Panoramic Analysis of WLFI Ecosystem and Token Economy: From USD1 Stablecoin Layout to Strategic Listed Company Binding

- 核心观点:WLFI构建USD 1稳定币生态,获上市公司战略投资。

- 关键要素:

- ALT 5 Sigma计划投资15亿美元。

- USD 1稳定币市值突破24亿美元。

- 代币初始流通市值约57亿美元。

- 市场影响:提升合规性与生态多样性,但存在抛压风险。

- 时效性标注:中期影响。

1. Latest Project Progress

Over the past year, World Liberty Financial (WLFI), centered around the USD 1 stablecoin, has gradually built a DeFi ecosystem encompassing lending, trading, payments, memes, LSD, AI, and public blockchains. Its strategic approach can be summarized in three steps: First, implementing DeFi scenarios like lending and trading on mainstream public chains like BSC, Ethereum, and Solana to build foundational demand for USD 1. Second, through investment and partnerships, it will integrate USD 1 into emerging sectors like memes, stablecoins, and AI, increasing usage and user engagement. Finally, it will invest strategically and participate in early-stage investments in promising projects, acquiring token equity and driving further USD 1 penetration.

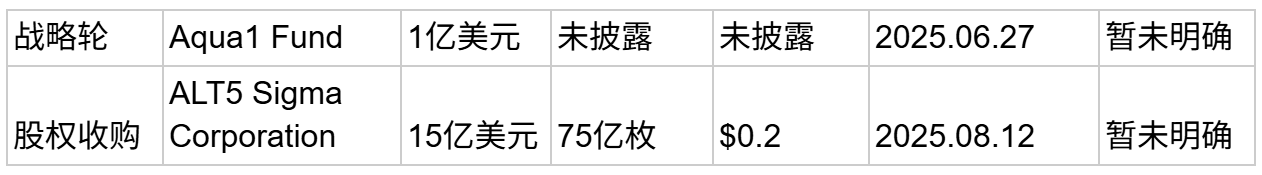

WLFI has completed four major financing rounds to date, including two public offerings priced at $0.015 and $0.05, respectively. The strategic round brought in leading institutions such as Justin Sun (Tron DAO), DWF Labs, Aqua 1 Fund, and Web 3 Port. The most significant event was WLFI's deep integration with Nasdaq-listed Alt 5 Sigma. In its latest S1 filing, Alt 5 Sigma announced plans to invest $1.5 billion in WLFI's governance tokens. This arrangement is widely viewed in the market as analogous to MicroStrategy's Bitcoin treasury model, which integrates tokens into corporate finances through holdings by listed companies, thereby giving them greater financialization and compliance attributes. Eric Trump joined Alt 5 Sigma's board of directors, while WLFI CEO Zach Witkoff assumed the role of chairman.

WLFI purchase cost list for each round

2. WLFI Token Economy and Market Performance

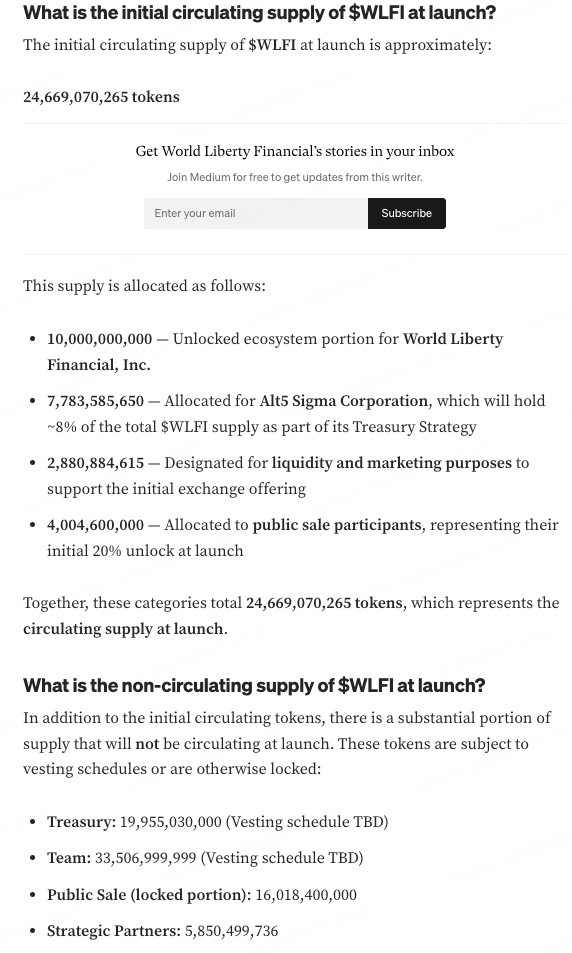

According to the WLFI blog, the initial circulation of TGE is 24,669,070,265 tokens, which is 24.6%, including

- 10 billion: Ecosystem

- 7.78 billion: Attributable to Alt 5

- 2.88 billion: for DEX & CEX liquidity and marketing

- 4 billion: Attributable to public investors

The portion of Alt 5 tokens that will theoretically not be circulated at the TGE is a strategic reserve. According to a tweet from a member of the WLFI wallet department, the ecosystem portion is related to the USD 1 points program and will therefore not be circulated at the TGE. Therefore, the actual circulating portion is the 20% unlocked from the public offering (a total of 4.288 billion tokens), while the remaining tokens will remain locked.

Market performance

After launching on September 1st, WLFI's token price has been relatively cautious due to the lack of transparency surrounding its initial circulation size. The price surged to $0.32 during the TGE, but quickly retreated due to selling pressure. As of September 2nd, it had fallen back to around $0.225. This gives WLFI an initial circulating market capitalization of approximately $5.71 billion, and a fully diluted valuation (FDV) of $23.1 billion.

In terms of returns, investors who participated in the first public offering at $0.015 saw a peak return of nearly 20x. Even participants in the second public offering at $0.05 saw returns multiplied several times during the TGE. Some strategic investors, such as Web 3 Port and DWF Labs, also saw significant returns in the short term. In contrast, ALT 5 Sigma entered the market through a large-scale strategic acquisition at $0.20, with its cost price nearly equivalent to the current price, creating a natural psychological support range in the market. Pre-market trading shows that WLFI has seen repeated buying near $0.20. A subsequent decline below this range could trigger a larger, emotional sell-off.

Currently, WLFI's price fluctuations are primarily influenced by two variables: first, the periodic selling pressure from investors in the public offering, and second, whether ecosystem allocations and the ALT 5 Sigma strategic reserve will flow into the secondary market. If the ecosystem token is indeed deeply tied to the USD 1 points program as officials have claimed, and if actual circulation is difficult in the short term, market selling pressure will be relatively manageable. However, if there is a mismatch in funding expectations, such as premature cashing out by ALT 5 Sigma or some ecosystem funds, WLFI's price stability may still face significant challenges.

3. WLFI Ecosystem

DeFi

1. Dolomite

Dolomite is a decentralized lending and margin trading protocol deployed on Ethereum. Dolomite has already pioneered integration with USD 1 (USD 1) and has adjusted its primary market trading pair to DOLO/USD 1, making it one of the largest USD 1 DeFi platforms. Currently, Dolomite provides approximately 90% of USD 1 lending liquidity on Ethereum and serves as the most important hub for WLFI within the Ethereum ecosystem. Dolomite co-founder Corey Caplan also serves as WLFI's CTO, ensuring a close integration with WLFI in terms of both its mechanisms and ecosystem.

2. Lista DAO

Lista DAO, a stablecoin and lending platform running on BSC, announced a strategic partnership with WLFI in May of this year, integrating USD 1 into Lista DAO's treasury system. Users can use USD 1 as collateral to borrow lisUSD. A USD 1/lisUSD liquidity pool has been established on PancakeSwap. WLFI facilitated the integration of USD 1 into Lista DAO, enhancing its lending and liquidity scenarios on BSC.

3. StakeStone

StakeStone is a full-chain LSD liquidity protocol. In May, it announced a partnership with WLFI to provide USD 1 users with full-chain liquidity infrastructure and cross-chain staking returns. Users can obtain more liquidity and returns on their pledged assets through USD 1.

Token Launch Platform

1. Lets.Bonk

Bonk.fun has partnered with WLFI to become the official launchpad for USD 1 on Solana. Its plan is to leverage the popularity of stablecoins and meme communities to drive the launch of more new projects based on USD 1.

2. Buildon

Buildon is a meme project launched on BSC. It plans to launch a USD 1 exclusive Launchpad feature in the future. This mechanism will integrate USD 1 into the meme scene and leverage the traffic effect to enhance the ecological influence of WLFI.

3. Blockstreet

Blockstreet is the official launch platform for WLFI, and co-founder Matthew Morgan is an advisor to WLFI and the CIO (Chief Information Officer) of ALT 5 Sigma, a Nasdaq-listed company that raised $1.5 billion to launch the WLFI treasury.

4. AOL

AOL is the Meme coin launched on Bonk.fun by WLFI advisor @cryptogle, who announced the launch of the Launchpad project America.fun.

RWA and Stablecoins

1. USD 1

USD 1 is a US dollar stablecoin issued by WLFI in March. As of September 1, its market capitalization exceeded US$2.4 billion. It has been deployed on BNB Chain, Ethereum, Tron, and Solana, with BNB Chain accounting for over 88.5% and becoming the main circulation network.

2. Chainlink (LINK)

WLFI has achieved cross-chain interoperability of USD 1 through Chainlink's CCIP technology, expanding its multi-chain applications.

3. Ethena (ENA)

WLFI established a partnership with Ethena Labs in December last year, and the two parties explored long-term collaboration using sUSDe as a starting point.

4. Ondo Finance (ONDO)

WLFI reached a cooperation with Ondo Finance in February, planning to include Ondo's RWA products (USDY, OUSG, etc.) in the reserves to enhance the asset support capacity of USD 1.

5. Falcon Finance

Falcon Finance is a synthetic stablecoin platform launched by DWF Labs, utilizing a dual-token model: USDf (stablecoin) and sUSDf (yield certificate). WLFI has made a strategic investment of $10 million and allows users to participate in Falcon's minting and earnings with USD 1.

6. Plume Network

Plume Network is an EVM public chain focused on RWAs, supporting the issuance of native stablecoins such as pUSD. WLFI has adopted USD 1 as its reserve asset to support the stability of pUSD. USD 1 has become the base currency of the Plume ecosystem, helping WLFI to deeply penetrate the RWA narrative.

Other projects

1. Vaulta (formerly EOS)

Vaulta, the rebranded public blockchain from EOS, is positioned as a Web 3 banking infrastructure, supporting asset custody, cross-chain payments, and lending. WLFI has pledged $6 million and integrated USD 1 as its core settlement asset.

2. EGL 1

EGL 1 is the winner of the USD 1 trading competition held by Four.Meme.

3. Liberty

Meme coin deployed on BNB Chain, a charity platform based on USD 1.

4. U

The WLFI public wallet holds over 45% of the Meme coin supply on BNB Chain.

5. Tagger

Tagger is a decentralized AI data platform that uses USD 1 as the settlement currency for Web 2 client enterprise orders, and plans to reward data annotators with USD 1.

IV. Summary

From the perspective of WLFI price, there are two potential possibilities for the actual circulation of WLFI:

1. Ideal Circulation Estimation

According to official WLFI data, only approximately 24.66 billion tokens were unlocked in the initial TGE, including 4 billion tokens allocated to public investors (approximately 20% of which are tradable), 2.88 billion tokens allocated for liquidity and marketing, and 2.88 billion tokens allocated for Alt 5 reserves and ecosystem allocations. While these tokens are nominally "unlocked," officials note that these tokens are tied to strategic reserves or the USD 1 Points program and, in theory, will not immediately enter circulation. Based on this logic, the current actual circulating supply is approximately 6.88 billion tokens, equivalent to a market capitalization of approximately $1.58 billion (based on the current trading price of $0.23).

2. Unlock the potential selling pressure risk in the structure

Conversely, both Alt 5 Sigma's strategic reserves and the ecosystem's reserves offer the flexibility to become future sell-off channels. While Alt 5 may not sell off immediately, if market returns are attractive, there's an urge to profit. The 10 billion tokens allocated by the ecosystem represent a potential flood of supply. Once a large amount is unlocked and enters the market, it will put significant pressure on trading depth and prices, becoming a destabilizing factor in the WLFI market.

Looking ahead, WLFI's development will continue to be centered around the USD 1 stablecoin ecosystem. As WLFI establishes partnerships with more projects or launches new features like staking and lending, it is expected to not only boost the market value of the associated project tokens but also further enrich the application scenarios and ecosystem diversity of the WLFI token. Furthermore, ALT 5 Sigma's $1.5 billion investment and its deep ties to the board of directors signify WLFI's successful integration into the core narrative of the compliant financial system. If it can replicate MicroStrategy's Bitcoin "corporate treasury" model, WLFI is expected to gain greater recognition in traditional financial markets and enhance its long-term financialization potential.

Risk Warning:

The above information is for informational purposes only and should not be construed as a recommendation to buy, sell, or hold any financial asset. All information is provided in good faith. However, we make no representations or warranties, express or implied, as to the accuracy, adequacy, validity, reliability, availability, or completeness of such information.

All cryptocurrency investments (including financial products) are inherently highly speculative and carry significant risks of loss. Past performance, hypothetical results, or simulated data are not necessarily indicative of future results. The value of digital currencies may rise or fall, and buying, selling, holding, or trading digital currencies may involve significant risks. Before trading or holding digital currencies, you should carefully evaluate whether such investments are suitable based on your investment objectives, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.