BitMart Weekly Market Report (October 13-19)

- 核心观点:宏观政策冲击致加密市场普跌。

- 关键要素:

- 特朗普对华关税致BTC单日暴跌。

- 主流币ETH周跌幅达8%。

- Meme板块逆势上涨超20%。

- 市场影响:资金转向高风险资产避险。

- 时效性标注:短期影响。

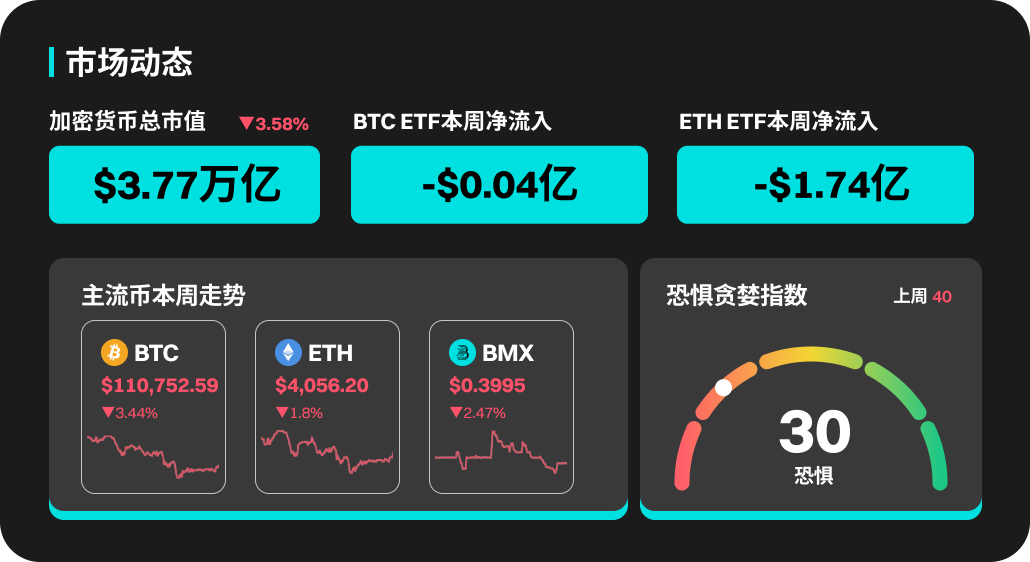

According to BitMart's market report on October 20, the total market value of cryptocurrencies in the past week was 3.77 trillion, down 3.58% from the previous week.

Crypto market dynamics this week

Last week saw significant volatility in Bitcoin's overall price. The upward trend continued at the start of the week, reaching a high of $126,296. However, market sentiment took a sharp turn on Friday after Trump announced 100% tariffs and export controls on Chinese goods. BTC plummeted to $102,000 on Binance before recovering and stabilizing around $112,980. Despite a weekend rebound above $115,000, continued selling pressure pushed the price back below $110,000 midweek, reaching $108,198 on Thursday. As of the current trading day, BTC is trading around $105,700, down over 7% for the week. Market sentiment has shifted to caution, and volatility has increased significantly.

Ethereum also experienced significant volatility. It surged strongly above $4,600 at the start of the week, but quickly retreated due to macroeconomic shocks and option expiration. On the day Trump's tariff announcement was made, ETH plummeted to $3,444 before rebounding to close at $3,836, a single-day drop of over 12%. Despite a brief rebound above $4,200 over the weekend, selling pressure persisted, pushing ETH back below $4,000 mid-week, hitting a low of $3,678. It currently hovers around $3,800. Overall, ETH is down approximately 8% for the week, with the market still impacted by macroeconomic uncertainty and high-volatility option expiration, resulting in a weak short-term outlook.

This week's popular currencies

Among popular cryptocurrencies, ENA, TAO, MORPHO, PAXG, and XAUt all performed well. ENA's price rose 13.29% this week, with a 24-hour trading volume of 1.3 billion. TAO's price rose 8.3%. XAUt and PAXG rose 4.11% and 4.26%, respectively.

U.S. market and hot news

On October 10, President Trump announced a 100% tariff increase on Chinese imports to the US, along with new export controls on "all critical software" effective November 1, further escalating trade tensions between China and the US and unsettling the market. The tariffs were imposed in response to China's expanded restrictions on rare earth minerals. These restrictions mean that foreign companies must obtain Chinese government approval to export products containing even trace amounts of Chinese rare earth elements.

Gold played its role as a hedge against macro uncertainty, rising 5% for the week, while the S&P 500 rebounded from its lows, closing the week down just 0.8%. In contrast, Bitcoin and Ethereum's rebounds were less robust, both closing the week down around 10%.

ETHShanghai 2025 will open on October 22nd

Wanxiang's 11th Blockchain Global Summit will be held on October 23

The U.S. Bureau of Labor Statistics will release the September CPI report at 8:30 a.m. on October 24 (8:30 p.m. Beijing time).

Unlock popular sections and projects

Meme Board

Driven by the Federal Reserve's interest rate cuts and the recovery of market liquidity, risk appetite has significantly increased, and the meme sector has become one of the high-beta sectors that saw the most concentrated inflows of funds last week. According to 7-day data, major meme tokens generally recorded double-digit gains: DOGE +14.2%, PEPE +18.6%, FLOKI +25.3%, WIF +27.8%, and BONK +21.5%, significantly outperforming BTC's +1.5%. Within the sector, differentiation is also evident: SHIB saw a relative stagnation of only +3.9%, while small-cap new tokens such as TURBO and MEMEAI saw gains exceeding 30%, indicating that market capital is favoring projects with compelling narratives and active communities.

Regarding on-chain data, trading activity for Meme coins on Solana and Base has increased significantly. In particular, on-chain transfer volumes for WIF and BONK have both reached monthly highs, reflecting a rapid rise in speculative sentiment. Overall, the Meme sector has regained attention amidst a period of easing liquidity, with funds flowing from mainstream assets and stablecoins to highly volatile small-cap tokens. However, given the rapid short-term gains and the prevalence of emotional trading, caution is warranted regarding potential pullbacks and profit-taking.

LayerZero (ZRO) will unlock approximately 25.71 million tokens at 7:00 PM Beijing time on October 20th, accounting for 7.86% of the current circulating supply and worth approximately $44.2 million.

KAITO (KAITO) will unlock approximately 8.35 million tokens at 8:00 PM Beijing time on October 20th, accounting for 3.06% of the current circulating supply and worth approximately US$8.7 million.

Plasma (XPL) will unlock approximately 88.89 million tokens at 8:00 PM Beijing time on October 25th, accounting for 4.97% of the current circulation and worth approximately $36.9 million.

Risk Warning:

Use of BitMart services is entirely at your own risk. All cryptocurrency investments (including returns) are highly speculative in nature and involve substantial risk of loss. Past, hypothetical, or simulated performance is not necessarily indicative of future results.

The value of digital currencies may rise or fall, and buying, selling, holding, or trading digital currencies may involve significant risks. You should carefully consider whether trading or holding digital currencies is appropriate for you based on your personal investment objectives, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.