Why is the upcoming quantitative easing considered a bubble-making machine?

- 核心观点:美联储宽松政策正刺激资产泡沫。

- 关键要素:

- 资产负债表扩张与利率下调。

- 财政赤字庞大且债务货币化。

- 资产估值高企与信贷充裕。

- 市场影响:推高金融资产价格,加剧泡沫风险。

- 时效性标注:中期影响

Author | @RayDalio

Compiled by Odaily Planet Daily ( @OdailyChina )

Translator | Dingdang ( @XiaMiPP )

Have you seen the Federal Reserve announce that it will stop quantitative tightening (QT) and launch quantitative easing (QE)? Although officials call it a "technical operation," it is still a substantial easing measure. To me, this is one of the signals worth watching closely to track the progress of the "Big Debt Cycle" I described in my previous book.

As Chairman Powell stated, "...at some point, we hope that reserves will begin to grow gradually to accommodate the expansion of the banking system and the economy. So we will begin increasing reserves at some point..."

How much the Federal Reserve will actually increase its reserves is something we must closely monitor going forward.

Since a core responsibility of the Federal Reserve is to control the "size of the banking system" during asset bubbles, we must pay attention to both the pace of its easing measures through interest rate cuts and the speed of its balance sheet expansion. More specifically, this applies if the following scenario occurs in the future:

—The balance sheet has expanded significantly;

—Interest rates continue to decline;

—The fiscal deficit remains enormous;

That could be seen as a typical scenario where "the Treasury and the Federal Reserve join forces to stimulate the economy by monetizing government debt."

If this situation occurs when private and capital market credit creation remains robust, the stock market hits new highs, credit spreads are low, unemployment is near historical lows, inflation is above target, and AI-related stocks are in a bubble phase (which is indeed the case according to my bubble indicator), then in my view, the Fed's stimulus policies are tantamount to creating a bubble.

Given that governments and many policymakers are now advocating for a significant relaxation of restrictions in order to achieve a “capitalist growth sprint” through monetary and fiscal policies; and considering the huge deficits, debt and the growing imbalance between supply and demand for bonds, I have every reason to suspect that this so-called “technical adjustment” may not be as simple as a technical issue.

I understand that the Federal Reserve is currently highly concerned about "risks in the money markets" and therefore tends to prioritize maintaining market stability rather than aggressively combating inflation, especially given the current political climate. However, whether this will evolve into a full-scale QE stimulus (i.e., large-scale net asset purchases) remains to be seen.

At this point, we should not ignore the fact that when the supply of US Treasury bonds exceeds demand, the central bank is forced to "print money" to buy bonds, and the Treasury shortens the issuance period to make up for the insufficient demand for long-term bonds , these phenomena are typical characteristics of the "late stage of the big debt cycle".

Although I have systematically explained its operating mechanism in my book * How Countries Go Broke: The Big Cycle *, I would like to point out that we are approaching a critical juncture in this cycle and briefly review its logic.

Give a man a fish and you feed him for a day; teach a man to fish and you feed him for a lifetime.

I hope to help you understand what's happening by sharing my thoughts on market mechanisms. I will point out the logic I see, but how to judge and act is up to you, as this is more valuable to you and avoids me becoming your investment advisor (which is also more suitable for me).

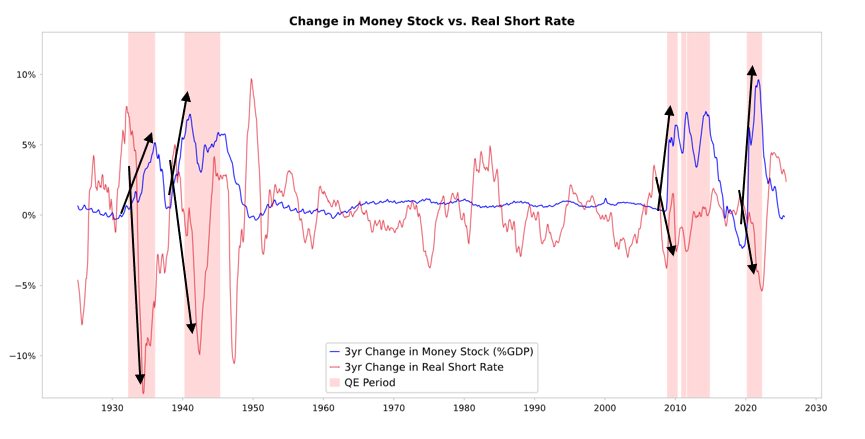

As you can see in the chart below, when the Federal Reserve or other central banks buy bonds, it releases liquidity and lowers real interest rates . What happens next depends on where that liquidity goes.

- If liquidity primarily remains in the financial asset market , then financial asset prices will be driven up, real yields will decline, price-to-earnings ratios will expand, risk spreads will narrow, and gold prices will rise, thus creating "financial asset inflation." This situation benefits those who hold financial assets, while marginalizing those without assets, thereby widening the wealth gap.

- Typically, some liquidity is transmitted to the goods, services, and labor markets to some extent. However, given the current context of accelerated automation replacing labor, this transmission effect may be weaker than in the past. If inflation is pushed up to a certain level, the rise in nominal interest rates may exceed the fall in real interest rates , thus impacting bonds and stocks simultaneously at both the nominal and real levels.

The essence of QE: transmission through relative prices

All fluctuations in financial markets stem from changes in relative attractiveness, not absolute levels.

Simply put, everyone possesses a certain amount of funds and credit, and the central bank influences these amounts through policy. People's investment decisions depend on a comparison of the relative expected returns of different assets.

For example, people decide whether to borrow or lend funds based on a comparison of borrowing costs and potential returns. Asset allocation choices primarily depend on the relative total returns of various options (i.e., asset yield plus price changes). For instance, gold's yield is 0%, while the 10-year US Treasury yield is approximately 4%. If you expect gold to rise less than 4% annually, you would choose bonds; conversely, if you expect a rise of more than 4%, gold is more attractive.

When assessing the performance of gold or bonds, inflation must be considered, as it erodes purchasing power. Generally, the higher the inflation, the better gold performs—because currency devaluation reduces purchasing power, while gold supply growth is limited. This is why I consistently monitor money and credit supply, as well as the actions of the Federal Reserve and other central banks .

In the long run, the value of gold is highly correlated with inflation trends. The higher the inflation rate, the less attractive bonds become. For example, when inflation is 5% and bond yields are only 4%, the real yield on bonds is -1%, which reduces the attractiveness of bonds and increases the attractiveness of gold. Therefore, the more money and credit central banks issue, the higher I expect the inflation rate to be, and the less attractive bonds will be relative to gold.

All other things being equal, if the Federal Reserve further expands QE, it is expected to lower real interest rates and increase liquidity by compressing risk premiums, lowering real yields, and pushing up price-to-earnings ratios. In particular, this would boost the valuations of long-duration assets (such as technology, AI, and growth stocks) and inflation-hedging assets (such as gold and inflation-linked bonds). When inflation risks resurface, companies with tangible asset attributes (such as mining, infrastructure, and energy) may outperform pure technology assets.

Of course, these effects have a lag. The decline in real interest rates triggered by quantitative easing will gradually become apparent after inflation expectations rise. Nominal valuations may still expand, but real returns will be weakened.

Therefore, it is entirely reasonable to expect a repeat of the situation at the end of 1999 or in 2010–2011—the liquidity-driven surge will eventually become too risky and must be curbed. And this frenzied phase, and the period before eventual tightening, is often the best time to sell .

This time is different: The Federal Reserve is "easing amidst a bubble."

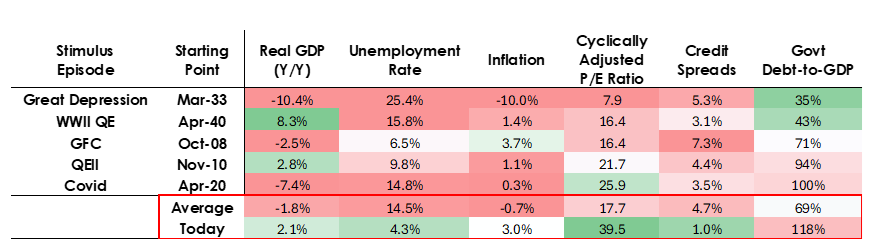

While I anticipate its mechanism will function as I've described, the conditions for implementing this round of quantitative easing are drastically different from previous ones. This is because the goal of this easing is to create bubbles, not to cause them to burst. More specifically, past quantitative easing policies have been implemented as follows:

- Asset valuations have fallen, prices are low, or they are not overvalued;

- The economy is shrinking or extremely weak;

- Inflation is low or declining;

- The debt and liquidity risks are prominent, and the credit spread is large.

Therefore, quantitative easing policies were once said to have "stimulated an economic recession."

But now, the situation is exactly the opposite:

- Asset valuations remain high and continue to rise . For example, the S&P 500's earnings yield is 4.4%, the nominal yield on 10-year US Treasury bonds is 4%, the real yield is about 1.8%, and the equity risk premium is only about 0.3%.

- The economy is relatively robust (real growth of about 2% over the past year, with an unemployment rate of only 4.3%).

- Inflation is above the target (slightly above 3%), but at a relatively moderate level, while deglobalization and tariff frictions are further pushing up prices;

- Credit is ample, liquidity is plentiful, and credit spreads are near historical lows.

Therefore, this round of quantitative easing will not "stimulate an economic recession," but rather "stimulate an economic bubble."

Let's take a look at how these mechanisms typically affect stocks, bonds, and gold.

Given the current highly stimulative nature of government fiscal policy (primarily due to the massive existing debt, severe fiscal deficit, and the Treasury's issuance of large amounts of government bonds in the relatively short term), quantitative easing (QE) is essentially a way to monetize government debt rather than simply injecting liquidity into the private sector.

This is precisely what makes the current situation different from the past—it appears more risky and more inflationary. Overall, it resembles a bold and dangerous gamble: betting on growth, especially AI-driven growth, while backing it with extremely loose fiscal, monetary, and regulatory policies. We must closely monitor this process to respond appropriately in a complex macroeconomic environment.