The crypto market in October 2025 will not be easy. Macro liquidity continues to tighten, US Treasury yields remain high, and risk assets are under pressure overall. The volatility of "10.11" nearly caused market sentiment to collapse, with some investors turning back to short-cycle, early-stage projects in search of high-rebound opportunities. In such a market phase of "risk aversion but still having desires," exchange listing strategies often become an important window into the industry's sentiment.

For BitMart, a leading global digital asset trading platform, October was not a period of "rest and recuperation against headwinds," but rather a crucial juncture for "continuing certainty." By maintaining a stable listing strategy and a refined asset selection process, the platform not only achieved steady growth during this volatile period but also demonstrated a level of certainty and insight exceeding the industry average in early-stage project discovery.

BitMart October Listing Overview: Steady Progress, Balancing Quality and Efficiency

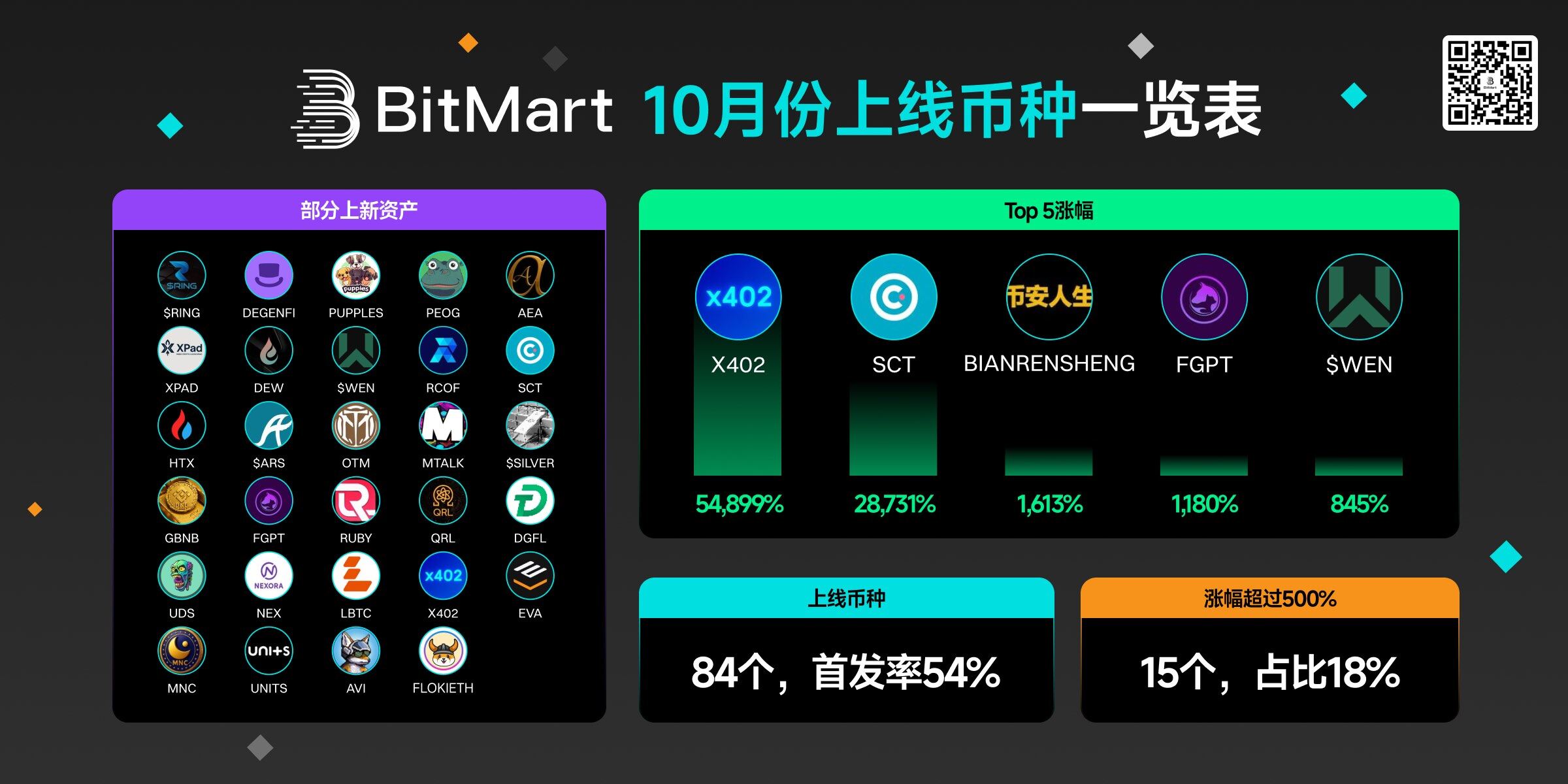

According to official BitMart data, 84 new assets were listed on the platform in October 2025, with 54% being initial public offerings (IPOs). Given the overall sluggishness of the macro market and the general slowdown in listing pace among peers, this pace is remarkable. More notably, the overall asset performance in October far exceeded expectations.

● Fifteen assets saw gains exceeding 500%, accounting for 18% of the total.

● The top 5 gainers are: X402 (+54,899%), SCT (+28,731%), BIANRENSHENG (+1,613%), FGPT (+1,180%), and $WEN (+845%).

Behind these data lies BitMart's long-established system of listing timing and strategies. The platform does not blindly pursue quantity, but rather uses a dynamic evaluation model to comprehensively assess project potential, community engagement, on-chain activity, and other dimensions to ensure that high-quality projects are listed at the optimal time.

It's worth noting that the BMD zone continued to play a key role in October. This zone focuses on discovering and introducing high-potential early-stage on-chain assets, and some blockbuster projects have launched their debut through BMD. BMD has become one of BitMart's signature product lines for differentiated competition and is also the core platform for building its "early value discovery" mechanism.

A Review of the First Half and the Third Quarter: From "Rapid Expansion" to "Establishing a Rhythm"

If we look at the longer timeline, BitMart's performance in October was not accidental, but rather a continuation of its steady growth in the first half of the year and the third quarter.

First Half Performance: BitMart listed 538 high-quality assets, of which 341 were initial public offerings (IPOs), accounting for a high 63%. More than 150 tokens saw gains exceeding 100%, with 24 of them exceeding 1,000%. These figures once made BitMart synonymous with "IPO hub," providing solid data support for its strategy of "early and accurate listings."

The third quarter saw a shift in pace: In July, BitMart listed 78 cryptocurrencies (34% initial offering rate); in August, the initial offering rate rebounded to 50%, sparking discussions about "intensity competition" within the industry; in September, the platform listed 95 projects, with an initial offering rate of 44%, a 17% increase month-over-month, and as many as 19 projects experiencing growth exceeding 500%. It can be seen that BitMart's strategy in the third quarter gradually shifted from "high-speed expansion" to "structural optimization," forming a stable growth curve: maintaining a high frequency of listings while also ensuring the quality of asset selection.

The core logic behind this shift lies in BitMart's move from a "speed-driven" to a "system-driven" approach—maintaining stable output across different market cycles through multi-dimensional asset screening mechanisms and risk control models. This was fully demonstrated in the October data.

Comparative Analysis: Trend Continuation and Positive Signals

If we observe the performance in the first half of the year, the third quarter, and October within the same framework, we can clearly see the continuity and self-consistency of BitMart's strategy.

First, there's the stability of the initial release ratio. From 63% in the first half of the year, to an average of 43%-50% in the third quarter, and then to 54% in October, BitMart has maintained a relatively constant initial release pace. This means that while ensuring quality, the platform has maintained strong market sensitivity and execution efficiency.

Secondly, there is the continuous output of high-potential projects. Whether it is ORGO and LST in July, AI rising stars in August, or X402 and SCT in October, BitMart has produced blockbuster products almost every month, and the price increase range shows a structural distribution, which shows the sustainability of its selection mechanism.

At the market level, BitMart's prudent listing strategy has also stabilized user expectations to some extent. Unlike some platforms that blindly launch new coins in pursuit of hype, BitMart emphasizes rhythm and certainty—neither slowing down nor getting caught in a "quantity war." This "steady yet fast" characteristic is precisely the most scarce capability during a downturn.

A deeper positive signal lies in BitMart's ecosystem strategy. The synergy of multiple components, including the BMD zone, LaunchPrime platform , and DEX , transforms the platform from merely a "coin listing platform" into a gradually building closed-loop asset ecosystem encompassing discovery and incubation. October's performance is a testament to the growing effectiveness of this systematic approach.

Summary: The Double Helix Logic of First-Time Launches and Sudden Wealth Effect

Looking back at 2025, BitMart has repeatedly demonstrated its capabilities in early-stage project discovery and market timing. And in October, the platform's two core characteristics were further reinforced:

First-mover advantage – continuation of strategic genes

BitMart's consistently top-tier launch rate has become its brand hallmark. For project teams, choosing BitMart for their initial launch means rapid global exposure and liquidity support; for users, BitMart has practically become the "gateway to early-stage projects." This inherent quality is not a product of short-term marketing, but rather the result of the platform's long-term strategic accumulation.

The get-rich-quick effect: a combination of certainty and imagination

Whether it's the 54,899% increase in X402 or the 28,731% increase in SCT after its community explosion, the "get rich quick" effect brought about by these projects not only strengthened users' trust but also gave BitMart a stronger market appeal in terms of narrative.

Of course, this kind of "sudden wealth" is not purely due to luck, but rather stems from the platform's precise asset screening mechanism and ability to control the pace of development. It is precisely because BitMart is able to capture on-chain trends and project growth inflection points in the early stages that these extreme returns become possible.

Perhaps it can be summarized like this:

Beyond the noise and fierce competition, BitMart is using a steady pace, real data, and continuous innovation to answer a question that runs throughout the entire crypto cycle—what constitutes a long-term competitive advantage for exchanges.

The crypto market in October 2025 will not be easy. Macro liquidity continues to tighten, US Treasury yields remain high, and risk assets are under pressure overall. The volatility of "10.11" nearly caused market sentiment to collapse, with some investors turning back to short-cycle, early-stage projects in search of high-rebound opportunities. In such a market phase of "risk aversion but still having desires," exchange listing strategies often become an important window into the industry's sentiment.

For BitMart, a leading global digital asset trading platform, October was not a period of "rest and recuperation against headwinds," but rather a crucial juncture for "continuing certainty." By maintaining a stable listing strategy and a refined asset selection process, the platform not only achieved steady growth during this volatile period but also demonstrated a level of certainty and insight exceeding the industry average in early-stage project discovery.

BitMart October Listing Overview: Steady Progress, Balancing Quality and Efficiency

According to official BitMart data, 84 new assets were listed on the platform in October 2025, with 54% being initial public offerings (IPOs). Given the overall sluggishness of the macro market and the general slowdown in listing pace among peers, this pace is remarkable. More notably, the overall asset performance in October far exceeded expectations.

● Fifteen assets saw gains exceeding 500%, accounting for 18% of the total.

● The top 5 gainers are: X402 (+54,899%), SCT (+28,731%), BIANRENSHENG (+1,613%), FGPT (+1,180%), and $WEN (+845%).

Behind these data lies BitMart's long-established system of listing timing and strategies. The platform does not blindly pursue quantity, but rather uses a dynamic evaluation model to comprehensively assess project potential, community engagement, on-chain activity, and other dimensions to ensure that high-quality projects are listed at the optimal time.

It's worth noting that the BMD zone continued to play a key role in October. This zone focuses on discovering and introducing high-potential early-stage on-chain assets, and some blockbuster projects have launched their debut through BMD. BMD has become one of BitMart's signature product lines for differentiated competition and is also the core platform for building its "early value discovery" mechanism.

A Review of the First Half and the Third Quarter: From "Rapid Expansion" to "Establishing a Rhythm"

If we look at the longer timeline, BitMart's performance in October was not accidental, but rather a continuation of its steady growth in the first half of the year and the third quarter.

First Half Performance: BitMart listed 538 high-quality assets, of which 341 were initial public offerings (IPOs), accounting for a high 63%. More than 150 tokens saw gains exceeding 100%, with 24 of them exceeding 1,000%. These figures once made BitMart synonymous with "IPO hub," providing solid data support for its strategy of "early and accurate listings."

The third quarter saw a shift in pace: In July, BitMart listed 78 cryptocurrencies (34% initial offering rate); in August, the initial offering rate rebounded to 50%, sparking discussions about "intensity competition" within the industry; in September, the platform listed 95 projects, with an initial offering rate of 44%, a 17% increase month-over-month, and as many as 19 projects experiencing growth exceeding 500%. It can be seen that BitMart's strategy in the third quarter gradually shifted from "high-speed expansion" to "structural optimization," forming a stable growth curve: maintaining a high frequency of listings while also ensuring the quality of asset selection.

The core logic behind this shift lies in BitMart's move from a "speed-driven" to a "system-driven" approach—maintaining stable output across different market cycles through multi-dimensional asset screening mechanisms and risk control models. This was fully demonstrated in the October data.

Comparative Analysis: Trend Continuation and Positive Signals

If we observe the performance in the first half of the year, the third quarter, and October within the same framework, we can clearly see the continuity and self-consistency of BitMart's strategy.

First, there's the stability of the initial release ratio. From 63% in the first half of the year, to an average of 43%-50% in the third quarter, and then to 54% in October, BitMart has maintained a relatively constant initial release pace. This means that while ensuring quality, the platform has maintained strong market sensitivity and execution efficiency.

Secondly, there is the continuous output of high-potential projects. Whether it is ORGO and LST in July, AI rising stars in August, or X402 and SCT in October, BitMart has produced blockbuster products almost every month, and the price increase range shows a structural distribution, which shows the sustainability of its selection mechanism.

At the market level, BitMart's prudent listing strategy has also stabilized user expectations to some extent. Unlike some platforms that blindly launch new coins in pursuit of hype, BitMart emphasizes rhythm and certainty—neither slowing down nor getting caught in a "quantity war." This "steady yet fast" characteristic is precisely the most scarce capability during a downturn.

A deeper positive signal lies in BitMart's ecosystem strategy. The synergy of multiple components, including the BMD zone, LaunchPrime platform , and DEX , transforms the platform from merely a "coin listing platform" into a gradually building closed-loop asset ecosystem encompassing discovery and incubation. October's performance is a testament to the growing effectiveness of this systematic approach.

Summary: The Double Helix Logic of First-Time Launches and Sudden Wealth Effect

Looking back at 2025, BitMart has repeatedly demonstrated its capabilities in early-stage project discovery and market timing. And in October, the platform's two core characteristics were further reinforced:

First-mover advantage – continuation of strategic genes

BitMart's consistently top-tier launch rate has become its brand hallmark. For project teams, choosing BitMart for their initial launch means rapid global exposure and liquidity support; for users, BitMart has practically become the "gateway to early-stage projects." This inherent quality is not a product of short-term marketing, but rather the result of the platform's long-term strategic accumulation.

The get-rich-quick effect: a combination of certainty and imagination

Whether it's the 54,899% increase in X402 or the 28,731% increase in SCT after its community explosion, the "get rich quick" effect brought about by these projects not only strengthened users' trust but also gave BitMart a stronger market appeal in terms of narrative.

Of course, this kind of "sudden wealth" is not purely due to luck, but rather stems from the platform's precise asset screening mechanism and ability to control the pace of development. It is precisely because BitMart is able to capture on-chain trends and project growth inflection points in the early stages that these extreme returns become possible.

Perhaps it can be summarized like this:

Beyond the noise and fierce competition, BitMart is using a steady pace, real data, and continuous innovation to answer a question that runs throughout the entire crypto cycle—what constitutes a long-term competitive advantage for exchanges.

- 核心观点:BitMart逆市稳健上币策略成效显著。

- 关键要素:

- 10月上线84资产,54%为首发。

- 15个项目涨幅超500%,最高54899%。

- BMD专区持续发掘早期高潜项目。

- 市场影响:增强平台竞争力与用户信心。

- 时效性标注:中期影响