BitMart VIP Insights | October Crypto Market Review and Hot Topic Analysis

- 核心观点:美国宽松政策难抵经济疲弱,加密市场震荡修复。

- 关键要素:

- 美联储降息至3.75%-4.0%,暂停缩表。

- 加密市场单日爆仓191亿美元,创历史新高。

- 比特币ETF净流入55.5亿美元,稳定币流通量增93.8亿。

- 市场影响:短期波动加剧,风险偏好下降。

- 时效性标注:短期影响

TL, DR

- In October 2025, the US will enter a period of monetary easing, with the Federal Reserve cutting interest rates and pausing its balance sheet reduction. However, the economic recovery will remain weak, with high inflation, a sluggish job market, low consumer confidence, and a mix of government and external risks impacting growth. While inflation has declined somewhat, it remains above target. Weak employment and fiscal constraints have diminished the short-term stimulative effect of easing policies on consumption and investment. Overall, the US is in the early stages of an easing cycle, with an improved policy environment, but uncertainties surrounding inflation, employment, and external risks continue to weigh on the economic recovery.

- The crypto market experienced significant volatility in October, with trading volume surging to a monthly peak of $428.2 billion during the "10/11" crash. Trading subsequently cooled, with weak liquidity and decreased risk appetite. Overall market capitalization declined slightly by 0.57% compared to the previous month, remaining volatile after the sharp pullback. Market sentiment was cautious, and new capital inflows were insufficient. Newly listed tokens were mainly from infrastructure, DeFi, and AI projects. Chinese memes saw a short-term surge but limited sustainability.

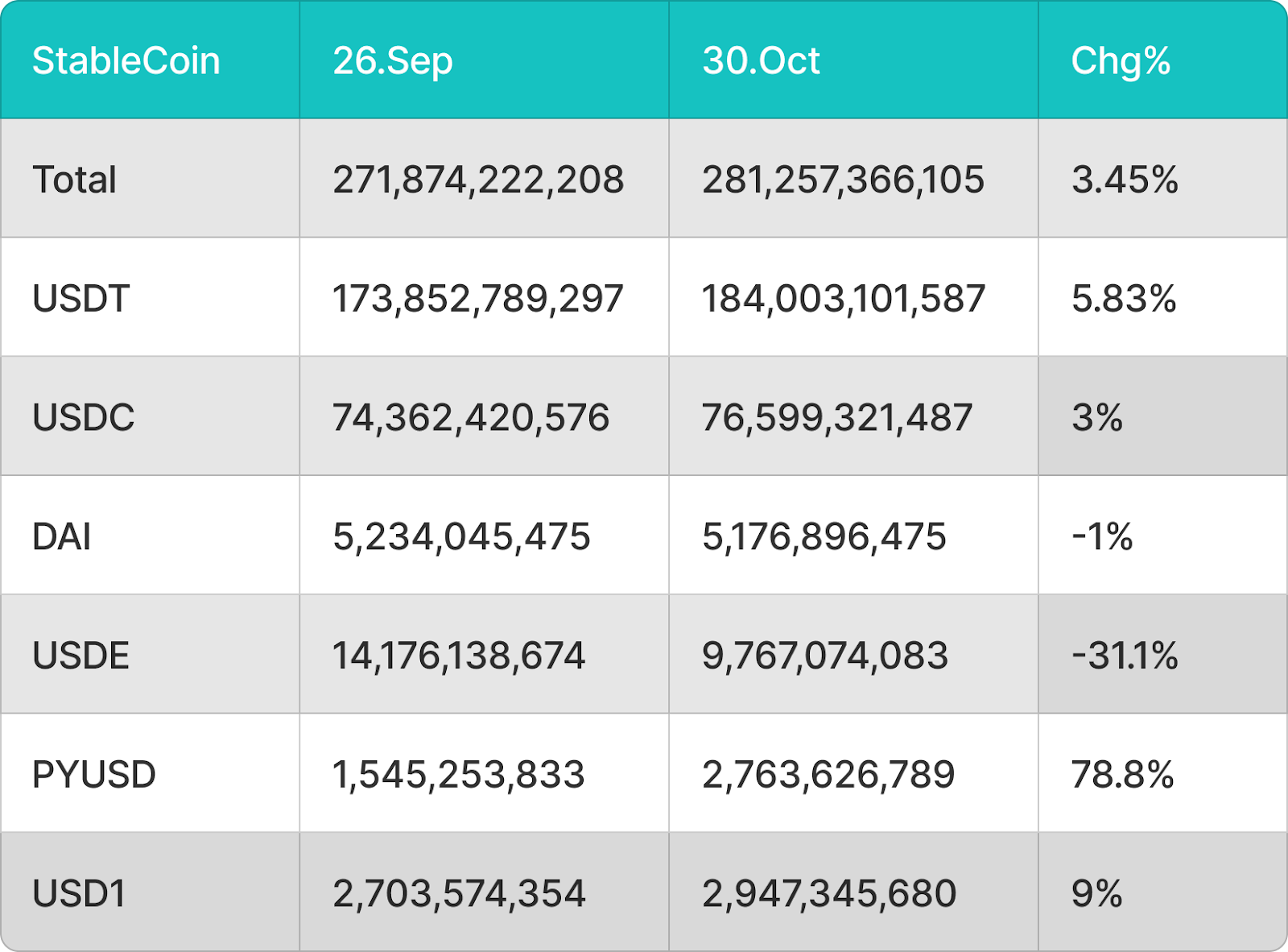

- In October, Bitcoin and Ethereum spot ETFs saw net inflows of $5.55 billion and $1.01 billion respectively, indicating that market confidence had recovered somewhat after the black swan event, but overall remained cautious. The total circulating supply of stablecoins increased by $9.38 billion, with USDT and USDC being the main sources of this increase, while USDE saw a significant 31.1% decline in circulating supply due to the de-pegging event.

- Bitcoin's short-term momentum has weakened, and the price failed to hold above the 50-day SMA, currently fluctuating around the 20-day EMA. A break below the $107,000 support level could accelerate the decline to $100,000, while $118,000 is a key resistance level. Ethereum is generally weak, with the price falling below the 50-day SMA. A break below the descending triangle support could lead to a further decline to $3,350; a return above the 50-day SMA could trigger a bullish rebound, but strong resistance remains. Solana is experiencing a clear tug-of-war between bulls and bears, failing to hold above the 20-day EMA. A break and hold above this level could lead to an upward move towards the channel resistance line, while a break below $190 would give the bears the upper hand, potentially leading to a decline to $177 or even testing the lower channel line.

- October saw the largest liquidation in the cryptocurrency market in history, with Bitcoin, Ethereum, and altcoins plummeting due to Trump's tariffs and the de-pegging of USDe. Total liquidations across the network reached a record high of $19.1 billion, highlighting systemic leverage risks. Chinese meme coins rapidly gained popularity on Binance and within the Solana and Base ecosystems. Projects like "Binance Life" experienced a short-term surge in market capitalization, attracting a large number of new traders and becoming a phenomenon. The launch of the x402 protocol sparked market attention, causing related project prices to spike briefly, but subsequently fall back, demonstrating the concentrated hype and volatile nature of innovative concepts.

- The prediction market is expected to continue its rapid expansion next month, with projects like Polymarket, Kalshi, and Truth Predict driving increased liquidity and attention in the industry, while capital and public blockchain ecosystem development are accelerating simultaneously. Although the crypto market suffered structural damage after the black swan event of October 11th, expectations of trade easing and favorable policies provide support for a short-term return to risk assets. Going forward, key factors to watch include the performance of new prediction market projects, progress in US-China trade, changes in the US dollar and liquidity environment, and leverage risks in the crypto market.

1. Macro perspective

In October 2025, the US economy will enter an easing cycle, but the recovery momentum will remain weak. The Federal Reserve will cut interest rates consecutively and pause its balance sheet reduction, shifting its policy focus from suppressing inflation to stabilizing growth and protecting employment, reflecting concerns about an economic slowdown. Inflation remains high, the job market continues to be weak, consumer confidence is declining, government shutdowns and external risks are intertwined, resulting in an economy in a state of "easing policies, but no growth momentum." Overall, the US is in the early stages of a cyclical inflection point; the policy environment is improving, but macroeconomic recovery will still take time.

Policy shift

In October, the Federal Reserve cut interest rates again by 25 basis points, lowering the federal funds rate to a range of 3.75%–4.00%, and announced a pause in balance sheet reduction to release liquidity and strengthen the easing effect. This marks a full shift in monetary policy towards a growth-oriented approach. The current policy logic prioritizes stabilizing growth; the Fed believes inflation risks are relatively controllable, while deteriorating employment and fiscal uncertainty are more pressing challenges. The market expects a possible further rate cut this year, but policy transmission will take time, and it will be difficult to quickly stimulate consumption and business investment in the short term.

Inflation remains above target

September's CPI rose 3.0% year-on-year, with core CPI also at 3.0%, lower than expected but still above the Federal Reserve's 2% target. Price increases in food, housing, and services remained robust, indicating that endogenous inflation has not completely dissipated. In his statement, Powell emphasized that while inflation is trending towards moderation, policymakers should not relax their vigilance prematurely. If the decline in inflation slows, the Fed may delay further easing. Inflation is currently under control, but the target range has not yet been reached.

The job market weakened further.

The rapid cooling of the labor market is the core trigger for this round of easing. Due to the US government shutdown, the Bureau of Labor Statistics suspended the release of September non-farm payroll data, leaving the market without a key reference point. The latest available data for August shows a significant slowdown in job growth, with only 22,000 new jobs added. Meanwhile, the June data was revised down to negative growth. The weak labor market is eroding the support from consumption and the service sector, and exacerbating the deterioration of household income expectations. There is widespread concern that if employment continues to deteriorate, the economy will fall into a deeper recession, forcing the Federal Reserve to take more aggressive easing measures.

Political, fiscal, and external risks remain.

The US government is shut down due to a failed budget, with some departments furloughed and operations suspended, reducing fiscal spending and data transparency. Continued geopolitical tensions, including Middle East conflicts and US-China technology clashes, are increasing risk premiums. Fiscal and external uncertainties are diminishing the marginal effectiveness of monetary easing, making the market recovery more sluggish. While easing provides short-term support, the policy transmission channel is obstructed, and the recovery in business confidence and long-term investment remains limited.

Outlook

The US is in the early stages of an easing cycle, with an improved policy environment but an unsustainable economic recovery. The key future focus will be on whether inflation can continue to decline, whether employment will stabilize, and whether the easing policies can effectively transmit to consumption and investment. Fiscal deadlock, geopolitical risks, and market confidence remain major uncertainties.

2. Overview of the Crypto Market

Currency data analysis

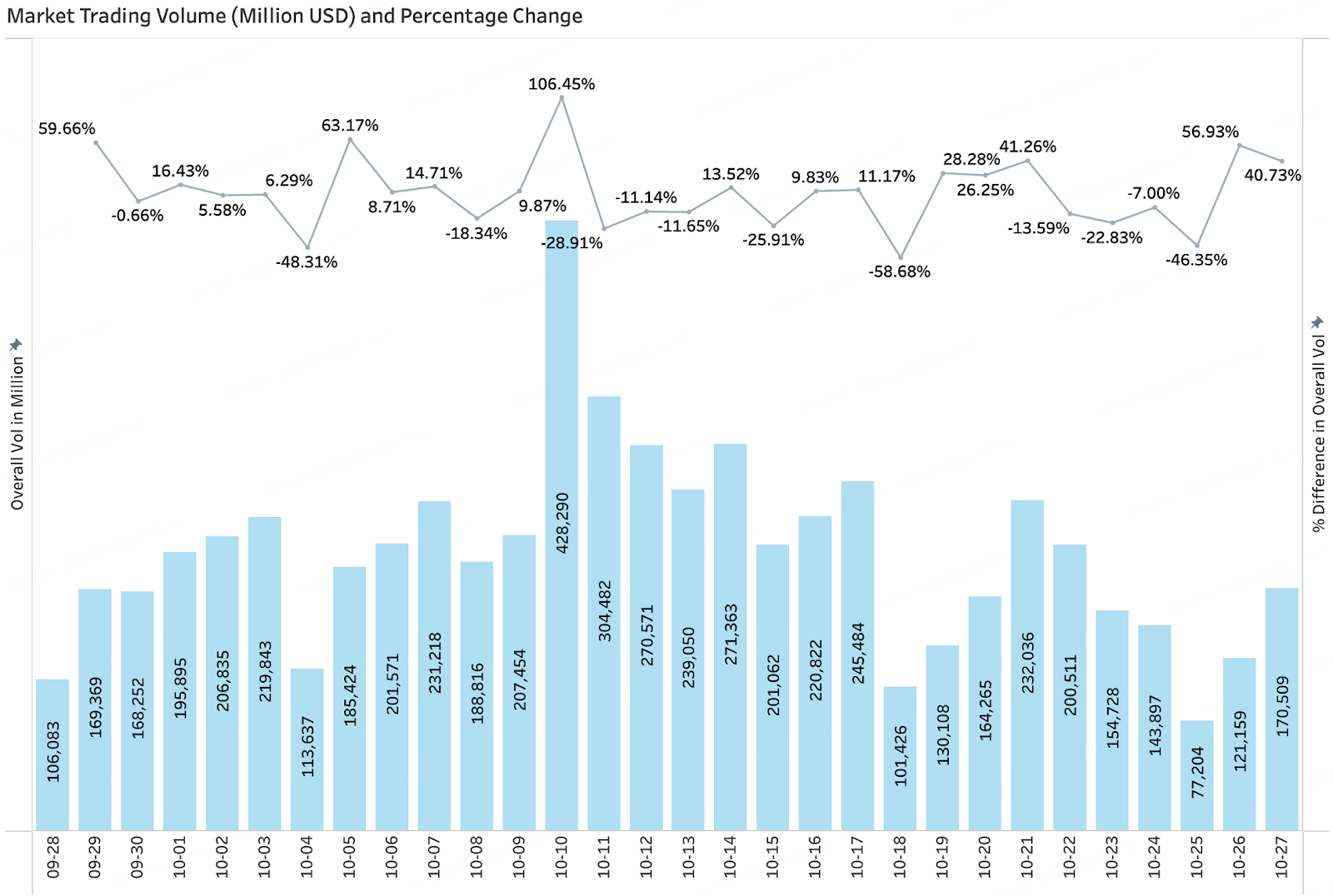

Trading volume & daily growth rate

According to CoinGecko data, as of October 27th, the overall trading volume in the crypto market fluctuated significantly. During the "10.11" crash, market sentiment surged dramatically, with trading volume soaring to $428.2 billion, a 106% increase month-over-month, reaching a monthly peak. Funds were released in a short period amid panic and speculation. Outside of this phase, overall market trading was relatively quiet, with trading volume mostly remaining between $150 billion and $200 billion, indicating a decline in investor risk appetite and a more cautious sentiment. Funding was somewhat weak, and the market lacked sustained new capital inflows. In the short term, further positive macroeconomic and policy factors are needed to drive a stronger upward momentum.

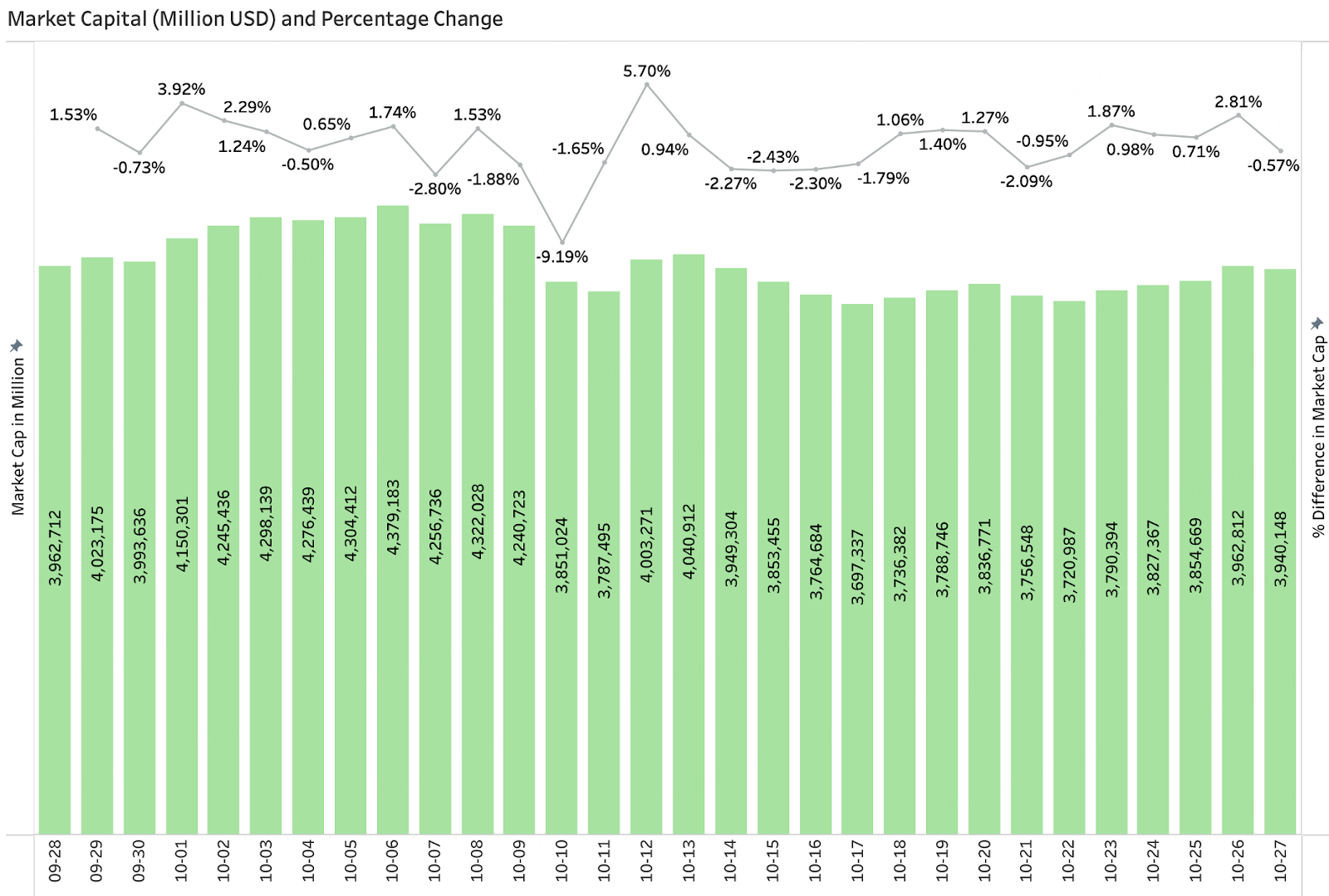

Total market capitalization & daily growth

According to CoinGecko data, as of October 27, the total market capitalization of cryptocurrencies was $3.94 trillion, a 0.57% decrease from the previous month. From the beginning of the month to October 9, the total market capitalization steadily increased from $3.96 trillion to $4.32 trillion, reflecting a gradual return of funds due to a period of positive news. However, the market experienced a sudden downturn on October 10-11, with a daily drop of over 9% in market capitalization, the largest pullback of the month, indicating panic selling during the "10.11" market event. Although the market subsequently rebounded briefly, rising by as much as 5.7%, the overall rebound was limited, and the market capitalization remained volatile between $3.7 trillion and $3.9 trillion. Overall, the market has stabilized after the sharp correction, with increased investor caution and insufficient willingness to enter the market, remaining in a consolidation phase.

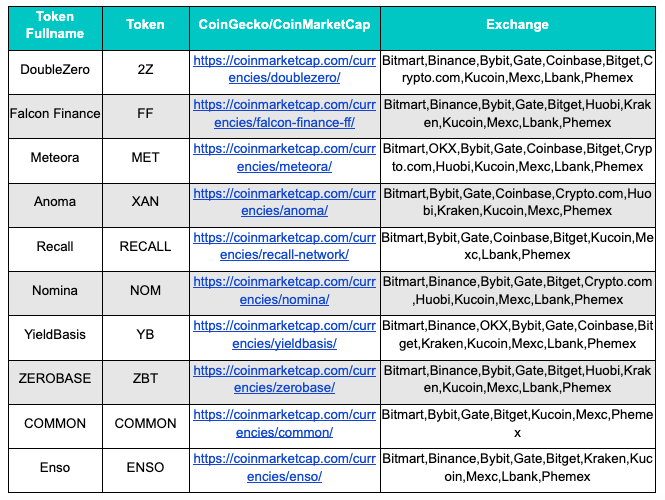

Popular new tokens in October

Popular tokens newly launched in October were mainly concentrated in the infrastructure, DeFi, and AI sectors, with VC-backed projects still dominating. Among them, Enso, Recall, Falcon Finance, YieldBasis, and ZEROBASE performed exceptionally well, showing relatively active trading volumes after their launch. Furthermore, the Chinese meme sector saw a short-term surge driven by the "Binance Life" effect and CZ's (Binance CEO) endorsements, with the launch of Binance Futures further fueling this sentiment.

3. On-chain data analysis

Analysis of BTC and ETH ETF inflows and outflows

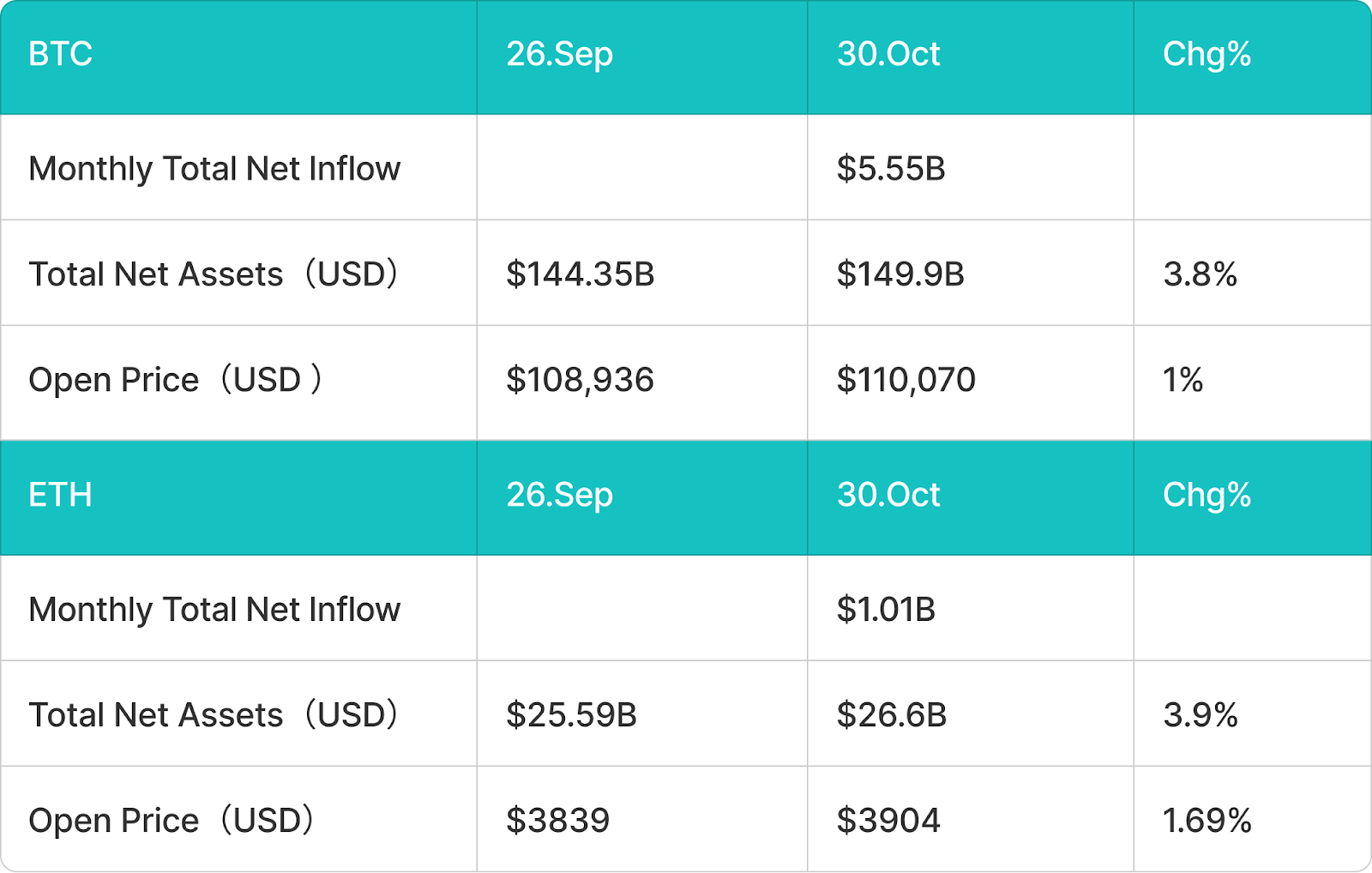

In October, BTC spot ETFs saw net inflows of $5.55 billion.

Bitcoin spot ETFs continued their inflow trend in October, with a net inflow of $5.55 billion, bringing total assets to $149.9 billion, a 3.8% increase month-over-month. The price of Bitcoin rose slightly from $108,936 at the end of September to $110,070, a 1% increase. While market confidence has improved somewhat after the black swan event of October 11th, overall market conditions remain sluggish.

In October, the ETH spot ETF saw a net inflow of $1.01 billion.

Ethereum spot ETFs recorded net inflows of approximately $1.01 billion in October, bringing total assets to $26.6 billion, a 3.9% increase month-over-month. The price of ETH rose from $3,839 to $3,904, a gain of 1.69%.

Stablecoin Inflow and Outflow Analysis

The total circulating supply of stablecoins surged by $9.38 billion in October.

Although the overall stablecoin market continued to see inflows and growth in October, market confidence was severely impacted by the black swan event on October 11th. USDE, in particular, experienced a significant drop in circulating supply, as the price de-pegging during the event led to market skepticism about its algorithmic stablecoin mechanism. In other areas, the total circulating supply of stablecoins increased by $9.38 billion, reaching $281.25 billion. USDT saw a monthly increase of $10.15 billion, maintaining its leading position. USDC ($2.23 billion) also became a major source of incremental growth.

4. Price Analysis of Major Currencies

BTC Price Change Analysis

Bitcoin's failure to hold above the 50-day simple moving average (SMA, $114,278) triggered renewed selling pressure, pushing the price back below the 20-day exponential moving average (EMA, $112,347). This indicates weakening short-term momentum and a more cautious market sentiment. If BTC closes below the 20-day EMA, bears may exert further pressure, pushing the BTC/USDT price towards the key support level of $107,000. Bulls are expected to defend this level aggressively, as a break below it would confirm a double-top pattern and could trigger a further decline towards the psychological level of $100,000.

On the upside, $118,000 remains a significant resistance level for bulls. A break and hold above this level would unleash strong upward momentum, pushing BTC towards the all-time high of $126,199. Until then, the market may consolidate around the moving averages, accompanied by increased short-term volatility.

ETH Price Change Analysis

Ethereum retreated again after touching the 50-day SMA ($4,220), indicating that short sellers are still actively entering the market at higher levels, and the overall trend remains weak. The current price is approaching the support line of a descending triangle, a key level that will determine the short-term direction. If this support is decisively broken, ETH/USDT could potentially fall further to $3,350 or even lower.

If the bulls can regain control above the 50-day SMA, it would indicate a recovery in short-term momentum. At that point, the price is expected to rebound to the upper boundary of the descending triangle, where selling pressure is anticipated to be very strong. Only if Ethereum successfully breaks through this resistance line and firmly establishes itself above it can a new upward trend begin and a medium-term reversal signal be confirmed.

SOL Price Change Analysis

Solana briefly broke through the 20-day EMA ($196), but failed to maintain its gains, indicating insufficient buying momentum at higher levels. Currently, the 20-day EMA is flattening, and the RSI indicator is fluctuating near the neutral zone, suggesting a tug-of-war between bulls and bears. If buyers can push the price up and firmly close above the 20-day EMA, SOL/USDT could potentially rise further to the channel resistance line. A successful breakout of this area would significantly strengthen bullish market expectations.

Conversely, if the price falls below $190, it would mean that the bears have regained control. In this case, SOL could fall back to $177 and further test the lower support of the ascending channel. If it finds support and stabilizes here, it could mean that funds are starting to accumulate at lower levels; however, if the support is breached, the correction could be more significant.

5. Hot Topics This Month

The crypto market is experiencing its biggest reckoning in history, with Trump's tariffs and the decoupling of USDe triggering a chain reaction of sharp declines.

On the evening of October 10th, US President Trump abruptly announced tariffs on 100% of Chinese imports starting November 1st, and canceled the planned US-China meeting during the Asia-Pacific Economic Cooperation (APEC) summit, triggering severe volatility in global financial markets. US stocks initially rose but then fell sharply, with the Dow Jones Industrial Average initially gaining 283 points before plunging 887 points, and the Nasdaq Composite Index plummeting over 3.5%. Risk assets experienced a chain reaction, with the cryptocurrency market experiencing a sharp decline within hours. Bitcoin fell to as low as $102,000, and Ethereum touched a low of $3,392. Total liquidations across the network reached a record high of $19.1 billion. According to Coinglass data, over 1.62 million people worldwide were liquidated, with long positions totaling $16.7 billion and short positions nearly $2.5 billion. Altcoins were hit hardest, with many falling by over 80%, and some smaller tokens even approaching zero. The stablecoin USDe briefly de-pegged to $0.6 on Binance before recovering to above $0.99.

This round of market crash was not only triggered by macroeconomic policy shocks, but also revealed the systemic risk of market makers' funding shortages. After Jump's collapse, market makers took over a large number of projects originally served by Jump, but with limited funds, they prioritized large Tier 0 and Tier 1 projects, causing smaller altcoins to almost lose support during the market sell-off. USDe's high-interest revolving lending activities were liquidated under extreme selling pressure, multiplying leverage and triggering a chain reaction of liquidations, further exacerbating market panic.

Chinese meme

In early October 2025, a social media post by Binance co-founder He Yi, "Wishing you a Binance life," unexpectedly ignited creative enthusiasm within the Chinese crypto community, giving rise to a meme coin called "Binance Life." This concept rapidly gained traction through community sharing and KOL promotion, skyrocketing its market capitalization to $500 million within days—a 6000-fold increase—becoming a phenomenal phenomenon. According to DeFiLlama statistics, the daily trading volume of the BNB chain DEX surged to $6.05 billion, attracting over 100,000 new traders.

It's worth noting that Solana and Base, two public chains primarily known for their memes, have recently seen a surge in popular Chinese memes. Solana's official Twitter account announced its Chinese name as "索拉拉" (Suo Lala), leading to the creation of the meme "索拉拉". The market capitalization of "Base人生" (Base Life) on Base has surpassed tens of millions, and several smaller-cap Chinese memes have also emerged on Base. Currently, with the successive popularity of projects like "Binan Life" (Binan Life), "修仙" (Cultivating Immortals), and "Customer Service Xiao He" (Customer Service Xiao He), Chinese memes have established a significant presence in the crypto market. With the continued expansion of the BSC ecosystem and the participation of more creators, it's expected that even more new meme projects inspired by Chinese topics, characters, or popular internet memes will emerge.

x402 protocol

x402, an AI payment protocol jointly launched by Coinbase and Cloudflare, is inspired by the long-dormant HTTP status code "402 Payment Required". The core innovation of the protocol lies in embedding payment logic into the web page interaction process, making payment an integral part of internet communication and creating a new "Payment as Interaction" model. Through x402, AI Agents, API services, and web applications can directly complete instant stablecoin payments within standard HTTP requests. Due to its inherent support for stablecoins, small amounts, high frequency, and low latency, x402 is suitable for AI Agents to purchase and use data, tools, and computing power on demand. It also allows Web2 services to access on-chain settlement with minimal modifications, eliminating the need for multiple hurdles such as registration, email, or complex signatures.

Although the x402 concept quickly became a hot topic in the market within two days of its launch, driving up the prices of several related projects—PING, for example, saw its price increase nearly 20 times in two days, reaching a market capitalization of $80 million, and Payai's market capitalization peaking at $70 million—its popularity quickly subsided after a week. Many popular projects experienced a nearly 80% correction from their peak. However, the concept has not faded away. With the successive launches of new tokens such as Kite and Pieverse, market attention to the x402 ecosystem is expected to be reignited.

6. Outlook for next month

Predicting the market is entering a phase of accelerated expansion.

In 2024–2025, the prediction market sector experienced explosive growth. The two leading projects, Polymarket and Kalshi, continued to dominate the industry, with their daily trading volume repeatedly exceeding $100 million and their cumulative trading volume reaching tens of billions of dollars. On the capital front, Polymarket and Kalshi completed new rounds of financing at valuations of approximately $9 billion and $5 billion respectively, marking a key inflection point in the prediction market's transition from fringe innovation to mainstream financial infrastructure.

In October, Trump's media outlet TMTG announced its official entry into the prediction market through the Truth Social platform, launching the Truth Predict service. This will not only further expand the influence of prediction markets in American politics and public opinion, but may also become a milestone event in the integration of traditional social media and the crypto prediction market. Simultaneously, capital and public blockchain ecosystem deployments are accelerating. YZI Labs invested in two prediction market projects this month—Opinion and Apro; Limitless, a prediction market protocol in which Coinbase has invested, officially issued its token this month, currently boasting a market capitalization of approximately $350 million. The active entry of mainstream institutions and leading ecosystems signifies that prediction markets are shifting from early "niche crypto experiments" to next-generation financial market infrastructure centered on liquidity, compliance, and composability. The market performance of tokens from projects like Limitless, Opinion (currently unissued), and Apro needs close monitoring, as they may generate new hot topics in the current market lacking compelling narratives.

Market recovery following the black swan event on October 11th

Since the "black swan" event on October 11, the cryptocurrency market has suffered significant structural damage and is likely to remain highly volatile and risky in the short term. On October 30, Trump met with Xi Jinping, easing tensions between the US and China; the following day, the US Senate passed a resolution with 51 votes in favor and 47 against, aiming to end Trump's comprehensive tariff policy globally. This policy shift is a positive signal for the market, potentially releasing expectations of trade easing and improving risk appetite. However, the structural damage has not been immediately repaired: although the tariff regime was rejected by Congress, its actual implementation and the comprehensive trade agreement between the US and China remain uncertain, and the policy's implementation is still subject to uncertainty; furthermore, the US government has shut down due to the failure to pass a budget, with some departments furloughed and operations suspended, weakening fiscal spending and data transparency. The cryptocurrency market is highly dependent on macro liquidity, the strength of the US dollar, geopolitical factors, and regulatory expectations, and multiple variables are still unfolding.

Looking ahead, if trade relations truly improve and drive a recovery in the real economy, it could provide a trigger for a "return to risky assets" in the crypto market. However, if policy implementation lags behind or new frictions arise, it could still trigger capital outflows and renewed market volatility. In this context, key areas of focus should be: first, the progress of US-China trade negotiations and the specific timetable for tariff removal/reinstatement; second, the dollar's trajectory, changes in the liquidity environment, and especially the transmission effects of US monetary and foreign exchange policies; and third, the use of leverage and liquidation risks in the crypto market, as passive liquidation of leveraged positions in a structurally damaged environment can easily trigger a chain reaction.