, Credit, Equities

Blockchain technology has already transformed people's understanding of "money," "ownership," and "trust." However, for years, this innovation has existed almost entirely in the digital world. Whether it's cryptocurrencies, NFTs, or DeFi tokens, they are shaping the foundation of decentralized finance, yet they have consistently lacked a direct connection to real-world value.

Now, all of this is changing. RWA (Real World Assets) is bridging the gap between the "physical world" and the "digital economy." It tokenizes traditional assets, such as government bonds, real estate, or gold, and records them on the blockchain, making these assets easier to trade, track, and verify globally.

Imagine being able to manage your own "mini" mansion, gold reserves, or corporate bonds from your mobile phone. That's the allure of RWA. It allows ordinary investors to access assets previously only available to institutions. Through tokenization, investing becomes not only more transparent and automated but also gains broader global reach.

In this guide, we'll give you a quick overview of the five main categories of RWA: bonds, real estate, commodities, credit, and equities . You'll understand how they work, key assessment points, and how to securely explore this new opportunity in the RWA section of XT.com .

Key Takeaways

- RWA brings real-world assets such as bonds, real estate, commodities, credit, and equity to the blockchain, making them freely tradable.

- By verifying records on the blockchain, we can achieve global investment, transparent information, and a more efficient settlement experience.

- Different types correspond to different returns and risks: stable interest, safe assets, preservation and appreciation of value, or growth potential.

- Before investing, please check the custodian institution, audit report, valuation method, and fee details.

- We recommend starting with small amounts and exploring more high-quality, trustworthy projects in the XT RWA zone .

What is RWA?

Simply put, RWA is an abbreviation for "Real World Assets," which involves digitizing tangible assets in the real world and mapping them onto the blockchain .

Operating principle:

- A real asset, such as government bonds, an apartment, or gold, is securely held in custody by a licensed custodian or trustee in accordance with a compliant legal framework.

- Smart contracts on the blockchain issue tokens that represent ownership or profit rights to the asset.

- Investors can freely trade and transfer these tokens on-chain, or use them within the decentralized finance system.

This model, which combines off-chain trust (custody, regulation, and auditing) with on-chain transparency (immutable records and 24-hour accessibility) , makes RWA one of the most practically valuable and credible innovations in blockchain.

Why it's important:

- Accessibility: Making traditional assets, previously only available to institutional investors, accessible to global investors.

- High efficiency: Significantly shortens settlement time and reduces intermediate costs.

- High transparency: Ownership and transaction records are publicly verifiable.

- Diversification: Helping investors balance their portfolios between crypto and traditional assets.

RWA Five Main Types

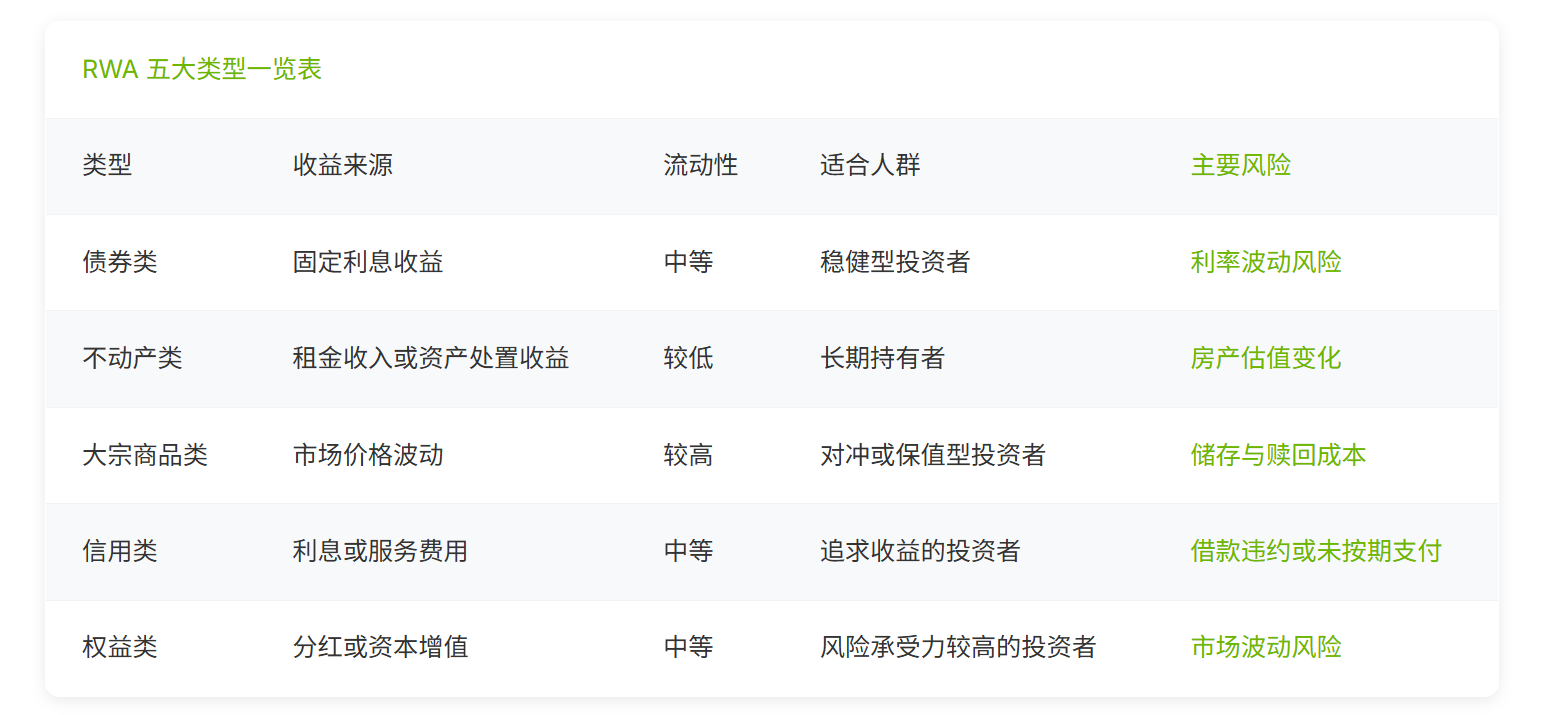

RWA can be viewed as five gateways to the real world of value. Each type has different sources of income, risk levels, and suitable target groups.

Bond-Backed Tokens

What is it:

Bond tokens are products that tokenize traditional debt instruments such as government bonds or corporate bonds. They typically offer stable, predictable returns from coupon interest and principal repayment at maturity.

Operation method:

The bonds are held by a compliant custodian, and investors purchase tokens representing partial ownership and receive interest income periodically at the bond's coupon rate.

Suitable for:

Investors who want consistent returns, seek stable profits, and are unwilling to take on the high volatility risk of the crypto market.

Things to consider before investing:

- Name, license and regulatory jurisdiction of the custodian institution

- Third-party audit or proof of reserve (PoR) report

- Pricing basis, such as benchmark yield or market quote.

- Redemption period (e.g., T+2, T+5, etc.)

Common fees:

Custody fees, management fees, redemption fees, and online transaction fees.

Key risks:

Risks include interest rate volatility, liquidity constraints during early redemption, and compliance risks in different regions.

Tip: Before subscribing to RWA bonds, please check the "Verified Custodian" label on XT.com and verify the latest audit and compliance disclosure information.

Real-Estate Tokens

What is it:

Real estate RWA represents ownership or income rights to real estate assets, such as apartments, office buildings, or real estate portfolios. Investors can earn rental income or share in the returns from property appreciation by holding the tokens.

Operation method:

Real estate is typically held or managed by a legal structure such as a special purpose vehicle (SPV). Rental income and capital gains generated by the property are distributed to token holders periodically.

Suitable for:

Investors who seek stable returns, prefer tangible asset backing, and are willing to hold for the medium to long term.

Things to consider before investing:

- Property ownership documents and trustee information

- Rental statements, occupancy rates and latest valuation report

- Profit distribution cycle (monthly, quarterly, or semi-annually)

- Redemption or transfer policy in the secondary market

Common fees:

Property management fees, custody fees, maintenance fees, and insurance costs.

Key risks:

Fluctuations in housing prices, legal disputes, inefficient property management, or insufficient liquidity can lead to extended redemption periods.

Tip: Before investing, check the property's latest valuation date and occupancy rate. The more transparent the data, the higher the project's credibility.

Commodity-Backed Tokens

What is it:

Commodity-based RWAs represent real physical reserve assets such as gold, silver, or crude oil. They are typically held in custody at a 1:1 ratio by certified vaults or storage facilities. These tokens do not generate direct returns but serve as safe-haven assets against inflation and market volatility.

Operation method:

The custodian is responsible for holding the physical goods, and each token corresponds to a certain amount of real assets. Some products support physical redemption, while others exist only in digital form.

Suitable for:

This is for investors who wish to preserve and increase their wealth, hedge against inflation risks, or diversify their portfolios beyond fiat currency and crypto assets.

Things to consider before investing:

- Custodian institution qualifications and location of cash deposit

- Frequency of updates to third-party audits or proof of reserve (PoR)

- Physical redemption process and related conditions

Common fees:

Storage fees, insurance fees, redemption fees, transportation fees, and online transaction fees.

Key risks:

The token price may be at a premium or discount to the market price, redemption and transportation costs may be high, and cross-border regulatory or customs procedures may restrict physical withdrawal.

Tip: Choosing token projects with regular audit plans and transparent disclosure of reserve information can better ensure asset security and credibility.

Credit and Receivable Tokens

What is it:

Credit-based RWAs tokenize negotiable instruments such as corporate loans, invoices, or short-term credit facilities. Investors' returns come from interest payments from borrowers and related service fees.

Operation method:

Financial institutions or lending platforms package multiple bill assets into an asset pool, which is then tokenized and issued to investors. After borrowers repay their loans, the returns are distributed proportionally to the token holders' accounts.

Suitable for:

Investors who seek stable returns, possess certain credit analysis skills, or are willing to accept moderate risk in exchange for higher returns.

Things to consider before investing:

- Borrower information, credit score, and repayment history

- Credit enhancement measures (such as insurance or over-collateralization)

- Loan term, default handling process and redemption mechanism

- Operational and performance records of lending or asset servicing platforms

Common fees:

Asset servicing fees, management fees, and potential early redemption fees.

Key risks:

Borrower default, insufficient information disclosure, delayed repayment, or difficulties in enforcement during debt recovery.

Tip: Prioritize projects that disclose borrower data and are verified by a third party to better reduce credit risk and ensure investment security.

Equity or Fund Tokens

What is it:

Equity-based real-value assets (RWAs) allow investors to participate in the distribution of profits from a company's equity or fund shares. Sources of return include dividends, profit sharing, or asset appreciation.

Operation method:

Within a compliant regulatory framework, these tokens represent economic rights similar to stocks or fund units. Investors can receive dividends from company profits or enjoy capital appreciation as the company or fund's value increases.

Suitable for:

Investors with some investment experience, who can withstand high volatility, and who value long-term growth potential.

Things to consider before investing:

- Legal structure and fund registration information

- Management team qualifications and past performance report

- Lock-up period or investor eligibility restrictions

- Latest performance benchmarks and market performance comparison

Common fees:

Management fees, platform service fees, and performance-based commissions.

Key risks:

Market volatility, complex legal structures, restrictions on transfers, or long redemption periods.

Tip: It is recommended to regularly check the fund's quarterly reports to understand the latest performance, profit distribution and the next redemption window arrangements, so as to better grasp the investment progress and risk situation.

How to read XT RWA project cards

In the RWA section of the XT exchange, each product has a detailed project card displaying key information such as custody, auditing, pricing, and fees. Learning to correctly interpret these project cards can help you more efficiently assess project quality and risk.

Your 5-step checklist:

Custody and Certification

- Confirm who is in charge of the assets and whether the custodian institution has the necessary licenses and compliance qualifications.

- Check if an audit report or proof of reserve is provided.

Valuation source

- Understand how asset prices or net asset value (NAV) are calculated.

- Check the last valuation update time to ensure the data is real-time and reliable.

Redemption and Settlement

- Check the fund arrival cycle (e.g., T+2, T+5, etc.).

- Note whether there is a redemption queue mechanism or redemption limit.

Fees and Costs

- Verify that all management fees, custody fees, and online transaction fees are clearly listed.

- Confirm whether there are performance-based bonuses or early redemption fees.

Investment Qualifications and Restrictions

- Understand regional restrictions and KYC verification requirements.

- Determine whether qualified investor status is required to participate.

Tip: When viewing projects on XT.com , you can scroll down to the "Disclosures" section at the bottom of the project card to view audit certificates, proof of reserves (PoR), and historical transaction records to obtain the most transparent project information.

A Brief Analysis of Risk and Compliance: A Must-Read for Beginners

RWA presents investors with entirely new opportunities, but all investments carry risks. Understanding the main types of risk can help you better manage your investment pace and expectations. The following three types of risk deserve the most attention:

I. Market Risks

- Asset prices may fluctuate due to changes in the economic environment or market supply and demand.

- During periods of market volatility, liquidity may decrease, leading to slower redemptions or transactions.

II. Operational Risks

- The custodian, smart contract, or platform may experience technical or managerial failures.

- Delayed updates to disclosed data or asset valuations may affect the accuracy of investment decisions.

III. Legal and Compliance Risks

- RWA products are subject to the regulatory requirements of each region, and some countries or regions may have restrictions on investor participation.

- If investors are unaware of their eligibility requirements, it may lead to transaction disruptions or compliance disputes.

Before investing, be sure to review the project disclosure and compliance statement, confirm that you meet the participation requirements, and operate through a trusted platform (such as the XT.com RWA Zone) to ensure asset security and investment compliance.

Conclusion: Making the real world a blockchain

The rise of RWA is reshaping people's understanding of investment. It is not only a new crypto trend, but also an important step towards a more inclusive, transparent, and globalized financial system .

By tokenizing bonds, real estate, commodities, and equities, RWA makes opportunities previously only accessible to institutions available to ordinary investors. It replaces cumbersome paper-based processes with smart contracts, allowing real value to be segmented, verified, and freely circulated.

For beginners, understanding the five types of RWA (Real Estate Investments) is the first step towards rational investing. Bonds represent stability and returns, real estate provides tangible value, commodities can be used to hedge against inflation, credit assets offer yield potential, and equity products symbolize long-term growth opportunities.

When exploring the RWA section on XT.com , please carefully read the disclosures and thoroughly evaluate the custodian and audit reports. Tokenization has changed how assets are acquired, but prudent research and risk awareness remain crucial for investment success. Learning to analyze and understand RWA products will not only help you invest more intelligently, but it also signifies that you are participating in the dawn of a new financial era: one that truly connects the real world with blockchain technology.

XT RWA Frequently Asked Questions (FAQs)

Q1: Can my country participate?

This depends on local regulatory policies. Some RWA products may be restricted to users in specific regions or only available to users with investor qualifications. XT will clearly disclose any relevant restrictions before purchase.

Q2: How long does it take to redeem funds?

Most RWA products use a T+N settlement mechanism , and funds typically arrive within a few business days after a redemption request is submitted. Holidays or network congestion may cause slight delays.

Q3: How can I confirm that the assets actually exist?

Please review the audit report, Proof of Reserve (PoR), and third-party verification information on the project page. Legitimate projects maintain transparent disclosure and updates.

Q4: Why do token prices differ from asset values?

Market supply and demand affect short-term prices. Discounts typically reflect insufficient liquidity, while premiums may indicate strong demand or lagging valuation updates.

Q5: Are there any hidden fees?

The transparent RWA project will publish a complete breakdown of fees. Before investing, please be sure to review the management fees, custody fees, and network transaction fees to ensure you understand all costs.

Q6: What if I am temporarily unable to redeem my funds?

For some projects, a queuing mechanism may be activated to ensure orderly processing when handling large redemptions. Updates will be announced through official XT announcements, and users can also contact the customer service team for assistance.

Quick Links

- November 2025 Market Outlook: From FOMC to x402 Agreement, a Comprehensive Analysis of Global Hot Topics

- XT.com and Dash discuss: Instant settlement, blockchain mechanisms, and privacy innovation.

- How to invest 100,000 USDT? XT Simple Earn helps you achieve a stable passive income of 10%+.

About XT.COM

Founded in 2018, XT.COM is a leading global digital asset trading platform with over 12 million registered users, operating in more than 200 countries and regions, and boasting an ecosystem traffic exceeding 40 million. The XT.COM cryptocurrency trading platform supports over 1300 high-quality cryptocurrencies and over 1300 trading pairs, offering diverse trading services including spot trading , leveraged trading , and contract trading , and is equipped with a secure and reliable RWA (Real World Asset) trading market. We are committed to the philosophy of "Explore Crypto, Trust Trading," dedicated to providing global users with a safe, efficient, and professional one-stop digital asset trading experience.

- 核心观点:RWA将现实资产代币化,连接实体与数字经济。

- 关键要素:

- 五大资产类别:债券、不动产、商品、信用、权益。

- 链上透明记录,全球化交易与结算。

- 降低投资门槛,提升资产流动性。

- 市场影响:推动传统金融与加密市场融合。

- 时效性标注:长期影响