Why Are Banks Determined to Ban Stablecoin Yields?

- Core Argument: The fundamental reason for the fierce opposition from the U.S. banking industry against "interest-bearing stablecoins" is not a fear of total deposit outflows. Instead, it is the fear that they will alter the structure of bank deposits, eroding the massive interest margin and fee-based revenue model built upon near-zero-cost "transactional deposits."

- Key Elements:

- The banking industry's stated reason for opposition is that stablecoins might cause deposit outflows. However, funds ultimately flow back into the banking system through stablecoin reserves, making this argument misleading.

- The core profit source for large U.S. commercial banks (low-interest banks) is absorbing "transactional deposits" by paying extremely low interest (approximately 1-11 basis points) and leveraging the huge spread between these deposits and the Federal Reserve's benchmark rate (3.5%-3.75%), along with payment fees, to generate annual profits exceeding $360 billion.

- The use cases for stablecoins (payments, transfers, settlements) directly compete with banks' most valuable "transactional deposits," posing a potential threat to the banks' core territory.

- The interest-bearing feature would attract interest-sensitive transactional funds to flow from banks to stablecoins, forcing banks to hold the returning reserve funds as higher-cost "non-transactional deposits," significantly compressing their interest margin.

- The banking industry's real concern is profit redistribution: Interest-bearing stablecoins would break their closed loop of "zero-cost liabilities + exclusive fees," diverting some profits to crypto ecosystem participants like stablecoin issuers.

- Consequently, the debate over whether to completely ban the interest-bearing path has become the most contentious focal point in the Senate's review of the cryptocurrency market structure bill (CLARITY).

Original | Odaily (@OdailyChina)

Author|Azuma (@azuma_eth)

With Coinbase's temporary "betrayal" and the Senate Banking Committee's delayed review, the Cryptocurrency Market Structure Act (CLARITY) has once again fallen into a phase of stagnation.

- Odaily Note: For previous context, please refer to "The Biggest Variable for the Crypto Market Outlook: Can the CLARITY Act Pass the Senate?" and "CLARITY Review Suddenly Delayed: Why is Industry Disagreement So Severe?".

Synthesizing the current market debate, the central point of contention surrounding CLARITY has now focused on "interest-bearing stablecoins." Specifically, to secure banking industry support, the GENIUS Act passed last year explicitly prohibited interest-bearing stablecoins. However, the Act only stipulated that stablecoin issuers must not pay holders "any form of interest or yield," but did not restrict third parties from providing yields or rewards. The banking industry was very dissatisfied with this "workaround" and attempted to overturn it in CLARITY, aiming to prohibit all types of interest-bearing pathways, which has drawn strong opposition from parts of the cryptocurrency community represented by Coinbase.

Why are banks so resistant to interest-bearing stablecoins, insisting on blocking all yield pathways? The goal of this article is to answer this question in detail by deconstructing the profit models of large US commercial banks.

Bank Deposit Outflows? Pure Nonsense

In arguments against interest-bearing stablecoins, the most common reason cited by banking industry representatives is "concern that stablecoins will cause bank deposit outflows" — Bank of America CEO Brian Moynihan stated in a conference call last Wednesday: "Up to $6 trillion in deposits (about 30% to 35% of all US commercial bank deposits) could migrate to stablecoins, thereby limiting banks' ability to lend to the overall US economy... and interest-bearing stablecoins could accelerate deposit outflows."

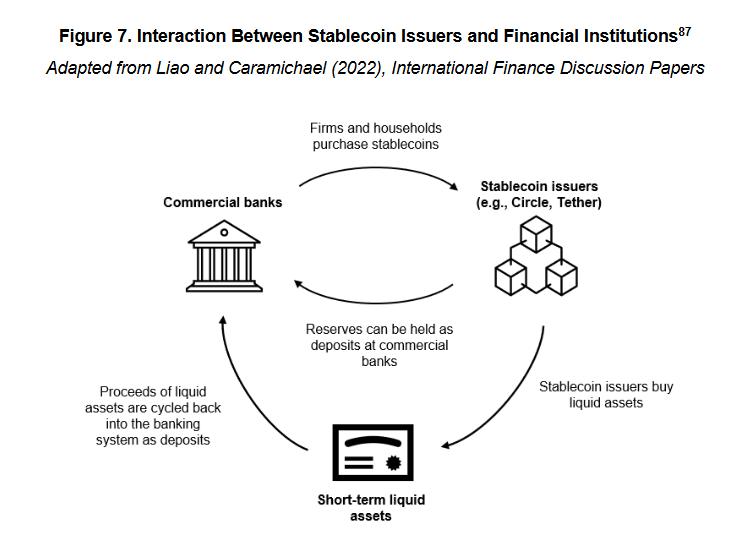

However, anyone with a basic understanding of stablecoin mechanics can see significant confusion and misleading elements in this statement. Because when $1 flows into a stablecoin system like USDC, that $1 does not vanish into thin air. Instead, it is placed into the reserve treasury of the stablecoin issuer (like Circle) and ultimately flows back into the banking system in the form of cash deposits or other short-term liquid assets (like Treasury bonds).

- Odaily Note: Stablecoins backed by crypto assets, futures hedging, algorithmic mechanisms, etc., are not considered here. Firstly, because such stablecoins constitute a small portion of the market; secondly, because these stablecoins fall outside the scope of this discussion on compliant stablecoins under the US regulatory framework — last year's GENIUS Act clearly defined reserve requirements for compliant stablecoins, limiting reserve assets to cash, short-term Treasury bonds, or central bank deposits, which must be segregated from operational funds.

So the facts are clear: Stablecoins do not cause bank deposit outflows because the funds ultimately always flow back to banks and can be used for credit intermediation. This is determined by the business model of stablecoins and has little to do with whether they bear interest.

The real crux of the issue lies in the change in deposit structure after the funds flow back.

The Cash Cow of American Megabanks

Before analyzing this change, we need to briefly introduce how US megabanks make money from interest.

Van Buren Capital General Partner Scott Johnsson cited a paper from the University of California, Los Angeles, stating that since the 2008 financial crisis damaged the banking industry's credibility, US commercial banks have diverged into two distinct forms in deposit-taking — high-rate banks and low-rate banks.

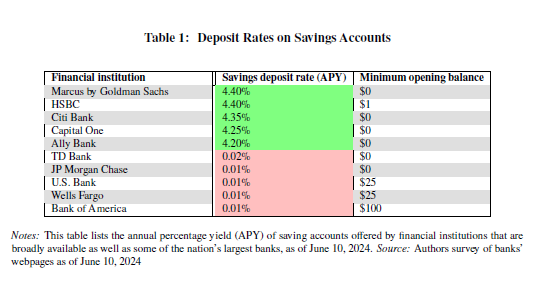

High-rate banks and low-rate banks are not formal regulatory classifications but common terms in market parlance — manifested in the fact that the deposit interest rate spread between high-rate and low-rate banks has reached over 350 basis points (3.5%).

Why is there such a significant interest rate difference for the same deposit? The reason is that high-rate banks are mostly digital banks or banks with business structures focused on wealth management and capital markets (like Capital One). They rely on high interest rates to attract deposits to support their lending or investment businesses. Conversely, low-rate banks are primarily national large commercial banks that hold the real power in the banking industry, such as Bank of America, JPMorgan Chase, and Wells Fargo. They possess vast retail customer bases and payment networks, allowing them to maintain extremely low deposit costs through customer stickiness, brand power, and branch convenience, without needing to compete for deposits with high interest rates.

From a deposit structure perspective, high-rate banks generally focus on non-transactional deposits, i.e., deposits primarily for savings or interest income — such funds are more sensitive to interest rates and are costlier for banks. Low-rate banks, however, generally focus on transactional deposits, i.e., deposits primarily used for payments, transfers, and settlements — the characteristics of such funds are high stickiness, frequent turnover, and extremely low interest rates, making them the most valuable liabilities for banks.

Latest data from the Federal Deposit Insurance Corporation (FDIC) shows that as of mid-December 2025, the average annual interest rate for US savings accounts was only 0.39%.

Note, this is data already factoring in the influence of high-rate banks. Since mainstream US megabanks operate on a low-rate model, the actual interest they pay depositors is far lower than this level — Galaxy founder and CEO Mike Novogratz stated bluntly in a CNBC interview that large banks pay depositors almost zero interest (around 1 - 11 basis points), while the Federal Reserve's benchmark rate during the same period was between 3.50% and 3.75%. This spread brings massive profits to banks.

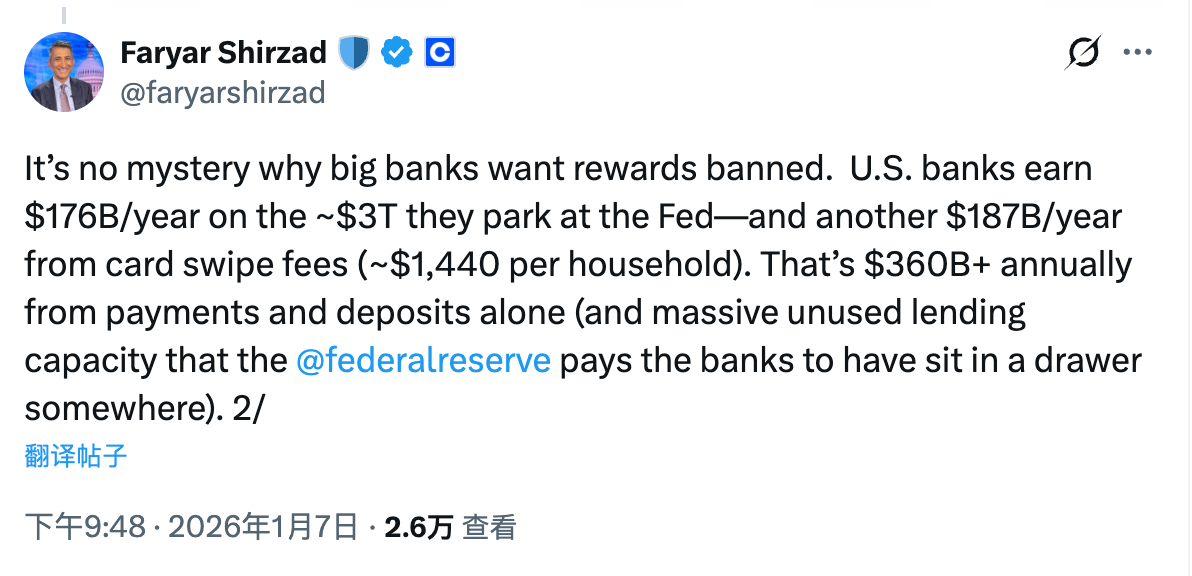

Coinbase Chief Compliance Officer Faryar Shirzad provided a clearer calculation — US banks profit approximately $176 billion annually from about $3 trillion in funds held at the Federal Reserve. Additionally, they profit about $187 billion annually from transaction fees paid by depositors. Just from deposit spreads and payment/transaction activities, this generates over $360 billion in annual revenue.

The Real Change: Deposit Structure and Profit Distribution

Returning to the topic, what changes will stablecoin systems bring to bank deposit structures? How will interest-bearing stablecoins accelerate this trend? The logic is actually quite simple. What are the use cases for stablecoins? The answers are nothing more than payments, transfers, settlements... Wait, doesn't that sound familiar!

As mentioned earlier, these functions are precisely the core utilities of transactional deposits, which are both the main deposit type for megabanks and their most valuable liabilities. Therefore, the banking industry's real concern about stablecoins is that — as a new transaction medium, stablecoins directly compete with transactional deposits in their use cases.

If stablecoins didn't have interest-bearing functionality, it might be tolerable. Considering the barriers to entry and the slight interest advantage of bank deposits (even a tiny advantage is something), stablecoins wouldn't pose a significant practical threat to this core stronghold of large banks. But once stablecoins are given the feasibility of bearing interest, driven by the interest rate spread, more and more funds could shift from transactional deposits to stablecoins. Although these funds would still ultimately flow back into the banking system, stablecoin issuers, for profit considerations, would inevitably invest most of their reserve funds into non-transactional deposits, only retaining a certain proportion of cash reserves for daily redemptions. This is the so-called change in deposit structure — while funds remain within the banking system, bank costs will rise significantly (the interest spread is compressed), and revenue from transaction fees will also shrink substantially.

At this point, the essence of the problem is very clear. The reason the banking industry is frantically opposing interest-bearing stablecoins has never been about "whether the total amount of deposits within the banking system will decrease," but rather about the potential change in deposit structure and the resulting redistribution of profits.

In the era without stablecoins, especially without interest-bearing stablecoins, US megabanks firmly controlled transactional deposits, a source of funds with "zero or even negative cost." They could earn risk-free profits from the spread between deposit rates and benchmark rates, and also continuously collect fees from basic financial services like payments, settlements, and clearing, thus building an extremely solid, closed loop that almost never required sharing profits with depositors.

The emergence of stablecoins essentially dismantles this closed loop. On one hand, stablecoins functionally highly compete with transactional deposits, covering core scenarios like payments, transfers, and settlements. On the other hand, interest-bearing stablecoins further introduce the variable of yield, making transactional funds, which were previously insensitive to interest rates, begin to have the possibility of being repriced.

In this process, funds do not leave the banking system, but banks may lose control over the profits from these funds — liabilities that were almost zero-cost are forced to transform into liabilities requiring market-rate yield payments; payment fees that were once monopolized by banks begin to be shared by stablecoin issuers, wallets, and protocol layers.

This is the change the banking industry truly cannot accept. Understanding this, it's not difficult to understand why interest-bearing stablecoins have become the most intense and hardest-to-compromise point of contention in CLARITY's legislative journey.