Claude takes the championship; the truth behind the showdown of 6 major AI grid strategies | OKX & AiCoin live trading review

- 核心观点:AI模型在网格策略中表现优于短线交易。

- 关键要素:

- 网格策略全员盈利,Claude夺冠。

- 短线交易整体亏损28%。

- Qwen3短线夺冠但网格垫底。

- 市场影响:推动AI策略向系统化、中性策略转型。

- 时效性标注:中期影响

NOF1's "AI Cryptocurrency Trading Arena" Season 1 finally concluded at 6:00 AM on November 4, 2025, whetting the appetites of the cryptocurrency, technology, and finance communities.

However, the outcome of this "AI IQ public test" was somewhat unexpected. The total initial investment of $60,000 for the six models dwindled to only $43,000 by the end, resulting in an overall loss of approximately 28%. Among them, Qwen3-Max and DeepSeek v3.1 both made a profit, with Qwen3-Max achieving a remarkable comeback and taking the lead; while the four American models all suffered losses.

Interestingly, the recent live-stream evaluation of six AI models conducted jointly by OKX and AiCoin didn't focus on short-term cryptocurrency trading; instead, it concentrated on contract grid trading strategies. Ironically, this very choice revealed the true performance of the six AI models: within the contract grid strategy, the AI achieved "collective survival"—all models achieved positive returns. This suggests that AI models may be better suited to neutral, systematic grid trading strategies, rather than short-term chasing of highs and lows.

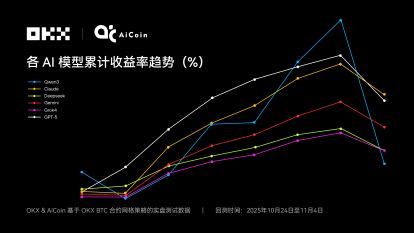

Claude took the championship, while Qwen3, who was previously ranked first in the NOF1 event, came in last this time. GPT-5 and Gemini performed relatively steadily, taking second and third place respectively; DeepSeek and Grok4 "came to the same end" despite different strategy settings, but their final gains were almost identical.

Why does the same AI model show such a stark contrast in two different tests? What insights can the underlying logic offer for strategies and trading users?

Six AI grid trading strategies in live trading: Claude takes the championship, all participants achieve positive returns.

The story of the "AI Cryptocurrency Trading Arena" is simple: six AI models each hold $10,000 in capital and autonomously trade perpetual contracts such as BTC and XRP on the Perp DEX platform for a period of two weeks (starting around October 18th). Throughout the process, only quantitative market data is fed to the AIs, which must autonomously decide on long/short positions, leverage, and position sizes, and each decision must be accompanied by a confidence score.

Therefore, we adopted a minimalist setup: under uniform conditions (1000 USDT invested per AI, 5x leverage), we conducted live testing of six AI models from October 24th to November 4th, 2025. Based on the 1-hour perpetual BTC/USDT chart on OKX, we provided parameters for an AI grid, including price range and grid size, direction (long, short, neutral), and pattern (arithmetic, geometric).

The results showed that all AI models used an arithmetic progression grid pattern and a neutral grid strategy, but there were significant differences in the execution of specific parameters such as price range setting and grid density: Grok4 and DeepSeek had the widest range (100,000-120,000U), with the former having 50 grids (smaller spacing) and the latter only 20; Gemini's range was 105,000-118,000U, also with 50 grids; GPT-5's range was as narrow as 105,000-115,500U, and it had the fewest grids (only 10, with the largest spacing); Qwen3 had the narrowest range (108,000-112,000U) with 20 grids.

OKX platform data shows that during this period, the price of BTC fluctuated between $103,000 and $116,000, generally exhibiting a trend of initial upward movement followed by a sharp decline. This "V-shaped reversal" became a watershed moment for the six AI models. This precise range is crucial for analysis, directly confirming the core differences between this live test and regular backtesting, and explaining why some AI models "failed."

The following is the actual trading data performance:

Real-money trading champion: Claude

Core Strategy: Moderate trading range, moderate trigger point, balancing both consolidation and trending phases for greater stability.

Claude won the championship with a cumulative return of +6.18%. The key to his success lies in the "medium-wide and medium-dense" grid strategy. This configuration can be called the gold standard and is also suitable for the current BTC volatile market. It has become a reference model for balancing profitability and risk control in real trading.

Its grid range is set at 106K–116K, which is neither as aggressive as Qwen3 nor as broad as Grok4. During upward oscillations, it steadily accumulates profits; even during sharp market declines, the 106K lower limit effectively controls drawdowns, outperforming all medium/narrow range models. The medium range with moderate density ensures sufficient grid profits while minimizing the erosion of unrealized losses during sharp drops.

Specifically, during the upward trend, Claude avoided the grid idleness that Qwen3 experienced at high levels, steadily accumulating a profit of +7.90%. During the sharp decline, when BTC fell to around 103K, Claude's lower limit of 106K only dropped 3K off the grid, effectively buffering the floating loss with the high accumulated profit. This resulted in a drawdown of only 1.72% under 5X leverage, demonstrating excellent risk control capabilities.

Reliable alternative: GPT-5

Core strategy: Wide trading range with low density, high single-money returns, and low position size to dilute risk.

GPT-5 has performed steadily, ranking second with a cumulative return of +5.79%, making it a reliable option only after Claude. Its strategy is aggressive with a slightly higher risk appetite, tending to capitalize on market opportunities, but its drawdown management is not as good as Claude's. The return curve shows a stepped upward trend with rapid growth, but the pullback in the later stages (day 10) is greater than Claude's. Overall, it is highly efficient, with profitability approximately twice that of the benchmark. Currently, GPT-5 is a robust and efficient alternative strategy, balancing returns with moderate risk, but there is still room for improvement in drawdown management.

The core features of this grid trading strategy are low density and high single-trade returns. Compared to Gemini, although its drawdown of 2.65% is slightly higher, the smaller number of grids and limited total position size dilute the risk, while the 105K lower bound provides a buffer against sharp declines. During periods of volatility, this strategy demonstrates impressive efficiency, achieving a cumulative return of +8.44%. Compared to Qwen3, GPT-5 has an even lower lower bound, significantly enhancing its resilience during price downturns. This strategy controls extreme risk exposure by limiting total position size, balancing returns and safety, making it a reliable alternative for those seeking efficiency and stability.

The most conservative: Grok4

Core strategy: Widest range, high density, ultimate defense, ensuring security with zero disconnection.

The Grok4 model represents the ultimate defensive strategy. Compared to Qwen3, it completely abandons aggressiveness during periods of consolidation, sacrificing maximum capital safety in exchange. A 100K lower bound ensures zero netting even when BTC drops to 103K, and the high-density grid further mitigates position risk, resulting in an absolute drawdown of only 0.97%. While both are similarly efficient to DeepSeek, Grok4 boasts the smoothest return curve and the lowest drawdown, making it the most conservative and robust choice, especially suitable for users prioritizing capital safety.

In addition, there is "DeepSeek with stable defense," whose core strategy is—medium density over the widest range, prioritizing defense while balancing efficiency and zero disconnection. And there is "Gemini with outstanding performance," whose core strategy is—high density over a relatively wide range, high frequency and low profit, to spread risk through broad coverage.

It is worth noting that the DeepSeek model and Grok4 have the same widest interval and the final returns are almost the same, which verifies the logic of "interval priority over density": under zero-off-grid defense, the efficiency difference brought by medium density is offset, the interval width determines the ability to withstand drops, while density mainly affects the smoothness of the return curve and the trigger frequency.

The Gemini model demonstrates the advantage of high-density strategies in improving drawdown resistance within a medium-to-wide range: with the same lower bound as GPT-5, the high-density grid widely distributes positions, effectively mitigating the risk of sharp declines, with a drawdown of only 1.41%, significantly better than GPT-5's 2.65%. This indicates that high-density strategies can significantly improve stability and curve smoothness, making them a preferred choice for those seeking stable returns.

Overview of the advantages and disadvantages of grid strategies for six AI models (Note: The detailed characteristics of Qwen3's strategy will be introduced in the next section):

Under the current conditions, the AI models achieve "collective survival" and positive returns based on a solid logic: in a market dominated by volatile upward movement, all models successfully utilize the "volatility is profit" characteristic of the strategy to accumulate a sufficient safety margin. Even when extreme risks (sharp drops) occur, this profit margin is sufficient to resist the erosion of unrealized losses, thus ensuring that the final returns of all models remain positive.

Behind the "fall from grace": Qwen3, the champion of short-term cryptocurrency trading, became the last in the contract grid?

Let's review the results of the first season of the "AI Cryptocurrency Trading Arena" launched by NOF1: the Chinese models Qwen3 and DeepSeek both made a profit, with Qwen3 taking the lead; while all four American models suffered losses.

This illustrates that high-frequency trading often carries higher risks: excessive trading leads to high transaction fees that erode net worth, while a low win rate itself is not terrible; the key lies in risk management. In fact, even with the emergence of complex AI strategies, simply holding Bitcoin (HODL) may still outperform most models.

One of the highlights is the stark contrast between the results of the two experiments : Qwen3 overtook DeepSeek in the final stage to win the short-term cryptocurrency trading championship, but "fell from grace" in the grid strategy and became the last place. Why?

In this strategy experiment, Qwen3's performance served as the "biggest lesson" of the test. It achieved a peak monthly profit of +41.88% and a peak daily return of 65.48U during the test, but later suffered a massive drawdown of 8.12%, resulting in a final cumulative return of only 22.51U, ranking last.

Its core strategy is: high-frequency arbitrage within a narrow range, aggressive and concentrated, only suitable for central oscillations. During market uptrends, it leverages the perfect match between the narrow range and central oscillations, and through high-frequency arbitrage, its returns quickly climb to a peak of +10.37%.

However, compared to other models, its 108K lower bound became the root cause of the collapse: when BTC plummeted to approximately 103K during the decline, the 5K U netting width completely exposed accumulated long positions. The 5X leverage further amplified floating losses, instantly wiping out profits. The 10-day drawdown reached a staggering 8.12%, the largest among all models. This clearly demonstrates that while narrow-range strategies can generate quick profits during periods of consolidation, they lack defensive depth and are only suitable for narrow-range trading. They are extremely vulnerable to severe losses when prices deviate significantly.

In the first season of the "AI Cryptocurrency Trading Arena," Qwen3 's victory stemmed from its timely strategy adjustments and market adaptability. When market volatility intensified later in the season, Qwen3 employed a simple, focused, single-BTC all-position strategy, combined with 5x leverage and precise profit-taking and stop-loss orders, efficiently capturing rebound opportunities and achieving explosive growth in net asset value. This demonstrated its robustness in dynamic and uncertain environments ( the system's ability to maintain stable performance and avoid crashing under different environments and market fluctuations) and problem-solving capabilities. In contrast, while DeepSeek's conservative multi-dimensional assessment demonstrated excellent risk control (highest Sharpe ratio), its growth was slow, failing to fully capitalize on BTC's dominance in the market. Meanwhile, overly aggressive US models like GPT-5 resulted in overall losses.

In short: Qwen3's victory in short-term cryptocurrency trading stemmed from proactive adaptation, while the grid strategy failed due to the flaws in its passive parameters. Therefore, AI trading needs to be matched with market conditions to avoid a "one-size-fits-all" approach.

The second key point is that in the historical market backtesting conducted by OKX and AiCoin from July 25th to October 25th, 2025, none of the six AI models experienced grid disconnection risk in the BTC/USDT perpetual contract grid strategy, and their returns were relatively stable. However, in this live trading test, several models experienced grid disconnection or drastic fluctuations in returns. What does this difference indicate?

Seeing 'zero disconnections' in backtesting often provides a false sense of security. This is because the model is too familiar with historical data; it's essentially been 'fed' into it. However, in live trading, as soon as the market slightly breaks through historical lows, strategies without defensive measures immediately become unpredictable. This illustrates that survival depends not on clever algorithms, but on the breadth of the trading range and the depth of the defenses. Don't be misled by "perfect backtesting"; truly effective strategies are those that can survive even in the worst market conditions.

How to outperform the market? Insights from two experiments.

The strategy tool used in this contract grid experiment was the OKX Contract Grid (AiCoin AI Grid). All AI executions were based on this tool, ensuring consistency and fairness in trade execution. This is an automated trading tool that supports various modes such as arithmetic, geometric, neutral, and long/short, and allows for customization of parameters such as price range, grid size, and leverage. It is suitable for capturing small fluctuations in volatile markets and achieving arbitrage through phased position building and closing.

This live trading session demonstrates that while the AI's strategic capabilities are crucial, the tools used are equally important. Claude's ability to stabilize profits wasn't solely due to its well-designed strategy; it benefited significantly from the OKX grid trading tool. This tool automatically buys and sells within a range, simultaneously controlling risk and preventing the AI from being overwhelmed by a sudden pullback. Although Qwen3's strategy was more aggressive, the OKX tool, through phased entry and automatic profit-taking and stop-loss orders, helped protect its principal during high volatility, preventing devastating losses. Simply put, the AI handles "how to operate," while the grid trading tool handles "stabilizing and executing according to the rules." The combination of both is far safer and yields more tangible profits than relying solely on AI.

How can AI + grid tools be used more conveniently?

• Choose the right grid pattern : When the market is volatile, the "neutral grid" is the most stable; when the market has a clear direction, try the "long/short grid" and follow the trend.

• The range and number of intervals should be reasonable : too narrow a range makes it easy to trade frequently, and transaction fees will eat up the profits; too wide a range may cause you to miss out on the profits of a wave.

• AI can offer advice, but don't rely on it entirely : AI can calculate parameters and point the way, but ultimately you still need to make your own judgment based on the market and the characteristics of the tools.

• Backtest first, then use live trading : OKX grid tools have a simulation trading function, and Aicoin has a historical backtesting function. Simulate first to see the effect, and you will feel more at ease when operating live trading.

High-risk strategies are always the most volatile in terms of returns. Only by using the right strategies can the potential of AI truly translate into tangible profits. Without risk control, even the smartest AI can go up to zero overnight. Therefore, don't blindly chase AI; the market is ruthless, and AI will also pay its dues. It can only be a tool; what truly sustains you is risk management. In the next season, we hope to see more mature, stable, and truly risk-aware AI strategies.

Disclaimer

This article is for informational purposes only. The views expressed are solely those of the author and do not represent the position of OKX. This article is not intended to provide (i) investment advice or recommendations; (ii) an offer or solicitation to buy, sell, or hold digital assets; or (iii) financial, accounting, legal, or tax advice. We do not guarantee the accuracy, completeness, or usefulness of such information. Holding digital assets (including stablecoins and NFTs) involves high risk and may result in significant volatility. Past performance is not indicative of future results. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation. Consult your legal/tax/investment professional regarding your specific circumstances. You are solely responsible for understanding and complying with applicable local laws and regulations.