Stablecoins on the public blockchain: A new paradigm from value attachment to value capture

- 核心观点:稳定币发行商自建公链以捕获价值。

- 关键要素:

- USDT和USDC占85%市场份额。

- 公链年收手续费上亿美元。

- 发行方推零手续费专属链。

- 市场影响:冲击传统公链,重塑支付生态。

- 时效性标注:中期影响。

1. Current Status of the Stablecoin Market

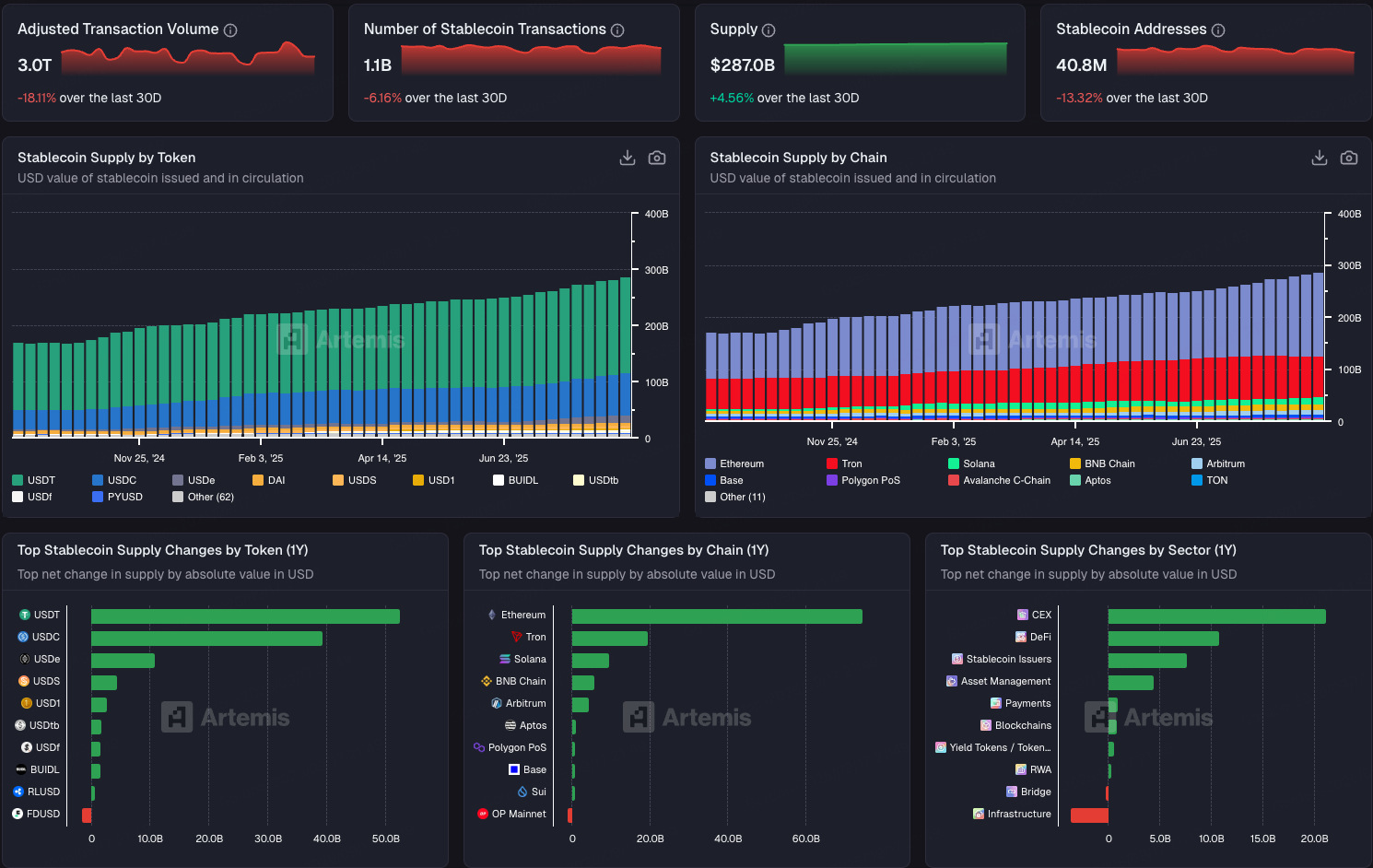

With the gradual implementation of stablecoin regulatory frameworks, stablecoins have become core infrastructure within the crypto-financial system and even cross-border payment networks over the past year. Whether meeting the trading needs of individual investors or traditional institutions exploring clearing, fund transfers, and compliance pilots, stablecoins are serving as a "digital dollar." As of September 2025, the total stablecoin circulation has reached $287 billion, and the market landscape exhibits distinct oligopoly characteristics: Tether's USDT holds approximately 59.6% of the market share, with a market capitalization exceeding $170.9 billion; Circle's USDC ranks second with a 25% share and a market capitalization of $74.2 billion. Together, they account for nearly 85% of the market share. Meanwhile, emerging stablecoins such as USDe, USDS, USD 1, and USDf have also rapidly emerged as mainstream stablecoins.

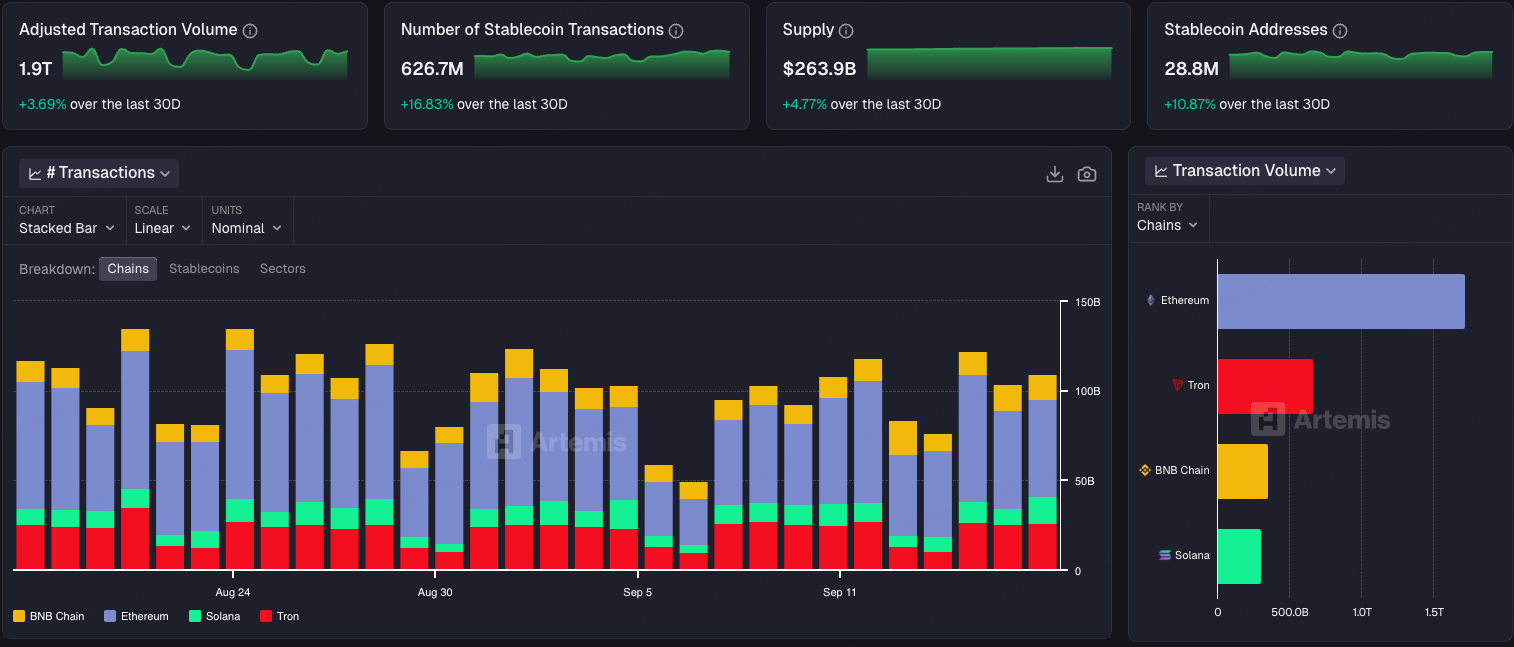

With the rapid expansion of stablecoins, the underlying public chains have become the biggest beneficiaries. In the past month alone, nearly 626 million stablecoin transactions were processed on-chain, with Ethereum, Tron, Solana, and BNB Chain leading the charge. For example, Tron saw approximately 69.8 million stablecoin transactions, with an average transaction fee of between $0.14 and $0.25 per transaction. This translates to monthly fee revenue from stablecoins alone of between $9.7 million and $17.4 million. However, this revenue is not accrued to the stablecoin issuers but rather captured entirely by the public chains. For a long time, the issuance and circulation of stablecoins has been heavily reliant on networks like Ethereum, Tron, and Solana, which provide a trading environment and security. However, with the expansion of transaction volume and application scenarios, the value distribution issues inherent in this dependency model have become increasingly prominent. The fees generated by every stablecoin transfer are captured by the underlying network, leaving issuers with virtually no direct profit sharing. Taking Tron as an example, the annual income from stablecoin transaction fees alone can reach hundreds of millions of dollars, but the issuer's income is zero.

This asymmetric value distribution is prompting stablecoin issuers to accelerate their exploration of independent public chain strategies. Circle launched the Arc blockchain in 2025, emphasizing compliance and payment optimization. Tether has successively released two dedicated stablecoin chains, Plasma and Stable, aiming to recover value previously flowing to Ethereum and Tron back to its own system. Converge, driven by the Ethena team, has also entered the testnet stage, focusing on a new stablecoin ecosystem that combines DeFi with compliance. With the implementation of these projects, the stablecoin industry is entering a new phase of "token-public chain dual-drive," redefining the landscape of value capture and ecosystem building.

2. Why do stablecoin issuers build their own public chains?

The core of the collective launch of stablecoin chains by issuers is to shift from value attachment to value capture. By improving the performance of public chains and strengthening compliance, they provide on-chain users with a dedicated public chain for their stablecoins, thereby expanding the scope of revenue and opening up new business models. The motivations can be summarized as follows:

1. Get rid of public chain dependence and enhance value capture

For stablecoin issuers like Tether and Circle, the more users and transactions they conduct, the higher the revenue generated by external public chains, while their own incremental revenue is close to zero. This imbalance in value capture has become a constraint on the expansion of stablecoins. By building their own chains, issuers gain full control over the underlying architecture, optimizing the stablecoin trading experience while ensuring that the fees and ecosystem benefits generated by every transaction flow directly into their own ecosystem.

2. Optimize the experience and lower the threshold

Under the current model, users need to hold tokens such as ETH and TRX to pay for gas, which is inconvenient. A dedicated chain can realize stablecoins as gas, allowing users to complete transfers and payments without holding additional tokens.

3. Enhance compliance capabilities and smoothly connect with institutions

Compliance has become a must for industry development. Private public chains can be embedded with regulatory nodes, blacklists, and audit functions to meet AML/KYC requirements, lower the entry threshold for institutions and banks, and improve policy friendliness.

4. Expand business models and ecosystems

In the past, stablecoins primarily profited from interest on their reserves. However, after launching on a public blockchain, they can achieve diversified growth through transaction fees, ecosystem applications, and developer networks. For example, Arc emphasizes cross-currency settlement, Stable and Plasma focus on payment networks, and Converge explores the DeFi+ compliance path.

3. Current Issuers’ Stablecoin Public Chains

Tether's dual public chain strategy: Plasma and Stable

As the world's largest stablecoin issuer, Tether launched two projects, Plasma and Stable, in 2025. This dual approach aims to further develop its own stablecoin public blockchain ecosystem. Stable targets institutions and cross-border settlements, while Plasma focuses on retail investors and small-value payments.

Plasma, a Bitcoin sidechain specifically designed for stablecoin payments, has secured $24 million in funding from Tether's parent company, Bitfinex, and Framework. Its governance token, XPL, is now available for pre-market trading on major exchanges, with a market capitalization of approximately $6.5 billion. Its official launch is expected on September 25th. Its key feature is zero-fee USDT transfers, and multiple rounds of USDT staking campaigns have been quickly sold out, demonstrating its market popularity. Plasma's uniqueness lies in its use of the Bitcoin mainnet as the final settlement layer, inheriting UTXO security while also being compatible with the EVM, enabling seamless smart contract migration. Furthermore, Plasma supports native privacy features, allowing users to hide addresses and amounts. It also incorporates BTC through a permissionless bridge, enabling low-slippage exchanges and BTC-collateralized stablecoin lending.

Stable is a payment-focused Layer 1 blockchain built specifically for USDT. Backed by Bitfinex and USDT0, and with Tether CEO Paolo Ardoino as an advisor, its core mission is to enable USDT to more naturally integrate into global payments, cross-border settlement, and institutional clearing scenarios. Stable's key advantage is its native USDT gas. Users can initiate transactions without holding the platform's tokens, and peer-to-peer transfers are completely gas-free, significantly lowering the barrier to entry. The network utilizes the StableBFT consensus, boasting a 0.7-second block time and single-confirmation rate. Future implementations will include parallel processing and a DAG architecture, supporting tens of thousands of transactions per second (TPS), accommodating both small-value payments and institutional clearing. Enterprises can obtain dedicated block space through GuaranteedBlockspace and utilize Confidential Transfer for compliant and private transfers. Stable is EVM-compatible and provides SDKs and APIs for easy application migration. Its wallet supports bank card binding, social login, and easy-to-read addresses, optimizing the Web 2 experience. Its strategy is to attract users with zero gas fees and a simplified experience, using free transfers as a key driver. It will gradually expand into cross-border payments, corporate finance, DeFi micropayments, and merchant acquiring, building a USDT core payment network and establishing a pivotal position once network effects are established.

The most compliant stablecoin public chain: Arc

Arc is Circle's Layer 1 platform designed specifically for stablecoin payments and Reliable Authenticator (RWA) assets. Its core features include using USDC as its native gas and full EVM compatibility. It also offers a specially designed Paymaster channel, allowing businesses to pay for gas using other stablecoins or tokenized fiat currencies, flexibly supporting diverse payment needs.

Arc's greatest advantage lies in its backing from Circle's deep foundation in traditional finance, which gives it a natural compliance advantage. This allows businesses to operate on-chain in a regulated environment, manage risk, and comply with regulatory requirements. To meet the needs of institutions, Arc has designed a series of specialized financial tools, including the ability to tokenize traditional assets like real estate and equity, as well as solutions for building enterprise-grade digital payment systems. This not only lowers the barrier to entry for traditional businesses on the blockchain but also provides secure and efficient financial infrastructure for institutions requiring compliance assurance.

DeFi + Stablecoin Public Chain: Converge

Converge is a public blockchain for RWA stablecoins jointly developed by Ethena Labs and Securitize. They focus on building a public settlement chain that meets the compliance needs of financial institutions while leveraging the decentralized advantages of DeFi. Its core design highlights high performance: Collaborating with Arbitrum and Celestia, it pushes performance limits to achieve block times of 100 milliseconds, thereby reducing cross-chain asset attrition costs. High compliance: USDe and USDtb are used for transaction fees, with USDtb relying on a stablecoin backed by the BUIDL Fund to achieve high compliance. High security: Incorporating Securitize's RegTech module, it introduces a unique Validator Network (CVN), which uses Ethena's ENA token for staking to ensure network security. CVN utilizes a permissioned validator (PoS) model and incorporates Know Your Customer (KYC)/Know Your Customer (KYB) mechanisms to ensure validators meet compliance requirements. This design is specifically targeted at institutional users, meeting their risk management and compliance needs.

4. Future Development

From a long-term perspective, the collective launch of self-built public chains by stablecoin issuers will undoubtedly challenge the dominance of established public chains like Ethereum and Tron. Leveraging the inherent design of stablecoins, these new chains offer unique advantages in their mechanisms, such as zero-fee transactions, the use of stablecoins as gas, and clearing and channel solutions tailored for institutional users. This highly verticalized architecture not only lowers the barrier to user migration but also significantly improves capital flow efficiency. The recent surge in Plasma staking activity is a prime example of the rapidly growing market interest in this new type of chain. More importantly, stablecoin issuers already have strong compliance and security systems in place. This inherent credibility and design will significantly enhance their acceptance among traditional financial institutions, driving a further influx of institutional capital.

However, realistically, self-built public chains will not completely replace established public chains like Ethereum and Tron in the short term. A more rational structure is one of complementary division of labor: stablecoin public chains focus more on deterministic settlement and large-scale payment flows, providing stable and efficient infrastructure; while ETH, SOL, and others remain the core platforms for innovative applications, complex financial instruments, and open ecosystems. Due to the highly diversified ecosystems of established public chains like Ethereum, they are difficult to disrupt for a while. The biggest potential variable may lie with TRON, whose stablecoin market share is heavily dependent on USDT. Once the Tether-dominated stable chain matures, TRON's core advantage will be weakened. Overall, the emergence of stablecoin public chains marks a new stage in the crypto market, driven by a dual-engine strategy of stablecoins and public chains. This has the potential to reshape the global payment and clearing system while also forcing traditional finance to reposition its role. The coming years are likely to be a critical turning point in the evolution of global financial infrastructure.

Risk Warning:

The above information is for informational purposes only and should not be construed as a recommendation to buy, sell, or hold any financial asset. All information is provided in good faith. However, we make no representations or warranties, express or implied, as to the accuracy, adequacy, validity, reliability, availability, or completeness of such information.

All cryptocurrency investments (including financial products) are inherently highly speculative and carry significant risks of loss. Past performance, hypothetical results, or simulated data are not necessarily indicative of future results. The value of digital currencies may rise or fall, and buying, selling, holding, or trading digital currencies may involve significant risks. Before trading or holding digital currencies, you should carefully evaluate whether such investments are suitable based on your investment objectives, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.