September Web3 Funding Report: Capital Chases Liquidity and Maturity

- 核心观点:Web3融资势头强劲但结构失衡。

- 关键要素:

- 9月融资72亿美元创春季来新高。

- 后期投资主导,Flying Tulip种子轮例外。

- 种子前融资持续下滑,新基金规模缩小。

- 市场影响:资本向成熟项目集中,早期融资承压。

- 时效性标注:中期影响

Original author: Robert Osborne, Outlier Ventures

Original translation by: AididiaoJP, Foresight News

Web3 funding surged in September 2025 but did not reach its peak.

160 deals raised $7.2 billion, the highest total since the spring surge. However, with the notable exception of seed-stage Flying Tulip, later-stage capital investment dominated, as was the case in the previous two months.

Market Overview: Strong but Top-Heavy

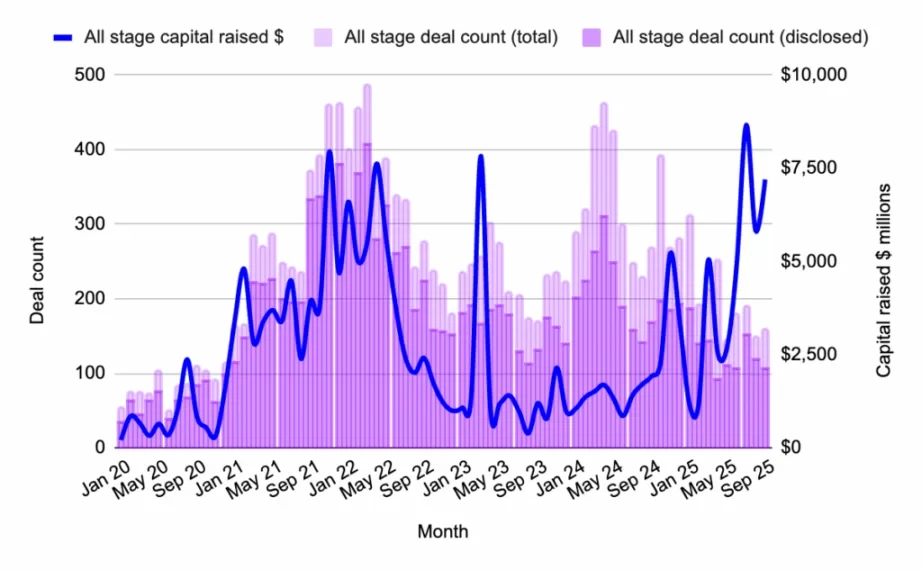

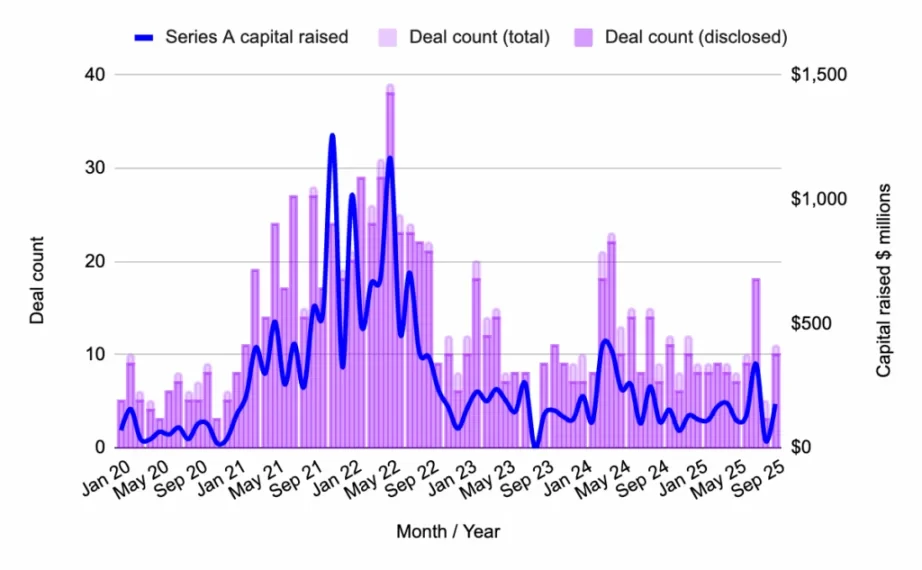

Figure 1: Number of Web3 capital deployments and transactions at each stage from January 2020 to September 2025. Source: Messari, Outlier Ventures.

- Total capital raised (disclosed): US$7.2 billion

- Disclosed transactions: 106

- Total transactions: 160

At first glance, September appears to be a high-profile return of risk appetite. However, with the exception of Flying Tulip, most capital investment has flowed into later-stage companies. This is a continuation of a trend we've observed in our recent quarterly market reports and aligns with VC insights we gathered at the Token2049 Singapore conference. September 2025 further demonstrates that while early-stage deal activity remains robust, real money is seeking maturity and liquidity.

Market Highlight: Flying Tulip ($200 million seed round, $1 billion valuation)

Flying Tulip raised $200 million in its seed round at a unicorn valuation. The platform aims to unify spot trading, perpetual contracts, lending, and structured yields into a single on-chain exchange, employing a hybrid AMM/order book model and supporting cross-chain deposits and volatility-adjusted lending.

Web3 Venture Fund: Shrinking in Size

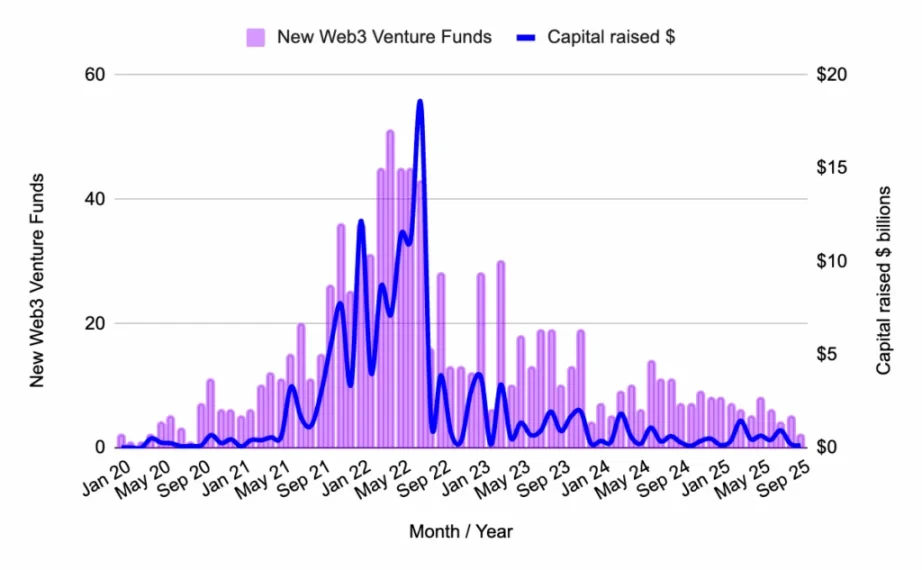

Figure 2: Number of Web3 venture capital funds launched from January 2020 to September 2025 and the capital raised. Source: Messari, Outlier Ventures.

New funds in September 2025:

- Onigiri Capital, $50 million: Focused on early-stage infrastructure and fintech in Asia.

- Archetype Fund III, $100 million: focused on modularity, developer tools, and consumer protocols.

Fund launches cooled in September 2025. Only two new funds were launched, both relatively small in size and highly focused on a single theme. This trend points to selectivity rather than a slowdown: venture capitalists are still raising funds, but around sharper, more focused themes.

Pre-seed rounds: A downward trend lasting 9 months

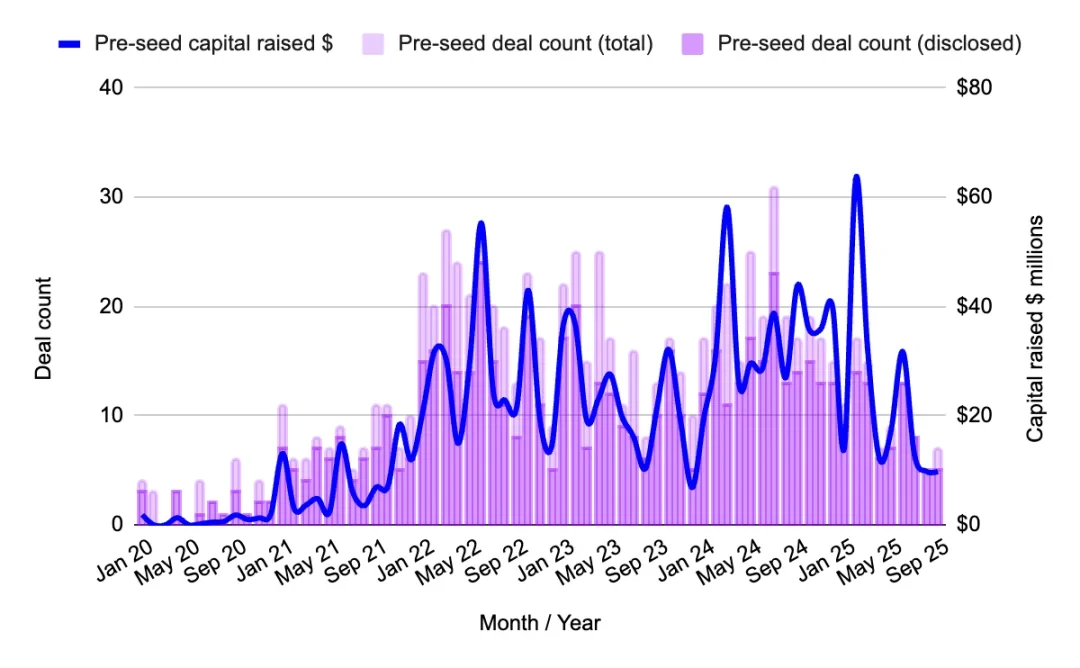

Figure 3: Number of pre-seed stage capital deployments and deals from January 2020 to September 2025. Source: Messari, Outlier Ventures.

- Total capital raised: US$9.8 million

- Disclosed transactions: 5

- Median funding round: $1.9 million

Pre-seed funding continues to decline, both in terms of the number of deals and the amount of capital raised. This stage remains weak, with few high-profile investors participating. Funding is scarce for founders at this stage, but those that do successfully raise funds do so because of a compelling narrative and strong technological conviction.

Pre-seeding highlight: Melee Markets ($3.5 million)

Melee Markets, built on Solana, allows users to speculate on influencers, events, and trending topics, combining prediction markets and social trading. Backed by Variant and DBA, it's a clever attempt to capture attention streams as asset classes.

Seed Round: Tulip Mania

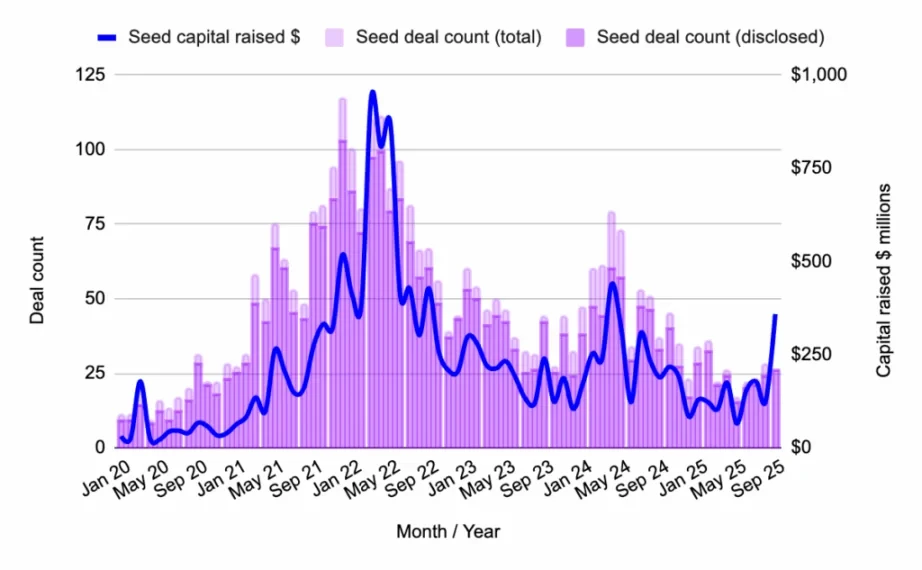

Figure 4: Number of seed-stage capital deployments and deals from January 2020 to September 2025. Source: Messari, Outlier Ventures.

- Total capital raised: US$359 million

- Disclosed transactions: 26

Seed-stage funding saw significant growth, but this was entirely thanks to Flying Tulip's $200 million round. Without it, funding in this category would have been roughly the same as in previous months.

More importantly, Flying Tulip's structure is not typical fundraising. Its on-chain redemption rights provide investors with capital security and yield exposure without sacrificing upside potential. The project is not consuming its own funding; instead, it uses DeFi yields to finance its growth, incentives, and buybacks. This is a capital-efficient, DeFi-native innovation that could influence how future protocols self-fund.

While Flying Tulip investors do have the right to withdraw these funds at any time, it is still a significant capital investment for Web3 venture capitalists who would otherwise have invested in other early-stage projects through less liquid instruments: namely SAFE and/or SAFT. This is another manifestation of the current trend among Web3 investors to seek exposure to more liquid assets.

Series A: Tends to Stabilize

Figure 5: Number of Series A funding rounds and deals from January 2020 to September 2025. Source: Messari, Outlier Ventures.

- Total capital raised: US$177 million

- Disclosed transactions: 10

- Median funding round: $17.7 million

After a sharp decline in August, Series A activity recovered slightly in September, but it wasn't a breakout month. Deal volume and deployed capital were just around the 2025 average. Investors remained selective, favoring later-stage momentum over chasing early-stage growth.

Series A Highlights: Digital Entertainment Asset ($38 million)

Singapore-based Digital Entertainment Asset has raised $38 million to build a Web3 gaming, ESG, and advertising platform with real-world payment capabilities. Backed by SBI Holdings and ASICS Ventures, the move reflects the growing interest in integrating blockchain with mainstream consumer industries in Asia.

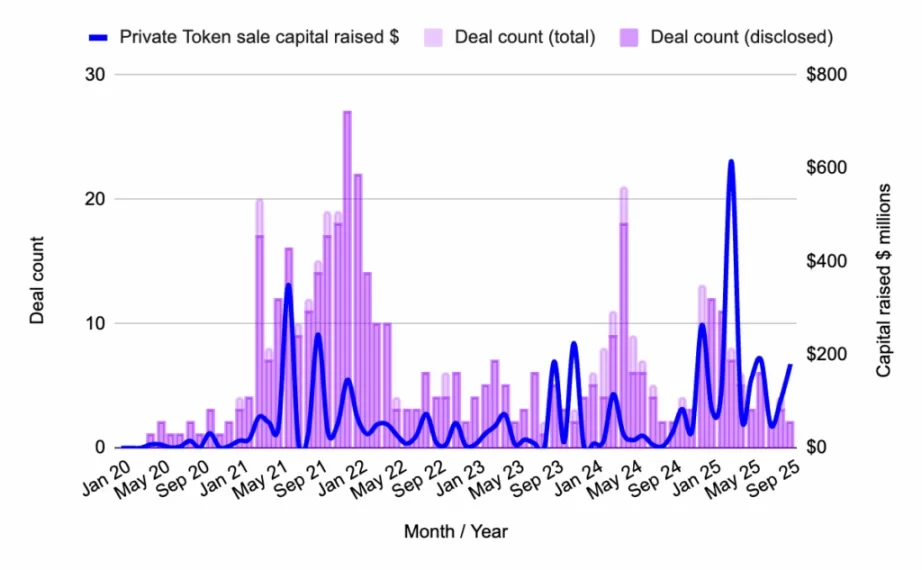

Private token sale: Huge sums of money, participation from prominent figures

Figure 6: Capital Deployment and Transaction Volume of Private Token Sales from January 2020 to September 2025. Source: Messari, Outlier Ventures.

- Total capital raised: US$180 million

- Disclosed transactions: 2

Private token activity remains concentrated, with a single massive funding round completing the process. The pattern of recent months continues: fewer token rounds, larger checks, and exchange-driven gameplay absorbing liquidity.

Highlight: Crypto.com ($178 million)

Crypto.com has raised a massive $178 million, reportedly in partnership with Trump Media. The exchange continues to push for global accessibility and mass-market crypto payment tools.

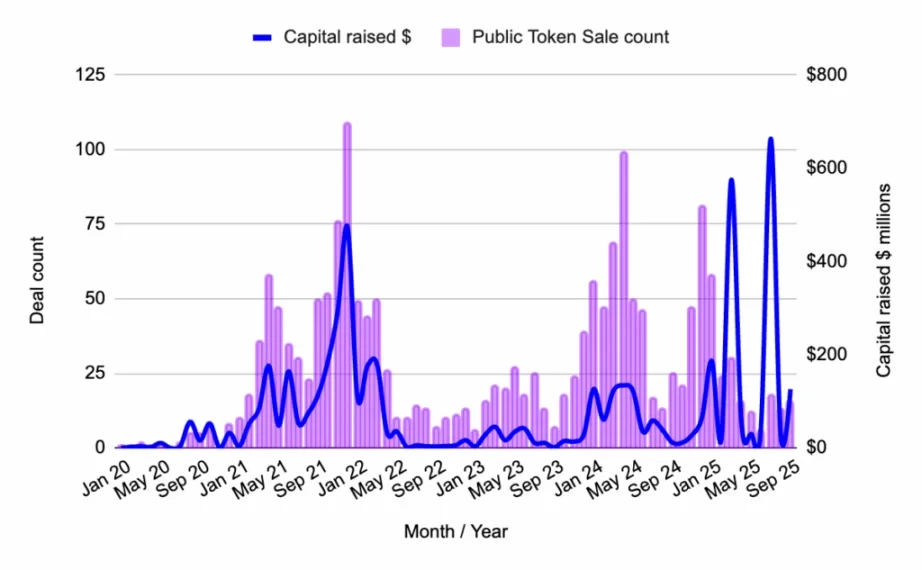

Public Token Sale: Bitcoin's Profit Moment

Figure 7: Capital Deployment and Transaction Volume of Public Token Sales from January 2020 to September 2025. Source: Messari, Outlier Ventures.

- Total capital raised: US$126.2 million

- Disclosed transactions: 16

Public token sales remain active, driven by two compelling narratives: Bitcoin yield (BTCFi) and AI agents. This serves as a reminder that public markets are still chasing narratives.

Highlight: Lombard ($94.7 million)

Lombard is bringing Bitcoin to DeFi with the launch of LBTC, an interest-bearing, cross-chain, liquid BTC asset designed to unify Bitcoin liquidity across ecosystems. This is part of the growing "BTCFi" trend, where users earn DeFi yields through BTC.

![Axe Compute [NASDAQ: AGPU] completes corporate restructuring (formerly POAI), and Aethir, an enterprise-grade decentralized GPU computing power, officially enters the mainstream market.](https://oss.odaily.top/image/2025/12/12/ff08e068a361495da15f80b89405441e.jpeg)