River's suspension of redemption caused a 70% drop in points, rendering the 180-day promise meaningless.

- 核心观点:River暂停积分兑换机制引发信任危机。

- 关键要素:

- 大户集中兑换并做空致币价暴跌。

- 项目方单方面暂停180天兑换承诺。

- River Pts单日暴跌超70%。

- 市场影响:削弱用户对链上承诺信任度。

- 时效性标注:短期影响

Original author: ChandlerZ, Foresight News

On the evening of November 9th, River, a blockchain-based stablecoin system, announced that it would temporarily suspend the mechanism for exchanging River Pts for RIVER tokens and plans a comprehensive upgrade. The official reason given was that the price of RIVER had recently been subjected to an organized and premeditated short-selling attack, with some large holders rapidly exchanging River Pts for RIVER tokens, coordinating with large short orders to suppress the market price.

River Pts are River's ecosystem points, which can be traded and staked as ERC20 tokens. Under River's unique Dynamic Airdrop Conversion mechanism, River Pts can be converted into RIVER tokens at any time within 180 days, allowing users to choose the time and market behavior themselves.

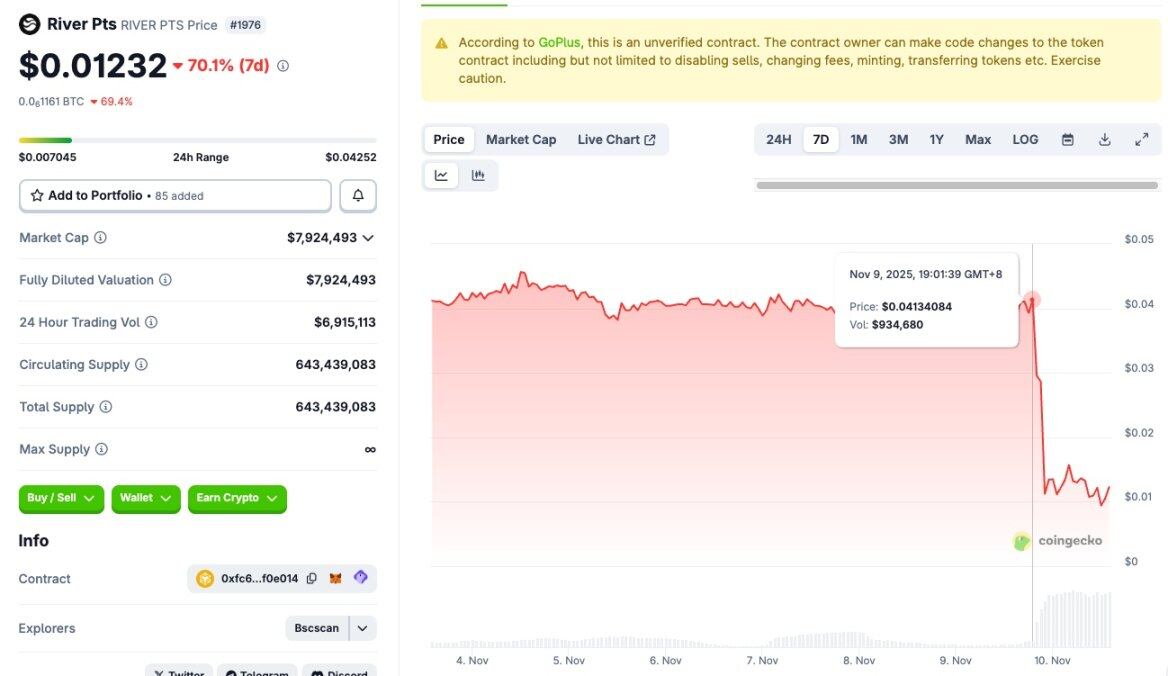

Following the announcement, River Pts immediately plummeted in the secondary market. Market data shows that River Pts fell from approximately $0.04 to around $0.01 that day, a drop of over 70%, indicating a concentrated surge in selling pressure.

What is River? And what is dynamic airdrop conversion?

The River project, developed by the RiverdotInc team, aims to build a chain-abstract stablecoin system for multi-chain ecosystems. This system connects assets, liquidity, and yields across different blockchains, enabling seamless cross-chain interaction without relying on traditional bridging or wrapping mechanisms.

On September 19th, River became the first BuildKey TGE project launched on Binance Wallet. BuildKey is an innovative issuance model launched by Binance in collaboration with Aspecta AI. This model consists of three phases: In the first phase, users need to meet the Alpha Points threshold and deposit BNB to obtain BuildKey credentials, which represent future token allocations. In the second phase (BuildKey trading), users can trade BuildKey in liquidity pools based on Bonding Curve to achieve pre-TGE price discovery. This phase has a relatively low barrier to entry. The core advantage of the BuildKey model in the third phase (TGE and exchange) lies in its fairness and transparency. The number of tokens subscribed was 2 million River, accounting for 2% of the total supply. Ultimately, over 100,000 BNB were deposited, worth over $100 million, setting a new Binance Wallet IDO fundraising record. The oversubscription rate reached 993 times, with over 33,000 participating addresses.

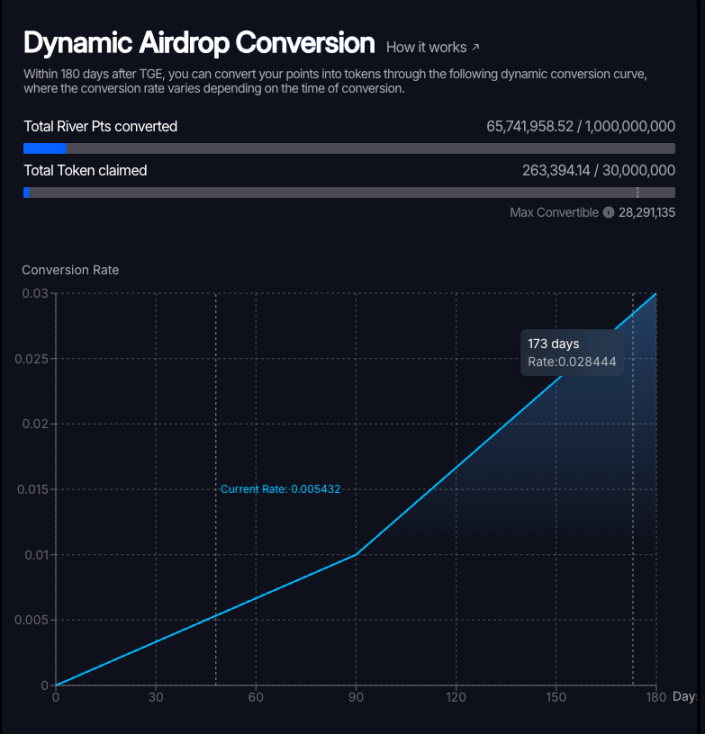

River previously garnered significant attention largely due to its proposed dynamic airdrop conversion mechanism. Unlike traditional airdrops that distribute rewards in a fixed, one-time manner, River incorporates time into its token economic model.

On September 22nd, River announced that the RIVER token airdrop is now open for claiming. The project has allocated 1 billion River Pts for the airdrop, corresponding to a maximum of 30 million RIVER tokens, approximately 30% of the total supply. The number of RIVER tokens that users can claim will increase over time; the longer the waiting period, the more tokens will be received, with a maximum waiting period of 180 days. If a user claims on the 180th day, the number of tokens received will be 270 times the number received on the first day.

The official example states that with the same 1 million Pts, if you redeem on the first day, you will only get about a thousand Rivers; if you persist until the 180th day, you can get up to 30,000 Rivers, which is 270 times the return of the first day.

In the project's narrative, this design aims to reward long-term users and punish those who "grab and run." The longer users wait, the stronger their trust in the project, and the more tokens they can ultimately obtain. Combined with the River Pts' staking and activity-based accumulation mechanism within the ecosystem, Dynamic Airdrop Conversion was once touted as the new standard for airdrop distribution.

This is why, after TGE, most users chose not to rush to redeem their Pts, but instead continued to hold or stake them, hoping to get a higher percentage of Rivers when they approached 180 days. This group also experienced the greatest "expectation gap" in this crisis.

According to its official website, as of November 10, approximately 65.74 million River Pts had been converted into RIVER tokens.

Official statement: To prevent systemic risks, it was necessary to apply the brakes.

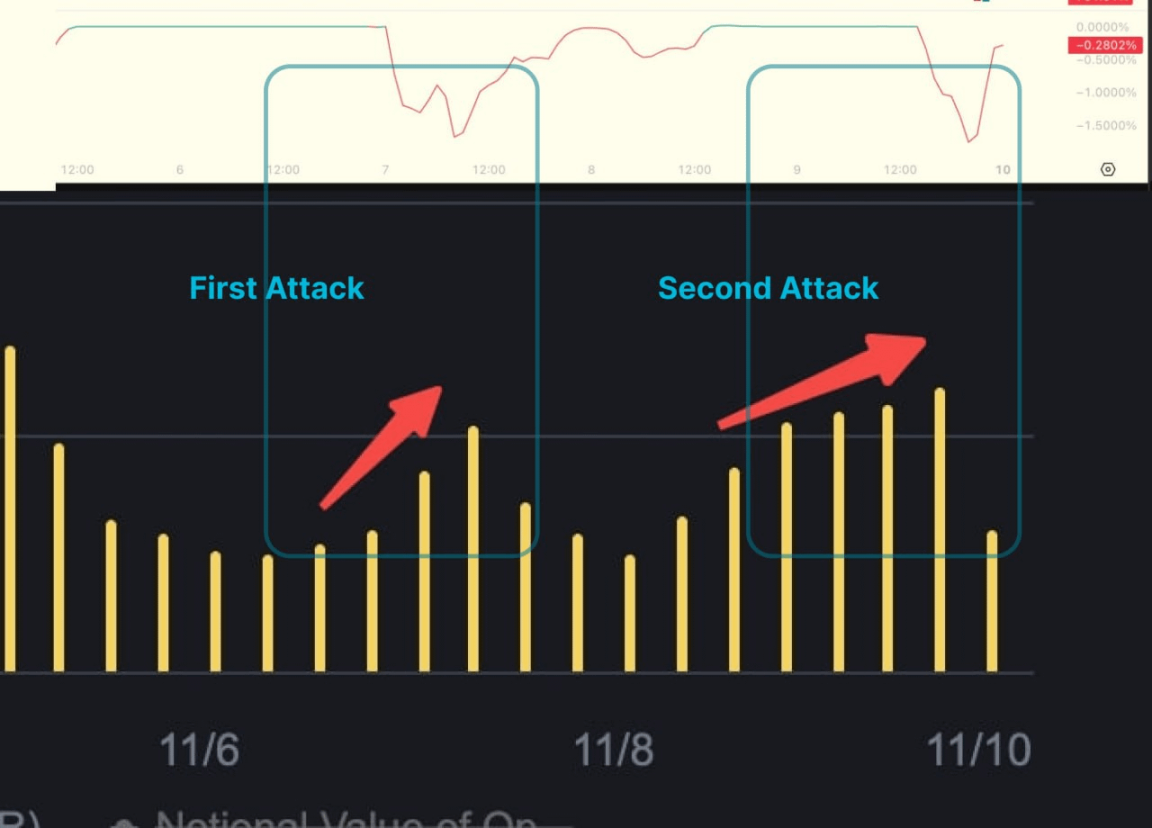

In its announcement on November 9, the River team stated that since November 7, it had observed unusual and suspicious activity on multiple exchanges, including addresses opening a large number of short positions simultaneously, a large amount of River Pts being exchanged for RIVER and immediately sold, and sharp changes in funding rates.

The announcement stated that malicious short sellers simultaneously placed large short orders while rapidly acquiring sellable River tokens using the Pts redemption mechanism, thus coordinating to suppress the price. This was described as an organized and premeditated attack targeting the River ecosystem and the points redemption mechanism itself.

Under this narrative, River's proposed solution is to immediately suspend the Pts to RIVER exchange channel, initiate market buybacks, and begin upgrading the mechanism. The team emphasizes that this is a temporary decision made in pursuit of long-term sustainable growth and promises to release more data, hold an AMA, listen to community feedback, and jointly design a new mechanism.

From the project team's perspective, this was a forced action to apply the brakes to prevent the main platform from collapsing under extreme market conditions. However, from the users' perspective, this touches on a more sensitive issue: does the rule still hold true?

The policy allows for renewal anytime within 180 days, so why can it be stopped midway?

The reason this incident escalated so quickly wasn't just the price crash of Pts, but rather the project team's handling of the rules' boundaries. Many participants pointed out that River had emphasized the 180-day redemption window, the freedom to choose the time, and even the option to redeem in batches in its FAQs, official articles, and airdrop page. Many users developed their own conversion and arbitrage strategies based on these rules.

With the redemption window not even halfway through, the mechanism has been temporarily suspended, and it remains unclear whether it will resume, when it will resume, or under what rules. To these users, this is no longer a simple strategy adjustment, but a forced change of rules in an ongoing game. Their Points, which could be converted into Riverrs tokens, have become points that can only be sold at a loss on the secondary market, their time value instantly diminished.

On the other hand, the debate over who is being protected is intensifying. Supporters argue that if a large-scale short-selling attack combined with concentrated exchanges truly occurs, continuing to open the mechanism could lead to a collapse of the RIVER spot market, harming the entire ecosystem and all token holders; suspending exchanges and then combining them with buybacks might indeed be necessary in extreme circumstances.

Opponents, however, question whether the suspension effectively prioritizes protecting the RIVER main price while shifting pressure onto Pts holders. Even more unsettling for many is that this suspension exposes a more fundamental issue: to what extent can the rules written into contracts and treated as on-chain commitments be unilaterally rewritten by project teams?

If the River contract retains strong modifiability, this means that the 180-day free redemption arrangement is not a hard rule completely locked in the code, but rather an operational plan that can be adjusted at any time by the contract owner.

In the crypto world where "code is law" is a tenet, this structure, where a few addresses hold the power of life and death, is enough to spark renewed discussion within the community about the foundations of trust. If contracts can be changed at any time, are users gambling against time or against the project team's subjective decisions?