Entering November, the cryptocurrency market is shrouded in a gloomy mood. South Korean retail investors, once the most fervent cryptocurrency traders, have begun to "vote with their feet" in recent years—leaving the crypto world and flocking to the stock market. The simultaneous decline in traffic on South Korean cryptocurrency exchanges Upbit and Bithumb signifies a complete retreat of retail investor sentiment. Investors who were once enthusiastically discussing altcoins on social media are now talking about "AI semiconductor concept stocks." The last remaining believers in the crypto world seem to be leaving, and even the traditional "ultimate sentiment indicator" of the South Korean market has lost its luster.

As it turns out, the speculative gene has never changed; only the battlefield has shifted. South Korean retail investors remain enthusiastic about the gamble, even leveraging heavily to rush into the stock market: margin loan balances have doubled in five years, high-leverage ETF shares have surged, and nearly half of young investors aged 25-35 are using leverage. In past crypto bull markets, whenever a global market downturn brought about a shift in the landscape—with retail investors switching sides and LBank's counter-trend breakout frenzy nearing its end—the South Korean market often played the role of the last "bagholder." From Dogecoin to PEPE, from LUNA to XRP, South Korean retail investors were always present, frantically chasing the highs. They bought in before the bubble burst, but now they are collectively absent, as if the crypto world has lost its last remaining believers.

The high-leverage frenzy has come to an end: whales are being liquidated one after another.

Retail investors fled, and the remaining professional traders aren't faring much better. The recent drama unfolding on the decentralized derivatives platform HyperLiquid vividly illustrates the dangers of greed and risk. This emerging high-leverage exchange gained immense popularity for its anonymity and extremely high leverage, but several top traders experienced a rollercoaster ride from heaven to hell.

In early November, according to on-chain data, six well-known contract whales on HyperLiquid were liquidated and forced to exit the market after accumulating tens of millions of dollars in profits, with an average loss of over $40 million per person! These former chosen ones included James Wynn, "insider" falling, AguilaTrades, "rolling account guy," "Machi Big Brother," and the "14-win streak whale." In short: regardless of whether the initial capital was in the millions or tens of millions of dollars, regardless of past profits of several times to dozens of times, they were all wiped out in the market turmoil. The high-leverage feast ended so tragically, confirming the ironclad rule of the speculative market: what goes around comes around. In just two weeks, these six experts accumulated losses of nearly $240 million, and their once remarkable profit myths were shattered. In the current context of tightening liquidity and market reversals, even the most skilled traders cannot withstand the market's torrent. For ordinary investors, this is undoubtedly a wake-up call: in high-leverage gambling, there are no permanent winners.

It's worth noting that major cryptocurrencies like Bitcoin and Ethereum were not spared from this round of violent fluctuations. In early November, BTC fell below the $100,000 mark and ETH dropped below $3,100, triggering a chain reaction of panic selling across the entire network. Over $10 billion in long positions were forcibly liquidated, market panic spread, prices continued to decline, and the crypto market entered another "darkest hour." However, while mainstream assets were suffering widespread losses, some small-cap tokens staged a dramatic independent rally.

The contrast between the sluggish performance of mainstream cryptocurrencies and the surge in altcoins.

A dismal market doesn't mean there are no opportunities. On the contrary, niche markets often breed dramatic reversals under extreme conditions. On November 5th, while mainstream cryptocurrencies were performing poorly, several smaller coins on the LBank trading platform bucked the trend and surged, with astonishingly dramatic increases:

- JELLYJELLY (JELLY): The price surged by as much as 3,495% during the day, and is currently priced at approximately 0.253 USDT. It still has a 38% increase in the last 24 hours.

- 1COIN: It rose as much as 2,033% during the session, and is currently priced at approximately 0.028 USDT, representing a daily increase of 64%.

- MMT: It surged as much as 1,306% during the session and is currently trading at 1.828 USDT, with a 24-hour increase of 426%.

- DTV: Up approximately 180% in 24 hours, currently priced at 0.0032 USDT.

- AIA: Up approximately 136% in 24 hours, currently priced at 2.76 USDT.

- KITE: Up about 58% in 24 hours, currently priced at 0.096 USDT.

In just one day, these previously unknown tokens saw their prices increase several times or even dozens of times, a real-life example of the "small-cap cryptocurrency wealth creation myth." This phenomenon is attributed not only to the positive fundamentals or news surrounding some projects, but also to the platform's promotion and liquidity support.

LBank, an exchange deeply rooted in emerging assets, has always been known for its 100x Gems Hub. According to data from CoinGecko and Messari, LBank has led the market this year in terms of 100x coins, initial public offering (IPO) gains, and market share in the meme coin sector. In other words, many assets that are unknown elsewhere often experience a surge in popularity and recognition after listing on LBank.

The market performance on November 5th perfectly illustrates this point: when mainstream markets lack hot topics, funds flow into smaller cryptocurrencies for speculation, creating a remarkable surge in gains. LBank provides just such a platform, allowing astute investors to position themselves early on these "dark horse" projects. It's important to emphasize that while the surge in smaller cryptocurrencies is tempting, the risks are equally high; ordinary investors should not blindly chase the highs. However, from a market perspective, the existence of these "high-risk, high-reward" opportunities reflects another side of the crypto market: even in a challenging macro environment, wealth stories still emerge within the micro-structure. The key lies in whether investors have the channels and capabilities to discover and participate in these opportunities. LBank, with its years of focus on discovering the value of emerging assets, has played a crucial role in this regard.

LBank's Counter-Trend Strategy: User Surge and Globalization

While many centralized exchanges (CEXs) are scaling back operations during this challenging period, LBank is expanding against the trend, consistently delivering positive news: significant user growth, brand upgrades, and global marketing efforts – a multi-pronged approach leading to steady progress. As of this fall, LBank's registered users have surpassed 20 million, a significant increase from the beginning of the year, with daily trading volume climbing to $10.5 billion, a 262.5% increase from the start of the year.

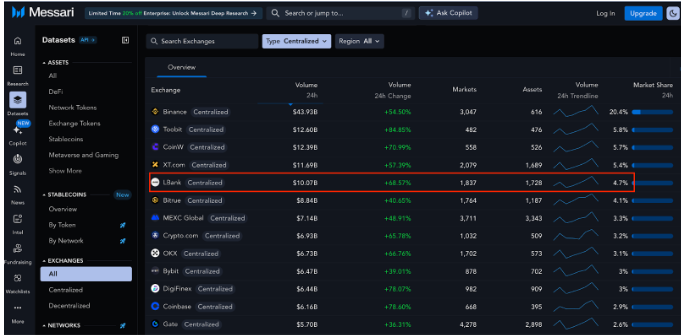

According to data from Messari and CoinGecko, LBank currently ranks among the top global exchanges, with its spot trading volume once accounting for 4.7% of the global market share, and its derivatives trading volume also entered the top five on November 5th. Achieving such results against the backdrop of an overall sluggish industry is truly remarkable. This is attributed to LBank's continued focus on emerging markets and innovative fields, forming its own differentiated advantages: on the one hand, the platform adheres to a "small but beautiful" strategy, discovering high-potential early-stage projects and becoming a recognized "cradle of 100x coins" in the industry; on the other hand, LBank emphasizes user penetration and global coverage, actively expanding into emerging markets such as Southeast Asia, the Middle East, and Latin America, while also maintaining a compliant presence in Europe and the United States. This strategy of accumulating resources and taking a long-term approach has enabled it to achieve a "double harvest" in user growth and trading volume against the trend.

This year marks LBank's 10th anniversary. Ten years of dedicated effort have cultivated a valuable reputation and a foundation of trust. To celebrate this milestone, LBank has launched a series of global reward activities and strategic initiatives: First, on September 26th, it officially announced its regional sponsorship of the Argentine national team (AFA), generating significant industry attention. As the reigning World Cup champions, led by "King of Football" Lionel Messi, the Argentine team possesses unparalleled international influence. LBank's partnership with the "Pampas Eagles" is not only a crucial step in its global brand strategy but also symbolizes the fusion of crypto technology and the spirit of sports. The partnership will reportedly cover the entire 2026 World Cup cycle, with LBank leveraging the allure of football to conduct a variety of brand activities globally, enhancing public awareness of digital assets.

Simultaneously with its sponsorship, LBank launched an enhanced bonus campaign totaling $100 million for its global users. This campaign boasted several highlights: users received a $100 bonus upon participation, and contract accounts enjoyed a 100% bonus on net deposits, with no upper limit on rewards. Such a large investment was particularly encouraging during the bear market, jokingly referred to by industry insiders as "spending hundreds of millions to invite global users to watch the game together." By linking itself to a world champion IP and offering substantial cash rewards, LBank significantly boosted user activity and brand reputation, laying the groundwork for user acquisition in the post-bear market era.

In addition to sports marketing, LBank also launched a series of community activities and product upgrades during its 10th anniversary celebration: including a global gratitude campaign with a total prize pool of $2 million (of which $1.7 million was used for a lucky draw to give away Apple products, mainstream cryptocurrencies and other luxury prizes, and $300,000 was used for a contract trading competition); and a "$1 billion crypto talent incubation program" for the next ten years to support global blockchain entrepreneurs and developers; these initiatives demonstrate LBank's user-centric and long-term development philosophy: actively "benefiting others" during the current market downturn and sharing growth dividends with users; and building momentum for industry recovery by securing a head start in the next bull market with a robust security and ecosystem layout.

Advantages and prospects accumulated over ten years

After a decade of ups and downs, LBank's ability to remain competitive in the fiercely competitive exchange industry stems from its unique competitive advantages and distinctive platform features:

- Emerging Asset Discovery Capabilities: LBank, with its experienced research team and rigorous listing screening mechanism, proactively invests in high-growth projects, earning it the media reputation as the "cradle of 100x coins." Whether it's early star projects or later-rising hot coins like Meme, LBank has repeatedly created industry-recognizing success stories. For users seeking high-potential investment opportunities, LBank provides an indispensable platform for finding hidden gems.

- Global Market Expansion: Since its inception, LBank has maintained a global perspective, currently boasting users in over 160 countries and regions. The platform interface supports multiple languages, and its localized community operations have deeply resonated with users. Through sponsoring World Cup champion teams and hosting offline meetups, LBank's brand awareness is steadily increasing. This international vision ensures the platform is not limited to regional market conditions, enabling it to capture global market dynamics 24/7 and provide users with a continuous stream of liquidity and trading opportunities.

- User Base and Liquidity: With over 20 million registered users and daily trading volume exceeding several billion US dollars, LBank has established itself as a leading exchange. Its large user base translates to excellent liquidity, with deep buy and sell orders for popular assets, low slippage, and a smooth user experience. Furthermore, its massive user base enables LBank to leverage network effects when launching new features and activities, creating a virtuous cycle.

- Security and Compliance: In a volatile industry, LBank has maintained stable operations for ten years without any major security incidents, a testament to its competitiveness. The platform has established a comprehensive risk control system and asset reserve mechanism (including a $100 million security fund and third-party audits). Regarding compliance, LBank actively embraces the regulatory requirements of various countries, strictly implements KYC/AML policies, and has obtained licenses or exemptions from multiple countries. Amidst the collapses of competitors like FTX, LBank's prudent approach has earned the trust of its users.

- Community and Services: LBank has always prioritized community building, boasting an active community and multi-channel customer support. Regardless of market conditions, the LBank team maintains frequent interaction with users, listens to feedback, and continuously optimizes the product. The recently launched "User Co-creation" program and generous referral rewards also reflect the platform's philosophy of shared growth. Positive user feedback has generated a self-propagating effect for LBank, attracting many new users and further strengthening the community ecosystem.

In conclusion, against the backdrop of a less-than-optimistic market and a slowdown in the growth of traditional centralized exchanges (CEXs), LBank has achieved a breakthrough against the odds, thanks to its deep experience in altcoins, its pragmatic and proactive global strategy, and its emphasis on user rights. On the one hand, it has satisfied investors' desire for "new stories," offering the possibility of "doubling the value of altcoins" when mainstream coins are stagnant; on the other hand, through ten years of perseverance and innovation, it has proven its reliability and uniqueness to the market.

From retail investors' frenzied migration to the stock market and the demise of whales' high-stakes gambles, to the emergence of new cryptocurrencies and platforms' efforts to transform, the crypto world is full of dramatic tension. But no matter how the market cycles, one thing is certain: opportunity always favors the prepared. For investors seeking their next opportunity, choosing a stable yet dynamic platform like LBank may be a wise move to weather the storm and plan for the future.

As some have said, the crypto market is never short of stories, but rather lacks the eyes to see them. When the tide recedes, the steadfast reveal themselves. LBank has demonstrated the significance of innovation and change in adversity through its actions, setting an example for the industry—seeds nurtured in a bear market will eventually usher in the next spring.

- 核心观点:加密市场低迷,资金转向股市与小币种。

- 关键要素:

- 韩国散户撤离,交易所流量衰退。

- 巨鲸高杠杆爆仓,亏损超2亿美元。

- LBank小币种逆势暴涨,涨幅超30倍。

- 市场影响:加速资金分化,凸显小币种投机机会。

- 时效性标注:短期影响