A $2,000 Christmas "heist": Trump and his tariff windfall

- 核心观点:特朗普关税红利政策引发加密市场短期狂欢。

- 关键要素:

- 比特币应声上涨1.75%,以太坊涨3.32%。

- 政策缺乏立法授权,实施概率仅23%。

- 大规模现金发放将推升通胀压力。

- 市场影响:短期刺激风险资产,长期加剧通胀风险。

- 时效性标注:短期影响

Every Christmas, children receive a gift from a mysterious old man, never questioning its cost. Now, Donald Trump is attempting to play Santa Claus for the adult world, promising a $2,000 "tariff bonus" that seems to have fallen from the sky, claiming the gift is paid for by a distant "foreign factory." The crypto market is already buzzing with excitement, like a bunch of children eagerly unwrapping their presents. But there's one overlooked detail in this grand magical spectacle: before clapping for the bunny that appeared out of nowhere, no one asks whose dinner it cost, or who's going hungry tonight.

I. When the President Announces Nationwide Money Splashing: A Market Frenzy

Source: Donald Trump

The crypto market is precisely that diner who doesn't care who pays for dinner, but only smells the aroma.

The last time they celebrated was with stimulus checks during the pandemic; this time, the main course of the feast has changed to Donald Trump's new trick—the "Tariff Dividend. " This 79-year-old "Santa Claus," who rushed into his new role more than a month early , officially announced on November 9th on his social media platform Truth Social that he would distribute $2,000 in cash to every low- and middle-income American. And the "magic" that conjured this money wasn't the traditional printing press, but rather his beloved import tariffs.

The market erupted in applause without hesitation. Within minutes of the announcement, Bitcoin surged 1.75%, and Ethereum rose 3.32%. Privacy coins, more sensitive to the "anonymous money-spraying" narrative, such as Zcash and Monero, recorded even more dramatic double-digit gains. Cryptocurrency exchange trading volumes skyrocketed, and social media was abuzz with cheers of a "new bull market stimulus."

Clearly, to these excited "children," Santa Claus had already set off in his sleigh.

Early-opened gift boxes: the source of the bonus

Trump’s obsession with tariffs can be traced back to his 2016 campaign promise, “America First.”

He firmly believed that high tariffs would protect American manufacturing and make foreign countries foot the bill for American debt. Upon taking office, he quickly launched a trade war with economies such as China and the European Union, imposing high tariffs on imported steel, aluminum, and consumer goods.

This logic is simple yet dangerous: tariffs are described as “protection money” paid by foreign countries , rather than as hidden taxes borne by American consumers.

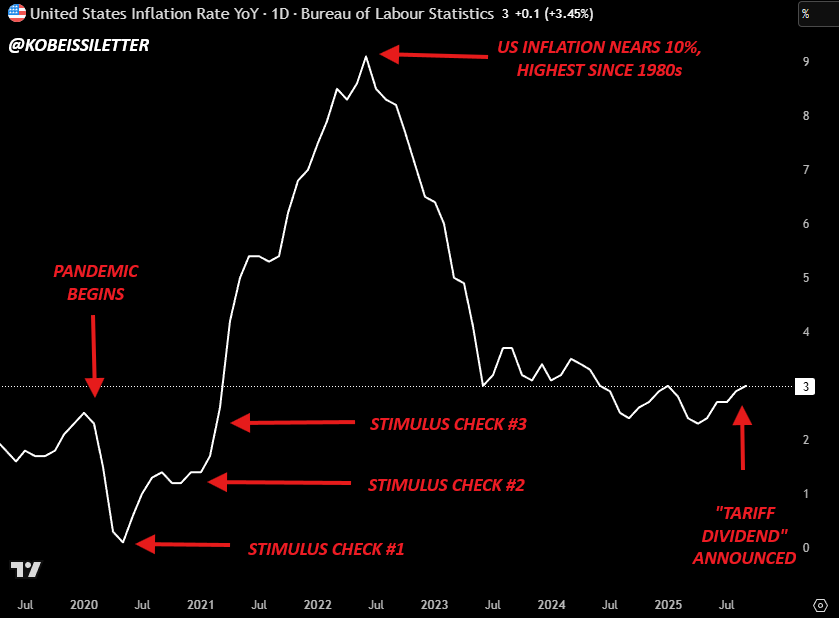

By fiscal year 2025, U.S. tariff revenue is projected to reach $195 billion. Trump has repeatedly claimed that this revenue could be used to pay off the U.S. national debt of $37 trillion. However, economists point out that businesses are simply passing on the costs to consumers, resulting in rising inflation and declining purchasing power.

But to Trump's supporters, this was a victory—tariffs made "foreign countries pay more, and America got richer." This narrative laid the political groundwork for his "tariff dividend" proposal.

How are dividends generated?

The concept of a "tariff bonus" didn't come out of thin air. In a television interview last month, Trump hinted at plans to return a portion of tariff revenue to Americans—ranging from $1,000 to $2,000 per person. He claimed that this policy could generate over $1 trillion annually, enough to cover the entire population's share.

On November 9, he officially announced the plan on Truth Social: "We are collecting trillions of dollars and will soon begin paying off our enormous debt. Everyone (excluding high-income earners!) will receive a bonus of at least $2,000."

Treasury Secretary Scott Bessent subsequently hinted that the bonus might be distributed in the form of tax cuts. However, Trump did not provide specific details .

In other words, this glittering gift box turned out to be empty when opened. There was no timetable, no eligibility criteria, and no approval from Congress.

According to calculations by investment analysts at the Kobeissi Letter, based on past pandemic stimulus check distribution patterns, approximately 220 million American adults are currently eligible to receive these stimulus checks. In form, this sounds like a "fiscal innovation"; in essence, it's a reenactment of a political script . First, they shout slogans to stimulate a market reaction.

In form, it sounds like a "fiscal innovation"; in essence, it's a reenactment of a political script . First, shout slogans to stimulate a market response.

The market has muscle memory. It clearly remembers that in 2020, the stimulus checks issued by the US government sent Bitcoin soaring from $4,000 to $69,000, creating the most frenzied bull market in crypto history. The market naturally expects history to repeat itself , kicking off the most extravagant party in crypto history. Now, the familiar music is playing again, and the market is naturally hoping for history to repeat itself.

But this time, the magician's trick has a flaw: the party of yesteryear was about the Federal Reserve printing wine out of thin air; today's "dividend" is simply transferring some of the guests' wine to another group. It's not a new feast, but merely a tax reformulation. Its scale and sustainability are both highly questionable.

*After the last round of stimulus measures, the US inflation rate was close to 10%.

II. Pre-paid Revelry and Unpaid Bills: Emotions, Revelry, Illusions

The market's short-term euphoria: Sentiment comes first, cash hasn't arrived yet.

The crypto market always reacts quickly to stories.

Within 24 hours of the announcement, major cryptocurrencies such as Bitcoin, Ethereum, and Solana all rose.

“Stocks and Bitcoin only react to one stimulus—up,” investor Anthony Pompliano wrote on his personal X platform after the news broke.

Bitcoin advocate Simon Dixon cautioned, "If you don't invest that $2,000 in assets, it will either be swallowed up by inflation or used to pay off debts and eventually flow back to the bank."

These words reveal the core psychology of the market: regardless of whether stimulus measures are actually implemented, expectations of liquidity are the fuel for price increases.

But this surge is more like a psychological speculative illusion .

1. First, the policy has not yet received any legislative authorization. If the Supreme Court rules the relevant tariffs illegal, the bonus plan may be stillborn.

2. Secondly, even if implemented, it would mean that fiscal revenue would be directly allocated instead of used for debt reduction. Trump's promise to "pay off US debt with foreign money" is likely to fail again.

3. More importantly, large-scale cash issuance will increase inflationary pressures, forcing the Federal Reserve to adopt a more hawkish monetary policy. At that time, liquidity will tighten, and risky assets will be the first to suffer.

Industry investment analysts warn that while some of the dividend funds will flow into the market and push up asset prices, in the long run, the consequences will be fiat currency inflation and a decline in purchasing power.

The Game of Prediction Markets: Kalshi vs Polymarket

Behind the fervor, a legal battle is underway. The U.S. Supreme Court is currently hearing a case regarding the legality of the tariffs. As of November 10th, according to data from the decentralized prediction market Polymarket, traders gave only a 23% probability of Supreme Court approval; on the prediction platform Kalshi, this figure was even lower, at only 22%. In other words, the majority of the market is betting that the plan will ultimately be rejected by the judiciary.

Source: Polymarket

Behind the fervor, a sober legal battle is underway. The U.S. Supreme Court is currently hearing a case regarding the legality of the tariffs, and "smart money" doesn't seem to be buying it. According to data from the prediction market Kalshi, traders give only a 23% chance that the Supreme Court will approve the plan; on the decentralized prediction platform Polymarket, this figure is even lower at 21%. In other words, the prevailing opinion in the market is that this drama will ultimately be canceled due to script (legal) issues.

But Trump himself is clearly a better "drama director." He directly asked on Truth Social:

"The US president is authorized by Congress to halt all trade with foreign countries—which is far more severe than imposing tariffs—but cannot impose taxes for national security purposes? What kind of logic is that?"

See, with just one sentence, he cleverly transformed a dull controversy into a political drama about "sovereignty."

This dramatic strategy is practically second nature to a "big shot" who once made a cameo appearance in the classic Christmas movie "Home Alone 2" and instructed the young protagonist on how to find the lobby.

III. Behind Christmas Candy: A Tooth Decay Called "Inflation"

In other words, behind the short-term frenzy lies a familiar script; the director hasn't changed, but the problems have been left to the next actor.

The "tariff bonus" is carefully packaged as a Christmas gift, but it is more like a melt-in-your-mouth Christmas candy . After the sweet taste (short-term stimulus) fades, what remains is the incurable cavity of "inflation".

- The $195 billion in revenue from tariffs is like filling a swimming pool with a single coin compared to the $37 trillion in national debt. Giving away that coin directly is tantamount to using future money to buy present applause.

- Short-term political gains come at the cost of long-term fiscal risks. Economists warn that this policy could create "double inflation": tariffs raise costs, while benefits stimulate demand, much like simultaneously pressing the accelerator and brake pedals on an already speeding car, ultimately leading to engine overheating and a fatal crash.

- The geopolitical aspect is equally important. This boisterous family party could also draw complaints or even retaliation from neighbors (other countries). As the trade war snowballs again, the windows of the global supply chain will rattle, which is nothing short of a blizzard for the crypto mining industry, which relies heavily on global chips.

In other words, behind the short-term euphoria lies a familiar script. Santa Claus simply stuffs a bill labeled "inflation," "deficit," and "trade war" into next year's Christmas stocking.

5. The last person to leave the table

In this grand political drama, Santa Claus Trump prepared a special gift not only for ordinary people but also for the crypto world. When he announced that he would take $2,000 from that red bag called "Tariffs" for every American, the entire crypto market seemed to hear the Christmas Eve bells ahead of time.

Today, the sleigh of history seems to be following the old path. The market's kids (retail investors) are eagerly watching the chimneys, convinced that some of the gifts will fall directly into their crypto wallets, ushering in another "altseason."

However, every child who believes in Santa Claus must eventually face a real question: what is the price of the gifts?

This time, Santa's gifts didn't magically appear in his North Pole workshop; he simply maxed out the nation's credit cards. This feast, totaling over $400 billion, has the bill of "inflation." When the holiday fever overheats the entire room (the economy), the adults (the Federal Reserve) may have to open the windows to let in the cool air (interest rate hikes), bringing this revelry to an early end.

Therefore, what lies before every crypto investor is a beautifully packaged gift box. In the short term, it shines with the alluring glow of history repeating itself; but in the long term, the back of the box may bear a bill for "inflation" printed in small print.

Is this a genuine gift that will warm you throughout the winter, or a Christmas candy that melts in your mouth but will cause cavities? For believers in the crypto world, choosing which story to believe will determine whether they can emerge unscathed from this feast.

The last one to leave the party pays the bill.