Original title: 11 Potential Crypto Narratives in the next 6 months

Original author: @PinkBrains_io

Original translation by Peggy, BlockBeats

Editor's Note: In the crypto world, narrative is the steering wheel of capital. This article outlines 11 of the most noteworthy crypto narratives, providing a comprehensive overview of the latest developments and potential sectors within the crypto ecosystem.

In a rapidly rotating market, instead of chasing every upward trend, it's better to select a few narratives, conduct in-depth research, and plan ahead. Hopefully, this article will provide you with a clear perspective and actionable guidance.

The following is a breakdown and analysis of 11 crypto narratives that are worth noting.

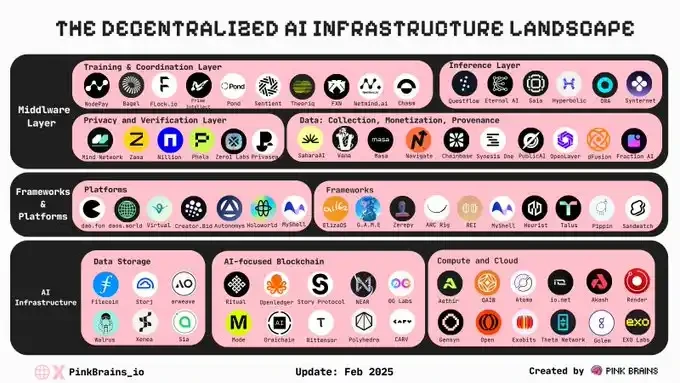

AI infrastructure and AI agents

Crypto x AI is no longer just about "AI tokens rising in tandem with Nvidia (NVDA)". The core question now is: "Who owns the computing power, who owns the data, and who owns the intelligent agents?" This is a battle for ownership.

Two important sub-narratives:

Decentralized AI infrastructure/computing power/training network

Representative projects include: OpenTensor, Gensyn, Kite, Flock, Fraction, Nous, Prime Intellect, Vana, etc.

On-chain AI agents: tradable, executable, and rewardable

Representative projects include: Mode, OpenServ, PlayAI, NOF1, Allora, etc.

The latest catalysts are ERC-8004 and x402.

ERC-8004: Ethereum developers are standardizing AI agents as tokenizable objects. ERC-8004 allows you to create an AI agent like minting an NFT, attach a reputation score on-chain, and perform delegation operations.

x402: An open inter-agent payment channel built by Coinbase for processing payments. This mechanism supports micropayments, API access, and settlement without intermediaries—Gartner predicts that this type of economy could reach $30 trillion by 2030.

This new narrative is just one example of how AI agents achieve product-market fit. They also have many other real-world applications of PFM (Personal Financial Management), such as trading, automated research, and e-commerce.

Projects worth noting in the AI intelligent agent field include: Virtuals, Almanak, Recall, and Talus Labs.

In a broader crypto x AI narrative, the following directions are worth noting:

AI funding platforms: USDai, Gaib

Decentralized Identity: Worldcoin

AI is still an emerging field in the technology sector, and more projects will emerge in the future. We recommend following @Defi0xJeff to get the latest updates in the AI field.

[ Related Reading ]

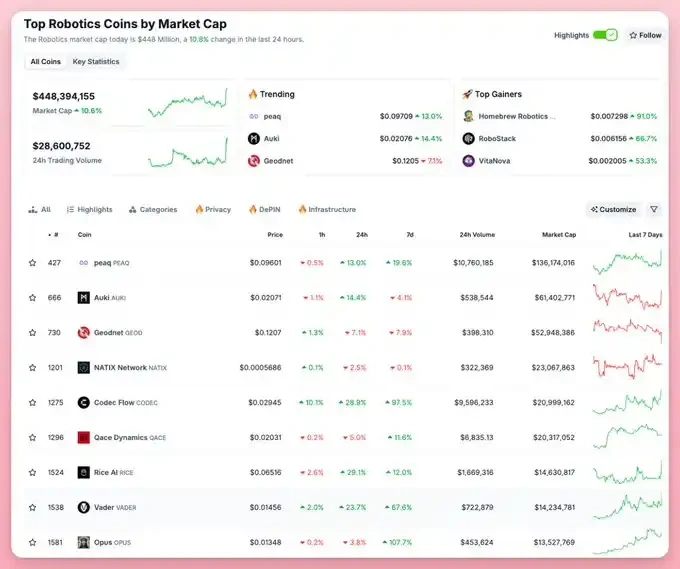

Robotics

Robotics may be another "epiphany" moment in the field of cryptography.

Web2 is investing billions of dollars in this sector, while the total market capitalization of the crypto market is only $440 million. Project 1X has just opened pre-orders for its NEO home robot, priced at $499 per month or a one-time payment of $20,000.

Starting next year, people may have humanoid robot companions to assist with various tasks at home (and very efficiently).

The bullish logic for crypto-robot narratives is simple: real-world applications require high-quality data, reliable multi-robot systems, and lower hardware costs.

New crypto projects are addressing these challenges:

Peaq provides machine IDs and a payment system for autonomous robots. In Hong Kong's "robot farms," robots are responsible for growing and selling crops, with the revenue paid to the NFT-based farm owners. This is a classic example of robot cash flow → token rewards.

PrismaX: Building a data marketplace that connects human operators with robots through remote operation.

OVR: Users can scan real-world spaces with their phones or 360° cameras and earn token rewards. Its spatial data from over 150,000 locations and 70 million images helps robots identify and navigate new environments.

Sui Network: Demonstrates multi-bot collaboration. Sui employs the Mysticeti consensus protocol, supporting ultra-low latency consensus mechanisms and dynamic object management.

OpenMind AGI, backed by Pantera Capital, is building "the Android of robots." Its OM1 operating system allows a single personality to run across all robot types.

Edge Network: Build a decentralized AWS for edge computing and robotic inference hardware, and integrate with DePIN infrastructure.

GEODNET: A decentralized RTK network that provides centimeter-level positioning data, offering precise layer support for the robotics economy.

[ Related Reading ]

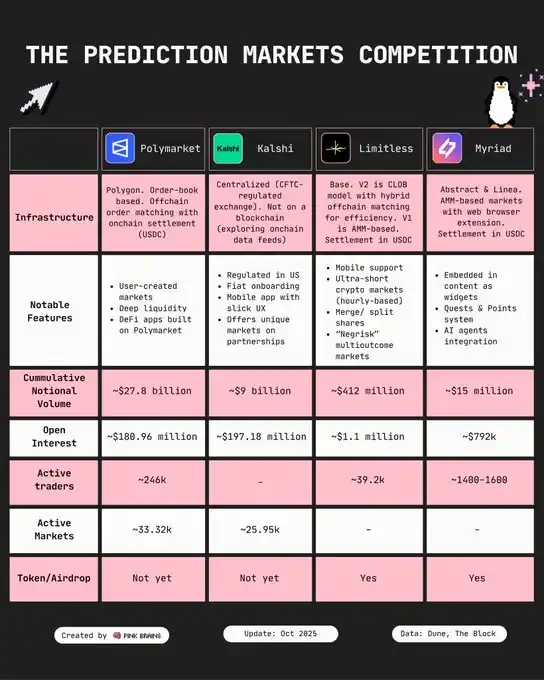

Prediction Markets

Prediction markets are gaining mainstream traction during the 2024 US presidential election, led by Polymarket and Kalshi, with monthly trading volumes reaching billions of dollars.

Despite doubts about whether the post-election hype would subside, by 2025, trading volume had increased nearly fivefold, approaching all-time highs.

Numerous catalysts are emerging for the crypto prediction market:

The parent company of the New York Stock Exchange announced plans to invest up to $2 billion in Polymarket, valuing the company at approximately $8 billion pre-transaction.

Polymarket acquired QCX, a CFTC-licensed clearing firm, for $112 million, allowing it to legally resume operations in the United States.

The NHL (National Hockey League) has signed a multi-year partnership agreement with Kalshi and Polymarket, granting them official data, brand usage rights, and broadcast exposure.

Key projects to watch in this sector include: Polymarket, Kalshi, Myriad Markets, and Opinion Labs (backed by YZi Labs).

Apart from TryLimitless, other platforms have not yet issued tokens, making them worth trying.

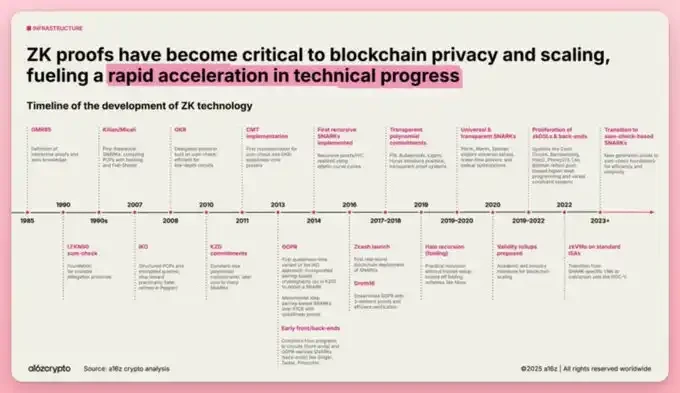

Privacy

With the widespread adoption of Web3, the demand for on-chain privacy is also growing.

Currently, there are three main technical approaches to achieving on-chain privacy:

Trusted Execution Environment (TEE): Similar to a hardware safe, it's used to run sensitive code. Smart contracts or applications can execute logic within this secure chip, undetectable from the outside. Representative projects include: Oasis Protocol, Secret Network, and Phala Network.

Zero-knowledge proofs (ZKP): Provers can prove a statement to a verifier as true without exposing the underlying data. ZKP is widely used in blockchains, rollups, decentralized exchanges, crypto cards, and tools. Representative projects include: Zcash, Polygon, Starknet, zkSync, Lighter, Hibachi, and Payy. ZKP infrastructure projects include: Succinct Labs and Boundless.

a16z also emphasized that ZKP is a key infrastructure for blockchain privacy and scalability.

Fully homomorphic encryption (FHE): Allows direct computation on encrypted data without decryption. It supports running arbitrary logic (such as smart contracts, analytics, etc.) in an encrypted state, making it an ideal technology for "default privacy" systems. Representative projects include: Zama, Mind Network, and Fhenix.

Other privacy-preserving supercomputing infrastructures, such as Nillion and Arcium, focus on building the underlying capabilities for privacy-preserving computing.

Revenue-Generating Protocols

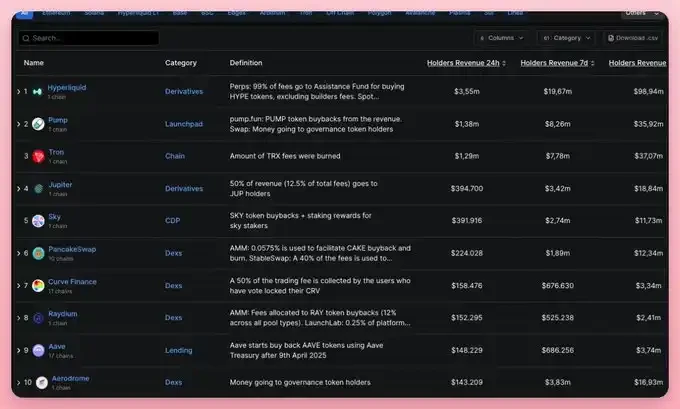

In September alone, DeFi protocols generated approximately $600 million in fees.

Uniswap: Governance is openly pushing forward with a "fee switch" mechanism.

Aave: It has officially channeled surplus funds into reserves and buyback mechanisms, and governance has begun to focus on cash flow.

Hyperliquid is a prime example in this sector. Its annualized protocol revenue is approximately $1.2 billion, with about $99 million in revenue over the past 30 days, of which approximately 95% was used to buy back its token $HYPE and reward holders.

GMX: This year, it has spent more than $20 million to buy back about 13% of the token supply, returning the value to stakers.

Last year, the market was dominated by memes, but this year, more emphasis is placed on fundamentals. The real winners are those projects that can convert real revenue into token value and achieve growth through a "buy-burn flywheel".

You can track project revenue and holder gains through platforms such as DefiLlama, Dune, and Token Terminal. Projects worth watching in this sector include: $HYPE, $AAVE, $ENA, $PUMP, $SKY, $AERO, and $JUP.

Stablecoins

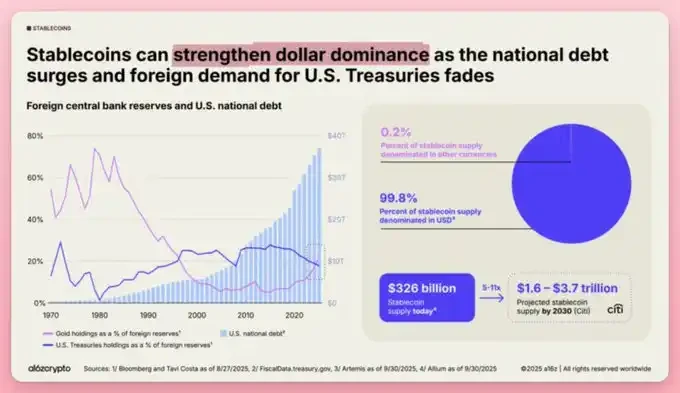

After the passage of the GENIUS Act, stablecoins officially entered the U.S. federal payment system from the gray area.

According to reports, stablecoin payments have increased by about 70% since the GENIUS Act, as businesses can finally run dollar payment systems on-chain more securely and efficiently.

According to a16z's report, stablecoins could further strengthen the dollar's global dominance against the backdrop of surging US Treasury bonds and weakening foreign demand for US debt.

Stablecoins are also merging with RWAs (Real-World Assets): new “interest-bearing stablecoins” have emerged, backed by tokenized U.S. Treasury bonds and other RWAs. This leads to the RWA narrative in the next section.

The ecosystem of interest-bearing stablecoins is very broad; it is recommended to read relevant summaries for a more comprehensive overview.

[ Related Reading ]

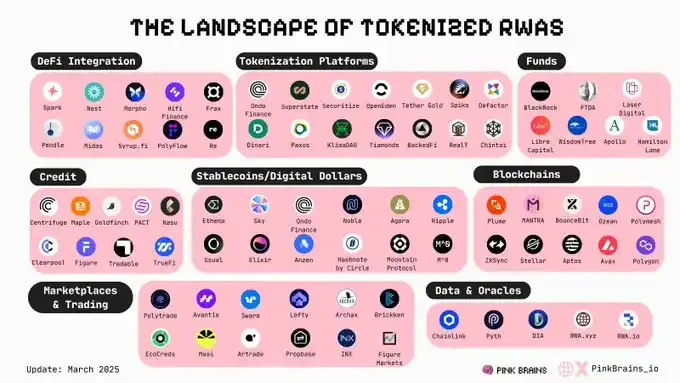

RWA / Asset Tokenization

RWA experienced strong growth this year thanks to the stablecoin craze, but as the world gradually moves onto blockchain, the wave of asset tokenization is only just beginning.

Tokenized U.S. Treasury bonds surged from $800 million to over $7.3 billion (as of September 2025), dominated by institutions such as BlackRock's BUIDL, Franklin Templeton, Ondo Finance, and Janus Henderson's JTRSY. These institutions hold idle funds in tokenized Treasury bond funds for instant settlement and returns.

Sky and Spark have turned RWA into a flywheel mechanism: Spark channels billions of dollars of stablecoin liquidity on-chain into government bonds and credit products, and then returns the yields to DeFi and its token economy.

The collateral mechanism is a key catalyst for RWA. Once perpetual contract DEXs, lending markets, and stablecoins begin using tokenized government bonds and credit assets as underlying collateral, RWA can become a core infrastructure of DeFi.

Not only Ethereum, but other chains such as Solana, Avax and Sui are also making asset tokenization a key development direction.

RWA projects worth noting include: Maple Finance, Sky, Plume, Clearpool, Midas, and Multiplifi.

You can view the latest data for this track via RWA.xyz.

[ Related Reading ]

Neobanks, the new crypto bank

Stablecoin payments and the crypto adoption of financial giants like VISA and Mastercard have driven a new narrative in the crypto space—the new crypto bank.

A new crypto bank is vying to become the "global permissionless version of Revolut," but with self-custody, stablecoins, crypto assets, and rewards mechanisms. It combines the convenience of traditional banking with the control of DeFi, allowing users to manage fiat currency and crypto assets on a single platform.

The core characteristics of the new bank include:

Integrated account: Savings, spending, transfers, and earning returns can all be done in one account.

Stablecoin-based: Use stablecoins such as USDT, USDC, and USDe as consumable currencies.

Built-in channel: Enables instant conversion between encrypted and fiat currencies by binding cards, relying on licensed banks and compliant payment networks.

User control: The self-custody mechanism ensures that funds belong to the users.

Representative projects include:

Plasma: The first new bank natively built on stablecoins, offering 4% cashback, 10%+ spending rewards, zero-fee USD₮ transfers, and a unified ecosystem within a single app; register to receive a virtual card.

Tria: A new self-custodied bank based on Arbitrum, supported by Wintermute, the Ethereum Foundation, and others. It offers virtual/physical cards, AI-optimized exchange, gas-free cross-chain payments, and built-in yield strategies.

EtherFi: The fastest-growing new stablecoin bank, expanding restaking into a fintech experience, with a TVL of $10.1 billion, a market capitalization of $629 million, and an FDV of $1.1 billion, supporting 3% cashback credit cards.

Avici Money: A fully on-chain, self-custodied internet banking infrastructure that eliminates reliance on central banks while integrating fiat currency channels, supporting Visa cards and USD/EUR virtual accounts, and enabling seamless conversion between fiat currency and crypto assets via Wise, SEPA, and ACH.

UR Global by Mantle: A new Swiss compliant bank connecting fiat currency and DeFi in Asia, offering zero withdrawal fees, free transfers, and a 5% annualized return on USDe. It supports multi-currency accounts and Mastercard global payments.

Frax Finance: Building a stablecoin operating system. frxUSD is a Frax stablecoin compliant with the GENIUS standard. FraxNet is its on-chain account system for minting, redeeming, and earning yield. Fraxtal is its high-performance Layer 1 blockchain that supports asset issuance, settlement, and real-time yield.

[ Related Reading ]

Perpetual contract DEXs (Perp DEXs)

In October 2025, the trading volume of decentralized perpetual contracts exceeded $1 trillion.

HyperliquidX leads the pack ($294 billion), followed by Lighter ($257 billion) and Aster ($225 billion). The sector's total monthly trading volume exceeds $1.06 trillion.

Hyperliquid has essentially become a high-performance chain and has launched its native stablecoin USDH. HIP3 enhances its financial capabilities, and the HyperEVM ecosystem has enormous potential.

Lighter is currently in public beta testing. It adopts a zkRollup + off-chain matching + on-chain settlement model, with a matching speed of less than 5 milliseconds. Its goal is to achieve institutional-grade latency. At the same time, it still uses Ethereum for proof-of-concept settlement and is the leader in the "CLOB on zkRollup" track.

Aster is a privacy-focused perpetual contract DEX on BNBChain, backed by YZi Labs.

Perpetual contract DEXs are among the strongest product-to-market fits (PMF) in the current crypto space, but the competition is also extremely fierce.

The current bullish logic is based on airdrops. We recommend paying attention to emerging tokenless perpetual contract DEXs and the HyperEVM ecosystem.

[ Related Reading ]

ICO and Token Sale Platforms

This is a sector whose discussion level is far lower than its potential. The 2021-style Launchpad is making a comeback, but with a more gamified design and a greater emphasis on KYC compliance.

Some of the top-performing ICO platforms include:

KaitoAI Capital Launchpad: Funds are allocated in stages based on social reputation, the Kaito ecosystem, and community consensus, with each offering being oversubscribed. Representative projects: Limitless, zkPass, Novastro, Hana Network, Theoriq.

Echo: Acquired by Coinbase for approximately $375 million, it raised over $200 million in 300 sales. Coinbase is integrating Echo, bringing on-chain fundraising directly to its exchange. Representative projects: MegaETH, Plasma.

Legion: Quota scoring is based on Clout + Degen + Dev metrics (social, on-chain, development). Recently successful launches include Yieldbasis and Almanak.

MetaDAO: A governance and fundraising platform on Solana, evolving from a "governance-as-a-service" platform to a platform for launching ownership tokens. It has raised nearly $18 million in total, with its three recent projects (Avici, Umbra, and Omnipair) all oversubscribed.

Buidlpad: One of the most active ICO platforms, with strong social media presence. Representative projects include: Momentum, Falcon, Lombard, and SaharaAI.

Jupiter Exchange will also launch its ICO platform in November.

At the other extreme of token launch platforms is Meme Launchpad, spearheaded by Pump.fun, as the internet capital market expands to multiple platforms.

However, the risks are also high, as most new tokens are simply Meme tokens. A smarter approach is to support the platform rather than blindly chasing after tokens.

[ Related Reading ]

11. High-performance blockchains

The scaling narrative has shifted from "cheaper than Ethereum" to "real-time, Wall Street-level throughput".

The goal of the next generation of high-performance blockchains is to support real-time applications, such as real-time perpetual contract order books, AI agent clusters, and settlement layers with Web2 speeds, without sacrificing Ethereum-level security and finality.

Monad: Fully compatible with EVM, supports parallel execution, achieving approximately 10,000 TPS, 1 second block production, and 0.8 seconds final confirmation, while reducing hardware costs through a customized architecture.

MegaETH: The first truly real-time blockchain, aiming for sub-millisecond latency and 100,000 TPS. It operates using a single, ultra-fast sorter, with future plans to achieve decentralization through rotating sorters and fraud/failure proofs. Its $MEGA ICO was oversubscribed 5.8 times, raising $275 million.

Rise Chain: The fastest Rollup-based chain, boasting a processing capacity of 100,000 TPS, a throughput of 10 Ggas/s, and a confirmation time of only 5 milliseconds. Ideal for CLOB perpetual contracts, high-frequency trading, and real-time AI collaboration.

These three chains are currently in the pre-mainnet stage.

On the other hand, some other Layer 1 (L1) blockchains have already verified their performance on the mainnet:

Sei Network: An EVM-compatible L1 network that employs parallel execution and Twin Turbo consensus mechanism to achieve final confirmation in less than 400 milliseconds, with a target of over 200,000 TPS.

Aptos Network: Providing over 160,000 TPS and sub-second final confirmation, it recently reached new partnerships with Google Cloud, Flowdesk, and others, and launched the Aptos Connect wallet layer.

Sui Network: Achieves approximately 130,000 TPS and approximately 480 milliseconds final confirmation, and has been integrated into ecosystems such as Alibaba Cloud, BytePlus, and Playtron.

Sonic Labs: Reconstructed from Fantom, aiming for 400,000 TPS and sub-second final confirmation, and launched a $150 million U.S. capital markets initiative to support RWA and ETF integration.

In this narrative, the real winners will be the blockchain projects that can support killer applications, retain users, and achieve large-scale connectivity with Web2 enterprises.

Crypto narratives change rapidly. Our advice is: don't try to chase every surge, but instead select a few narratives, study them in depth, and plan ahead.

- 核心观点:未来6个月关注11个加密赛道叙事。

- 关键要素:

- AI智能体与算力所有权之争。

- RWA代币化规模激增至73亿美元。

- 永续合约DEX月交易量破万亿美元。

- 市场影响:引导资本流向新兴高增长领域。

- 时效性标注:中期影响