Since October, the crypto market has experienced two rounds of deep corrections, with Bitcoin falling back after its surge and entering a period of wide-range fluctuations. Coupled with the pause in the Federal Reserve's interest rate hike cycle and the slowdown in the pace of institutional funds flowing into the crypto market, market sentiment has shifted from "aggressive chasing of gains" to "cautious seeking of stability." Investors' demand for assets with "stable returns and strong security" has increased significantly, and "certainty" is becoming the core screening criterion for current fund allocation.

In fact, this bull market has been quite different from previous retail-driven broad-based rallies since its inception, exhibiting characteristics of institutionalization and fundamentals-driven growth: listed companies have included Bitcoin in their strategic reserves, and traditional financial institutions such as JPMorgan Chase and Fidelity have launched Bitcoin and Ethereum spot ETFs, allowing professional capital to enter the market. Market share has shifted from being dominated by retail investors to being controlled by institutions, and the market has changed from a "broad-based rally" to a "structural bull market".

Investors' preferences have also changed accordingly, no longer clinging to the past broad-based gains, but placing more emphasis on "certainty of returns": First, after experiencing multiple rounds of market fluctuations, risk appetite has significantly decreased, and the pragmatic need for "principal preservation + appreciation" far outweighs the pursuit of "excess returns"; Second, with the uncertainty of the global macroeconomic environment still present, the safe-haven attributes and stable return capabilities of crypto assets have become important considerations for capital allocation.

Correspondingly, investment strategies have shifted from "pursuing high risk and high return" to "anchoring certain returns." Among these, stablecoins with risk-free return attributes and mainstream public chain tokens with both staking returns and appreciation potential have become indispensable core assets in investment portfolios due to their certainty of returns and defensive attributes.

The TRON ecosystem demonstrates significant yield advantages in both asset classes: its stablecoins lead the global mainstream public chains such as Ethereum, BNB Chain, and Solana in risk-free yield; and its native public chain token, TRX, ranks among the top-performing mainstream crypto assets in terms of annual growth, exhibiting both strong price resilience and high appreciation potential.

This combination of "leading stablecoin yields + strong public chain token appreciation" makes TRON a core hub for global capital retention and appreciation. Furthermore, relying on a robust DeFi ecosystem, it provides investors with practical, ecosystem-supported, diversified, and risk-free return solutions, helping them navigate the volatile cycles of the crypto market with stability.

TRON Ecosystem: A Dual Benchmark for Stablecoin Yields and Public Chain Token Appreciation

In an era where the crypto market generally seeks "certain returns," the TRON ecosystem stands out with two core advantages: firstly, the risk-free, high returns offered by stablecoins; and secondly, the high appreciation potential and substantial staking returns of its native public chain token, TRX. Coupled with the ecosystem's backing of "high security" and "large scale," TRON on-chain assets combine high yields with stable returns, making them not only a crucial hub for global capital retention and appreciation but also a preferred platform for achieving steady asset growth in the crypto market.

Currently, investors have different focuses in their allocation needs for the two core asset classes: stablecoins and mainstream public chain tokens.

Stablecoins are recognized in the market as a "safe haven". Users can obtain risk-free returns through staking, lending, liquidity mining and other scenarios, without having to bear the risk of token price fluctuations. They are an ideal choice for cautious investors and risk-averse funds.

Mainstream public chain tokens not only offer fixed returns from basic network staking, but also have the opportunity to appreciate in value along with the development of the public chain ecosystem (such as increased DeFi activity and user growth), forming a dual-drive model of "fixed returns from basic staking + floating returns from ecosystem growth and price appreciation," which precisely meets investors' diversified allocation needs of "stable foundation + flexible appreciation."

The TRON ecosystem perfectly aligns with investors' dual asset allocation needs of "stable returns + growth potential." Its risk-free high returns from stablecoins and the appreciation potential of its native public chain token TRX both comprehensively outperform similar assets in the market, forming an irreplaceable core competitiveness.

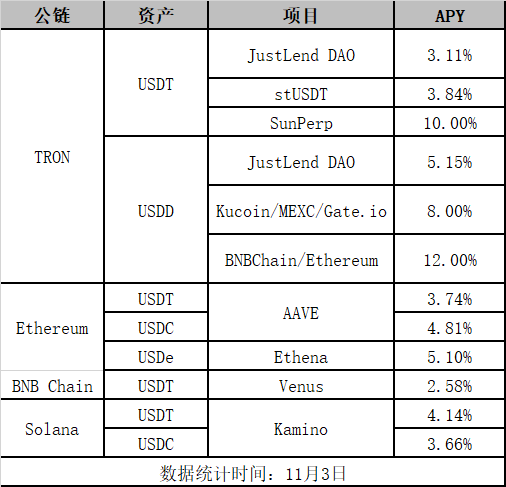

In terms of stablecoin returns, stablecoins within the TRON ecosystem lead the market in risk-free returns, significantly outperforming other mainstream public chains. According to the latest data from November 5th, the annualized yield of stablecoins within the TRON ecosystem can reach over 10%, far exceeding that of mainstream public chains such as Ethereum, BNB Chain, and Solana (which generally offer annualized yields between 3% and 5%), providing a highly attractive investment option for stablecoin investors seeking risk-free returns.

Specifically, TRON has built multiple yield systems around the mainstream stablecoin USDT and the native decentralized stablecoin USDD:

As the main circulating currency in the TRON ecosystem, USDT offers diverse revenue streams and multiple ways to increase its value:

1. Earn interest on deposits : Deposit USDT directly into the lending center JustLend DAO and receive approximately 3.11% interest in real time on November 3rd. Deposits and withdrawals are supported at any time.

2. RWA Returns : By locking USDT through the RWA product stUSDT, you can indirectly capture the returns of assets in traditional financial markets, such as US Treasury bonds, with an annualized return of 3.84% on November 3.

3. Locked-up yield on contract platform : Locking up USDT on the decentralized contract platform SunPerp can yield up to 10% in returns.

USDD, as the native decentralized stablecoin of the TRON ecosystem, supports flexible cross-chain value appreciation and has been deployed across Ethereum and BNB Chain, with different focus on different yield scenarios on different chains:

1. On the TRON blockchain , USDD returns are mainly divided into two categories: one is directly storing USDD on JustLend DAO, with a basic annualized return of 5.2%; the other is participating in USDD exchange staking subsidy programs, staking USDD on exchanges such as KuCoin and MEXC, with an annualized return of up to 8%.

2. In the multi-chain ecosystem (Ethereum/BNB Chain) , locking up USDD can earn interest-bearing tokens sUSDD, with an annualized yield of up to 12%.

More importantly, Sun.io's stablecoin exchange tool PSM on its DEX platform within the TRON ecosystem supports a 1:1 exchange between USDD and USDT with no slippage and zero fees. This means that USDT holders can seamlessly exchange their USDT for USDD, thereby capturing USDD's high yields without any risk.

In terms of native public blockchain token appreciation, TRX has performed exceptionally well in both price increases and staking yields. It not only possesses remarkable price appreciation potential but also offers stable and reliable staking returns. Furthermore, it can leverage the synergistic effects of DeFi applications within the TRON ecosystem to further amplify investment returns, making it a high-quality asset that is both offensive and defensive.

Despite the recent sharp corrections in the crypto market, data as of November 5th shows that TRX has still achieved a remarkable 76% price increase over the past year, demonstrating outstanding resilience and high growth potential. In comparison, ETH saw a 37% annual increase, BNB a 70.49%, while SOL experienced a 3.1% decline. This data undoubtedly proves that TRX leads the mainstream public blockchains in both resilience and appreciation potential.

Besides its leading price increase, TRX also boasts competitive staking yields. Currently, the annualized yield for basic staking on JustLendDAO is 7%. In comparison, the staking yields for other major public chains are as follows: ETH (staking via Lido) has an annualized yield of 2.6%, SOL (staking via Jito) has 5.88%, while BNB (staking via ListaDAO) has a basic annualized yield of only 0.99%, which, after Binance Launchpool incentives, reaches 11.32%. Therefore, TRX's staking yields do not rely on any additional incentives; basic staking alone can achieve considerable and stable returns, making it undoubtedly more attractive and user-friendly for ordinary investors.

Furthermore, leveraging TRON's mature and comprehensive DeFi ecosystem, users can further amplify their TRX staking returns through a series of combined operations. For example, the liquid staking certificate sTRX can be directly stored in JustLend DAO, enjoying an annualized return of up to 7.1%. Simultaneously, sTRX can also be used as collateral to mint the stablecoin USDD, which can then be stored in JustLend DAO. Through this "staking-lending-re-value-adding" cyclical model, users' returns, calculated in cryptocurrency terms, are expected to exceed 15%.

This combination of "stable collateralized returns + highly elastic price appreciation" makes TRX a high-quality asset that is both offensive and defensive. It can meet the fixed income needs of conservative investors and provide ample room for appreciation for aggressive investors, thus becoming a core asset that suits all types of needs.

With its leading 10%+ risk-free returns offered by stablecoins, the comprehensive return advantages of TRX, and the flexible return switching and amplification mechanism within the ecosystem, the TRON ecosystem has firmly established itself as a dual benchmark for "stablecoin returns + public chain token appreciation," becoming an irreplaceable core anchor of certain returns in the crypto market.

DeFi infrastructure provides a solid foundation for long-term stable returns, while TRON builds a value ecosystem that can weather economic cycles.

Against the backdrop of the crypto market shifting from a "broad-based rally" back to "value investing," the TRON ecosystem, leveraging the advantages of "risk-free, high-yield stablecoins + high-growth native token TRX," has created a yield system for users that can weather market cycles and achieve steady asset appreciation. Its core competitiveness lies not only in its leading annualized yield (APY), but also in its mature and comprehensive DeFi infrastructure, which deeply integrates "asset returns and appreciation" with "ecosystem development and prosperity," providing investors with stable and sustainable returns.

Currently, investors in the crypto market are no longer blindly chasing high APY on the surface, but are paying more attention to the transparency of asset return strategies, the sustainability of returns, the real profitability of the ecosystem, and core dimensions such as the security, maturity and potential risks of the protocol.

As a veteran public blockchain that has weathered multiple market cycles, TRON has developed significant differentiated advantages in these key dimensions, perfectly aligning with the changing trends in market demand. It not only possesses absolute dominance in security and ecosystem scale, but its on-chain assets also offer high yields and strong stability. Furthermore, with its real ecosystem returns and long-term cash flow stability, it has become a core destination for global capital retention and appreciation.

In the face of recent security incidents such as the Balancer hack and the de-pegging of stablecoins like xUSD, asset security has become a primary consideration for investors. TRON and its core on-chain DeFi ecosystem (JustLend DAO, Sun.io, etc.) have been operating stably for many years, withstanding multiple rounds of extreme market conditions in the crypto space, and have never experienced a major security incident, providing a solid foundation for fund security.

In terms of ecosystem scale, TRON boasts a massive ecosystem worth tens of billions of dollars, with its huge user base and accumulated funds providing irreplaceable core support for long-term stable returns. Specifically, in terms of asset size, as a core global stablecoin settlement center, TRON's on-chain stablecoin circulating market capitalization has remained stable at around $80 billion, and the total value locked (TVL) of its ecosystem funds has remained at a high level of $28.8 billion, providing ample liquidity for return scenarios through massive fund flows. In terms of user base, the on-chain user base has exceeded 342 million, with daily active accounts exceeding 5 million, and the large user base drives the continuous prosperity of the ecosystem. In terms of profitability, according to Messari's latest Q3 report, TRON's Q3 revenue reached $1.2 billion, a 30.5% increase quarter-over-quarter and a new all-time high, further demonstrating the high-quality and healthy development of its ecosystem through its strong profitability.

Compared to its massive user base and vast capital reserves, TRON's core advantage lies in the fact that both stablecoin yields and TRX's appreciation logic are rooted in real DeFi businesses within its ecosystem. Currently, the TRON ecosystem has built a full-chain DeFi infrastructure covering "asset issuance - trading and exchange - yield appreciation - cross-chain circulation," which not only supports efficient asset circulation but also provides solid business support for the yields of the two core asset classes.

Specifically, the core infrastructure features complementary functions and comprehensive scenario coverage: Sun.io, a one-stop DEX trading center, integrates diverse services, including SunSwap decentralized trading, SunCurve and PSM stablecoin exchange tools, as well as the SunPump Meme issuance platform and the recently launched SunPerp contract trading product, fully covering the entire process from asset issuance and basic exchange to derivatives trading; JustLend DAO, the lending core, is feature-rich, supporting not only lending storage interest (SBM) but also integrating high-frequency services such as TRX staking and energy leasing; the RWA product stUSDT opens up cross-border channels for asset appreciation, while the native stablecoin USDD builds a high-yield system across multiple chains; the cross-chain protocol BTTC enables asset interoperability between TRON and EVM-compatible chains such as Ethereum and BNB Chain, ensuring smooth cross-chain asset liquidity; and the new brand AINFT expands into the fields of AI and NFT innovation, continuously enriching the dimensions of the ecosystem's business.

These DeFi and ecosystem products have built a "full-chain value-added scenario" for TRON on-chain assets, ensuring that mature applications support each step of the asset's journey from entering the ecosystem to achieving multi-dimensional value-added, thus guaranteeing stable and sustainable returns and completely eliminating dependence on short-term policy stimulus.

Taking stablecoins as an example, the highest risk-free yield of 10%+ within the TRON ecosystem stems from the robust ecosystem support of "a complete product matrix + a closed loop of DeFi scenarios": JustLend DAO's basic storage yield, SunPerp's high contract lock-up yield, USDD's cross-chain value-added returns, plus PSM's risk-free exchange and stUSDT's traditional financial integration. Each type of yield has solid application scenarios, rather than short-term policy subsidies.

The excess returns of the native public chain token TRX are also inseparable from the deep empowerment of DeFi infrastructure: in addition to the basic network staking returns, the returns can be further amplified through derivative scenarios of infrastructure such as JustLend DAO (such as the revaluation of staking certificates and revolving lending), forming a multi-return model of "basic returns + derivative value-added", unlocking a higher dimension of return space.

More importantly, the TRON ecosystem is also supported by a long-term influx of incremental funds from "compliant infrastructure." Through compliant channels such as the US-listed company Tron, it continuously leverages traditional financial and institutional funds, injecting long-term liquidity into the ecosystem and enhancing return stability. In June of this year, the listed company Tron pledged 365 million TRX through the JustLend DAO platform; in September, Tron received another $110 million in new investment, with the Treasury adding 312.5 million TRX; as of November 5th, the listed company Tron held over 670 million TRX. This portion of funds, through "long-term lock-up + infrastructure pledging," not only enhances TRX price stability but also provides ample liquidity support for the return scenarios of core infrastructure such as JustLend DAO.

Leveraging its full-chain DeFi infrastructure and external ecosystem expansion, TRON has built a "multi-dimensional, multi-layered" asset return system that covers all needs from "basic value-added services to cross-border investment," satisfying both the security and stability demands of conservative users and the high-yield pursuit of aggressive users.

Whether you are a cautious investor seeking "principal preservation + steady growth" (who can obtain risk-free returns through USDT/USDD storage and staking), an aggressive investor valuing "fixed income + price elasticity" (who can allocate TRX to enjoy comprehensive returns), or an institutional investor with compliance requirements (who can choose stUSDT), the TRON ecosystem provides a clear asset allocation path.

- 核心观点:波场TRON生态提供确定性收益优势。

- 关键要素:

- 稳定币年化收益最高10%+。

- TRX年度涨幅76%,质押收益7%。

- TVL达288亿美元,用户超3.4亿。

- 市场影响:成为资金避险与增值核心选择。

- 时效性标注:中期影响。