Trump's First Year as President, Family Launches "Crypto Money Printing Machine"

- Core Viewpoint: The Trump family is systematically building its crypto industry network through multi-dimensional deployments in DeFi, stablecoins, mining, political IP tokens, and traditional financial products. This network has contributed approximately $14 billion in assets to them over the past year, accounting for nearly 20% of their total net worth.

- Key Elements:

- DeFi Hub World Liberty Financial: Its governance token WLFI has a market cap of about $4.7 billion, and its stablecoin USD1 has a market cap of about $3.2 billion. The annualized interest income from the latter's reserve assets could reach $105 million to $135 million.

- Mining Company American Bitcoin Corp: Holds approximately 5,427 Bitcoin in reserve (worth about $486 million) and is expanding its hash rate through a BTC-collateralized financing model, with daily output accounting for about 2% of newly minted global Bitcoin.

- Political IP Tokens TRUMP and MELANIA: The TRUMP token has brought affiliated companies approximately $1.36 billion in paper profits; the MELANIA team was accused of cashing out about $35.76 million through on-chain operations within four months.

- Digital Trading Card NFT Series: Through four rounds of sales, it has generated over $20 million in direct revenue for Trump, with royalties from secondary market resales.

- Financial Layout of Trump Media Group: Holds approximately 11,500 Bitcoin (worth about $1.03 billion), has launched multiple traditional thematic ETFs, and has filed for several pure crypto ETFs (pending approval).

Original | Odaily (@OdailyChina)

Author | Ding Dang (@XiaMiPP)

On January 20, Trump Media & Technology Group (NASDAQ: DJT) announced that the record date for its previously disclosed digital token plan is set for February 2, 2026. Beneficial owners and registered shareholders who hold at least one full share of DJT stock as of that record date will be eligible to receive the future digital token issuance and accompanying incentives. Following the record date, Trump Media will partner with Crypto.com for the token's minting and distribution, with specific execution mechanisms still to be disclosed.

On the surface, this appears to be an experiment at the intersection of crypto and traditional finance: while it's an airdrop, the recipients are not crypto natives but U.S. stock investors. However, anything involving "the Trump family + token launch" inevitably stirs market nerves.

After all, Trump has a proven track record of "handling" crypto retail investors; the spectacle of the last TRUMP token launch is still fresh in memory. It created wealth for many but was later accused of draining market liquidity, as the broader market experienced a sharp correction afterward. This time, the DJT shareholder token plan represents the Trump family's new twist on financialization and securitization, yet it evokes a familiar sense of being on the receiving end of a "harvest." Why is that?

Since Trump began his second presidential term, his public stance has notably shifted to be crypto-friendly: advocating for regulatory frameworks while his family businesses simultaneously accelerate their expansion in the crypto industry. Over the past year, crypto assets have become a significant component of the Trump family's wealth structure, systematically building a crypto industry network spanning DeFi, stablecoins, hashrate, and public company financial products.

Recent reports indicate that crypto-related projects have added approximately $1.4 billion to the Trump family's asset size within a year. Within an overall net worth of about $6.8 billion, the proportion of crypto assets has risen to nearly 20% for the first time.

Based on this, Odaily attempts a systematic overview of the Trump family's current trackable major crypto ventures.

1. World Liberty Financial: The Core DeFi Hub

This is the core crypto project within the Trump family's portfolio. It is positioned as a decentralized finance protocol and governance platform, aiming to bridge traditional finance (TradFi) and DeFi through blockchain technology, offering users lending, governance participation, and yield opportunities, while emphasizing the role of a USD stablecoin in the global digital financial system.

The project was launched in 2024 by Trump himself, his sons Donald Trump Jr. and Eric Trump, in collaboration with partners like real estate developer Steve Witkoff.

World Liberty Financial's governance token is WLFI, with a total supply of 100 billion tokens and a current market cap of approximately $4.7 billion. The token sale began in October 2024, raising a total of about $550 million. According to the circulated profit distribution structure, roughly 75% of the net proceeds from the sale go to Trump family entities, meaning this single venture could potentially bring them about $400 million in cash returns.

Regarding token allocation, the family-linked company DT Marks DeFi LLC holds about 2.25 billion WLFI, representing 22.5% of the total supply. At the current price of around $0.17, its book value is approximately $380 million.

More noteworthy is its stablecoin, USD1.

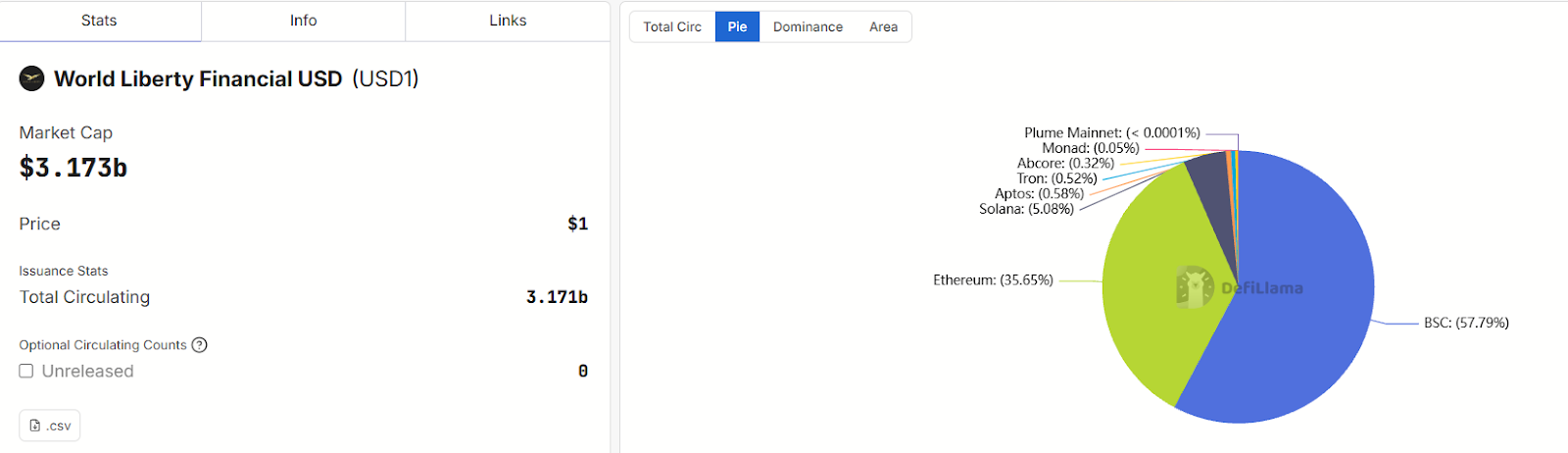

USD1 employs a 100% reserve-backed mechanism primarily composed of short-term U.S. Treasuries, cash deposits, and money market funds. Defillama data shows USD1's current market cap is about $3.2 billion, ranking seventh among stablecoins. For a stablecoin launched only in April 2025, its growth rate is remarkable.

The most critical driving factor is Binance's deep integration and traffic support. On the BSC chain, USD1's supply is about $1.83 billion, accounting for 57.8% of its total issuance.

Assuming a reserve scale of about $3 billion and an estimated annualized yield for short-term U.S. Treasuries in 2026 between 3.5%–4.5%, the interest income from the reserve assets alone could reach $105 million to $135 million annually. Under the current model, this cash flow primarily belongs to the issuing entity.

From a financial structure perspective, this makes USD1 not just a stablecoin but a financial instrument capable of generating continuous USD cash flow. For the Trump family, it functions as a long-term "interest machine."

2. American Bitcoin Corp.: Dual-Driven by Hashrate and Reserves

American Bitcoin Corp (NASDAQ: ABTC) is a Bitcoin mining and strategic reserve company, controlled by Hut 8 Corp, one of North America's largest listed mining companies, and operated in partnership with the Trump family. Hut 8 holds approximately 80% equity, while Eric Trump, Donald Trump Jr., and early shareholders of American Data Centers collectively hold the remaining 20%. Eric Trump personally holds a direct stake of about 7.4%-7.5%.

The company is not merely an investment vehicle; it operates multiple large-scale mining facilities in locations like Texas. In November 2025, Eric Trump showcased a Texas-based mining site in a public video, deploying about 35,000 mining machines, stating it was only part of their total hashrate, implying American Bitcoin Corp's equipment holdings likely far exceed 35,000 units. He claimed its daily output accounts for about 2% of global daily new Bitcoin production. Context suggests the company produces approximately 9 Bitcoins daily (global daily new production is about 450), equating to roughly 3,285 Bitcoins annually.

According to American Bitcoin Corp's Q3 2025 financial report, quarterly revenue was about $64.2 million, with a net profit of approximately $3.5 million, reversing a loss of $576,000 in the same period last year. The quarter's mining output was 563 Bitcoins. Back-calculating, the average Bitcoin price during that period was around $114,000. If prices fluctuate in the current range of about $89,000, profitability would clearly be compressed, potentially leading to losses.

bitcointreasuries.net data shows American Bitcoin Corp's current Bitcoin reserve, accumulated through mining and market purchases, totals 5,427 Bitcoins, valued at approximately $486 million, placing it within the top twenty listed companies by Bitcoin holdings.

However, the company does not fully pay for new miners in cash but uses a "BTC collateral + installment/guarantee" structure, pledging part of its own Bitcoin as collateral to acquire equipment from manufacturers with deferred payments. The Q3 report disclosed pledged BTC of about 2,385 coins, which has not been deducted from the total reserve.

Many mining companies adopt this method, using BTC as "high-value collateral" to acquire physical equipment. Therefore, for mining firms, this cycle of "mining output → partial collateral financing for new miners → increased hashrate → more mining output" can amplify capital returns during Bitcoin price uptrends but also magnify operational leverage during bear markets.

3. TRUMP & MELANIA Tokens: Monetizing Political IP Traffic

Compared to the infrastructure-type ventures above, TRUMP and MELANIA represent direct monetization leveraging the Trump family's brand influence and market hype.

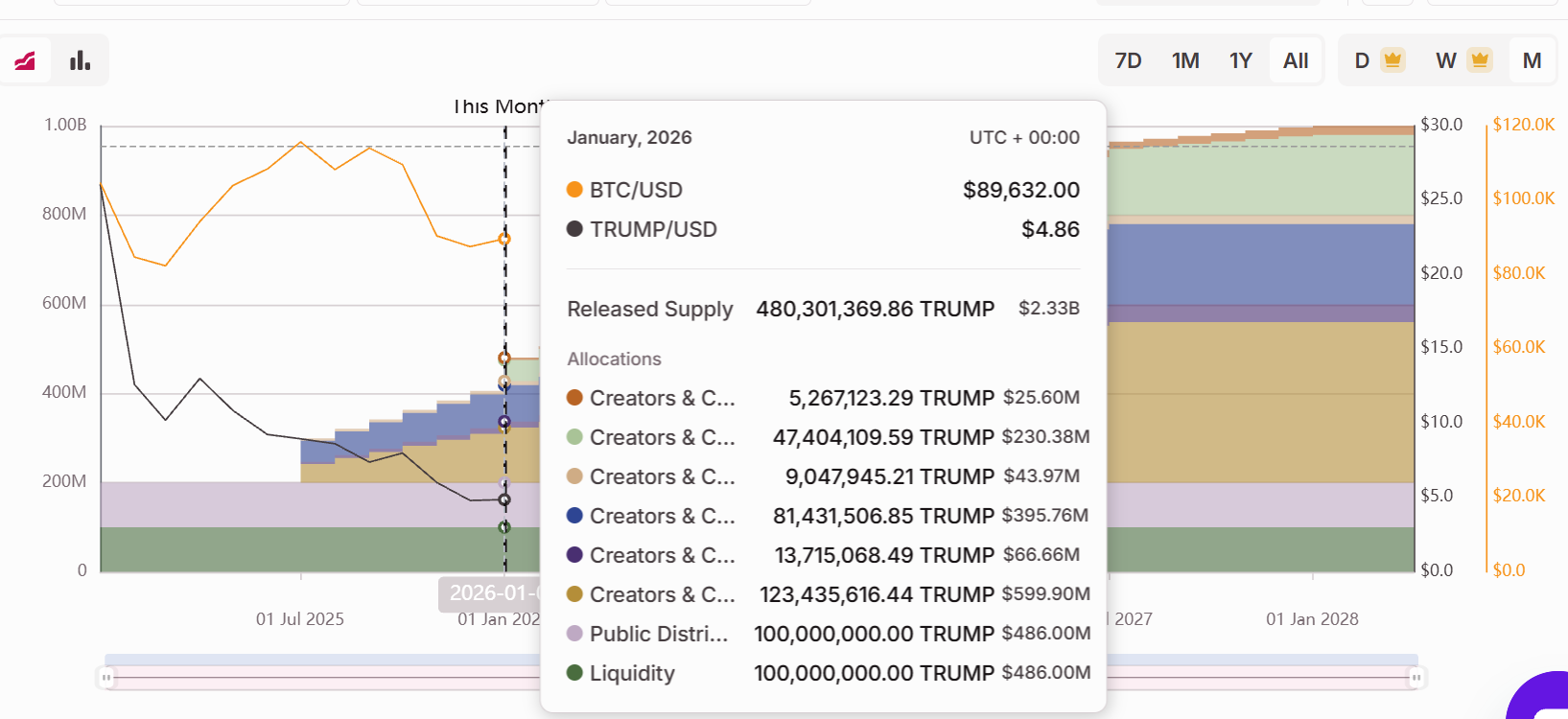

TRUMP was launched by Trump-linked companies CIC Digital LLC and Fight Fight Fight LLC. The token has a total supply of 1 billion, with an initial circulating supply of 200 million. The remaining 800 million are expected to unlock linearly over 3 years. However, the two linked entities hold 80% of the TRUMP tokens, with a lock-up period of 3–12 months, followed by gradual release over 24 months.

According to data from tokenomist, TRUMP's current circulating supply is 480 million tokens. Of these, 200 million were for airdrops and liquidity support, unlocked at initial circulation, and the remaining 280 million are owned by Trump-linked companies. At the current price of $4.86, this represents paper profits of about $1.36 billion, even though TRUMP's price has fallen over 90% from its peak of $77.

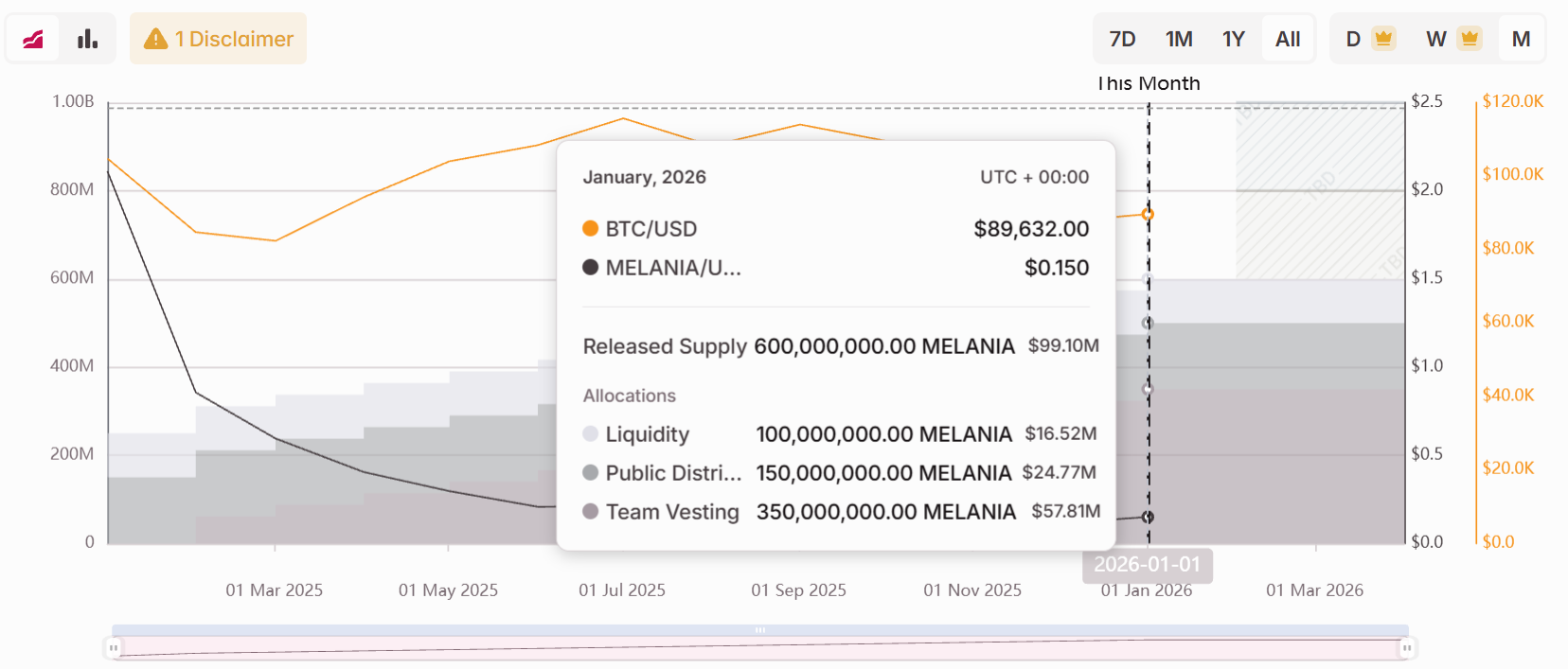

MELANIA is marketed by MKT World LLC, a Florida-registered company under First Lady Melania. The total supply is also 1 billion tokens, with about 600 million currently unlocked. The team's allocation is 350 million tokens, worth approximately $57.8 million at the current price.

However, the Melania team has been accused of selling at highs and defrauding investors. In June 2025, on-chain data showed that team-related addresses sold 82.18 million MELANIA tokens over 4 months through 44 wallets, primarily by adding and removing liquidity, cashing out a cumulative 245,000 SOL, worth about $35.76 million at the time. It's conceivable their actual profits may far exceed the current data.

4. Trump Digital Trading Cards NFT Series

NFTs were Trump's entry point into the crypto world.

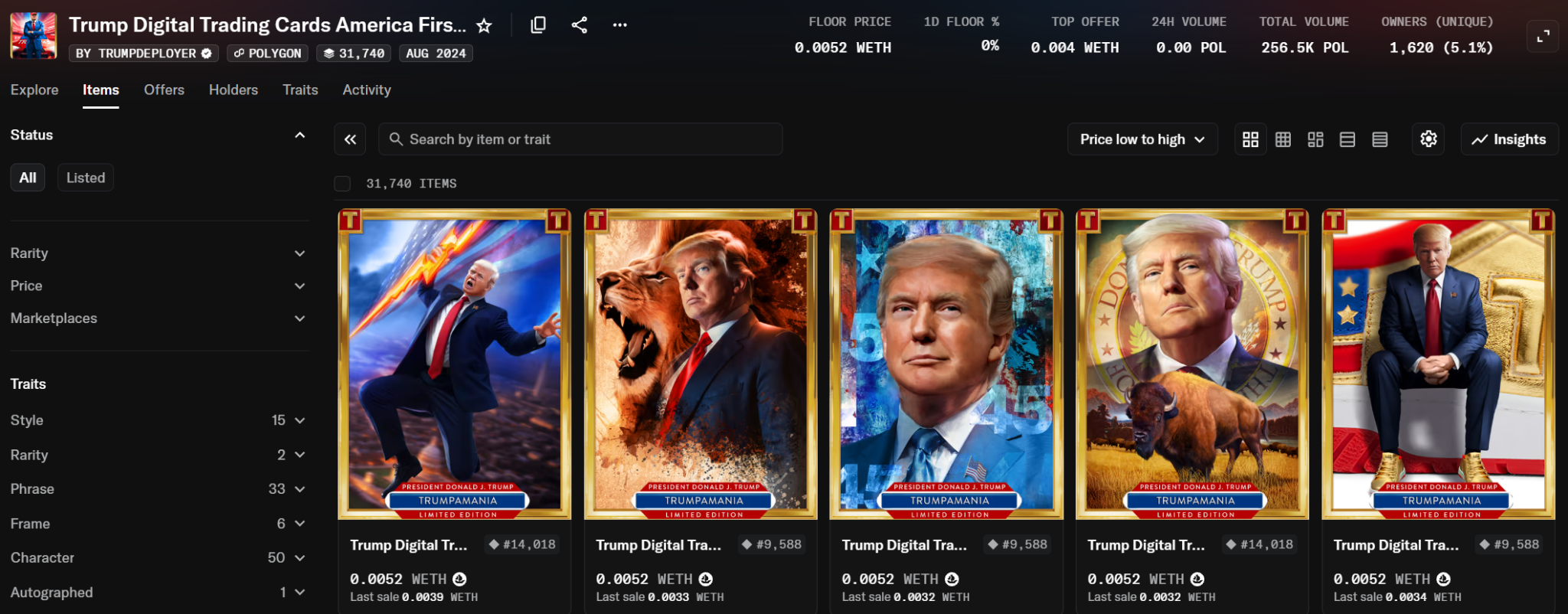

In December 2022, Trump announced the launch of Trump Digital Trading Card NFTs via his social media platform Truth Social. The series was minted on the Polygon blockchain, initially creating 45,000 NFTs priced at $99 each. Purchasing 45 cards would grant a ticket to dinner with Trump. Despite initial mockery, the series sold out in less than two days, generating direct profits of $4.45 million.

Following the initial success, Trump subsequently launched Series 2 and Series 3, still priced at $99 per card. However, Series 2 totaled 47,000 cards, and Series 3 reached 100,000 cards. Despite the inflated numbers, they ultimately sold out through Trump's varied marketing tactics, generating an additional cumulative revenue of about $14.55 million from these two sales.

In August 2024, Trump launched Series 4, again priced at $99 per card, but with an astonishing total of 360,000 cards. This time, the market couldn't absorb it. Opensea data shows approximately 32,000 cards from this series were sold, generating profits of about $3.18 million.

Overall, this NFT series has still brought Trump direct income exceeding $20 million, not including the 10% royalty earned on each secondary market sale of the NFTs.

5. Trump Media's Financial Product Ambitions

Since 2025, Trump Media & Technology Group has launched the "America First" series of ETFs and crypto treasury initiatives through Truth.Fi. These ETFs officially listed on the New York Stock Exchange (NYSE) on December 30, 2025, launched jointly by TMTG and Yorkville America Equities (a branch of Yorkville Advisors). The first batch consists of five ETFs, all equity-themed funds focusing on the "Made in America" concept, covering defense, security, technology, energy, and real estate sectors, with only one related to Bitcoin.

However, TMTG has indeed filed for multiple pure-crypto ETFs (e.g., Truth Social Bitcoin ETF, Bitcoin & Ethereum ETF, Crypto Blue Chip ETF). These funds plan to directly hold assets like Bitcoin, Ethereum, Solana, and Cronos (CRO) (for instance, the Crypto Blue Chip ETF initially allocates 70% BTC, 15% ETH, etc.). However, these crypto ETFs are still in the SEC filing/approval stage and have not been approved for listing or begun trading.

Nevertheless, Trump Media & Technology Group itself holds approximately 11,500 Bitcoins, valued at about $1.03 billion, ranking 12th among listed companies by Bitcoin reserves, with no record of sales to date.