Grants DAO has allocated over $180 million in total to fully support the prosperity of the JustLend DAO ecosystem and the enhancement of JST's value.

- 核心观点:JST大规模回购销毁推动代币通缩。

- 关键要素:

- 首轮销毁5.59亿枚JST,占总量5.66%。

- Grants DAO将每季度执行常态化销毁。

- 已累计向生态拨款超1.88亿美元。

- 市场影响:增强JST稀缺性,提振市场信心。

- 时效性标注:中期影响

Recently, JustLend DAO, the core DeFi protocol of the TRON ecosystem, successfully completed its first large-scale "JST buyback and burn" operation—burning approximately 559 million JST tokens, representing 5.66% of the total token supply. This powerful deflationary measure has quickly attracted widespread attention in the crypto market.

Throughout the entire JST buyback and burn program, JustLend Grants DAO (Grants DAO for short) is not only the core executor, but will also be responsible for the routine burn operations every quarter thereafter, ensuring the full implementation of the deflationary mechanism and becoming an indispensable driving force for the strategy.

As a sub-DAO organization under JustLend DAO, Grants DAO is a community-led incentive program organization dedicated to providing solid support to projects and builders who contribute to the development of JustLend DAO and the entire JUST ecosystem through diverse means, while also being responsible for building a defense line for the safe development of the ecosystem.

Grants DAO's functions extend far beyond managing the ecosystem's treasury funds; it is the core engine driving the JustLend DAO ecosystem's development and JST's value growth. From resource support and developer incentives to meticulous market risk management, Grants DAO's reach extends to all key aspects of ecosystem building. While systematically promoting the comprehensive development of JustLend DAO and the JUST ecosystem, it also ensures that the interests of all ecosystem participants, including JST holders and liquidity providers, are protected and enhanced to the greatest extent possible.

Grants DAO: The core driver and implementer behind the JST buyback and burn program

In fact, the entire process of this round of JST buyback and burn was inseparable from the promotion and execution of the Grants DAO organization. From the community initiating the proposal and formal voting to the implementation of the first round of burns, and then to the routine implementation every quarter thereafter, Grants DAO has always been the core player throughout.

In this round of JST buyback and burn program, Grants DAO first extracted over 59 million USDT from JustLend DAO's existing revenue. Then, it burned 30% of the existing revenue in the first round, equivalent to burning approximately 559 million JST, accounting for 5.66% of the total token supply. The remaining 70% of the existing revenue will be burned in batches over the next four quarters. It has now been deposited into the SBM USDT lending market to earn interest, and subsequent revenue will also be used to buy back and burn JST.

According to the burning rules, the JST buyback and burning work in each subsequent quarter will also be handled entirely by Grants DAO. In the first four quarters, at the beginning of each quarter, "17.5% of the previous quarter's JustLend DAO incremental net income + existing income" must be burned simultaneously. After the USDD multi-chain ecosystem income exceeds the $10 million mark, the ecosystem will also be included in this burning mechanism.

It can be said that behind the sophisticated economic operations of JST's buyback and burn program, Grants DAO is not only the core implementing entity throughout, but also a key driving force propelling the JustLend DAO ecosystem forward. Through this buyback and burn program, Grants DAO has transformed from a behind-the-scenes executor and promoter into a key player familiar to users, and is now an important pillar in building the value of the JustLend DAO ecosystem.

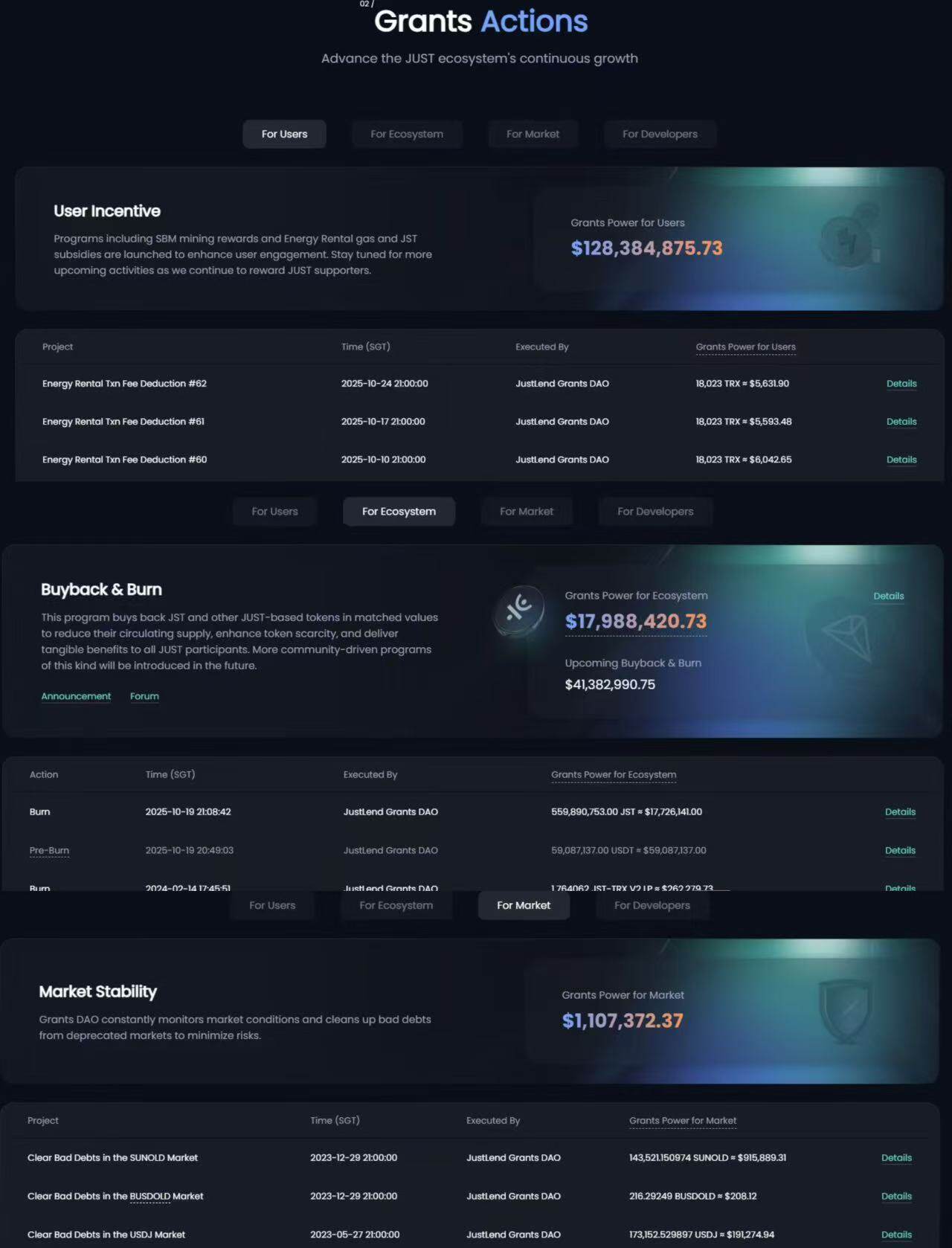

Currently, the Grants DAO website has disclosed relevant data and details regarding the JST buyback and burn, providing highly transparent information with key details readily available: including the number of tokens burned and the amount to be burned. Subsequent quarterly burn data will also be continuously updated on this website, allowing users to easily understand the real-time progress and core data of the JST buyback and burn without additional queries, and intuitively grasp the deflationary process.

In addition, on October 29, JustLend DAO added an "Operational Data Transparency" page to its website , disclosing its financial data, revenue distribution, and the progress of its JST buyback and burn program.

Grants DAO has allocated over $180 million in grants to the JustLend DAO ecosystem through its "grant pool" of ecosystem funds.

For GrantsDAO, executing JST buybacks and burns is just one of its many core functions. As the community-led incentive organization and core ecosystem enabler of JustLend DAO, GrantsDAO's core mission is to provide comprehensive support for developers, contributors, and all ecosystem projects, while striving to maintain the stability and prosperity of the market.

As of October 29, the Grants DAO treasury has allocated over $188 million to the JustLend DAO ecosystem, fully supporting its prosperity and development. These funds have been precisely allocated to core areas such as energy leasing subsidies, JST buyback and burn, and market bad debt liquidation, comprehensively safeguarding the stable operation and efficient development of the ecosystem from multiple dimensions, including infrastructure, deflation mechanisms, and risk management.

Grants DAO, relying on its core mechanism—the Grants Pool—achieves flexible allocation and efficient circulation of ecological treasury funds, providing comprehensive empowerment for JustLend DAO ecosystem construction and JST value enhancement, making it a core booster for JustLend DAO ecosystem development.

Specifically, Grants DAO pools JUST ecosystem reserves and partner-supported funds, injecting them into the Grants Pool. Then, through various channels such as user incentives, ecosystem funding, market stabilization, and developer support, it systematically empowers all key aspects of the ecosystem. Ultimately, this allows all ecosystem participants—JST holders, voters, liquidity providers, and others—to share in the development benefits, building a self-reinforcing, intrinsically value-generating, and virtuous cycle of shared ecosystem benefits.

The Grants DAO's grants pool is primarily funded by two main sources: one part comes from ecosystem reserves, including the JUST ecosystem's own accumulation, stablecoin reserves, and a portion of the interest paid by borrowers; the other part comes from partner funds, which include targeted donations and special support from ecosystem partners through various channels.

This dual-driven funding model of "internal ecosystem self-circulation + external cooperation empowerment" fundamentally ensures that Grants DAO's funding is not a "one-off investment" but a sustainable supply to the ecosystem. Internal reserves directly reflect JustLend DAO's self-sustaining ecosystem capabilities, with their size deeply tied to the activity level of the ecosystem, forming a symbiotic relationship where "the more prosperous the ecosystem, the fuller the treasury." Meanwhile, the injection of external cooperation funds not only effectively expands the treasury but also builds bridges between JustLend DAO and external ecosystems, laying the foundation for subsequent cross-scenario cooperation and ecosystem boundary expansion.

At the ecosystem building level, Grants DAO's funding initiatives are precisely targeted at the core needs of the ecosystem, covering all aspects from user incentives and developer support to market risk control and ecosystem scenario expansion. Each grant corresponds to a clear goal of enhancing ecosystem value.

To date, Grants DAO has allocated approximately $188 million to support the development of the JustLend DAO ecosystem. Specifically, this includes: in user incentives, Grants DAO has launched several incentive programs, including SBM mining rewards and energy leasing gas subsidies, with a cumulative allocation of approximately $128 million; in ecosystem development, Grants DAO has burned approximately $17.98 million worth of JST-related assets (including $17.72 million recently burned + $260,000 burned through the RAW product stUSDT in February 2024), with approximately $41.38 million still awaiting burning; and in market security maintenance, Grants DAO has processed bad debts exceeding $1.1 million.

If the JST buyback and burn is the well-known "explicit action" of Grants DAO, then the cumulative ecosystem grants of over $188 million are the "implicit cornerstone" supporting JustLend DAO's long-term development, providing continuous and strong momentum for its past prosperity and growth.

It is evident that Grants DAO's value extends far beyond being a "stockpile" for the JST buyback and destruction program; it is also the core "startup fuel" propelling the JustLend DAO ecosystem from "basic function implementation" to "multi-scenario expansion," providing core impetus for the ecosystem's advanced development.

Grants DAO comprehensively empowers JustLend DAO ecosystem development and JST value growth.

Grants DAO is not only the manager of the ecosystem's treasury funds, but also the core hub for resource allocation and strategic development within the JustLend DAO ecosystem. It has built a comprehensive support system around user incentives, ecosystem prosperity, market stability, and developer support, driving the JustLend DAO ecosystem from "stable operation" to "autonomous prosperity," simultaneously contributing to the growth of JST's value.

In terms of user incentives, Grants DAO has launched several targeted incentive programs covering various user participation scenarios, including SBM mining rewards (such as supplying USDD on JustLend DAO, which not only earns basic interest but also additional mining rewards); energy leasing transaction gas fee subsidies (when users use JustLend DAO's energy leasing services, the platform will subsidize up to 90% of the on-chain energy transaction fees); and JST token mining subsidies. In the future, Grants DAO also plans to launch more community-driven activities, allowing users to upgrade from "ecosystem users" to "ecosystem co-builders" and share in the development dividends.

In terms of ecosystem empowerment, Grants DAO enhances the scarcity of the JST token through a "buyback and burn" mechanism, thereby driving up the token's value and truly benefiting all ecosystem users. As of October 29, Grants DAO has launched two buyback initiatives, burning assets worth over $17.98 million.

- First time (February 2024): TRON ecosystem's RWA product stUSDT allocated part of its revenue to repurchase JST and TRX tokens, burning $260,000 worth of tokens;

- This round: A long-term JST buyback and burn plan has been established within the JustLend DAO and USDD multi-chain ecosystem, extracting over $59 million from JustLend DAO's existing revenue. The first round has completed 30% burning, with the remaining approximately $41.38 million to be burned in phases. In the future, Grants DAO will launch more community-led buyback and burn schemes.

To maintain market stability, Grants DAO has established a dedicated JustLend DAO market monitoring mechanism to track key indicators such as lending rates, bad debt rates, and token prices in real time. In the event of abnormal fluctuations, Grants DAO can quickly initiate response measures and promptly liquidate outdated or potentially risky assets to minimize losses and ensure the stability and healthy development of the market. This proactive market stabilization mechanism has enabled JustLend DAO to remain robust despite numerous extreme market conditions in the crypto space, and to date, there have been no service interruptions or large-scale user losses due to market volatility.

In terms of developer support, Grants DAO has built a comprehensive empowerment system encompassing funding, resources, and incentives. This system primarily includes two aspects: firstly, encouraging developers to build DeFi applications and tools based on the JustLend DAO protocol, participating in the growth of the decentralized ecosystem; secondly, encouraging community members to report any bugs or vulnerabilities through a bug bounty program to improve protocol security. Furthermore, Grants DAO organizes events such as "Developer Hackathons" and "Ecosystem Cooperation Summits" to provide platforms for developers to exchange ideas and collaborate. This comprehensive support for developers promotes technological innovation and progress, becoming the "core driving force" for the expansion of the JustLend DAO ecosystem, while also providing strong guarantees for the security and stability of the entire ecosystem.

From incentivizing community users to supporting developers, from maintaining market security to promoting overall ecosystem value enhancement, Grants DAO is comprehensively and systematically driving the healthy development of the JustLend DAO ecosystem and the steady growth of the JST token value. This ecosystem-wide layout and long-term strategy will lay a solid foundation for the prosperous development of JustLend DAO.

For the JustLend DAO ecosystem, the value of Grants DAO goes far beyond simply "performing burns" or "distributing grants." It acts as an "ecosystem lifeblood," leveraging the robust foundation of the entire JUST ecosystem and the powerful support of TRON, the world's largest stablecoin network. Through a continuous supply of funds from its liquidity pool, JustLend DAO possesses the ability to "fight for the long haul" in the highly competitive DeFi market. Simultaneously, it serves as an "ecosystem value connector," cleverly linking all ecosystem participants, including users, developers, and partners, ensuring that everyone's contributions are transformed into ecosystem value and fed back to participants through deflationary mechanisms and incentives. Furthermore, it functions as a "self-governance incubator," promoting decentralized self-governance of the ecosystem through community decision-making.

In the future, as more empowerment initiatives of Grants DAO are implemented (such as USDD multi-chain ecosystem mining rewards, cross-chain DeFi tool development support, etc.), the boundaries of the JustLend DAO ecosystem will be further expanded, and Grants DAO will continue to play multiple roles as "executor, donor, and enabler" to promote the ecosystem toward a higher level of self-governance.